Fact Sheet:Middle East and Africa ESG Screened Index Equity Sub

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bank Hapoalim B.M., Tel-Aviv, Israel

Bank Hapoalim B.M., Tel-Aviv, Israel 2016 Resolution Plan – Public Section Bank Hapoalim B.M. (“Bank Hapoalim”) is a publicly held banking corporation organized and operating under Israeli law, and subject to comprehensive supervision by the Bank of Israel. In the United States, Bank Hapoalim owns (through PCM-HSU Holdings, Inc., a Delaware-incorporated holding company) Hapoalim Securities USA, a Delaware-incorporated SEC-registered broker-dealer that has offices in New York, California, and Florida. Bank Hapoalim also operates Bank Hapoalim B.M. New York Branch (the “Insured Branch”), a New York state-licensed FDIC-insured branch; Bank Hapoalim B.M. Plaza Branch and Bank Hapoalim Americas Tower Branch, New York state-licensed uninsured branches; Bank Hapoalim B.M. Miami Branch, a Florida state-licensed uninsured branch; and Bank Hapoalim B.M. Los Angeles Representative Office, a California state-licensed representative office. Despite the relatively limited size of its US operations, Bank Hapoalim is subject to US resolution planning requirements under the Dodd-Frank Wall Street Reform and Consumer Protection Act because it has consolidated assets on a global basis of over $50 billion. Because of the relatively limited size and simplified structure of its US operations, Bank Hapoalim’s initial resolution plan, filed in December 2013, was an abbreviated or “tailored” resolution plan and Banks Hapoalim’s second resolution plan, filed in December 2014, was a brief update to its 2013 plan. Based on their review of the 2014 plan, by letter dated July 24, 2015, the FDIC and the Board of Governors of the Federal Reserve System (the “Agencies”) authorized Bank Hapoalim to file a resolution plan that focuses solely on (i) material changes to its 2014 resolution plan; (ii) any actions taken to strengthen the effectiveness of its plan; and (iii) its strategy for ensuring that the Insured Branch will be adequately protected from risks arising from the activities of Bank Hapoalim’s nonbank subsidiaries. -

Public Companies Profiting from Illegal Israeli Settlements on Palestinian Land

Public Companies Profiting from Illegal Israeli Settlements on Palestinian Land Yellow highlighting denotes companies held by the United Methodist General Board of Pension and Health Benefits (GBPHB) as of 12/31/14 I. Public Companies Located in Illegal Settlements ACE AUTO DEPOT LTD. (TLV:ACDP) - owns hardware store in the illegal settlement of Ma'ale Adumim http://www.ace.co.il/default.asp?catid=%7BE79CAE46-40FB-4818-A7BF-FF1C01A96109%7D, http://www.machat.co.il/businesses.php, http://www.nytimes.com/2007/03/14/world/middleeast/14israel.html?_r=3&oref=slogin&oref=slogin&, http://investing.businessweek.com/research/stocks/snapshot/snapshot.asp?ticker=ACDP:IT ALON BLUE SQUARE ISRAEL LTD. (NYSE:BSI) - has facilities in the Barkan and Atarot Industrial Zones and operates supermarkets in many West Bank settlements www.whoprofits.org/company/blue- square-israel, http://www.haaretz.com/business/shefa-shuk-no-more-boycotted-chain-renamed-zol-b-shefa-1.378092, www.bsi.co.il/Common/FilesBinaryWrite.aspx?id=3140 AVGOL INDUSTRIES 1953 LTD. (TLV:AVGL) - has a major manufacturing plant in the Barkan Industrial Zone http://www.unitedmethodistdivestment.com/ReportCorporateResearchTripWestBank2010FinalVersion3.pdf (United Methodist eyewitness report), http://panjiva.com/Avgol-Ltd/1370180, http://www.haaretz.com/print-edition/business/avgol- sees-bright-future-for-nonwoven-textiles-in-china-1.282397 AVIS BUDGET GROUP INC. (NASDAQ:CAR) - leases cars in the illegal settlements of Beitar Illit and Modi’in Illit http://rent.avis.co.il/en/pages/car_rental_israel_stations, http://www.carrentalisrael.com/car-rental- israel.asp?refr= BANK HAPOALIM LTD. (TLV:POLI) - has branches in settlements; provides financing for housing projects in illegal settlements, mortgages for settlers, and financing for the Jerusalem light rail project, which connects illegal settlements with Jerusalem http://www.haaretz.com/print-edition/business/bank-hapoalim-to-lead-financing-for-jerusalem-light-rail-line-1.97706, http://www.whoprofits.org/company/bank-hapoalim BANK LEUMI LE-ISRAEL LTD. -

Domestically Owned Versus Foreign-Owned Banks in Israel

Domestic bank intermediation: domestically owned versus foreign-owned banks in Israel David Marzuk1 1. The Israeli banking system – an overview A. The structure of the banking system and its scope of activity Israel has a highly developed banking system. At the end of June 2009, there were 23 banking corporations registered in Israel, including 14 commercial banks, two mortgage banks, two joint-service companies and five foreign banks. Despite the spate of financial deregulation in recent years, the Israeli banking sector still plays a key role in the country’s financial system and overall economy. It is also highly concentrated – the five main banking groups (Bank Hapoalim, Bank Leumi, First International Bank, Israel Discount Bank and Mizrahi-Tefahot Bank) together accounted for 94.3% of total assets as of June 2009. The two largest groups (Bank Leumi and Bank Hapoalim) accounted for almost 56.8% of total assets. The sector as a whole and the large banking groups in particular are organised around the concept of “universal” banking, in which commercial banks offer a full range of retail and corporate banking services. Those services include: mortgages, leasing and other forms of finance; brokerage in the local and foreign capital markets; underwriting and investment banking; and numerous specialised services. Furthermore, until the mid-1990s, the banking groups were deeply involved in non-financial activities. However, a law passed in 1996 forced the banks to divest their controlling stakes in non-financial companies and conglomerates (including insurance companies). This development was part of a privatisation process which was almost completed in 2005 (with the important exception of Bank Leumi). -

Delek Cover English 04.2006

ANNUAL REPORT 2005 Delek Group Ltd 7, Giborei Israel St., P.O.B 8464, Industrial Zone South, Netanya 42504, Israel Tel: 972 9 8638444, 972 9 8638555 Fax: 972 9 885495 www.delek-group.com Table of Contents: Chapter A Corporate Description Chapter B Director's Report on the Corporation Chapter C Financial Statements for December 31, 2004 Chapter D Additional Information on the Corporation Chapter E MATAV - CABLE SYSTEMS MEDIA LTD IMPORTANT This document is an unofficial translation from the Hebrew original of the 2005 annual report of Delek Group Ltd. that was submitted to the Tel-Aviv Stock Exchange and the Israeli Securities Authority on March 29, 2006. The Hebrew version submitted to the TASE and the Israeli Securities Authority shall be the sole binding version. Investors are urged to review the full Hebrew report. Part One – A Description of the General Development of the Company's Businesses 1. The Company's Activities and the Development of its Business ......................... 3 2. Sectors of Operation .................................................................................................. 6 3. Equity Investments in the Company and Transactions in its Shares................... 7 4. Dividend Distribution ................................................................................................. 8 5. Financial Information Regarding the Group's Sectors........................................... 9 6. The General Environment and Outside Influences................................................. 9 7. Oil Refining Sector -

A Description and Analysis of the Implementation of the Concentration Law and Its Economic

A Description and Analysis of the Implementation of the Concentration Law and Its Economic Impact on the Israeli Economy Written by: Noam Botosh, Economist | Approved by: Ami Tzadik, Head of the Budgetary Control Department Date: February 25rd 2020 Economic Review www.knesset.gov.il/mmm Knesset Research and Information Center 1 | A Description and Analysis of the Implementation of the Concentration Law and Its Economic Impact on the Israeli Economy Summary This review was written at the request of MK Ofer Shelah, and it addresses the implementation of the Law for Promotion of Competition and Reduction of Concentration, 5774-2013 (herein, "the Concentration Law" or "the Law") and provides a preliminary analysis of the Law's impact on the Israeli economy. A Bank of Israel study from 2009 about business groups showed that, compared to other developed countries, the level of concentration in Israel is high, as reflected in the number of existing business groups, and that these groups possess high levels of financial leverage. The study suggested that this structure of business groups may constitute a risk to Israel's financial stability due to the groups' size and complexity. In October 2010, the Committee on Increasing Competitiveness in the Economy was established in order to examine general market competitiveness in Israel—mainly due to the existence of large business groups— and to recommend possible policy tools to promote market competitiveness. According to the committee's interim report, which was published in October 2011, the ownership structure of public companies in Israel is centralized, and the committee identified a phenomenon of large business groups controlling a large share of real and financial assets. -

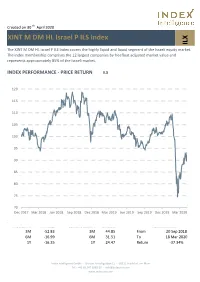

ILX XINT M DM HL Israel P ILS Index

Created on 30 th April 2020 XINT M DM HL Israel P ILS Index ILX The XINT M DM HL Israel P ILS Index covers the highly liquid and liquid segment of the Israeli equity market. The index membership comprises the 12 largest companies by freefloat adjusted market value and represents approximately 85% of the Israeli market. INDEX PERFORMANCE - PRICE RETURN ILX 120 115 110 105 100 95 90 85 80 75 70 Dec 2017 Mar 2018 Jun 2018 Sep 2018 Dec 2018 Mar 2019 Jun 2019 Sep 2019 Dec 2019 Mar 2020 Index Return % annualised Standard Deviation % annualised Maximum Drawdown 3M -52.83 3M 44.85 From 20 Sep 2018 6M -16.99 6M 31.51 To 18 Mar 2020 1Y -16.35 1Y 24.47 Return -37.34% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com TOP 10 Largest Constituents FFMV million Weight Industry Sector Check Point Software Technologies Ltd 17.07% 4,471,198 17.07% Technology Teva Pharmaceutical Industries Ltd 15.55% 4,072,206 15.55% Health Care Nice Ltd 13.77% 3,605,623 13.77% Technology Bank Leumi Le Israel BM 10.57% 2,769,635 10.57% Banks Bank Hapoalim BM 9.74% 2,551,239 9.74% Banks Wix.com Ltd 8.43% 2,206,957 8.43% Technology Israel Discount Bank Ltd 5.05% 1,323,487 5.05% Banks CyberArk Software Ltd 4.94% 1,294,068 4.94% Technology Elbit Systems Ltd 4.40% 1,152,520 4.40% Industrial Goods & Services Mizrahi Tefahot Bank Ltd 3.86% 1,010,693 3.86% Banks Total 24,457,627 93.37% This information has been prepared by Index Intelligence GmbH (“IIG”). -

44644 Report 4C Pgs Interior.Indd

First and foremost, we are committed to delivering quality, affordable healthcare products that improve 2008 ANNUAL REPORT T H E R I G H T P L A C E . Y . T H E R I G H P A N the quality of people’s lives. T T I M E . T H E R I G H T C O M 515 Eastern Avenue Allegan, Michigan 49010 (269) 673-8451 www.perrigo.com 2008 ANNUAL REPORT ©2008 Perrigo Company. All rights reserved. Shareholder Information Directors Executive Offi cers Independent Accountants Joseph C. Papa Through fi scal 2008, Chairman, President and BDO Seidman, LLP Chief Executive Offi cer Grand Rapids, Michigan Judy L. Brown Commencing fi scal 2009, Executive Vice President and Ernst & Young, LLP Chief Financial Offi cer Grand Rapids, Michigan Thomas M. Farrington Senior Vice President and Chief Fiscal 2008 Cash Information Offi cer Dividend Data John T. Hendrickson Fiscal Record Payable Per Share Executive Vice President, Global Quarter Date Date Amount Operations and Supply Chain 1st 8/24/07 9/18/07 $0.045 Moshe Arkin Laurie Brlas Gary M. Cohen Todd W. Kingma Former Vice Chairman, Senior Vice President, Executive Vice President, Executive Vice President, 2nd 11/23/07 12/18/07 $0.050 Perrigo Company Chief Financial Offi cer Becton, Dickinson and Company General Counsel and Secretary Director since 2005 and Treasurer, Director since 2003 3rd 2/22/08 3/18/08 $0.050 Cleveland-Cliffs, Inc. Sharon Kochan Director since 2003 Executive Vice President, U.S. Generics 4th 5/25/08 6/20/08 $0.050 Refael Lebel Executive Vice President and President, Perrigo Israel Shareholder Account Information Jeffrey R. -

Delek Subsidiary, Phoenix, Signs MOU with Bank Hapoalim to Acquire 25% of an Israeli Credit Card Company

Delek Subsidiary, Phoenix, Signs MOU with Bank Hapoalim to Acquire 25% of an Israeli Credit Card Company Tel Aviv, March 11th 2007, Delek Group (TASE: DLEKG) announced today that its subsidiary company The Phoenix Holdings Ltd. (“the Phoenix”), reported that on March 9th 2007 they signed a Memorandum of Understanding with Bank Hapoalim Ltd. (“Bank Hapoalim”), according to which the Phoenix will acquire 25% of total issued share capital of Isracard Ltd. and Europay (Eurocard) Israel Ltd. (“the Companies”). The Companies are fully controlled by Bank Hapoalim. Please find attached below a translation of the detailed press release as issued today by the Phoenix: Phoenix Holdings Ltd. (“the Company”) announces that on 9th March 2007 they signed a memorandum of understanding with Bank Hapoalim Ltd. (“Bank Hapoalim”), according to which the Phoenix will acquire 25% of total issued share capital of Isracard Ltd. and Europay (Eurocard) Israel Ltd. (“the Companies”), that are currently fully controlled by Bank Hapoalim, and Phoenix will be entitled to representation on the Board of Directors, as agreed in the Memorandum of Understanding. The Company will pay a total consideration based on a combined Companies value of NIS 2.55 billion, subject to adjustments for dividend distributions, if, and so long as, the dividends are distributed prior to the date of the completion and execution of the transaction. Should the Companies complete an Initial Public Offering (“IPO”) within the next 15 months, the combined value of the Companies will be amended to reflect 90% of the Companies' IPO value, if and only in the situation where the valuation of the Companies at IPO is above the combined value of NIS2.7 billion. -

Bank Hapoalim BM, Tel-Aviv, Israel 2013 Resolution Plan

Bank Hapoalim B.M., Tel-Aviv, Israel 2013 Resolution Plan – Public Section I. Executive summary – 12 C.F.R. §§ 243.8(c), 381.8(c) Bank Hapoalim is a publicly held banking corporation organized and operating under Israeli law, and subject to comprehensive supervision by the Bank of Israel. With total assets of over $100 billion,1 it is one of the largest banking groups in Israel, and conducts a variety of banking, financial and non- banking activities through over 250 offices in Israel and in more than a dozen other countries. In the United States, Bank Hapoalim owns (through PCM-HSU, a Delaware-incorporated holding company) HSUSA, a Delaware-incorporated SEC-registered broker-dealer that has offices in New York, California, and Florida. Bank Hapoalim also operates a New York state-licensed FDIC-insured branch, two New York state-licensed uninsured branches, a Florida state-licensed uninsured branch, and a California state-licensed representative office which began operations on December 16, 2013. These US operations have combined assets of approximately $9 billion. Despite the relatively limited size of its US operations, Bank Hapoalim is subject to US resolution planning requirements under the Dodd-Frank Wall Street Reform and Consumer Protection Act because it has consolidated assets on a global basis of over $50 billion. However, although it is therefore classified as a foreign-based covered company subject to these requirements, Bank Hapoalim is eligible to file an abbreviated or “tailored” resolution plan by virtue of the size and structure of its US operations. In addition to being able to file a tailored plan, Bank Hapoalim also has determined, consistent with the Regulations and applicable guidance, that it has no critical operations, core business lines, or material entities that are located in the United States or conducted in whole or material part in the United States. -

Class Actions Against Banks Under the New Israeli Law on Class Actions

CLASS ACTIONS AGAINST BANKS UNDER THE NEW ISRAELI LAW ON CLASS ACTIONS * DR. RUTH PLATO SHINAR I. Introduction....................................................................256 II. Causes of Action for Class Actions Against Banks ....... 259 III. The Representative Filing The Action ........................... 264 IV. The Conditions for Certification of a Class Action....... 265 V. Conclusion .................................................................... 281 * Dr. Ruth Plato Shinar is the Senior Lecturer and Director of the Center for Banking Law, Netanya Academic College, Israel. The author wishes to thank the Van Calker Foundation and the Swiss Institute of Comparative law for their generous support of the research for this article, which was principally conducted at the Swiss Institute of Comparative Law in Lausanne, Switzerland during the summer of 2006. 2007 CLASS ACTIONS AGAINST BANKS IN ISRAEL 256 I. INTRODUCTION In March 2006, Israel enacted a modern and far-reaching Class Action Law1 (the “Class Action Law”) to regulate class action suits in a centralized and exhaustive manner. Prior to the law’s enactment, class actions in Israel were common in various fields,2 including banking. The basis for class actions against banks was the Banking (Service to Customer) Law (“the Banking Law”), which contained a chapter on class actions. However, the new Class Action Law abolished this chapter, as well as all other laws concerning Class Actions in different fields, and today the arrangement of class actions is concentrated in -

Figure 1.3 A

Bank Leumi Group Figure 1.3 A. Banking and finance in Israel Bank Leumi Le-Israel Ltd. (1) The structure of Israel's banking system and a Arab Israel Bank Ltd. (1) C. Capital market and financial companies investments in main investee companies , Leumi Mortgage Bank Ltd. (merged with Leumi Card Ltd.(5) Bank Hapoalim Group Bank Leumi Le-Israel Ltd. as of December Leumi Securities and Investments Ltd. (9) December 2012 Leumi Capital Market Services Ltd. (9) 31, 2012) (2) A. Banking and finance in Israel (1) Leumi Leasing and Investments Ltd. (3) The Bank Leumi Le-Israel Trust Co Ltd. (9) Bank Hapoalim Ltd. Leumi Finance Company Ltd. (4) Leumi Partners Ltd. (7)(9) Total assets: NIS 1,301 billion B. Banking and finance abroad (6) Leumi Industrial Development Bank Ltd. (7) D. Non-banking corporations Herfindahl index: H = 0.217 Bank Hapoalim (Switzerland) Ltd. Leumi Real Holdings Ltd. (7) The Israel Corporation Ltd. Bank Hapoalim (Luxembourg) Ltd. Leumi Financial Holdings Ltd. (7) CR 2 = 58% Bank Hapoalim (Cayman Islands) Ltd. B. Banking and finance abroad (6) Bank Hapoalim (Latin America) S.A. Bank Leumi (USA) Bank Pozitif Kredi Ve Kalkinma Bankasi A.S. (with Bank Leumi (UK) plc a holding in JSC Bank Pozitif) Leumi Private Bank S.A. C. Capital market and financial companies (9) Bank Leumi Luxembourg Isracard (5) Bank Leumi Romania Poalim Express Ltd. (5) Leumi International Investments NV Bank Leumi Group, Bank Hapoalim Group, Poalim Capital Markets Ltd. (8) Leumi Re Limited (9) 29% 29% Poalim Sahar Ltd. (9) The Bank Hapoalim Trust Co Ltd. -

Bluestar Israel Global Total Investable Market Index

FACTSHEET BlueStar Israel Global Total Investable Market Index The BlueStar Israel Global Total Investable Market Index (BITM) tracks all Israeli equities, across all sectors of the economy, irrespective of their listing venue. The definition of an Israeli company is based on MVIS's proprietary research-driven framework. BITM covers 100% of the investable universve. Key Features Size and Liquidity Requirements Full MCap of at least 150 mln USD.Three month average-daily-trading volume of at least 1 mln USD at a review and also at the previous two reviews.At least 250,000 shares traded per month over the last six months at a review and also at the previous two reviews. Pure-Play Index includes non-local companies. Diversification Company weightings are capped at 10%. Review All Time High/Low 52-Week High/Low Semiannual in June and December. Total Return Net Index 397.27/92.33 397.27/273.88 Index Data INDEX PARAMETERS FUNDAMENTALS* ANNUALISED PERFORMANCE* Launch Date 31 May 2016 Components 173.00 Price/Earnings Trailing 69.05 1 Month 1.67% Type Country Volatility (1 year) 18.82 Price/Book 2.32 1 Year 28.91% Currency USD Full MCap bn USD 0.32 Price/Sales 2.31 3 Years 12.38% Base Date 31 Dec 2008 Float MCap bn USD 0.32 Price/Cash Flow 11.14 5 Years 11.60% Base Value 100.00 Correlation* (1 year) 0.85 Dividend Yield 1.10 Since Inception 11.37% * as of 31 Jul 2021 * MSCI Daily TR Gross Israel USD * Total Return Net Index Country and Size Weightings COUNTRY WEIGHTINGS EXCL.