Bankruptcy Futures: Hedging Against Credit Card Default

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Section 1256 and Foreign Currency Derivatives

Section 1256 and Foreign Currency Derivatives Viva Hammer1 Mark-to-market taxation was considered “a fundamental departure from the concept of income realization in the U.S. tax law”2 when it was introduced in 1981. Congress was only game to propose the concept because of rampant “straddle” shelters that were undermining the U.S. tax system and commodities derivatives markets. Early in tax history, the Supreme Court articulated the realization principle as a Constitutional limitation on Congress’ taxing power. But in 1981, lawmakers makers felt confident imposing mark-to-market on exchange traded futures contracts because of the exchanges’ system of variation margin. However, when in 1982 non-exchange foreign currency traders asked to come within the ambit of mark-to-market taxation, Congress acceded to their demands even though this market had no equivalent to variation margin. This opportunistic rather than policy-driven history has spawned a great debate amongst tax practitioners as to the scope of the mark-to-market rule governing foreign currency contracts. Several recent cases have added fuel to the debate. The Straddle Shelters of the 1970s Straddle shelters were developed to exploit several structural flaws in the U.S. tax system: (1) the vast gulf between ordinary income tax rate (maximum 70%) and long term capital gain rate (28%), (2) the arbitrary distinction between capital gain and ordinary income, making it relatively easy to convert one to the other, and (3) the non- economic tax treatment of derivative contracts. Straddle shelters were so pervasive that in 1978 it was estimated that more than 75% of the open interest in silver futures were entered into to accommodate tax straddles and demand for U.S. -

Buying Options on Futures Contracts. a Guide to Uses

NATIONAL FUTURES ASSOCIATION Buying Options on Futures Contracts A Guide to Uses and Risks Table of Contents 4 Introduction 6 Part One: The Vocabulary of Options Trading 10 Part Two: The Arithmetic of Option Premiums 10 Intrinsic Value 10 Time Value 12 Part Three: The Mechanics of Buying and Writing Options 12 Commission Charges 13 Leverage 13 The First Step: Calculate the Break-Even Price 15 Factors Affecting the Choice of an Option 18 After You Buy an Option: What Then? 21 Who Writes Options and Why 22 Risk Caution 23 Part Four: A Pre-Investment Checklist 25 NFA Information and Resources Buying Options on Futures Contracts: A Guide to Uses and Risks National Futures Association is a Congressionally authorized self- regulatory organization of the United States futures industry. Its mission is to provide innovative regulatory pro- grams and services that ensure futures industry integrity, protect market par- ticipants and help NFA Members meet their regulatory responsibilities. This booklet has been prepared as a part of NFA’s continuing public educa- tion efforts to provide information about the futures industry to potential investors. Disclaimer: This brochure only discusses the most common type of commodity options traded in the U.S.—options on futures contracts traded on a regulated exchange and exercisable at any time before they expire. If you are considering trading options on the underlying commodity itself or options that can only be exercised at or near their expiration date, ask your broker for more information. 3 Introduction Although futures contracts have been traded on U.S. exchanges since 1865, options on futures contracts were not introduced until 1982. -

What the United States Can Learn from the New French Law on Consumer Overindebtedness

Michigan Journal of International Law Volume 26 Issue 2 2005 La Responsabilisation de L'economie: What the United States Can Learn from the New French Law on Consumer Overindebtedness Jason J. Kilborn Louisiana State University Paul M. Hebert Law Center Follow this and additional works at: https://repository.law.umich.edu/mjil Part of the Bankruptcy Law Commons, Comparative and Foreign Law Commons, Consumer Protection Law Commons, and the Legislation Commons Recommended Citation Jason J. Kilborn, La Responsabilisation de L'economie: What the United States Can Learn from the New French Law on Consumer Overindebtedness, 26 MICH. J. INT'L L. 619 (2005). Available at: https://repository.law.umich.edu/mjil/vol26/iss2/3 This Article is brought to you for free and open access by the Michigan Journal of International Law at University of Michigan Law School Scholarship Repository. It has been accepted for inclusion in Michigan Journal of International Law by an authorized editor of University of Michigan Law School Scholarship Repository. For more information, please contact [email protected]. LA RESPONSABILISATION DE L'ECONOMIE:t WHAT THE UNITED STATES CAN LEARN FROM THE NEW FRENCH LAW ON CONSUMER OVERINDEBTEDNESS Jason J. Kilborn* I. THE DEMOCRATIZATION OF CREDIT IN A CREDITOR-FRIENDLY LEGAL SYSTEM ......................................623 A. Deregulationof Consumer Credit and the Road to O ver-indebtedness............................................................. 624 B. A Legal System Ill-Equipped to Deal with Overburdened Consumers .................................................627 1. Short-Term Payment Deferrals ...................................628 2. Restrictions on Asset Seizure ......................................629 3. Wage Exem ptions .......................................................630 II. THE BIRTH AND GROWTH OF THE FRENCH LAW ON CONSUMER OVER-INDEBTEDNESS ............................................632 A. -

Options Strategy Guide for Metals Products As the World’S Largest and Most Diverse Derivatives Marketplace, CME Group Is Where the World Comes to Manage Risk

metals products Options Strategy Guide for Metals Products As the world’s largest and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. CME Group exchanges – CME, CBOT, NYMEX and COMEX – offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, metals, weather and real estate. CME Group brings buyers and sellers together through its CME Globex electronic trading platform and its trading facilities in New York and Chicago. CME Group also operates CME Clearing, one of the largest central counterparty clearing services in the world, which provides clearing and settlement services for exchange-traded contracts, as well as for over-the-counter derivatives transactions through CME ClearPort. These products and services ensure that businesses everywhere can substantially mitigate counterparty credit risk in both listed and over-the-counter derivatives markets. Options Strategy Guide for Metals Products The Metals Risk Management Marketplace Because metals markets are highly responsive to overarching global economic The hypothetical trades that follow look at market position, market objective, and geopolitical influences, they present a unique risk management tool profit/loss potential, deltas and other information associated with the 12 for commercial and institutional firms as well as a unique, exciting and strategies. The trading examples use our Gold, Silver -

Derivative Securities

2. DERIVATIVE SECURITIES Objectives: After reading this chapter, you will 1. Understand the reason for trading options. 2. Know the basic terminology of options. 2.1 Derivative Securities A derivative security is a financial instrument whose value depends upon the value of another asset. The main types of derivatives are futures, forwards, options, and swaps. An example of a derivative security is a convertible bond. Such a bond, at the discretion of the bondholder, may be converted into a fixed number of shares of the stock of the issuing corporation. The value of a convertible bond depends upon the value of the underlying stock, and thus, it is a derivative security. An investor would like to buy such a bond because he can make money if the stock market rises. The stock price, and hence the bond value, will rise. If the stock market falls, he can still make money by earning interest on the convertible bond. Another derivative security is a forward contract. Suppose you have decided to buy an ounce of gold for investment purposes. The price of gold for immediate delivery is, say, $345 an ounce. You would like to hold this gold for a year and then sell it at the prevailing rates. One possibility is to pay $345 to a seller and get immediate physical possession of the gold, hold it for a year, and then sell it. If the price of gold a year from now is $370 an ounce, you have clearly made a profit of $25. That is not the only way to invest in gold. -

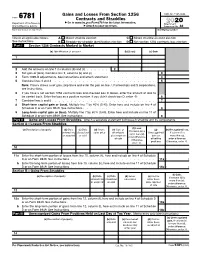

Form 6781 Contracts and Straddles ▶ Go to for the Latest Information

Gains and Losses From Section 1256 OMB No. 1545-0644 Form 6781 Contracts and Straddles ▶ Go to www.irs.gov/Form6781 for the latest information. 2020 Department of the Treasury Attachment Internal Revenue Service ▶ Attach to your tax return. Sequence No. 82 Name(s) shown on tax return Identifying number Check all applicable boxes. A Mixed straddle election C Mixed straddle account election See instructions. B Straddle-by-straddle identification election D Net section 1256 contracts loss election Part I Section 1256 Contracts Marked to Market (a) Identification of account (b) (Loss) (c) Gain 1 2 Add the amounts on line 1 in columns (b) and (c) . 2 ( ) 3 Net gain or (loss). Combine line 2, columns (b) and (c) . 3 4 Form 1099-B adjustments. See instructions and attach statement . 4 5 Combine lines 3 and 4 . 5 Note: If line 5 shows a net gain, skip line 6 and enter the gain on line 7. Partnerships and S corporations, see instructions. 6 If you have a net section 1256 contracts loss and checked box D above, enter the amount of loss to be carried back. Enter the loss as a positive number. If you didn’t check box D, enter -0- . 6 7 Combine lines 5 and 6 . 7 8 Short-term capital gain or (loss). Multiply line 7 by 40% (0.40). Enter here and include on line 4 of Schedule D or on Form 8949. See instructions . 8 9 Long-term capital gain or (loss). Multiply line 7 by 60% (0.60). Enter here and include on line 11 of Schedule D or on Form 8949. -

Consumer Credit Access in France and America Working Paper

Regulating for Legitimacy: Consumer Credit Access in France and America Gunnar Trumbull Working Paper 11-047 Copyright © 2010 by Gunnar Trumbull Working papers are in draft form. This working paper is distributed for purposes of comment and discussion only. It may not be reproduced without permission of the copyright holder. Copies of working papers are available from the author. Regulating for Legitimacy: Consumer Credit Access in France and America Gunnar Trumbull November 2010 Abstract Theories of legitimate regulation have emphasized the role of governments either in fixing market failures to promote greater efficiency, or in restricting the efficient functioning of markets in order to pursue public welfare goals. In either case, features of markets serve to justify regulatory intervention. I argue that this causal logic must sometimes be reversed. For certain areas of regulation, its function must be understood as making markets legitimate. Based on a comparative historical analysis of consumer lending in the United States and France, I argue that national differences in the regulation of consumer credit had their roots in the historical conditions by which the small loan sector came to be legitimized. Americans have supported a liberal regulation of credit because they have been taught that access to credit is welfare promoting. This perception emerged from an historical coalition between commercial banks and NGOs that promoted credit as the solution to a range of social ills. The French regulate credit tightly because they came to see credit as both economically risky and a source of reduced purchasing power. This attitude has its roots in the early postwar lending environment, in which loans were seen to be beneficial only if they were accompanied by strong government protections. -

Futures Options: Universe of Potential Profit

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Directory of Open Access Journals Annals of the „Constantin Brâncuşi” University of Târgu Jiu, Economy Series, Issue 2/2013 FUTURES OPTIONS: UNIVERSE OF POTENTIAL PROFIT Teselios Delia PhD Lecturer, “Constantin Brancoveanu” University of Pitesti, Romania [email protected] Abstract A approaching options on futures contracts in the present paper is argued, on one hand, by the great number of their directions for use (in financial speculation, in managing and risk control, etc.) and, on the other hand, by the fact that in Romania, nowadays, futures contracts and options represent the main categories of traded financial instruments. Because futures contract, as an underlying asset for options, it is often more liquid and involves more reduced transaction costs than cash product which corresponds to that futures contract, this paper presents a number of information regarding options on futures contracts, which offer a wide range of investment opportunities, being used to protect against adverse price moves in commodity, interest rate, foreign exchange and equity markets. There are presented two assessment models of these contracts, namely: an expansion of the Black_Scholes model published in 1976 by Fischer Black and the binomial model used especially for its flexibility. Likewise, there are presented a series of operations that can be performed using futures options and also arguments in favor of using these types of options. Key words: futures options, futures contracts, binomial model, straddle, strangle JEL Classification: G10, G13, C02. Introduction Economies and investments play a particularly important role both at macroeconomic level and at the level of each person or company. -

Securitization Continues to Grow As a Funding Source for the Economy, with RMBS

STRUCTURED FINANCE SECTOR IN-DEPTH Structured finance - China 25 March 2019 Securitization continues to grow as a funding source for the economy, with RMBS TABLE OF CONTENTS leading the way Summary 1 China's securitization market Summary continues to grow, providing an increasing share of debt funding for The share of debt funding for the Chinese economy provided by securitization continues the economy 2 to grow, driven in large part by the growing issuance of structured finance deals backed by Securitization market is evolving as consumer debt such as residential mortgages and auto loans. funding needs change, with consumer debt a growing focus 4 » China's securitization market continues to grow, providing an increasing share RMBS and auto ABS issuance of debt funding for the economy. Securitization accounted for 4.6% of total debt growing, but credit card, micro-loan and CLO deals in decline 5 capital market new issuance for the Chinese economy in 2018, up from 3.7% in 2017. Market developments support further At the end of 2018, the total value of outstanding securitization notes stood at RMB2.7 growth 10 trillion, making China the largest securitization market in Asia and the second largest in Moody’s related publications 12 the world behind the US. However, while it continues to grow, securitization still provides a relatively small share of total debt financing for the Chinese economy compared with Contacts what occurs in the US and other more developed markets. Gracie Zhou +86.21.2057.4088 » Securitization market is evolving as funding needs change, with consumer debt a VP-Senior Analyst growing focus. -

Financial Derivatives Classification of Derivatives

FINANCIAL DERIVATIVES A derivative is a financial instrument or contract that derives its value from an underlying asset. The buyer agrees to purchase the asset on a specific date at a specific price. Derivatives are often used for commodities, such as oil, gasoline, or gold. Another asset class is currencies, often the U.S. dollar. There are derivatives based on stocks or bonds. The most common underlying assets include stocks, bonds, commodities, currencies, interest rates and market indexes. The contract's seller doesn't have to own the underlying asset. He can fulfill the contract by giving the buyer enough money to buy the asset at the prevailing price. He can also give the buyer another derivative contract that offsets the value of the first. This makes derivatives much easier to trade than the asset itself. According to the Securities Contract Regulation Act, 1956 the term ‘Derivative’ includes: i. a security derived from a debt instrument, share, loan, whether secured or unsecured, risk instrument or contract for differences or any other form of security. ii. a contract which derives its value from the prices or index of prices, of underlying securities. CLASSIFICATION OF DERIVATIVES Derivatives can be classified into broad categories depending upon the type of underlying asset, the nature of derivative contract or the trading of derivative contract. 1. Commodity derivative and Financial derivative In commodity derivatives, the underlying asset is a commodity, such as cotton, gold, copper, wheat, or spices. Commodity derivatives were originally designed to protect farmers from the risk of under- or overproduction of crops. Commodity derivatives are investment tools that allow investors to profit from certain commodities without possessing them. -

Quarterly Consumer Debt Report: 2019 Update

Hawaii Consumer Debt Report: 2019 Update October 2019 Department of Business, Economic Development & Tourism Research and Economic Analysis Division Acknowledgement This report is prepared by Wayne Liou, Ph. D., Economist, with research assistance from Andrew Wilson. Joseph Roos, Ph. D., Economic Research Program Manager, and Eugene Tian, Ph. D., Division Administrator, provided guidance on this report. Page | 2 Data Source and Terminology The primary debt and delinquency data was provided by Experian Information Solutions, Inc. The data is based on a 10 percent random sample drawn from a population of consumers with at least one credit line; Hawaii residents were identified as consumers with at least one credit line and a Hawaii address (in the 2nd quarter of 2019, data covered 124,000 Hawaii resident consumers and 29.7 million consumers nationwide). Total consumer debt includes all consumer debt product types included in Experian’s database. It does not include loans from family and friends and other non-commercial debt sources. The main part of the report includes tables with the following credit indicators, measured both for Hawaii and for the U.S.: the total amount of loans outstanding for a specific category (expressed in millions of dollars); the average balance per account (in dollars); number of accounts, percent of population using the specific category of debt (measured as a proportion of the number of accounts to the total population with at least one credit line), and the delinquency rate (measured as the percentage of total accounts in a specific category that are 90 days or more overdue). Per capita references, widely used in this report, are calculated based on the scored population of consumers with at least one credit line, not the overall population. -

Debt, Delinquencies, and Consumer Spending Jonathan Mccarthy

February 1997 Volume 3 Number 3 Debt, Delinquencies, and Consumer Spending Jonathan McCarthy The sharp rise in household debt and delinquency rates over the last year has led to speculation that consumers will soon revert to more cautious spending behavior. Yet an analysis of the past relationship between household liabilities and expenditures provides little support for this view. Analysts forecasting the course of the U.S. economy reflecting the fact that mounting delinquencies prompt pay close attention to consumer spending. Because per- lenders to tighten consumer credit. sonal consumption expenditures make up about two- thirds of the country’s gross domestic product, factors Interpreting Household Debt and Expenditures that could influence consumer spending can have sig- One can construct two very different hypotheses to nificant effects on the economy’s health. Among these explain the increased indebtedness of U.S. households factors, the sharp increase of household indebtedness and its effect on spending. The first hypothesis— and the rising share of income going to payments on which underlies current concerns about a retrench- credit cards, auto loans, mortgages, and other house- ment in spending—suggests that households have hold loans have recently caused some concern. Could taken on too much debt in recent years, placing them- rising debt burdens precipitate a significant cutback in selves in a precarious financial position. Over time, spending as apprehensive consumers take steps to sta- these households will recognize that their indebted- bilize their finances? ness has made them more susceptible to financial dis- tress in the event of a serious illness, job loss, or other To determine whether such concerns are justified, misfortune.