Toward a More Universal Currency: the Impact of the Clearing Mechanism on Developing Economies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

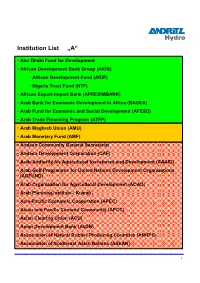

Institution List „A“

Institution List „A“ • Abu Dhabi Fund for Development • African Development Bank Group (AfDB) • African Development Fund (AfDF) • Nigeria Trust Fund (NTF) • African Export-Import Bank (AFREXIMBANK) • Arab Bank for Economic Development in Africa (BADEA) • Arab Fund for Economic and Social Development (AFESD) • Arab Trade Financing Program (ATFP) • Arab Maghreb Union (AMU) • Arab Monetary Fund (AMF) • Andean Community General Secretariat • Andean Development Corporation (CAF) • Arab Authority for Agricultural Investment and Development (AAAID) • Arab Gulf Programme for United Nations Development Organizations (AGFUND) • Arab Organization for Agricultural Development (AOAD) • Arab Planning Institute - Kuwait • Asia-Pacific Economic Cooperation (APEC) • Asian and Pacific Coconut Community (APCC) • Asian Clearing Union (ACU) • Asian Development Bank (AsDB) • Association of Natural Rubber Producing Countries (ANRPC) • Association of Southeast Asian Nations (ASEAN) 1 Institution List „B-C“ • Bank of Central African States (BEAC) • Central Bank of West African States (BCEAO) • Common Market for Eastern and Southern Africa (COMESA) • Baltic Council of Ministers • Bank for International Settlements (BIS) • Black Sea Trade and Development Bank (BSTDB) • Caribbean Centre for Monetary Studies (CCMS) • Caribbean Community (CARICOM) • Caribbean Development Bank (CDB) • Caribbean Regional Technical Assistance Centre (CARTAC) • Center for Latin American Monetary Studies (CEMLA) • Center for Marketing Information and Advisory Services for Fishery Products -

Development of Payment and Settlement System

CHAPTER 7 Development of Payment and Settlement System Khin Thida Maw This chapter should be cited as: Khin Thida Maw, 2012. “Development of Payment and Settlement System.” In Economic Reforms in Myanmar: Pathways and Prospects, edited by Hank Lim and Yasuhiro Yamada, BRC Research Report No.10, Bangkok Research Center, IDE- JETRO, Bangkok, Thailand. Chapter 7 Development of Payment and Settlement System Khin Thida Maw ______________________________________________________________________ Abstract The new government of Myanmar has proved its intention to have good relations with the international community. Being a member of ASEAN, Myanmar has to prepare the requisite measures to assist in the establishment of the ASEAN Economic Community in 2015. However, the legacy of the socialist era and the tight control on the banking system spurred people on to cash rather than the banking system for daily payment. The level of Myanmar’s banking sector development is further behind the standards of other regional banks. This paper utilizes a descriptive approach as it aims to provide the reader with an understanding of the current payment and settlement system of Myanmar’s financial sector and to recommend some policy issues for consideration. Section 1 introduces general background to the subject matter. Section 2 explains the existing domestic and international payment and settlement systems in use by Myanmar. Section 3 provides description of how the information has been collected and analyzed. Section 4 describes recent banking sector developments and points for further consideration relating to payment and settlement system. And Section 5 concludes with the suggestions and recommendation. ______________________________________________________________________ 1. Introduction Practically speaking, Myanmar’s economy was cash-based due to the prolonged decline of the banking system after nationalization beginning in the early 1960s. -

New Monetarist Economics: Methods∗

Federal Reserve Bank of Minneapolis Research Department Staff Report 442 April 2010 New Monetarist Economics: Methods∗ Stephen Williamson Washington University in St. Louis and Federal Reserve Banks of Richmond and St. Louis Randall Wright University of Wisconsin — Madison and Federal Reserve Banks of Minneapolis and Philadelphia ABSTRACT This essay articulates the principles and practices of New Monetarism, our label for a recent body of work on money, banking, payments, and asset markets. We first discuss methodological issues distinguishing our approach from others: New Monetarism has something in common with Old Monetarism, but there are also important differences; it has little in common with Keynesianism. We describe the principles of these schools and contrast them with our approach. To show how it works, in practice, we build a benchmark New Monetarist model, and use it to study several issues, including the cost of inflation, liquidity and asset trading. We also develop a new model of banking. ∗We thank many friends and colleagues for useful discussions and comments, including Neil Wallace, Fernando Alvarez, Robert Lucas, Guillaume Rocheteau, and Lucy Liu. We thank the NSF for financial support. Wright also thanks for support the Ray Zemon Chair in Liquid Assets at the Wisconsin Business School. The views expressed herein are those of the authors and not necessarily those of the Federal Reserve Banks of Richmond, St. Louis, Philadelphia, and Minneapolis, or the Federal Reserve System. 1Introduction The purpose of this essay is to articulate the principles and practices of a school of thought we call New Monetarist Economics. It is a companion piece to Williamson and Wright (2010), which provides more of a survey of the models used in this literature, and focuses on technical issues to the neglect of methodology or history of thought. -

TORC3: Token-Ring Clearing Heuristic for Currency Circulation

TORC3: Token-Ring Clearing Heuristic for Currency Circulation Carlos Humes Jr.∗, Marcelo S. Lauretto†, Fábio Nakano†, Carlos A.B. Pereira∗, Guilherme F.G. Rafare∗∗ and Julio M. Stern∗,‡ ∗Institute of Mathematics and Statistics of the University of São Paulo, Brazil †School of Arts, Sciences and Humanities of the University of São Paulo, Brazil ∗∗FinanTech Ltda. ‡[email protected] Abstract. Clearing algorithms are at the core of modern payment systems, facilitating the settling of multilateral credit messages with (near) minimum transfers of currency. Traditional clearing procedures use batch processing based on MILP - mixed-integer linear programming algorithms. The MILP approach demands intensive computational resources; moreover, it is also vulnerable to operational risks generated by possible defaults during the inter-batch period. This paper presents TORC3 - the Token-Ring Clearing Algorithm for Currency Circulation. In contrast to the MILP approach, TORC3 is a real time heuristic procedure, demanding modest computational resources, and able to completely shield the clearing operation against the participating agents’ risk of default. Keywords: Bayesian calibration; Clearing algorithms; Heuristic optimization; Multilateral netting; Operational risk; Payment systems; Real-time heuristic procedures. 1. INTRODUCTION Clearing algorithms are at the core of modern payment systems, facilitating multilat- eral netting, that is, the settling of multilateral credit messages with (near) minimum transfers of currency. Traditional clearing procedures use batch processing based on mixed-integer linear programming algorithms. Large scale mixed-integer programming demands intensive computational resources; most of the traditional clearing algorithms require large mainframe computers. Furthermore, this approach delays all payments to after the batch processing (usually overnight). Moreover, batch processing introduces an operational risk originated from the possibility of a participant’s default in the iter-batch processing period. -

International Barter

WORKING PAPER ALFRED P. SLOAN SCHOOL OF MANAGEMENT INTERNATIONAL BARTER Adrian E. Tschoegl Sloan School of Management M.I.T. Working Paper #996-78 May 1978 MASSACHUSETTS INSTITUTE OF TECHNOLOGY 50 MEMORIAL DRIVE CAMBRIDGE, MASSACHUSETTS 02139 INTERNATIONAL BARTER* Adrian E. Tschoegl Sloan School of Management M.I.T. Working Paper #996-78 May 1978 *I would like to thank Edward M, Graham, Donald R, Lessard, N.G. Tschoegl, and N.W. Tschoegl for their comments, criticism, and assistance. -1- I. Introduction Barter is the oldest form of trade. The payment for goods with goods predates the invention of money and is still with us today. This paper has two purposes: first, to expose the student of international business to this form of trade between nations; and second, to contradict the sentiments ex- pressed in this quotation: "It is difficult for Americans, so committed to free trade, to understand the logic behind trade without money. Per- haps there is no 'logic,' at least in terms of traditional Western economic theory. Maybe the-re are only reasons that few Americans can understand and even fewer can accept. "' In this section we summarily review the nature of 'trade without money' and its recent history. Section II examines the various modes of barter in some detail, focusing on the common provisions and pitfalls of such transactions. Section III discusses two proximate causes for barter, price distortions and the need for liquidity, and two benefits, improvement in the terms of trade and the creation of long-term contracts and trading relationships. Section IV concerns itself with the political-economy of barter, that is, the reasons behind the proximate causes. -

Ben S Bernanke: Clearinghouses, Financial Stability, and Financial Reform

Ben S Bernanke: Clearinghouses, financial stability, and financial reform Speech by Mr Ben S Bernanke, Chairman of the Board of Governors of the Federal Reserve System, at the 2011 Financial Markets Conference, Stone Mountain, Georgia, 4 April 2011. The original speech, which contains various links to the documents mentioned, can be found on the US Federal Reserve System’s website. * * * I am pleased to speak once again at the Federal Reserve Bank of Atlanta’s Financial Markets Conference. This year’s conference covers an interesting mix of topics bearing on the vital ongoing global debate on how best to prevent and respond to financial crises. Tonight I would like to discuss post-crisis reform as it relates to a prominent part of our financial market infrastructure – namely, clearinghouses for payments, securities, and derivatives transactions. This audience, I know, recognizes the importance of what is often called the “plumbing” of the financial system – a set of institutions that very safely and efficiently handles, under most circumstances, enormous volumes of financial transactions each day. Because clearinghouses and other parts of the financial infrastructure fared relatively well during the crisis – despite moments of significant stress – the public debate on financial reform has understandably focused on the risks posed by so-called too-big-to-fail financial firms, whose dramatic failures or near failures put our financial system and economy in dire jeopardy. Nevertheless, the smooth operation and financial soundness of clearinghouses and related institutions are essential for financial stability, and we must not take them for granted. Importantly, title 8 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) contains provisions aimed at improving the transparency, resilience, and financial strength of clearinghouses, which the act calls financial market utilities. -

Nber Working Paper Series David Laidler On

NBER WORKING PAPER SERIES DAVID LAIDLER ON MONETARISM Michael Bordo Anna J. Schwartz Working Paper 12593 http://www.nber.org/papers/w12593 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 October 2006 This paper has been prepared for the Festschrift in Honor of David Laidler, University of Western Ontario, August 18-20, 2006. The views expressed herein are those of the author(s) and do not necessarily reflect the views of the National Bureau of Economic Research. © 2006 by Michael Bordo and Anna J. Schwartz. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. David Laidler on Monetarism Michael Bordo and Anna J. Schwartz NBER Working Paper No. 12593 October 2006 JEL No. E00,E50 ABSTRACT David Laidler has been a major player in the development of the monetarist tradition. As the monetarist approach lost influence on policy makers he kept defending the importance of many of its principles. In this paper we survey and assess the impact on monetary economics of Laidler's work on the demand for money and the quantity theory of money; the transmission mechanism on the link between money and nominal income; the Phillips Curve; the monetary approach to the balance of payments; and monetary policy. Michael Bordo Faculty of Economics Cambridge University Austin Robinson Building Siegwick Avenue Cambridge ENGLAND CD3, 9DD and NBER [email protected] Anna J. Schwartz NBER 365 Fifth Ave, 5th Floor New York, NY 10016-4309 and NBER [email protected] 1. -

Exchange Clearing of Financial Transmission Rights (Eftrs)

APRIL 22, 2021 Exchange Clearing of Financial Transmission Rights (EFTRs) NEPOOL Budget & Finance Subcommittee Meeting Cheryl Arnold DIRECTOR, FINANCE & ACCOUNTING ISO NEW ENGLAND Sylvie Jobes SENIOR MANAGER, RISK & STRATEGIC ANALYSIS NODAL EXCHANGE, LLC ISO-NE PUBLIC Contents of Presentation Page(s) • Project Objectives 3 • Introduction: Current Financial Transmission Rights (FTR) Mechanisms 4-7 • Overview of Design Concept 8-9 • Proposed Design 10-33 – Participating Entities – Background on Clearing House Model – Sequence for Exchanging FTR Awards to Futures Contracts – Billing, Collections and Settlement Process – Benefits of Proposed Design/Risk Management • Legal and Regulatory Considerations 34 • Tentative Project Schedule 35-36 ISO-NE PUBLIC 2 Project Objectives • Replace ISO-NE Financial Assurance requirements for holding Financial Transmission Rights (FTRs) with clearing of equivalent futures contracts by a CFTC jurisdictional exchange / clearing house – A clearing house is better positioned to handle valuation (margin) on an ongoing basis – Default risk is shifted from ISO-NE’s market participants to clearing house • Facilitate secondary market trading ISO-NE PUBLIC 3 Introduction: Current FTR Mechanisms (1) • An FTR is a financial instrument − acquired in an ISO-NE auction − that entitles the holder to receive compensation for congestion costs. It can be used to hedge the Day-Ahead LMP congestion component difference on a specific path between receipt and delivery points in the New England energy market. • Revenues from the -

Introduction Establishment

ACU 1974 INTRODUCTION OBJECTIVES Secretary General settlement periods by a decision taken by unanimous vote of all of the Directors. Asian Clearing Union (ACU) is the simplest form of • To provide a facility to settle payments, on a multilateral The Board is authorized to appoint a Secretary General payment arrangements whereby the participants settle basis, for current international transactions among for a term of three years. The Secretary General may Interest payments for intra-regional transactions among the the territories of participants; be reappointed and shall cease to hold office when the Interest shall be paid by net debtors and transferred to participating central banks on a multilateral basis. The Board so decides. • To promote the use of participants’ currencies net creditors on daily outstandings between settlement main objectives of a clearing union are to facilitate in current transactions between their respective Agent dates. The rate of interest applicable for a settlement payments among member countries for eligible territories and thereby effect economies in the use period will be the closing rate on the first working day transactions, thereby economizing on the use of foreign The Board of Directors may make arrangements with of the participants’ exchange reserves; of the last week of the previous calendar month offered exchange reserves and transfer costs, as well as a central bank or monetary authority of a participant by the Bank for International Settlements (BIS) for one promoting trade among the participating countries. The • To promote monetary cooperation among the to provide the necessary services and facilities for the month US dollar and Euro deposits. -

Clearing and Settlement

Clearing and Settlement OmniPay is First Data’s™ cost effective, industry-leading payment processing platform. Flexible data capture, batch handling and posting options At-a-Glance First Data’s goal is to provide the data that you need, when you need The OmniPay platform enables efficient and cost effective it. The OmniPay platform receives, consolidates, formats and posts Clearing and Settlement services transaction data at a designated frequency and according to a client’s and outstanding responsiveness required processing calendar. And because it’s designed for domestic to acquiring customers and their and international schemes, processing can occur in alignment with banks’ customer’s needs. different time zones, different bank holidays, and varying volumes across varying countries, etc. Even sub-groups of activity within an institution can each be processed distinctly. Clearing and Settlement Extensive business, transaction and Settlement product support Settlement data is instantly visible through First Data’s The OmniPay platform supports acquiring for a broad Remote Access Module (RAM). One click lets you locate range of merchant segments: scheme reports or utilise a suite of production reconciliation reporting tools. • The volume of contract deliverables puts a strain on resources to keep up with timely review and approval The OmniPay platform predicts when settlement will occur—even before the transactions are cleared—by assessing • Retail the characteristics of individual transactions to determine the • eCommerce service under which they will be settled. : • Aggregator merchants Interchange management • Airline acquiring Interchange fees are estimated before settlement occurs, • Car hire ensuring clients can bill at least what they will pay in interchange. -

Required Clearing Balances by E.J

Required Clearing Balances by E.J. Stevens E.J. Stevens is an assistant vice president and economist at the Federal Reserve Bank of Cleve- land. The author thanks Cheryl L. Edwards for helpful comments on an earlier draft of this article and Ann Dombrosky for invaluable re- search assistance. Introduction Bank to comply with the combined require- ments. For each of these institutions, the conse- Few people realize that in addition to complying quences of modest account deficiencies or with a Federal Reserve System regulation for surpluses are reckoned on the basis of re- holding a required reserve balance, many banks quired clearing balance rules. Only if a bank simultaneously meet an additional requirement fails to meet any of its clearing balance require- to hold a clearing balance in their account at a ment does it face the familiar "discount rate Federal Reserve Bank. This clearing balance re- plus 2 percent" penalty for a required reserve quirement differs from the familiar reserve re- deficiency. Likewise, such a bank wastes sur- quirement in three significant ways. First, a bank's plus balances by earning no rate of return only agreement to meet the requirement is typically a if its actual balance exceeds its required bal- business decision, not a legal necessity. Second, ance by more than a preestablished margin. the amount of the requirement is mostly discre- Almost all analyses of bank reserve manage- tionary, not a fixed percentage of the bank's de- ment behavior focus entirely on reserve require- posit liabilities. And third, the rate of return on a ments, ignoring clearing balances because they clearing balance is about equal to the federal are a relatively recent innovation.2 Clearly, how- funds rate, not zero, although a bank can use the ever, an important set of banks now maintains earnings only to pay for services it buys from a balances at the Fed following a somewhat differ- Federal Reserve Bank. -

By:Bill Medley

By: Bill Medley Highways of Commerce Central Banking and The U.S. Payments System By: Bill Medley Highways of Commerce Central Banking and The U.S. Payments System Published by the Public Affairs Department of the Federal Reserve Bank of Kansas City 1 Memorial Drive • Kansas City, MO 64198 Diane M. Raley, publisher Lowell C. Jones, executive editor Bill Medley, author Casey McKinley, designer Cindy Edwards, archivist All rights reserved, Copyright © 2014 Federal Reserve Bank of Kansas City No part of this book may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior consent of the publisher. First Edition, July 2014 The Highways of Commerce • III �ontents Foreword VII Chapter One A Calculus of Chaos: Commerce in Early America 1 Chapter Two “Order out of Confusion:” The Suffolk Bank 7 Chapter Three “A New Era:” The Clearinghouse 19 Chapter Four “A Famine of Currency:” The Panic of 1907 27 Chapter Five “The Highways of Commerce:” The Road to a Central Bank 35 Chapter Six “A problem…of great novelty:” Building a New Clearing System 45 Chapter Seven Bank Robbers and Bolsheviks: The Par Clearance Controversy 55 Chapter Eight “A Plump Automatic Bookkeeper:” The Rise of Banking Automation 71 Chapter Nine Control and Competition: The Monetary Control Act 83 Chapter Ten The Fed’s Air Force: A Plan for the Future 95 Chapter Eleven Disruption and Evolution: The Development of Check 21 105 Chapter Twelve Banks vs. Merchants: The Durbin Amendment 113 Afterword The Path Ahead 125 Endnotes 128 Sources and Selected Bibliography 146 Photo Credits 154 Index 160 Contents • V ForewordAs Congress undertook the task of designing a central bank for the United States in 1913, it was clear that lawmakers intended for the new institution to play a key role in improving the performance of the nation’s payments system.