BRIEFING on DRAFT REPORT 12 October 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Western Downs Development Status Report

Toowoomba and Surat Basin Enterprise Western Downs Development Status Report June 2020 www.tsbe.com.au WESTERN DOWNS DEVELOPMENT STATUS REPORT The Western Downs, located in the agricultural heartland of Southern Queensland, is a region experiencing strong economic growth, investment and consistently high employment. The region is well known for its rich agriculture and great liveability, but its biggest wealth is in its people and communities. Home to a growing population of 34,500 people, the Western Downs is a region known for welcoming industry and innovation as well as extending its country hospitality to all new residents and businesses. The Western Downs Development Status Report is a document produced in partnership with Western Downs Regional Council and is updated annually. It equips readers with knowledge including costs, locations and estimated completion dates for known developments in the Western Downs region across infrastructure and services, property development, building and construction, resources and renewable energy projects. Toowoomba and Surat Basin Enterprise (TSBE) is committed to fostering and facilitating the sustainable growth and development of the region and works with stakeholders across the Western Downs to support the local business community. TSBE supports regional businesses through the delivery of information, business support programs, advocacy and regional promotion, as well as membership services to many local businesses. The cornerstones of the economy are agriculture, intensive agriculture, energy and manufacturing — industries which continue to boast a significant number of projects in the pipeline for the Western Downs area. TSBE and Western Downs Regional Council hope this report will encourage further investment in the region, while also providing businesses with important information to help them explore new opportunities. -

Powerlink Queensland Revenue Proposal

2023-27 POWERLINK QUEENSLAND REVENUE PROPOSAL Appendix 5.02 – PUBLIC 2020 Transmission Annual Planning Report © Copyright Powerlink Queensland 2021 Transmission Annual Planning Report 2020 Transmission Annual Planning Report Please direct Transmission Annual Planning Report (TAPR) enquiries to: Stewart Bell A/Executive General Manager Strategy and Business Development Division Powerlink Queensland Telephone: (07) 3860 2801 Email: [email protected] Disclaimer: While care is taken in the preparation of the information in this report, and it is provided in good faith, Powerlink Queensland accepts no responsibility or liability for any loss or damage that may be incurred by persons acting in reliance on this information or assumptions drawn from it. 2020 TRANSMISSION ANNUAL PLANNING REPORT Table of contents Executive summary __________________________________________________________________________________________________ 7 1. Introduction ________________________________________________________________________________________________ 15 1.1 Introduction ___________________________________________________________________________________________ 16 1.2 Context of the TAPR _________________________________________________________________________________ 16 1.3 Purpose of the TAPR _________________________________________________________________________________ 17 1.4 Role of Powerlink Queensland _______________________________________________________________________ 17 1.5 Meeting the challenges of a transitioning energy system ___________________________________________ -

Renewable Energy in the Western Downs

‘Renewable Energy is an integral part of the Western Downs future economy creating short- and long- Renewable Energy in the term employment Western Downs opportunities for our The Western Downs is known as the RENEWABLE ENERGY region.’ Energy Capital of Queensland, and is INDUSTRY: now emerging as the Energy Capital of According to the Clean Energy Australia - Paul McVeigh, Australia. Report, as at 2018, Queensland Mayor Western Downs This reputation is due to strong renewables make up 9.5% of Renewable investment over the past 15 years Energy Penetration across Australian Regional Council 4 by the Energy Production Industry states. (EPI), into large-scale resource As at January 2019, the Western Electricity transmission services industry developments in coal seam Downs contributes towards this provider, Powerlink Queensland, gas (CSG) and coal. More recently percentage with more than $4 billion connects renewable energy farms renewable energy farms have invested in renewable energy projects in the across the region into the Queensland in the region with multiple solar and pipeline. 5 transmission network using existing, wind energy farms currently either Renewable energy projects offer and where required, expanding on under construction, or approved for short and long-term work within the transmission networks and substations. construction. Gas and coal-fired power region, with a range of industries and This existing infrastructure supports stations also feature prominently in the businesses involved. This creates a the connection of non-synchronous region. strong flow-on effect in the supply generation of electricity into the chain, economy and local communities. Economic growth in the Western Queensland transmission network. -

Queensland Major Projects Pipeline 2019 Queensland Major Projects Pipeline

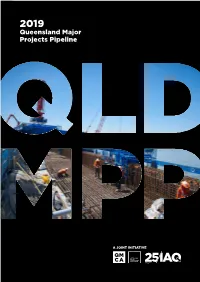

2019 Queensland Major Projects Pipeline 2019 2019 Queensland Major Projects Pipeline Queensland Major Projects A JOINT INITIATIVE $M Total Pipeline 39,800,000,000 Annual Ave 7,960,000,000 Weekly Ave 153,000,000 Daily Ave 21,860,000 Hourly Ave 910,833 AT A GLANCE Major Projects Pipeline readon Unfunded split $41.3 billion total (over 5 years) Credibly Under Under Unlikely Prospective proposed Announced procurement construction* 37 39 15 36 15 52 projects valued at projects valued at projects valued at projects valued at projects valued at projects valued at $3.13bn $6.61bn $4.03bn $10.14bn $6.66bn $10.77bn Unfunded $13.77 billion Funded $27.57 billion *Under construction or completed in 2018/19 Total Pipeline Major Project Scale of Major Value Activity Recurring Projects Jobs Expenditure $8.3b per year The funded pipeline will support $6.5b 11,900 workers $41.3b North Queensland each year on average $23m per day $12.4b Fully-funding the pipeline Funding will support an extra 6.8b Central split Various Queensland 5,000 workers each year on average $23.4b $15.6b $2.2m Public Projects $41.3b Total South East A JOINT INITIATIVE $17.9b Queensland $159m per Private Projects working per week hour $M Total Pipeline 39,800,000,000 Annual Ave 7,960,000,000 Weekly Ave 153,000,000 Daily Ave 21,860,000 Hourly Ave 910,833 Major Projects Pipeline – Breakdown Unfunded split $41.3 billion total (over 5 years) Credibly Under Under Unlikely Prospective proposed Announced procurement construction* 37 39 15 36 15 52 projects valued at projects valued at projects -

Australian Pipeline Trust

Australian Pipeline Ltd ACN 091 344 704 | Australian Pipeline Trust ARSN 091 678 778 | APT Investment Trust ARSN 115 585 441 Level 25, 580 George Street Sydney NSW 2000 | PO Box R41 Royal Exchange NSW 1225 Phone +61 2 9693 0000 | Fax +61 2 9693 0093 APA Group | apa.com.au 22 August 2018 ASX ANNOUNCEMENT APA Group (ASX: APA) (also for release to APT Pipelines Limited (ASX: AQH)) Annual Financial Results The following announcements are attached: • Australian Pipeline Trust Appendix 4E • Australian Pipeline Trust Annual Report • APT Investment Trust Annual Report • Sustainability Report Nevenka Codevelle Company Secretary Australian Pipeline Limited For further information please contact: Investor enquiries: Media enquiries: Jennifer Blake Louise Watson Telephone: +61 2 9693 0097 Telephone: +61 2 8011 0591 Mob: +61 455 071 006 Mob: +61 419 185 674 Email: [email protected] Email: [email protected] About APA Group (APA) APA is a leading Australian energy infrastructure business, owning and/or operating in excess of $20 billion of energy infrastructure assets. Its gas transmission pipelines span every state and territory on mainland Australia, delivering approximately half of the nation’s gas usage. APA has direct management and operational control over its assets and the majority of its investments. APA also holds ownership interests in a number of energy infrastructure enterprises including SEA Gas Pipeline, SEA Gas (Mortlake) Partnership, Energy Infrastructure Investments and GDI Allgas Gas Networks. APTFor personal use -

Queensland Renewable Energy Expert Panel Draft Report

Credible pathways to a 50% renewable energy target for Queensland Final Report, 30 November 2016 Report of the Queensland Renewable Energy Expert Panel Queensland Renewable Energy Expert Panel Queensland Renewable Energy Expert Panel www.QLDREpanel.com.au Contents Contents 1. Executive Summary .................................................................................................................. 1 1.1. Summary of key themes ................................................................................................. 1 1.2. Overview of findings ....................................................................................................... 4 1.3. Recommendations .......................................................................................................... 9 1.4. Summary of key projected outcomes .......................................................................... 12 1.5. Summary of feedback from stakeholders on Draft Report ........................................ 12 2. Basis of the public inquiry ...................................................................................................... 14 2.1. Role of the Expert Panel ............................................................................................... 14 2.2. The Panel’s approach ................................................................................................... 14 2.3. Report outline ............................................................................................................... 15 3. Queensland’s -

Origin Energy Limited and Its Controlled Entities Appendix 4D 31 December 2018

Origin Energy Limited and its Controlled Entities Appendix 4D 31 December 2018 Origin Energy Limited ABN 30 000 051 696 1 Origin Energy Limited and its Controlled Entities Appendix 4D Results for announcement to the market 31 December 2018 31 December 31 December 2018 2017 Total Group Revenue ($million) up 2% to 7,660 7,491 Revenue ($million) - continuing operations up 5% to 7,660 7,262 Revenue ($million) - discontinued operations down nm* to - 229 Net gain/(loss) for the period attributable to members of the parent entity ($million) up nm* to 796 (207) From continuing operations ($million) up nm* to 796 (136) From discontinued operations ($million) up nm* to - (71) 31 December 30 June 2018 2018 Net tangible asset backing per ordinary security up 15% to $4.22 $3.68 Dividends Franked amount per security at Amount per 30 per cent security tax Interim dividend determined subsequent to 31 December 2018 10 cents 10 cents Previous corresponding period (31 December 2017) nil nil Record date for determining entitlements to the dividend 4 March 2019 Dividend payment date 29 March 2019 Brief explanation of any of the figures reported above or other item(s) of importance not previously released to the market. Refer to the attached Directors' Report and Operating and Financial Review for explanations. Discussion and Analysis of the results for the year ended 31 December 2018. Refer to the attached Directors' Report and Operating and Financial Review for commentary. * not meaningful 2 Origin Energy Limited and its Controlled Entities Interim Financial -

Insights from the First Wave of Large-Scale Solar Projects in Australia

Insights From the First Wave of Large-Scale Solar Projects in Australia JANUARY 2020 INTRODUCTION In 2016 the Australian Renewable Energy Agency (ARENA) ran a $100 million competitive grant funding round with the aim of driving down the cost of delivering large-scale solar photovoltaic (PV) projects in Australia. Under the Large-Scale Solar (LSS) Funding Round, ARENA funded 12 projects. Two additional projects that did not receive funding signed up to ARENA’s knowledge sharing obligations. This brought the portfolio to 14 projects totalling 603 MW (the LSS Round Projects). The Clean Energy Finance Corporation (CEFC) offered a long-term debt product alongside ARENA’s grant funding to 10 of the LSS projects. This was to provide finance certainty irrespective of whether projects had a guaranteed revenue stream from a power purchase agreement (PPA) prior to ARENA grant allocation and financial close. Following the LSS Round, in 2017 and 2018, the CEFC provided finance to eight projects that did not require ARENA grant funding (the Post-LSS Round Projects). ARENA’s LSS Funding Round played an important role in the development of the large-scale solar industry in Australia by helping to drive down the cost of large-scale solar development, construction and finance. The round also attracted international engineering, procurement and construction (EPC) providers to Australia, which further improved the cost competitiveness of the local EPCs. Today, the building, owning and operation of large-scale solar farms in Australia no longer requires grant funding. The project proponents were obliged to share knowledge, insights and data from their funded projects. -

FCAS Causer Pays Settlement Factors

FCAS Causer Pays Settlement Factors Issued: 15/11/2019 Period of Application: 1/12/2019 to 28/12/2019 Sample Period: 12:05AM, 13/10/2019 to 12:00AM, 10/11/2019 Queensland, New South Wales, Victoria, South Australia and Tasmania Region Causer Pays Factors Scheduled and Semi-Scheduled Aggregations Factor AETV Pty Ltd 0.039385402 AGL Hydro Partnership 5.179931579 AGL Loy Yang Marketing Pty Ltd 0.576687438 AGL Macquarie Pty Limited 1.69583735 AGL PARF NSW Pty Ltd 0.941928307 AGL PARF QLD Pty Limited 0.236213556 AGL SA Generation Pty Limited 1.528034598 Alinta Energy Retail Sales Pty Ltd 0 Ararat Wind Farm Pty Ltd 1.137754732 Arrow Southern Generation Pty Ltd And Arrow Braemar 2 Pty Ltd 0 Boco Rock Wind Farm Pty Ltd 0.073585072 Bodangora Wind Farm Pty Limited 0.164128256 Braemar Power Project Pty Ltd 1.212235696 Callide Power Trading Pty Limited 0 Childers Solar Pty Ltd ATF The Childers Solar Trust 0.49909493 Clare Solar Farm Pty Ltd 1.230106194 CleanCo Queensland Limited 0.780794073 Clermont Asset Co Pty Ltd ATF Clermont Solar Unit Trust 0.059232739 Coleambally Solar Pty Ltd 2.360300715 Crookwell Development Pty Ltd 0.099239854 CS Energy Limited 0.502105199 Darling Downs Solar Farm Pty Ltd 0.677772754 Daydream Solar Farm Pty Ltd As The Trustee For The Daydream Solar Farm Trust 2.271818449 Delta Electricity 1.047351802 Diamond Energy Pty Ltd 0.205870383 EnergyAustralia Ecogen Pty Ltd 0.18369207 EnergyAustralia Pty Ltd 1.226847923 EnergyAustralia Yallourn Pty Ltd 0 Ergon Energy Queensland Pty Ltd 1.616570087 ERM Power Retail Pty Ltd 0.010281939 -

TSBE Development Status Report 16072016.Indd

Toowoomba and Surat Basin Enterprise Western Downs Development Status Report January 2019 www.tsbe.com.au WESTERN DOWNS DEVELOPMENT STATUS REPORT The Western Downs, located in the agricultural heartland of southern Queensland, is a region experiencing Wandoan strong economic growth, investment and consistently high employment. The region is well known for its rich agriculture and great liveability, but its biggest wealth Jandowae is in its people and communities. Home to a growing population of 34,000 people, the Western Downs is a region known for welcoming industry and innovation as well as extending its country hospitality to all new residents and businesses. The Western Downs Development Status Report, is a document produced in partnership with the Western Downs Regional Council and updated annually to equip readers with knowledge including costs, locations and estimated completion dates for known developments in the Western Downs region across Infrastructure and Services, Property Development, Building and Construction, Resources and Renewable Energy Projects. TSBE is committed to fostering and facilitating the sustainable growth and development of our region and works with stakeholders across the Western Downs to support the local business community. TSBE supports regional businesses through the delivery of information, business support programs, advocacy and regional promotion as well as membership services to many local businesses. The cornerstones of the economy are agriculture, intensive agriculture, manufacturing and energy — industries which continue to boast a significant number of projects in the pipeline for the Western Downs area. By publishing this report TSBE and WDRC hope this report will encourage further investment and lend confidence, while also providing businesses with important information to help them explore new opportunities. -

FCAS Causer Pays Settlement Factors

FCAS Causer Pays Settlement Factors Issued: 16/10/2020 Period of Application: 1/11/2020 to 28/11/2020 Sample Period: 12:05AM, 13/09/2020 to 12:00AM, 11/10/2020 Queensland, New South Wales, Victoria, South Australia and Tasmania Region Causer Pays Factors Scheduled and Semi-Scheduled Aggregations Factor AETV Pty Ltd 0.045365842 AGL Hydro Partnership 3.268965682 AGL Loy Yang Marketing Pty Ltd 1.229882182 AGL Macquarie Pty Limited 0 AGL PARF NSW Pty Ltd 0.662202397 AGL PARF QLD Pty Limited 0.723780159 AGL SA Generation Pty Limited 0 Alinta Energy Retail Sales Pty Ltd 0.355069407 Ararat Wind Farm Pty Ltd 0.678857755 Arrow Southern Generation Pty Ltd And Arrow Braemar 2 Pty Ltd 0 Boco Rock Wind Farm Pty Ltd 0 Bodangora Wind Farm Pty Limited 0.204426512 Bomen Solar Farm Pty Ltd As Trustee For Bomen SF Trust 0.782557422 Braemar Power Project Pty Ltd 0.470541765 Bulgana Wind Farm Pty Ltd 0.179840527 Callide Power Trading Pty Limited 0.0806542 Cherry Tree Wind Farm Pty Ltd As Trustee For The Cherry Tree Project Trust 0.133421436 Childers Solar Pty Ltd ATF The Childers Solar Trust 0.277124853 Clare Solar Farm Pty Ltd 0.348847833 CleanCo Queensland Limited 0.575546735 Clermont Asset Co Pty Ltd ATF Clermont Solar Unit Trust 1.059561007 Coleambally Solar Pty Ltd 1.206781605 Crookwell Development Pty Ltd 0.155674763 CS Energy Limited 0 Darling Downs Solar Farm Pty Ltd 0.713150334 Darlington Point Solar Farm Pty Ltd 0 Daydream Solar Farm Pty Ltd As The Trustee For The Daydream Solar Farm Trust 1.352029255 Delta Electricity 0.524934581 Diamond Energy -

Green Infrastructure List

Climate Bonds Initiative August 2018 AUS & NZ Green Infrastructure list Australia Low carbon transport Project name Proponent Location State Classification Advanced Train Management Australian National Under Cross cutting, ICT System implementation on Government construction ARTC network Inland Rail Australian VIC to QLD Planned Freight rail, Infrastructure Government/ ARTC Melbourne - Adelaide - Perth Australian VIC to WA Planned Freight rail, Infrastructure rail upgrade Government Reliance Rail NSW Government/ NSW Complete Public Passenger Transport, Rail, Rolling stock Reliance Rail Sydney Light Rail NSW Government NSW Under Public Passenger Transport, construction Rail, Infrastructure Newcastle Light Rail NSW Government NSW Under Public Passenger Transport, construction Rail, Infrastructure Sydney Metro Northwest NSW Government NSW Under Public Passenger Transport, construction Rail, Infrastructure Sydney Metro: NSW Government NSW Planned Public Passenger Transport, Rail, Infrastructure - West - City and Southwest Parramatta Light Rail NSW Government NSW Planned Public Passenger Transport, Rail, Infrastructure - Stage 1 - Stage 2 North South Rail link - Stage 1 NSW Government NSW Planned Public Passenger Transport, Rail, Infrastructure Regional Rail Fleet NSW Government NSW Planned Public Passenger Transport, replacement Rail, Infrastructure Inner West Bus Services NSW Government NSW Planned Public Passenger Transport, optimisation Bus, Infrastructure Circular Quay Renewal NSW Government NSW Planned Cross cutting, Integration of transport