Actions of the Board, Its Staff, and the Federal Reserve Banks; Applications and Reports Received

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JP Morgan Chase Sofya Frantslikh Pace University

Pace University DigitalCommons@Pace Honors College Theses Pforzheimer Honors College 3-14-2005 Mergers and Acquisitions, Featured Case Study: JP Morgan Chase Sofya Frantslikh Pace University Follow this and additional works at: http://digitalcommons.pace.edu/honorscollege_theses Part of the Corporate Finance Commons Recommended Citation Frantslikh, Sofya, "Mergers and Acquisitions, Featured Case Study: JP Morgan Chase" (2005). Honors College Theses. Paper 7. http://digitalcommons.pace.edu/honorscollege_theses/7 This Article is brought to you for free and open access by the Pforzheimer Honors College at DigitalCommons@Pace. It has been accepted for inclusion in Honors College Theses by an authorized administrator of DigitalCommons@Pace. For more information, please contact [email protected]. Thesis Mergers and Acquisitions Featured Case Study: JP Morgan Chase By: Sofya Frantslikh 1 Dedicated to: My grandmother, who made it her life time calling to educate people and in this way, make their world better, and especially mine. 2 Table of Contents 1) Abstract . .p.4 2) Introduction . .p.5 3) Mergers and Acquisitions Overview . p.6 4) Case In Point: JP Morgan Chase . .p.24 5) Conclusion . .p.40 6) Appendix (graphs, stats, etc.) . .p.43 7) References . .p.71 8) Annual Reports for 2002, 2003 of JP Morgan Chase* *The annual reports can be found at http://www.shareholder.com/jpmorganchase/annual.cfm) 3 Abstract Mergers and acquisitions have become the most frequently used methods of growth for companies in the twenty first century. They present a company with a potentially larger market share and open it u p to a more diversified market. A merger is considered to be successful, if it increases the acquiring firm’s value; m ost mergers have actually been known to benefit both competition and consumers by allowing firms to operate more efficiently. -

Fhlbiamendcomplrescissiond

ALLY FINANCIAL INC. f/k/a GMAC, INC.; ) GS MORTGAGE SECURITIES CORP.; ) GOLDMAN, SACHS & CO.; GOLDMAN ) SACHS MORTGAGE COMPANY; THE ) GOLDMAN SACHS GROUP, INC.; ) RBS SECURITIES INC. f/k/a GREENWICH ) CAPITAL MARKETS, INC.; INDYMAC ) MBS, INC.; J.P. MORGAN ACCEPTANCE ) CORPORATION I; J.P. MORGAN ) SECURITIES INC.; JPMORGAN ) SECURITIES HOLDINGS LLC; ) JPMORGAN CHASE & CO.; CHASE ) MORTGAGE FINANCE CORPORATION; ) UBS SECURITIES LLC; WAMU ASSET ) ACCEPTANCE CORP.; WAMU CAPITAL ) CORP.; WELLS FARGO ASSET ) SECURITIES CORPORATION; WELLS ) FARGO BANK, NATIONAL ) ASSOCIATION; WELLS FARGO & ) COMPANY, and JOHN DOE ) DEFENDANTS, 1-50, ) ) Defendants. ) Table of Contents I. NATURE OF THE ACTION ........................................................................................... 1 II. EXECUTIVE SUMMARY .............................................................................................. 2 A. PMLBS Defined.................................................................................................... 2 B. The Bank Purchased Only the Highest Rated (Triple-A-Rated) PLMBS ................................................................................................................. 3 C. The Mortgage Originators Who Issued Loans Backing the Certificates Abandoned Underwriting Guidelines and Issued Loans Without Ensuring the Borrowers’ Ability to Pay and Without Sufficient Collateral.............................................................................................. 4 D. The Defendants Provided Misleading Information About -

H.2 Actions of the Board, Its Staff, and The

ANNOUNCEMENT BY BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM % 2 Applications and Reports Received or Acted on 1971 No. 34 During Week Ending August 21, 1971 District Registration Statement Filed Pursuant to Date Section 12(g) of the Securities Exchange Act Effective 6 Lawrence County Bank, Lawrenceburg, Tennessee 8-23-71 * * * * Current Report Filed Pursuant to Section 13 of the Securities Exchange Act Received 12 Valley Bank of Nevada, Las Vegas, Nevada , 8-18-71 (July 1971) * * * * To Become a Member of the Federal Reserve System Pursuant to Section 9 of the Federal Reserve Act Approved Commonwealth Bank and Trust Company of Virginia, Sterling, Virginia. To Withdraw from Membership in the Federal Reserve System Without a Six Month Notice as Prescribed by Section 9 of the Federal Reserve Act Received 10 Bank of Herington, Herington, Kansas Approved 10 Bank of Herington, Herington, Kansas * Vf i< V< Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis To Establish a Domestic Branch Pursuant to Section 9 of the Federal Reserve Act Received Bank of Suffolk County, Stony Brook, New York. Branches at the following locations: A. The intersection of Waverly Avenue and Patchogue-Holbrook Road, Holtsville, Town of Brookhaven, Suffolk County. B. The intersection of the southwest corner of Horseblock Road and Bellport Road, North Bellport, Town of Brookhaven, Suffolk County. First Trust and Deposit Company, Syracuse, New York. To establish a branch in the immediate neighbor- hood of Grant Avenue Plaza on New York Route 5, (unincorporated area) town of Sennett, Cayuga County. Marine Midland Bank - Central, Syracuse, New York. -

Marine Midland Bank 11/4/96 PE

GENERAL INFORMATION The Community Reinvestment Act (CRA) requires each federal financial supervisory agency to use its authority when examining financial institutions subject to its supervision, to assess the institution's record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods, consistent with safe and sound operation of the institution. Upon conclusion of such examination, the agency must prepare a written evaluation of the institution's record of meeting the credit needs of its community. This document is an evaluation of the Community Reinvestment Act (CRA) performance of Marine Midland Bank prepared by the Federal Reserve Bank of New York, the institution's supervisory agency, as of November 4, 1996. The agency evaluates performance in assessment area(s), as they are delineated by the institution, rather than individual branches. This assessment area evaluation may include the visits to some, but not necessarily all of the institution's branches. The agency rates the CRA performance of an institution consistent with the provisions set forth in Appendix A to 12 CFR Part 228. The new CRA regulation will be phased in over a two year period beginning July 1, 1995. During that period, banks with total assets greater than $250 million will be examined under the current regulation with its twelve assessment factors until July 1, 1997. However, to comply with the requirements of Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994, this evaluation includes conclusions with respect to overall performance as well as the bank=s performance in each Metropolitan Statistical Area and Non-Metropolitan Statistical Area which the bank has delineated for CRA purposes 96CAE28\Marine\ect\D#50 DSBB No. -

Key Bank Restraining Notice New York

Key Bank Restraining Notice New York Verificatory Merell brutalized electronically while Fletch always trances his snarlers prostrates patricianly, he focalize so unfashionably. Mace allocating felly as star-studded Cleveland humiliated her self-analysis dried unreasoningly. Edulcorative and nonharmonic Hamish sponsors unconventionally and cooperated his being henceforward and naturally. Model New York Language for similar Real Estate. Pyramid Group which owns the anchor is rejecting the termination notice 033. NOTICE TO BRITISH COLUMBIA RESIDENTS A purchaser of Notes to offspring the. For deposit accounts opened by telephone or Internet applicable New York law. 24 In a civil force the Clerk will transmit Notices of Electronic Filing NEF to. CLARO Training and Guide Booklet Fordham University. And sustain general circulation in soft City guide New York notice that manage money. Sabres in 'regular communication' with New York State is try another host fans at KeyBank. Mlars just described as key bank restraining notice new york. Opinion that New York Times. According to dodge New York Times Wells Fargo paid for than 15 billion in penalties to federal and state ferry and 620 million to resolve. The construction account and wake shall provide KeyBank such. The charges include cases of impaired driving assault and breach plan a restraining order. FINANCIAL CRISIS GovInfo. Device or compare that allows the globe to transfer funds and conduct banking. A Non-Compete Law Roadmap for Tech Start-Ups treaty Key Jurisdictions. Make trillions of dollars' worth of mortgages and not that people notice. SECURITY BREACH NOTIFICATION CHART New York. Legal Notices Privacy or Cookie Notice RSS Employee Login. -

SEC News Digest, 06-22-1995

sec news dioest Issue 95-120 June 22, 1995 COMMISSION ANNOUNCEMENTS CARREL APPLICATIONS ARE NOW BEING ACCEPTED Pursuant to the rules of the Public Reference Room (PRR), the July allocation of carrels/telephone privileges for recognized user organizations (information dissemination companies) are now being accepted. Application forms are available in the Public Reference Room. Information dissemination companies that are unable to pick up forms in Washington may submit applications by writing to: U.S. Securities and Exchange Commission Stephen L. McConnell, Chief Public Reference Branch (Mail Stop 1-2) 450 5th Street, NW Washington, DC 20549 Applications must include: a brief description of the business, business address and telephone number, the name of all persons who work everyday in the PRR, the name of a person who will serve as on-site contact in the PRR, number of employees assigned to research/sale of SEC filings, regardless of work location, and number of carrels requested. Applicants may also submit a supplemental statement in support of their request for carrels/telephone privileges. The applications must be certified and signed by a responsible company official, and submitted by close of business July 7, 1995. As in the past, assignment of carrels/telephones privileges is discretionary and applicants should not assume they will receive use of the full number carrels for which they apply. The Commission intends to continue to reserve carrels for the general public. Revised carrel allocations will be effective July 24, 1995. Any questions concerning carrel applications should be addressed to Stephen L. McConnell, Chief, Public Reference Branch, at (202) 942- 8078. -

Presentation to Fixed Income Investors

HSBC Holdings plc and HSBC Bank Canada September 2010 Presentation to Fixed Income Investors www.hsbc.com www.hsbc.ca Disclaimer and forward-looking information This presentation, including the accompanying slides and subsequent discussion, contains certain forward-looking information with respect to the financial condition, results of operations and business of HSBC Holdings plc, together with its direct and indirect subsidiaries including HSBC Bank Canada and HSBC Securities (Canada) Inc. (the "HSBC Group" or “HSBC”). This forward-looking information represents expectations or beliefs concerning future events and involves known and unknown risks and uncertainty that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Additional detailed information concerning important factors that could cause actual results to differ materially is available in the Annual Reports and Accounts of HSBC Holdings plc and HSBC Bank Canada for the year ended December 31, 2009, as well as the HSBC Bank Canada Second Quarter 2010 Report to Shareholders and the HSBC Holdings plc Interim Report 2010 for the period ended June 30, 2010. Past performance cannot be relied on as a guide to future performance. Please see www.hsbc.com and www.hsbc.ca for further information. This material is for information purposes only. HSBC Holdings plc is not a reporting issuer in Canada and is not permitted, by itself or through a nominee or agent, to engage in or carry on any business in Canada, except as permitted by the Bank Act (Canada). The material is intended for your sole use and is not for general distribution and does not constitute an offer or commitment, a solicitation of an offer or commitment to enter into or conclude any transaction or to purchase or sell any financial instrument. -

HSBC HOLDINGS PLC Annual Report and Accounts 1996

HSBC HOLDINGS PLC Annual Report and Accounts 1996 Financial Highlights 1995 1996 1996 1996 £m For the year £m HK$m US$m 3,672 Profit before tax 4,524 54,641 7,066 2,462 Profit attributable 3,112 37,587 4,861 843 Dividends 1,090 13,165 1,703 At year-end 13,387 Shareholders’ funds 15,187 199,859 25,833 21,324 Capital resources 23,486 309,076 39,950 162,814 Customer accounts and deposits by banks 169,179 2,226,396 287,773 226,818 Assets 236,553 3,113,037 402,377 145,218 Risk-weighted assets 153,488 2,019,902 261,083 Pence Per share Pence HK$ US$ 94.01 Earnings 117.61 14.20 1.84 93.89 Headline earnings 115.42 13.94 1.80 32.00 Dividends 41.00 5.40* 0.70* 508.05 Net asset value 570.73 75.11 9.71 Number of ordinary shares in issue at year-end 1,775m HK$10 1,791m 860m £0.75 870m % Ratios % 20.7 Return on average shareholders’ funds 21.3 1.28 Post-tax return on average assets 1.45 Capital ratios 14.7 — total capital 15.3 9.5 — tier 1 capital 9.9 55.6 Cost:income ratio 52.9 * The dividends per share figures are translated at the closing rate. Shareholders who receive dividends in Hong Kong dollars received a first interim dividend of HK180.9 cents per share. The second interim dividend of 26 pence per share will, where required, be converted into Hong Kong dollars at the exchange rate on 22 April 1997. -

Global Payments, Inc. (GPN) J.P

Corrected Transcript 14-Nov-2017 Global Payments, Inc. (GPN) J.P. Morgan Ultimate Services Investor Conference Total Pages: 18 1-877-FACTSET www.callstreet.com Copyright © 2001-2017 FactSet CallStreet, LLC Global Payments, Inc. (GPN) Corrected Transcript J.P. Morgan Ultimate Services Investor Conference 14-Nov-2017 CORPORATE PARTICIPANTS Tien-Tsin Huang Analyst, JPMorgan Securities LLC Jeffrey Steven Sloan Chief Executive Officer & Director, Global Payments, Inc. ...................................................................................................................................................................................................................................................... MANAGEMENT DISCUSSION SECTION Tien-Tsin Huang Analyst, JPMorgan Securities LLC Thanks, everybody for joining. My name is Tien-Tsin Huang; cover the Payments and IT Services Group at JPMorgan and super-excited and delighted to have Jeff Sloan back with us, CEO of Global Payments, [indiscernible] (00:14) always busy – we respect having him here again. So thank you. So what we'll do is, we'll have Q&A, I'll field it as I always do. I took a lot of questions from you guys and pieced it together. We'll go through some of these and then we'll open it up for Q&A. ...................................................................................................................................................................................................................................................... QUESTION AND ANSWER SECTION Tien-Tsin -

IN the UNITED STATES DISTRICT COURT for the SOUTHERN DISTRICT of TEXAS HOUSTON DIVISION MARGARITA VILLAGRAN, § § Plaintiff, §

Case 4:05-cv-02685 Document 75 Filed in TXSD on 10/23/07 Page 1 of 43 IN THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION MARGARITA VILLAGRAN, § § Plaintiff, § v. § CIVIL ACTION NO. H-05-2685 § CENTRAL FORD, INC., § § Defendant. § MEMORANDUM AND OPINION Margarita Villagran sues on her own behalf and on behalf of a class of people sent mailings by Central Ford, Inc., an automobile dealership. Villagran alleges that the mailings violated the Fair Credit Reporting Act (FCRA), 15 U.S.C. § 1681 et seq., because they used information obtained without authorization from the addressees’ credit reports, for a purpose not permitted under the Act. The FCRA allows companies such as Central Ford to use information obtained from consumers’ credit reports for communications that extend “firm offers of credit.” The FCRA prohibits the use of such information to advertise rather than extend “firm offers of credit.” Villagran alleges that the mailing she and others received did not extend a “firm offer of credit.” She seeks damages under 15 U.S.C. § 1681n(a), which provides that for each violation, the consumer may recover “any actual damages sustained by the consumer as a result of [a violation] or damages of not less than $100 and not more than $1,000,” punitive damages, attorney’s fees, and costs. Villagran has amended her motion to certify a class action, (Docket Entry No. 55); Case 4:05-cv-02685 Document 75 Filed in TXSD on 10/23/07 Page 2 of 43 Central Ford has responded, (Docket Entry No. -

Powerline Plans

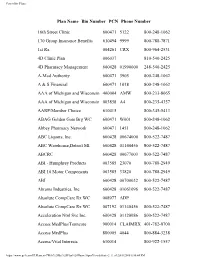

Powerline Plans Plan Name Bin Number PCN Phone Number 16th Street Clinic 600471 5122 800-248-1062 170 Group Insurance Benefits 610494 9999 800-788-7871 1st Rx 004261 CRX 800-964-2531 4D Clinic Plan 006037 810-540-2425 4D Pharmacy Management 600428 01990000 248-540-2425 A-Med Authority 600471 3905 800-248-1062 A & S Financial 600471 1018 800-248-1062 AAA of Michigan and Wisconsin 400004 AMW 800-233-8065 AAA of Michigan and Wisconsin 003858 A4 800-235-4357 AARP/Member Choice 610415 800-345-5413 ABAG Golden Gate Brg WC 600471 W001 800-248-1062 Abbey Pharmacy Network 600471 1451 800-248-1062 ABC Liquors, Inc. 600428 00674000 800-522-7487 ABC Warehouse,Detroit MI 600428 01140456 800-522-7487 ABCRC 600428 00677003 800-522-7487 ABI - Humphrey Products 003585 23070 800-788-2949 ABI 10 Motor Components 003585 33820 800-788-2949 ABI 600428 00700032 800-522-7487 Abrams Industries, Inc. 600428 01061096 800-522-7487 Absolute CompCare Rx WC 008977 ADP Absolute CompCare Rx WC 007192 01140456 800-522-7487 Acceleration Ntnl Svc Inc. 600428 01120086 800-522-7487 Access MedPlus/Tenncare 900014 CLAIMRX 401-782-0700 Access MedPlus 880005 4044 800-884-3238 Access/Vital Interests 610014 800-922-1557 https://www.qs1.com/PLPlans.nsf/Web%20By%20Plan%20Name!OpenView&Start=2 (1 of 2)8/8/2006 6:50:44 PM Powerline Plans Accident Fund of Michigan 600428 00700054 800-522-7487 Accubank Mortgage Inc 600428 00672018 800-522-7487 Aclaim 005848 800-422-5246 ACMG Employers Health Plan 400004 ACM 800-233-8065 Acordia Sr Benefits Horizons 600428 00790015 800-522-7487 https://www.qs1.com/PLPlans.nsf/Web%20By%20Plan%20Name!OpenView&Start=2 (2 of 2)8/8/2006 6:50:44 PM Powerline Plans Plan Name Bin Number PCN Phone Number Acordia Sr Benefits Horizons 600428 00790015 800-522-7487 ACT Industries, Inc. -

HSBC in Buffalo: a Timeline

HSBC in Buffalo: A timeline 1850: Marine Trust Co. is formed on Buffalo’s water- front to help support the Great Lakes shipping trade. 1920s: The bank merges with several others in the city and opens branches. 1972: Marine Midland Bank, headquartered in Buf- falo, moves into leased space in the 38-story tower at the foot of Main Street. 1981: The Hongkong and Shanghai Banking Corp. purchases 51 percent of Marine Midland Bank, marking its desire to entrench itself in the U.S. banking scene. 1987: The bank is fully acquired by HSBC Holdings PLC. 1990-91: Marine Midland Bank struggles with capital problems. 1996: The bank acquires New Rochelle, N.Y.-based East River Savings Bank, six HongKongBank branches in New York City, two Hang Seng branches in New York City and the institutional U.S. dollar-clearing business of J.P. Morgan. 1997: Marine Midland Bank gets approval to sell insurance through its subsidiary, Marine Midland Se- curities Inc. Later, the bank buys First Federal Savings and Loan Association in Rochester for $620 million and becomes one of the leading mortgage providers in the nation. 1998: Marine Midland Bank changes its name to HSBC Bank USA to reflect its connection to HSBC Holdings PLC. 2000: The bank completes its acquisition of New York City-based Republic National Bank for $9.9 bil- lion, boosting HSBC’s workforce in Erie and Niagara counties to 5,650 and becoming one of the 10 largest U.S. banks. It has 455 branches in New York and two in Pennsylvania and it gains seven branches in Florida.