AQ INTERACTIVE Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MARVELOUS Company Profile-2019-ENG.Indd

President Shuichi Motoda 2 MARVELOUS COMPANY PROFILE For games, video, music and stage. Excitement has no borders. After food, clothing and shelter comes fun. To have fun is to live. The more we keep our hearts entertained, the more fulfilling our lives will be. Marvelous Inc. is an all-round entertainment company that produces fun. We create interesting and original intellectual property (IP) for games, video, music and stage. Leveraging our strength in “multi-content, multi-use and multi-device,” we transcend changes in the times to consistently create fresh entertainment. We strive to deliver wonder and excitement never seen before to the people of the world. Before you know it, we will be one of Japan’s leading content providers. And we will be an entertainment company that offers a multitude of challenges and thrills and leaves people wondering, “What’s coming next from this company?” Personally, I’m really looking forward to what lies ahead at Marvelous. President Shuichi Motoda MARVELOUS COMPANY PROFILE 3 In the Online Game Business, we are engaged in the planning, development, and operation of online games for App Store, Google Play, and SNS platforms. In order to provide the rapidly evolving online game market quickly and consistently with ONLINE GAME buzz-worthy content, we are engaged in proactive development efforts through alliances with other IPs in addition to our own. By promoting multi-use of original IP produced by Marvelous Delivering buzz-worthy content and and multi-device compatibility of products for PC, mobile, expanding the number of users smartphone, tablet and other devices, we work to diversify worldwide revenue streams. -

PROCEDURAL CONTENT GENERATION for GAME DESIGNERS a Dissertation

UNIVERSITY OF CALIFORNIA SANTA CRUZ EXPRESSIVE DESIGN TOOLS: PROCEDURAL CONTENT GENERATION FOR GAME DESIGNERS A dissertation submitted in partial satisfaction of the requirements for the degree of DOCTOR OF PHILOSOPHY in COMPUTER SCIENCE by Gillian Margaret Smith June 2012 The Dissertation of Gillian Margaret Smith is approved: ________________________________ Professor Jim Whitehead, Chair ________________________________ Associate Professor Michael Mateas ________________________________ Associate Professor Noah Wardrip-Fruin ________________________________ Professor R. Michael Young ________________________________ Tyrus Miller Vice Provost and Dean of Graduate Studies Copyright © by Gillian Margaret Smith 2012 TABLE OF CONTENTS List of Figures .................................................................................................................. ix List of Tables ................................................................................................................ xvii Abstract ...................................................................................................................... xviii Acknowledgments ......................................................................................................... xx Chapter 1: Introduction ....................................................................................................1 1 Procedural Content Generation ................................................................................. 6 1.1 Game Design................................................................................................... -

Using Trade Dress to Protect the Look and Feel of Video Games

THE JOHN MARSHALL REVIEW OF INTELLECTUAL PROPERTY LAW TRYING ON TRADE DRESS: USING TRADE DRESS TO PROTECT THE LOOK AND FEEL OF VIDEO GAMES BENJAMIN C.R. LOCKYER ABSTRACT With the creation of video games for smart phones, video games are some of the most accessible forms of entertainment on the market. What was once only an attraction inside the designated location of arcade halls, is now within the grip of nearly every smart phone user. With new game apps for smart phones going viral on a regular basis, the video game industry has become one of the most profitable in the entertainment realm. However, the industry's overall success has also led to increased competition amongst game developers. As a result, competing developers create near exact copies of highly successful video games called clones. By copying non-copyrightable elements, clone developers can create confusingly similar video games. This comment examines the creation of clone video games and how their developers avoid copyright infringement by exploiting scènes à faire and the merger doctrine. The exploitation of copyright law for video game developers could be combated by trademark law. By using the Lanham Act's protection for trade dress, non-copyrightable elements that identify popular games may be protected. By seeking trade dress protection against clones, game developers can sustain the value of their investment in gaming apps, while also minimizing the issue of consumer confusion. Copyright © 2017 The John Marshall Law School Cite as Benjamin C.R. Lockyer, Trying on Trade Dress: Using Trade Dress to Protect the Look and Feel of Video Games, 17 J. -

Vgarchive : My Video Game Collection 2021

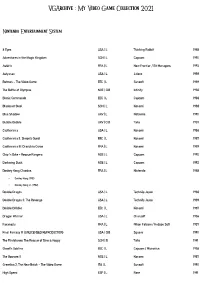

VGArchive : My Video Game Collection 2021 Nintendo Entertainment System 8 Eyes USA | L Thinking Rabbit 1988 Adventures in the Magic Kingdom SCN | L Capcom 1990 Astérix FRA | L New Frontier / Bit Managers 1993 Astyanax USA | L Jaleco 1989 Batman – The Video Game EEC | L Sunsoft 1989 The Battle of Olympus NOE | CiB Infinity 1988 Bionic Commando EEC | L Capcom 1988 Blades of Steel SCN | L Konami 1988 Blue Shadow UKV | L Natsume 1990 Bubble Bobble UKV | CiB Taito 1987 Castlevania USA | L Konami 1986 Castlevania II: Simon's Quest EEC | L Konami 1987 Castlevania III: Dracula's Curse FRA | L Konami 1989 Chip 'n Dale – Rescue Rangers NOE | L Capcom 1990 Darkwing Duck NOE | L Capcom 1992 Donkey Kong Classics FRA | L Nintendo 1988 • Donkey Kong (1981) • Donkey Kong Jr. (1982) Double Dragon USA | L Technōs Japan 1988 Double Dragon II: The Revenge USA | L Technōs Japan 1989 Double Dribble EEC | L Konami 1987 Dragon Warrior USA | L Chunsoft 1986 Faxanadu FRA | L Nihon Falcom / Hudson Soft 1987 Final Fantasy III (UNLICENSED REPRODUCTION) USA | CiB Square 1990 The Flintstones: The Rescue of Dino & Hoppy SCN | B Taito 1991 Ghost'n Goblins EEC | L Capcom / Micronics 1986 The Goonies II NOE | L Konami 1987 Gremlins 2: The New Batch – The Video Game ITA | L Sunsoft 1990 High Speed ESP | L Rare 1991 IronSword – Wizards & Warriors II USA | L Zippo Games 1989 Ivan ”Ironman” Stewart's Super Off Road EEC | L Leland / Rare 1990 Journey to Silius EEC | L Sunsoft / Tokai Engineering 1990 Kings of the Beach USA | L EA / Konami 1990 Kirby's Adventure USA | L HAL Laboratory 1993 The Legend of Zelda FRA | L Nintendo 1986 Little Nemo – The Dream Master SCN | L Capcom 1990 Mike Tyson's Punch-Out!! EEC | L Nintendo 1987 Mission: Impossible USA | L Konami 1990 Monster in My Pocket NOE | L Team Murata Keikaku 1992 Ninja Gaiden II: The Dark Sword of Chaos USA | L Tecmo 1990 Rescue: The Embassy Mission EEC | L Infogrames Europe / Kemco 1989 Rygar EEC | L Tecmo 1987 Shadow Warriors FRA | L Tecmo 1988 The Simpsons: Bart vs. -

Upcoming Wii Game List

A Partial List of Some Upcoming Wii™ Games Note that game titles are subject to change. Launch dates are TBD. Publisher Game Tony Hawk’s Downhill Jam™ Activision Marvel™: Ultimate Alliance Call of Duty® 3 AQ Interactive Boxing Action Atari Dragon Ball Z Budokai: Tenkaichi 2 Atlus Trauma Center: Second Opinion BANPRESTO Family Action Game Disney’s Chicken Little: Ace in Action Buena Vista Games Disney’s Meet the Robinsons Capcom Resident Evil series SIMPLE series D3Publisher Original Action Game Eidos Title TBD Madden NFL ’07 Electronic Arts Medal of Honor Airborne EPOCH Title TBD From Software Action Game Genki Title TBD BOMBERMAN LAND HUDSON SOFT Flight Game JALECO Title TBD KOEI Sengoku Action Elebits Konami Digital Entertainment Soccer Game Majesco Bust-A-Move Revolution BOKUJO MONOGATARI Heroes Marvelous Interactive KAWA NO NUSHITSURI Original Simulation Mastiff Mr. D. Goes to Town (working title) The Ant Bully Midway Games Happy Feet New Vertical Scroll Shooting Game MILESTONE New Action Game Character Action Game MTO SAN-X All-star Revolution – more – A Partial List of Some Upcoming Wii Games Page 2 FINAL FURLONG Mobile Suit GUNDAM SD GUNDAM G BREAKER DIGIMON NAMCO BANDAI Games ONE PIECE UNLIMITED ADVENTURE New Action Game New RPG TAMAGOTCHI Title TBD Natsume (developed by Marvelous) Harvest Moon Disaster: Day of Crisis™ Excite Truck™ Fire Emblem™ Metroid® Prime 3: Corruption Nintendo Project H.A.M.M.E.R. ™ Super Mario® Galaxy The Legend of Zelda®: Twilight Princess WarioWare™: Smooth Moves Wii Sports Super Monkey Ball Banana Blitz -

Brochure2106e.Pdf

President Shuichi Motoda 2 MARVELOUS COMPANY PROFILE For games, video, music and stage. Excitement has no borders. After food, clothing and shelter comes fun. To have fun is to live. The more we keep our hearts entertained, the more fulfilling our lives will be. Marvelous Inc. is an all-round entertainment company that produces fun. We create interesting and original intellectual property (IP) for games, video, music and stage. Leveraging our strength in “multi-content, multi-use and multi-device,” we transcend changes in the times to consistently create fresh entertainment. We strive to deliver wonder and excitement never seen before to the people of the world. Before you know it, we will be one of Japan’s leading content providers. And we will be an entertainment company that offers a multitude of challenges and thrills and leaves people wondering, “What’s coming next from this company?” Personally, I’m really looking forward to what lies ahead at Marvelous. President Shuichi Motoda MARVELOUS COMPANY PROFILE 3 Comprehensive entertainment company NE GAM NLI E that produce O multi-content "Various entertainment contents" in multi-use Various entertainment "Various business areas" for contents Various business areas "Various devices" C L O A N U S Managing policy S U I V Creating new entertainment M & E to provide R IO G “ Wonder ”and“ Excitement ” A multi-device D M AU to the world E Various devices 4 MARVELOUS COMPANY PROFILE In the Online Game Business, we are engaged in the planning, development, and operation of online games for App Store, Google Play, and SNS platforms. -

G Gam Me Spa Ace E

Gamespace Plaay & Architecture in Videoogames Georgia Leigh McGregor Doctor of Philosophy School of Media Arts, University of New South Wales 2009 ii Abstract Videogames are created for play. In videogames play takes place in an artificially constructed environment – in gamespace. Gameplay occurs in gamespace. To understand videogames, it is essential to understand how their spaces are implicated in play. This thesis asks what are the relationships between play and space in videogames? This thesis examines the relationships between space and play by looking at how architecture is constructed in gamespace and by looking at gamespace as an architectonic construct. In short, this thesis examines the architecture in and of gamespace. The relationships between space and play in videogames are examined by looking at the structure of gamespace, by looking at the differences between real space and gamespace and by analysing architectural and spatial functionality. This thesis discovers a series of important relationships between space and play, arguing that gamespace is used to create, manipulate and control gameplay, while gameplay dictates and influences the construction of gamespace. Particular forms of play call for particular constructions of gamespace. Particular types of gamespace construct play in particular ways. This thesis identifies a number of ways in which gamespace is configured for play. Finally this thesis operates as a conceptual framework for understanding gamespace and architecture in videogames. iii Contents Abstract ii Acknowledgements -

RAC-962 Art 1

Disponível em http://www.anpad.org.br/rac RAC, Rio de Janeiro, v. 17, n. 1, art. 1, pp. 1-17, Jan./Fev. 2013 A New Conceptual Model for Business Ecosystem Visualization and Analysis Luiz Felipe Hupsel Vaz * E-mail: [email protected] Universidade Federal do Rio de Janeiro – COPPEAD/UFRJ Rio de Janeiro, RJ, Brasil. Antonio Roberto Ramos Nogueira E-mail: [email protected] Universidade Federal do Rio de Janeiro – COPPEAD/UFRJ Rio de Janeiro, RJ, Brasil. Marco Aurélio de Souza Rodrigues E-mail: [email protected] Universidade Federal do Rio de Janeiro – COPPEAD/UFRJ Rio de Janeiro, RJ, Brasil. Paula Castro Pires de Souza Chimenti E-mail: [email protected] Universidade Federal do Rio de Janeiro – COPPEAD/UFRJ Rio de Janeiro, RJ, Brasil. * Endereço: Luiz Felipe Hupsel Vaz COPPEAD-UFRJ, Rua Pascoal Lemme, 355, Ilha do Fundão, Rio de Janeiro/RJ, 21941-918. Artigo recebido em 20.06.2012. Última versão recebida em 23.11.2012. Aprovado em 24.11.2012. L. F. H. Vaz, A. R. R. Nogueira, M. A. de S. Rodrigues, P. C. P. de S. Chimenti 2 Resumo O presente estudo teve por objetivo plotar os efeitos de externalidade de rede e de softwares superstars na visualização e análise de ecossistemas de negócios. O resultado foi possível por meio da coleta de resultado de vendas de jogos, a partir de um site da indústria, associando cada venda a um consumidor único e utilizando um software de visualização de redes. O produto final foi um gráfico que mostra o posicionamento estratégico de editores e plataformas, servindo como ferramenta estratégica para acadêmicos e profissionais. -

REPLY COMMENTSOF the MUSEUMOF ART and DIGITALENTERTAINMENT Item A. Commenter Information Museum of Art and Digital Entertainmen

REPLY COMMENTS OF THE MUSEUM OF ART AND DIGITAL ENTERTAINMENT Item A. Commenter Information Museum of Art and Digital Entertainment Represented by Alex Handy Samuelson Law, Technology & Public Policy Clinic 3400 Broadway Univ. of California, Berkeley, School of Law Oakland, CA 94611 Rob Walker (510) 282-4840 Brookes Degen [email protected] Michael Deamer 334 Boalt Hall, North Addition Berkeley, CA 94720 (510) 664-4875 [email protected] The Museum of Art and Digital Entertainment (the “MADE”) is a 501(c)(3) non-profit organization in Oakland, California dedicated to the preservation of video game history. The MADE supports the technical preservation of video games, presents exhibitions concerning historically significant games, and hosts lectures, tournaments, and community events. The MADE has personal knowledge and experience regarding this exemption through past participation in the sixth tri- ennial rulemaking relating to access controls on video games. The MADE is represented by the Samuelson Law, Technology & Public Policy Clinic at the Univer- sity of California, Berkeley, School of Law (“Samuelson Clinic”). The Samuelson Clinic is the lead- ing clinical program in technology and public interest law, dedicated to training law and graduate students in public interest work on emerging technologies, privacy, intellectual property, free speech, and other information policy issues. ITEM B. PROPOSED CLASS ADDRESSED Proposed Class 8: Computer Programs—Video Game Preservation ITEM C. OVERVIEW 1. Introduction From 1912 to -

May 20, 2019 Final Fantasy XI Online

RETAIL COUNT: 555 DIGITAL COUNT: 289 TOTAL COUNT: 844 LAST UPDATE: May 20, 2019 Final Fantasy XI Online – 2007 Edition Square Enix 2007 EUR | CiB Final Fantasy XI Online – Starter Pack Square Enix 2007 EUR | CiB Nox Westwood Studios 2000 EUR | L Worms 2 Team17 Software 1997 EUR | L Amnesia: The Dark Descent Frictional Games 2010 EUR Baldur's Gate – Enhanced Edition BioWare / Overhaul Games 2012 EUR Dota 2 Valve 2013 EUR Final Fantasy VII Square Enix 2012 EUR Portal Valve 2007 EUR Tom Clancy's Splinter Cell: Chaos Theory Ubisoft Montréal 2005 EUR Beneath a Steel Sky Revolution Software 1994 EUR Fallout InterplayInterplay ProductionsProductions 1997 EUR Fallout 2 Black Isle Studios 1998 EUR Leisure Suit Larry: Love for Sail! Sierra On-Line 1996 EUR Lure of the Temptress Revolution Software 1992 EUR Machinarium [Collector's Edition] Amanita Design 2009 EUR SimCity Maxis Software 1989 EUR Supaplex Think!Ware Development 1991 EUR The Elder Scrolls: Arena Bethesda Softworks 1994 EUR The Elder Scrolls: Chapter II – Daggerfall Bethesda Softworks 1996 EUR Star Wars: The Old Republic BioWare Austin 2011 EUR 8 Eyes Thinking Rabbit 1988 USA | L Adventures in the Magic Kingdom Capcom 1990 SCN | L Astérix New Frontier / Bit Managers S.L. 1993 FRA | L Batman – The Video Game Sunsoft 1989 EEC | L The Battle of Olympus InfinityInfinity 1988 NOE | CiB Bionic Commando Capcom 1988 EEC | L Blue Shadow Natsume 1990 UKV | L Bubble Bobble Taito 1987 UKV | CiB Castlevania Konami 1986 USA | L Castlevania II: Simon's Quest Konami 1987 EEC | L Castlevania III: Dracula's -

AQ INTERACTIVE INC. (TSE2 Securities Code: 3838) May 18, 2011

Business Results for the Fiscal Year Ended March 31, 2011 AQ INTERACTIVE INC. (TSE2 Securities Code: 3838) May 18, 2011 Copyright © AQ INTERACTIVE INC. All rights reserved. Contents P.3 Summary of FY3/11 Consolidated Business Results P.12 Consolidated Financial Forecast for FY3/12 P.19 Launch of Marvelous AQL, Inc. Copyright © AQ INTERACTIVE INC. All rights reserved. 2 Summary of FY3/11 Consolidated Business Results Copyright © AQ INTERACTIVE INC. All rights reserved. Summary of FY3/11 Consolidated Business Results (Versus FY3/10) Consumer Game and Arcade Game Businesses post declines Net Sales Total sales reached last year’s level due to Network Content Business’s growth Operating Driven by Network Content Business’s earnings, recorded significant improvement Income One-time profit boost due to sales of MICRO CABIN INC. shares (¥236 million) Net Income One-time loss due to cancellation of title development project (¥157 million); special retirement payout (¥66 million); lump-sum amortization of goodwill (¥34 million) Consolidated FY3/10 Actual FY3/11 Actual YoY (\ million) Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Change Net Sales 764 2,143 1,461 2,829 7,197 1,596 2,001 1,861 1,779 7,239 0.6% Gross Profit 47 691 465 1,383 2,586 898 1,107 662 975 3,644 40.9% SG&A Expenses 640 635 597 655 2,527 654 612 538 767 2,573 1.8% Operating Income ▲ 593 55 ▲ 132 728 58 244 495 123 207 1,070 1744.8% Ordinary Income ▲ 594 41 ▲ 124 740 63 221 475 123 220 1,041 1552.4% Extraordinary Income - - 18 47 65 3 0 0 238 241 270.8% Extraordinary Loss 8 44 3 1 56 -

Final Fantasy Vii (1997): It’S Never Final in the World of Fantasy

Like what you see? Buy the book at the Focal Bookstore Vintage Games Bill Loguidice and Matt Barton ISBN 978-0-240-81146-8 7 FINAL FANTASY VII (1997): IT’S NEVER FINAL IN THE WORLD OF FANTASY For countless gamers in the United States and Japan, the Final Fantasy series are more than just games—they’re the games. Just hearing the word “Chocobo” or “Moogle”1 is enough to tickle the thumbs of dedicated fans all over the world. Indeed, few video- game franchises in the history of the industry have enjoyed the popularity, longevity, and high acclaim of Hironobu Sakaguchi’s epic series. The fi rst Final Fantasy , developed during a fi nancial crisis at Square, not only rescued the company but soon became Final Fantasy VII offered an immense area to explore, including populated towns where players could buy equipment, talk to the locals, and advance the plot. The red triangles indicate possible exits, and the white glove makes it easier to spot the main character. 1 Not to be confused with J. K. Rowling’s word “Muggle,” meaning a person not born in a magical world and lacking any sort of magical ability, in the 1997 U.K. book Harry Potter and the Philosopher’s Stone . 77 78 Chapter 7 FINAL FANTASY VII (1997): IT’S NEVER FINAL IN THE WORLD OF FANTASY a defi nitive console role-playing game—a reputation the series continues to enjoy. Because the series is much too lengthy and complex to cover adequately in a single chapter, we’ve decided to focus here on Final Fantasy VII.