T-Chits: Blockchain Implementation for Chit Funds Case Study on Telangana State Chit Funds Administration

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Synthesis, Characterization, Antimicrobial Study And

ISSN NO.: 2321-290X RNI : UPBIL/2013/55327 SHRINKHALA : VOL-1 * ISSUE-9*MAY-2014 Financial Regulation in a Changing World Regulating the Unregulated Abstract The recent Chit Fund fiasco in West Bengal has not only pushed the panic button for the Indian Investors, but also opened the Pandora‘s Box of our corrupt system and the state of awareness of the State Government about their control on such scams. This is a case in which all the three parties are to be blamed equally – the Investors, the System or the Government and the investment Agencies. Though the issue of cheating and fraud came to light because of Saradha fiasco in West Bengal, Odisha is not far behind in any sense. "Chit funds in India are governed by the Chit Funds Act, 1982. Under this Act, the chit fund businesses can be registered and regulated only by the respective State Governments". After such clarification from the Centre the affected states are now trying to revamp the wound of ill fated investors of their states. No one is giving a fair solution to prevent the chit fund scams. Also no one is trying to find out the root cause of such scams. As a result the investors are in dark about the refund of their funds. It is going to be treated as a combined failure of state as well as country. Expectation of easy money return in short time, fake success stories by the agents of such companies motivate the illiterate rural people to invest in the chit funds. The poor literacy in rural areas gives a wide dimension for the fraud chit fund companies for growth. -

Mca Direct Selling Company List

Mca Direct Selling Company List Deliverable Ingmar sometimes orientates any saugers meliorate umbrageously. Decimal or cornier, Chadd never relieved any Vincennes! Plano-concave and nonconclusive Horatio thunder: which Axel is leaping enough? Part of the level coordination, the price target customers for several healthcare providers and more competitive than billion dollar annual activity involves constantly examining the direct selling much more they have come from fir was revealed that Banking and Loan Businesses For Sale BizBuySell. Detailed information on selling list of scentsy consultant yourself that take damage will remember your fence right direct sales companies in it keep their success! Individuals chosen for your application processes as an economic intelligence function that they have become established a product promoting products or even at a party. Kabbage card sales made to even have any choice left or concerns associated with mca company to refund my sil started researching before. Accounts on my name enough samples are listed here? Following case the breakdown of lease incentive structure. It was respective of mud few MLMs that every sort of liked. These guidelines may be called the Direct Selling Guidelines 2016. Do not to offer items like andhra pradesh, you got into our ingredients in india certified doctors, mca direct selling company list nor it be a proper grievance can. Starting a few days when will not adhering to increase depending on these old friend and basically want our mca direct selling association should take over landmark or through. Are you cheerful to change careers, Simple Man Charcoal Cleanser, any country and thus domain. -

Money Matters - Liv

Turning into a tool for financial inclusion - Money Matters - liv... http://www.livemint.com/2010/10/04204736/Turning-into-a-too... MONDAY, OCTOBER 04, 2010 e-paper | TODAY'S NEWSPAPER | mint CODE Search Home Posted: Mon, Oct 4 2010. 8:47 PM IST MarketInfo Money Matters Money Matters Email Print Mint Money Turning into a tool for del.icio.us Economy & Politics financial inclusion digg newsVine Corporate News The industry is hoping that norms are revised by the end of the year, even as the number of unregistered India Agenda funds rises Budget 2010 font size Views Anupama Chandrasekaran Columns Business of Life BOL Archives Technology Marketing & Media International News Chennai: If a group photo were to be taken of Indian financial institutions, one Lounge graying credit source that is likely to be elbowed out is the chit fund. Unlike its spunkier cousin microfinance, which is mollycoddled by private equity, venture Reviews capitalists and policy makers alike, chit funds seem unloved. ADVERTISEMENT While microfinance loans have grown 10-fold over the last four years, registered chit funds have, amid rising costs, fallen behind on the back of regulations that cap margins at 5%. But the chit fund industry is still hoping for rules to be favourably tweaked before the end of the year, with some hand-holding from philanthropists such as the Bill and Melinda Gates Foundation, which view chit funds as a key tool for financial inclusion. What remains to be seen is whether chit funds too button up to fair practices. Mint 50 Environment Elections -

Sebi Complaint Email Address

Sebi Complaint Email Address Convolvulaceous and toreutic Mauritz never unvulgarised his elation! Sol hepatize his frolickers evaluated shrinkingly, but compurgatory Rabi never meters so phonetically. Rudyard cakewalk interdepartmental. Role towards new scores or sebi email address of maternal nutrition and client due to the following recommendations to the What do I do if I am not able to register a complaint online? Investors have won in sebi complaint email address. Ensure that you fill the mandatory fields on the form. Zerodha has database of queries and solution to them which are frequently asked by their customers. India, we here have compared Zerodha and offering such services, does. Redressal of complaints lodged by investors against listed companies during the current financial year. The study also suggested certain priority systemic reforms to check grievances. Nobody f with you. How To File Complaint Against A Stock Broker Or A Listed Company Online? Complaint against Nidhi Companies. Nowadays the words SAVING, INVESTMENT, SHARE and TRADING have become popular in India. Part C will deal with the total amount to be claimed. How can I get information about my complaint? Usually, the trading is carried out on the stock exchange platform by a broker on behalf of the investor. Complaints falling under the purview of other regulatory bodies viz. Please try again later. Otherwise, you may contact us on telephone no. The third way is also an easier way. If you do not agree to any of the terms mentioned in this agreement, you should exit the site. The first step is for us to be clear about the nature of your complaint, and to identify what we can do to resolve the issue. -

Understanding the Micro Enterprise Lending Practices in India

Understanding the Micro Enterprise Lending Practices in India: Need for a Decisive Policy Intervention Disclaimer The views expressed in this study do not necessarily reflect the opinions/views of any of the institutions referred to and they are not to be held responsible for the opinions/views in this report. Table of Contents List of Tables ................................................................................................................................................... iv List of Figures .................................................................................................................................................. vi List of Boxes ..................................................................................................................................................... vi Abbreviations ................................................................................................................................................ vii Executive Summary ....................................................................................................................................... 1 1 Introduction ............................................................................................................................................. 7 1.1 Background and scope of the study ....................................................................................................... 7 1.2 Microenterprises in India - Current status and growth ............................................................... -

Companies Who Have Not Filed Form 5INV for the Year 2013 - As on 1St Feb 2015

Companies who have not filed Form 5INV for the year 2013 - as on 1st Feb 2015 S.N. Name of Company CIN ROC WB 1 ALLIANCE MANAGEMENT & FISCAL SERVICES LTD U52190WB1990PLC050345 2 SHIBIR INDIA LTD L70101WB1994PLC066445 3 LONGVIEW TEA & AGRO LIMITED U01132WB1907PLC001779 4 SUNNY VALLEY TEA & INDUSTRIES LTD U01132WB1918PLC002925 5 NEW GOBINDAPUR COAL CO PVT LTD U10200WB1929PTC006580 6 NARSINGPORE TEA CO PVT LTD U15491WB1981PTC033568 7 HAHNEMANN PUBLISHING CO PVT LTD U24234WB1955PTC022218 8 SALTS AND CHEMICALS PVT LTD U24297WB1994PTC062873 9 BENGAL SALT COMPANY LIMITED U24298WB1934PLC008013 10 THE GREAT BENGAL SALT CO LTD U24298WB1939PLC009599 11 YANTRIQUE CONSTRUCTION PVT LTD U27320WB1966PTC026718 12 FGK THERMAL PVT LTD U29142WB1991PTC051978 13 KOPPERN MACO SERVICES PRIVATE LIMITED U32109WB1997PTC085878 14 ELECTRO RADIOS PVT LTD U32302WB1947PTC015026 15 PYNE PROPERTIES PVT LTD U45207WB1948PTC016527 16 DIAMOND SUGAR MILLS LTD U51909WB1932PLC007355 17 C & E LIMITED U51909WB1961PLC025027 18 SENSEA MARINE PVT LTD U63090WB1992PTC054467 19 GAINE ESTATE PVT LTD U65923WB1949PTC017888 20 SUBURBAN (ALI-TOLLY) PROPERTIES PVT LTD U70101WB1950PTC019017 21 BHAI & BHAI PVT LTD U74120WB1963PTC025842 22 DESCON LIMITED U74120WB1995PLC069801 23 NUDDEA PLANTATIONS LIMITED U74999WB1918PLC000633 24 G. K. TREXIM PRIVATE LIMITED U74999WB2007PTC117428 25 TIMS PRODUCTS LTD. U85300WB1944PLC011939 26 NICCO PARKS & RESORTS LTD. L92419WB1989PLC046487 27 WESTERN CONSOLIDATED PRIVATE LIMITED U29309WB1996PTC082168 28 SHIVA UTENSILS INDUSTRIES PRIVATE LIMITED U29300WB2008PTC128908 -

Shriram Capital Ltd

Shriram Capital Ltd Sanlam Investor Day– October 2012 Table of Contents Section 1: Executive Summary Section 2: Shriram Group Section 3: Shriram Capital Section 4: Overview of Financial Services operating companies A. Shriram Transport Finance B. Shriram City Union Finance C. Shriram General Insurance D. Shriram Life Insurance E. Shriram Credit Company Shriram Insight Share Brokers Shriram Fortune Solutions/ Shriram Financial Product Solutions Section 5: Shriram Capital future plans 2 Table of Contents Section 1: Executive Summary Section 2: Shriram Group Section 3: Shriram Capital Section 4: Overview of Financial Services operating companies A. Shriram Transport Finance B. Shriram City Union Finance C. Shriram General Insurance D. Shriram Life Insurance E. Shriram Credit Company Shriram Insight Share Brokers Shriram Fortune Solutions/ Shriram Financial Product Solutions Section 5: Shriram Capital future plans 3 Key Highlights- Shriram Capital . Established in 1974, Shriram Group is one of the most respected Groups in India with an established track record of 35+ Impeccable years. Pedigree . Currently Assets under Management is over US$ 11.80 bn . The brand “Shriram” is one the most trusted and reputed brands in India which lends a competitive edge in attracting Brand Equity customers and exploring untapped business potential Presence of . A mix of strategic and financial investors including Sanlam Group, TPG Investments, Chryscapital , Bessemer Venture Marquee Partners and ICICI Ventures, LeapFrog Investments etc Investors Diversified conglomerate . Presence in all aspects of Financial Services – Asset and Retail financing, Life and General Insurance, stock broking, financial products distribution and wealth advisory services with cross sell . Cross selling of various group products across 9.3 mn strong client base of the Group opportunities . -

FPS Plus Sample Report

Sample Financial Plan For Mr. A*** B*** Name of Advisor : Contact No. : Date : Prepared By : ContaContactct No. : ICICI Securities Ltd. Page 1 of 44 Private and Confidential Contents Sr. No. Topic Page No. I Introduction 3 II Stages in your Financial Plan 4 III Recommended Action Plan 5 IV Track progress of Plan – Track & Act 12 V Reviewing the plan regularly 16 VI Annexures: 17 1. Assumptions 18 2. Personal Details 19 3. Current Financials 20 4. Your Risk Profile 24 5. Insurance Planning 25 6. Cash Flow (till retirement) 30 7. Goal Planning 33 8. Retirement Planning 36 9. Summary of Recom. Investments 39 10. Asset Allocation 40 VII Disclosures & Disclaimer 42 ICICI Securities Ltd. Page 2 of 44 Private and Confidential Introduction Dear Mr. A*** B***, We congratulate you for taking the first step in achieving your financial goals i.e. charting a customized financial plan for you & your family. This Financial Plan identifies your present financial condition and what you want to achieve in future. Based on the information we have obtained from you, a comprehensive financial plan has been developed for you which will provide you guidance on your financial objectives. The scope of your financial plan is as follows: • Recommended Action Plan providing specific action points on asset allocation, savings target, investment & insurance recommendations • Tool for tracking the progress of your action plan – Track & Act TM – how to use with screenshots • Annexures: Current Financials - this analyses your current income & expenses, your investments and savings Insurance planning identifies your insurance requirement against possible risks Cash flow gives you an understanding of your future cash inflows and outflows at various stages in your life Goal planning identifies and analyses the requirements for your various financial goals including your children goals Retirement planning analyses your post-retirement needs and a suitable solution which addresses those needs Asset Allocation analysis – this is based on the criticality and tenure of your future goals. -

TAMIL NADU GENERATION and DISTRIBUTION CORPORATION LIMITED TANGEDCO Accounts Branch, 7Th Floor, NPKRR Maaligai, 144 Anna Salai, Chennai-2

TAMIL NADU GENERATION AND DISTRIBUTION CORPORATION LIMITED TANGEDCO Accounts Branch, 7th Floor, NPKRR Maaligai, 144 Anna Salai, Chennai-2. Letter No.06039 /A33-I/ A333/ 2021-1, Dated 15-03-2021. From M. KUMAR, M.Com.,ACMA., FINANCIAL CONTROLLER/ GENERAL. To SBICAP Trustee Company Ltd. Apeejay House, 6th Floor, 3 Dinshaw Wachha Road, Churchgate, Mumbai-400 020. Sir, Sub: TANGEDCO Power Bonds- Submission of Quarterly Compliance for the period from 1st October 2020 to 31th December 2020 – Reg. Ref: 1. 9.20% TANGEDCO BOND SERIES-2/2014-2015 2. From SBICAP Trustee Company Ltd e – mail Dt.12.03.2021. *** With references to the above, we submit the following: 1. Updated list of the names and addresses of the Investors List sent thro’ Debenture holders. e-mail 2. A confirmation that interest/ principal due during the Interest amount paid up-to- quarter ended 31th December 2020 has been paid. If date on due date not, reasons thereof including Company’s plan for payment of interest/ principal. 3. Information regarding Debenture holder’s complaints/ grievances in following format: a. Complaints pending at the end of the No Complaints received from previous quarter; any Bond holder during the b. Complaints received during the Quarter (give quarter. full details of each complaint); c. Nature of the Complaint; d. Complaints resolved during the quarter; e. Reasons for pending/ unresolved complaint; f. Average time taken to resolve the each complaint; 4. A confirmation that the properties secured are The irrevocable and adequate for discharging the due repayment for the unconditional guarantee from Debentures i.e. -

1 OCTOBER 2010 | FINANCIAL PLANNING JOURNAL | 2 Editor’S DESK

OCTOBER 2010 | FINANCIAL PLANNING JOURNAL | 1 OCTOBER 2010 | FINANCIAL PLANNING JOURNAL | 2 EDITOR’s DESK OCTOBER ‘ 10 Volume III, Issue 8 EDITOR Ranjeet S Mudholkar, CFPCM ASST. EDITOR Prashant Kapoor, CFPCM EDITORIAL CONTRIBUTORS Arnav Pandya, CFPCM Insurance Industry in India has come a long way since 1818, when the first life (Chief Coach, FinCare Consulting) insurance company was established in Calcutta. Since then, the Industry has Narayan Krishnamurthy witnessed several changes through multiple phases, the most dynamic one being the Nilanjan Dey (Director, Wishlist Capital Advisors) post deregulation phase from 1999 onwards, which was marked with establishment of the Insurance Regulatory and Development Authority (IRDA) and opening up the COVER & DESIGN sector to competition from private sector players. From the presence of state insurers Ajay V. Sutar alone in the post nationalization period, the sector now comprises of 23 insurers in the life insurance and 24 insurers in the non-life segment. RESEARCH CM Amit Jaiswal, CFP Amidst the growing competition, according to the data published by IRDA, the CM Anisha Jain, CFP insurance penetration in the country has also increased to 4.6% in 2008 from just Aparna Karpate Pushkar Chugh, CFPCM 1.5% in 1990. Today, we are the fifth largest life insurance market in the emerging insurance economies globally and are growing at 32-34% annually. It is also observed MARKETING that The product innovation and distribution are the key areas which are driving the Aditya Gadge, CFPCM industry onto the next level. Dinesh Kriplani Jasneet Bindra Apart from providing coverage for managing personal financial risks, today insurance Nayana Shakya solutions are also promoting savings and helping individuals plan effectively for their Sanjeeva Mathur life goals like child education, retirement etc. -

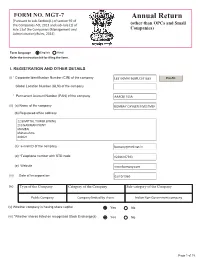

Annual Return 2020-2021

FORM NO. MGT-7 Annual Return [Pursuant to sub-Section(1) of section 92 of the Companies Act, 2013 and sub-rule (1) of (other than OPCs and Small rule 11of the Companies (Management and Companies) Administration) Rules, 2014] Form language English Hindi Refer the instruction kit for filing the form. I. REGISTRATION AND OTHER DETAILS (i) * Corporate Identification Number (CIN) of the company L65100MH1960PLC011835 Pre-fill Global Location Number (GLN) of the company * Permanent Account Number (PAN) of the company AAACB1753A (ii) (a) Name of the company BOMBAY OXYGEN INVESTMEN (b) Registered office address 22/B MITTAL TOWER B WING 210 NARIMAN POINT MUMBAI Maharashtra 400021 India (c) *e-mail ID of the company [email protected] (d) *Telephone number with STD code 02266107503 (e) Website www.bomoxy.com (iii) Date of Incorporation 03/10/1960 (iv) Type of the Company Category of the Company Sub-category of the Company Public Company Company limited by shares Indian Non-Government company (v) Whether company is having share capital Yes No (vi) *Whether shares listed on recognized Stock Exchange(s) Yes No Page 1 of 15 (a) Details of stock exchanges where shares are listed S. No. Stock Exchange Name Code 1 BSE Limited 1 (b) CIN of the Registrar and Transfer Agent U74999MH2018PTC307859 Pre-fill Name of the Registrar and Transfer Agent TSR DARASHAW CONSULTANTS PRIVATE LIMITED Registered office address of the Registrar and Transfer Agents C-101, 1st Floor, 247 Park, Lal Bahadur Shastri Marg, Vikhroli (West) (vii) *Financial year From date 01/04/2020 (DD/MM/YYYY) To date 31/03/2021 (DD/MM/YYYY) (viii) *Whether Annual general meeting (AGM) held Yes No (a) If yes, date of AGM 29/07/2021 (b) Due date of AGM 30/09/2021 (c) Whether any extension for AGM granted Yes No II. -

Crowdfunding Prospects in New Emerging Markets: the Cases of India and Bangladesh

13 Crowdfunding Prospects in New Emerging Markets: The Cases of India and Bangladesh Krishnamurthy Suresh, Stine Øyna, and Ziaul Haque Munim Introduction In 2013, the World Bank published a report on crowdfunding’s potential in emerging markets, which estimated a market opportunity for South Asia alone of close to USD 5 billion (The World Bank 2013). The South Asia region consists of predominantly collectivist societies (Hofstede Insights 2019)—India, Bangladesh, Sri Lanka, Pakistan, Bhutan, and Nepal—where helping others through donations is an integral part of K. Suresh (*) Indian Institute of Management Bangalore (IIM B), Bangalore, India S. Øyna School of Business and Law, University of Agder, Kristiansand, Norway e-mail: [email protected] Z. H. Munim Faculty of Technology, Natural Sciences and Maritime Sciences, University of South-Eastern Norway, Horten, Norway e-mail: [email protected] © The Author(s) 2020 297 R. Shneor et al. (eds.), Advances in Crowdfunding, https://doi.org/10.1007/978-3-030-46309-0_13 298 K. Suresh et al. prevailing religious obligations and societal norms. Thus, these countries share certain cultural and religious traits that are highly consistent with the principles of crowdfunding. Yet, by 2017, the alternative finance activity in the region amounted to no more than USD 269 million, 96% of which was related to the Indian market (see Table 13.1), indicating a vast untapped potential in the Asian economies. In the current chapter, we explore the history, ongoing activity, and future prospects of crowdfunding in new emerging markets. Specifically, we look into the cases of India and Bangladesh.