INTRODUCTION Introduction Insurance in India Has Taken Galloping Stage

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kingfisher Airlines, Spice Jet, Air Deccan and Many More

SUMMER TRAINING REPORT ON Aviation Sector in India “Submitted in the Partial Fulfillment for the Requirement of Post Graduate Diploma in Management” (PGDM) Submitted to: Submitted by: Mr. Sandeep Ranjan Pattnaik Biswanath Panigrahi Marketing and Sales Manager Roll No: 121 At Air Uddan Pvt.ltd (2011-2013) Jagannath International Management School Kalkaji, New Delhi. 1 | P a g e Acknowledgment I have made this project report on “Aviation Sector in India” under the supervision and guidance of Miss Palak Gupta (Internal Mentor) and Mr.Sandeep Ranjan Pattnaik (External Mentor). The special thanks go to my helpful mentors, Miss Palak Gupta and Mr.Sandeep Ranjan Pattnaik. The supervision and support that they gave truly helped the progression and smoothness of the project I have made. The co-operation is much indeed appreciated and enjoyable. Besides, this project report making duration made me realize the value of team work. Name: Biswanath Panigrahi STUDENT’S UNDERTAKING 2 | P a g e I hereby undertake that this is my original work and have never been submitted elsewhere. Project Guide: (By:Biswanath Panigrahi) Mr. Sandeep Ranjan Pattnaik Marketing and Sales Manager Air Uddan Pvt.ltd (EXTERNAL GUIDE) Ms. Palak Gupta (Astt. Professor JIMS) S.NO. CHAPTERS PAGE NO. 01. CHAPTER 1 5 3 | P a g e EXECUTIVE SUMMARY 02. CHAPTER 2 8 COMPANY PROFILE 03. CHAPTER 3 33 Brief history of Indian Aviation sector 04. CHAPTER 4 40 OBJECTIVE OF THE PROJECT 05. CHAPTER 5 43 RESEARCH METHODOLOGY 06. CHAPTER 6 46 ANALYSIS AND INTERPRETATION 07. CHAPTER 7 57 FINDINGS AND INTERFERENCES 08. CHAPTER 8 60 RECOMMENDATION 09. -

Aw...Cover Page

RNI REGD.: DELENG/2015/66174 150 VOLUME 06 ISSUE 03 ; MARCH-APRIL 2021 www.aviationworld.in AIRPORT PRIVATISATION AERO INDIA 2021 NEW INDIA POLICY EXCLUSIVE FEATURE AVIATION BUDGET MOCA: ROLES & HOLDING AT 36000 FEET INITIATIVES OF 2020 KING AIR 260 AND KING AIR 360 THE NEXT KING RISES 28th - 29th 2021 APRIL BANGALORE INDIA SUMMIT - 2021 “The Evolution of Smart & Futuristic Airports” TiEr onE SPONSORS TiEr TWo SPONSORS TiEr ThrEE SPONSORS SupporTing PARTNERS officiAl mAgAzinE PARTNER officiAl mEdiA PARTNER MEDIA & PUBLICATIONS India’s Premier Aviation Magazine traicon For Sponsorship Opportunities Alfin | Tel: +91 90369 81048 | Email: [email protected] IN THIS ISSUE MARCH-APRIL 2021 VOLUME 06 ISSUE 03 2 Contents 3 Foreword 4 Advertorial Innovative Solutions for Airport Professionals 6 General News 10 Global News 14 Air Show Report Aero India 2021 17 Defence Update HAL Mega Deal of TEJAS 18 Cover Story King Air 260 & King Air 360 : The Next King Rises 22 MOCA Update 06 2020: Year End Review 26 Budget Update Union Budget 2021 : Major Highlights 28 Airport Business Maximizing Non-Aeronautical Revenue 30 Policy Matter Airport Privitisation Inevitable! 32 Aerospace Innovation Aluminium Alloys: Past, Present & Future 14 33 Policy Matter Budget 2021 for Aviation Still Holding at 36000 Feet 34 Infrastructure - Airport Development 35 Air Safety Space Based ADS-B Air Traffic Surveillance System 36 Safety eVTOL and its Safety Concerns 37 Regulatory Affairs Gulfstream Earns FAA approvals 26 38 Awards Airport Service Quality ( ASQ) Awards 2020 39 Innovation India's First Inflatable Hanger 40 Event India Aircraft Leasing Summit 21 41 Webinar Role of Aviation Technical Consultants in Aviation Leasing Industry 42 In Conversation 34 Exploring Journey's in Arabia with STA 44 Adventure Delta 105 : An Army experimental Zone NO. -

Leakproof Form-Work Gives Long Lasting Concrete

REGIONAL DEVELOPMENTS THROUGH AVIATION IN INDIA—CREATION OF NEW REGIONAL AIRPORTS AND REGIONAL AIRLINES —CreationRegionalCurrent Developments in Air and SpaceDevelopments Lawof new Regional through airports aviation and Regionalin India airlines Debabrat Mishra* Introduction One of the fastest growing aviation industries in the world is Indian Aviation Industry. With the liberalization of the Indian aviation sector, a rapid revolution has undergone in Indian aviation industry. Primarily it was a government-owned industry, but now it is dominated by privately owned full service airlines and low cost carriers. Around 75% share of the domestic aviation market is shared by private airlines. Earlier only few people could afford air travel, but now it can be afforded by a large number of people as it has become much cheaper because of stiff competition. The civil aviation traffic has seen an unprecedented traffic in the past few years on account of booming Indian economy, growing tourism industry, and entry of low cost carriers in the private sector, liberalization of international bi-lateral agreements and liberalization of civil aviation policy. In future also the civil aviation traffic is expected to grow at the same pace despite current slowdown due to global recession. But airport infrastructure has not kept pace with the growth of the civil aviation traffic. This has resulted in congestion and inefficient services in major airports, limited landing slots, inadequate parking bays and congestion during peak hours for airlines. Development of quality infrastructure will have an impact on international competitiveness and economic growth. This requires faster development of civil aviation infrastructure on public private partnership mode. -

7757-A-2017.Pdf

Available Online at http://www.recentscientific.com International Journal of CODEN: IJRSFP (USA) Recent Scientific International Journal of Recent Scientific Research Research Vol. 8, Issue, 6, pp. 17527-17531, June, 2017 ISSN: 0976-3031 DOI: 10.24327/IJRSR Research Article EMERGING SCENARIO OF INDIAN AVIATION SECTOR FACING ISSUES AND CHALLENGES IN ECONOMY Anuradha Yadav Department of Commerce Bhagini Nivedita College University of Delhi DOI: http://dx.doi.org/10.24327/ijrsr.2017.0806.0372 ARTICLE INFO ABSTRACT Article History: This research paper studies on the structure, issues and challenges of Indian aviation industry and impact on economic growth. The milestones and major issues faced by the companies in Indian Received 05th March, 2017 st aviation industry are discussed. The monopoly of public sector may have ended, after entry of Received in revised form 21 private players in the airline industry, but the industry growth is restricted by tax structure, lack of April, 2017 infrastructure, cartel formation by public sector oil companies, lack of vision by the government, Accepted 06th May, 2017 th poor regulation and management issues of companies. There are few factors such as entry of Low Published online 28 June, 2017 costs carriers (LLC), modern airports, vision of the new government regarding tourism and Key Words: transportation, foreign direct investments, cutting edge technology, and vision of regional connectivity are driving the industry towards transformation. Industry has faced many challenges Issues and challenges, Indian aviation and still it is going on. Many new players are entering into this market. Policy change such as 49 industry, Airline industry, Economic percent investment through foreign direct investment (FDI) is changing the face of the industry. -

Airports Economic Regulatory Authority of India Determination Of

[F. No. AERA/20010/MYTP/HIAL/CP-II/2016-17/Vol-IV] Consultation Paper No. 30/2017-18 Airports Economic Regulatory Authority of India Determination of Aeronautical Tariffs in respect of Rajiv Gandhi International Airport, Shamshabad, Hyderabad for the 2nd Control Period (01.04.2016 – 31.03.2021) New Delhi: 19th December, 2017 AERA Building Administrative Complex Safdarjung Airport New Delhi - 110003 Table of Contents 1. Brief facts ................................................................................................................. 4 2. Guiding Principles for the Authority .......................................................................... 8 3. Consideration of True-ups for Pre Control Period and 1st Control Period .................. 17 a HIAL Submission on True-up for the 1st Control Period ............................... 17 b Authority’s examination of HIAL’s submission on True-up for the pre- Control Period and 1st Control Period .......................................................... 27 4. Control Period ......................................................................................................... 42 a HIAL Submission on Control Period ............................................................. 42 b Authority’s Examination of HIAL Submissions on Regulatory Period .......... 42 5. Regulatory Asset Base ............................................................................................. 43 a HIAL submission on Regulatory Asset Base (RAB) ....................................... 43 b Authority’s -

1. Citymax มีแผนจะขยายสาขา Krispy Kreme เพิ่มในประเทศอินเดีย

Mumbai Edition 20-26 ตุลาคม 2014 1. Citymax มีแผนจะขยายสาขา Krispy Kreme เพิ่มในประเทศอินเดีย หลังจากที่ตัดสินใจหยุดที่จะขยายร้านกาแฟภายใต้แบรนด์ Gloria Jeans Coffee บริษัท Citymax ได้เปลี่ยนทิศมุ่ง ไปท าธุรกิจโดนัทแทน และถือได้ว่าได้การตอบรับที่ดีจากผู้บริโภคชาวอินเดียวอย่างล้นหลาม ท าให้ตัดสินใจที่จะขยายสาขา เพิ่ม บริษัท Citymax ภายใต้การดูแลของ Landmark Group ที่มีส านักงานใหญ่อยู่ที่ดูไบ เป็นแฟรนไชส์เจ้าหลักให้กับ Krispy Kreme ในอินเดียทางตอนใต้และตะวันตก และมีแผนว่าจะขยายธุรกิจของตนผ่านร้านคาเฟ่และโรงงาน และใน 1 ปี ที่ผ่านมา Citymax ได้ท าการเปิดร้านจ าหน่ายโดนัทภายใต้แบรนด์ Krispy Kreme ไปแล้วกว่า 11 ร้านด้วยกันในเมืองบังกะลอร์ นาย Kabir Lumba กรรมการผู้จัดการใหญ่ Lifestyle International ซึ่งอยู่ภายใต้ Landmark Group เช่นเดียวกับ Citymax กล่าวถึงชาวอินเดียว่าเป็นชาติชอบรับประทานของหวาน และโดนัทก็ตอบโจทย์ตรงนี้ได้ดีกว่ากาแฟ บริษัทจึง ตัดสินใจที่จะหยุดการขยายร้านกาแฟ Gloria Jeans Coffee แล้วหันมามุ่งขยายแบรนด์ Krispy Kreme แทน ซึ่งจะขยาย Disclaimer: การเผยแพร่ข้อมูลใน “สายตรงจากอินเดีย” มีวัตถุประสงค์เพื่อเป็นการให้ข้อมูลแก่ผู้สนใจเท่านั้น ส านักงานส่งเสริมการค้าระหว่างประเทศ ณ เมืองมุมไบ จะไม่รับผิดชอบต่อความเสียหายใดๆ ที่อาจเกิดขึ้นจาก การน าข้อมูลนี้ไปใช้ ร้านใน 2 รูปแบบด้วยกันคือร้านแบบ standalone และร้านที่ตั้งอยู่ในห้างสรรพสินค้า และจะเปิดทั้งหมด 25 ร้ านด้วยกันใน ปีนี้ ค่าเช่าที่ถือได้ว่าอุปสรรคหลักๆในการท าก าไรของธุรกิจร้านค้าปลีกต่างๆ ซึ่ง Citymax ตัดสินใจว่าจะไม่เข้าไปอยู่ใน สถานที่ๆมีค่าเช่าสูงมากนักเช่นในย่าน Colaba Causeway ของมุมไบตอนใต้ ซึ่งแม้แบรนด์ Krispy Kreme เป็นแบรนด์จาก สหรัฐฯและมีอายุกว่า 80 ปีแล้ว แต่ในอินเดีย -

SP's Aviation November 2011

SARANG: SYMPHONY IN THE AIR SP’s AN SP GUIDE PUBLICATION ED BUYER ONLY) ED BUYER AS -B A NDI I News Flies. We Gather Intelligence. Every Month. From India. 75.00 ( ` Aviationwww.spsaviation.net november • 2011 + • Environment & Commercial Aviation • Chartered Services in India • LCC Model - How Viable IAF • Business Aircraft Operators • C-130J Induction & Capacity Association Enhancement • Helicopters for Medevac • Sarang Team • NBAA 2011 • 79th Anniversary Celebrations • MMRCA Update • Selection of Apache • Training Mechanism Introspection RNI NUMBER: DELENG/2008/24199 flying-high-india-SP-Aviation.pdf 1 30/09/2011 08:29:38 C M Y CM MY CY CMY K SP’s AN SP GUIDE PUBLICATION TABLE of CONTENTS News Flies. We Gather Intelligence. Every Month. From India. AviationIssue 11 • 2011 a plane and a partnership. C-130J. redefining capability and commitment. 38 IAF SPECIAL: 26 IAF SPECIAL: The Sarang team of the IAF has carried C-130Js delivery ahead of schedule out numerous displays in India and abroad has ushered a new era of Indo-US performing in more than 35 air shows relationship TECKNOW 47 Helicopter Selection 12 Fly Faster & Safer Cover Story One & Only 50 Air Force Day FIRST 79 Going Strong 14 Manned Multicopter SO UNIQUE, SO SPECIAL SHOW REPORT Since 1956, more than 40 CIVIL 54 NBAA variants of C-130 Hercules 15 Environment A Festive Affair The Way Forward have enhanced the tactical airlift capability of over 50 HALL OF famE 19 Business Aviation 59 Bessie Coleman Charting a Path nations across the globe. The C-130J Super Hercules is 22 Helicopters REGULAR DEPARTMENTS Life Savers the latest in the series. -

SP's Avn 9 of 08 Civil & Military Special Issue

4QFDJBM *446& 41T "/41(6*%&16#-*$"5*0/ /FXT'MJFT8F(BUIFS*OUFMMJHFODF&WFSZ.POUI'SPN*OEJB *446&r "WJBUJPO4FFVTBU*OEJB"WJBUJPO)ZEFSBCBE )BMM$ #PPUI 888414"7*"5*0//&5 5)&#&*+*/("*31035 %PXFIBWFB 7JTJPOUPNBUDI 3/*/6.#&3%&-&/( 41T"WJBUJPOMPPLTBUUIFOFFEPGUIFIPVS 1"(& $*7*- 4QFDJBM "8PSEGSPN&EJUPS %FTQJUFUIFDMPVEIPWFSJOH PWFSUIFBWJBUJPOJOEVTUSZ UIFSFJTDPOTJEFSBCMFJOUFSFTU FYQFDUBUJPOBOEFYDJUFNFOU PWFSUIFGPSUIDPNJOH*OEJB "WJBUJPOBU)ZEFSBCBE IFMBVODIPGUIFDVSSFOUJTTVFPG41T"WJBUJPODP UIF*OEJBODJWJMBWJBUJPOTDFOBSJP8IJMFUIFSFBSFTFSJPVT JODJEFTXJUI*OEJB"WJBUJPO BDJWJMBWJBUJPOBJS EJGGJDVMUJFTQMBHVJOHUIFBWJBUJPOJOEVTUSZBUUIJTQPJOUJO TIPXPSHBOJTFECZ'*$$*UPHFUIFSXJUIUIF.JO UJNF UIFSFBSFBMTPSFBTPOTUPCFPQUJNJTUJDBCPVUCFUUFS JTUSZPG$JWJM"WJBUJPO *OEJBBOE'BSOCPSPVHIPG UJNFTJOUIFGVUVSF 5&OHMBOE UIFMBUUFSBTUIFPWFSTFBTQBSUOFS5IFBJSTIPX %FTQJUFUIFDMPVEPGVODFSUBJOUJFTIPWFSJOHPWFSUIF JTTDIFEVMFEUPCFIFMEGSPN0DUPCFSUP BUUIF BWJBUJPOJOEVTUSZ UIFSFJTDPOTJEFSBCMFJOUFSFTU FYQFDUB PMEDJWJMBJSQPSUBU#FHVNQFU )ZEFSBCBE UJPOBOEFYDJUFNFOUPWFSUIFGPSUIDPNJOHFWFOUBU)ZEFS "GUFSBQFSJPEPGJNQSFTTJWFHSPXUI UIFDJWJMBWJBUJPO BCBE5IFQMBOOFEEJTQMBZBUUIFBJSTIPXCZUIF" JOEVTUSZJO*OEJBJTDVSSFOUMZQBTTJOHUISPVHIUVSCVMFOU PG"JSCVT*OEVTUSJFXIJDI,JOHGJTIFS"JSMJOFTIBTDIPTFO UJNFT CVGGFUFECZGJOBODJBMVQIFBWBMT5IJTJTTVFPG41T GPSJUTJOUFSOBUJPOBMPQFSBUJPOTJTFYQFDUFEUPCFBNB "WJBUJPOIBTBUUFNQUFEUPFYQMPSFUIFWBSJPVTJTTVFT BS KPSDSPXEQVMMFS#FTJEFT NBOZPGUIFPUIFSQMBZFSTIBWF FBTPGDPODFSOBOEQSPCMFNTBGGMJDUJOHUIJTTFDUPSUIBUDBMM FWJODFELFFOJOUFSFTUJOQBSUJDJQBUJPOJOUIFBJSTIPXFWFO GPSVSHFOUBUUFOUJPOBUEJGGFSFOUMFWFMT -

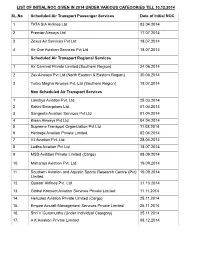

List of Initial Noc Given in 2014 Under Various Categories Till 10.12.2014

LIST OF INITIAL NOC GIVEN IN 2014 UNDER VARIOUS CATEGORIES TILL 10.12.2014 SL.No Scheduled Air Transport Passenger Services Date of Initial NOC 1 TATA SIA Airlines Ltd 03.04.2014 2 Premier Airways Ltd 17.07.2014 3 Zexus Air Services Pvt Ltd 18.07.2014 4 Air One Aviation Services Pvt Ltd 18.07.2014 Scheduled Air Transport Regional Services 1 Air Carnival Private Limited (Southern Region) 24.06.2014 2 Zav Airways Pvt Ltd (North Eastern & Eastern Region) 30.06.2014 3 Turbo Megha Airways Pvt. Ltd (Southern Region) 18.07.2014 Non Scheduled Air Transport Services 1 Lakshya Aviation Pvt. Ltd. 25.03.2014 2 Kakini Enterprises Ltd. 01.04.2014 3 Sangeeta Aviation Services Pvt Ltd 01.04.2014 4 Kiaan Airways Pvt.Ltd 04.04.2014 5 Supreme Transport Organization Pvt Ltd 11.08.2014 6 Heritage Aviation Private Limited. 02.04.2014 7 VJ Aviation Pvt. Ltd. 28.04.2014 8 Lodha Aviation Pvt Ltd 18.07.2014 9 MSD Aviation Private Limited (Cargo) 08.09.2014 10. Maharaja Aviation Pvt. Ltd. 19.09.2014 11. Southern Aviation and Aquatic Sports Research Centre (Pvt) 19.09.2014 Limited. 12. Quasar Airlines Pvt. Ltd. 31.10.2014 13. Global Konnect Aviation Services Private Limited 11.11.2014 14. Hercules Aviation Private Limited (Cargo) 25.11.2014 15. Empire Aircraft Management Services Private Limited 25.11.2014 16. Shri V Gurumurthy (Under Individual Category) 25.11.2014 17. A K Aviation Private Limited 08.12.2014 LIST OF INITIAL NOC GIVEN IN 2013 UNDER VARIOUS CATEGORIES Sr. -

(BIAL) Spokesperson

DREAMING IT BIG WITH CAPT. BOEING DELIVERS TRIO OF SRINIVAS RAO, CEO, FLYBIG, 777 FREIGHTERS TO QATAR THE NEWEST AIRLINE OF INDIA AIRWAYS CARGO India’s premier aviation monthly magazine Vol 07 Issue 05 FEBRUARY 2021 ` 100 www.aviationmagazine.in UPDATE On Aero India, covid safety, and beyond-In conversation with Bangalore International Airport Limited (BIAL) Spokesperson Col. H.S. Shankar talks Ruminating on the future of about persistence, vitality, Aviation with Praveen PA, and supreme growth Director, Aerospace and Defence, Govt of Telangana contents 20 Aero India ALL SET TO KICK OFF 2021 AMIDST THE COVID ERA 06 Boeing Delivers Trio of 777 Vistara Commences Freighters to Qatar Airways 05 Services to Sharjah Cargo 08 Airbus updates production rates in response to market Rolls-Royce runs environment 09 first engine on world’s largest and smartest aerospace Raytheon Technologies 16 Testbed Appoints Marie R. Sylla-Dixon as Chief Diversity Officer to IAI Board Chairman Further Advance Diversity, 15 Harel Locker Equity and Inclusion Initiatives Announces Plans to Step Down 28 Boeing to Provide Six More Solar Arrays for International Space Station Rolls-Royce & 26 UK Space Agency 32 Garmin GFC 600 Digital launches first study Autopilot Approved for Select into nuclear power King Air C90 and E90 Aircraft for space exploration AVIATION UPDATE FEBRUARY 2021 3 EDITORIAL BOARD AVIATION India’s premier aviation monthly magazineUPDATE Vol : 07 Issue : 5 FEBRUARY - 2021 Editor-in-Chief : B. Kartikeya EDITORIAL Associate Editor : Ipsit Roy Special Editor : Rohit Reddy Hello my dear Readers, Correspondent : B. Martin CREATIVE HEAD : Badree elcome to yet another edition of Aviation Update, India’s most trusted PHOTOGRAPHER : Krishanth W premier aviation magazine, like nowhere else. -

VISTARA: P 26 Ahead Leap Years Tion Frominda

VIEWPOINT: LEAP YEARS BUSINESS AvIATION THE AIRASIA AHEAD CORE TO MIDDLE DISASTER EAST GROWTH P 8 P 26 P 28 DEC 2014-JAN 2015 `100.00 (INDIA-BASED BUYER ONLY) VOLUME 7 • iSSUE 6 WWW.SPSAIRBUZ.COM ANAIRBUZ EXCLUSIVE MAGAZINE ON CIVIL AVIATION FROM INDIA VISTARA: A DREAM COME TRUE! AN SP GUIDE PUBLICATION RNI NUMBER: DELENG/2008/24198 TABLE OF CONTENTS CIVIL / ROUND-UP 2014 P10 2014: A MIXED YEAR VIEWPOINT: LEAP YEARS BUSINESS AVIATION THE AIRASIA AHEAD CORE TO MIDDLE DISASTER EAST GROWTH P 8 P 26 P 28 DEC 2014-JAN 2015 `100.00 The industry story is largely positive, (INDIA-BASED BUYER ONLY) VOLUME 7 • ISSUE 6 Cover: WWW.SPSAIRBUZ.COM ANAIRBUZ EXCLUSIVE M A G A ZINE ON C IVIL AVIA TION FROM I NDI A but there are a number of risks in Tata-Singapore International VISTARA: A DREAM today’s global environment—political Airlines joint venture Vistara COME TRUE! unrest, conflicts and some weak will take to the skies on regional economies—among them. January 9, 2015. Cover Image: AN SP GUIDE PUBLICATION Airbus RNI NUMBER: DELENG/2008/24198 SP's Airbuz Cover 06-2014 final.indd 1 02/01/15 4:20 PM CIVIL / VIEWPOINT P8 THE AIRASIA DISASTER In all probability, the pilot of Flight QZ8501 too has blundered into a violent thunderstorm and lost control of the aircraft. PHOTO FEATURE / 2014 P13 IMPORTANT EVENTS AND LAUNCHES OF THE YEAR 2014 IN PHOTOGRAPHS P20 AIRLINES / INFRASTRUCTURE LOW-COST AIRPORTS P24 AVIATION / REGULATIONS DOING AWAY WITH ARCHAIC RULES P26 ENGINES / CFM LEAP LEAP YEARS AHEAD P28 SHOW REPORT / MEBA 2014 BUSINESS AVIATION CORE TO MIDDLE EAST GROWTH DEPARTMENTS P2 A WORD FROM EDITOR AIRLINES / BILATERAL AGREEMENTS AVIATION / POLICY P3 NEWS BRIEFS P17 BEYOND BORDERS, BETWEEN P22 CIVIL AVIATION AUTHORITY P32 FINALLY BOUNDARIES The passage of the CAA Bill is eagerly International aviation is regulated by a awaited by the Indian civil aviation industry complex web of over 3,000 interlocking and there is optimism about changes Bilateral Air Service Agreements. -

THE DEVELOPMENT TEAM Principal Investigator Prof. S. P. Bansal, Vice

Paper 8: Cargo Operations and Management Module-13: Issues and challenges faced by the airline cargo Operations-Part-I THE DEVELOPMENT TEAM Principal Investigator Prof. S. P. Bansal, Vice Chancellor, Indira Gandhi University, Rewari Co-Principal Investigator Dr. Prashant K. Gautam, Director, UIHTM, Panjab University, Chandigarh Paper Coordinator Prof. S. P. Bansal, Vice Chancellor, Indira Gandhi University, Rewari Paper Co-Coordinator Dr. Amit Katoch, Assistant Professor, UIHTM, Panjab University, Chandigarh Content Writer Dr. Arvind Kumar, Assistant Professor, Department of Tour and Travel (Head of Department), Vallabh Govt. College, Mandi, Himachal Pradesh Content Reviewer Prof. S.Kabia, Chairman, Institute of Tourism and Hotel Management, Bundelkhand University, Jhansi TERMS DESCRIPTION OF MODULE Subject Name Tourism and Hospitality Paper Name Cargo Operations and Management Module Title Issues and Challenges Faced by the Airline Cargo Operations-Part-I Module Id Module no-13 Pre- Requisites Issues and problems faced by airlines cargo activities Objectives To study issues and challenges faced by airline cargo operations. Keywords Airline, cargo, issues & challenges. TABLE OF CONTENTS 1. Learning Outcome 2. Introduction 3. Issues and challenges faced by airline cargo operations 4. Position of Indian aviation industry 5. Problems faced by Indian aviation industry 6. Summary QUADRANT-I 1. Learning Outcome The module will help students to know about: i. Issues and challenges faced by airline cargo operations. ii. Position of Indian aviation industry. iii. Problems faced by Indian aviation industry. iv. Opportunities in Indian Aviation Sector. Image 1:Cargo Operations Source: https://www.google.co.in/search?q=air+cargo+operations&source=lnms&tbm=isch&sa=X&ved =0ahUKEwibmIauo_TUAhVEMY8KHWFPANwQ_AUIBigB&biw=1280&bih=694#imgrc=- L8QVW20n1obBM: 2.