Security Analysis of Machine Learning Systems for the Financial Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Synergies of Hedge Funds and Reinsurance

The Synergies of Hedge Funds and Reinsurance Eric Andersen May 13th, 2013 Advisor: Dwight Jaffee Department of Economics University of California, Berkeley Acknowledgements I would like to convey my sincerest gratitude to Dr. Dwight Jaffee, my advisor, whose support and assistance were crucial to this project’s development and execution. I also want to thank Angus Hildreth for providing critical feedback and insightful input on my statistical methods and analyses. Credit goes to my Deutsche Bank colleagues for introducing me to and stoking my curiosity in a truly fascinating, but infrequently studied, field. Lastly, I am thankful to the UC Berkeley Department of Economics for providing me the opportunity to engage this project. i Abstract Bermuda-based alternative asset focused reinsurance has grown in popularity over the last decade as a joint venture for hedge funds and insurers to pursue superior returns coupled with insignificant increases in systematic risk. Seeking to provide permanent capital to hedge funds and superlative investment returns to insurers, alternative asset focused reinsurers claim to outpace traditional reinsurers by providing exceptional yields with little to no correlation risk. Data examining stock price and asset returns of 33 reinsurers from 2000 through 2012 lends little credence to support such claims. Rather, analyses show that, despite a positive relationship between firms’ gross returns and alternative asset management domiciled in Bermuda, exposure to alternative investments not only fails to mitigate market risk, but also may actually eliminate any exceptional returns asset managers would have otherwise produced by maintaining a traditional investment strategy. ii Table of Contents Acknowledgements .......................................................................................................................... i Abstract .......................................................................................................................................... -

The Association of Exchange Rates and Stock Returns. (Linear Regression Analysis)

March 2007 U.S.B.E- Umeå School of Business Masters Program: Accounting and Finance Masters Thesis- Spring Semester 2007 Author : Akumbu Martin Nshom Supervisor : Stefan Sundgren Thesis seminar : 7 th May 2007 The Association of Exchange rates and Stock returns. (Linear regression Analysis) Acknowledgement I will start by thanking God Almighty for giving me the intellect to complete this project. A big thanks goes to my supervisor Stefan Sundgren for giving me guidance and all the help I needed to complete this thesis To my family for their continuous help and support to see that I under take my studies here especially my Mother Lydia Botame. Finally to all my friends and well wishers who supported me in one way or an other through out my stay here in Umeå, may God bless you all! ABSTRACT The association of exchange rates with stock returns and performance in major trading markets is widely accepted. The world’s economy has seen unprecedented growth of interdependent; as such the magnitude of the effect of exchange rates on returns will be even stronger. Since the author perceives the importance of exchange rates on stock returns, the author found it interesting to study the effect of exchange rates on some stocks traded on the Stock exchange. There has been a renewed interest to investigate the relationship between returns and exchange rates as such; the author has chosen to investigate the present study to focus in the United Kingdom with data from the London Stock exchange .The author carried out his research on 18 companies traded on the London Stock Exchange in the process, using linear regression analysis. -

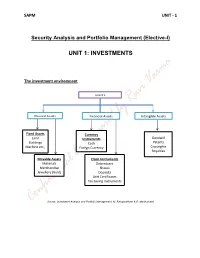

Unit 1: Investments

SAPM UNIT - 1 Security Analysis and Portfolio Management (Elective-I) UNIT 1: INVESTMENTS The investment environment ASSETS Physical Assets Financial Assets Intangible Assets Fixed Assets Currency Goodwill Land Instruments Patents Buildings Cash Machine etc., Copyrights Foregn Currency Royalties Movable Assets Claim Instruments Materials Debentures Merchandise Shares Jewellery (Gold) Deposits Unit Certificates Tax Saving Instruments Source: Investment Analysis and Portfolio Management, M. Ranganatham & R. Madhumathi SAPM UNIT - 1 Classification of Financial Markets: Financial Markets Securities Market Currency Market/ Forex market National Market International Market Domestic Segment Foreign Segment Capital Market Money Market Equity Market Debt Market Primary Market Secondary Market Spot Market Derivative Market Source: Investment Analysis and Portfolio Management, M. Ranganatham & R. Madhumathi SAPM UNIT - 1 SAPM UNIT - 1 Investment Meaning & Definition: investment is an activity that is engaged in by people who have savings i.e. investments are made from savings. Investment may be defined as a “commitment of funds made in the expectations of some positive rate of return.” Characteristics of Investment: Return Risk Safety Liquidity Objectives of Investment: Maximisation of Return Minimization of Risk Hedge against Inflation Investment Vs Speculation: Traditionally investment is distinguished from speculation with respect to four factors. These are: Risk Capital Gain Time Period Leverage Financial instruments (Investment Avenues available in India): Corporate Securities Deposits in banks and non-banking companies UTI and other mutual fund schemes SAPM UNIT - 1 Post office deposits and certificates Life insurance policies Provident fund schemes Government and semi government securities Regulatory Environment: In India the ministry of finance, the reserve bank of india, the securities and exchange board of India etc. -

Ba7021 Security Analysis and Portfolio Management 1 Sce

BA7021 SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT A Course Material on SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT By Mrs.V.THANGAMANI ASSISTANT PROFESSOR DEPARTMENT OF MANAGEMENT SCIENCES SASURIE COLLEGE OF ENGINEERING VIJAYAMANGALAM 638 056 1 SCE DEPARTMENT OF MANAGEMENT SCIENCES BA7021 SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT QUALITY CERTIFICATE This is to certify that the e-course material Subject Code : BA7021 Subject : Security Analysis and Portfolio Management Class : II Year MBA Being prepared by me and it meets the knowledge requirement of the university curriculum. Signature of the Author Name : V.THANGAMANI Designation: Assistant Professor This is to certify that the course material being prepared by Mrs.V.THANGAMANI is of adequate quality. He has referred more than five books amount them minimum one is from abroad author. Signature of HD Name: S.Arun Kumar SEAL 2 SCE DEPARTMENT OF MANAGEMENT SCIENCES BA7021 SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT CONTENTS CHAPTER TOPICS PAGE NO INVESTMENT SETTING 1.1 Financial meaning of investment 1.2 Economic meaning of Investment 7-25 1 1.3 Characteristics and objectives of Investment 1.4 Types of Investment 1.5 Investment alternatives 1.6 Choice and Evaluation 1.7 Risk and return concepts. SECURITIES MARKETS 2.1 Financial Market 2.2 Types of financial markets 2.3 Participants in financial Market 2.4 Regulatory Environment 2 2.5 Methods of floating new issues, 26-64 2.6 Book building 2.7 Role & Regulation of primary market 2.8 Stock exchanges in India BSE, OTCEI , NSE, ISE 2.9 Regulations of stock exchanges 2.10 Trading system in stock exchanges 2.11 SEBI FUNDAMENTAL ANALYSIS 3.1 Fundamental Analysis 3.2 Economic Analysis 3.3 Economic forecasting 3.4 stock Investment Decisions 3.5 Forecasting Techniques 3 3.6 Industry Analysis 65-81 3.7 Industry classification 3.8 Industry life cycle 3.9 Company Analysis 3.10Measuring Earnings 3.11 Forecasting Earnings 3.12 Applied Valuation Techniques 3.13 Graham and Dodds investor ratios. -

Security Analysis and Portfolio Management

TECEP® Test Description for FIN-321-TE SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Security Analysis and Portfolio Management presents an overview of investments with a focus on asset types, financial instruments, security markets, and mutual funds. The course provides a foundation for students entering the fields of investment analysis or portfolio management. This course examines portfolio theory, debt and equity securities, and derivative markets. It provides information on sound investment management practices, emphasizing the impact of globalization, taxes, and inflation on investments. It also provides guidance in evaluating the performance of an investment portfolio. (3 credits) ● Test format: 80 multiple choice questions (1 point each). ● Passing score: 60% (48/80 points). Your grade will be reported as CR (credit) or NC (no credit). ● Time limit: 2 hours Note: Scientific, graphing or financial calculator allowed (no phones or tablets); one sheet of scratch paper at a time, can request additional sheets. OUTCOMES ASSESSED ON THE TEST ● Discuss financial assets, financial markets, and the role of financial intermediaries ● Differentiate among equity and debt markets and stock and bond market indexes ● Assess the mechanics of various securities markets, mutual funds/investment companies, and the roles of investment bankers and brokers ● Calculate the expected rate of return from risky and risk-free investment portfolios ● Analyze portfolio theory, including measures of risk ● Discuss bond characteristics and compute bond prices and yields ● Explain equity valuation models ● Evaluate the effects of equity expense calculations, including EPS, P/E, dividends, stock betas ● Describe options and futures markets TECEP Test Description for FIN-321-TE by Thomas Edison State University is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. -

Security Analysis: an Investment Perspective

Security Analysis: An Investment Perspective Kewei Hou∗ Haitao Mo† Chen Xue‡ Lu Zhang§ Ohio State and CAFR LSU U. of Cincinnati Ohio State and NBER March 2020¶ Abstract The investment CAPM, in which expected returns vary cross-sectionally with invest- ment, profitability, and expected growth, is a good start to understanding Graham and Dodd’s (1934) Security Analysis within efficient markets. Empirically, the q5 model goes a long way toward explaining prominent equity strategies rooted in security anal- ysis, including Frankel and Lee’s (1998) intrinsic-to-market value, Piotroski’s (2000) fundamental score, Greenblatt’s (2005) “magic formula,” Asness, Frazzini, and Peder- sen’s (2019) quality-minus-junk, Buffett’s Berkshire Hathaway, Bartram and Grinblatt’s (2018) agnostic analysis, and Penman and Zhu’s (2014, 2018) expected return strategies. ∗Fisher College of Business, The Ohio State University, 820 Fisher Hall, 2100 Neil Avenue, Columbus OH 43210; and China Academy of Financial Research (CAFR). Tel: (614) 292-0552. E-mail: [email protected]. †E. J. Ourso College of Business, Louisiana State University, 2931 Business Education Complex, Baton Rouge, LA 70803. Tel: (225) 578-0648. E-mail: [email protected]. ‡Lindner College of Business, University of Cincinnati, 405 Lindner Hall, Cincinnati, OH 45221. Tel: (513) 556-7078. E-mail: [email protected]. §Fisher College of Business, The Ohio State University, 760A Fisher Hall, 2100 Neil Avenue, Columbus OH 43210; and NBER. Tel: (614) 292-8644. E-mail: zhanglu@fisher.osu.edu. ¶For helpful comments, -

Security Analysis of Unified Payments Interface and Payment Apps in India

Security Analysis of Unified Payments Interface and Payment Apps in India Renuka Kumar1, Sreesh Kishore , Hao Lu1, and Atul Prakash1 1University of Michigan Abstract significant enabler. Currently, there are about 88 UPI payment apps and over 140 banks that enable transactions with those Since 2016, with a strong push from the Government of India, apps via UPI [40,41]. This paper focuses on vulnerabilities smartphone-based payment apps have become mainstream, in the design of UPI and UPI’s usage by payment apps. with over $50 billion transacted through these apps in 2018. We note that hackers are highly motivated when it comes to Many of these apps use a common infrastructure introduced money, so uncovering any design vulnerabilities in payment by the Indian government, called the Unified Payments In- systems and addressing them is crucial. For instance, a recent terface (UPI), but there has been no security analysis of this survey states a 37% increase in financial fraud and identity critical piece of infrastructure that supports money transfers. theft in 2019 in India [12]. Social engineering attacks to This paper uses a principled methodology to do a detailed extract sensitive information such as one-time passcodes and security analysis of the UPI protocol by reverse-engineering bank account numbers are common [17, 23, 34, 57, 58]. the design of this protocol through seven popular UPI apps. Payment apps, including Indian payment apps, have been We discover previously-unreported multi-factor authentica- analyzed before, with vulnerabilities discovered [9,48], and tion design-level flaws in the UPI 1.0 specification that can an Indian mobile banking service was found to have PIN lead to significant attacks when combined with an installed recovery flaws [47]. -

Fundamental and Technical Analysis - Economic Analysis , Industry Analysis ,Company Analysis and Efficient Market Theory

UNIT IV Fundamental and Technical Analysis - Economic Analysis , Industry Analysis ,company Analysis and Efficient market theory: Security analysis is the analysis of tradeable financial instruments called securities. It deals with finding the proper value of individual securities. Security analysis refers to the method of analysing the value of securities like shares and other instruments to assess the total value of business which will be useful for investors to make decisions. There are three methods to analyse the value of securities fundamental, technical, and quantitative analysis. Security analysts must act with integrity, competence, and diligence while conducting the investment profession. The securities can broadly be classified into equity instruments (stocks), debt instruments (bonds), derivatives (options), or some hybrid (convertible bond). Considering the nature of securities, security analysis can broadly be performed using the following three methods:- 1.Fundamental Analysis This type of security analysis is an evaluation procedure of securities where the major goal is to calculate the intrinsic value of a stock. It studies the fundamental factors that effects stocks intrinsic value like profitability statement & position statements of a company, managerial performance and future outlook, present industrial conditions, and the overall economy. Components of Fundamental Analysis Fundamental analysis consists of three main parts: 1.Economic analysis 2.Industry analysis 3.Company analysis Fundamental analysis is an extremely comprehensive approach that requires a deep knowledge of accounting, finance, and economics. For instance, fundamental analysis requires the ability to read financial statements, an understanding of macroeconomic factors, and knowledge of valuation techniques. It primarily relies on public data, such as a company’s historical earnings and profit margins, to project future growth. -

Security Analysis and Investment Management

M.B.A IV Semester Course 406 FM-02 SECURITY ANALYSIS AND INVESTMENT MANAGEMENT LESSONS 1 TO 6 INTERNATIONAL CENTRE FOR DISTANCE EDUCATION AND OPEN LEARNING HIMACHAL PRADESH UNIVERSITY, GYAN PATH, SUMMERHILL, SHIMLA-171005 Contents Sr. No. Topoc Page No. LESSON-1 STOCK MARKET 1 LESSON-2 NEW ISSUE MARKET 15 LESSON-3 VALUATION OF SECURITIES 26 LESSON-4 FUNDAMENTAL ANALYSIS 37 LESSON-5 TECHNICAL ANALYSIS 58 LESSON-6 PORTFOLIO MANAGEMENT 80 LESSON-1 STOCK MARKET Structure 1.0 Learning Objectives 1.1 Introduction 1.2 Financial Market 1.3 Components of Financial Market 1.4 Stock Exchange 1.5 Nature and Characteristics of Stock Exchange 1.6 Function of Stock Exchange 1.7 Advantages of Stock Exchange 1.8 Organisation of Stock Exchange in India 1.9 Operational Mechanism of Stock Exchanges 1.10 Listing of Securities 1.11 Self-check Questions 1.12 Summary 1.13 Glossary 1.14 Answers: Self-check Questions 1.15 Terminal Questions 1.16 Suggested Readings 1.0 Learning Objectives After going through this lesson the learners should be able to: 1. Understand the financial market. 2. Discuss the components of financial market. 3. Understand the function of stock market. 4. Describe the operational mechanism of the stock exchange. 1.1 Introduction Stock market or secondary market is a place where buyer and seller of listed securities come together. This market is one of the important components of financial markets. In order to understand stock markets in detail, we shall understand the structure of financial market in an economy. Sections of this unit explain briefly the financial markets, components of financial markets, nature and functions of stock market, its Organization and statutory regulations for listing securities on stock markets. -

Security Analysis by Benjamin Graham and David L. Dodd

PRAISE FOR THE SIXTH EDITION OF SECURITY ANALYSIS “The sixth edition of the iconic Security Analysis disproves the adage ‘’tis best to leave well enough alone.’ An extraordinary team of commentators, led by Seth Klarman and James Grant, bridge the gap between the sim- pler financial world of the 1930s and the more complex investment arena of the new millennium. Readers benefit from the experience and wisdom of some of the financial world’s finest practitioners and best informed market observers. The new edition of Security Analysis belongs in the library of every serious student of finance.” David F. Swensen Chief Investment Officer Yale University author of Pioneering Portfolio Management and Unconventional Success “The best of the past made current by the best of the present. Tiger Woods updates Ben Hogan. It has to be good for your game.” Jack Meyer Managing Partner and CEO Convexity Capital “Security Analysis, a 1940 classic updated by some of the greatest financial minds of our generation, is more essential than ever as a learning tool and reference book for disciplined investors today.” Jamie Dimon Chairman and CEO JPMorgan Chase “While Coca-Cola found it couldn’t improve on a time-tested classic, Seth Klarman, Jim Grant, Bruce Greenwald, et al., prove that a great book can be made even better. Seth Klarman’s preface should be required reading for all investors, and collectively, the contributing editors’ updates make for a classic in their own right. The enduring lesson is that an understand- ing of human behavior is a critical part of the process of security analysis.” Brian C. -

Security Analysis (B8368-01) Spring 2020- Bidding Syllabus

Security Analysis (B8368-01) Spring 2020- Bidding Syllabus PROFESSOR: Michael J. Mauboussin TEACHING ASSISTANT: TBD Phone: 917-617-0950 Phone: TDB E-mail: [email protected] E-mail: TBD Classroom Location: TBD Wednesdays: 5:45 – 9:00 pm Office Hours: By appointment Communications from professor and teaching assistants about the course will take place through Canvas. Students should make sure they regularly check for announcements and messaging notifications. COURSE DESCRIPTION The course has two parts. The first part (14 to 16 lectures) develops the essential tools that a security analyst needs to come to a thoughtful investment recommendation. These tools include basic capital market concepts, analysis of competitive advantage, valuation methods, and techniques for proper decision making. The second part (8 sessions) allows the students to apply these lessons by presenting an analysis of a company and an investment conclusion regarding the shares of the company. A senior executive of a corporation will join the class toward the end of the first section to discuss competitive advantage. This session will give students the opportunity to question a management team directly on all facets of corporate strategy. Further, accomplished portfolio managers will attend student presentations to provide constructive feedback, to share their insights into the security analysis process, and to answer questions. The learning objective of the course is to combine various analytical frameworks and mental models into an investment recommendation. Further, students will learn to make a clear and persuasive presentation based on well-reasoned analysis. This course will be of most value to students who intend to pursue a career in investment management. -

FIN 377-3: SECURITY ANALYSIS (Spring 2017) FINANCIAL ANALYST PROGRAM Instructor: Dr

FIN 377-3: SECURITY ANALYSIS (Spring 2017) FINANCIAL ANALYST PROGRAM Instructor: Dr. Kamm, Department of Finance, CBA 6.304D Email: [email protected] Instructor Office Hours: 5-6:15 Tuesdays and Thursdays, extra hours before due dates T.A.s: Tae Hoon Ahn, Anerudh Athrey Section numbers 03665: 11 to 12:30, GSB 3.120 Course Packet: 2 GSB course packets (series of cases, 1st simulation, 2nd simulation) Other Highly Recommended Materials: WSJ also on-line sign up; to support research Canvas: Class web site, Excel spreadsheets, extra material posted Financial Calculator Required: Financial Calculator HP 10b11 recommended (need YTM) Financial Software: Bloomberg, FactSet, Stock-Trak FINANCIAL ANALYST PROGRAM OVERVIEW: The Financial Analyst Program is a program designed for outstanding finance juniors who will be participants in this academic / applied investment program for the next year and a half. The program is an opportunity for students to develop their skills and experiences as financial analysts. It is an intensive, “hands-on” experience in financial analysis and valuation in corporate, investment, and financial service settings. The program requires that students integrate and apply previously acquired skills in finance, accounting and economics. Students selected for the program learn to assess the operating, financing and investing performance of a company as well as make financial projections relative to both the company’s recent operating performance and its peer group of competitors. Participants learn to compare and interpret financial data by way of financial software in the EDS trading and technological center, a center that is equipped with real-time data feed of financial information.