Indianapolis Office Rents Rising at a Record Pace

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Architectural Significance

Historic Significance Photo Source: Vegetable Market on Delaware Street, 1905, Indiana Historical Society Collection 33 Monument Circle District Preservation Plan 34 Monument Circle District Preservation Plan HISTORIC SIGNIFICANCE City Planning and Development Carved out of the Northwest Territory, Indiana entered the Union as the nineteenth state in 1816. The city of Indianapolis was founded in 1821 as the state capital, when the Indiana State Legisla- ture sought a central location for the city and appointed a committee to choose the site. Once the site was chosen surveyors Alexander Ralston and Elias Fordham were hired to lay out the city, which was proposed as a grid of north-south and east-west streets in a mile square plat. This plat was influenced by the Pierre L’Enfant plan for Washington, D.C., which in turn was in- spired by the royal residence of Versailles. Since Indianapolis was planned as a state capital, the plat sited the State House Square and the Court House Square equidistant from Circle Street (now Monument Circle), located in the center of the Mile Square. The Governor’s house was to be situ- ated in the circular lot framed by Circle Street, and the four city blocks framing the Circle were known as the “Governor’s Square.” Four diagonal streets radiated out from the far corners of the four blocks framing the circle. All streets of the Mile Square were 90 feet wide with the exception of Washington Street, which was 120 feet wide to accommodate its intended use as the capital’s main street. The sale of lots in the new capital city on October 8, 1821 reveal the street’s importance, as lots fronting it com- manded the highest prices. -

Downtown Indy, Inc.'S 2017 Community Report

I nd ia na Av e. North St. d v l B y t i s r e v i n U Pedestrian Bridge Washington St. r D W y w k P r e v i R e t i h W . S . ve Exit 110A r A ive R I-65 North Ray St. Downtown Indy, Inc. is a private, not-for-profit organization uniquely positioned to address issues that affect the area’s growth and well-being. Downtown Indy, Inc. focuses on advancing Downtown as a great place to live, learn, work and play. DowntownIndy.org HELLO INDIANAPOLIS, On behalf of the board and staff of Downtown Indy, Inc., we are pleased to present this Community Report to provide a glimpse of the current state of our Downtown. There is great momentum reflected in the data and trends presented on the following pages, as well as opportunities for growth to continue making Downtown Indianapolis an outstanding place to live, learn, work and play. Civic success can best be witnessed at the intersection of intentionality and organic growth and development. This intersection is where we witness the spirit of collaboration by our board, staff, volunteers, members, residents, elected officials, civic partners and business and community leaders who are collectively committed to excellence for Downtown. From the entrepreneurial spirit fueling new leaders to the steadfast corporate giants on whose shoulders we stand as a community, Downtown is the benefactor of visionary leadership and bold decisions. Downtown continues to offer its residents, workers, students and visitors a connectivity that inspires new relationships, experiences and diversity. -

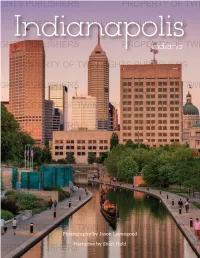

View Entire Book

PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHE PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS Indianapolis Indiana PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OFA photographicTWIN LIGHTS portrait PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERSPhotography by Jason Lavengood PROPERTY OF TWIN LIGHTS PUBLISHERS Narrative by Shari Held PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERSTWIN LIGHTS PUB L I SH ER S | ROCK P ORT, MAPROPERTYSSACHUSETTS OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHE PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS PROPERTY OF TWIN LIGHTS PUBLISHERS Copyright © 2017 by Twin Lights Publishers, Inc. -

MARKET STUDY WEST MICHIGAN Montcalm Muskegon NORTHERN INDIANA �REAT��� REA� �A�UE

WEST MICHIGAN NORTHERN INDIANA CENTRAL INDIANA 25TH ANNUAL COMMERCIAL REAL ESTATE MARKET STUDY WEST MICHIGAN Montcalm Muskegon NORTHERN INDIANA CREATING REAL VALUE Kent Founded in 1978, Bradley Company is a diversified real estate firm providing commercial brokerage services, Ionia commercial and multi-housing management, real estate tax consulting, maintenance services, project and facilities CENTRAL INDIANA Ottawa management, research services, corporate services and strategic planning. Bradley Company is the largest full service commercial real estate solutions provider in Indiana and West Michigan. ADDITIONAL COUNTIES OF SERVICE Allegan Barry Eaton REAL ESTATE TAX CONSULTING Over $1 million saved in Van Buren Calhoun tax liabilities since 2011 Lake Kalamazoo Michigan MULTI-HOUSING Cass Branch CORPORATE SERVICES St. Joseph 3,000± Conventional, Berrien BROKERAGE Strategic partner serving Aordable, Senior, Student Over 50 brokers in 8 oces & corporate clients in all and Special Needs units classes of property LaGrange an average of 700 listings per year Steuben under management St. Joseph Elkhart LaPorte Porter DeKalb Noble COMMERCIAL Lake Marshall CAPITAL MARKETS Starke Kosciusko MANAGEMENT Over $1.5 billion 10± million commercial Whitley in experience Allen square feet managed Pulaski Fulton Newton Jasper Huntington Wabash White Cass Adams Wells 250+ Benton Miami EMPLOYEES Carroll Grant Blackford Howard Jay Warren Tippecanoe Clinton Tipton Delaware Madison Randolph Hamilton 40 Fountain Montgomery Boone YEARS IN BUSINESS n Henry Wayne Marion Hancock Vermillio Parke Hendricks Putnam Rush Union Fayette Shelby Morgan Johnson $202M+ Vigo Clay Franklin VALUE OF BROKERAGE Owen Decatur Bartholomew TRANSACTIONS IN 2017 Brown Monroe CONTENTS WEST 04 MICHIGAN PRESIDENT’S LETTER 42 06 NORTHERN CENTRAL PROFESSIONALS INDIANA INDIANA 16 RESEARCH | ANALYSIS LAYOUT | DESIGN COPY EDITOR STEVEN HEATHERLY MICHELLE MOREY MARSHALL V. -

P.E. Macallister Collection

Collection # P 0492 P. E. MACALLISTER COLLECTION 1974–2010 (DVDS, 1982–2007) Collection Information Biographical Sketch Scope and Content Note Series Contents Processed by Sarah Newell and Barbara Quigley June 12, 2012 Revised June 16, 2015 Manuscript and Visual Collections Department William Henry Smith Memorial Library Indiana Historical Society 450 West Ohio Street Indianapolis, IN 46202-3269 www.indianahistory.org COLLECTION INFORMATION VOLUME OF 309 titles on DVD (1982–2007); 10 folders of manuscript and COLLECTION: printed materials (1974–2010) COLLECTION 1974–2010 (DVDs, 1982–2007) DATES: PROVENANCE: Donated by P.E. MacAllister, 2008; second accession in December 2008 of 94 DVDs of On Site programs (ca. 1983- 2006) from IUPUI special collections, who in turn got them from P.E. MacAllister; MacAllister Machinery newsletters mailed to IHS in 2010 RESTRICTIONS: None COPYRIGHT: REPRODUCTION Permission to reproduce or publish material in this collection RIGHTS: must be obtained from the Indiana Historical Society. ALTERNATE FORMATS: RELATED HOLDINGS: ACCESSION 2008.0004, 2008.0380, 2010.0382X NUMBER: NOTES: BIOGRAPHICAL SKETCH P.E. (Pershing Edwin) MacAllister is chairman of the board at MacAllister Machinery Co., a Caterpillar dealership started by his father. He was born 30 August 1918 in Green Bay, Wisconsin, to Edwin W. and Hilda MacAllister. His father, a WWI veteran, named him Pershing after General John Joseph “Black Jack” Pershing. P.E. graduated from Carroll College in Waukesha, Wisconsin, with a major in history and minors in English and speech. Upon his graduation he enlisted in the U.S. Army Air Corps and reported for duty at the Muskogee, Oklahoma, Air Corps Primary Training School. -

5,849 SF of Restaurant Space Available in Downtown Indianapolis

5,849 SF of Restaurant Space Available in Downtown Indianapolis 6351 Crawfordsville Rd, Indianapo- 14 E Washington St, Indianapolis, IN 46204 Property Highlights: • Turn-Key Restaurant: Equipped with full bar, hoods, walk-in • 5,849 sq. ft. of restaurant space available coolers, two ADA restrooms, grease interceptor • Located in the heart of Indianapolis’ Central Business District • Exposed brick, high ceilings, original hard wood floors • Patio capabilities fronting the Cultural Trail FOR MORE INFORMATION Andrew Demaree John Holloway PLEASE CONTACT: T: 317-472-1800 T: 317-472-1800 E: [email protected] E: [email protected] 5,849 SF of Restaurant Space Available in Downtown Indianapolis 14 E Washington St, Indianapolis, IN 46204 14 E Washington St, Indianapolis, IN 46204 Main Level: Front Dining Area Main Level: Full Bar + Kitchen Lower Level: Temp-Controlled Wine Display Lower Level: Seating, Restrooms, & Private Dining FOR MORE INFORMATION Andrew Demaree John Holloway PLEASE CONTACT: T: 317-472-1800 T: 317-472-1800 E: [email protected] E: [email protected] 5,849 SF of Restaurant Space Available in Downtown Indianapolis 5,849 SF of Restaurant Space Available in Downtown Indianapolis 14 E Washington St, Indianapolis, IN 46204 6 Cultural trail - Mass Ave to (one way south) 28,710 Students Broad Ripple 2,800 Faculty (one way south) )ts a e y a w e n o( (one way south) 10 12 15 4 9 SITE 14 5 3 (one way west) (one way north) 2 1 1 9 6 7 )ts a e y a w e n o( (one way north) 3 13 2 • 276 Conventions Per Year • 2,058,701 Attendees Per Year 10 8 • $3.6B Spent by Convention Visitors 8 4 Former GM Plant Mixed Use Redevelopment Top Existing Hotels New Development Hotels Cultural trail - 1. -

Centre Offering Memorandum

Symphony Centre Confidential offering memorandum 32 East Washington Street, Indianapolis, Indiana Unique opportunity to acquire a historic building in the heart of downtown Indianapolis. 1 | Symphony Centre | 32 E. Washington St. Contents Investment summary 05 Property overview 06 Location overview 13 Market overview 21 Transaction guidelines 25 2 | Symphony Centre | 32 E. Washington St. JLL | 3 Investment summary Symphony Centre | 32 E. Washington St. The Offering JLL is pleased to offer for sale Symphony Centre (the “Property”), a 73,017 square foot building, located in the heart of a thriving downtown Indianapolis. The historic, 17-story building is situated along East Washington Street less than one block from Monument Circle and within walking distance of exceptional NORTH MERIDIAN STREET area amenities. With a timeless brick exterior, an exceptional window line and efficient floorplates, the Property boasts historic character with an eclectic feel that appeals to the modern tenant. INVESTMENT HIGHLIGHTS • Flexible zoning opportunity. CBD-1 zoning allows for flexible opportunities including retail, outdoor cafe or redevelopment opportunities. • Significant upside potential. With a recent remeasurement to BOMA square footage and expiring rents at approximately $3.00 below market, there is a significant upside potential by rolling expiring PENNSYLVANIA AVENUE leases to rental rates reflective of current market rates. • Appeal to today’s tenants. With a footprint reflective of the highest velocity of tenant demand, Symphony Centre offers everything today’s modern tenants want. The unique finishes, panoramic views and value-add potential for a rooftop patio add to the appeal. WASHINGTON STREET DELAWARE STREET • Healthy submarket and office market strength. Leasing activity in the CBD continues its uphill climb and represents 43% of the completed leases in Indianapolis MSA year to date. -

DOWNTOWN INDY BUILDING for LEASE 14,631± SF Including Lower Level | 127 E Michigan Street | Indianapolis, in 46204

DOWNTOWN INDY BUILDING FOR LEASE 14,631± SF including lower level | 127 E Michigan Street | Indianapolis, IN 46204 COMMON SPACES RECENTLY UPDATED AND INCLUDES 46 ON-SITE PARKING SPACES DOWNTOWN INDY BUILDING FOR LEASE 14,631± SF including lower level | 127 E Michigan Street | Indianapolis, IN 46204 COMMON SPACES RECENTLY UPDATED INCLUDES 46 ON-SITE PARKING SPACES PROPERTY FEATURES: elevator elevator janitor equipment HVAC electrial vending room • 11,902± RSF available in free-standing building stairs lobby located Downtown Indianapolis on .32± Acres • 2nd, 4th, 5th, and 6th floors available: 2,729 RSF available per floor (divisible to 1,500 SF) unfinished storage rd storage • 3 floor: 986 RSF available open room elevator shaft • 2,729 RSF of amenity space (conference/ meeting room, fitness center and storage) stairs • Located at SWC of E Michigan St and N 2,729 RSF Delaware St; just two blocks west of Mass Ave LOWERfitness room LEVEL and 4 blocks north of Monument Circle—a great location within easy walking distance to many amenities located in Downtown Indy and the Central Business District LOWER LEVEL • Property includes parking lot with 46 parking ramp spaces—a huge plus in downtown area. elevator • Building has historic feel and features six stories restrooms and lower level with lots of natural light. HVAC stairs telephone reception • Includes conference room, restrooms on each lobby floor, elevator access and storage and fitness rear entry room on lower level lobby front entry stairs SCOTT LINDENBERG, CCIM LEASED 317.506.7885 [email protected] FIRST FLOOR 5915 N. College Avenue, Suite 200, Indianapolis, IN 46220 | reliantpcr.com No warranty or representation, express or implied, is made as to the accuracy of information contained herein, same is submitted subject to errors, omissions, price change or other conditions, withdrawal notice without and to any specific listing conditions, imposed by our principals. -

Largest Indianapolis-Area Commercial Property Management

Largest Indianapolis-Area Commercial Property Management Firms (Ranked by gross leasable area managed locally (1)) LOCAL FTE: BROKERS / PERCENT: LOCAL PROPERTIES AGENTS PROPERTY RANK FIRM GLA MANAGED:(1) OFFICE MANAGED HEAD(S) OF LOCAL EMPLOYEES: OWNERSHIP: ESTAB. 2013 ADDRESS LOCALLY RETAIL LARGEST INDIANAPOLIS-AREA % OF SPACE OPERATIONS, TITLE(S) PROPERTY MGT. % INDIANA LOCALLY rank TELEPHONE / FAX / WEBSITE NATIONALLY INDUSTRIAL PROPERTIES MANAGED OWNED BY FIRM LOCAL DIRECTOR(S) TOTAL % OTHER HQ CITY Cassidy Turley 32.9 million 30 Keystone at the Crossing, 308 Jeffrey L. Henry, 29 24 1918 One American Square, Suite 1300, 46282 400.0 million 4 The Precedent Office Park, 0 regional managing principal 145 76 Washington, 1 (317) 634-6363 / fax (317) 639-0504 / cassidyturley.com 66 OneAmerica Tower Timothy J. Michel 209 D.C. 1 Duke Realty Corp. 27.5 million 22 AllPoints Midwest Bldg. 1, 164 Keith Konkoli, Charlie Podell, 9 94 1972 600 E. 96th St., Suite 100, 46240 15.3 million 0 AllPoints Midwest Bldg. 3, 91 SVPs; Jeff Stone, VP 18 6 Indianapolis 2 (317) 808-6000 / fax (317) 808-6650 / dukerealty.com 78 AllPoints at Anson Bldg. 1 Chris Yeakey, Ryan Rothacker 360 2 Cushman & Wakefield/Summit Realty Group (2) 10.2 million 20 BMO PLaza, 58 Matt Langfeldt, Brian Zurawski, DND DND 1993 241 N. Pennsylvania St, Suite 300, 46204 DND 1 ISTA Center, DND managing partners 23 DND Indianapolis 3 (317) 713-2100 / fax (317) 713-2103 / summitrealtygroup.com 79 One and Two Penn Mark Kenneth M. Petruska DND 3 Simon Property Group Inc. 7.0 million 1 Castleton Square, 13 David E. -

2Nd Generation Restaurant Opportunities in CBD Downtown Indy 6, 10 & 24 W

2nd Generation Restaurant Opportunities in CBD Downtown Indy 6, 10 & 24 W. Washington Street, Indianapolis, IN 46204 Overview Employee Aerial Hotel Aerial Parking Map Micro Aerial Columbia Club Market St apartmentsapartments 10,126 SF w/ 4,571 SF Finished 2,858 SF 2,177 SF Basement Delaware St Delaware FutureFuture 11 N.N. Future St Delaware Illinois St Illinois St Meridian Hotel Pacers Bike Share IndianapolisIndianapolis CulturalCultural TrailTrail IndianapolisIndianapolis CulturalCultural TrailTrail Pacers Bike Share Washington St 11,727 ADT IndianapolisIndianapolis CulturalCultural TrailTrail StationStation Meridian St 6,345 ADT Circle Centre Mall Meridian St 6,345 ADT Future Pennsylvania St Pennsylvania Pennsylvania St Pennsylvania Maryland St 11,926 ADT Property Highlights: • Three 2nd generation restaurant spaces available in CBD Downtown Indianapolis o 6 W. Washington Street = 2,177 SF former restaurant (no hood) 2020 DEMOGRAPHICS 1 miles 2 miles 3 miles o 10 W. Washington Street = 10,126 SF former restaurant with 4,571 SF finished basement o 24 W. Washington Street = 2,858.5 SF former restaurant Population 15,966 49,496 104,016 • Surrounded by hotels with new hotel projects under-construction or planned nearby, restaurants, Avg. HHI $88,453 $66,033 $54,305 and retail. Located across from Circle Centre mall Employees 99,956 164,981 191,072 • Located in the heart of downtown Indianapolis’ Central Business District with 99,956 employees within 1 mile. Floors 2-7 of the building above the retail opportunities are leased by Indiana Department of Health Median Age 31.9 33.1 29.9 with 650+ employees • Located one block south of Indianapolis’ Monument Circle which is a host to local, state and national events and gatherings • Excellent parking with 10 parking garage within two blocks of the site and metered street parking surrounding the site • Patio opportunities along Indianapolis Cultural Trail which is a large walking, running, biking trail that connects all of downtown from 10th Street to Fountain Square • Busiest Pacers Bike Share Station on Cultral Trail. -

The Effect of Urban Fortification on Public Space

University of Wisconsin Milwaukee UWM Digital Commons Theses and Dissertations 8-1-2013 The Effect of Urban Fortification on Public Space Ryan Lee Anderson University of Wisconsin-Milwaukee Follow this and additional works at: https://dc.uwm.edu/etd Part of the Sociology Commons Recommended Citation Anderson, Ryan Lee, "The Effect of Urban Fortification on Public Space" (2013). Theses and Dissertations. 655. https://dc.uwm.edu/etd/655 This Dissertation is brought to you for free and open access by UWM Digital Commons. It has been accepted for inclusion in Theses and Dissertations by an authorized administrator of UWM Digital Commons. For more information, please contact [email protected]. THE EFFECT OF URBAN FORTIFICATION ON PUBLIC SPACE by Ryan Anderson A Dissertation Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy in Urban Studies at The University of Wisconsin-Milwaukee August 2013 ABSTRACT THE EFFECT OF URBAN FORTIFICATION ON PUBLIC SPACE by Ryan Anderson The University of Wisconsin-Milwaukee, 2013 Under the Supervision of Professor Donald Green This dissertation contributes to empirical studies on the spatial extent and intensity of urban fortification/security zones and their influence on urban public space. Urban public space has been based on creating open and safe environments for city dwellers. However, ultra-secure urban spaces have been found to filter citizens, restrict movement, and modify individual behavior. This first part of this study determines where security zones manifest themselves, quantify the fortification of the security zones, and measure the intensity of these spaces in three major U.S. -

COMMERCIAL BUILDING for LEASE | 4,090± SF (Divisible) NWQ of Downtown Indianapolis | 222 W

COMMERCIAL BUILDING FOR LEASE | 4,090± SF (divisible) NWQ of Downtown Indianapolis | 222 W. Michigan Street | Indianapolis, IN 46204 NEC OF W MICHIGAN STREET & N SENATE AVENUE COMMERCIAL BUILDING FOR LEASE | 4,090± SF (divisible) NWQ of Downtown Indianapolis | 222 W. Michigan Street | Indianapolis, IN 46204 PROPERTY FEATURES: • 4,090± SF Commercial Building AVAILABLE (divisible to 1,850 SF and 2,240 SF) • Zoned CBD2 with 18± dedicated parking spaces • Cafe space has open feel concept with lots of natural light. • Directly across from Downtown Kroger store and Axis luxury apartments and adjacent to Cosmopolitan on the Canal luxury apartments. • Average daily traffic volume well over 29,000 ADT on Capitol Avenue and Michigan Street combined • On Indy Go Bus route and just one block northwest of Red Line Indy Go Bus Stop (commencing 2019) at N Capitol Ave & W Vermont St • Just 1 block east of Canal, 3 blocks east of IUPUI Campus and 6 blocks northwest of Monument Circle • Excellent visibility on Michigan Street with easy access to parking from Michigan St or Senate Ave SCOTT LINDENBERG, CCIM 317.506.7885 [email protected] 5915 N. College Avenue, Suite 200, Indianapolis, IN 46220 | reliantpcr.com No warranty or representation, express or implied, is made as to the accuracy of information contained herein, same is submitted subject to errors, omissions, price change or other conditions, withdrawal notice without and to any specific listing conditions, imposed by our principals. COMMERCIAL BUILDING FOR LEASE | 4,090± SF (divisible) NWQ of Downtown Indianapolis | 222 W. Michigan Street | Indianapolis, IN 46204 Lucas Oil Stadium Eli Lilly Corporate Campus Bankers Life Fieldhouse Victory Field Chase Tower Indiana State Museum Circle Centre Mall Indiana Convention Center Market Square Center Market Tower BMO Harris Indiana State House One America Indiana Government Center NCAA Hall of Champions Regions Tower Monument Circle Eteljorg Museum Indiana War Memorial Military Park Asian Harbor Pure Barre Mass Ave.