Section 3.2 — Loans

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cash Management and Fiduciary Banking Services

The Winterbotham Merchant Bank a division of The Winterbotham Trust Company Limited CASH MANAGEMENT AND FIDUCIARY BANKING SERVICES Table of Contents Winterbotham Group 4 Regulated Subsidiaries 5 Cash Management and Fiduciary Banking Services 6 Critical Advantages 7 What is Fiduciary Banking? 8 Additional Cash Management Services 9 The Winterbotham Merchant Bank 9 Winterbotham International Securities 10 WINTERBOTHAM GROUP Since our founding in 1990 The Winterbotham Group has focused on the provision of high quality financial services to a global clientele, utilizing the most modern technology, delivered personally. At Winterbotham we seek to add value and our suite of services and the location of their delivery has expanded as the needs of our clients have grown. Today Winterbotham operates in six international financial centers from which we offer services which are individually customized and delivered with an attention to detail now often lost as the transfer of service ‘online’ encourages financial decisions to be self-directed. During our almost three decades of growth Winterbotham’s ownership remains vested in the hands of its founder and his family and this continuity is mirrored in our vision which has not changed: YOUR OBJECTIVES = OUR OBJECTIVES ENABLING YOUR BUSINESS TO THRIVE The Winterbotham Trust Company Limited is a Bank and Trust Company, Broker/Dealer and Investment Fund Administrator, with Head Offices in Nassau, The Bahamas. Winterbotham operates a subsidiary Bank, WTC International Bank Corporation, in San Juan, Puerto Rico and non-banking regional offices/subsidiaries in the Cayman Islands, Chennai, Montevideo and Hong Kong. The group has developed a niche offering in the provision of back office, structuring, administration, corporate governance, IT and accounting services for entrepreneurs and their companies, wealthy individuals and families, their family offices, and for financial institutions. -

Calculating Interest Rates

Calculating interest rates A reading prepared by Pamela Peterson Drake O U T L I N E 1. Introduction 2. Annual percentage rate 3. Effective annual rate 1. Introduction The basis of the time value of money is that an investor is compensated for the time value of money and risk. Situations arise often in which we wish to determine the interest rate that is implied from an advertised, or stated rate. There are also cases in which we wish to determine the rate of interest implied from a set of payments in a loan arrangement. 2. The annual percentage rate A common problem in finance is comparing alternative financing or investment opportunities when the interest rates are specified in a way that makes it difficult to compare terms. One lending source 1 may offer terms that specify 9 /4 percent annual interest with interest compounded annually, whereas another lending source may offer terms of 9 percent interest with interest compounded continuously. How do you begin to compare these rates to determine which is a lower cost of borrowing? Ideally, we would like to translate these interest rates into some comparable form. One obvious way to represent rates stated in various time intervals on a common basis is to express them in the same unit of time -- so we annualize them. The annualized rate is the product of the stated rate of interest per compounding period and the number of compounding periods in a year. Let i be the rate of interest per period and let n be the number of compounding periods in a year. -

Financing Your Business Financial Options and Funding Sources

FINANCING YOUR BUSINESS Financial Options and Funding Sources 25 • Financing Options » SBA’s Loan Guaranty Programs 26 » Commercial Loans 29 » SBA Micro Lenders 29 30 • Funding Sources » Arizona’s Incentives, Programs and Grants 31 » Funding for Innovation and Technology Companies 32 While every effort has been made to ensure the reliability of the information presented in this publication, the Arizona Commerce Authority cannot guarantee the accuracy of this information due to the fact that much of the information is created by external sources. Changes/updates brought to the attention of the Arizona Commerce Authority and verified will be corrected in future editions. 3 The Access to Capital Academy presented by the Phoenix Community & Economic Development and Investment Corporation (PCDIC) – helps entrepreneurs learn how to approach potential lenders with confidence and an increased chance at securing loans. 24 AZ EE FINANCING OPTIONS FI NAN CI NG YOUR There are several sources to consider when looking for three years of business tax returns, etc.) and financing. It is important to explore all of your options prospective (projections) basis. before making a decision. Collateral – property pledged by a borrower to protect the interest of the lender. By putting up collateral, you B The primary source of capital for most new businesses US show that you are committed to the success of your come from personal savings and other forms of personal I NESS resources such as friends and family, when starting out. business. While credit cards often are used to finance business A financial institution avoids making loans without needs, there may be better options available, even for F collateral. -

Cash Or Credit?

LESSON 15 Cash or Credit? LESSON DESCRIPTION • Compare the advantages and disadvantages AND BACKGROUND of using credit. Most students are aware of the variety of pay - • Explain how interest is calculated. ment options available to consumers. Cash, • Analyze the opportunity cost of using credit checks, debit cards, and credit cards are often and various forms of cash payments. used by their parents; however, the students • Evaluate the costs and benefits of various probably do not understand the implications of credit card agreements. each. This lesson examines the advantages and disadvantages of various payment methods and focuses especially on using credit. The students TIME REQUIRED are challenged to calculate the cost of credit, Two or three 45-minute class periods compare credit card agreements, and analyze case studies to determine whether credit is being used wisely. MATERIALS Lesson 15 is correlated with national standards • A transparency of Visual 15.1 , 15.2 , and 15.3 for mathematics and economics, and with per - • A copy for each student of Introduction to sonal finance guidelines, as shown in Tables 1-3 Theme 5 and Introduction and Vocabulary in the introductory section of this publication. sections of Lesson 15 from the Student Workbook ECONOMIC AND PERSONAL FINANCE • A copy for each student of Exercise 15.1 , CONCEPTS 15.2 , and 15.3 from the Student Workbook • Annual fee • APR • A copy for each student of Lesson 15 Assessment from the Student Workbook • Credit limit • Finance charge • Credit card application forms—one for each student. Collect these ahead of time, or have • Grace period students bring in those their parents receive. -

UK (England and Wales)

Restructuring and Insolvency 2006/07 Country Q&A UK (England and Wales) UK (England and Wales) Lyndon Norley, Partha Kar and Graham Lane, Kirkland and Ellis International LLP www.practicallaw.com/2-202-0910 SECURITY AND PRIORITIES ■ Floating charge. A floating charge can be taken over a variety of assets (both existing and future), which fluctuate from 1. What are the most common forms of security taken in rela- day to day. It is usually taken over a debtor's whole business tion to immovable and movable property? Are any specific and undertaking. formalities required for the creation of security by compa- nies? Unlike a fixed charge, a floating charge does not attach to a particular asset, but rather "floats" above one or more assets. During this time, the debtor is free to sell or dispose of the Immovable property assets without the creditor's consent. However, if a default specified in the charge document occurs, the floating charge The most common types of security for immovable property are: will "crystallise" into a fixed charge, which attaches to and encumbers specific assets. ■ Mortgage. A legal mortgage is the main form of security interest over real property. It historically involved legal title If a floating charge over all or substantially all of a com- to a debtor's property being transferred to the creditor as pany's assets has been created before 15 September 2003, security for a claim. The debtor retained possession of the it can be enforced by appointing an administrative receiver. property, but only recovered legal ownership when it repaid On default, the administrative receiver takes control of the the secured debt in full. -

Personal Vs. Business Credit

The Keys to Successful Small Business Ownership, Finance and Credit™ Client Curriculum - Personal vs. Business Credit Small Business Owner Financial With financial support from: Education brought to you by: Sharpen Your Financial Focus® The Keys to Successful Small Business Ownership, Finance and Credit™ National Foundation for Credit Counseling® (NFCC®) - Small Business Owner Counseling Program Client Workbook Version 6.0 March 26, 2018 INTRODUCTION Welcome! It is our goal you find this material helpful as it was hand selected to address some of the most common challenges faced by the self-employed or small business owners. We aim for this content to complement budget counseling sessions for people like you engaged with a member agency of the National Foundation for Credit Counseling® (NFCC®) across the U.S. Whether you just started on a self-employment journey, have a business on the side or have dreams of serving millions, you are important to our national economy and local community by creating a job for yourself or others. It is our hope this program empowers you to make informed decisions about being self-employed and a small business owner by providing you access to a NFCC counselor, information, resources, and tools. As you develop a greater understanding of personal and business finance best practices, you can choose the best course of action to meet your goals. We would like to thank and acknowledge TD Bank, America’s Most Convenient Bank®, and the TD Charitable Foundation, the charitable giving arm of TD Bank, for their support of the NFCC Small Business Owner Financial Counseling and Education Program supporting Small Business Owner Financial Wellness. -

HIGH YIELD OR “JUNK' BONDS, HAVEN OR HORROR by Mason A

HIGH YIELD OR “JUNK’ BONDS, HAVEN OR HORROR By Mason A. Dinehart III, RFC A high yield, or “junk” bond is a bond issued by a company that is considered to be a higher credit risk. The credit rating of a high yield bond is considered “speculative” grade or below “investment grade”. This means that the chance of default with high yield bonds is higher than for other bonds. Their higher credit risk means that “junk” bond yields are higher than bonds of better credit quality. Studies have demonstrated that portfolios of high yield bonds have higher returns than other bond portfolios, suggesting that the higher yields more than compensate for their additional default risk. It should be noted that “unrated” bonds are legally in the “junk” category and may or may not be speculative in terms of credit quality. High yield or “junk” bonds get their name from their characteristics. As credit ratings were developed for bonds, the credit agencies created a grading system to reflect the relative credit quality of bond issuers. The highest quality bonds are “AAA” and the credit scale descends to “C” and finally to “D” or default category. Bonds considered to have an acceptable risk of default are “investment grade” and encompass “BBB” bonds (Standard & Poors) or “Baa” bonds (Moody’s) and higher. Bonds “BB” and lower are called “speculative grade” and have a higher risk of default. Rulemakers soon began to use this demarcation to establish investment policies for financial institutions, and government regulation has adopted these standards. Since most investors were restricted to investment grade bonds, speculative grade bonds soon developed negative connotations and were not widely held in investment portfolios. -

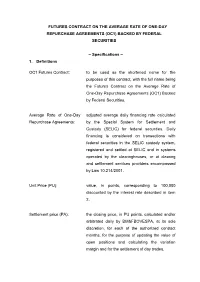

Futures Contract on the Average Rate of One-Day Repurchase Agreements (Oc1) Backed by Federal Securities

FUTURES CONTRACT ON THE AVERAGE RATE OF ONE-DAY REPURCHASE AGREEMENTS (OC1) BACKED BY FEDERAL SECURITIES – Specifications – 1. Definitions OC1 Futures Contract: to be used as the shortened name for the purposes of this contract, with the full name being the Futures Contract on the Average Rate of One-Day Repurchase Agreements (OC1) Backed by Federal Securities. Average Rate of One-Day adjusted average daily financing rate calculated Repurchase Agreements: by the Special System for Settlement and Custody (SELIC) for federal securities. Daily financing is considered on transactions with federal securities in the SELIC custody system, registered and settled at SELIC and in systems operated by the clearinghouses, or at clearing and settlement services providers encompassed by Law 10.214/2001. Unit Price (PU): value, in points, corresponding to 100,000 discounted by the interest rate described in item 2. Settlement price (PA): the closing price, in PU points, calculated and/or arbitrated daily by BM&FBOVESPA, at its sole discretion, for each of the authorized contract months, for the purpose of updating the value of open positions and calculating the variation margin and for the settlement of day trades. Reserve-day: business day for the purposes of financial market transactions, as established by the National Monetary Council. BM&FBOVESPA: BM&FBOVESPA S.A. – Bolsa de Valores, Mercadorias e Futuros. BCB: Central Bank of Brazil 2. Underlying asset The effective interest rate until the contract’s expiration date, defined for these purposes by the accumulation of the daily rates of repurchase agreements in the period as of and including the transaction’s date up to and including the contract’s expiration date. -

Understanding Alpha Versus Beta in High Yield Bond Investing

PERITUS ASSET MANAGEMENT, LLC Market Commentary Independent Credit Research – Leveraged Finance – July 2012 Understanding Alpha versus Beta in High Yield Bond Investing Investors have come to recognize that there is a secular change occurring in financial markets. After the 2008 meltdown, we have watched equities stage an impressive rally off the bottom, only to peter out. There is no conviction and valuations are once again stretched given the lack of growth as the world economy remains on shaky ground. In another one of our writings (“High Yield Bonds versus Equities”), we discussed our belief that U.S. businesses would plod along, but valuations would continue their march toward the lower end of their historical range. So far, this looks like the correct call. Europe still hasn’t been fixed, the China miracle is slowing and, perhaps, the commodity supercycle is also in the later innings. The amount of debt assumed by the developed world is unsustainable so deleveraging began a few years ago. These are not short or pleasant cycles and both governments and individuals will be grumpy participants in this event. It simply means that economic growth will be subdued for years to come. I have never really been able to understand economic growth rates that are significantly ahead of the population growth anyway…oh yeah, the productivity miracle. I have written chapter and verse on the history of financial markets and where returns have come from: yield. Anyone with access to the internet can verify that dividends, dividend growth and dividend re-investment are what have driven stock returns over the decades. -

What the United States Can Learn from the New French Law on Consumer Overindebtedness

Michigan Journal of International Law Volume 26 Issue 2 2005 La Responsabilisation de L'economie: What the United States Can Learn from the New French Law on Consumer Overindebtedness Jason J. Kilborn Louisiana State University Paul M. Hebert Law Center Follow this and additional works at: https://repository.law.umich.edu/mjil Part of the Bankruptcy Law Commons, Comparative and Foreign Law Commons, Consumer Protection Law Commons, and the Legislation Commons Recommended Citation Jason J. Kilborn, La Responsabilisation de L'economie: What the United States Can Learn from the New French Law on Consumer Overindebtedness, 26 MICH. J. INT'L L. 619 (2005). Available at: https://repository.law.umich.edu/mjil/vol26/iss2/3 This Article is brought to you for free and open access by the Michigan Journal of International Law at University of Michigan Law School Scholarship Repository. It has been accepted for inclusion in Michigan Journal of International Law by an authorized editor of University of Michigan Law School Scholarship Repository. For more information, please contact [email protected]. LA RESPONSABILISATION DE L'ECONOMIE:t WHAT THE UNITED STATES CAN LEARN FROM THE NEW FRENCH LAW ON CONSUMER OVERINDEBTEDNESS Jason J. Kilborn* I. THE DEMOCRATIZATION OF CREDIT IN A CREDITOR-FRIENDLY LEGAL SYSTEM ......................................623 A. Deregulationof Consumer Credit and the Road to O ver-indebtedness............................................................. 624 B. A Legal System Ill-Equipped to Deal with Overburdened Consumers .................................................627 1. Short-Term Payment Deferrals ...................................628 2. Restrictions on Asset Seizure ......................................629 3. Wage Exem ptions .......................................................630 II. THE BIRTH AND GROWTH OF THE FRENCH LAW ON CONSUMER OVER-INDEBTEDNESS ............................................632 A. -

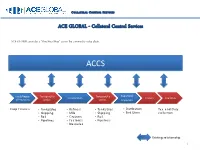

Collateral Control Services

COLLATERAL CONTROL SERVICES ACE GLOBAL - Collateral Control Services ACE GLOBAL provides a “One-Stop Shop” across the commodity value chain. ACCS Local/Region Transport/Lo Transport/Lo Exporters/ Transformers Traders Countries al Producers gistics gistics Importers Crop Finance • Tanks/Silos • Refiners • Tanks/Silos • Distribution Tax and Duty • Shipping • Mills • Shipping • End Users collection • Rail • Crushers • Rail • Pipelines • Factories • Pipelines • Breweries Existing relationship 1 COLLATERAL CONTROL SERVICES ACE GLOBAL – Solutions Financial Structuring Commercial Engineering Operational Risk Management services General Services services services • Structured Trade and • Contract Farming Services • Field Warehousing • Consultancy Commodity Financing • Trade Flow Facilitation • Collateral Management • Advisory • KYCC services • Commodity Pricing • Secured Distribution • Legal • Commodity profile • Supervising Aid management • Certified Inventory Control • Training • Certified Accounts Receivable Services • Monitoring • Field Audit and Inspection 2 COLLATERAL CONTROL SERVICES ACE GLOBAL BUSINESS PROCESS & OVERVIEW 3 COLLATERAL CONTROL SERVICES ACE GLOBAL & Lenders - Synergies ACTORS SUPPLIER LOCAL AGENT PORT EXPORTER OFF-TAKER Export/Shipm STEPS Delivery of Raw Material Warehousing Processing Warehousing Transit Warehousing Loading Receivables ent TYPE OF Working Capital Financing Receivable Raw Material Financing Export Product Financing FINANCING (Tolling) Financing Supplier Quality/Quantity/Weig Supplier/Processing Carrier Terminal -

Company Voluntary Arrangements: Evaluating Success and Failure May 2018

Company Voluntary Arrangements: Evaluating Success and Failure May 2018 Professor Peter Walton, University of Wolverhampton Chris Umfreville, Aston University Dr Lézelle Jacobs, University of Wolverhampton Commissioned by R3, the insolvency and restructuring trade body, and sponsored by ICAEW This report would not have been possible without the support and guidance of: Allison Broad, Nick Cosgrove, Giles Frampton, John Kelly Bob Pinder, Andrew Tate, The Insolvency Service Company Voluntary Arrangements: Evaluating Success and Failure About R3 R3 is the trade association for the UK’s insolvency, restructuring, advisory, and turnaround professionals. We represent insolvency practitioners, lawyers, turnaround and restructuring experts, students, and others in the profession. The insolvency, restructuring and turnaround profession is a vital part of the UK economy. The profession rescues businesses and jobs, creates the confidence to trade and lend by returning money fairly to creditors after insolvencies, investigates and disrupts fraud, and helps indebted individuals get back on their feet. The UK is an international centre for insolvency and restructuring work and our insolvency and restructuring framework is rated as one of the best in the world by the World Bank. R3 supports the profession in making sure that this remains the case. R3 raises awareness of the key issues facing the UK insolvency and restructuring profession and framework among the public, government, policymakers, media, and the wider business community. This work includes highlighting both policy issues for the profession and challenges facing business and personal finances. 2 Company Voluntary Arrangements: Evaluating Success and Failure Executive Summary • The biggest strength of a CVA is its flexibility. • Assessing the success or failure of CVAs is not straightforward and depends on a number of variables.