Israel Discount Bank Ltd. Resolution Plan for United States Operations

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fact Sheet:Middle East and Africa ESG Screened Index Equity Sub

EMEA_INST Managed Pension Funds Limited Middle East and Africa ESG Screened Index Equity Sub-Fund Equities 30 June 2021 Fund Objective Performance ® The Sub-Fund aims to track the FTSE Developed Annualised Fund Benchmark Difference Middle East and Africa ex Controversies ex CW 1 Year (%) 23.30 23.28 0.01 Index, or its recognised replacement or equivalent. 3 Year (%) 4.75 4.84 -0.09 Investment Strategy 5 Year (%) 0.78 0.89 -0.11 The Sub-Fund primarily invests at all times in a Since Inception (%) 4.04 4.18 -0.14 sample of equities constituting the Index with such other securities as MPF shall deem it necessary Cumulative to capture the performance of the Index. Stock 3 Month (%) 11.54 11.51 0.04 index futures can be used for efficient portfolio 1 Year (%) 23.30 23.28 0.01 management. 3 Year (%) 14.95 15.24 -0.29 The following are excluded by the index provider from the index: Controversies (as defined by the ten 5 Year (%) 3.96 4.52 -0.56 principles of the UN Global Compact); Controversial Since Inception (%) 65.75 68.57 -2.81 weapons (including chemical & biological weapons, cluster munitions and anti-personnel landmines). Calendar 2021 (year to date) 9.74 9.71 0.03 Benchmark 2020 -1.28 -1.47 0.19 FTSE Developed Middle East and Africa ex 2019 10.82 11.07 -0.24 Controversies ex CW Index 2018 -0.47 -0.12 -0.35 Structure 2017 -10.77 -10.66 -0.12 Limited Company Past performance is not a guarantee of future results. -

Domestically Owned Versus Foreign-Owned Banks in Israel

Domestic bank intermediation: domestically owned versus foreign-owned banks in Israel David Marzuk1 1. The Israeli banking system – an overview A. The structure of the banking system and its scope of activity Israel has a highly developed banking system. At the end of June 2009, there were 23 banking corporations registered in Israel, including 14 commercial banks, two mortgage banks, two joint-service companies and five foreign banks. Despite the spate of financial deregulation in recent years, the Israeli banking sector still plays a key role in the country’s financial system and overall economy. It is also highly concentrated – the five main banking groups (Bank Hapoalim, Bank Leumi, First International Bank, Israel Discount Bank and Mizrahi-Tefahot Bank) together accounted for 94.3% of total assets as of June 2009. The two largest groups (Bank Leumi and Bank Hapoalim) accounted for almost 56.8% of total assets. The sector as a whole and the large banking groups in particular are organised around the concept of “universal” banking, in which commercial banks offer a full range of retail and corporate banking services. Those services include: mortgages, leasing and other forms of finance; brokerage in the local and foreign capital markets; underwriting and investment banking; and numerous specialised services. Furthermore, until the mid-1990s, the banking groups were deeply involved in non-financial activities. However, a law passed in 1996 forced the banks to divest their controlling stakes in non-financial companies and conglomerates (including insurance companies). This development was part of a privatisation process which was almost completed in 2005 (with the important exception of Bank Leumi). -

Delek Cover English 04.2006

ANNUAL REPORT 2005 Delek Group Ltd 7, Giborei Israel St., P.O.B 8464, Industrial Zone South, Netanya 42504, Israel Tel: 972 9 8638444, 972 9 8638555 Fax: 972 9 885495 www.delek-group.com Table of Contents: Chapter A Corporate Description Chapter B Director's Report on the Corporation Chapter C Financial Statements for December 31, 2004 Chapter D Additional Information on the Corporation Chapter E MATAV - CABLE SYSTEMS MEDIA LTD IMPORTANT This document is an unofficial translation from the Hebrew original of the 2005 annual report of Delek Group Ltd. that was submitted to the Tel-Aviv Stock Exchange and the Israeli Securities Authority on March 29, 2006. The Hebrew version submitted to the TASE and the Israeli Securities Authority shall be the sole binding version. Investors are urged to review the full Hebrew report. Part One – A Description of the General Development of the Company's Businesses 1. The Company's Activities and the Development of its Business ......................... 3 2. Sectors of Operation .................................................................................................. 6 3. Equity Investments in the Company and Transactions in its Shares................... 7 4. Dividend Distribution ................................................................................................. 8 5. Financial Information Regarding the Group's Sectors........................................... 9 6. The General Environment and Outside Influences................................................. 9 7. Oil Refining Sector -

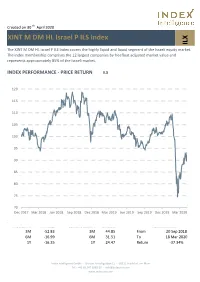

ILX XINT M DM HL Israel P ILS Index

Created on 30 th April 2020 XINT M DM HL Israel P ILS Index ILX The XINT M DM HL Israel P ILS Index covers the highly liquid and liquid segment of the Israeli equity market. The index membership comprises the 12 largest companies by freefloat adjusted market value and represents approximately 85% of the Israeli market. INDEX PERFORMANCE - PRICE RETURN ILX 120 115 110 105 100 95 90 85 80 75 70 Dec 2017 Mar 2018 Jun 2018 Sep 2018 Dec 2018 Mar 2019 Jun 2019 Sep 2019 Dec 2019 Mar 2020 Index Return % annualised Standard Deviation % annualised Maximum Drawdown 3M -52.83 3M 44.85 From 20 Sep 2018 6M -16.99 6M 31.51 To 18 Mar 2020 1Y -16.35 1Y 24.47 Return -37.34% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com TOP 10 Largest Constituents FFMV million Weight Industry Sector Check Point Software Technologies Ltd 17.07% 4,471,198 17.07% Technology Teva Pharmaceutical Industries Ltd 15.55% 4,072,206 15.55% Health Care Nice Ltd 13.77% 3,605,623 13.77% Technology Bank Leumi Le Israel BM 10.57% 2,769,635 10.57% Banks Bank Hapoalim BM 9.74% 2,551,239 9.74% Banks Wix.com Ltd 8.43% 2,206,957 8.43% Technology Israel Discount Bank Ltd 5.05% 1,323,487 5.05% Banks CyberArk Software Ltd 4.94% 1,294,068 4.94% Technology Elbit Systems Ltd 4.40% 1,152,520 4.40% Industrial Goods & Services Mizrahi Tefahot Bank Ltd 3.86% 1,010,693 3.86% Banks Total 24,457,627 93.37% This information has been prepared by Index Intelligence GmbH (“IIG”). -

Class Actions Against Banks Under the New Israeli Law on Class Actions

CLASS ACTIONS AGAINST BANKS UNDER THE NEW ISRAELI LAW ON CLASS ACTIONS * DR. RUTH PLATO SHINAR I. Introduction....................................................................256 II. Causes of Action for Class Actions Against Banks ....... 259 III. The Representative Filing The Action ........................... 264 IV. The Conditions for Certification of a Class Action....... 265 V. Conclusion .................................................................... 281 * Dr. Ruth Plato Shinar is the Senior Lecturer and Director of the Center for Banking Law, Netanya Academic College, Israel. The author wishes to thank the Van Calker Foundation and the Swiss Institute of Comparative law for their generous support of the research for this article, which was principally conducted at the Swiss Institute of Comparative Law in Lausanne, Switzerland during the summer of 2006. 2007 CLASS ACTIONS AGAINST BANKS IN ISRAEL 256 I. INTRODUCTION In March 2006, Israel enacted a modern and far-reaching Class Action Law1 (the “Class Action Law”) to regulate class action suits in a centralized and exhaustive manner. Prior to the law’s enactment, class actions in Israel were common in various fields,2 including banking. The basis for class actions against banks was the Banking (Service to Customer) Law (“the Banking Law”), which contained a chapter on class actions. However, the new Class Action Law abolished this chapter, as well as all other laws concerning Class Actions in different fields, and today the arrangement of class actions is concentrated in -

Bluestar Israel Global Total Investable Market Index

FACTSHEET BlueStar Israel Global Total Investable Market Index The BlueStar Israel Global Total Investable Market Index (BITM) tracks all Israeli equities, across all sectors of the economy, irrespective of their listing venue. The definition of an Israeli company is based on MVIS's proprietary research-driven framework. BITM covers 100% of the investable universve. Key Features Size and Liquidity Requirements Full MCap of at least 150 mln USD.Three month average-daily-trading volume of at least 1 mln USD at a review and also at the previous two reviews.At least 250,000 shares traded per month over the last six months at a review and also at the previous two reviews. Pure-Play Index includes non-local companies. Diversification Company weightings are capped at 10%. Review All Time High/Low 52-Week High/Low Semiannual in June and December. Total Return Net Index 397.27/92.33 397.27/273.88 Index Data INDEX PARAMETERS FUNDAMENTALS* ANNUALISED PERFORMANCE* Launch Date 31 May 2016 Components 173.00 Price/Earnings Trailing 69.05 1 Month 1.67% Type Country Volatility (1 year) 18.82 Price/Book 2.32 1 Year 28.91% Currency USD Full MCap bn USD 0.32 Price/Sales 2.31 3 Years 12.38% Base Date 31 Dec 2008 Float MCap bn USD 0.32 Price/Cash Flow 11.14 5 Years 11.60% Base Value 100.00 Correlation* (1 year) 0.85 Dividend Yield 1.10 Since Inception 11.37% * as of 31 Jul 2021 * MSCI Daily TR Gross Israel USD * Total Return Net Index Country and Size Weightings COUNTRY WEIGHTINGS EXCL. -

Creatingvalue in a Changing World

CREATINGVALUE IN A CHANGING WORLD 2012 ANNUAL REPORT 2011 ANNUAL REPORT ABOUT US FINANCIAL HIGHLIGHTS Founded in 2001, Delek US Holdings, Inc. (NYSE: DK) SEGMENT CONTRIBUTION MARGIN is a diversified energy company with assets in the IN MILLIONS petroleum refining, logistics and retail industries. Delek US consists of three business segments: $37.2 $45.2 REFINING, LOGISTICS and RETAIL. LOGISTICS RETAIL Refining Segment $586.1 REFINING $30.4 Delek US’ subsidiaries own and operate refineries in Tyler, Texas, $45.2 and El Dorado, Arkansas, with a combined nameplate production capacity of 140,000 barrels per day. Tyler is a 60,000-barrel-per- day inland refinery that processes primarily local sweet crude $379.6 oils and manufactures mostly light, high-value, refined products, such as gasoline and distillate fuel. Tyler primarily serves a niche $24.8 market in east Texas. El Dorado is an 80,000-barrel-per-day $52.4 inland, mid-continent refinery that has the flexibility to process a combination of local, Mid-Continent, Gulf Coast and rail-supplied crudes. El Dorado manufactures a combination of light products, $62.4 in addition to a slate of industrial products, including asphalt. 2010 2011 2012 Logistics Segment HSD 5-3-2 GULF COAST CRACK SPREAD PER BARREL Delek US beneficially owns 62.4 percent (including the 2 percent general partner interest) of Delek Logistics Partners, LP. (NYSE: DKL). Delek Logistics Partners is a growth-oriented master limited partnership focused on owning and operating midstream energy infrastructure assets. On November 7, 2012, Delek Logistics completed its initial public offering, which includes certain assets formerly in the Delek US marketing segment, and pipeline and $17.54 $23.14 $30.80 $20.34 $23.87 $25.42 $29.96 $26.71 related tankage assets previously in the Delek US refining segment. -

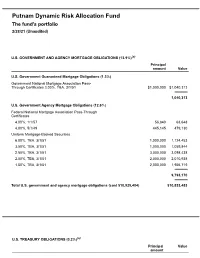

Dynamic Risk Allocation Fund Q3 Portfolio Holdings

Putnam Dynamic Risk Allocation Fund The fund's portfolio 2/28/21 (Unaudited) U.S. GOVERNMENT AND AGENCY MORTGAGE OBLIGATIONS (13.9%)(a) Principal amount Value U.S. Government Guaranteed Mortgage Obligations (1.3%) Government National Mortgage Association Pass- Through Certificates 3.00%, TBA, 3/1/51 $1,000,000 $1,040,313 1,040,313 U.S. Government Agency Mortgage Obligations (12.6%) Federal National Mortgage Association Pass-Through Certificates 4.00%, 1/1/57 56,840 63,648 4.00%, 5/1/49 445,145 479,130 Uniform Mortgage-Backed Securities 6.00%, TBA, 3/1/51 1,000,000 1,124,453 3.50%, TBA, 3/1/51 1,000,000 1,059,844 2.50%, TBA, 3/1/51 3,000,000 3,098,438 2.00%, TBA, 3/1/51 2,000,000 2,010,938 1.50%, TBA, 3/1/51 2,000,000 1,956,719 9,793,170 Total U.S. government and agency mortgage obligations (cost $10,925,404) $10,833,483 U.S. TREASURY OBLIGATIONS (0.2%)(a) Principal Value amount U.S. Treasury Notes 2.00%, 4/30/24(i) $116,000 $122,910 Total U.S. treasury obligations (cost $122,910) $122,910 COMMON STOCKS (11.8%)(a) Shares Value Basic materials (1.3%) Anglo American PLC (United Kingdom) 2,799 $107,695 BHP Billiton, Ltd. (Australia) 438 16,558 BHP Group PLC (United Kingdom) 2,150 67,954 Compagnie De Saint-Gobain (France)(NON) 1,992 106,724 Covestro AG (Germany) 1,509 109,200 CRH PLC (Ireland) 1,562 67,483 Eiffage SA (France)(NON) 425 43,652 Fortescue Metals Group, Ltd. -

Ngo Documents 2013-11-01 00:00:00 Financing the Israeli Occupation the Current Involvement Of

Financing the Israeli Occupation The Current Involvement of Israeli Banks in Israeli Settlement Activity Flash Report November 2013 In October 2010, Who Profits published a report about the Israeli banks' involvement in the Israeli occupation. The Israeli banks provide the financial infrastructure for activities of companies, governmental agencies and individuals in the occupied Palestinian territories and the Syrian Golan Heights. Who Profits' research identified six categories in which Israeli banks are involved in the occupation: providing mortgage loans for homebuyers in settlements; providing financial services to settlements' local authorities; providing special loans for construction projects in settlements; operating branches in Israeli settlements; providing financial services to businesses in settlements; and benefiting from access to the Palestinian monetary market as a captured market. Additionally, as Who Profits' report shows, it is evident that the banks are well aware of the types and whereabouts of the activity that is being carried out with their financial assistance. Our new flash report reveals that all the Israeli banks are still heavily involved in financing Israeli settlements, providing services to settlements and financially supporting construction project on occupied land. Contents: Dexia Israel .......................................................................................................................................... 2 Hapoalim Bank ................................................................................................................................... -

Schedule 14A

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ___) Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐ Check the appropriate box: ☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☑ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Pursuant to § 240.14a-12 Delek US Holdings, Inc. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☑ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: ____________________________________ (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set (4) Proposed maximum aggregate value of transaction: ___________________________________________ (5) Total fee paid: _________________________________________________________________________ ☐ Fee paid previously with preliminary materials. ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: NOTICE OF THE -

US Ishares Template

iShares MSCI Israel ETF EIS Factsheet as of 30-Jun-2021 The iShares MSCI Israel ETF seeks to track the investment results of a broad-based index composed of Israeli equities. KEY FACTS Fund Launch Date 26-Mar-2008 Expense Ratio 0.59% WHY EIS? Benchmark MSCI Israel Capped 1 Exposure to a broad range of companies in Israel Investable Market Index 2 Targeted access to Israeli stocks Number of Holdings 102 Net Assets of Share $156,614,394 3 Use to express a single country view Class Ticker EIS GROWTH OF 10,000 USD SINCE INCEPTION CUSIP 464286632 Exchange NYSE Arca TOP HOLDINGS (%) WIX.COM LTD 8.46 NICE LTD 8.03 CHECK POINT SOFTWARE TECHNOLOGIES 6.83 BANK LEUMI LE ISRAEL 5.79 TEVA PHARMACEUTICAL INDUSTRIES ADR 5.69 BANK HAPOALIM BM 4.78 FIVERR INTERNATIONAL LTD 3.42 ISRAEL DISCOUNT BANK LTD 2.91 KORNIT DIGITAL LTD 2.84 Fund Benchmark CYBER ARK SOFTWARE LTD 2.64 The Growth of $10,000 chart reflects a hypothetical $10,000 investment and assumes reinvestment of 51.39 dividends and capital gains. Fund expenses, including management fees and other expenses were deducted. Holdings are subject to change ANNUALIZED PERFORMANCE 1 Year 3 Years 5 Years 10 Years Since Inception NAV 35.45% 11.29% 9.67% 4.35% 4.56% Market Price 34.94% 11.22% 9.63% 4.28% 4.56% Benchmark 36.03% 11.85% 10.11% 4.68% 5.03% Calendar Year Returns 2020 2019 2018 2017 2016 Fund 11.48 20.91 -4.99 13.08 -4.08 Benchmark 11.94 21.99 -4.70 13.55 -4.06 The performance quoted represents past performance and does not guarantee future results. -

My Fellow Shareholders

MY FELLOW SHAREHOLDERS, completed the sale by Atrium European Real Estate of 72 smaller format non-core retail assets in the Czech Republic. These initiatives also allowed us to strengthen our financial position and increase the Group’s total liquidity to more than NIS 13.5 billion. As a result, we were also able to continue the process of reducing our leverage which now stands at 51.0% as of December 31 2014 compared to 55.1% in December 2013. While our overriding aim is to continue bringing the Group’s gearing levels down over the long term, we are also acutely aware of the need to remain flexible and opportunistic in our approach to making acquisitions in order I am very pleased to report another positive year for Gazit- to deliver on our strategy of continually improving the quality Globe, both in the progression of our strategy to improve of our portfolio. As such, we are willing to increase our levels the quality of the underlying assets in our core portfolio and of debt in the short term, if that helps us achieve our wider in terms of the strong financial results we have delivered, business goals. further demonstrating our continued ability to generate long term value. Our 2014 same property NOI grew by 1.7% while we increased our FFO by 2%. This upward trend is driven Gazit-Globe now controls and manages a $21 billion by growing rental income from our well-established and portfolio comprising some 524 properties in more than 20 increasingly high quality portfolio.