Can I Qualify for a Business Loan SBDC

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Financing Your Business Financial Options and Funding Sources

FINANCING YOUR BUSINESS Financial Options and Funding Sources 25 • Financing Options » SBA’s Loan Guaranty Programs 26 » Commercial Loans 29 » SBA Micro Lenders 29 30 • Funding Sources » Arizona’s Incentives, Programs and Grants 31 » Funding for Innovation and Technology Companies 32 While every effort has been made to ensure the reliability of the information presented in this publication, the Arizona Commerce Authority cannot guarantee the accuracy of this information due to the fact that much of the information is created by external sources. Changes/updates brought to the attention of the Arizona Commerce Authority and verified will be corrected in future editions. 3 The Access to Capital Academy presented by the Phoenix Community & Economic Development and Investment Corporation (PCDIC) – helps entrepreneurs learn how to approach potential lenders with confidence and an increased chance at securing loans. 24 AZ EE FINANCING OPTIONS FI NAN CI NG YOUR There are several sources to consider when looking for three years of business tax returns, etc.) and financing. It is important to explore all of your options prospective (projections) basis. before making a decision. Collateral – property pledged by a borrower to protect the interest of the lender. By putting up collateral, you B The primary source of capital for most new businesses US show that you are committed to the success of your come from personal savings and other forms of personal I NESS resources such as friends and family, when starting out. business. While credit cards often are used to finance business A financial institution avoids making loans without needs, there may be better options available, even for F collateral. -

Personal Vs. Business Credit

The Keys to Successful Small Business Ownership, Finance and Credit™ Client Curriculum - Personal vs. Business Credit Small Business Owner Financial With financial support from: Education brought to you by: Sharpen Your Financial Focus® The Keys to Successful Small Business Ownership, Finance and Credit™ National Foundation for Credit Counseling® (NFCC®) - Small Business Owner Counseling Program Client Workbook Version 6.0 March 26, 2018 INTRODUCTION Welcome! It is our goal you find this material helpful as it was hand selected to address some of the most common challenges faced by the self-employed or small business owners. We aim for this content to complement budget counseling sessions for people like you engaged with a member agency of the National Foundation for Credit Counseling® (NFCC®) across the U.S. Whether you just started on a self-employment journey, have a business on the side or have dreams of serving millions, you are important to our national economy and local community by creating a job for yourself or others. It is our hope this program empowers you to make informed decisions about being self-employed and a small business owner by providing you access to a NFCC counselor, information, resources, and tools. As you develop a greater understanding of personal and business finance best practices, you can choose the best course of action to meet your goals. We would like to thank and acknowledge TD Bank, America’s Most Convenient Bank®, and the TD Charitable Foundation, the charitable giving arm of TD Bank, for their support of the NFCC Small Business Owner Financial Counseling and Education Program supporting Small Business Owner Financial Wellness. -

The Arundel Business Loan Fund

Anne Arundel Economic Development Corporation Economic Development Revenue Bonds The ABL Fund is a viable non-bank alternative source of financing ready and Anne Arundel County encourages private- able to assist small businesses in Anne sector financing for economic development Arundel County. The ABL Fund’s partners projects through the issuance of private are: the U.S. Small Business Administration, The Arundel Business activity revenue bonds. Tax-exempt bonds the Maryland Industrial Development Loan Fund Financing Authority (MIDFA), The Maryland provide access to long term capital markets an SBA Lender for fixed-asset financing at tax-exempt Small Business Development Financing rates. Federal tax law limits eligibility to Authority (MSBDFA) and 19 banks Guidelines for a Small Business Loan • Bank of America • Bay Bank • Branch Banking & Trust (BB&T) • Essex Bank • First Mariner Bank • First National Bank • M&T Bank • Old Line Bank • PNC Bank manufacturing facilities, 501(c)(3) non- • Howard Bank profit organizations, and certain energy • Revere Bank projects. Additional limitations apply, • SECU depending on the specific transaction. • Sandy Spring Bank • Severn Savings Bank Most importantly, you have a • SunTrust Bank resource at AAEDC. Contact us • TD Bank with questions and for details. • The Bank of Glen Burnie • The Columbia Bank The Anne Arundel Economic Development Corporation mission is to serve business needs and to increase Anne Arundel County’s economic base through job growth and investment. For more information about the -

Business Financing Opportunities

1st Stop Business Connection www.development.ohio.gov/onestop Revised 08/012010 Business Financing Opportunities Table of Contents Sections Page Number Money 2 -Calculate how much you need Financing 3 - 4 -Types of financing -Business and loan proposals Glossary of Business Terms 5 -A head start on your business vocabulary Federal Loan Programs 6 - 11 State Loan Programs 12 – 17 State Energy Programs 18 - 20 Small Business Development Center Directory 21 -Find the SBDC nearest to you 1 MONEY One of the toughest parts of starting a small business is finding the necessary capital. In other words: Where do you find the money? This publication will help you figure out where to find the money you need to start and run a small business. First, you must know how much money you'll need. Write down the equipment you have and the equipment and inventory you need. How much will it cost to buy or lease the equipment and inventory? Equipment you already have Equipment and inventory you must purchase or lease Cost _______________________ ___________________________________________ $___________ _______________________ ___________________________________________ $___________ _______________________ ___________________________________________ $___________ _______________________ ___________________________________________ $___________ _______________________ ___________________________________________ $___________ TOTAL $ __________ Now, it's time to estimate how much it will cost to keep your business running: Business space $______________________________ -

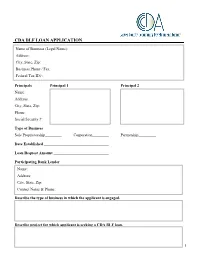

Cda Blf Loan Application

CDA BLF LOAN APPLICATION NameName of of Business Business (Legal (Legal Name): Name): Address:Address: City,City, State, State, Zip: Zip: BusinessBusiness Phone Phone / / Fax: Fax: FederalFederal Tax Tax ID ID#: #: Principals Principal 1 Principal 2 Name: Address: City, State, Zip: Phone: Social Security #: Type of Business Sole Proprietorship Corporation Partnership Date Established Loan Request Amount Participating Bank Lender Name:Name: Address:Address: City,City, State, State, Zip: Zip: ContactContact Person: Name & Phone: Contact Phone: Describe the type of business in which the applicant is engaged. Describe project for which applicant is seeking a CDA BLF loan. 1 EXISTING BUSINESS FINANCING OBLIGATIONS (Date of most recent balance sheet) ORIGINAL AMOUNT/ PRESENT MATURITY INTEREST MONTHLY PAYMENT CREDITOR NAME DATE BALANCE DATE RATE PAYMENT STATUS PROJECT FINANCING SUMMARY SOURCE AND USE OF FUNDS CDA BLF BANK EQUITY OTHER OTHER TOTAL Property Acquisition Site Improvement Building Renovation New Construction Machinery & Equipment Working Capital Inventory Debt Refinancing Other Other Total PROPOSED FINANCING TERMS CDA BLF BANK EQUITY OTHER OTHER TOTAL Amount $ $ $ $ $ $ % of Project Cost % % % % % % Term (years) yrs yrs yrs yrs yrs yrs Interest Rate % % % % % % Debt Service yrs yrs yrs yrs yrs yrs Lien Position Collateral Guarantee ADDITIONAL REQUIRED INFORMATION The information included in the attached “Exhibit A – Application Exhibits” shall also be provided to TCCCF as part of this loan application 2 I declare that the information provided on this application and the accompanying exhibits is true and complete to the best of my knowledge. I understand that the Carver County CDA Business Loan Fund has the right to verify this information and will be in contact with those individuals and institutions involved in the proposed project. -

Public Sector Duplication of Small Business Administration Loan And

PUBLIC SECTOR DUPLICATION OF SMALL BUSINESS ADMINISTRATION LOAN AND INVESTMENT PROGRAMS: AN ANALYSIS OF OVERLAP BETWEEN FEDERAL, STATE, AND LOCAL PROGRAMS PROVIDING FINANCIAL ASSISTANCE TO SMALL BUSINESSES Final Report January 2008 Prepared for: U.S. Small Business Administration Prepared by: Rachel Brash The Urban Institute 2100 M Street, NW ● Washington, DC 20037 Public Sector Duplication of Small Business Administration Loan and Investment Programs: An Analysis of Overlap between Federal, State, and Local Programs Providing Financial Assistance to Small Businesses Final Report January 2008 Prepared By: Rachel Brash The Urban Institute Metropolitan Housing and Communities Policy Center 2100 M Street, NW Washington, DC 20037 Submitted To: U.S. Small Business Administration 409 Third Street, SW Washington, DC 20416 Contract No. GS23F8198H UI No. 07112-020-00 The Urban Institute is a nonprofit, nonpartisan policy research and educational organization that examines the social, economic, and governance problems facing the nation. The views expressed are those of the authors and should not be attributed to the Urban Institute, its trustees, or its funders. Public Sector Duplication of SBA Loan and Investment Programs i CONTENTS INTRODUCTION ..........................................................................................................................1 BACKGROUND............................................................................................................................2 Definition of Duplication ...........................................................................................................2 -

Peoplefund (CDC) 504 Checklist and Loan Application

PeopleFund (CDC) Equal Opportunity 504 Checklist and Loan Application Lender _____ 1. Completed 504 Loan Application and signed Assistance Agreement (this form) _____ 2. Brief History of the Business. (Business Plan for start-ups) _____ 3. Personal History (SBA Form 912): All individuals who own 20% or more, officers, & key managers complete this form. (Write hand-written initials in 4 places.) _____ 4. Resumes of owners and key management (Resume template available) _____ 5. Copy of photo ID (Driver license, etc) _____ 6. Current personal financial statement: not more than 90 days old. (SBA Form 413 or Bank Form may be used.) _____ 7. Personal cash flow statement (Template available) _____ 8. Personal income tax returns (3 years). Include K1s and W-2s. _____ 9. Current interim financial statements of business including income statement, balance sheet, aging reports, and debt schedule; not more than 90 days old. ____ 10. Business income tax returns (3 years) ____ 11. Bank Statements for the business (3 months) ____ 12. Affiliate business tax returns (3 years) ____ 13. Projections of Revenues and Expenses with assumptions, if needed. (2 years for existing operations; Start-ups should provide month-to-month projections for first year.) ____ 14. Cost Documents: Copies of real estate purchase agreement, written construction bid from contractor, written estimate of FF&E from vendor. Include itemized list of professional fees or quotes. ____ 15. For debt refi loan applications: Copies of existing bank loan agreement, promissory note, DOT (recorded), settlement statement (HUD), 12-mo payment history/transcript. ____ 16. For franchised operations: Copy of franchise agreement ____ 17. -

Small Business Loan Fact Sheet

CORONAVIRUS (COVID-19) Small Business Loan Fact Sheet Paycheck Protection Program • Do not require a personal guarantee or collateral for the loan. • Defers payments for six months, but interest will continue to Loan: $349 billion accrue over this period. The Paycheck Protection Program (PPP) allows the Small Business • This loan may be forgiven and not counted as income to the Administration (SBA) to back loans to small businesses suffering person or business, if it’s spent during the first eight weeks on economic losses due to the COVID-19 pandemic through their lo- operating expenses. cal lenders. According to the SBA, the organization currently works with more than 1,800 lenders—including participating SBA 7(a) • To underwrite PPP loans, lenders will need to verify that the lenders, federally insured depository institutions, federally insured borrower was in operation on Feb. 15, 2020, and that it had credit unions and Farm Credit System institutions—and plan to employees for whom it paid salaries and payroll taxes. The expand that number given the anticipated demand. Find lender lender will also have to verify the dollar amount of average near you. The program will be available through June 30, 2020, and payroll costs. The SBA will not review loan applications, accord- banks can begin processing applications on April 3, 2020. Individu- ing to a senior administration official, but lenders will receive als can now download the borrower application and lender applica- an SBA loan number and verify that the applicant has not al- tion forms. The PPP loans: ready received a PPP loan. -

Bulletin No. 2020–21 May 18, 2020 HIGHLIGHTS of THIS ISSUE

HIGHLIGHTS Bulletin No. 2020–21 OF THIS ISSUE May 18, 2020 These synopses are intended only as aids to the reader in identifying the subject matter covered. They may not be relied upon as authoritative interpretations. ADMINISTRATIVE obtained on a group basis for subordinate organizations af- filiated with and under the general supervision or control of a central organization. Rev. Proc. 2020-29, page 859. This procedure modifies Rev. Proc. 2020-1 temporarily to allow for the electronic submission of requests for letter INCOME TAX rulings, closing agreements, determination letters, and information letters issued by the Associate Chief Counsel Notice 2020-32, page 837. (Corporate), Associate Chief Counsel (Financial Institutions This notice provides guidance regarding the nonde- and Products), Associate Chief Counsel (Income Tax and ductibility of costs that are the subject of loan for- Accounting), Associate Chief Counsel (International), Asso- giveness under section 1106 of the Coronavirus Aid, ciate Chief Counsel (Passthroughs and Special Industries), Associate Chief Counsel (Procedure and Administration), Relief, and Economic Security Act (CARES Act), Public and Associate Chief Counsel (Employee Benefits, Exempt Law 116-136, 134 Stat. 281 (March 27, 2020). Organizations, and Employment Taxes). This procedure also contains revised procedures for determination letters Notice 2020-34, page 838. issued by the IRS Large Business and International Division. This notice provides the applicable reference price for qual- ified natural gas production from qualified marginal wells during taxable years beginning in calendar year 2019 for EXEMPT ORGANIZATIONS the purpose of determining the marginal well production credit under §45I. The applicable reference price for taxable Notice 2020-36, page 840. -

World Report 2017

RELIGIOUS FREEDOM WORLD REPORT 2017 Public Affairs and Religious Liberty 12501 Old Columbia Pike Silver Spring, MD 20904 USA RELIGIOUS FREEDOM WORLD REPORT 2017 © 2018 Public Affairs and Religious Liberty 12501 Old Columbia Pike Silver Spring, MD 20904 USA RELIGIOUS FREEDOM WORLD REPORT 2017 4 4 | RELIGIOUS FREEDOM WORLD REPORT 2017 CONTENTS INTRODUCTION 6 COUNTRIES 9 SOURCES 337 THE SEVENTH-DAY ADVENTIST CHURCH & RELIGIOUS FREEDOM 339 THANK YOU 340 CONTACT INFORMATION 341 RELIGIOUS FREEDOM WORLD REPORT 2017 5 RELIGIOUS FREEDOM WORLD REPORT 2017 | 5 INTRODUCTION “Once a self-evident truth, religious freedom is now subject to the deepest deconstructionist suspicion.”1 As a point of contention, this issue goes beyond academic debates, as is evident in a recent report of the United States Civil Rights Commission in which “religious exemptions” are positioned over against civil rights. It states: “Religious exemptions to the protections of civil rights based upon classifications such as race, color, national origin, sex, disability status, sexual orientation, and gender identity, when they are permissible, significantly infringe upon these civil rights.” The chairman of the Commission, in a separate statement, further argued that: “The phrases ‘religious liberty’ and ‘religious freedom’ will stand for nothing except hypocrisy so long as they remain code words for discrimination, intolerance, racism, sexism, homophobia, Islamophobia, Christian supremacy or any form of intolerance.” The framing of religious liberty or assimilation of its content with the above evils is deeply reductionist and troubling. Should “religious liberty” be caught in a crossfire of proxy wars on morality between radical secularists and religiously driven persons? Religious liberty deserves a broader and more legitimate platform. -

Business Plan Workbook Create Your Business Plan Without Creating a Headache the PLAN

Small Business Banking Business Plan Workbook Create your business plan without creating a headache THE PLAN I N T R O D U C T I O N Planning is your map to success THE PLAN helps you find hidden in the business world. You need to business flaws and makes you write a business plan if you are: think carefully about each phase of your business. • starting or buying a business It is important that you write • financing or refinancing your business plan. Why? You your business will gain in-depth knowledge • raising debt or about your business which will equity capital make it easier to answer lenders’ Much money is made then lost questions. The process of writing because one area of a business your business plan will clarify fails, dragging the positive parts what is involved in making your down with it. business work successfully. Design: © NewGround Publications. (Phone: 800 207-3550) Text: © John Nelson & Karen Couto. All rights reserved. Photocopying any part of this book is against the law. This book may not be reproduced in any form, including xerography, or by any electronic or mechanical means, including information storage and retrieval systems, without prior permission in writing from the publisher. 0208 How To Business Loan Basics ASK YOURSELF THESE QUESTIONS: Use This • How much money do I need? ______________________________________ • What type of lender do I need? (bank, state or federal agency, venture capitalist firm, or other investor) ______________________________________ Workbook • What is the lender’s minimum and maximum loan size? ________________ • Can the lender meet my present and future needs?______________________ • What types of businesses will the lender finance? ______________________ Divide your business plan into sections that match the “contents” • What collateral does the lender accept?________________________________ outline shown on the next page. -

2019 Consumer Financial Literacy Survey

2019 Consumer Financial Literacy Survey Prepared For: March 25, 2019 1 Survey Methodology The 2019 Financial Literacy Survey was conducted online within the United States by Harris Poll on behalf of the NFCC (National Foundation for Credit Counseling) between March 8th and March 13th, 2019 among 2,086 U.S. adults ages 18+. Figures for age, sex, race/ethnicity, education, region and household income were weighted where necessary to bring them into line with their actual proportions in the population. Propensity score weighting was used to adjust for respondents’ propensity to be online. Prior to 2013, this survey was conducted by telephone. All sample surveys and polls, whether or not they use probability sampling, are subject to multiple sources of error which are most often not possible to quantify or estimate, including sampling error, coverage error, error associated with nonresponse, error associated with question wording and response options, and post- survey weighting and adjustments. Therefore, Harris Poll avoids the words “margin of error” as they are misleading. All that can be calculated are different possible sampling errors with different probabilities for pure, unweighted, random samples with 100% response rates. These are only theoretical because no published polls come close to this ideal. Respondents for this survey were selected from among those who have agreed to participate in Harris Poll surveys. The data have been weighted to reflect the composition of the adult population. Because the sample is based on those who agreed to participate in the Harris Poll panel, no estimates of theoretical sampling error can be calculated. Significance Testing When results from sub-groups of a sample appear in the detailed tabulations, an indicator of statistically significant differences is added to the tables run on our standard demographic banners.