Voting February 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Finn-Ancial Times Finncap Financials & Insurance Quarterly Sector Note

finn-ancial Times finnCap Financials & Insurance quarterly sector note Q3 2020 | Issue 9 Highlights this quarter: Elevated uncertainty and volatility have been hallmarks of the last 18 months, with Brexit, the UK General Election and more recently COVID-19 all contributing to the challenges that face investors wishing to carve out solid and stable returns amid these ‘unprecedented’ times. With this is mind, and simulating finnCap’s proven Slide Rule methodology, we found the highest quality and lowest value stocks across the financials space, assessing how the make-up of these lists changed over the period January 2019 to July 2020, tracking indexed share price performance over the period as well as movements in P/E and EV/EBIT valuations. The top quartile list of Quality companies outperformed both the Value list and the FTSE All Share by rising +2.5% over the period versus -5.4% for the All Share and -14.3% for Value stocks. Furthermore, the Quality list had protection on the downside in the market crash between February and March 2020, and accelerated faster amid the market rally between late March and July 2020. From high to low (January to March), Quality moved -36.3% against the Value list at -45.5%, while a move off the lows to July was +37.4% for Quality and +34.0% for Value. There was some crossover between the Quality and Value lists, with 7 companies of the top quartile (16 companies in total) appearing in both the Quality and Value lists. This meant that a) investors could capture what we call ‘Quality at Value’ (i.e. -

FTSE Factsheet

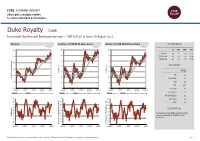

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Duke Royalty DUKE Investment Banking and Brokerage Services — GBP 0.4125 at close 10 August 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 10-Aug-2021 10-Aug-2021 10-Aug-2021 0.45 140 140 1D WTD MTD YTD Absolute -2.4 -1.2 -1.8 35.2 130 130 0.4 Rel.Sector -2.4 -0.5 -3.6 25.9 Rel.Market -2.8 -1.7 -3.7 20.9 120 120 0.35 VALUATION 110 110 0.3 Trailing 100 100 Relative Price Relative Price Relative 0.25 PE -ve Absolute Price (local (local currency) AbsolutePrice 90 90 EV/EBITDA -ve 0.2 80 80 PB 2.0 PCF 28.1 0.15 70 70 Div Yield 4.6 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Price/Sales -ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 90 90 90 Div Payout -ve 80 80 80 ROE -ve 70 70 70 Share Index) Share Share Sector) Share - 60 - 60 60 DESCRIPTION 50 50 50 40 40 The Company is a globally focused investment 40 RSI RSI (Absolute) 30 30 company specialising in diversified royalty investment. -

Annual Report and Accounts 2019

TP ICAP Annual Report and Accounts 2019 Annual Report and Accounts 2019 We provide access to global Contents financial and commodities Strategic report: Financial and strategic highlights 1 At a glance 2 markets, improving price Our business model 4 Chairman’s statement 6 discovery, flow of liquidity Chief Executive Officer’s review 8 Market factors 13 Strategy 14 and distribution of data, Case studies 15 Key performance indicators 18 working with and supporting Financial and operating review 20 Viability statement and the communities in which we going concern 33 Risk management 34 Principal risks and uncertainties 36 operate and facilitating Resources, relationships economic growth. and responsibilities 40 Governance report: Compliance with the UK Corporate Code 2018 46 Chairman’s introduction > Our brokers match buyers and sellers of financial, to governance 47 Board of Directors 50 energy and commodities products and facilitate Corporate governance report 52 price discovery, execution and risk management. How the Board has satisfied its section 172 duty 57 Report of the Nominations > We provide independent data to participants in and Governance Committee 66 the financial, energy and commodities markets, Report of the Audit Committee 70 Report of the Risk Committee 75 including live and historical pricing content, Report of the Remuneration and advanced valuation and risk analytics. Committee 78 Directors’ report 100 > We are a trusted partner to our clients, enabling Statement of Directors’ Responsibilities 105 them to transact with -

Stoxx® Europe Total Market Financial Services Index

STOXX® EUROPE TOTAL MARKET FINANCIAL SERVICES INDEX Components1 Company Supersector Country Weight (%) LONDON STOCK EXCHANGE Financial Services GB 10.21 DEUTSCHE BOERSE Financial Services DE 9.72 INVESTOR B Financial Services SE 8.23 PARTNERS GRP HLDG Financial Services CH 5.46 3I GROUP PLC. Financial Services GB 4.58 STANDARD LIFE ABERDEEN Financial Services GB 3.39 EXOR NV Financial Services IT 2.91 INVESTOR A Financial Services SE 2.82 GRP BRUXELLES LAMBERT Financial Services BE 2.74 M&G Financial Services GB 2.63 HARGREAVES LANSDOWN Financial Services GB 2.32 INTERMEDIATE CAPITAL GRP Financial Services GB 2.01 KINNEVIK B Financial Services SE 1.93 SCHRODERS Financial Services GB 1.68 AMUNDI Financial Services FR 1.54 EURONEXT Financial Services FR 1.41 INDUSTRIVARDEN A Financial Services SE 1.37 INDUSTRIVARDEN C Financial Services SE 1.32 INVESTEC Financial Services GB 1.24 WENDEL Financial Services FR 1.20 QUILTER Financial Services GB 1.17 ACKERMANS & VAN HAAREN Financial Services BE 1.14 SOFINA Financial Services BE 1.09 IG GRP HLDG Financial Services GB 1.08 MAN GRP Financial Services GB 1.04 PARGESA Financial Services CH 1.01 TP ICAP Financial Services GB 0.98 EURAZEO Financial Services FR 0.98 ASHMORE GRP Financial Services GB 0.97 BOLSAS Y MERCADOS ESPANOLES Financial Services ES 0.93 GRENKE N Financial Services DE 0.92 AZIMUT HLDG Financial Services IT 0.84 ONESAVINGS BANK Financial Services GB 0.80 JUPITER FUND MANAGEMENT Financial Services GB 0.79 JOHN LAING GROUP Financial Services GB 0.78 LATOUR INVESTMENT B Financial -

Notice of the 2019 Annual General Meeting of TP ICAP Plc to Be

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to the action you should take, please take advice immediately from an independent professional adviser authorised under the Financial Services and Markets Act 2000. If you have sold or otherwise transferred all of your shares, please send this document, together with the accompanying documents, at once to the purchaser or transferee, or to the stockbroker, bank or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Notice of the 2019 Annual General Meeting of TP ICAP plc to be held on Wednesday 15 May 2019 at 12.45pm (BST) at the offices of Allen & Overy LLP, One Bishops Square, London E1 6AD TP ICAP plc Registered in England and Wales no. 5807599 TP ICAP plc Registered in England and Wales no. 5807599 9 April 2019 Dear shareholder, On behalf of the Directors of TP ICAP plc (together the ‘Directors’), it gives me great pleasure to invite you to attend the Annual General Meeting (or ‘AGM’) of TP ICAP plc (the ‘Company’) which will be held at the offices of Allen & Overy LLP, One Bishops Square, London E1 6AD on Wednesday 15 May 2019 at 12.45pm (BST). Notice of AGM The formal Notice of AGM is set out on the following pages of this document, detailing the resolutions that the shareholders are being asked to vote on along with explanatory notes of the business to be conducted at the AGM. The AGM provides shareholders with an opportunity to communicate with the Directors and we welcome your participation. -

Creating the World's Largest Interdealer Broker

TP ICAP Annual Report and Accounts 2016 Creating the world’s largest interdealer broker Annual Report and Accounts 2016 Introduction TP ICAP is a global brokerage and information firm that plays Strategic report a central role at the heart of the world’s wholesale financial, Highlights 1 Who we are 2 energy and commodities markets. Our transformation and the > Our brokers match buyers and sellers of financial, energy and benefits it creates 4 commodities products and facilitate price discovery Our business model 6 Our strategy 8 > We provide independent data to participants in the financial, Key performance indicators 10 energy and commodities markets, including live and historical Chairman’s statement 12 pricing content, and advanced valuation and risk analytics Chief Executive’s review 14 Business and operating review 18 > We are a trusted partner to our clients, enabling them to transact Financial review 26 with confidence Risk management 32 > We facilitate the flow of capital and commodities around the world, Our principal risks and uncertainties 34 enhancing investment and contributing to economic growth Resources, relationships and responsibilities 38 Governance report Chairman’s Governance review 42 Board of Directors 44 This Annual Report has been prepared for, and only for, the members of the Company as a body, and no other persons. The Company, Corporate governance report 46 its Directors, employees, agents or advisers do not accept or assume responsibility to any other person to whom this document is shown or into whose hands it may come and such responsibility is expressly disclaimed. By their nature, the statements concerning the risks Report of the Nominations Committee 50 and uncertainties facing the Group in this Annual Report involve uncertainty since future events and circumstances can cause results Report of the Audit Committee 51 and developments to differ materially from those anticipated. -

Women in Finance Charter List of 273 Signatories

Women in Finance Charter List of 273 signatories 68 new Charter signatories announced on 11 July 2018 Links to gender diversity targets to be published here in September Admiral Group AE3 Media Armstrong Wolfe Australia and New Zealand Banking Group Limited Barrington Hibbert Associates BNP Paribas Personal Finance BondMason Bovill Ltd Bower Recruitment Brooks Macdonald plc Canada Life Coventry Building Society Daiwa Capital Markets Europe Ltd EIS Association Ellis Davies Financial Planning Ltd Engage Financial Services Ltd Equifax Ltd Evolution Financial Planning Fintech Strategic Advisors Ltd Fintellect Recruitment First Wealth LLP Flood Re Ltd Foresight Franklin Templeton Investments GAM Global Processing Services Goji Investments Grant Thornton Hinckley and Rugby Building Society HUBX ICAEW Intermediate Capital Group Investec Asset Management Limited 11 July 2018 11 July 2018 J. P. Morgan Kames Capital plc Lazard & Co Limited Lazard Asset Management Limited LifeSearch Magenta Financial Planning Marsh Ltd Medianett Ltd Mortgages for Businesses Ltd MT Finance Ltd Mustard Seed Impact Ltd National Association of Commercial Finance Brokers Nomura International PIMCO Prytania Solutions Limited Pukka Insure Ltd Rathbone Brothers plc Scottish Equity Partners SDB Bookkeeping Services Semper Capital Management Shepherd Compello Ltd St. James’s Place plc Stonehaven International Sussex Independent Financial Advisers Ltd Tesco Underwriting The British United Provident Association (BUPA) The Meyer Partnership The Mortgage & Insurance Bureau TP -

TP ICAP Or New TP ICAP

THIS DOCUMENT AND ANY ACCOMPANYING DOCUMENTS ARE IMPORTANT AND REQUIRE YOUR IMMEDIATE ATTENTION. PART 2 OF THIS DOCUMENT CONTAINS AN EXPLANATORY STATEMENT IN COMPLIANCE WITH SECTION 897 OF THE COMPANIES ACT 2006. If you are in any doubt about the Proposals or the contents of this document or what action you should take, you are recommended to seek your own independent financial advice immediately from your stockbroker, bank manager, solicitor, accountant or other independent financial adviser duly authorised under the Financial Services and Markets Act 2000 if you are resident in the United Kingdom or, if not, from another appropriately authorised independent financial adviser. This document does not constitute an offer or invitation to any person to subscribe for or purchase any securities in TP ICAP or New TP ICAP. This document should be read in conjunction with the Prospectus relating to New TP ICAP, the Group and the New TP ICAP Ordinary Shares, prepared in accordance with the Prospectus Regulation Rules under Part VI of the FSMA and to be published today. The Prospectus will not be sent to you but you may obtain a copy from TP ICAP’s website www.tpicap.com/investors. A copy of the Prospectus will also be available for inspection at Floor 2, 155 Bishopsgate, London EC2M 3TQ from the date of publication until Admission during normal business hours on any Business Day. In accordance with paragraph 9.6.1 of the Listing Rules, a copy of the Prospectus will be submitted to the National Storage Mechanism and will be available for inspection at https://data.fca.org.uk/#/nsm/nationalstoragemechanism. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Schroder Income Growth Fund Plc Unaudited Portfolio Holdings at 30Th June 2021

Schroder Income Growth Fund plc Unaudited portfolio holdings at 30th June 2021 The investments listed below have been valued on a fair value basis using closing bid prices. Market Nominal value Investment SEDOL ISIN holding £ 3I Group Ord GBP0.738636 B1YW440 GB00B1YW4409 284,300 3,334,839 Anglo American USD0.549 B1XZS82 GB00B1XZS820 321,481 9,234,542 Assura PLC Ord GBP0.1000 REIT BVGBWW9 GB00BVGBWW93 4,811,621 3,563,005 AstraZeneca USD0.25 989529 GB0009895292 149,464 12,977,959 Avast PLC Ord GBP0.1 BDD85M8 GB00BDD85M81 483,767 2,369,007 BAE Systems Ord GBP0.025 263494 GB0002634946 1,128,624 5,891,417 Balfour Beatty Ord GBP0.50 96162 GB0000961622 1,606,643 4,925,967 BHP Group PLC Com USD0.50 BH0P3Z9 GB00BH0P3Z91 283,756 6,044,003 British American Tobacco Ord GBP0.25 287580 GB0002875804 80,161 2,244,508 BT Group Ord GBP0.05 3091357 GB0030913577 2,748,594 5,330,898 Bunzl Ord GBP0.32142 B0744B3 GB00B0744B38 127,315 3,039,009 Burberry Group Ord GBP0.0005 3174300 GB0031743007 337,887 6,977,367 Daily Mail And General Trust PLC A Ord GBP0.125 BJQZC27 GB00BJQZC279 287,117 2,764,937 Direct Line Insurance Plc Ord GBP0.109 BY9D0Y1 GB00BY9D0Y18 1,045,713 2,980,282 Drax Group Ord GBP0.11551 B1VNSX3 GB00B1VNSX38 557,884 2,366,544 Empiric Student Property PLC Ord GBP0.01 BLWDVR7 GB00BLWDVR75 7,023,630 6,040,322 Galp Energia SGPS SA-B EUR1 B1FW751 PTGAL0AM0009 429,364 3,372,559 GlaxoSmithKline Ord GBP0.25 925288 GB0009252882 820,897 11,651,812 Hollywood Bowl Group PLC Ord NPV BD0NVK6 GB00BD0NVK62 2,254,945 5,366,769 Intermediate Capital Group PLC Ord GBP0.2625