List of Companies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BIOS EPOX, Motherboard 4PCA HT ======Change Optimized Defaults Are Marked !!! Změny Oproti DEFAULT Jsou Označeny !!! ======

BIOS EPOX, motherboard 4PCA HT =================================================== Change Optimized Defaults are marked !!! Změny oproti DEFAULT jsou označeny !!! =================================================== Standard CMOS Features ====================== Halt On [All, But Keyboard] !!! Advanced BIOS Features ====================== CPU Feature-Delay Prior to Termal [16 Min] Limit CPUID MaxVal [Disabled] Hard Disk Boot Priority Bootovani disku CPU L1 & L2 Cache [Enabled] Hyper-Threading Technology [Enabled] !!! First Boot Device [HDD] !!! Second Boot Device [Disabled] !!! Third Boot Device [Disabled] !!! Boot Other Device [Disabled] !!! Boot Up Floppy Seek [Disabled] !!! Boot Up NumLock Status [On] Security Option [Setup] x APIC Mode (zasedle) [Enabled] HDD S.M.A.R.T .... [Disabled] Advanced Chipset Features ========================= DRAM Timing Selectable [By SPD] x x x x Agresive Memory Mode [Standard] x x x System BIOS Cacheable [Enabled] VIDEO BIOS Cacheable [Disabled] AGP Aperture ... [128] Init Display First [AGP] DRAM DATA Inregrity Mode [ECC] Integrated Peripherals ====================== On Chip IDE Device: IDE HDD [Enabled] IDE DMA [Enabled] On-Chip Primary [Enabled] IDE Primary MASTER PIO [Auto] ... [Auto] On-Chip Secondary [Enabled] IDE Secondary MASTER PIO[Auto] ... [Auto] On Chip Serial ATA [Disabled] (ostatni sede) OnBoard Device: USB Controller [Enabled] USB 2.0 [Enabled] USB Keyboard [Auto] USB Mouse [Disabled] !!! AC97 Audio [Disabled] !!! Game Port [Disabled] !!! Midi Port [Disabled] !!! On Board LAN Device [Enabled] -

September 04, 2017 DIXON TECHNOLOGIES (INDIA) LIMITED

DIXON TECHNOLOGIES (INDIA) LIMITED September 04, 2017 SMC Ranking (3/5) About the Company Issue Highlights Incorporated in 1993, Dixon Technologies is engaged in manufacturing products in the Industry Consumer Durable consumer durables, lighting and mobile phones markets. The product portfolio of the Total Issue (Shares) - Offer for sale 3,053,675 company includes (i) Consumer electronics like LED TVs (ii) Home appliances like washing Total Issue (Shares) - Fresh Issue 339,750 machines (iii) Lighting products like LED bulb, tube lights, CFL bulbs etc. and (iv) Mobile Net Offer to the Public 3,393,425 phones. Dixon manufacture products for popular retail brands including Panasonic, Issue Size (Rs. Cr.) 597-600 Price Band (Rs.) 1760-1766 Philips, Haier, Gionee, Surya Roshni, Reliance Retail, Intex Technologies, Mitashi and Offer Date 6-Sep-16 Dish. The company is also a leading Original Design Manufacturer (ODM) in India. The Close Date 8-Sep-16 Company develops and designs products in-house at its R&D facility. The ODM business Face Value 10 contributes over 25% of its revenue. The company has six manufacturing facilities located Lot Size 8 Per Equity Share in the states of Uttar Pradesh and Uttarakhand. Issue Composition In shares Total Issue for Sale 3,393,425 QIB 1,696,713 NIB 509,014 Retail 1,187,699 Shareholding Pattern (%) Competitive Strengths Particulars Pre-issue Post -issue Promoters & promoters group 46.20% 39.21% Leading market position in key verticals: The Company believes that its experience in QIB 28.53% 25.51% manufacturing, successful backward integration and design capabilities, strong NIB 4.35% 4.49% relationships with its global suppliers and anchor customers have helped the company to Retail 20.92% 30.78% Total 100.00% 100.00% achieve leading position in its key verticals. -

Standard-Essential Patents: the International Landscape

Intellectual Property Committee │ ABA Section of Antitrust Law Spring 2014 Standard-Essential Patents: The International Landscape Koren W. Wong-Ervin* Federal Trade Commission Investigations and litigation involving standard-essential patents (SEPs) have begun to spring up around the globe. On April 29, 2014, the European Commission (EC) confirmed that it adopted two decisions, one involving Samsung Electronics Co., Ltd. and the other involving Motorola Mobility Inc. (MMI), that for the first time in the European Union (EU), establish a framework for determining whether and under what circumstances patent owners seeking to enforce SEPs in the European Economic Area (EEA) may violate EU antitrust laws. Both decisions create a “safe harbor” approach from injunctive relief, under which implementers can demonstrate that they are a “willing licensee” by agreeing that a court or a mutually agreed arbitrator shall adjudicate the fair, reasonable and non-discriminatory (FRAND) terms in the event that negotiations fail. The decisions do not preclude injunctive relief for FRAND-encumbered SEPs per se, nor do they make findings on the definition of a “willing licensee” outside the safe harbor.1 While the EC’s approach is similar to the approach taken by the U.S. Federal Trade Commission (FTC) in MMI/Google, there are differences. For example, the EC’s decisions preclude injunctions only in the EEA, and only on patents granted in the EEA, whereas the FTC’s consent decree in MMI/Google covers patents issued or pending in the United States or anywhere else in the world. In China, in April 2014, the Guangdong People’s Court made public two decisions in Huawei v. -

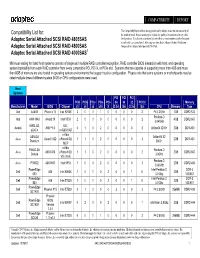

Compatibility List For: Adaptec Serial Attached SCSI RAID 4805SAS Adaptec Serial Attached SCSI RAID 4800SAS Adaptec Serial Atta

COMPATIBILITY REPORT This Compatibility Report reflects testing performed by Adaptec to test the interoperability of Compatibility List for: the products listed. It does not attempt to validate the quality of or preference for any of the Adaptec Serial Attached SCSI RAID 4805SAS listed products. It is also not an inclusive list and reflects a representative sample of products in each of the categories listed. All testing was done by the Adaptec Product Verification Adaptec Serial Attached SCSI RAID 4800SAS Group and the Adaptec InterOperability Test Lab. Adaptec Serial Attached SCSI RAID 4000SAS1 Minimum testing for listed host systems consists of single and multiple RAID controller recognition, RAID controller BIOS interaction with host, and operating system bootability from each RAID controller from every compatible PCI, PCI-X, or PCIe slot. Systems that are capable of supporting more than 4GB and more then 8GB of memory are also tested in operating system environments that support such a configuration. Please note that some systems or motherboards may be listed multiple times if different system BIOS or CPU configurations were used. Host Systems PCI PCI PCI PCIe PCIe PCIe PCIe PCI- 64 64 32 PCI 32 Memory Manufacturer Model BIOS Chipset x1 x4 x8 x16 X (3.3v) (5v) (3.3v) (5v) CPU Memory Type Abit AA8XE Phoenix 16 Intel 925XE 3 0 0 1 0 0 0 0 2 P4 3.2GHz 1GB DDR2-533 Pentium-D Abit AW8-MAX Award 19 Intel 955X 2 0 0 0 0 0 0 0 2 4GB DDR2-667 3.04GHz 939SLI32- ULI - Asrock AMI P1.0 0 1 0 2 0 0 0 0 3 Athlon64 3200+ 2GB DDR-400 eSATA m1695/1697 -

Results for the Quarter Ended December 31, 2004 Under

FOR IMMEDIATE RELEASE Results for the Quarter ended December 31, 2004 under Consolidated Indian GAAP Wipro records 56% growth in Profit After Tax Dollar Revenue in Global IT business grows 41% YoY; Operating Margin in Global IT business (before 1% non-cash charge for RSUs) at 27% Bangalore, January 21, 2005 –Wipro Limited today announced its audited results approved by the Board of Directors for the quarter ended December 31, 2004. Highlights for the Quarter ended December 31, 2004: • Profit Before Interest & Tax (PBIT) grew by 66% year on year to Rs. 4.76 billion (Rs. 476 Crores). Revenue for the quarter was Rs. 21.10 billion (Rs.2,110 Crores), an increase of 39% year on year. • Profit After Tax grew by 56% year on year to Rs.4.27 billion (Rs.427 Crores). • Global IT Services & Products Revenue increased 38% year on year, at Rs. 15.89 billion (Rs. 1,589 Crores). • Global IT Services & Products PBIT was Rs. 4.14 billion (Rs. 414 Crores), an increase of 65% year on year, contributed by pricing growth and productivity improvements. • Global IT Services & Products Operating Margin (excluding 1% non-cash charge for Restricted Stock Units -RSUs) was 27%, despite increase in compensation cost and Rupee appreciation • Global IT Services & Products added 26 new clients in the quarter. • India, Middle East and Asia Pacific IT Services and Products Revenues grew by 45% and PBIT grew by 69% year on year. Outlook for the Quarter ending March 31, 2005: Azim Premji, Chairman of Wipro commenting on the results said “We continued our strong performance into the third quarter of the fiscal year. -

Dixon Technologies (India) Limited Corporate Presentation

Dixon Technologies (India) Limited Corporate Presentation October 2017 Company Overview Dixon Technologies (India) Limited Corporate Presentation 2 Dixon Overview – Largest Home Grown Design-Focused Products & Solutions Company Business overview Engaged in manufacturing of products in the consumer durables, lighting and mobile phones markets in India. Company also provide solutions in reverse logistics i.e. repair and refurbishment services of set top boxes, mobile phones and LED TV panels Fully integrated end-to-end product and solution suite to original equipment manufacturers (“OEMs”) ranging from global sourcing, manufacturing, quality testing and packaging to logistics Diversified product portfolio: LED TVs, washing machine, lighting products (LED bulbs &tubelights, downlighters and CFL bulbs) and mobile phones Leading Market position1: Leading manufacturer of FPD TVs (50.4%), washing machines (42.6%) and CFL and LED lights (38.9%) Founders: 20+ years of experience; Mr Sunil Vachani has been awarded “Man of Electronics” by CEAMA in 2015 Manufacturing Facilities: 6 state-of-the-art manufacturing units in Noida and Dehradun; accredited with quality and environmental management systems certificates Backward integration & global sourcing: In-house capabilities for panel assembly, PCB assembly, wound components, sheet metal and plastic moulding R&D capabilities: Leading original design manufacturer (“ODM”) of lighting products, LED TVs and semi-automatic washing machines Financial Snapshot: Revenue, EBITDA and PAT has grown at -

IBEF Presentation

CONSUMER DURABLES For updated information, please visit www.ibef.org January 2020 Table of Content Executive Summary……………….….…….3 Advantage India…………………..….……..4 Market Overview …………………….……..6 Recent Trends and Strategies …………..15 Growth Drivers……………………............18 Opportunities…….……….......……………23 Industry Associations…….……......……...27 Useful Information……….......…………….29 EXECUTIVE SUMMARY . Indian appliance and consumer electronics market stood at Rs Indian Appliance and Consumer Electronics Industry (US$ 76,400 crore (US$ 10.93 billion) in 2019. billion) 30 . It is expected to increase at a 9 per cent CAGR to reach Rs 3.15 CAGR 11.7% trillion (US$ 48.37 billion) in 2022. 20 21.18 . According to the retail chains and brands, there is 9-12 per cent 10 10.93 increase in the sales of consumer electronics in Diwali season in 0 October 2019. 2018 2025F . Electronics hardware production in the country increased from Rs 1.90 trillion (US$ 31.13 billion) in FY14 to Rs 3.88 trillion (US$ 60.13 Electronics Hardware Production in India (US$ billion) billion) in FY18. Demand for electronics hardware in India is 80 expected to reach US$ 400 billion by FY24*. CAGR 26.7% 60 . Consumer durable exports reached US$ 362.12 million in 2018. 40 Consumer electronics exports from India reached US$ 451.29 million 60.13 20 in FY19. 31.13 0 . Television industry in India is estimated to have reached Rs 740 FY14 FY18 billion (US$ 10.59 billion) in CY2018 and projected to reach Rs 955 billion (US$ 13.66 billion) in CY2021. Television Market in India (US$ billion) . ByY F 22, television industry in India is estimated to reach Rs 15 CAGR 9.8% 1,227.34 billion (US$ 17.56 billion). -

Government of India Ministry of Heavy Industries and Public Enterprises Department of Public Enterprises

GOVERNMENT OF INDIA MINISTRY OF HEAVY INDUSTRIES AND PUBLIC ENTERPRISES DEPARTMENT OF PUBLIC ENTERPRISES LOK SABHA UNSTARRED QUESTION NO. 1428 TO BE ANSWERED ON THE 11th FEBRUARY, 2020 ‘Job Reservation for SCs, STs and OBCs in PSUs’ 1428. SHRI A.K.P. CHINRAJ : SHRI A. GANESHAMURTHI : Will the Minister of HEAVY INDUSTRIES AND PUBLIC ENTERPRISES be pleased to state:- (a) whether the Government is planning to revamp job reservations issue for Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in State-run companies following sharp fall of employment opportunities to them consequent upon disinvestment in all the Public Sector Enterprises (PSEs); (b) if so, the details thereof; (c) whether it is true that the Department of Investment and Public Asset Management (DIPAM) is examining the issue of job reservations for SCs, STs and OBCs in State run companies following disinvestment and if so, the details thereof; (d) the total disinvestment made in various PSEs company and category-wise during the last three years along with the reasons for disinvestment; (e) the total number of SCs, STs and OBCs presently working in various PSEs company and category-wise; and (f) the total number of SCs, STs and OBCs who lost their jobs in these companies during the said period? ANSWER THE MINISTER FOR HEAVY INDUSTRIES & PUBLIC ENTERPRISES (SHRI PRAKASH JAVADEKAR) (a to d): Job reservation is available to Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in Central Public Sector Enterprises (CPSEs) as per the extant Government policy. The Government follows a policy of disinvestment in CPSEs through Strategic Disinvestment and Minority Stake sale. -

A Review of Indian Mobile Phone Sector

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 20, Issue 2. Ver. II (February. 2018), PP 08-17 www.iosrjournals.org A Review of Indian Mobile Phone Sector Akash C.Mathapati, Dr.K Vidyavati Assistant Professor, Department of Management Studies, Dr.P G Halakatti College of Engineering, Vijayapura Professor, MBA Department, Sahyadri College of Engineering & Management, Mangaluru Corresponding Author: Akash C.Mathapati, Abstract: The Paper Has Attempted To Understand The Indian Mobile Handset Overview, Market Size, Competitive Landscape With Some Of The Category Data. Also Some Relevant Studies On Indian Mobile Handset And Its Global Comparison Have Been Focused With The Impact On Economy And Society. Keywords: India, Mobile handsets, market size, Global Comparisons, GSM --------------------------------------------------------------------------------------------------------------------------------------- Date of Submission: 15-01-2018 Date of acceptance: 09-02-2018 ------------------------------------------------------------------------------------------------------------------------------------- I. Introduction India is currently the 2nd second-largest telecom market and has registered strong growth in the past decade and a half. The Indian mobile economy is growing quickly and will contribute extensively to India’s Gross Domestic Product (GDP), according to report prepared by GSM Association (GSMA) in association with the “Boston Consulting Group” (BCG). The direct and reformist strategies of the GoI have been instrumental alongside solid customer request in the quick development in the Indian telecom division. The administration has empowered simple market section to telecom gear and a proactive administrative and reasonable structure that has guaranteed openness of telecom administrations to the customer at sensible costs. The deregulation of "Outside Direct Investment" (FDI) standards has made the segment one of the top developing and a main 5 business opportunity maker in the nation. -

Annual Report 2007 | Reports & Filings | Investors

Once upon a time, the world was spiky. Opportunities were unequal across countries, information was often walled and new economies were unheard of. But around the mid 990s, things started changing. Wealth began to spread, opening up fresh markets. A baby-boomer generation aged in developed countries while a Gen-Y exploded in emerging ones, rebalancing the workforce and propelling new economies. Technology became ubiquitous, connecting people and information. Together, these disruptive forces rearranged and leveled the global business-scape. Braving the waves of complex regulations and changing customer expectations, a new breed of entrepreneurs arrived to claim the unexplored land. They found a flat world. We live in exciting times. Infosys Annual Report 2006-07 | Winning in the Flat World Nandan M. Nilekani, CEO and Managing Director, Infosys Technologies Ltd., in conversation with Brianna Yvonne Dieter, Executive – Academic Relations, Infosys Technologies Ltd. Recently you have been talking about the world becoming companies should beat them by making their operations more flat. Could you elaborate further? cost-competitive and globally efficient. We believe that four major trends are changing the business Create customer loyalty through faster innovation: Customers stay landscape. They are: with companies which have the most innovative and useful products and services. Therefore, companies must be able to innovate rapidly The emergence of developing economies creating new markets l to offer products and services that customers value. In many cases, and accessible talent pools, this may require co-creating these offerings with customers or l A global shift in demographics, driving companies to tap young partners. and skilled talent pools outside of industrialized countries, Make money from information: Despite years of investment in l The ongoing adoption of technology which is changing how systems, few companies are truly able to leverage information to consumers and companies use technology, and improve their operational or financial performance. -

The Halting Progress of Privatization in India. Nandini Gupta* Current

From Commanding Heights to Family Silver: The Halting Progress of Privatization in India. Nandini Gupta* Current status of the privatization program In February 2010, India’s United Progressive Alliance (UPA) government, led by the Congress party, resurrected its stalled privatization program with a secondary offering of shares in National Thermal Power Corporation Ltd (NTPC), one of India’s best performing government-owned firms, which owns 20% of India’s power generation capacity. The sale of the $1.8 billion block of shares reduced the government’s existing stake in the company by an additional 5%, leaving 85% still under government control. However, the poor performance of the offering has raised alarm bells for the government’s future privatization plans. NTPC was subscribed just 1.2 times for the secondary offering, mainly with the help of government-owned financial institutions (“NTPC issue scrapes through with support from SBI, LIC,” The Economic Times, February 6, 2010). Although two foreign investment banks, Citigroup and J.P. Morgan were advising the company, the secondary offering did not attract any foreign institutional investment. The poor performance of the offering has also raised questions regarding the growth prospects of this company, which is a “navratna”, one of the nine “jewels” in the government’s crown. In a recent speech, the top ranking bureaucrat in the power ministry, HS Brahma, pointed out the company’s low employee productivity (“Power secretary censures NTPC for low productivity,” Daily News and Analysis India, February 15, 2010). The lackluster performance may also be due to investor skepticism regarding the company’s ability to compete effectively with a rapidly growing private sector. -

Bharat Electronics

Call Success - Bharat Electronics We had recommended a BUY on Bharat Electronics in our Idea2Act report dated 03rd December 2020, with a target price of ₹139. We are pleased to inform you that the stock met the target of ₹139 on 14th January 2021, giving a return of ~24%! Bharat Electronics Recommendation on 3rd December 2020 BUY Recommended price ₹ 112 Target price ₹ 139 As on 14th January 2021 Stock has hit a high of ₹ 139.7 25% . In this period, Nifty grew only 10.9% Previous Recommendations: Date Stock Name Reco Price Target Price P & L % Status 26-May-20 Emami Limited 205 241 18% Target Achieved Active Call (Dividend Rs10.15 2-Jul-20 ITC 201 235 10% exdate 6th Jul 2020) 2-Jul-20 NHPC 19.5 24 23% Target Achieved 15-Jul-20 HCL Tech 610 695 14% Target Achieved 30-Jul-20 INDIGO 920 1074 17% Target Achieved 11-Aug-20 JB Chemicals & Pharmaceuticals 750 867 16% Target Achieved 13-Aug-20 UPL 480 555 2% Active Call 18-Aug-20 Crompton Consumer 256 299 17% Target Achieved 28-Aug-20 Sudarshan Chemical 474 557 6% Active Call 14-Sep-20 Apollo Tyres 114.5 138 21% Target Achieved 1-Oct-20 Manappuram Finance Ltd 155.5 186 10% Active Call 15-Oct-20 Cyient Ltd 370 440 19% Target Achieved 28-Oct-20 Amara Raja Batteries 770 898 17% Target Achieved 2-Now-20 SIS (I) Ltd 363 423 17% Target Achieved 3-Dec-20 Bharat Electronics 112 139 24% Target Achieved 16-Dec-20 RBL Bank 233 273 17% Target Achieved 6-Jan-21 Alembic Pharmaceuticals 1075 1252 1% Active call Closing Price as on 13th January 2021 for Active Calls.