Baltimore Retail Market SECOND QUARTER | 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Baltimore County Visitor's Guide

VISITORS GUIDE EnjoyBaltimoreCounty.com Crab Cake Territory | Craft Beer Destination PAPPASPAPPAS RESTAURANTRESTAURANT&: & SPORTSSPORTS BARBAR Ship our famous crab cakes nationwide: 1-888-535-CRAB (2722) or www.PappasCrabCakes.com Oprah’s Favorite Crab Cake OPENING BALTIMORE RAVENS SEASON 2018 Pappas Seafood Concession Stand inside M&T Bank Stadium’s lower level! CHECK OUT PAPPAS AT MGM NATIONAL HARBOR AND HOLIDAY INN INNER HARBOR PAPPAS MGM 301-971-5000 | PAPPAS HOLIDAY INN 410-685-3500 PARKVILLE COCKEYSVILLE GLEN BURNIE PAPPAS 1725 Taylor Avenue 550 Cranbrook Rd. 6713 Governor Ritchie Hwy SEAFOOD COMPANY Parkville, MD 21234 Cockeysville, MD 21030 Glen Burnie, MD 21061 1801 Taylor Avenue 410-661-4357 410-666-0030 410-766-3713 Parkville, MD 21234 410-665-4000 PARKVILLE & COCKEYSVILLE LOCATIONS Less than fi ve miles Serving carry out Private Dining available: 20–150 ppl. from BWI Airport! steamed crabs year round! 2 EnjoyBaltimoreCounty.com Featuring farm brewed beers from Manor Hill Brewing, brick oven pizzas, and other seasonal offerings in Old Ellicott City. • Manor Hill Tavern is a roud th family owned V t · p part of e plenty .. 1c oria Restaurant Group. Columbia. MD Clarksville. MD v1ctoriagas-tropub com foodplenty com EnjoyBaltimoreCounty.com 3 ENJOYr.AI, .. #,, BALTIMORE~~ CONTENTS ON THE COVER: Boordy Vineyards Located in northern Baltimore County 8 Celebrate With Us in the Long Green Valley, Boordy Vine- yards is Maryland’s oldest family-run winery, having been established in 12 The Arts for Everyone 1945. Boordy is owned and operated by the Deford family, for whom “grow- 14 Wine Country ing and making wine is our life and our pleasure.” Boordy reigns as a leading winery in the region. -

BALTIMORE COUNTY Hunt Valley Towne Center, Legal Owner PRISMM Ofhunt Valley, LLC, * Case No

IN RE: PETITION FOR SPECIAL EXCEPTION * BEFORE THE N/S Shawan Road, 1,382' NE of clline McConnick Road * ZONING COMMISSIONER (118 Shawan Road) 8th Election District * FOR 3rd Council District * BALTIMORE COUNTY Hunt Valley Towne Center, Legal Owner PRISMM ofHunt Valley, LLC, * Case No. 2009-0272-X Contract Lessee * Petitioners * * * * * * * * * * FINDINGS OF FACT AND CONCLUSIONS OF LAW This matter comes before the Zoning Commissioner for consideration of a Petition for Special Exception filed by PRISMM of Hunt Valley, LLC tla Damon's of Hunt Valley, the lessee of the subject property, legally owned by Hunt Valley Towne Center, LLC c/o Greenberg Commercial, by and through their attorney C. William Clark, Esquire. The Petitioners request a special exception for an arcade, as a use in combination with a restaurant, in a B.M.-C.T. zone, pursuant to Sections 423.1B and 422.1A(1l) of the Baltimore County Zoning Regulations (B.C.Z.R.). The subject property and requested relief are more particularly described on the site plan submitted into evidence and marked as Petitioner's Exhibit 1 and the interior layout of the restaurant marked into evidence as Petitioners' Exhibit 2. Appearing at the requisite public hearing in support of the request were Joseph J. Stonik, l appearing on behalf of Petitioner , Rick Richardson, a professional engineer with Richardson I: ·t Engineering, LLC, the engineering consultants who prepared the site plan for the property, and if,"'8 ": t,{' ~ rf'; C. William Clark, Esquire, of Nolan, Plumhoff & Williams, Chtd, attorney for Petitioner. ~ ~ ~"{. Appearing as an interested citizen was Mary Ellen Morrison, a member of the Hunt Valley ~,~llI It ;> 'U ,~ti l 4 ~~ J 1 Mr. -

The Dying Mall Reinventing Shopping Malls to Revitalize the Community the Dying Mall

THE DYING MALL REINVENTING SHOPPING MALLS TO REVITALIZE THE COMMUNITY The Iconic American Shopping Mall THE DYING MALL One third of the 1,200 US enclosed shopping malls are dead or endangered. The Iconic American Shopping Mall THE DYING MALL • Changing demographics and tastes • Loss of anchor stores • Loss of national retail chains • Being replaced by lifestyle centers and power centers • Online Shopping Community Impact THE DYING MALL • Big problem for the community • Loss of community vibrancy • Loss of tax revenue • Difficult to refill the space Reinvention THE DYING MALL • What’s the solution? • What can the community do? • Rethink the enclosed shopping mall. The Panel THE DYING MALL The Dying Mall - Overview Terry L. Reed, Vice President SSM Group, Inc. Malls Revisioned - Success Stories Drew A. Romanic, Associate Principal The Martin Architectural Group Zoning, Contract, and Regulatory Issues in Redevelopment Joseph G. Riper, Shareholder Riley Riper Hollin & Colagreco Bringing New Life to a Delaware County Suburban Mall Michael P. Markman, President BET Investments MALLS REVISIONED - SUCCESS STORIES Drew A. Romanic, Associate Principal The Martin Architectural Group MALLS REVISIONED - SUCCESS STORIES Original Aerial Original BEFORE: Hunt Valley Mall Valley Hunt BEFORE: MALLS REVISIONED - SUCCESS STORIES Current New with Aerial Residential AFTER: Hunt Valley Towne Centre Towne Valley Hunt AFTER: Mall Interior View MALLS REVISIONED Mall Interior View Entry to Food Court Area Upper Level - SUCCESS STORIES BEFORE: Hunt Valley Mall MALLS -

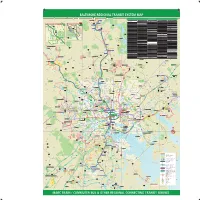

Baltimore Regional Transit System Map Marc Train

BALTIMORE REGIONAL TRANSIT SYSTEM MAP ional at Cir n r e Hunt Valley t n Regal Hunt G PLACES OF INTEREST I Towne Valley u HUNT VALLEY Centre n Stadium 12 p 9 International Cir HUNT VALLEY o MAJOR ATTRACTIONS/LANDMARKS MAJOR ATTRACTIONS/LANDMARKS SHOPPING CENTERS GOVERNMENT FACILITIES HOSPITALS/OTHER MEDICAL w B S MD d e haw American Visionary World Trade Center DT Arundel Mills I2 Baltimore City Courthouse DT Bon Secours Hospital F3 Dear Friends: a a e v n R Farmers Rd e d per r Arts Museum F4 r ep War Memorial DT Avenue at White Marsh D7 Baltimore City Detention Center DT Children’s Hospital E3 Market P F D a a Arena Players DT m l Erdman Shopping Center E5 Baltimore City Hall DT Franklin Square Hospital D6 Thank you for your interest in Maryland and our award winning public transportation system operated by the Maryland ls R Schilling Cir PEPPER ROAD Avenue Market E3 d MAJOR EMPLOYMENT CENTERS Eastpoint Mall F6 Baltimore City Jail DT Good Samaritan Hospital D5 #"" # M %"%" #"" ##"" # J #"" # o HUNT VALLEY B & O Railroad Museum DT Transit Administration (MTA). With Local Bus, Commuter Bus, Light Rail, Metro Subway, MARC Train and Mobility/Paratransit Oregon c Airport 100 Business Park I2 Baltimore City Police HQ DT Greater Baltimore 97 n 98 C The Gallery DT n e o L s McCORMICK ROAD BUSINESS g 0th St r Baltimore Convention Center DT Medical Center C4 n G Jones 4 U m Airport Square H3 Baltimore County Courthouse C4 ri r niv 143 Glen Burnie Mall H4 p Rola Bee e F i COMMUNITY S Fa e a c d t St Elm l k options, the MTA can quickly and affordably transport you throughout the Baltimore Region and Central Maryland. -

In the United States Bankruptcy Court for the District of Delaware

Case 20-13076-BLS Doc 148 Filed 12/15/20 Page 1 of 62 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------------- x In re: : Chapter 11 : FRANCESCA’S HOLDINGS CORPORATION, : Case No. 20-13076 (BLS) et al.,1 : Debtors. : Jointly Administered ------------------------------------------------------------------- x AFFIDAVIT OF SERVICE I, Victoria X. Tran, depose and say that I am employed by Stretto, the claims and noticing agent for the Debtors in the above-captioned case. Commencing on December 9, 2020, at my direction and under my supervision, employees of Stretto caused the following documents to be served via first-class mail on the service list attached hereto as Exhibit A, and via first-class mail to thirty-two thousand seven hundred and sixty four (32,764) confidential parties not listed herein: • Notice of Telephonic Section 341 Meeting (Docket No. 65) • Notice of Chapter 11 Bankruptcy Case (Docket No. 107) In addition to the methods of service set forth herein, parties who have requested electronic notification of filings via the Bankruptcy Court’s CM/ECF system were sent the above referenced documents via electronic service. Dated: December 15, 2020 Victoria X. Tran State of Colorado ) ) SS. County of Denver ) Subscribed and sworn before me this 15th day of December 2020 by Victoria X. Tran. ____________________________________________ 1 The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are Francesca’s Holdings Corporation (4704), Francesca’s LLC (2500), Francesca’s Collections, Inc. (4665), and Francesca’s Services Corporation (5988). The address of the Debtors’ corporate headquarters is 8760 Clay Road, Houston, Texas 77080. -

In the United States Bankruptcy Court for the District of Delaware

Case 20-13078-BLS Doc 7 Filed 12/31/20 Page 1 of 67 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x In re: : Chapter 11 : FRANCESCA’S HOLDINGS CORPORATION, : Case No. 20-13076 (BLS) 1 et al., : Debtors. : Jointly Administered ------------------------------------------------------------ x STATEMENT OF FINANCIAL AFFAIRS FOR FRANCESCA'S COLLECTIONS, INC. (CASE NO. 20-13078) ____________________________________________ 1 The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are Francesca’s Holdings Corporation (4704), Francesca’s LLC (2500), Francesca’s Collections, Inc. (4665), and Francesca’s Services Corporation (5988). The address of the Debtors’ corporate headquarters is 8760 Clay Road, Houston, Texas 77080. Case 20-13078-BLS Doc 7 Filed 12/31/20 Page 2 of 67 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x : In re: : Chapter 11 : Case No. 20-13076 (BLS) FRANCESCA’S HOLDINGS CORPORATION, : et al.,1 : Jointly Administered : Debtors. : ------------------------------------------------------------ x GLOBAL NOTES, METHODOLOGY, AND SPECIFIC DISCLOSURES REGARDING THE DEBTORS’ SCHEDULES OF ASSETS AND LIABILITIES AND STATEMENTS OF FINANCIAL AFFAIRS Introduction Francesca’s Holdings Corporation and its affiliated debtors and debtors in possession (collectively, the “Debtors”), with the assistance of their advisors, have filed their respective Schedules of Assets and Liabilities (collectively, the “Schedules”) and Statements of Financial Affairs (collectively, the “Statements and together with the Schedules, the “Schedules and Statements”) with the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”), pursuant to section 521 of title 11 of the United States Code, §§ 101- 1532, et seq. -

IN the UNITED STATES BANKRUPTCY COURT for the DISTRICT of DELAWARE ------X in Re: : Chapter 11 : FRANCESCA’S HOLDINGS CORPORATION, : Case No

Case 20-13076-BLS Doc 493 Filed 02/24/21 Page 1 of 4 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x In re: : Chapter 11 : FRANCESCA’S HOLDINGS CORPORATION, : Case No. 20-13076 (BLS) et al.,1 : Debtors. : Jointly Administered : : Re: D.I. 384 ------------------------------------------------------------ x NOTICE OF BUYER’S DESIGNATION OF EXECUTORY CONTRACTS AND UNEXPIRED LEASES AS ASSUMED CONTRACTS, RETAINED CONTRACTS, AND REJECTED CONTRACTS AS OF CLOSING DATE OF SALE OF SUBSTANTIALLY ALL OF THE DEBTORS’ ASSETS PLEASE TAKE NOTICE that, on January 22, 2021, the United States Bankruptcy Court for the District of Delaware entered the Order (A) Approving the Purchase Agreement; (B) Authorizing the Sale of Substantially All of the Debtors’ Assets Free and Clear of All Liens, Claims, Encumbrances and Interests; (C) Authorizing the Assumption and Assignment of Certain Executory Contracts and Unexpired Leases; and (D) Granting Related Relief [D.I. 384] (the “Sale Order”),2 which, among other things, authorized Francesca’s Holdings Corporation and its affiliated debtors and debtors in possession (collectively, the “Debtors”) to consummate the Sale to Buyer pursuant to the terms of the Purchase Agreement. PLEASE TAKE FURTHER NOTICE that the closing of the transactions contemplated by the Purchase Agreement occurred on January 30, 2021 (the “Closing”). 1 The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are Francesca’s Holdings Corporation (4704), Francesca’s LLC (2500), Francesca’s Collections, Inc. (4665), and Francesca’s Services Corporation (5988). The address of the Debtors’ corporate headquarters is 8760 Clay Road, Houston, Texas 77080. -

Mall List By

September 30, 2021 DMA Average HH GLA Monthly Rank DMA Mall Name City State Income Sq. Ft. Traffic 1 New York, NY Bridgewater Commons Bridgewater NJ $124,791 970,000 1,194,000 1 New York, NY Broadway Commons Hicksville NY $134,338 1,153,302 700,000 1 New York, NY Galleria at White Plains White Plains NY $87,375 900,000 1,026,000 1 New York, NY Monmouth Mall Eatontown NJ $126,404 1,500,000 823,000 1 New York, NY Paramus Park Mall Paramus NJ $123,848 771,000 774,195 1 New York, NY Staten Island Mall Staten Island NY $69,445 1,274,000 1,675,202 1 New York, NY Woodbridge Center Woodbridge NJ $88,656 1,633,000 1,533,644 2 Los Angeles, CA Galleria at Tyler Riverside CA $72,983 1,200,000 1,010,000 2 Los Angeles, CA MainPlace Mall Santa Ana CA $110,747 1,100,000 612,000 2 Los Angeles, CA Northridge Fashion Center Northridge CA $80,145 1,440,000 1,753,000 2 Los Angeles, CA Panorama Mall Panorama City CA $59,148 312,000 804,000 2 Los Angeles, CA Plaza West Covina West Covina CA $93,904 1,200,000 641,000 2 Los Angeles, CA Simi Valley Town Center Simi Valley CA $99,151 637,728 451,000 2 Los Angeles, CA The Shoppes at Chino Hills Chino Hills CA $102,746 375,000 210,000 3 Chicago, IL Fox Valley Mall Aurora IL $117,024 1,500,000 631,000 3 Chicago, IL Hawthorn Mall Vernon Hills IL $159,578 1,300,000 521,000 3 Chicago, IL Northbrook Court Northbrook IL $121,617 1,000,000 1,047,000 3 Chicago, IL Spring Hill Mall West Dundee IL $98,009 1,370,000 1,282,000 3 Chicago, IL The Promenade Bolingbrook Bolingbrook IL $82,921 750,000 1,000,000 4 Philadelphia, PA Christiana Mall Newark DE $84,666 1,278,000 1,617,000 4 Philadelphia, PA Hamilton Mall Hamilton Township NJ $81,561 1,036,000 1,000,000 4 Philadelphia, PA Neshaminy Mall Bensalem PA $72,061 1,020,000 1,043,000 4 Philadelphia, PA Palmer Park Mall Easton PA $73,957 457,000 537,000 5 Dallas-Ft. -

State Highway Administration Research Report Trip

MD-09-SP808B4J Martin O’Malley, Governor Beverley Swaim-Staley, Secretary Anthony G. Brown, Lt. Governor Neil J. Pedersen, Administrator STATE HIGHWAY ADMINISTRATION RESEARCH REPORT TRIP GENERATION STUDIES FOR SPECIAL GENERATORS MANSOUREH JEIHANI AND RICARDO A. CAMILO MORGAN STATE UNIVERSITY Project number MD-09-SP808B4J FINAL REPORT December 2009 The contents of this report reflect the views of the author who is responsible for the facts and the accuracy of the data presented herein. The contents do not necessarily reflect the official views or policies of the Maryland State Highway Administration. This document is disseminated under the sponsorship of the U.S. Department of Transportation, University Transportation Centers Program, in the interest of information exchange. The U.S. government assumes no liability for the contents or use thereof. This report does not constitute a standard, specification or regulation. Technical Report Documentation Page Report No. 2. Government Accession No. 3. Recipient's Catalog No. MD-09-SP808B4J 4. Title and Subtitle 5. Report Date Trip Generation Studies for Special Generators September 2009 6. Performing Organization Code 7. Author/s 8. Performing Organization Report No. Mansoureh Jeihani and Ricardo Camilo 9. Performing Organization Name and Address 10. Work Unit No. (TRAIS) Morgan State University 1700 E. Cold Spring Lane Baltimore, MD 21251 11. Contract or Grant No. SP808B4J 12. Sponsoring Organization Name and Address 13. Type of Report and Period Covered Maryland State Highway Administration Final Report Office of Policy & Research 14. Sponsoring Agency Code 707 North Calvert Street (7120) STMD - MDOT/SHA Baltimore MD 21202 Morgan State University National Transportation Center 1700 East Cold Spring Lane Baltimore, MD 21251 15. -

In Maryland—And 21/2 Times More Likely to Be on Food Stamps

PETER ANGELOS’ LAWSUIT The Orioles owner takes on Otis Elevator. PAGE 3 ON THE WEB: baltimorebusinessjournal.com FACEBOOK TWITTER: bbjonline Vol. 28 No. 37 © 40 Pages January 14-20, 2011 $3.00 In Md., specter of budget cuts looms A $1.6B shortfall has Medicaid accounts for business groups fearful $1.1B of projected gap SCOTT DANCE | STAFF EMILY MULLIN | STAFF [email protected] [email protected] Where the 2010 General Assembly Don’t be surprised if lawmakers’ bud- session had action, in 2011, there will get ax falls hardest on Maryland’s health likely be reaction. care industry this year. There will be scarce time or money That’s because Medicaid, the state’s for more than a select few business ini- health care program for low-income resi- tiatives this year, as the first year of a dents that makes up about half of Mary- new political cycle is focused on dulling land’s annual budget, is responsible for a $1.6 billion budget gap’s blow to public nearly three-fourths of its looming $1.6 education, health care and safety. That billion budget chasm. contrasts with a pre-election 2010 ses- With a $900 million Medicaid budget sion that included a long list of programs hole projected for the fiscal year that be- aimed at helping business- gins July 1, and another $225 million gap es recover from the reces- still to plug in this year’s budget, Mary- sion. NICHOLAS GRINER | STAFF land is staring at a more than $1.1 billion It has business leaders Gov. -

Baltimore County, Maryland; (Ii) Under Existing Law, the Bans and the Interest NEW ISSUES–Book-Entryonly

PRELIMINARY OFFICIAL STATEMENT DATED FEBRUARY 21, 2018 NEW ISSUES – Book-Entry Only Fitch Ratings: Moody’s Investors Service: S&P Global Ratings: See “Ratings” Official Statement Relating to the Issuance of $491,000,000 BALTIMORE COUNTY, MARYLAND General Obligation Bond Anticipation Notes $245,000,000 Baltimore County Metropolitan District Bond Anticipation Notes – 2018 Series $246,000,000 Baltimore County Consolidated Public Improvement Bond Anticipation Notes – 2018 Series Dated: Date of Delivery Due: March 18, 2019 The Bond Anticipation Notes (“BANs”) will be issuable as fully registered notes in the denomination of $5,000 each or any integral multiple thereof. As described under “DESCRIPTION OF THE BANS - Book-Entry Only System,” the BANs will initially be issued in book-entry form and registered in the name of Cede & Co., as nominee of The Depository Trust Company, New York, New York (“DTC”), to which principal and interest payments on the BANs will be made so long as Cede & Co. is the registered owner of the BANs. The BANs will bear interest from the date of delivery to the maturity date of the BANs, computed on the basis of a year consisting of twelve 30- day months. Interest on the BANs will be payable on September 18, 2018 and the maturity date of the BANs. Baltimore County, Maryland will act as Paying Agent and Note Registrar. The BANs are not redeemable prior to maturity. In the opinion of Bond Counsel, (i) the BANs will be valid and legally binding general obligations of Baltimore County, Maryland; (ii) under existing law, the BANs and the interest payable on them are exempt from State of Maryland and local taxation; no opinion is expressed as to estate or inheritance taxes, or any other taxes not levied or assessed directly on the BANs or the interest thereon; and (iii) assuming compliance with certain covenants described herein and under existing statutes, regulations and decisions, interest on the BANs will be excludable from gross income for federal income tax purposes. -

In the United States Bankruptcy Court for the District of Delaware

Case 20-13076-BLS Doc 1022 Filed 08/05/21 Page 1 of 150 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x In re: : Chapter 11 : 1 FHC HOLDINGS CORPORATION, et al., : Case No. 20-13076 (BLS) : Debtors. (Jointly Administered) : ------------------------------------------------------------ x AFFIDAVIT OF SERVICE I, Amanda Hinchey, depose and say that I am employed by Stretto, the claims and noticing agent for the Debtors in the above-captioned case. On July 30, 2021, at my direction and under my supervision, employees of Stretto caused the following documents to be served via first-class mail on the service list attached hereto as Exhibit A, and via electronic mail on the service list attached hereto as Exhibit B: • Sixth Monthly Application for Compensation and Reimbursement of Expenses of Province, LLC as Financial Advisor to the Official Committee of Unsecured Creditors, for the Period from May 1, 2021 Through May 31, 2021 (Docket No. 1015) • Twentieth Notice of Assumption and Assignment of Certain Executory Contracts and Unexpired Leases (Docket No. 1016) • Notice of (I) Confirmation of Debtors’ First Amended Combined Disclosure Statement and Chapter 11 Plan of Liquidation and (II) Occurrence of the Effective Date (Docket No. 1017) Furthermore, on July 30, 2021, at my direction and under my supervision, employees of Stretto caused the following document to be served via first-class mail on Francesca’s Holdings Corporation at Attn: Kate Venturina, 8760 Clay Road, Houston, TX 77080, and via electronic mail on the service list attached hereto as Exhibit C: • Notice of Filing of Quarterly Report Regarding Payments Made to Ordinary Course Professionals During the Period from April 1, 2021 Through June 30, 2021 (Docket No.