Fundamental and Technical Analysis - Economic Analysis , Industry Analysis ,Company Analysis and Efficient Market Theory

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Synergies of Hedge Funds and Reinsurance

The Synergies of Hedge Funds and Reinsurance Eric Andersen May 13th, 2013 Advisor: Dwight Jaffee Department of Economics University of California, Berkeley Acknowledgements I would like to convey my sincerest gratitude to Dr. Dwight Jaffee, my advisor, whose support and assistance were crucial to this project’s development and execution. I also want to thank Angus Hildreth for providing critical feedback and insightful input on my statistical methods and analyses. Credit goes to my Deutsche Bank colleagues for introducing me to and stoking my curiosity in a truly fascinating, but infrequently studied, field. Lastly, I am thankful to the UC Berkeley Department of Economics for providing me the opportunity to engage this project. i Abstract Bermuda-based alternative asset focused reinsurance has grown in popularity over the last decade as a joint venture for hedge funds and insurers to pursue superior returns coupled with insignificant increases in systematic risk. Seeking to provide permanent capital to hedge funds and superlative investment returns to insurers, alternative asset focused reinsurers claim to outpace traditional reinsurers by providing exceptional yields with little to no correlation risk. Data examining stock price and asset returns of 33 reinsurers from 2000 through 2012 lends little credence to support such claims. Rather, analyses show that, despite a positive relationship between firms’ gross returns and alternative asset management domiciled in Bermuda, exposure to alternative investments not only fails to mitigate market risk, but also may actually eliminate any exceptional returns asset managers would have otherwise produced by maintaining a traditional investment strategy. ii Table of Contents Acknowledgements .......................................................................................................................... i Abstract .......................................................................................................................................... -

Investors' Awareness of Fundamental and Technical Analysis For

International Journal of Innovative Technology and Exploring Engineering (IJITEE) ISSN: 2278-3075, Volume-8 Issue-9, July 2019 Investors’ Awareness of fundamental and Technical Analysis for Investments in Securities Market Jayalakshmi. R, N. Lakshmi Abstract: The role of investors in the securities market reveals the rising prominence of financial savings and also the II. REVIEW OF LITERATURE growth of industry and the economy. The focal point is to survey the investors’ awareness of the fundamental and technical Wiwik Utami (2017) conducted a case study on investors’ analysis for investment in the securities market. The study stock investment decisions in Indonesia. The result showed identified an analysis of the economy, industries and companies that the period of investment and experience influenced the as the three fundamental components that influence and affect method of security analysis adopted before investment the investors’ investment in the securities market. decisions. Technical analysis was mostly preferred by Keywords: securities market, investors, rising prominence, regular tradinginvestors for quick decision-making. financial savings & technical analysis. Prasaanna Prakash (2016) found that the retail investors were less aware of the various investment options and the I. INTRODUCTION protective measures taken by the government. A majority of Investment in the securities market needs analysis to the retail investors chose investments for a short duration. identify and select the right instruments and right time to The researcher suggested that the retail investors be given invest to reap high returns, which in turn, can increase the proper attention. Investors’ decisions were based on investors’ wealth. Based on the analysis, the investment psychological, emotional and behavioral factors. -

Fundamental Analysis to Access the Fair Value Based on Price Earning

International Conference on Education For Economics, ISSN (Print) 2540-8372 Business, and Finance (ICEEBF) 2016 ISSN (Online) 2540-7481 Fundamental Analysis to Access the Fair Value Based on Price Earning Ratio (PER) and Dividend Discount Model (DDM) Approach as the basis for Investment Decision Making (A Study on the Insurance Sub Sector Listing in Indonesia Stock Exchange Period 2013-2015) Lisa Rahayu Ningsih Faculty of Economics, Universitas Negeri Malang, Indonesia Email: [email protected] Abstract This research aims to give explanation to assess and determine the reasonableness stock price of comparing fair value with market price. Assessing the reasonableness of stock price by Price Earning Ratio and Dividend Discount Model approaches in insurance companies listed in Indonesia Stock Exchange 2013-2015 to make investment decision. The research use descriptive research with quantitative approach. The population in this study is 12 insurance companies and the sampling technique is purposive sampling which 7 companies taken as sample with ticker stock code ABDA, AMAG, ASBI, ASDM, LPGI, MREI, ASRM. Fundamental ratio used in this research is Return On Equity (ROE), Earning Per Share (EPS), Dividend Per Share (DPS), and Dividend Payout Ratio (DPR). The result of this research showed one company that the price of its share which are undervalued and six companies that the price of overvalued condition when it measured with Price Earning Ratio method. Beside that comparing final result by using Dividend Discount Model showed that three companies is an undervalued position and four companies is an overvalued position. The decision that can be taken by investor based on undervalued condition is to buy or hold the shares whereas overvalued condition is to sell. -

Kochmeister Awards Ceremony at the Budapest Stock Exchange

Kochmeister awards ceremony at the Budapest Stock Exchange Budapest, 14 June 2010 Kochmeister award is handed over today for the seventh time at the Budapest Stock Exchange. The Budapest Stock Exchange founded the Kochmeister Award in 2004 to reward talented young people who submit the best paper(s) on predetermined topics related to the Stock Exchange. The award is named after Baron Frigyes Kochmeister, who played a leading role in 1864, in establishing the Budapest Commodity and Stock Exchange, and, as the first chairman of the Exchange, managed the institution for years. BSE Chief Executive Officer György Mohai handed over the prizes. Zsolt Kelemen, Deputy CEO of Finance of CIG Pannónia Life Insurance Plc. handed over the special prize offered by the company. Eighteen essays that arrived from eight national and transborder higher education institutions were in competition in the contest dedicated to the memory of Frigyes Kochmeister in 2011. The professional jury is awarded the following winners: First place: Zita-Klára Málnási - student of Babes-Bolyai University, Cluj-Napoca Title: Fundamental Analysis of the E-Star Alternative Plc. Second place: Viktor Vajda - student of Corvinus University, Budapest Title: New types of security trading platforms in the European Union Third place: Gábor Szentirmai - student of Corvinus University of Budapest Title: Fundamental Analysis of the E-Star Alternative Plc. Special prize offered by CIG Pannónia Life Insurance Plc.: Péter Szentirmai – student of Corvinus University of Budapest Title: Testing the technical trading rules of forecastability at the Budapest Stock Exchange About the Budapest Stock Exchange The CEE Stock Exchange Group (CEESEG), which comprises of the stock exchanges of Budapest, Ljubljana, Prague and Vienna, is the largest stock exchange group in the region. -

The Association of Exchange Rates and Stock Returns. (Linear Regression Analysis)

March 2007 U.S.B.E- Umeå School of Business Masters Program: Accounting and Finance Masters Thesis- Spring Semester 2007 Author : Akumbu Martin Nshom Supervisor : Stefan Sundgren Thesis seminar : 7 th May 2007 The Association of Exchange rates and Stock returns. (Linear regression Analysis) Acknowledgement I will start by thanking God Almighty for giving me the intellect to complete this project. A big thanks goes to my supervisor Stefan Sundgren for giving me guidance and all the help I needed to complete this thesis To my family for their continuous help and support to see that I under take my studies here especially my Mother Lydia Botame. Finally to all my friends and well wishers who supported me in one way or an other through out my stay here in Umeå, may God bless you all! ABSTRACT The association of exchange rates with stock returns and performance in major trading markets is widely accepted. The world’s economy has seen unprecedented growth of interdependent; as such the magnitude of the effect of exchange rates on returns will be even stronger. Since the author perceives the importance of exchange rates on stock returns, the author found it interesting to study the effect of exchange rates on some stocks traded on the Stock exchange. There has been a renewed interest to investigate the relationship between returns and exchange rates as such; the author has chosen to investigate the present study to focus in the United Kingdom with data from the London Stock exchange .The author carried out his research on 18 companies traded on the London Stock Exchange in the process, using linear regression analysis. -

(Form ADV, Part 2A) Cavanal Hill

Item 1 – Cover Page Firm Brochure (Form ADV, Part 2A) Cavanal Hill Investment Management, Inc. One Williams Center 15th Floor Tulsa, Oklahoma 74172 (800) 958-2942 May 2020 This brochure (“B r o c h u r e”) provides information about the qualifications and business practices of Cavanal Hill Investment Management, Inc. If you have questions about the contents of this brochure, please contact us at (800) 955-2942 or www.cavanalhill.com. The information in this brochure has not been approved or verified by the United States Securities and Exchange Commission or by any state securities authority. Additional information about Cavanal Hill Investment Management, Inc. is available on the SEC’s website at www.adviserinfo.sec.gov. Note: While Cavanal Hill Investment Management, Inc. may refer to itself as a “registered investment adviser” or “RIA” you should be aware that registration itself does not imply any level of skill or training. 1 Item 2 – Material Changes Annual Update The Material Changes section of this brochure is updated to report any material changes to the previous version of Form ADV, Part 2A (the Firm Brochure). The section bellows provides a summary of material changes since the last update. Summary of Material Changes since the Last Update The U.S. Securities and Exchange Commission requires that each Investment Adviser provide its new clients with a copy of its Form ADV, Part 2A. The rule requires completion of specific mandatory sections and those sections are to be organized in the order specified by the rule. Investment adviser must update the information in their Form ADV, Part 2A, when a material change has occurred. -

Download Download

International Business & Economics Research Journal – November/December 2014 Volume 13, Number 6 The Random Walk Theory And Stock Prices: Evidence From Johannesburg Stock Exchange Tafadzwa T. Chitenderu, University of Fort Hare, South Africa Andrew Maredza, North West University, South Africa Kin Sibanda, University of Fort Hare, South Africa ABSTRACT In this paper, we test the Johannesburg Stock Exchange market for the existence of the random walk hypothesis using monthly time series of the All Share Index (ALSI) covering the period 2000 – 2011. Traditional methods, such as unit root tests and autocorrelation test, were employed first and they all confirmed that during the period under consideration, the JSE price index followed the random walk process. In addition, the ARIMA model was constructed and it was found that the ARIMA (1, 1, 1) was the model that most excellently fitted the data in question. Furthermore, residual tests were performed to determine whether the residuals of the estimated equation followed a random walk process in the series. The authors found that the ALSI resembles a series that follow random walk hypothesis with strong evidence of a wide variance between forecasted and actual values, indicating little or no forecasting strength in the series. To further validate the findings in this research, the variance ratio test was conducted under heteroscedasticity and resulted in non-rejection of the random walk hypothesis. It was concluded that since the returns follow the random walk hypothesis, it can be said that JSE, in terms of efficiency, is on the weak form level and therefore opportunities of making excess returns based on out-performing the market is ruled out and is merely a game of chance. -

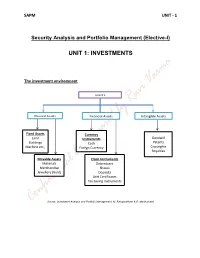

Unit 1: Investments

SAPM UNIT - 1 Security Analysis and Portfolio Management (Elective-I) UNIT 1: INVESTMENTS The investment environment ASSETS Physical Assets Financial Assets Intangible Assets Fixed Assets Currency Goodwill Land Instruments Patents Buildings Cash Machine etc., Copyrights Foregn Currency Royalties Movable Assets Claim Instruments Materials Debentures Merchandise Shares Jewellery (Gold) Deposits Unit Certificates Tax Saving Instruments Source: Investment Analysis and Portfolio Management, M. Ranganatham & R. Madhumathi SAPM UNIT - 1 Classification of Financial Markets: Financial Markets Securities Market Currency Market/ Forex market National Market International Market Domestic Segment Foreign Segment Capital Market Money Market Equity Market Debt Market Primary Market Secondary Market Spot Market Derivative Market Source: Investment Analysis and Portfolio Management, M. Ranganatham & R. Madhumathi SAPM UNIT - 1 SAPM UNIT - 1 Investment Meaning & Definition: investment is an activity that is engaged in by people who have savings i.e. investments are made from savings. Investment may be defined as a “commitment of funds made in the expectations of some positive rate of return.” Characteristics of Investment: Return Risk Safety Liquidity Objectives of Investment: Maximisation of Return Minimization of Risk Hedge against Inflation Investment Vs Speculation: Traditionally investment is distinguished from speculation with respect to four factors. These are: Risk Capital Gain Time Period Leverage Financial instruments (Investment Avenues available in India): Corporate Securities Deposits in banks and non-banking companies UTI and other mutual fund schemes SAPM UNIT - 1 Post office deposits and certificates Life insurance policies Provident fund schemes Government and semi government securities Regulatory Environment: In India the ministry of finance, the reserve bank of india, the securities and exchange board of India etc. -

Ba7021 Security Analysis and Portfolio Management 1 Sce

BA7021 SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT A Course Material on SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT By Mrs.V.THANGAMANI ASSISTANT PROFESSOR DEPARTMENT OF MANAGEMENT SCIENCES SASURIE COLLEGE OF ENGINEERING VIJAYAMANGALAM 638 056 1 SCE DEPARTMENT OF MANAGEMENT SCIENCES BA7021 SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT QUALITY CERTIFICATE This is to certify that the e-course material Subject Code : BA7021 Subject : Security Analysis and Portfolio Management Class : II Year MBA Being prepared by me and it meets the knowledge requirement of the university curriculum. Signature of the Author Name : V.THANGAMANI Designation: Assistant Professor This is to certify that the course material being prepared by Mrs.V.THANGAMANI is of adequate quality. He has referred more than five books amount them minimum one is from abroad author. Signature of HD Name: S.Arun Kumar SEAL 2 SCE DEPARTMENT OF MANAGEMENT SCIENCES BA7021 SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT CONTENTS CHAPTER TOPICS PAGE NO INVESTMENT SETTING 1.1 Financial meaning of investment 1.2 Economic meaning of Investment 7-25 1 1.3 Characteristics and objectives of Investment 1.4 Types of Investment 1.5 Investment alternatives 1.6 Choice and Evaluation 1.7 Risk and return concepts. SECURITIES MARKETS 2.1 Financial Market 2.2 Types of financial markets 2.3 Participants in financial Market 2.4 Regulatory Environment 2 2.5 Methods of floating new issues, 26-64 2.6 Book building 2.7 Role & Regulation of primary market 2.8 Stock exchanges in India BSE, OTCEI , NSE, ISE 2.9 Regulations of stock exchanges 2.10 Trading system in stock exchanges 2.11 SEBI FUNDAMENTAL ANALYSIS 3.1 Fundamental Analysis 3.2 Economic Analysis 3.3 Economic forecasting 3.4 stock Investment Decisions 3.5 Forecasting Techniques 3 3.6 Industry Analysis 65-81 3.7 Industry classification 3.8 Industry life cycle 3.9 Company Analysis 3.10Measuring Earnings 3.11 Forecasting Earnings 3.12 Applied Valuation Techniques 3.13 Graham and Dodds investor ratios. -

Security Analysis and Portfolio Management

TECEP® Test Description for FIN-321-TE SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Security Analysis and Portfolio Management presents an overview of investments with a focus on asset types, financial instruments, security markets, and mutual funds. The course provides a foundation for students entering the fields of investment analysis or portfolio management. This course examines portfolio theory, debt and equity securities, and derivative markets. It provides information on sound investment management practices, emphasizing the impact of globalization, taxes, and inflation on investments. It also provides guidance in evaluating the performance of an investment portfolio. (3 credits) ● Test format: 80 multiple choice questions (1 point each). ● Passing score: 60% (48/80 points). Your grade will be reported as CR (credit) or NC (no credit). ● Time limit: 2 hours Note: Scientific, graphing or financial calculator allowed (no phones or tablets); one sheet of scratch paper at a time, can request additional sheets. OUTCOMES ASSESSED ON THE TEST ● Discuss financial assets, financial markets, and the role of financial intermediaries ● Differentiate among equity and debt markets and stock and bond market indexes ● Assess the mechanics of various securities markets, mutual funds/investment companies, and the roles of investment bankers and brokers ● Calculate the expected rate of return from risky and risk-free investment portfolios ● Analyze portfolio theory, including measures of risk ● Discuss bond characteristics and compute bond prices and yields ● Explain equity valuation models ● Evaluate the effects of equity expense calculations, including EPS, P/E, dividends, stock betas ● Describe options and futures markets TECEP Test Description for FIN-321-TE by Thomas Edison State University is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. -

How the Stock Market Works: a Beginner's

i ii iii iv If you speculate on the stock market, you do so at your own risk. Publisher’s note Every possible effort has been made to ensure that the information contained in this book is accurate at the time of going to press, and the publishers and authors cannot accept responsibility for any errors or omissions, however caused. No responsibility for loss or damage occasioned to any person acting, or refraining from action, as a result of the mate- rial in this publication can be accepted by the editor, the publisher or either of the authors. First published in 2002 Reprinted in 2002, 2003 Second edition, 2004 Reprinted in 2005, 2006, 2007 (twice), 2009 Third edition 2010 Apart from any fair dealing for the purposes of research or private study, or criticism or review, as permitted under the Copyright, Designs and Patents Act 1988, this publication may only be reproduced, stored or transmitted, in any form or by any means, with the prior permission in writing of the publishers, or in the case of reprographic reproduction in accordance with the terms and licences issued by the CLA. Enquiries concerning reproduction outside these terms should be sent to the publishers at the undermentioned addresses: 120 Pentonville Road 525 South 4th Street, #241 London N1 9JN Philadelphia PA 19147 United Kingdom USA www.koganpage.com © Michael Becket, 2002, 2004 © Michael Becket and Yvette Essen, 2010 The right of Michael Becket and Yvette Essen to be identified as the authors of this work has been asserted by them in accordance with the Copyright, Designs and Patents Act 1988. -

Security Analysis: an Investment Perspective

Security Analysis: An Investment Perspective Kewei Hou∗ Haitao Mo† Chen Xue‡ Lu Zhang§ Ohio State and CAFR LSU U. of Cincinnati Ohio State and NBER March 2020¶ Abstract The investment CAPM, in which expected returns vary cross-sectionally with invest- ment, profitability, and expected growth, is a good start to understanding Graham and Dodd’s (1934) Security Analysis within efficient markets. Empirically, the q5 model goes a long way toward explaining prominent equity strategies rooted in security anal- ysis, including Frankel and Lee’s (1998) intrinsic-to-market value, Piotroski’s (2000) fundamental score, Greenblatt’s (2005) “magic formula,” Asness, Frazzini, and Peder- sen’s (2019) quality-minus-junk, Buffett’s Berkshire Hathaway, Bartram and Grinblatt’s (2018) agnostic analysis, and Penman and Zhu’s (2014, 2018) expected return strategies. ∗Fisher College of Business, The Ohio State University, 820 Fisher Hall, 2100 Neil Avenue, Columbus OH 43210; and China Academy of Financial Research (CAFR). Tel: (614) 292-0552. E-mail: [email protected]. †E. J. Ourso College of Business, Louisiana State University, 2931 Business Education Complex, Baton Rouge, LA 70803. Tel: (225) 578-0648. E-mail: [email protected]. ‡Lindner College of Business, University of Cincinnati, 405 Lindner Hall, Cincinnati, OH 45221. Tel: (513) 556-7078. E-mail: [email protected]. §Fisher College of Business, The Ohio State University, 760A Fisher Hall, 2100 Neil Avenue, Columbus OH 43210; and NBER. Tel: (614) 292-8644. E-mail: zhanglu@fisher.osu.edu. ¶For helpful comments,