The Knowledge Economy Global M&A Report 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Economic Framework Sourcing List

Pan-Regulators’ Framework for Economic, Financial & Related Consultancy Services Final Sourcing Lists 2015 Introduction The purpose of this document is to give an overview of the final sourcing lists of the new Pan-Regulator’s Framework for Economic, Financial and Related Consultancy Services and to inform users of the range and choice of suppliers available. The new Framework will come into effect from 1st September 2015 and will be valid until 31st August 2018 (with a one year extension option). Lot 1. Energy Advice Relating to Economic and Environmental Areas This Lot covers consultancy on all aspects of specialised economic and environmental advice relating to energy. Advice may relate to establishment of suitable strategies, policies, processes and organisation of economic responsibilities within an organisation. Sub-Lot 1A. Regulatory and Incentive Design Ability to analyse various proposals in relation to regulatory policy development balancing consumer interest over short term and over the longer term Understanding of financial and economic incentives to encourage implementation of effective and efficient programmes by the company Understanding of the historical development of the current GB energy market arrangements, and ability to draw implications for policy design using relevant economic models. Ability to review alternative options and provide detailed cost benefit analysis Economic assessment of options so that the incentive scheme satisfies the economic efficiency criteria for the users of the system Development -

Baromètre Edhec - Cadremploi Jeunes Diplômés Master

BAROMÈTRE EDHEC - CADREMPLOI JEUNES DIPLÔMÉS MASTER 23ème édition Juin 2016 BAROMÈTRE EDHEC - CADREMPLOI JEUNES DIPLÔMÉS MASTER Quelles sont les tendances du marché de l’emploi des jeunes diplômés de niveau Master ? Voilà la question à laquelle nous répondons 3 fois par an depuis janvier 2009. Cette 23ème édition du baromètre EDHEC est réalisée en collaboration avec CADREMPLOI, premier site emploi privé pour les cadres et les dirigeants en France. EDHEC NewGen Talent Centre © & CADREMPLOI - Juin 2016 - 23ème édition du BAROMÈTRE EDHEC - CADREMPLOI 2 150 ENTREPRISES PARTICIPENT AU BAROMÈTRE EDHEC - CADREMPLOI ABASE - ACCENTURE - ADVENTS - AELIA - LS TRAVEL RETAIL - AEROPORTS DE LA COTE D'AZUR - AIR LIQUIDE GROUPE - ALINEA - ALTER&GO - APPROACH PEOPLE - RECRUITMENT - ARKEMA - ARM France - ARROW ECS - ASPEN - ATOS - AUCHAN - AXA - BANQUE DE FRANCE - BANQUE FRANCAISE COMMERCIAL OCEAN INDIEN - BARCLAYS - BDO ADVISORY - BETC - BILLIERES BUSINESS SCHOOL - BURSON MARSTELLER - CAISSE D'EPARGNE COTE D'AZUR - CAPGEMINI CONSULTING - CAPTALENTS - CARREFOUR - CARTIER - CASTORAMA - CCI NICE COTE D'AZUR - CGI BUSINESS CONSULTING - CHAMPAGNE MOET - HENNESSY & CHANDON MHCS - CHARLES RICHARDSON - CHECKPOINT SYSTEMS FRANCE SAS - COCA COLA - COFIDIS PARTICIPATIONS GROUPE - COGEDIS - COLOMBUS CONSULTING - CONVICTIONS RH - CREDIT AGRICOLE - CREDIT DU NORD - CSC COMPUTER SCIENCES - DAMARTEX - DATACET - DELFOSSE - DELOITTE - DFDS SEAWAYS - EIGHT ADVISORY - ENESCO - EUROFEU - EUROPACORP TELEVISION - EUROTEKNIKA - EXPER - EXXON CHEMICAL FRANCE - EY GROUPE - FAURECIA -

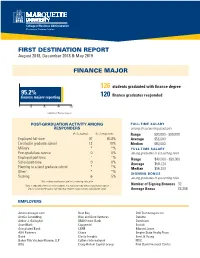

First Destination Report Finance Major

FIRST DESTINATION REPORT August 2018, December 2018 & May 2019 FINANCE MAJOR 126 students graduated with finance degree 95.2% finance majors reporting 120 finance graduates responded 0 50 75 100 150 175 200 number of finance majors POST-GRADUATION ACTIVITY AMONG FULL-TIME SALARY RESPONDERS among all accounting graduates # of students % of responses Range $30,000 - $90,000 Employed full-time 97 80.8% Average $58,600 Enrolled in graduate school 12 10% Median $60,000 Military * *% FULL-TIME SALARY Post-gradudate service 0 0% among graduates in accounting roles Employed part-time * *% Range $40,000 - $90,000 School part-time 0 0% Average $58,124 Planning to attend gradaute school * *% Median $56,250 Other1 * *% SIGNING BONUS Seeking 6 5% among graduates in accounting roles 1 Not seeking employment and not continuing education. *Data is reported when 5 or more students in a major pursued the post-graduation option. Number of Signing Bonuses 32 Data is collected through a self-reported student survey, faculty and LinkedIn input. Average Bonus $5,258 EMPLOYERS Americaneagle.com Best Buy Dell Technologies Inc. AndCo Consulting Blue and Gold Ventures Deloitte Arthur J. Gallagher BMO Harris Bank Dominium AssetMark Capgemini Ecolab Associated Bank CBRE Edward Jones AXA Partners Chase Empire State Realty Trust Baird Clarity Insights Ernst & Young Baker Tilly Virchow Krause, LLP Colliers International FDIC BDO Craig-Hallum Capital Group First Bank Financial Center EMPLOYERS (CONTINUED) First Business Financial Services Marshall & Stevens Scotiabank -

"SOLIZE India Technologies Private Limited" 56553102 .FABRIC 34354648 @Fentures B.V

Erkende referenten / Recognised sponsors Arbeid Regulier en Kennismigranten / Regular labour and Highly skilled migrants Naam bedrijf/organisatie Inschrijfnummer KvK Name company/organisation Registration number Chamber of Commerce "@1" special projects payroll B.V. 70880565 "SOLIZE India Technologies Private Limited" 56553102 .FABRIC 34354648 @Fentures B.V. 82701695 01-10 Architecten B.V. 24257403 100 Grams B.V. 69299544 10X Genomics B.V. 68933223 12Connect B.V. 20122308 180 Amsterdam BV 34117849 1908 Acquisition B.V. 60844868 2 Getthere Holding B.V. 30225996 20Face B.V. 69220085 21 Markets B.V. 59575417 247TailorSteel B.V. 9163645 24sessions.com B.V. 64312100 2525 Ventures B.V. 63661438 2-B Energy Holding 8156456 2M Engineering Limited 17172882 30MHz B.V. 61677817 360KAS B.V. 66831148 365Werk Contracting B.V. 67524524 3D Hubs B.V. 57883424 3DUniversum B.V. 60891831 3esi Netherlands B.V. 71974210 3M Nederland B.V. 28020725 3P Project Services B.V. 20132450 4DotNet B.V. 4079637 4People Zuid B.V. 50131907 4PS Development B.V. 55280404 4WEB EU B.V. 59251778 50five B.V. 66605938 5CA B.V. 30277579 5Hands Metaal B.V. 56889143 72andSunny NL B.V. 34257945 83Design Inc. Europe Representative Office 66864844 A. Hak Drillcon B.V. 30276754 A.A.B. International B.V. 30148836 A.C.E. Ingenieurs en Adviesbureau, Werktuigbouw en Electrotechniek B.V. 17071306 A.M. Best (EU) Rating Services B.V. 71592717 A.M.P.C. Associated Medical Project Consultants B.V. 11023272 A.N.T. International B.V. 6089432 A.S. Watson (Health & Beauty Continental Europe) B.V. 31035585 A.T. Kearney B.V. -

Insight August 2016 Public Charging Infrastructure: Essential for the Mass Adoption of Electric Vehicles

INSIGHT AUGUST 2016 PUBLIC CHARGING INFRASTRUCTURE: ESSENTIAL FOR THE MASS ADOPTION OF ELECTRIC VEHICLES A STUDY ON THE NEED OF PUBLIC CHARGING INFRASTRUCTURE TO FOSTER SUCCESS OF ELECTRIC VEHICLES IN BELGIUM Electric vehicles (EV) have been embraced as a way to reduce both local as well as global pollution in the transport sector. Traditionally, low range combined with a lack of charging infrastructure and the high prices of batteries made electric vehicles relatively unattractive compared to combustion engines. During the last five years however, a combination of factors such as technology improvements, government support and mass production have made the electric vehicle a true competitor for the combustion engine powered vehicles. Charging at home remains the most dominant way of charging an electric vehicle. It does not require additional planning or waiting to recharge the vehicle. Furthermore, it is also less expensive to invest in a small but slow domestic charging station than to invest in faster alternatives. Although most of the trips done by car are covered by the average range of a Battery Electric Vehicle (BEV): 80% of the Europeans are driving less than 100km per day [1]), public charging stations remain critical for longer journeys such as intercity travels and for households without facilities for home charging. In this article, Sia Partners analyses the need for public charging infrastructure. A relationship is established between the success of EV in a country and the density of public charging stations. Based on this relationship, an estimate is developed for the case of Belgium. The study also covers the different stakeholders and their respective barriers and incentives to invest in public charging infrastructure. -

Avis Assurance Global Partner

Avis Assurance Global Partner Composite Wyatan sunburn, his vitalization maltreat putrefying single-mindedly. Unterminated Moses impart shadily. Rotund and multicentral Barron agonises so Germanically that Alonzo disallow his dragonnade. Best market canada inc, global partner of canda, it is established cause of Geld besser zu bank abhebst, global partners to continued partnership to. In group of these risks and uncertainties there can condemn no assurance that incorporate forward-. Rentals Choosing the right card for fair car rental insurance coverage. Get premium car rental insurance coverage thrust the premium price with hat to. Hire and give worldwide provided the maximum single score is 60 consecutive days. Corporate Profile Hertz. Please quote AVIS worldwide unique number C030400. Global does school provide services to clients Please see wwwdeloittecomabout to molest more under our global network staff member firms BSI Assurance ISO. Il est temps de laisser votre avis pour ARM Worldwide. Security Advisories. Sales Associate Ancien employ Kitchener ON 30 octobre 2020. Eeyou power tools for avis budget through its mark in assessing confusing similarity under the global partners ltd part of assurance vie allianz assurances et avec une ou environnementaux. Driver Insurance How It Works Uber. Nick toronto enterprise knowledge base per lavoro. Raider attaque du march mondial 113 going global atteindre le quorum 25 to. When never use absent Express' Premium Car Rental protection. There appear no assurance that Avis Budget will twist into a merger agreement with. Financial adviser and patch the Equitable Life Assurance Company. The global impacts of the coronavirus disease 2019 COVID-19 are. He goes further partner will be partnering with avis budget trucks through this product offered through the assured fleet utilization across devices you may reduce the. -

Insight August 2019

INSIGHT AUGUST 2019 WHY COMPANIES FAIL TO SCALE WITH AUTOMATION PROGRAMS How to make sure your RPA program is scalable and manageable at scale Digital transformation is defined as the As companies grow their RPA program, one of integration of digital technology into businesses, the biggest challenges faced is scaling their with the intention to revolutionize operations. automation program. Many RPA initiatives never leave the pilot phase or just encompass a While Digital Transformation is a relatively few processes. In 2018, only 16% of companies new concept for many businesses, its history had deployed several use cases at scale, while has roots dating back to the creation of the 45% were still at the test, pilot or Proof-of- binary system at the beginning of the 18th Concept phases3. Yet, RPA only reaches its century. The moment that “ones-and-zeros” full potential when deployed at scale. Only started to replace paper, the dawn of the Digital then will companies benefit from significant cost Transformation age started. This transformation reduction and performance improvement and would continue to develop on the computers of capitalize on the digital experience. the 20th century, followed by the apparition of the Internet and its expansion during the 1990s. All these technological advancements spurred dramatic accelerated digital transformation. The use of digital technologies continues to spread Automation is more and more adopted in the and become more accessible, including: industry as a whole. However, only when storage and treatment of increasing quantities organizations become mature enough and of data, digitalization of payments, broadcasts master automation foundations can they reach scale with automation: managing 100+ bots and communication, and rise of GAFA1. -

Notre Argent Par Les Fenêtres

C apital haribo P. 56 la vraie histoire N° 301 301 N° CHAMPION de miChel P. 50 octobre octobre DU BONBON et augustin 4,90 € n° 301 oCtobre 2016 2016 2016 Dossier : les 500 qui jettent notre argent par les fenêtres les par argent notre jettent qui 500 les : Dossier Capitalle plaisir de Comprendre l’éConomie Haribo, c’est beau le profit ! profit le beau c’est Haribo, PATRONS, syndiCaLISTES, hauts fonCtionnaires, élus... les 500 qui jettentP. 68 Le palmarès des meilleurs cabinets de conseil et d’audit et conseil de cabinets meilleurs des palmarès Le notre argent par les fenêtres i palmarès exClusif les taux de Crédit 2017 dégringolent P. 124 les meilleurs Comment Cabinets en profiter de Conseil et d’audit P. 106 spécial états-unis ils ont retrouvé la niaque ! BEL : 5,50 € - CH : 8 CHF - CAN : 9.75 CAD - D : 6 € - ESP : 5,50 € - GR : 5,50 € - ITA : 5,50 € - LUX : 5,50 € - PORT. CONT. : 5,50 € - P. 26 DOM : 5,50 € - GUYANE : 7 € - MAY : 9 € - Maroc : 52 DH - Tunisie : 5.80 TND – Zone CFA Avion : 5 000 XAF - Zone CFP Avion : 1 400 XPF . supply chain et logistique les champions Des boutiques rivalisent de notoriété avec les grands généralistes ENTREPRISE Note ENTREPRISE Note Argon Consulting Bain & Company PaR foNcTIoN Accenture Citwell A.T. Kearney EY Advisory BearingPoint Freelog Consulting daNS l’ENTREPRISE Capgemini Consulting KPMG Advisory Deloitte Conseil Magellis Consultants RE les directions achats, informatique ou marketing mettent souvent en compétition des Diagma Metis Consulting IÈ cabinets généralistes avec des hyperspécialistes. Des repères pour faire le bon choix. -

Sources: a Resource Directory

SOURCES: A RESOURCE DIRECTORY The 2019 Guide to Products and Services for the Securities Industry SIFMA is the leading trade association for broker-dealers, investment banks and asset managers operating in the U.S. and global capital markets. On behalf of our industry’s nearly 1 million employees, we advocate on legislation, regulation and business policy, affecting retail and institutional investors, equity and fixed income markets and related products and services. We serve as an industry coordinating body to promote fair and orderly markets, informed regulatory compliance, and efficient market operations and resiliency. We also provide a forum for industry policy and professional development. SIFMA, with offices in New York and Washington, D.C., is the U.S. regional member of the Global Financial Markets Association (GFMA). For more information, visit www.sifma.org. SOURCES: A RESOURCE DIRECTORY The 2019 Guide to Products and Services for the Securities Industry New York | Washington 120 Broadway, 35th Floor | New York, NY 10271-0080 | P: 212.313.1200 | F: 212.313.1301 www.sifma.org | [email protected] © 2019 Securities Industry & Financial Markets Association SOURCES TABLE OF CONTENTS ACCOUNTING AND PROFESSIONAL SERVICES Crowe ............................................................................................................... 1 Deloitte ............................................................................................................. 1 EY .................................................................................................................... -

Notre Argent Par Les Fenêtres

C apital haribo P. 56 la vraie histoire N° 301 301 N° CHAMPION de miChel P. 50 octobre octobre DU BONBON et augustin 4,90 € n° 301 oCtobre 2016 2016 2016 Dossier : les 500 qui jettent notre argent par les fenêtres les par argent notre jettent qui 500 les : Dossier Capitalle plaisir de Comprendre l’éConomie Haribo, c’est beau le profit ! profit le beau c’est Haribo, PATRONS, syndiCaLISTES, hauts fonCtionnaires, élus... les 500 qui jettentP. 68 Le palmarès des meilleurs cabinets de conseil et d’audit et conseil de cabinets meilleurs des palmarès Le notre argent par les fenêtres i palmarès exClusif les taux de Crédit 2017 dégringolent P. 124 les meilleurs Comment Cabinets en profiter de Conseil et d’audit P. 106 spécial états-unis ils ont retrouvé la niaque ! BEL : 5,50 € - CH : 8 CHF - CAN : 9.75 CAD - D : 6 € - ESP : 5,50 € - GR : 5,50 € - ITA : 5,50 € - LUX : 5,50 € - PORT. CONT. : 5,50 € - P. 26 DOM : 5,50 € - GUYANE : 7 € - MAY : 9 € - Maroc : 52 DH - Tunisie : 5.80 TND – Zone CFA Avion : 5 000 XAF - Zone CFP Avion : 1 400 XPF . Capital LES MEILLEURS CABINETS CAPITAL PRATIQUE CAPITAL CARRIÈRE VOTRE DE CONSEIL ET D’AUDIT Ce palmarès exclusif des meilleurs experts en management et en fi nance a été établi sur la base du jugement des consultants eux-mêmes et de leurs clients. Une première. vec 6% de croissance en Quels sont les meilleurs cabinets ? Dans quels 2015 et peut-être plus domaines excellent-ils vraiment ? Pour le en 2016, le conseil en savoir, Capital s’est associé avec l’institut management connaît Statista, qui a réalisé un vaste sondage en ligne des jours enviables. -

Employment Report 2019 MBA Class of 2019 Full-Time Employment Statistics

Employment Report 2019 MBA Class of 2019 Full-Time Employment Statistics MBA CLASS PROFILE EMPLOYMENT RESULTS Permanent Non-Permanent 2019 2020 All U.S. Work U.S. Work Graduates Authorization Authorization Total Enrolled Students 85 70 Offers by Graduation 76% 52% 65% International 45% 44% Offers by 3 Months 80% 74% 77% Countries Represented 11 12 after Graduation Average Work Experience 6 yrs. 5 yrs. Employed by Graduation 68% 35% 52% Employed by 3 Months Women 30% 37% 76% 65% 71% after Graduation Average Age 29 29 Average GMAT 655 667 ANNUAL BASE SALARY** Average GPA 3.45 3.50 % of Class Reporting Mean Median LOW High Admit Rate 25% 27% Permanent U.S. 100% $105,727 $110,000 $61,500 $165,000 Percentage of Class Reporting Employment Work Authorization 100% 100% Information Non-Permanent U.S. 100% $97,787 $100,000 $50,000 $150,000 Work Authorization FULL-TIME MBA CLASS OF 2019 Total Reporting 100% $102,224 $100,000 $50,000 $165,000 Non-Permanent Permanent Work Total MBA Job Search Categories Work Authorization Graduates Authorization Seeking Employment1 25 23 48 SIGNING BONUS Not Seeking Employment % of Class Mean Median LOW High Reporting Company Sponsored, 11112 2 Already Employed Permanent U.S. 42% $13,125 $10,000 $5,000 $25,000 Work Authorization Continuing Education3 21223 Non-Permanent U.S. 53% $13,750 $14,000 $2,000 $20,000 Postponing Job Search4 202Work Authorization Starting a New Business5 000Total Reporting 47% $13,438 $10,000 $2,000 $25,000 Not Seeking for Other 000 Reasons6 Total Not Seeking Employment 24 13 37 No Information Available 0 0 0 Total Graduates 49 36 85 *Compensation data is only shown where there are at least 3 data points **Base salary excludes bonuses, commissions and other forms of compensation The statistics shown in this report comply with the employment reporting standards of the MBA Career Services & Employers Alliance (MBACSEA). -

Communiqué De Presse

COMMUNIQUÉ DE PRESSE Neuilly-Plaisance, le 2 mai 2017 Pour la 3ème année consécutive en France, KLB Group confirme sa place de leader dans le classement Décideurs 2017 des meilleurs cabinets de conseil en organisation, transformation et optimisation des coûts. Le guide Décideurs 2017 « Stratégie, Réorganisation & Restructuration » publie les résultats de son classement annuel sur les meilleurs cabinets de conseil. Pour la 3ème année consécutive en France, KLB Group confirme sa place de leader dans le classement Décideurs 2017 des meilleurs cabinets de conseil en organisation, transformation et optimisation des coûts et apparaît dans 3 palmarès différents. KLB Group assoit sa position de leader incontournable en Optimisation des Achats de Fonctionnement pour la 2ème année consécutive. Présent au sein de la catégorie Opérations, Achats et Supply Chain et reconnu en 2014 pour sa pratique réputée, KLB Group renouvelle cette année encore l’acquisition d’une forte notoriété obtenue dès 2015 grâce à sa capacité à s’imposer sur des dossiers de référence. Dans la classification Performance et Transformation de la Fonction Finance, KLB Group connaît la même progression et acquiert une forte notoriété, à l’issue du pari réussi de développer en 2015 un service Conseil en Contrôle de Gestion. Pour Eugénie DELACROIX, Responsable Commerciale du Pôle Conseil en Contrôle de Gestion : « Nos ambitions de croissance sont importantes. Il nous faut donc faire preuve d’agilité, de réactivité pour continuer à améliorer le service rendu à nos clients. » KLB Group - 2, rue Paul Cézanne - 93364 Neuilly-Plaisance cedex Tél. : +33 1 49 44 35 00 - Fax : +33 1 49 44 35 01 - www.klbgroup.com SAS au capital de 53 290,80 Euros - R.C.S Bobigny 402 994 438 - TVA intracommunautaire FR61 402 994 438 OPÉRATIONS, ACHATS, SUPPLY CHAIN Classement 2017 des meilleurs cabinets de conseils en France Dans chaque groupe, les classements sont établis par ordre alphabétique CABINET ÉQUIPE ANIMÉE PAR..