Safe Banking: Finance and Democracy Adam J

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Rationale of Central Banking

THE RATIONALE OF CENTRAL BANKING A Liberty Press Edition Vera C. Smith THE RATIONALE OF CENTRAL BANKING and the Free Banking Alternative PREFACE BY LELAND B. YEAGER r . ,'7/ Liberty Fund Indianapolis LibertyPress is a publishing imprint of Liberty Fund, Inc., a foundation established to encourage study of the ideal of a society of free and responsible individuals. The cuneiform inscription that serves as our logo and as the design motif for our endpapers is the earliest-known written appearance of the word °freedom" (amagiJ, or "liberty _It is taken from a clay document written about 2300 B (. in the Sumerian city-state of Lagash Reprinted by permission of A. Wilson-Smith. Prelate ©1990 by Leland B Yeager All rights reserved.All inquirms should be addressed to Liberty Fund, lnc, 8335 Allison Pointe Trail, Suite 300, Indianapolis, IN 46250-1687. This book was manufactured in the United States of America. Library of Congress Cataloging-in-Publication Data Smith, Vera C., 1912-1976 [Rationale of central banking] The rationale of central banking and the free banking alternative Vera C. Smith; preface by Leland B. Yeager p. cm. Reprint. Originally published" The rationale of central banking. Westminster, England: P.S King & Son Ltd., 1936 Includes bibliographical references 1. Banks and banking, Central 2. Banks and banking, Central-- Europe--History 3. Banks and banking, Central--United States-- History. HG1811.$5 1990 332.1' 1'094--dc20 90-30937 CIP ISBN 0-86597-086-6 ISBN 0-86597-087-4 (pbk) 1098765432 Contents Preface by Leland B. Yeager xiii Publisher's Note xxvii Foreword by Vera C. -

Citizens Financial Group, Inc

Citizens Financial Group, Inc. 165(d) Resolution Plan Public Summary December 31, 2016 CFG 165(d) Resolution Plan Public Section PUBLIC SECTION Table of Contents Introduction ......................................................................................................................... 1 1. Material Entities............................................................................................................... 3 2. Core Business Lines ....................................................................................................... 3 3. Summary of Financial Information, Capital and Major Funding Sources........................ 7 4. Derivative and Hedging Activities.................................................................................... 10 5. Membership in Material Payment, Clearing and Settlement Systems ............................ 12 6. Foreign Operations ......................................................................................................... 13 7. Material Supervisory Authorities...................................................................................... 13 8. Principal Officers ............................................................................................................. 14 9. Resolution Planning Corporate Governance, Structure and Processes ......................... 14 10. Material Management Information Systems.................................................................. 14 11. High Level Description of Citizens' Resolution Strategy............................................... -

Free Banking in America: Disaster Or Success?

Free Banking in America: Disaster or Success? Chris Surro December 17, 2015 Even among the strongest proponents of free markets, there is widespread agreement that there is a role for government in money. We can trust the invisible hand to organize pin factories, but not to issue currency. And in a world where central banks have come to dominate around the world, it becomes hard to imagine any system other than a government monopoly on money. But that wasn't always the case. History has seen many examples where banks freely competed, generating bank notes at their own discretion, usually backed by a commodity but not by a government. In the last thirty years, even as monetary systems have largely converged to centralization, there has been a resurgence in research surrounding alternative arrangements. Economic history has a large role to play in this resurgence. Studying past examples of banking systems, analyzing their strengths and weaknesses, could help us understand and improve modern banking institutions. The American \free banking era," which lasted from roughly 1836-1862, is one ex- ample of a monetary system that has generated substantial research and debate. Before 1836, banks in the United States required a charter from the state they were located in, giving them permission to issue currency. However, starting with Michigan in 1836, many states began to enact laws allowing free entry of banks and by 1860, the number of free banking states had grown to eighteen. Traditional accounts paint a picture of the free banking era as a period of monetary chaos. Lack of regulation allowed \Wildcat banks" to issue more currency than could ever hope to be redeemed, making banking panics frequent. -

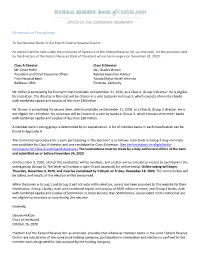

Nomination Procedures

Nomination Procedures To the Member Banks of the Fourth Federal Reserve District: An election will be held under the provisions of Section 4 of the Federal Reserve Act, as amended, for the positions held by the directors of the Federal Reserve Bank of Cleveland whose terms expire on December 31, 2020: Class A Director Class B Director Mr. Dean Miller Mr. Charles Brown President and Chief Executive Officer Retired Executive Advisor First National Bank Toyota Motor North America Bellevue, Ohio Florence, Kentucky Mr. Miller is completing his first term that concludes on December 31, 2020, as a Class A, Group 3 director. He is eligible for reelection. The director in this seat will be chosen in a vote by banks in Group 3, which consists of member banks with combined capital and surplus of less than $30million. Mr. Brown is completing his second term, which concludes on December 31, 2020, as a Class B, Group 3 director. He is not eligible for reelection. His successor will be chosen in a vote by banks in Group 3, which consists of member banks with combined capital and surplus of less than $30 million. A member bank's voting group is determined by its capitalization. A list of member banks in each classification can be found in Appendix A. The nomination procedure for a bank participating in this election* is as follows: Each bank in Group 3 may nominate one candidate for Class A director and one candidate for Class B director. (See the limitations on eligibility for nomination for Class A and Class B directors.) The nominations must be made by a duly authorized officer of the bank and submitted on or before November 24, 2020. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the FISCAL YEAR ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ___________________ to ___________________ Commission Registrant; State of Incorporation; I.R.S. Employer File Number Address; and Telephone Number Identification No. 333-21011 FIRSTENERGY CORP 34-1843785 (An Ohio Corporation) 76 South Main Street Akron OH 44308 Telephone (800) 736-3402 SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered Common Stock, $0.10 par value per share FE New York Stock Exchange SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

A Model of the International Monetary System∗

A MODEL OF THE INTERNATIONAL MONETARY SYSTEM∗ EMMANUEL FARHI AND MATTEO MAGGIORI We propose a simple model of the international monetary system. We study the world supply and demand for reserve assets denominated in different curren- cies under a variety of scenarios: a hegemon versus a multipolar world; abundant versus scarce reserve assets; and a gold exchange standard versus a floating rate system. We rationalize the Triffin dilemma, which posits the fundamental insta- bility of the system, as well as the common prediction regarding the natural and beneficial emergence of a multipolar world, the Nurkse warning that a multipolar world is more unstable than a hegemon world, and the Keynesian argument that a scarcity of reserve assets under a gold standard or at the zero lower bound is recessionary. Our analysis is both positive and normative. JEL Codes: D42, E12, E42, E44, F3, F55, G15, G28. I. INTRODUCTION We propose a formal model of the the International Mone- tary System (IMS). We consider the IMS as the collection of three key attributes: (i) the supply of and demand for reserve assets; (ii) the exchange rate regime; and (iii) international monetary in- stitutions. We show how modern theories developed to analyze sovereign debt crises, oligopolistic competition, and Keynesian ∗We thank Pol Antras,` Julien Bengui, Guillermo Calvo, Dick Cooper, Ana Fostel, Jeffry Frieden, Mark Gertler, Gita Gopinath, Pierre-Olivier Gourinchas, Veronica Guerrieri, Guido Lorenzoni, Arnaud Mehl, Brent Neiman, Jaromir Nosal, Maurice Obstfeld, Jonathan Ostry, -

February 2016 CURRICULUM VITAE

February 2016 CURRICULUM VITAE CHARLES W. CALOMIRIS ADDRESS: Division of Finance and Economics Columbia Business School, Columbia University 3022 Broadway, 601 Uris Hall New York, NY 10027 (212) 854-8748 [email protected] EDUCATION: Ph.D., Economics, Stanford University, June 1985. B.A., Economics, Yale University, Magna Cum Laude, May 1979. CURRENT POSITIONS Henry Kaufman Professor of Financial Institutions (March 2003-present; Paul M. Montrone Professor, 1996-2003), Division of Finance and Economics, Columbia Business School, and Professor of International and Public Affairs, Columbia School of International and Public Affairs, 1996-present. Academic Director, Program for Financial Studies, and Director of the PFS Initiative on Finance and Growth in Emerging Markets, July 1-present. Shadow Open Market Committee, April 2009-present. Researcher, Office of Financial Research, U.S. Treasury, July 1, 2014-June 30, 2016. Research Associate, National Bureau of Economic Research, October 1996-present. (Faculty Research Fellow, October 1991-October 1996) Financial Economists Roundtable, November 2007-present. Co-Director, Hoover Institution Program on Regulation and the Rule of Law, January 2014-present, and Distinguished Visiting Fellow, Hoover Institution, January 2015-present. Adjunct Fellow, Manhattan Institute, December 2014-present. PREVIOUS POSITIONS Visiting Scholar, Research Department, International Monetary Fund, May 2013-September 2014. Advisory Scientific Committee, European Systemic Risk Board, European System of Financial Supervision, September 2011-November 2013. Shadow Financial Regulatory Committee, Dec 1997-Dec 2004, Dec 2005-Dec 2012. Houblon-Norman Senior Fellow, Bank of England, January-April 2011. Podlich Distinguished Fellow & Visiting Professor, Claremont-McKenna College, Fall 2010. Academic Director, Jerome Chazen Institute of International Business, Columbia Business School, October 2004-July 2007, and Director, Center for International Business and Education Research, Columbia University, October 2004-July 2007. -

Nine Lives of Neoliberalism

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Plehwe, Dieter (Ed.); Slobodian, Quinn (Ed.); Mirowski, Philip (Ed.) Book — Published Version Nine Lives of Neoliberalism Provided in Cooperation with: WZB Berlin Social Science Center Suggested Citation: Plehwe, Dieter (Ed.); Slobodian, Quinn (Ed.); Mirowski, Philip (Ed.) (2020) : Nine Lives of Neoliberalism, ISBN 978-1-78873-255-0, Verso, London, New York, NY, https://www.versobooks.com/books/3075-nine-lives-of-neoliberalism This Version is available at: http://hdl.handle.net/10419/215796 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative -

Free Banking and the Free Bankers

Free Banking and the Free Bankers Jijrg Guido Hiilsmann he literature on free banking has expanded dramatically in the last two decades. A young generation of economists Thas regained interest in questions of money, banking, and currency that, for a very long time, had disappeared from broad discussion. This renewed interest was partly sparked by poor results from government regulation of the money supply by cen- tral banks, as well as other legal devices and restrictions. Such failures have undermined the once-common belief that blessings can flow from government monetary meddling. Because free banking was the historical predecessor of and natural alternative to monetary interventions, the theory and practice of free bank- ing has attracted a great deal of interest. It is common for people eager to fight for a specific cause to employ intellectual means unfit to serve their ends. As a result, they may achieve the opposite of their intentions, undermining the ideals and ideas they are seeking to promote. Such is the case with free banking. The case for authentic free banking has been obscured by the strongest defenders of free banking.' In defending views that are not only unrelated to free banking but even fallacious, the free bankers do much harm to their case, inadvertently adding weight to the critique of free banking offered by advocates of central banking and government money. Jorg Guido Hiilsmann is instructor of economics at the Technische Akademie Wuppertal. I wish to thank the referees for extensive comments on this paper. '~evinDowd, David Glasner, Steven Horwitz, A. J. Rolnick, Larry Sechrest, George Selgin, Lawrence White, and Richard Timberlake. -

1951 Has Become Known As the Era of 'Free-Banking' in Nigeria, Because of the Complete Absence of Laws Go'

- Journal of Finance And Economic Research Vol. 2, No.1, March 2009 SCOPE AND EFFICACY OF BANKING SECTOR REFORMS IN NIGERIA SINCE THE 1950S: AN APPRAISAL. By Hamilton O. Isu, Ph.D Professor of Banking, Finance and Forecasting Abia State University Uturu. ABSTRACT Over the past six decad.__s, many changes have taken place in Nigeria's banking sector. In fact, many stakeholders believe that our banks lack the capacity and durability to compete in the international banking space, and that the system is increasingly vel}' marginal relative to the potential of the economy. Many banks have shown signs of perennialzmder--capitali::ation, are perennially under-controlled, under• supervised, and under-regulated. Some of the banks were unable to withstand mildfinancial shock" (IS shown in the frequent technical insolvencies pervading their existence and operations. 171ispaper takes incisive excursions into the issues that have necessitated periodic reforms of the banking sector, 'i.:, critical assessments of the reform strategies and results. Keywords: Banks, Financial System, Banking Sector,Capitalization, Systemic Risk, Insolvency. Non-performing Loans, Undercapitalization. 1.0 INTRODUCTION. Banking institutions occupy a central position in the financial system of any economy. Banks, as we know. act as intermediaries for the efficient transfer of resources from surplus to deficit units, through the normal processes of intermediation. One recalls that formal commercial banking activities began in Nigeria iJ:1 189). when the South Africa based African Banking Corporation (ABC) opened a branch in Lagos. TIle opening of (1 branch of Barclays Dank DCO (1-[(y\'; Urjz;.t1 Bank of Nigeria) in Lagos in J 917 was a significant event. -

John Dickinson Papers Dickinson Finding Aid Prepared by Finding Aid Prepared by Holly Mengel

John Dickinson papers Dickinson Finding aid prepared by Finding aid prepared by Holly Mengel.. Last updated on September 02, 2020. Library Company of Philadelphia 2010.09.30 John Dickinson papers Table of Contents Summary Information....................................................................................................................................3 Biography/History..........................................................................................................................................4 Scope and Contents....................................................................................................................................... 6 Administrative Information........................................................................................................................... 8 Related Materials......................................................................................................................................... 10 Controlled Access Headings........................................................................................................................10 Collection Inventory.................................................................................................................................... 13 Series I. John Dickinson........................................................................................................................13 Series II. Mary Norris Dickinson..........................................................................................................33 -

Lessons for Eu Integration from Us History

LESSONS FOR EU INTEGRATION FROM US HISTORY Jacob Funk Kirkegaard and Adam S. Posen, editors Report to the European Commission under Tender Reference 2016: ECFIN 004/A Washington, DC January 2018 © 2018 European Commission. All rights reserved. The Peterson Institute for International Economics is a private nonpartisan, nonprofit institution for rigorous, intellectually open, and indepth study and discussion of international economic policy. Its purpose is to identify and analyze important issues to make globalization beneficial and sustainable for the people of the United States and the world, and then to develop and communicate practical new approaches for dealing with them. Its work is funded by a highly diverse group of philanthropic foundations, private corporations, and interested individuals, as well as income on its capital fund. About 35 percent of the Institute’s resources in its latest fiscal year were provided by contributors from outside the United States. Funders are not given the right to final review of a publication prior to its release. A list of all financial supporters is posted at https://piie.com/sites/default/files/supporters.pdf. Table of Contents 1 Realistic European Integration in Light of US Economic History 2 Jacob Funk Kirkegaard and Adam S. Posen 2 A More Perfect (Fiscal) Union: US Experience in Establishing a 16 Continent‐Sized Fiscal Union and Its Key Elements Most Relevant to the Euro Area Jacob Funk Kirkegaard 3 Federalizing a Central Bank: A Comparative Study of the Early 108 Years of the Federal Reserve and the European Central Bank Jérémie Cohen‐Setton and Shahin Vallée 4 The Long Road to a US Banking Union: Lessons for Europe 143 Anna Gelpern and Nicolas Véron 5 The Synchronization of US Regional Business Cycles: Evidence 185 from Retail Sales, 1919–62 Jérémie Cohen‐Setton and Egor Gornostay 1 Realistic European Integration in Light of US Economic History Jacob Funk Kirkegaard and Adam S.