February 2021 Disclaimer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Uila Supported Apps

Uila Supported Applications and Protocols updated Oct 2020 Application/Protocol Name Full Description 01net.com 01net website, a French high-tech news site. 050 plus is a Japanese embedded smartphone application dedicated to 050 plus audio-conferencing. 0zz0.com 0zz0 is an online solution to store, send and share files 10050.net China Railcom group web portal. This protocol plug-in classifies the http traffic to the host 10086.cn. It also 10086.cn classifies the ssl traffic to the Common Name 10086.cn. 104.com Web site dedicated to job research. 1111.com.tw Website dedicated to job research in Taiwan. 114la.com Chinese web portal operated by YLMF Computer Technology Co. Chinese cloud storing system of the 115 website. It is operated by YLMF 115.com Computer Technology Co. 118114.cn Chinese booking and reservation portal. 11st.co.kr Korean shopping website 11st. It is operated by SK Planet Co. 1337x.org Bittorrent tracker search engine 139mail 139mail is a chinese webmail powered by China Mobile. 15min.lt Lithuanian news portal Chinese web portal 163. It is operated by NetEase, a company which 163.com pioneered the development of Internet in China. 17173.com Website distributing Chinese games. 17u.com Chinese online travel booking website. 20 minutes is a free, daily newspaper available in France, Spain and 20minutes Switzerland. This plugin classifies websites. 24h.com.vn Vietnamese news portal 24ora.com Aruban news portal 24sata.hr Croatian news portal 24SevenOffice 24SevenOffice is a web-based Enterprise resource planning (ERP) systems. 24ur.com Slovenian news portal 2ch.net Japanese adult videos web site 2Shared 2shared is an online space for sharing and storage. -

List of Brands

Global Consumer 2019 List of Brands Table of Contents 1. Digital music 2 2. Video-on-Demand 4 3. Video game stores 7 4. Digital video games shops 11 5. Video game streaming services 13 6. Book stores 15 7. eBook shops 19 8. Daily newspapers 22 9. Online newspapers 26 10. Magazines & weekly newspapers 30 11. Online magazines 34 12. Smartphones 38 13. Mobile carriers 39 14. Internet providers 42 15. Cable & satellite TV provider 46 16. Refrigerators 49 17. Washing machines 51 18. TVs 53 19. Speakers 55 20. Headphones 57 21. Laptops 59 22. Tablets 61 23. Desktop PC 63 24. Smart home 65 25. Smart speaker 67 26. Wearables 68 27. Fitness and health apps 70 28. Messenger services 73 29. Social networks 75 30. eCommerce 77 31. Search Engines 81 32. Online hotels & accommodation 82 33. Online flight portals 85 34. Airlines 88 35. Online package holiday portals 91 36. Online car rental provider 94 37. Online car sharing 96 38. Online ride sharing 98 39. Grocery stores 100 40. Banks 104 41. Online payment 108 42. Mobile payment 111 43. Liability insurance 114 44. Online dating services 117 45. Online event ticket provider 119 46. Food & restaurant delivery 122 47. Grocery delivery 125 48. Car Makes 129 Statista GmbH Johannes-Brahms-Platz 1 20355 Hamburg Tel. +49 40 2848 41 0 Fax +49 40 2848 41 999 [email protected] www.statista.com Steuernummer: 48/760/00518 Amtsgericht Köln: HRB 87129 Geschäftsführung: Dr. Friedrich Schwandt, Tim Kröger Commerzbank AG IBAN: DE60 2004 0000 0631 5915 00 BIC: COBADEFFXXX Umsatzsteuer-ID: DE 258551386 1. -

QIU, Yuanbo 420026435 Thesis

The Political Economy of Live Streaming in China: Exploring Stakeholder Interactions and Platform Regulation Yuanbo Qiu A thesis submitted in fulfilment of the requirements for the degree of Doctor of Philosophy Faculty of Arts and Social Sciences The University of Sydney 2021 i Statement of originality This is to certify that to the best of my knowledge, the content of this thesis is my own work. This thesis has not been submitted for any degree or other purposes. I certify that the intellectual content of this thesis is the product of my own work and that all the assistance received in preparing this thesis and sources have been acknowledged. Yuanbo Qiu February 2021 ii Abstract Watching online videos provides a major form of entertainment for internet users today, and in recent years live streaming platforms such as Twitch and Douyu, which allow individual users to live stream their real-time activities, have grown significantly in popularity. Many social media websites, including YouTube and Facebook, have also embedded live streaming services into their sites. However, the problem of harmful content, data misuse, labour exploitation and the burgeoning political and economic power of platform companies is becoming increasingly serious in the context of live streaming. Live streaming platforms have enabled synchronous interactions between streamers and viewers, and these practices are structured by platform companies in pursuit of commercial goals. Arising out of these interactions, we are seeing unpredictable streaming content, high-intensity user engagement and new forms of data ownership that pose challenges to existing regulation policies. Drawing on the frameworks of critical political economy of communication and platform regulation studies by Winseck, Gillespie, Gorwa, Van Dijck, Flew and others, this thesis examines regulation by platform and regulation of platform in a Chinese context. -

Page 1 of 375 6/16/2021 File:///C:/Users/Rtroche

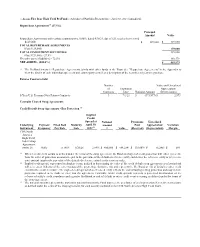

Page 1 of 375 :: Access Flex Bear High Yield ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited) Repurchase Agreements(a) (27.5%) Principal Amount Value Repurchase Agreements with various counterparties, 0.00%, dated 4/30/21, due 5/3/21, total to be received $129,000. $ 129,000 $ 129,000 TOTAL REPURCHASE AGREEMENTS (Cost $129,000) 129,000 TOTAL INVESTMENT SECURITIES 129,000 (Cost $129,000) - 27.5% Net other assets (liabilities) - 72.5% 340,579 NET ASSETS - (100.0%) $ 469,579 (a) The ProFund invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix to view the details of each individual agreement and counterparty as well as a description of the securities subject to repurchase. Futures Contracts Sold Number Value and Unrealized of Expiration Appreciation/ Contracts Date Notional Amount (Depreciation) 5-Year U.S. Treasury Note Futures Contracts 3 7/1/21 $ (371,977) $ 2,973 Centrally Cleared Swap Agreements Credit Default Swap Agreements - Buy Protection (1) Implied Credit Spread at Notional Premiums Unrealized Underlying Payment Fixed Deal Maturity April 30, Amount Paid Appreciation/ Variation Instrument Frequency Pay Rate Date 2021(2) (3) Value (Received) (Depreciation) Margin CDX North America High Yield Index Swap Agreement; Series 36 Daily 5 .00% 6/20/26 2.89% $ 450,000 $ (44,254) $ (38,009) $ (6,245) $ 689 (1) When a credit event occurs as defined under the terms of the swap agreement, the Fund as a buyer of credit protection will either (i) receive from the seller of protection an amount equal to the par value of the defaulted reference entity and deliver the reference entity or (ii) receive a net amount equal to the par value of the defaulted reference entity less its recovery value. -

Streamwiki: Enabling Viewers of Knowledge Sharing Live Streams to Collaboratively Generate Archival Documentation for Effective In-Stream and Post-Hoc Learning

StreamWiki: Enabling Viewers of Knowledge Sharing Live Streams to Collaboratively Generate Archival Documentation for Effective In-Stream and Post-Hoc Learning ZHICONG LU, Computer Science, University of Toronto, Canada SEONGKOOK HEO, Computer Science, University of Toronto, Canada DANIEL WIGDOR, Computer Science, University of Toronto, Canada Knowledge-sharing live streams are distinct from traditional educational videos, in part due to the large concurrently-viewing audience and the real-time discussions that are possible between viewers and the streamer. Though this medium creates unique opportunities for interactive learning, it also brings about the challenge of creating a useful archive for post-hoc learning. This paper presents the results of interviews with knowledge sharing streamers, their moderators, and viewers to understand current experiences and needs for sharing and learning knowledge through live streaming. Based on those findings, we built StreamWiki, a tool which leverages the availability of live stream viewers to produce useful archives of the interactive learning experience. On StreamWiki, moderators initiate high-level tasks that viewers complete by conducting microtasks, such as writing summaries, sending comments, and voting for informative comments. As a result, a summary document is built in real time. Through the tests of our prototype with streamers and viewers, we found that StreamWiki could help viewers understand the content and the context of the stream, during the stream and also later, for post-hoc learning. CSS Concepts: • Human-centered computing → Collaborative and social computing → Collaborative and social computing systems and tools KEYWORDS Live streaming; knowledge sharing; knowledge building; collaborative documentation; learning ACM Reference format: Zhicong Lu, Seongkook Heo, and Daniel Wigdor. -

Biggest Moneymaker’ in the $150 Billion Gaming

Gaming is booming in China as the coronavirus means more time at home With the coronavirus still raging on in China and70,548 confirmed cases, and 1,770 deaths it is no wonder that much of China remains in lockdown. As a result, online gaming activity is setting record highs in China as more people spend more time at home. The implication for investors is that Chinese gaming-related companies should be in for a booming quarter when they next report results. While some of this is already priced into gaming stocks, should the coronavirus last longer more gains can be expected. Tencent rallies 10% in the past month as more Chinese stay at home gaming Last month when I wrote: “The Wuhan Coronavirus crisis leads to some investment opportunities” I mentioned that Chinese internet stocks can be possible winners including gaming and social media giant Tencent (OTC: TCEHY). The stock has rallied 10% since then. The longer the coronavirus has a significant impact then I expect the Tencent rally to continue. Game live streaming hours watched up 17% in January VentureBeat just reported that game live streaming was up 17% to nearly 500 million view hours in January 2020. The most popular streaming sites were Amazon’s Twitch (NASDAQ: AMZN), Alphabet Google’s (NASDAQ: GOOGL) (NASDAQ: GOOG) YouTube Gaming, Facebook Gaming (NASDAQ: FB), and Microsoft (NASDAQ: MSFT) Mixer. In China, Tencent backed Douyu and Huya will benefit from increased live streaming. Ironically Douyu’s headquarters is located in Wuhan, the center of the coronavirus epidemic. A game called ‘Plague Inc.’ has become highly popular and is like the real-life coronavirus threat Ironically one of the most popular games in China nowadays is titled “Plague Inc’. -

Investor Deck

ROUNDHILL INVESTMENTS NERD The Esports & Digital Entertainment ETF INVESTOR PRESENTATION JUNE 2021 ROUNDHILL INVESTMENTS Disclaimer Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the NERD ETF please call 1-877-220-7649 or visit the website at roundhillinvestments.com/etf/nerd. Read the prospectus or summary prospectus carefully before investing. Investing involves risk, including possible loss of principal. Esports gaming companies face intense competition, both domestically and internationally, may have products that face rapid obsolescence, and are heavily dependent on the protection of patent and intellectual property rights. Such factors may adversely affect the profitability and value of video gaming companies. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Fund investments will be concentrated in an industry or group of industries, and the value of Fund shares may risk and fall more than diversified funds. Foreign investing involves social and political instability, market illiquidity, exchangerate fluctuation, high volatility and limited regulation risks. Emerging markets involve different and greater risks, as they are smaller, less liquid and more volatile than more developed countries. Depository Receipts involve risks similar to those associated investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. Please see the prospectus for details of these and other risks. Roundhill Financial Inc. serves as the investment advisor. The Funds are distributed by Foreside Fund Services, LLC which is not affiliated with Roundhill Financial Inc., U.S. -

A Model for Information Behavior Research on Social Live Streaming Services (Slsss)

A Model for Information Behavior Research on Social Live Streaming Services (SLSSs) Franziska Zimmer(&), Katrin Scheibe(&), and Wolfgang G. Stock Department of Information Science, Heinrich Heine University Düsseldorf, Düsseldorf, Germany {franziska.zimmer,katrin.scheibe}@hhu.de, [email protected] Abstract. Social live streaming services (SLSSs) are synchronous social media, which combine Live-TV with elements of Social Networking Services (SNSs) including a backchannel from the viewer to the streamer and among the viewers. Important research questions are: Why do people in their roles as producers, consumers and participants use SLSSs? What are their motives? How do they look for gratifications, and how will they obtain them? The aim of this article is to develop a heuristic theoretical model for the scientific description, analysis and explanation of users’ information behavior on SLSSs in order to gain better understanding of the communication patterns in real-time social media. Our theoretical framework makes use of the classical Lasswell formula of communication, the Uses and Gratifications theory of media usage as well as the Self-Determination theory. Albeit we constructed the model for under- standing user behavior on SLSSs it is (with small changes) suitable for all kinds of social media. Keywords: Social media Á Social live streaming service (SLSS) Live video Á Information behavior Á Users Á Lasswell formula Uses and gratifications theory Á Motivation Á Self-determination theory 1 Introduction: Information Behavior on SLSSs On social media, users act as prosumers [1], i.e. both as producers of content as well as its consumers [2]. Produsage [3] amalgamates active production and passive con- sumption of user-generated content. -

Cultivating Community: Presentation of Self Among Women Game Streamers in Singapore and the Philippines

Proceedings of the 54th Hawaii International Conference on System Sciences | 2021 Cultivating Community: Presentation of Self among Women Game Streamers in Singapore and the Philippines Katrina Paola B. Alvarez Vivian Hsueh-hua Chen Wee Kim Wee School Wee Kim Wee School of Communication & Information of Communication & Information Nanyang Technological University Nanyang Technological University [email protected] [email protected] Abstract explores how women game streamers in Southeast Asia manage their presentation of self [9] while This study explored how women game live cultivating a stable community of viewers and streamers in Singapore and the Philippines make navigating a medium perceived as dominated by North sense of their presentation of self as performers and American and European content creators, in a region gamers in a medium dominated by Western games, whose game industry and culture are also led by performers, and platforms. We conducted six in-depth foreign games [10][11]. interviews guided by interpretive phenomenological The presentation of self framework proposes that analysis in order to understand their experiences, social interactions can be understood as performance. uncovering issues such as audience connection and People engage in various practices in order to maintenance, the difficulties of presenting their own cultivate, manage, and manipulate others’ impressions femininity, and the influence of being Singaporean, of them, their actions, and the situation. Often, the Filipina, and Asian on their success as performers. We performed persona or presented self can be different discuss directions for study that further explore from the self that has no audience present [9]. As gaming and streaming as a form of cultural labor in researchers and streamers alike similarly view Asia. -

China Ecommerce: Video Live Streaming: the Crucial Piece of The

FOCUS Equity Research 8 July 2020 China eCommerce INDUSTRY UPDATE Video Live Streaming: The Crucial U.S. Internet Piece of the eCommerce Jigsaw Puzzle POSITIVE Unchanged The Key Takeaways: We view live streaming as a crucial function in the differentiation of eCom service offerings, as it creates an interactive scene to seamlessly connect U.S. Internet consumers with sellers and boosts the conversion rates. The function generated Gregory Zhao CNY451bn (US$64bn) GMV in CY19, c.4% of China’s eCom GMV, and is forecast to +1 212 526 2268 reach CNY2.9tn (US$410bn) in CY22, representing c.16% market share, according to [email protected] BCI, US iResearch. We view eCom platforms and short video apps as the primary beneficiaries of the tailwind – noting the former’s comprehensive eCom infrastructure and the Ross Sandler latter’s considerable top-of-funnel user traffic – enabling both to embed eCom live +1 415 263 4470 streaming into their ecosystems. The Covid-19 lockdown has given live streaming an [email protected] BCI, US opportunity to gain market share from offline, with a wide product spectrum from apparel to fresh foods reached by live broadcasting. As eCom and short video Jane Han companies both explore the best model to maximize their financial economics, we think +1 212 526 9317 the win-win strategy is for the two to harness their respective advantages and [email protected] cooperate with each other. We view the Street’s concerns over the threat from the BCI, US “decentralized” eCom of short video apps as overdone, as the industry expertise of eCom companies and their well-established supply chain and logistics services are hard to disrupt in the foreseeable future. -

Listed Funds Trust Form NPORT-P Filed 2021-05-28

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-05-28 | Period of Report: 2021-03-31 SEC Accession No. 0001145549-21-033652 (HTML Version on secdatabase.com) FILER Listed Funds Trust Mailing Address Business Address 615 E. MICHIGAN STREET 615 E. MICHIGAN STREET CIK:1683471| IRS No.: 826272597 | Fiscal Year End: 0831 MILWAUKEE WI 53202 MILWAUKEE WI 53202 Type: NPORT-P | Act: 40 | File No.: 811-23226 | Film No.: 21980242 414-765-5144 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Roundhill Streaming Services & Technology ETF Schedule of Investments March 31, 2021 (Unaudited) Shares Value COMMON STOCKS — 99.8% Advertising Agencies — 3.1% CyberAgent, Inc. (a) 40,000 $ 721,448 The Trade Desk, Inc. - Class A (b) 804 523,935 1,245,383 All Other Business Support Services — 8.4% Bilibili, Inc. - ADR (a)(b) 16,869 1,805,995 DouYu International Holdings Ltd. - ADR (a)(b) 76,182 793,055 HUYA, Inc. - ADR (a)(b) 42,662 831,056 3,430,106 All Other Information Services — 1.1% LiveRamp Holdings, Inc. (b) 8,617 447,050 All Other Publishers — 1.1% Agora, Inc. - ADR (a)(b) 9,257 465,349 Audio & Video Equipment Manufacturing — 2.8% Sonos, Inc. (b) 30,668 1,149,130 Cable & Other Subscription Programming — 8.5% Comcast Corp. - Class A 8,812 476,817 Discovery, Inc. - Class A (b) 29,314 1,273,986 Roku, Inc. (b) 5,257 1,712,573 3,463,376 Custom Computer Programming Services — 1.6% Magnite, Inc. (b) 15,582 648,367 Electronic Shopping & Mail-Order Houses — 1.0% Amazon.com, Inc. -

JHVIT Quarterly Holdings 6.30.2021

John Hancock Variable Insurance Trust Portfolio of Investments — June 30, 2021 (unaudited) (showing percentage of total net assets) 500 Index Trust 500 Index Trust (continued) Shares or Shares or Principal Principal Amount Value Amount Value COMMON STOCKS – 97.6% COMMON STOCKS (continued) Communication services – 10.9% Hotels, restaurants and leisure (continued) Diversified telecommunication services – 1.2% Marriott International, Inc., Class A (A) 55,166 $ 7,531,262 McDonald’s Corp. 155,101 35,826,780 AT&T, Inc. 1,476,336 $ 42,488,950 MGM Resorts International 86,461 3,687,562 Lumen Technologies, Inc. 208,597 2,834,833 Norwegian Cruise Line Holdings, Ltd. (A) 75,206 2,211,808 Verizon Communications, Inc. 858,032 48,075,533 Penn National Gaming, Inc. (A) 30,865 2,360,864 93,399,316 Royal Caribbean Cruises, Ltd. (A) 45,409 3,872,480 Entertainment – 1.9% Starbucks Corp. 244,224 27,306,685 Activision Blizzard, Inc. 160,872 15,353,624 Wynn Resorts, Ltd. (A) 21,994 2,689,866 Electronic Arts, Inc. 60,072 8,640,156 Yum! Brands, Inc. 62,442 7,182,703 Live Nation Entertainment, Inc. (A) 30,014 2,628,926 151,933,613 Netflix, Inc. (A) 91,957 48,572,607 Household durables – 0.4% Take-Two Interactive Software, Inc. (A) 24,146 4,274,325 D.R. Horton, Inc. 68,073 6,151,757 The Walt Disney Company (A) 376,832 66,235,761 Garmin, Ltd. 31,500 4,556,160 145,705,399 Leggett & Platt, Inc. 27,959 1,448,556 Interactive media and services – 6.3% Lennar Corp., A Shares 55,918 5,555,453 Alphabet, Inc., Class A (A) 62,420 152,416,532 Mohawk Industries, Inc.