Bank Sinopac

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

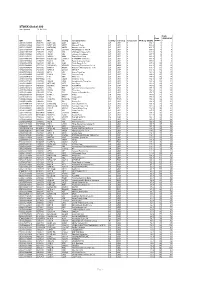

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

STOXX Global 200 Last Updated: 01.02.2018

STOXX Global 200 Last Updated: 01.02.2018 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) US0378331005 2046251 AAPL.OQ AAPL Apple Inc. US USD Y 694.2 1 1 US5949181045 2588173 MSFT.OQ MSFT Microsoft Corp. US USD Y 588.4 2 2 US0231351067 2000019 AMZN.OQ AMZN Amazon.com Inc. US USD Y 466.7 3 3 US30303M1027 B7TL820 FB.OQ US20PD FACEBOOK CLASS A US USD Y 355.6 4 4 US46625H1005 2190385 JPM.N CHL JPMorgan Chase & Co. US USD Y 329.9 5 5 US4781601046 2475833 JNJ.N JNJ Johnson & Johnson US USD Y 297.7 6 6 US30231G1022 2326618 XOM.N XON Exxon Mobil Corp. US USD Y 296.9 7 7 US02079K1079 BYY88Y7 GOOG.OQ US40C2 ALPHABET CLASS C US USD Y 289.1 8 8 US0605051046 2295677 BAC.N NB Bank of America Corp. US USD Y 250.0 9 9 US9497461015 2649100 WFC.N NOB Wells Fargo & Co. US USD Y 237.5 10 11 KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 223.3 11 10 US0846707026 2073390 BRKb.N BRKB Berkshire Hathaway Inc. Cl B US USD Y 218.2 12 13 CH0038863350 7123870 NESN.S 461669 NESTLE CH CHF Y 216.1 13 12 US4370761029 2434209 HD.N HD Home Depot Inc. US USD Y 192.8 14 17 US1667641005 2838555 CVX.N CHV Chevron Corp. US USD Y 190.6 15 15 US00206R1023 2831811 T.N SBC AT&T Inc. US USD Y 184.6 16 14 US92826C8394 B2PZN04 V.N U0401 VISA Inc. -

STOXX Greater China 80 Last Updated: 01.08.2017

STOXX Greater China 80 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.9 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 3 3 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 51.5 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 6 6 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 7 9 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 8 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 9 8 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 10 10 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 11 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 12 11 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 13 13 TW0003008009 6451668 3008.TW TW05PJ LARGAN Precision TW TWD Y 19.7 14 15 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 17 19 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. -

Emerging Index - QSR

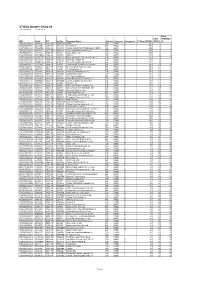

2 FTSE Russell Publications 19 August 2021 FTSE RAFI Emerging Index - QSR Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) Absa Group Limited 0.29 SOUTH BRF S.A. 0.21 BRAZIL China Taiping Insurance Holdings (Red 0.16 CHINA AFRICA BTG Pactual Participations UNT11 0.09 BRAZIL Chip) Acer 0.07 TAIWAN BYD (A) (SC SZ) 0.03 CHINA China Tower (H) 0.17 CHINA Adaro Energy PT 0.04 INDONESIA BYD (H) 0.12 CHINA China Vanke (A) (SC SZ) 0.09 CHINA ADVANCED INFO SERVICE 0.16 THAILAND Canadian Solar (N Shares) 0.08 CHINA China Vanke (H) 0.2 CHINA Aeroflot Russian Airlines 0.09 RUSSIA Capitec Bank Hldgs Ltd 0.05 SOUTH Chongqing Rural Commercial Bank (A) (SC 0.01 CHINA Agile Group Holdings (P Chip) 0.04 CHINA AFRICA SH) Agricultural Bank of China (A) (SC SH) 0.27 CHINA Catcher Technology 0.2 TAIWAN Chongqing Rural Commercial Bank (H) 0.04 CHINA Agricultural Bank of China (H) 0.66 CHINA Cathay Financial Holding 0.29 TAIWAN Chunghwa Telecom 0.32 TAIWAN Air China (A) (SC SH) 0.02 CHINA CCR SA 0.14 BRAZIL Cia Paranaense de Energia 0.01 BRAZIL Air China (H) 0.06 CHINA Cemex Sa Cpo Line 0.7 MEXICO Cia Paranaense de Energia (B) 0.07 BRAZIL Airports of Thailand 0.04 THAILAND Cemig ON 0.03 BRAZIL Cielo SA 0.13 BRAZIL Akbank 0.18 TURKEY Cemig PN 0.18 BRAZIL CIFI Holdings (Group) (P Chip) 0.03 CHINA Al Rajhi Banking & Investment Corp 0.52 SAUDI Cencosud 0.04 CHILE CIMB Group Holdings 0.11 MALAYSIA ARABIA Centrais Eletricas Brasileiras S.A. -

Taiwan's Top 50 Corporates

Title Page 1 TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATES We provide: A variety of Chinese and English rating credit Our address: https://rrs.taiwanratings.com.tw rating information. Real-time credit rating news. Credit rating results and credit reports on rated corporations and financial institutions. Commentaries and house views on various industrial sectors. Rating definitions and criteria. Rating performance and default information. S&P commentaries on the Greater China region. Multi-media broadcast services. Topics and content from Investor outreach meetings. RRS contains comprehensive research and analysis on both local and international corporations as well as the markets in which they operate. The site has significant reference value for market practitioners and academic institutions who wish to have an insight on the default probability of Taiwanese corporations. (as of June 30, 2015) Chinese English Rating News 3,440 3,406 Rating Reports 2,006 2,145 TRC Local Analysis 462 458 S&P Greater China Region Analysis 76 77 Contact Us Iris Chu; (886) 2 8722-5870; [email protected] TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATESJenny Wu (886) 2 872-5873; [email protected] We warmly welcome you to our latest study of Taiwan's top 50 corporates, covering the island's largest corporations by revenue in 2014. Our survey of Taiwan's top corporates includes an assessment of the 14 industry sectors in which these companies operate, to inform our views on which sectors are most vulnerable to the current global (especially for China) economic environment, as well as the rising strength of China's domestic supply chain. -

Ctbc Financial Holding Co., Ltd. and Subsidiaries

1 Stock Code:2891 CTBC FINANCIAL HOLDING CO., LTD. AND SUBSIDIARIES Consolidated Financial Statements With Independent Auditors’ Report For the Six Months Ended June 30, 2019 and 2018 Address: 27F and 29F, No.168, Jingmao 2nd Rd., Nangang Dist., Taipei City 115, Taiwan, R.O.C. Telephone: 886-2-3327-7777 The independent auditors’ report and the accompanying consolidated financial statements are the English translation of the Chinese version prepared and used in the Republic of China. If there is any conflict between, or any difference in the interpretation of the English and Chinese language independent auditors’ report and consolidated financial statements, the Chinese version shall prevail. 2 Table of contents Contents Page 1. Cover Page 1 2. Table of Contents 2 3. Independent Auditors’ Report 3 4. Consolidated Balance Sheets 4 5. Consolidated Statements of Comprehensive Income 5 6. Consolidated Statements of Changes in Stockholder’s Equity 6 7. Consolidated Statements of Cash Flows 7 8. Notes to the Consolidated Financial Statements (1) History and Organization 8 (2) Approval Date and Procedures of the Consolidated Financial Statements 8 (3) New Standards, Amendments and Interpretations adopted 9~12 (4) Summary of Significant Accounting Policies 12~39 (5) Primary Sources of Significant Accounting Judgments, Estimates and 40 Assumptions Uncertainty (6) Summary of Major Accounts 40~202 (7) Related-Party Transactions 203~215 (8) Pledged Assets 216 (9) Significant Contingent Liabilities and Unrecognized Contract 217~226 Commitment (10) Significant Catastrophic Losses 227 (11) Significant Subsequent Events 227 (12) Other 227~282 (13) Disclosures Required (a) Related information on significant transactions 283~287 (b) Related information on reinvestment 287~289 (c) Information on investment in Mainland China 289~290 (14) Segment Information 291 KPMG 11049 5 7 68 ( 101 ) Telephone + 886 (2) 8101 6666 台北市 信義路 段 號 樓 台北 大樓 68F., TAIPEI 101 TOWER, No. -

指數etf (2805) 截至 31/01/2014 2805

領航富時亞洲(日本除外)指數ETF (2805) 截至 31/01/2014 2805 成分股數目 669 證券百分比 99.66% 現金及現金等類百分比 0.34% 其他 0.00% 證券名稱 證券代號 交易所 資產淨值百分比 Samsung Electronics Co. Ltd. 005930 XKRX 4.36% Taiwan Semiconductor Manufacturing Co. Ltd. 2330 XTAI 2.82% Tencent Holdings Ltd. 700 XHKG 2.20% AIA Group Ltd. 1299 XHKG 1.91% China Construction Bank Corp. 939 XHKG 1.78% China Mobile Ltd. 941 XHKG 1.69% Industrial & Commercial Bank of China Ltd. 1398 XHKG 1.59% Hyundai Motor Co. 005380 XKRX 1.14% Bank of China Ltd. 3988 XHKG 1.13% Hon Hai Precision Industry Co. Ltd. 2317 XTAI 1.13% Hutchison Whampoa Ltd. 13 XHKG 0.98% Infosys Ltd. INFY XNSE 0.97% CNOOC Ltd. 883 XHKG 0.84% Oversea-Chinese Banking Corp. Ltd. O39 XSES 0.74% Housing Development Finance Corp. HDFC XNSE 0.73% DBS Group Holdings Ltd. D05 XSES 0.72% Reliance Industries Ltd. RELIANCE XNSE 0.72% Galaxy Entertainment Group Ltd. 27 XHKG 0.72% China Life Insurance Co. Ltd. 2628 XHKG 0.71% Singapore Telecommunications Ltd. Z74 XSES 0.70% PetroChina Co. Ltd. 857 XHKG 0.70% POSCO 005490 XKRX 0.69% Shinhan Financial Group Co. Ltd. 055550 XKRX 0.69% Hong Kong Exchanges and Clearing Ltd. 388 XHKG 0.68% China Petroleum & Chemical Corp. 386 XHKG 0.68% Hyundai Mobis 012330 XKRX 0.67% Cheung Kong Holdings Ltd. 1 XHKG 0.66% Sands China Ltd. 1928 XHKG 0.62% Sun Hung Kai Properties Ltd. 16 XHKG 0.62% United Overseas Bank Ltd. U11 XSES 0.62% SK Hynix Inc. -

Ir 20170817012.Pdf

Spokesperson Neili Texturizing Plant Name: Humphrey Cheng Address: 2 Yuan Dong Rd., Neili, Chungli, Title: Corporate Management President Taiwan, R.O.C Tel: 886-2-27338000 #8969 Tel: 886-3-4555136 Fax: 886-2-27367184 E-mail: [email protected] Hukou Mill Address: 30, Hexing Rd., Hukou, Hsinchu, Taiwan, R.O.C Deputy Spokesperson Tel: 886-3-5997135 Name: David Wang Title: Chief Financial Officer Yilan Garment Factory Tel: 886-2-27338000 #8735 Address: No. 49, Sec. 6, Jiaosi Rd., Jiaosi, Fax: 886-2-27358175 Yilan, Taiwan R.O.C E-mail: [email protected] Tel: 886-3-9881411 Headquarters, Branches & Plants Common Share Transfer Agent and Registrar Headquarters Address: 36F, Taipei Metro Tower, 207, Oriental Securities Corporation Tun Hwa South Rd., Sec.2, Taipei, Taiwan, Address: 3F, 86, Chung Ching South Rd., R.O.C. Sec. 1, Taipei, Taiwan Tel: 886-2-27338000 Tel: 886-2-23618608 Website: http://www.osc.com.tw Plants Hsinpu Chemical Fiber Plant Address: 369, Yadong Sec., Wen Shan Rd., Auditors Hsinpu, Hsinchu, Taiwan R.O.C. Deloitte & Touche Tel: 886-3-5882511 Auditors: Cho Ming Hsing, CPA, Huang Shu Chieh, CPA Kuanyin Chemical Fiber Plant Address: 12F, Hung Tai Century Tower, 156 Address: 3, Jingjian 6th Rd., Kuanyin Min Sheng East Rd., Sec.3, Taipei, Taiwan Industrial Park, Kuanyin, Taoyuan, Taiwan Tel.: 886-2-25459988 R.O.C. Website: http://www.deloitte.com.tw Tel: 886-3-4832720 Overseas Securities Exchange Kuanyin Dyeing and Finishing Plant Luxembourg Stock Exchange Address: 1, Kuojiang 2nd Rd., Kuanyin, Disclosed information can be found at Hsulin, Taoyuan, Taiwan R.O.C. -

2012 Annual Report Sino-American Silicon Products Inc

Stock Code:5483 Sino-American Silicon Products Inc. 2012 Annual Report Issue Date: May 16, 2013 Information website: http://newmops.twse.com.tw I. Company Spokesperson: 1. Spokesman Name: Simon Tai Position: Finance Manager Tel:+886-3-577-2233 E-mail: [email protected] 2. Deputy spokesperson: Name: CW Lee Position: Strategic Planning Manager Tel:+886-3-577-2233 E-mail: CWLee @saswafer.com II. Address and Telephone Number of The Company Headquarter, Subsidiaries, and Plants 1. Company Headquarter Address: 4F, No.8, Industrial East Road 2, Science-Based Industrial Park, Hsinchu, Taiwan Tel: +886-3-577-2233 Fax: +886-3-578-1706 2. Chunan Plant I Address: No. 21, Kejung Rd., Chunan, Miaoli County, Hsinchu Science Park, Taiwan Tel: +886-37-582533 Fax: +886-37-580206 3. Chunan Plant II Address: No. 6, Kejung Rd., Chunan, Miaoli County, Hsinchu Science Park, Taiwan Tel: +886-37-582533 Fax: +886-37-580206 4. Subsidiaries and Plants Name: GlobalWafers Co., Ltd. Address: No.8, Industrial East Road 2, Science-Based Industrial Park, Hsinchu, Taiwan Tel: +886-3-577-2255 Fax: +866-3-578-1706 III. Stock Transfer Agency Agency name: Stock Agency Department, Yuanta Securities Address: B1, No. 210, Sec. 3, Chengde Rd., Taipei, Taiwan Tel: +886-2-2586-5859 Website: http://www.yuanta.com.tw/ IV. External Auditor Name of Accounting Firm: KPMG Taiwan Name of CPAs: Tseng, Mei-Yu, Chen, Chien-Chen Address: 68F, No. 7, Sec. 5, Hsinyi Rd., Taipei, Taiwan Tel: +886-2-8101-6666 Website: http://www.kpmg.com V. Global Depositary Receipt (GDR) Agency Luxembourg Stock Exchange How to Query Website: http://www.bourse.lu VI. -

Listing Changes in 2003

Listing Changes in 2003 Listings Name Code Date Listings Name Code Date Common First Financial Holding Co. Ltd. 2892 2-Jan Compal Communications Inc. 8078 9-Dec Stocks Johnson Health Tech. Co., Ltd. 1736 9-Jan Sitronix Technology Corp. 8016 25-Dec Makalot Industrial Co., Ltd. 1477 21-Jan Formosa Petrochemical Corp 6505 26-Dec KING BILLION ELECTRONICS CO., LTD. 3056 3-Mar Taiwn Chang Type Industrial Co., Ltd. 541 19-Mar Depository FORMOSA EPITAXY INCORPORATION 3061 11-Apr Receipts Mustek Limited 9104 20-Jan MIN AIK TECHNOLOGY CO., LTD. 3060 21-Apr Cal-Comp Electronics(Thailand) Public Co., Ltd. 9105 22-Sep GENERAL PLASTIC INDUSTRIAL CO., LTD. 6128 16-Jun Warrants Gemtek Technology Co., Ltd. 4906 30-Jun CyberTAN Technology, Inc. 3062 28-Jul Yunta Core Pacific-Uni-President Enterprises Corp. Jul. 03 0768 3-Jan SYSAGE THCHNOLOGY CO., LTD. 6112 4-Aug Fubon-Chinatrust Group Jan. 04 0769 6-Jan JYE TAI PRECISION INDUSTRIAL. CO., LTD. 6165 4-Aug Fubon-Sinopac Holdings Jan. 04 0770 8-Jan RECHI PRECISION CO., LTD. 4532 4-Aug Jih Sun-Asustek Jan. 04 0771 9-Jan CAMEO COMMUNICATIONS, INC. 6142 4-Aug China Trust-Fubon Financial Jul. 03 0772 10-Jan TECO ENTERPRISE CO., LTD. 6119 4-Aug Yuanta Core Pacific-Asustek Computer Jul. 03 0773 16-Jan Wistron Corporation 3231 19-Aug Masterlink-Pou Chen Jul. 03 0774 17-Jan SIGURD MICROELECTRONICS CORP. 6257 25-Aug Yuanta Core Pacific-Via Technologies Jul. 03 0775 20-Jan HannStar Board Corp. 5469 25-Aug Sinopac-Siliconware Jul. 03 0777 21-Jan EverFocus Electronics Corp. -

Asian Daily EPS, TP and Rating Changes Top of the Pack

Thursday, 13 February 2014 (Global Edition) Asian Daily EPS, TP and Rating changes Top of the pack ... EPS TP (% change) T+1 T+2 Chg Up/Dn Rating Commonwealth Bank 3 2 0 0 U (U) Asia Equity Strategy Sakthi Siva (3) Australia New report: Cyclicals have outperformed defensives YTD. Continue? China Mengniu Dairy (6) (7) 20 25 O (O) PRADA S.p.A. (10) (12) (5) 29 O (O) India IT Services Sector Anantha Narayan (4) Apollo Tyres 8 2 10 22 O (O) Is it too crowded for further performance? Cipla Limited (6) 0 0 1 N (N) Jaiprakash Power Ventures (60) (17) (14) 107 O (O) Page Industries 3 3 2 13 O (O) Asia Technology Sector Keon Han (5) Perusahaan Gas Negara (1) 1 2 31 O (O) New report: LED—entering expansion phase Softbank 0 0 — R (R) UMW Oil & Gas 0 (7) 31 3 N (N) China Mengniu Dairy (2319.HK) – Maintain O Kevin Yin (6) Universal Robina Corp. 1 1 0 18 O (O) 2014 outlook: Should pass through 10% raw milk price inflation; EPS likely to grow 35.9% YoY Huaku Development (3) (1) (5) 32 O (O) Novatek Microelectronics 3 1 3 (18) U (U) CS pic of the day Sinopac Holdings 2 2 3 8 N (N) AIS PCL (4) (7) (4) 29 O (O) Global general lighting and LED lighting market size Siam City Cement 0 (2) (5) 0 U (U) The LED general lighting industry is now shifting from the initial penetration phase to a rapid expansionary TAC PCL 0 0 0 44 O (O) phase. -

Bank Sinopac

Bank SinoPac Financial Statements for the Years Ended December 31, 2008 and 2007 and Independent Auditors’ Report INDEPENDENT AUDITORS’ REPORT The Board of Directors and Stockholders Bank SinoPac We have audited the accompanying balance sheets of Bank SinoPac as of December 31, 2008 and 2007, and the related statements of income, changes in stockholders’ equity and cash flows for the years then ended. These financial statements are the responsibility of the Bank SinoPac’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with the Rules Governing Auditing and Certification of Financial Statements of the Financial Industry by Certified Public Accountants and auditing standards generally accepted in the Republic of China. Those rules and standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion. In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Bank SinoPac as of December 31, 2008 and 2007, and the results of its operations and its cash flows for the years then ended, in conformity with Criteria Governing the Preparation of Financial Reports by Public Banks, requirements of the Business Accounting Law and Guidelines Governing Business Accounting relevant to financial accounting standards, and accounting principles generally accepted in the Republic of China.