BT Cellnet&BT3G/One2one Personal Comm

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ofcom CEO Resists Openreach Sell-Off

CityFibre chief gets Why we should listen UK’s dark fibre ducts to Sabio on customer in a row p28 engagement p30 VOL 21 ISSUE 3 AUGUST 2016 www.comms-dealer.com ADVERTISEMENT ADVERTISEMENT 7025_Comms DealerTHE Ear April new logoHEARTBEAT UPDATED.indd13/07/2016 110:24 OF THE UK COMMS 7025_CommsINDUSTRY Dealer Ear April new logo UPDATED.indd13/07/2016 210:24 created by Cloud Billing made easy. Multiple online billing 01256 799812 solutions designed for every business requirement. www.quickstart-billing.co.uk 3-23 Industry News Catch up with events in comms channeltelecom.com 24 Business Matters Connectivity firms CommsdealerjunePRINT.pdf 1 23/06/2016 12:11 set growth pace 32 676_CT_Comms_Dealer_40x60_advert_3.inddC 28/07/2016 1 18:20 Business. Business. Business. Business. Business. Business. Business. BusineOfcomss. CEO resists Interview Business. Business. Business. Business. Business. Business. M Business. BusineYourss. success, Business. Business. Business. Business. Business. Business. Business. COLT ramps up YBusiness. Multiplied.Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. channel strategy CMBusiness. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. MY Business. Business. Business. Business. Business. Business. Business. BusineOpenreachss. sell-off Business. Business. Business. Business. Business. Business. Business. Business. CYBusiness. Business. Business. Business. Business. Business. Business. Business. 36 Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. Business. CMY OFCOM resisted the full separation of Openreach from BT Group in last Business. Business. Business. Business. Business. Business. Business. Business. News Update Business. -

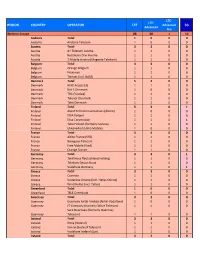

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced 5G Advanced Pro Western Europe 88 68 1 10 Andorra Total 10 0 0 Andorra Andorra Telecom 10 0 0 Austria Total 33 0 0 Austria A1 Telekom Austria 11 0 0 Austria Hutchison Drei Austria 11 0 0 Austria T‐Mobile Austria (Magenta Telekom) 11 0 0 Belgium Total 33 0 0 Belgium Orange Belgium 11 0 0 Belgium Proximus 11 0 0 Belgium Telenet (incl. BASE) 11 0 0 Denmark Total 54 0 0 Denmark Hi3G Access (3) 11 0 0 Denmark Net 1 Denmark 10 0 0 Denmark TDC (YouSee) 11 0 0 Denmark Telenor Denmark 11 0 0 Denmark Telia Denmark 11 0 0 Finland Total 53 0 1 Finland Aland Telecommunications (Alcom) 10 0 0 Finland DNA Finland 11 0 0 Finland Elisa Corporation 11 0 1 Finland Telia Finland (formerly Sonera) 11 0 0 Finland Ukkoverkot (Ukko Mobile) 10 0 0 France Total 44 0 0 France Altice France (SFR) 11 0 0 France Bouygues Telecom 11 0 0 France Free Mobile (Iliad) 11 0 0 France Orange France 11 0 0 Germany Total 33 0 1 Germany Telefonica Deutschland Holding 11 0 0 Germany Telekom Deutschland 11 0 0 Germany Vodafone Germany 11 0 1 Greece Total 33 0 0 Greece Cosmote 11 0 0 Greece Vodafone Greece (incl. Hellas Online) 11 0 0 Greece Wind Hellas (incl. Tellas) 11 0 0 Greenland Total 10 0 0 Greenland TELE Greenland 10 0 0 Guernsey Total 32 0 0 Guernsey Guernsey Airtel Limited (Airtel‐Vodafone) 10 0 0 Guernsey JT Guernsey (formerly Wave Telecom) 11 0 0 Sure Guernsey (formerly Guernsey Guernsey Telecom) 11 0 0 Iceland Total 33 0 0 Iceland Nova (Iceland) 11 0 0 Iceland Siminn (Iceland Telecom) 11 0 0 Iceland Vodafone Iceland (Syn) -

European Telecom Services: the Rise of the Wholesale-Only Model

Equity Research 3 May 2018 European Telecom Services INDUSTRY UPDATE The rise of the Wholesale-Only model European Telecom Services Until recently it was almost unthinkable that any company would consider creating POSITIVE a third expensive parallel Telecom infrastructure, competing with EU incumbents Unchanged and cable, given the high barrier to entry/cost of rollout, relatively stable competition plus mature nature of the industry. However, we are now seeing European Telecom Services strategic moves across a number of European markets, with Open Fiber in Italy the Maurice Patrick highest profile case study, and others following. In this detailed report we analyse +44 (0)20 3134 3622 Open Fiber’s prospects, its key success factors, and identify risks to other EU [email protected] markets. We conclude that Italy is in many ways a “perfect storm”, creating a fertile Barclays, UK investment opportunity for alternative infrastructure. Only Germany and the UK are Mathieu Robilliard likely to see wholesale only on a similar scale, given low incumbent FTTH builds and +44 203 134 3288 high service provider interest. Today we downgraded BT to EW and upgraded TEF [email protected] DE to OW, and we believe OW-rated VOD and ORA are de-risked vs. peers. Barclays, UK Open Fiber – Driving cost-effective rollout and high penetration. Open Fiber will Daniel Morris double its FTTH footprint to c5m homes by end-2018, and 19m by 2023. The company +44 (0)20 7773 2113 sees c.50% penetration in “mature” areas, with newly built areas at c.10% and rising, [email protected] per our recent meeting. -

41201000=Telephone Systems Int Inc;Afghanistan 41220000=Telephone Development Co;Afghanistan 27601000=Albanian Mobile Comms;Alba

41201000=Telephone Systems Int Inc;Afghanistan 41220000=Telephone Development Co;Afghanistan 27601000=Albanian Mobile Comms;Albania 27602000=Vodafone;Albania 60301000=Algerian Mobile Network;Algeria 60302000=Orascom Telecom Algerie Spa;Algeria 54411000=Blue Sky;American Samoa 21303000=S.T.A. MobilAnd;Andorra 63102000=Unitel;Angola 34403000=APUA PCS;Antigua & Barbuda 72202000=Nextel;Argentina 72204000=Globalstar;Argentina 72207000=UNIFON;Argentina 72231000=CTI Movil;Argentina 72234000=Telecom Personal SA;Argentina 72235000=Hutchison-PORT HABLE;Argentina 28301000=ArmenTel;Armenia 28304000=Karabakh Telecom;Armenia 36301000=SETAR;Aruba 50500000=Globalstar;Australia 50501000=Telstra Mobile Comms;Australia 50502000=Singtel Optus-Cable + Wireless Optus;Australia 50503000=Vodafone;Australia 50506000=Hutchinson 3G;Australia 50508000=Australia One-Tel;Australia 23201000=Mobilkom Austria ;Austria 23203000=T-Mobile ;Austria 23205000=One Connect;Austria 23207000=Telering ;Austria 23208000=Telefonica Austria;Austria 23209000=Tele2;Austria 23210000=3 AT;Austria 40001000=Azercell Telekom B.M.;Azerbaijan 40002000=J.V.Bakcell GSM 2000;Azerbaijan 36439000=Bahamas Telcom Co;Bahamas 42601000=Batelco;Bahrain 47001000=Grameen Phone;Bangladesh 47002000=TM Int'l AKTEL;Bangladesh 47019000=Sheba Telecom;Bangladesh 34260000=Cable & Wireless;Barbados 25701000=VELCOM Belarus;Belarus 20601000=Belgacom Mobile Proximus;Belgium 20610000=Mobistar;Belgium 20620000=KPN Orange Belgium SA;Belgium 70267000=Belize Telecom;Belize 70268000=Int Telecom INTELCO;Belize 61600400=BBCOM;Benin -

GOLDBERG, GODLES, WIENER & WRIGHT April 22, 2008

LAW OFFICES GOLDBERG, GODLES, WIENER & WRIGHT 1229 NINETEENTH STREET, N.W. WASHINGTON, D.C. 20036 HENRY GOLDBERG (202) 429-4900 JOSEPH A. GODLES TELECOPIER: JONATHAN L. WIENER (202) 429-4912 LAURA A. STEFANI [email protected] DEVENDRA (“DAVE”) KUMAR HENRIETTA WRIGHT THOMAS G. GHERARDI, P.C. COUNSEL THOMAS S. TYCZ* SENIOR POLICY ADVISOR *NOT AN ATTORNEY April 22, 2008 ELECTRONIC FILING Marlene H. Dortch, Secretary Federal Communications Commission 445 12th Street, SW Washington, DC 20554 Re: Broadband Industry Practices, WC Docket No. 07-52 Dear Ms. Dortch: On April 21, on behalf of Vuze, Inc. (“Vuze”), the undersigned e-mailed the attached material to Aaron Goldberger and Ian Dillner, both legal advisors to Chairman Kevin J. Martin. The material reflects the results of a recent study conducted by Vuze, in which Vuze created and made available to its users a software plug-in that measures the rate at which network communications are being interrupted by reset messages. The Vuze plug-in measures all network interruptions, and cannot differentiate between reset activity occurring in the ordinary course and reset activity that is artificially interposed by a network operator. While Vuze, therefore, has drawn no firm conclusions from its network monitoring study, it believes the results are significant enough to raise them with network operators and commence a dialog regarding their network management practices. Accordingly, Vuze has sent the attached letters to four of the network operators whose rate of reset activity appeared to be higher than that of many others. While Vuze continues to believe that Commission involvement in this Marlene H. -

Telenor Mobil in New European “

Telenor Mobil in new European “Mobile Alliance” Nine leading independent mobile operators today announced the formation of the Mobile Alliance to provide seamless, enhanced voice and data solutions for business and consumer customers across Europe. Amena (Spain), O2 (Germany, UK and Ireland), One (Austria), Pannon GSM (Hungary), sunrise (Switzerland), Telenor Mobil (Norway) and Wind (Italy) yesterday signed a formal agreement in Munich, Germany. This new alliance will initially span the European territories of its members and reach more than 40 million subscribers. It aims to be quick to market with new, innovative cross-border products and services as well as co-operate on initiatives, including technology, sourcing and sales. As the alliance develops, it will expand to cover other key regions to further enhance the reach and 'home-away-from- home' experience of its customers, backed by the same simplicity, convenience and service quality to which they are accustomed. Customers will benefit from progressively introduced services such as seamless GPRS and MMS connectivity across the members' networks, and simple access to home services such as voice-mail and customer service using familiar short-codes. In addition, the alliance members will roll-out a pre-paid top-up service, allowing customers to quickly and easily top-up their credit when travelling in member countries. Corporate customers will benefit from the phased launch of highly competitive price plans and products, providing simple access to important services across the alliance footprint. Future service packages will be supported by a brand helping to guide the customer while travelling abroad. For further information: Sigurd Sandvin, Head of Information, Telenor Mobil, +47 905 21 100 Amena Amena is amember of Auna Group, the leading alternative telecom operator in Spain. -

Moving up the Mobile Commerce Value Chain: 3G Licenses, Customer Value and New Technology

IGI PUBLISHING ITB14567 701 E. Chocolate Avenue, Suite 200, Hershey PA 17033-1240, USA Tel: 717/533-8845; Fax 717/533-8661; URL-http://www.igi-pub.com This paper appears in the publication, Cases on Telecommunications and Networking 128 Fahy, Feller, Finnegan, & Murphyedited by M. Khosrow-Pour © 2006, IGI Global Chapter IX Moving Up the Mobile Commerce Value Chain: 3G Licenses, Customer Value and New Technology Martin Fahy, National University of Ireland, Galway, Ireland Joseph Feller, University College Cork, Ireland Pat Finnegan, University College Cork, Ireland Ciaran Murphy, University College Cork, Ireland EXECUTIVE SUMMARY In the spring of 2002, a team within Digifone, in the Republic of Ireland, deliberated on how they would generate revenues from a Third Generation (3G) mobile license. Their plan was to facilitate third-party mobile commerce services, and receive a percentage of the resulting revenue. A key challenge would be differentiating the value of content based on transaction context. Mediation technology, based on open standards, was seen as the solution. The case describes Digifone’s evaluation of an XML vocabulary as the basis for a mediation and billing solution. The Digifone experience suggests that the key to exploiting 3G technology is inter-industry agreement on measurement standards to effectively manage the value of the associated services — a “bar code” for measuring value and distributing revenue amongst value Web participants. Copyright © 2006, Idea Group Inc. Copying or distributing in print or electronic forms without written permission of Idea Group Inc. is prohibited. Moving Up the Mobile Commerce Value Chain 129 INTRODUCTION The sun was shining as Brian Noble looked out over Dublin from his office in Digifone Headquarters in Lower Baggot Street. -

Case Study for Telefonica O2 UK

Case study for Telefonica O 2 UK Company profile O2 is a leading provider of mobile services to pre- and post-pay subscribers and corporate customers in the UK and Ireland. O2 also has fixed and mobile businesses in Germany (Telefónica O 2 Germany GmbH & Co. OHG), the Czech Republic (Telefónica O2 Czech Republic) and the Isle of Man (Manx Telecom). In addition, O2 has established the Tesco Mobile and Tchibo Mobilfunk joint venture businesses in the UK and Germany respectively. O2 is a wholly-owned subsidiary of Telefónica S.A. www.o2.com . • Over 22 million UK customers. • Revenues in excess of £6 billion. • 27% of UK market share (rank #2). • #1 rating for customer satisfaction. Business situation Over 50% of O2’s UK subscriber-base is made up of pre-pay (Pay & Go) customers, who typically buy an O2 SIM card in a supermarket or other retail outlet, or receive a free SIM, and top-up their account as needed. They have no contract with O2, and could switch to an alternative provider in an instant. In the majority of cases, the only contact detail that O2 has for these customers is their mobile phone number, and traditional methods of marketing communication (such as email and post) can’t be applied. Keeping these pre-pay customers loyal to the O2 brand is a business imperative, and part of O2’s strategy to achieve this is through a wide range of tariffs and bolt-ons, offering service differentiation and best-value. Successfully marketing these offers to O2 subscribers, when all you have is a mobile number, is not easy. -

Pension Scheme Liability

Latest revision of this document: https://library.prospect.org.uk/id/2013/00584 This revision: https://library.prospect.org.uk/id/2013/00584/2013-04-25 annual report 2012 union for professionals INDEX Introduction 1 Membership, recruitment and organisation 3 2 Managing the union 6 3 Rights at work 10 4 Benefits and services 14 5 Training and skills 16 6 Awards 20 7 Other organisations 21 8 Finance 24 Financial statement and accounts 28 Statement of responsibilities of the National Executive Committee 28 Report of the auditors 28 Statement to members 40 Donations and affiliations 41 Schedule of investments 42 Prospect Benevolent Fund 44 Education Trust 47 9 Executive, officers and committees 48 Prospect branches 53 Pay settlements 2012 57 Prospect structure 59 ii Prospect Annual Report 2012 INTRODUCTION The annual report provides the opportunity attacking poor policy and decisions through for Prospect to review the previous year and evidence derived from the experience and account to members for our actions and expertise of members and representatives. management of resources. In the past year we We have also backed members in protest, could have easily concluded that the strain including industrial action, where they on us, and the decline in membership, had wanted to take that course. We have also dulled Prospect’s vibrancy. We do have to played a full part in national protests through focus on the challenges we face, particularly the TUC. in organisation and recruitment, but this We have also litigated to defend our report tells the broader story of a union members’ individual and collective interests. -

European Telecom Services: Make up Or Break Up

FOCUS Equity Research 23 August 2018 European Telecom Services INDUSTRY UPDATE Make up or Break up European Telecom Services Are incumbents still the best placed to monetize data? After years of incumbents POSITIVE Unchanged squeezing challengers and promoting network advantage, we believe the balance of power is now swinging back towards challengers. We see challengers increasingly For a full list of our ratings, price target and having more effective tools with which to profitably fight back, jeopardizing earnings changes in this report, please see incumbent retail and wholesale businesses. We believe incumbents will need to table on page 2. consider forms of separation in order to derisk future cashflows and boost return on capital. Key challenger beneficiaries, in our view, are TEF De, 1&1 Drillisch and European Telecom Services DNA – all OW rated. We also upgrade Sunrise, TalkTalk and Masmovil to OW. Maurice Patrick +44 (0)20 3134 3622 Quad-play strategies are starting to backfire as challengers strike back. Most EU [email protected] incumbents have promoted quad play in recent periods, discounting/deflating mobile Barclays, UK in an effort to take market share and reduce the churn pool. This is now backfiring Mathieu Robilliard somewhat as challengers fight back. We see challengers 1) using alternative/ +44 203 134 3288 wholesale-only FTTH business models to drive fixed market share; 2) exploiting quad [email protected] play pricing gap opportunities to push convergence, especially in the mid to value Barclays, UK segments, where incumbents have back-book risks; and 3) driving hard fixed-mobile Daniel Morris substitution in copper/VDSL areas. -

Nber Working Paper Series Cables, Sharks and Servers

NBER WORKING PAPER SERIES CABLES, SHARKS AND SERVERS: TECHNOLOGY AND THE GEOGRAPHY OF THE FOREIGN EXCHANGE MARKET Barry Eichengreen Romain Lafarguette Arnaud Mehl Working Paper 21884 http://www.nber.org/papers/w21884 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 January 2016, Revised April 2021 We are grateful to Mark Aguiar, Pol Antràs, Thorsten Beck, Geert Bekaert, Bruno Biais, Jérôme Busca, Estelle Cantillon, Giancarlo Corsetti, Alexander Duering, Torsten Ehlers, Benoît Geller, Jérôme Héricourt, Jean Imbs, Takatoshi Ito, Amit Khandelwal, Philip Lane, Istvan Mak, Guy- Charles Marhic, Philippe Martin, Martin Uribe, Frank Packer, Hashem Pesaran, Romain Rancière, Andrew Rose, Alan Taylor and Xavier Vives for comments and discussions, as well as to seminar participants at the ECB, Goethe University Frankfurt and USC Dornsife and to participants at the Clausen Center Conference on Global Economic Issues, Berkeley, and to the Cambridge-INET conference on the microstructure of the FX market for comments. We thank Ziqi Li for excellent research assistance. We are also grateful to Denis Pêtre and Philip Wooldridge for providing unpublished Bank for International Settlements data on offshore foreign exchange trading. The views expressed are those of the authors and do not necessarily reflect those of the ECB, the Eurosystem, the IMF, or the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2016 by Barry Eichengreen, Romain Lafarguette, and Arnaud Mehl. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. -

Signature Redacted Signatures of Authors

-4 A Study of Two Wireless Telecommunications Companies' Globalization Strategies - An Analysis of Vodafone's and NTT DoCoMo's Foreign Investments by Hyungchul Joo B.S. Computer Engineering Seoul National University, 1989 & Peter D. Honkanen B.S. Electrical Engineering Boston University, 1985 Submitted to the Sloan School of Management in Partial Fulfillment of the Requirements for a Degree of Master of Science in Management at the Massachusetts Institute of Technology June 2003 D 2003 Massachusetts Institute of Technology All rights reserved Signature redacted Signatures of Authors .... ,....... ........ ,I.... ........... .,............. ISTo anSchool of Management May 9, 2003 Signature redacted C ertified b y ......................................................................................... Arnoldo C. Hax Alfred P. Sloan Professor of Management Thesis Supervisor Signature redacted A ccepted by........................................... ....... "tephen J. Sacca Director, Sloan Fellows Program ASSACHUStJSTSINSTITUTE IFCTHWLOGY ACIEARCHIVES A UG 0 4 2003 EIBFJI1 LIBRARIES U -~ -~ A Study of Two Wireless Telecommunications Companies' Globalization Strategies - An Analysis of Vodafone's and NTT DoCoMo's Foreign Investments by Hyungchul Joo & Peter D. Honkanen Submitted to the Sloan School of Management in Partial Fulfillment of the Requirements for a Degree of Master of Science in Management ABSTRACT NTT DoCoMo's and Vodafone's globalization strategies, as expressed through their foreign investments, were examined via direct interviews,