FY2020 Investor Pack

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Western Downs Development Status Report

Toowoomba and Surat Basin Enterprise Western Downs Development Status Report June 2020 www.tsbe.com.au WESTERN DOWNS DEVELOPMENT STATUS REPORT The Western Downs, located in the agricultural heartland of Southern Queensland, is a region experiencing strong economic growth, investment and consistently high employment. The region is well known for its rich agriculture and great liveability, but its biggest wealth is in its people and communities. Home to a growing population of 34,500 people, the Western Downs is a region known for welcoming industry and innovation as well as extending its country hospitality to all new residents and businesses. The Western Downs Development Status Report is a document produced in partnership with Western Downs Regional Council and is updated annually. It equips readers with knowledge including costs, locations and estimated completion dates for known developments in the Western Downs region across infrastructure and services, property development, building and construction, resources and renewable energy projects. Toowoomba and Surat Basin Enterprise (TSBE) is committed to fostering and facilitating the sustainable growth and development of the region and works with stakeholders across the Western Downs to support the local business community. TSBE supports regional businesses through the delivery of information, business support programs, advocacy and regional promotion, as well as membership services to many local businesses. The cornerstones of the economy are agriculture, intensive agriculture, energy and manufacturing — industries which continue to boast a significant number of projects in the pipeline for the Western Downs area. TSBE and Western Downs Regional Council hope this report will encourage further investment in the region, while also providing businesses with important information to help them explore new opportunities. -

Diamantina and Leichhardt Power Stations

Diamantina and Leichhardt Power Stations 29 March 2016 Disclaimer This presentation has been prepared by Australian Pipeline Limited (ACN 091 344 704) the responsible entity of the Australian Pipeline Trust (ARSN 091 678 778) and APT Investment Trust (ARSN 115 585 441) (APA Group). Summary information: This presentation contains summary information about APA Group and its activities current as at the date of this presentation. The information in this presentation is of a general background nature and does not purport to be complete nor does it contain all the information which a prospective investor may require in evaluating a possible investment in APA Group. It should be read in conjunction with the APA Group’s other periodic and continuous disclosure announcements which are available at www.apa.com.au. Not financial product advice: Please note that Australian Pipeline Limited is not licensed to provide financial product advice in relation to securities in the APA Group. This presentation is for information purposes only and is not financial product or investment advice or a recommendation to acquire APA Group securities and has been prepared without taking into account the objectives, financial situation or needs of individuals. Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own objectives, financial situation and needs and consult an investment adviser if necessary. Past performance: Past performance information given in this presentation is given for illustrative purposes only and should not be relied upon as (and is not) an indication of future performance. Future performance: This presentation contains certain “forward-looking statements” such as indications of, and guidance on, future earnings and financial position and performance. -

Powerlink Queensland Revenue Proposal

2023-27 POWERLINK QUEENSLAND REVENUE PROPOSAL Appendix 5.02 – PUBLIC 2020 Transmission Annual Planning Report © Copyright Powerlink Queensland 2021 Transmission Annual Planning Report 2020 Transmission Annual Planning Report Please direct Transmission Annual Planning Report (TAPR) enquiries to: Stewart Bell A/Executive General Manager Strategy and Business Development Division Powerlink Queensland Telephone: (07) 3860 2801 Email: [email protected] Disclaimer: While care is taken in the preparation of the information in this report, and it is provided in good faith, Powerlink Queensland accepts no responsibility or liability for any loss or damage that may be incurred by persons acting in reliance on this information or assumptions drawn from it. 2020 TRANSMISSION ANNUAL PLANNING REPORT Table of contents Executive summary __________________________________________________________________________________________________ 7 1. Introduction ________________________________________________________________________________________________ 15 1.1 Introduction ___________________________________________________________________________________________ 16 1.2 Context of the TAPR _________________________________________________________________________________ 16 1.3 Purpose of the TAPR _________________________________________________________________________________ 17 1.4 Role of Powerlink Queensland _______________________________________________________________________ 17 1.5 Meeting the challenges of a transitioning energy system ___________________________________________ -

Renewable Energy in the Western Downs

‘Renewable Energy is an integral part of the Western Downs future economy creating short- and long- Renewable Energy in the term employment Western Downs opportunities for our The Western Downs is known as the RENEWABLE ENERGY region.’ Energy Capital of Queensland, and is INDUSTRY: now emerging as the Energy Capital of According to the Clean Energy Australia - Paul McVeigh, Australia. Report, as at 2018, Queensland Mayor Western Downs This reputation is due to strong renewables make up 9.5% of Renewable investment over the past 15 years Energy Penetration across Australian Regional Council 4 by the Energy Production Industry states. (EPI), into large-scale resource As at January 2019, the Western Electricity transmission services industry developments in coal seam Downs contributes towards this provider, Powerlink Queensland, gas (CSG) and coal. More recently percentage with more than $4 billion connects renewable energy farms renewable energy farms have invested in renewable energy projects in the across the region into the Queensland in the region with multiple solar and pipeline. 5 transmission network using existing, wind energy farms currently either Renewable energy projects offer and where required, expanding on under construction, or approved for short and long-term work within the transmission networks and substations. construction. Gas and coal-fired power region, with a range of industries and This existing infrastructure supports stations also feature prominently in the businesses involved. This creates a the connection of non-synchronous region. strong flow-on effect in the supply generation of electricity into the chain, economy and local communities. Economic growth in the Western Queensland transmission network. -

APA Group Investor Day Disclaimer

MORE THAN THE SUM OF OUR PARTS APA Group Investor Day 14 November 2013 Sydney Disclaimer This presentation has been prepared by Australian Pipeline Limited (ACN 091 344 704) the responsible entity of the Australian Pipeline Trust (ARSN 091 678 778) and APT Investment Trust (ARSN 115 585 441) (APA Group). Summary information: This presentation contains summary information about APA Group and its activities current as at the date of this presentation. The information in this presentation is of a general background nature and does not purport to be complete. It should be read in conjunction with the APA Group’s other periodic and continuous disclosure announcements which are available at www.apa.com.au. Not financial product advice: Please note that Australian Pipeline Limited is not licensed to provide financial product advice in relation to securities in the APA Group. This presentation is for information purposes only and is not financial product or investment advice or a recommendation to acquire APA Group securities and has been prepared without taking into account the objectives, financial situation or needs of individuals. Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own objectives, financial situation and needs and consult an investment adviser if necessary. Past performance: Past performance information given in this presentation is given for illustrative purposes only and should not be relied upon as (and is not) an indication of future performance. Future performance: This presentation contains certain “forward‐looking statements” such as indications of, and guidance on, future earnings and financial position and performance. -

For Personal Use Only Use Personal For

ASX RELEASE 6 October 2011 The Manager Company Announcements Office Australian Securities Exchange 4th Floor, 20 Bridge Street Sydney NSW 2000 Electronic Lodgement Dear Sir or Madam Company Announcement I attach the following announcement for release to the market: • APA and AGL to build gas-fired power station in Mount Isa Yours sincerely Mark Knapman Company Secretary For personal use only ASX RELEASE 6 October 2011 APA and AGL to build gas-fired power station in Mount Isa APA Group (ASX:APA), Australia’s largest natural gas infrastructure business, will jointly develop a 242 MW gas-fired power station at Mount Isa, Queensland following the signing today of a long-term agreement to supply electricity to Xstrata Mount Isa Mines through to 2030. The Diamantina Power Station will be constructed jointly with AGL Energy (ASX:AGK) in a 50:50 joint venture and will be underpinned by contracts with other major energy users. The power station will produce sufficient electricity to supply mines and communities in the region, with scope for further expansion in line with energy demand increases. APA, together with AGL, today finalised a long term energy supply agreement with Xstrata Mount Isa Mines, a wholly owned subsidiary of Xstrata, for the supply of electricity commencing in late 2013. Under the arrangements, AGL has contracted transportation capacity in APA’s Carpentaria Gas Pipeline to supply gas to the Diamantina Power Station for the initial ten year period. Xstrata Mount Isa Mines will then be responsible for sourcing gas for the remaining seven year period through to 2030 under a tolling arrangement with the Diamantina Power Station. -

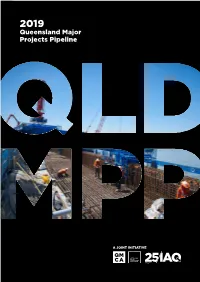

Queensland Major Projects Pipeline 2019 Queensland Major Projects Pipeline

2019 Queensland Major Projects Pipeline 2019 2019 Queensland Major Projects Pipeline Queensland Major Projects A JOINT INITIATIVE $M Total Pipeline 39,800,000,000 Annual Ave 7,960,000,000 Weekly Ave 153,000,000 Daily Ave 21,860,000 Hourly Ave 910,833 AT A GLANCE Major Projects Pipeline readon Unfunded split $41.3 billion total (over 5 years) Credibly Under Under Unlikely Prospective proposed Announced procurement construction* 37 39 15 36 15 52 projects valued at projects valued at projects valued at projects valued at projects valued at projects valued at $3.13bn $6.61bn $4.03bn $10.14bn $6.66bn $10.77bn Unfunded $13.77 billion Funded $27.57 billion *Under construction or completed in 2018/19 Total Pipeline Major Project Scale of Major Value Activity Recurring Projects Jobs Expenditure $8.3b per year The funded pipeline will support $6.5b 11,900 workers $41.3b North Queensland each year on average $23m per day $12.4b Fully-funding the pipeline Funding will support an extra 6.8b Central split Various Queensland 5,000 workers each year on average $23.4b $15.6b $2.2m Public Projects $41.3b Total South East A JOINT INITIATIVE $17.9b Queensland $159m per Private Projects working per week hour $M Total Pipeline 39,800,000,000 Annual Ave 7,960,000,000 Weekly Ave 153,000,000 Daily Ave 21,860,000 Hourly Ave 910,833 Major Projects Pipeline – Breakdown Unfunded split $41.3 billion total (over 5 years) Credibly Under Under Unlikely Prospective proposed Announced procurement construction* 37 39 15 36 15 52 projects valued at projects valued at projects -

Australian Pipeline Trust

Australian Pipeline Ltd ACN 091 344 704 | Australian Pipeline Trust ARSN 091 678 778 | APT Investment Trust ARSN 115 585 441 Level 25, 580 George Street Sydney NSW 2000 | PO Box R41 Royal Exchange NSW 1225 Phone +61 2 9693 0000 | Fax +61 2 9693 0093 APA Group | apa.com.au 22 August 2018 ASX ANNOUNCEMENT APA Group (ASX: APA) (also for release to APT Pipelines Limited (ASX: AQH)) Annual Financial Results The following announcements are attached: • Australian Pipeline Trust Appendix 4E • Australian Pipeline Trust Annual Report • APT Investment Trust Annual Report • Sustainability Report Nevenka Codevelle Company Secretary Australian Pipeline Limited For further information please contact: Investor enquiries: Media enquiries: Jennifer Blake Louise Watson Telephone: +61 2 9693 0097 Telephone: +61 2 8011 0591 Mob: +61 455 071 006 Mob: +61 419 185 674 Email: [email protected] Email: [email protected] About APA Group (APA) APA is a leading Australian energy infrastructure business, owning and/or operating in excess of $20 billion of energy infrastructure assets. Its gas transmission pipelines span every state and territory on mainland Australia, delivering approximately half of the nation’s gas usage. APA has direct management and operational control over its assets and the majority of its investments. APA also holds ownership interests in a number of energy infrastructure enterprises including SEA Gas Pipeline, SEA Gas (Mortlake) Partnership, Energy Infrastructure Investments and GDI Allgas Gas Networks. APTFor personal use -

BRIEFING on DRAFT REPORT 12 October 2016

Queensland BRIEFING ON Renewable Energy Expert Panel DRAFT REPORT 12 October 2016 1 The panel COLIN ALLISON PAUL AMANDA PAUL MUGGLESTONE WARBURTON HYSLOP MCKENZIE MEREDITH 12/10/2016 2 Overarching themes Short-term QLD likely to Longer term Project pipeline opportunity to attract significant policy should be will need to grow leverage funding renewable flexible and to meet 50% under national investment adaptable LRET QLD likely to see 4,000-5,500 MW of large-scale Govt should encourage the Govt should work considerable investment renewable capacity required market to deliver renewable proactively to support the over the coming years from 2021-2030 to reach 50% energy projects utilising development of integrated Around 2,500 MW of by 2030 LRET funding up to 2020 climate and energy policies projects in the pipeline Generation capacity to meet the Subject to actual delivery of at the national level to target could be lower than 5,500 projects, Govt may consider maximise efficiencies and MW depending on future load reverse auctions for up to uptake of renewable requirements in QLD 400 MW energy Private sector should be QLD approach should be encouraged to contract and adaptable and flexible to scale up or down 12/10/2016 build renewable energy 3 wherever possible Queensland has a strong renewable resource potential SOLAR IRRADIATION WIND SPEED AT 80 METRES Average annual sun, period 2007-2012 Wind speed (meters/second) <1,100 1,300 1,500 1,700 1,900 2,100 2,300 > kWh/m2 4.3 5.6 5.8 6.0 6.1 6.2 6.3 6.4 6.5 6.6 6.7 6.9 7.0 7.2 7.8 9.6 12/10/2016 -

APA Group Letterhead and Follow-On

ASX ANNOUNCEMENT 25 September 2015 APA Group (ASX: APA) (also for release to APT Pipelines Limited (ASX: AQH)) ANNUAL REVIEW AND SUSTAINABILITY REPORT, ANNUAL REPORT AND NEWSLETTER The following documents are attached for release to the market: • Annual Review and Sustainability Report 2015 • Annual Report 2015 • In the Pipeline newsletter Mark Knapman Company Secretary Australian Pipeline Limited For further information please contact: Investor enquiries: Media enquiries: Yoko Kosugi David Symons Telephone: +61 2 9693 0049 Telephone: +61 2 8306 4244 Mob: +61 438 010 332 Mob: +61 410 559 184 Email: [email protected] Email: [email protected] About APA Group (APA) APA is Australia’s largest natural gas infrastructure business, owning and/or operating around $19 billion of energy infrastructure assets. Its gas transmission pipelines span every state and territory on mainland Australia, delivering approximately half of the nation’s gas usage. APA has direct management and operational control over its assets and the majority of its investments. APA also holds minority interests in a number of energy infrastructure enterprises including SEA Gas Pipeline, Energy Infrastructure Investments, GDI Allgas Gas Networks and Diamantina and Leichhardt Power Stations. APT Pipelines Limited is a wholly owned subsidiary of Australian Pipeline Trust and is the borrowing entity of APA Group. For more information visit APA’s website, www.apa.com.au APA GROUP ANNUAL REVIEW AND SUSTAINABILITY REPORT 2015 CONNECTING MARKETS CREATING OPPORTUNITIES APA Group | Annual Review and Sustainability Report 2015 A Front cover: APA’s most recent and largest acquisition - the Wallumbilla CONNECTING Gladstone Pipeline (“WGP”). This is APA’s delivery station for the Queensland Curtis LNG facility MARKETS located on Curtis Island near Gladstone where the WGP emerges from the underground 556 kilometres from its starting point in the Surat Basin, Queensland. -

Queensland Renewable Energy Expert Panel Draft Report

Credible pathways to a 50% renewable energy target for Queensland Final Report, 30 November 2016 Report of the Queensland Renewable Energy Expert Panel Queensland Renewable Energy Expert Panel Queensland Renewable Energy Expert Panel www.QLDREpanel.com.au Contents Contents 1. Executive Summary .................................................................................................................. 1 1.1. Summary of key themes ................................................................................................. 1 1.2. Overview of findings ....................................................................................................... 4 1.3. Recommendations .......................................................................................................... 9 1.4. Summary of key projected outcomes .......................................................................... 12 1.5. Summary of feedback from stakeholders on Draft Report ........................................ 12 2. Basis of the public inquiry ...................................................................................................... 14 2.1. Role of the Expert Panel ............................................................................................... 14 2.2. The Panel’s approach ................................................................................................... 14 2.3. Report outline ............................................................................................................... 15 3. Queensland’s -

11 March 2014 by EMAIL Dear Sir/Madam Stanwell Corporation Limited & Diamantina Power Station Pty

Our Ref: 53999 Contact Officer: Hayley Parkes Contact Phone: 03 9290 6926 11 March 2014 BY EMAIL Dear Sir/Madam Stanwell Corporation Limited & Diamantina Power Station Pty Ltd - application for authorisation A91412 & A91413 - interested party consultation The Australian Competition and Consumer Commission (the ACCC) has received applications for authorisation from Stanwell Corporation Limited & Diamantina Power Station Pty Ltd (the Applicants). As a potentially interested party, the ACCC invites you to provide a submission in relation to these applications. If you do not wish to make a submission, no further action is required from you. Applications for authorisation The Applicants both operate (or will operate) electricity generators which supply electricity to the North West Power System (NWPS) for use by an energy retailer and large companies, predominately mining operations. The NWPS is an isolated electricity generation and transmission network based in Mt Isa and is not connected to the national grid. The Applicants are seeking authorisation of the technical and operational arrangements related to the operation of the NWPS. Specifically, the parties are seeking authorisation to agree rules related to the coordination of dispatch of generators, and demand management and load shedding of certain electricity consumers within the NWPS (the Dispatch Protocol). Authorisation has been sought for 5 years. Attachment A sets out the full scope of conduct for which the Applicants are seeking authorisation. A full copy of the application for authorisation is available on the ACCC’s website <www.accc.gov.au/AuthorisationsRegister>. Request for submissions The ACCC invites you to make a submission on the likely public benefits and effect on competition, or any other public detriment, from the proposed arrangements.