Citizens Financial Group, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retail Banking Announcement

Frequently asked questions 26 May 2021 What the repositioning of the HSBC USA Wealth and Personal Banking business means for our customers, here and abroad Why did HSBC take this action? In February 2020, we set out a plan to shift our business strategy in the United States to maximize the connection between our clients and our world-class international network. Our primary business will be a wholesale bank focused on the international needs of clients. We are renewing our emphasis on the US$5 trillion international wealth management opportunity from globally mobile and affluent individuals in the United States. Is HSBC exiting the United States? No, HSBC is not exiting its US business. We aim to be the leading international bank in the United States and are focused on what we do best – connecting Americans to a world of opportunity and bringing cross-border business and investment to the United States. We will continue to provide banking services not only to our wholesale banking clients, but also to our Premier, Jade and Private Banking customers. I have personal accounts at HSBC and I’m in the United States. How will these agreements affect me? Upon completion of the transactions, the accounts of in-scope customers will be transferred to Citizens or Cathay Bank. We thank those customers for their business and will ensure the transfer occurs with as minimum disruption as possible. Premier, Jade, Private Banking and other clients who will remain HSBC customers are in the process of being transitioned to one of our new 20-25 Wealth Centers. -

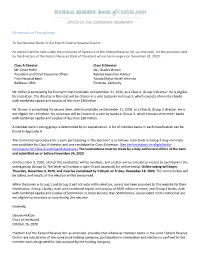

Nomination Procedures

Nomination Procedures To the Member Banks of the Fourth Federal Reserve District: An election will be held under the provisions of Section 4 of the Federal Reserve Act, as amended, for the positions held by the directors of the Federal Reserve Bank of Cleveland whose terms expire on December 31, 2020: Class A Director Class B Director Mr. Dean Miller Mr. Charles Brown President and Chief Executive Officer Retired Executive Advisor First National Bank Toyota Motor North America Bellevue, Ohio Florence, Kentucky Mr. Miller is completing his first term that concludes on December 31, 2020, as a Class A, Group 3 director. He is eligible for reelection. The director in this seat will be chosen in a vote by banks in Group 3, which consists of member banks with combined capital and surplus of less than $30million. Mr. Brown is completing his second term, which concludes on December 31, 2020, as a Class B, Group 3 director. He is not eligible for reelection. His successor will be chosen in a vote by banks in Group 3, which consists of member banks with combined capital and surplus of less than $30 million. A member bank's voting group is determined by its capitalization. A list of member banks in each classification can be found in Appendix A. The nomination procedure for a bank participating in this election* is as follows: Each bank in Group 3 may nominate one candidate for Class A director and one candidate for Class B director. (See the limitations on eligibility for nomination for Class A and Class B directors.) The nominations must be made by a duly authorized officer of the bank and submitted on or before November 24, 2020. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the FISCAL YEAR ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ___________________ to ___________________ Commission Registrant; State of Incorporation; I.R.S. Employer File Number Address; and Telephone Number Identification No. 333-21011 FIRSTENERGY CORP 34-1843785 (An Ohio Corporation) 76 South Main Street Akron OH 44308 Telephone (800) 736-3402 SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered Common Stock, $0.10 par value per share FE New York Stock Exchange SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

A Model of the International Monetary System∗

A MODEL OF THE INTERNATIONAL MONETARY SYSTEM∗ EMMANUEL FARHI AND MATTEO MAGGIORI We propose a simple model of the international monetary system. We study the world supply and demand for reserve assets denominated in different curren- cies under a variety of scenarios: a hegemon versus a multipolar world; abundant versus scarce reserve assets; and a gold exchange standard versus a floating rate system. We rationalize the Triffin dilemma, which posits the fundamental insta- bility of the system, as well as the common prediction regarding the natural and beneficial emergence of a multipolar world, the Nurkse warning that a multipolar world is more unstable than a hegemon world, and the Keynesian argument that a scarcity of reserve assets under a gold standard or at the zero lower bound is recessionary. Our analysis is both positive and normative. JEL Codes: D42, E12, E42, E44, F3, F55, G15, G28. I. INTRODUCTION We propose a formal model of the the International Mone- tary System (IMS). We consider the IMS as the collection of three key attributes: (i) the supply of and demand for reserve assets; (ii) the exchange rate regime; and (iii) international monetary in- stitutions. We show how modern theories developed to analyze sovereign debt crises, oligopolistic competition, and Keynesian ∗We thank Pol Antras,` Julien Bengui, Guillermo Calvo, Dick Cooper, Ana Fostel, Jeffry Frieden, Mark Gertler, Gita Gopinath, Pierre-Olivier Gourinchas, Veronica Guerrieri, Guido Lorenzoni, Arnaud Mehl, Brent Neiman, Jaromir Nosal, Maurice Obstfeld, Jonathan Ostry, -

Natwest Group United Kingdom

NatWest Group United Kingdom Active This profile is actively maintained Send feedback on this profile Created before Nov 2016 Last update: Feb 23 2021 About NatWest Group NatWest Group, founded in 1727, is a British banking and insurance holding company based in Edinburgh, Scotland. Its main subsidiary companies are The Royal Bank of Scotland, NatWest, Ulster Bank and Coutts. Prior to a name-change in July 2020, it was known as Royal Bank of Scotland (RBS) Group. After a massive bailout in 2008, a majority of RBS' shares were purchased by the UK Government. In 2014 the bank embarked on a restructuring process that saw it refocus on its business in the UK and Ireland. As part of this process it divested its ownership of Citizens Financial Group, the 13th largest bank in the United States, in 2015. As of 2020 it remains 61.93% UK Government owned, via UK Financial Investments (UKFI). Website https://www.natwestgroup.com/ Headquarters 36 St Andrew Square EH2 2YB Edinburgh Scotland United Kingdom CEO/chair Alison Rose CEO Supervisor Bank of England Annual report Annual report 2020 Ownership listed on London Stock Exchange Natwest Group is majority-owned by the UK government since 2008, which currently holds 61.93 % of the shares. Complaints NatWest Group does not operate a complaints channel for individuals and communities that may be adversely affected by and its finance. However, the bank can be contacted via the contact form here (e.g. using ‘General Service’ as account type). grievances Stakeholders may raise complaints via the OECD National Contact Points (see OECD Watch guidance). -

John Dickinson Papers Dickinson Finding Aid Prepared by Finding Aid Prepared by Holly Mengel

John Dickinson papers Dickinson Finding aid prepared by Finding aid prepared by Holly Mengel.. Last updated on September 02, 2020. Library Company of Philadelphia 2010.09.30 John Dickinson papers Table of Contents Summary Information....................................................................................................................................3 Biography/History..........................................................................................................................................4 Scope and Contents....................................................................................................................................... 6 Administrative Information........................................................................................................................... 8 Related Materials......................................................................................................................................... 10 Controlled Access Headings........................................................................................................................10 Collection Inventory.................................................................................................................................... 13 Series I. John Dickinson........................................................................................................................13 Series II. Mary Norris Dickinson..........................................................................................................33 -

Lessons for Eu Integration from Us History

LESSONS FOR EU INTEGRATION FROM US HISTORY Jacob Funk Kirkegaard and Adam S. Posen, editors Report to the European Commission under Tender Reference 2016: ECFIN 004/A Washington, DC January 2018 © 2018 European Commission. All rights reserved. The Peterson Institute for International Economics is a private nonpartisan, nonprofit institution for rigorous, intellectually open, and indepth study and discussion of international economic policy. Its purpose is to identify and analyze important issues to make globalization beneficial and sustainable for the people of the United States and the world, and then to develop and communicate practical new approaches for dealing with them. Its work is funded by a highly diverse group of philanthropic foundations, private corporations, and interested individuals, as well as income on its capital fund. About 35 percent of the Institute’s resources in its latest fiscal year were provided by contributors from outside the United States. Funders are not given the right to final review of a publication prior to its release. A list of all financial supporters is posted at https://piie.com/sites/default/files/supporters.pdf. Table of Contents 1 Realistic European Integration in Light of US Economic History 2 Jacob Funk Kirkegaard and Adam S. Posen 2 A More Perfect (Fiscal) Union: US Experience in Establishing a 16 Continent‐Sized Fiscal Union and Its Key Elements Most Relevant to the Euro Area Jacob Funk Kirkegaard 3 Federalizing a Central Bank: A Comparative Study of the Early 108 Years of the Federal Reserve and the European Central Bank Jérémie Cohen‐Setton and Shahin Vallée 4 The Long Road to a US Banking Union: Lessons for Europe 143 Anna Gelpern and Nicolas Véron 5 The Synchronization of US Regional Business Cycles: Evidence 185 from Retail Sales, 1919–62 Jérémie Cohen‐Setton and Egor Gornostay 1 Realistic European Integration in Light of US Economic History Jacob Funk Kirkegaard and Adam S. -

New York and the Politics of Central Banks, 1781 to the Federal Reserve Act

New York and the Politics of Central Banks, 1781 to the Federal Reserve Act Jon R. Moen and Ellis W. Tallman Working Paper 2003-42 December 2003 Working Paper Series Federal Reserve Bank of Atlanta Working Paper 2003-42 December 2003 New York and the Politics of Central Banks, 1781 to the Federal Reserve Act Jon R. Moen, University of Mississippi Ellis W. Tallman, Federal Reserve Bank of Atlanta Abstract: The paper provides a brief history of central banking institutions in the United States. Specifically, the authors highlight the role of New York banking interests in the legislations affecting the creation or expiration of central banking institutions. In our previous research we have detected that New York City banking entities usually exert substantial influence on legislation, greater than their large proportion of United States’ banking resources. The authors describe how this influence affected the success or failure of central banking movements in the United States, and the authors use this evidence to support their arguments regarding the influence of New York City bankers on the legislative efforts that culminated in the creation of the Federal Reserve System. The paper argues that successful central banking movements in the United States owed much to the influence of New York City banking interests. JEL classification: N21, N41 Key words: financial crisis, central bank, banking legislation The authors gratefully acknowledge William Roberds for helpful comments and conversations. The views expressed here are the authors’ and not necessarily those of the Federal Reserve Bank of Atlanta or the Federal Reserve System. Any remaining errors are the authors’ responsibility. -

Home Field Advantage It Has Proven Difficult for Global Banks to Run a Successful Retail Banking Business Outside Their Core Domestic Markets

Sector: Banks Kathleen Shanley, CFA June 2, 2021 [email protected] Home Field Advantage It has proven difficult for global banks to run a successful retail banking business outside their core domestic markets. Citigroup, which had been the most ambitious U.S. bank operating overseas, said in April that it would retreat from consumer banking in 13 primarily Asian countries including China, Indonesia, and Korea, as well as Australia, Poland, and Russia (see GC report dated 4/19/21). Foreign banks operating in the U.S. have fared no better, opening an opportunity for U.S.-based banks to extend their domestic franchises. Just yesterday, PNC Financial Services completed its $11.6 billion acquisition of BBVA USA Bancshares from its Spanish parent company Banco Bilbao Vizcaya Argentaria, S.A. (see GC report dated 4/27/21). Citizens Financial Group (CFG) is the latest regional bank to capitalize on this trend. Last week, the company said it will acquire 80 branches and an online deposit business, including $9.0 billion in deposits and $2.2 billion in loans, from HSBC Bank U.S.A. HSBC is giving up on mass market retail banking in the U.S., ending relationships with retail clients maintaining balances below $75,000 and small businesses with less than $5 million in annual revenue. (It will continue to do wholesale business in the U.S.) The company had already signaled last year that it would shift its investments away from underperforming areas in the U.S. and Europe, to focus on higher growth markets, primarily in Asia. -

The 'Bank' Or 'RBS Plc') Is a Wholly-Owned Subsidiary of the Royal Bank of Scotland Group Plc (The 'Holding Company' Or 'RBSG')

RNS Number : 3641X Royal Bank of Scotland PLC 27 August 2015 The Royal Bank of Scotland plc Results for the half year ended 30 June 2015 The Royal Bank of Scotland plc (the 'Bank' or 'RBS plc') is a wholly-owned subsidiary of The Royal Bank of Scotland Group plc (the 'holding company' or 'RBSG'). The 'Group' comprises RBS plc and its subsidiary and associated undertakings. 'RBS Group' comprises the holding company and its subsidiary and associated undertakings. Contents Page Financial review 2 Condensed consolidated income statement 4 Condensed consolidated statement of comprehensive income 4 Condensed consolidated balance sheet 5 Condensed consolidated statement of changes in equity 6 Condensed consolidated cash flow statement 7 Notes 8 Independent review report 48 Summary risk factors 50 Statement of directors' responsibilities 54 Forward-looking statements 55 Additional information 56 Appendix 1 - Williams & Glyn Financial review Operating (loss)/profit Operating loss before tax was £115 million compared with a profit of £1,744 million in the first half of 2014. The decrease was due to a reduction in non-interest income, down £1,174 million, reflecting the planned scaling back of Corporate & Institutional Banking (CIB) and an increase in operating expenses, up £1,227 million, mainly in relation to litigation, conduct and restructuring costs, only partially offset by impairment releases of £420 million compared with impairment losses of £178 million in the first half of 2014. Net interest income Net interest income was stable, with good asset growth in UK PBB and Commercial Banking partially offsetting declines in other portfolios. Non-interest income Non-interest income decreased by £1,174 million, 32% to £2,541 million compared with £3,715 million in the first half of 2014. -

RBS Resolution Plan

Logo RBS Public Section RBS Group pic Resolution Plan Pursuant to 12 C.F.R. Parts 217 & 381 and RBS Citizens, N.A. Resolution Plan Pursuant to 12 C.F.R. 360 July 1, 2013 Table of Contents III IntroductionRBS Group pageand RBS 1 Americas page 2 II.CII.BII.A MaterialGlobalPrincipal Operations Supervisory Officers of of RBS AuthoritiesRBS Group Group plcpage page page 4 2 5 IIIII.EII.D RBSCNA SummaryResolution IDI of PlanningPlan Financial and Corporate RBS Information, Citizens Governance, CapitalResolution and Structure PlanMajor page Funding and 10 Processes Sources pagepage 67 III.CIII.BIII.A CoreMaterialSummary Business Entities of Financial Lines page page 11Information, 12 Capital and Major Funding Sources page 13 III.FIII.EIII.D ForeignMembershipDerivative Operations and in HedgingMaterial page Payment,Activities 17 pageClearing 16 and Settlement Systems page 17 III.IIII.HIII.G RBS PrincipalMaterial Citizens' SupervisoryOfficers Resolution page Authorities 17 Planning page Corporate 17 Governance, Structure and III.KIII.JProcesses MaterialHigh-Level page Management Description 18 Information of RBS Citizens' Systems Resolution page 19 Strategy page 20 IV.BIV.AIV Markets CoreMaterial Business & EntitiesInternational Lines page page Banking22 23 Americas page 22 IV.EIV.DIV.C MembershipsDerivativeSummary ofand Financial in Hedging Material Information, Activities Payment, page CapitalClearing 24 and and Major Settlement Funding Systems Sources page page 24 24 IV.HIV.GIV.F ForeignPrincipalMaterial Operations SupervisoryOfficers page page Authorities 25 25 page 25 IV.JIV.I M&IBA'sMaterial ManagementResolution Planning Information Corporate Systems Governance, page 26 Structure and Processes page 25 StrategyIV.K High-Level page 26 Description of Markets & International Banking Americas' Resolution Chapter 1. -

The Preservation and Adaptation of a Financial Architectural Heritage

University of Pennsylvania ScholarlyCommons Theses (Historic Preservation) Graduate Program in Historic Preservation 1998 The Preservation and Adaptation of a Financial Architectural Heritage William Brenner University of Pennsylvania Follow this and additional works at: https://repository.upenn.edu/hp_theses Part of the Historic Preservation and Conservation Commons Brenner, William, "The Preservation and Adaptation of a Financial Architectural Heritage" (1998). Theses (Historic Preservation). 488. https://repository.upenn.edu/hp_theses/488 Copyright note: Penn School of Design permits distribution and display of this student work by University of Pennsylvania Libraries. Suggested Citation: Brenner, William (1998). The Preservation and Adaptation of a Financial Architectural Heritage. (Masters Thesis). University of Pennsylvania, Philadelphia, PA. This paper is posted at ScholarlyCommons. https://repository.upenn.edu/hp_theses/488 For more information, please contact [email protected]. The Preservation and Adaptation of a Financial Architectural Heritage Disciplines Historic Preservation and Conservation Comments Copyright note: Penn School of Design permits distribution and display of this student work by University of Pennsylvania Libraries. Suggested Citation: Brenner, William (1998). The Preservation and Adaptation of a Financial Architectural Heritage. (Masters Thesis). University of Pennsylvania, Philadelphia, PA. This thesis or dissertation is available at ScholarlyCommons: https://repository.upenn.edu/hp_theses/488 UNIVERSITY^ PENN5YLV^NIA. UBKARIE5 The Preservation and Adaptation of a Financial Architectural Heritage William Brenner A THESIS in Historic Preservation Presented to the Faculties of the University of Pennsylvania in Partial Fulfillment of the Requirements for the Degree of MASTER OF SCIENCE 1998 George E. 'Thomas, Advisor Eric Wm. Allison, Reader Lecturer in Historic Preservation President, Historic District ouncil University of Pennsylvania New York City iuatg) Group Chair Frank G.