Clovis, NM 88101 Table of Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JEWEL-OSCO (Albertsons | Chicago MSA) 12803 Harlem Avenue Palos Heights, Illinois 60463 TABLE of CONTENTS

NET LEASE INVESTMENT OFFERING JEWEL-OSCO (Albertsons | Chicago MSA) 12803 Harlem Avenue Palos Heights, Illinois 60463 TABLE OF CONTENTS TABLE OF CONTENTS I. Executive Profile II. Location Overview III. Market & Tenant Overview Executive Summary Photographs Demographic Report Investment Highlights Drones Market Overview Property Overview Aerial Tenant Overview Rent Schedule Site Plan Map NET LEASE INVESTMENT OFFERING DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. STATEMENT: It is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING EXECUTIVE SUMMARY EXECUTIVE The Boulder Group is pleased to exclusively market for sale the fee simple interest in a single tenant absolute triple net SUMMARY: leased Jewel-Osco grocery store located within the Chicago MSA in Palos Heights, Illinois. -

Star Market Co. Division, Jewel Companies Inc. (Rhode Island Division) and United Food and Commercial Workers, AFL-CIO, Local 328 (1985)

Cornell University ILR School DigitalCommons@ILR Retail and Education Collective Bargaining Agreements - U.S. Department of Labor Collective Bargaining Agreements 6-2-1985 Star Market Co. Division, Jewel Companies Inc. (Rhode Island Division) and United Food and Commercial Workers, AFL-CIO, Local 328 (1985) Follow this and additional works at: https://digitalcommons.ilr.cornell.edu/blscontracts2 Thank you for downloading an article from DigitalCommons@ILR. Support this valuable resource today! This Article is brought to you for free and open access by the Collective Bargaining Agreements at DigitalCommons@ILR. It has been accepted for inclusion in Retail and Education Collective Bargaining Agreements - U.S. Department of Labor by an authorized administrator of DigitalCommons@ILR. For more information, please contact [email protected]. If you have a disability and are having trouble accessing information on this website or need materials in an alternate format, contact [email protected] for assistance. Star Market Co. Division, Jewel Companies Inc. (Rhode Island Division) and United Food and Commercial Workers, AFL-CIO, Local 328 (1985) Location RI; MA; CT Effective Date 6-2-1985 Expiration Date 5-31-1986 Number of Workers 1460 Employer Star Market Co. Division, Jewel Companies Inc. (Rhode Island Division) Union United Food and Commercial Workers Union Local 328 NAICS 44 Sector P Item ID 6178-008b173f019_03 Keywords collective labor agreements, collective bargaining agreements, labor contracts, labor unions, United States Department of Labor, Bureau of Labor Statistics Comments This digital collection is provided by the Martin P. Catherwood Library, ILR School, Cornell University. The information provided is for noncommercial, educational use, only. -

Get Your Seasonal Flu Shot

www.uhcwest.com Protect yourself and those around you. Get your seasonal flu shot. The flu affects millions of people each year and can lead to serious illness, or even death. The flu is a contagious illness caused by influenza viruses that infect the lungs, throat and nose. According to the Centers for Disease Control and Prevention (CDC), the best way to prevent the flu is by getting vaccinated each year.1 Where to get your flu shot There are several ways you can obtain this year’s flu vaccine. Be sure to use a contracted Most UnitedHealthcare network provider such as those listed in this flier. medical plans cover 1. Contact your primary care physician to schedule your annual flu shot. A normal office visit annual flu shots at 100 copayment or coinsurance may apply. percent when you use 2. Visit one of the select retail locations or pharmacies listed on this flier. Vaccine supplies a contracted network may vary by location. provider, such as those Please call in advance for details and present your membership card at the time of service. listed in this flier. Ask (Members in Oklahoma must also present a signed doctor’s order if the flu shot is given by your employer or check a pharmacist.) 3. To locate a network provider, visit www.uhcwest.com or call the Customer Care phone your plan documents number on your health plan ID card. for your specific coverage details. Retail locations and pharmacies2 Members may go to any of the listed select retail pharmacies with their health plan ID card to obtain a flu shot on a walk-in basis. -

PGY1 Community-Based Pharmacy Residency Program Chicago, Illinois

About Albertsons Companies Application Requirements • Albertsons Companies is one of the largest food and drug • Residency program application retailers in the United States, with both a strong local • Personal statement PGY1 Community-Based presence and national scale. We operate stores across 35 • CV or resume states and the District of Columbia under 20 well-known Pharmacy Residency Program banners including Albertsons, Safeway, Vons, Jewel- • Three electronic references Chicago, Illinois Osco, Shaw’s, Haggen, Acme, Tom Thumb, Randalls, • Official transcripts United Supermarkets, Pavilions, Star Market and Carrs. • Electronic application submission via Our vision is to create patients for life as their most trusted https://portal.phorcas.org/ health and wellness provider, and our mission is to provide a personalized wellness experience with every patient interaction. National Matching Service Code • Living up to our mission and vision, we have continuously 142515 advanced pharmacist-provided patient care and expanded the scope of pharmacy practice. Albertsons Companies has received numerous industry recognitions and awards, Contact Information including the 2018 Innovator of the Year from Drug Store Chandni Clough, PharmD News, Top Large Chain Provider of Medication Therapy Management Services by OutcomesMTM for the past 3 Residency Program Director years, and the 2018 Corporate Immunization Champion [email protected] from APhA. (630) 948-6735 • Albertsons Companies is pleased to offer residency positions by Baltimore, Boise, Chicago, Denver, Houston, Philadelphia, Phoenix, Portland, and San Francisco. To build upon the Doctor of Pharmacy (PharmD) education and outcomes to develop www.albertsonscompanies.com/careers/pharmacy-residency-program.html community‐based pharmacist practitioners with diverse patient care, leadership, and education skills who are eligible to pursue advanced training opportunities including postgraduate year two (PGY2) residencies and professional certifications. -

So What Business Are You REALLY In? By: Rob Andrews Formatted: Font: 10 Pt

Formatted: Indent: Left: 0.08", Line spacing: At least 10 pt So what business are you REALLY in? By: Rob Andrews Formatted: Font: 10 pt My contention is that many boards, CEOs, and leadership teams do not fully understand the business they’re in. 74% of acquisitions fail. 23% have a neutral effect, and a miniscule 3% actually result in increased enterprise value, principally due to a lack of understanding of the acquisition. Here is an article citing one perfect example: Jim Dudlicek, Editor-in-Chief of Stagnitomedia, the leading resource periodical for specialty, gourmet, and convenience retailing said it perfectly in an article published October 159, 2013:. I can't say that it was a complete Commented [HB1]: A link ought to be added. Or some surprise to hear of Safeway's decision to pull out of the Chicago market after its 15-year attempt to make a go kind of citation. I find it here, but with Oct 9, 2013 as the of Dominick's. date (and a variety of other changes in the post): http://www.progressivegrocer.com/viewpoints-blogs/aisle- chatter/end-road-dominicks?nopaging=1 But I can say the news came with some sadness. I grew up in the Chicago suburbs, and my family became regular Dominick's shoppers after one opened close enough to home to make straying from our neighborhood Formatted: Font: Italic Jewel a convenient option. As an adult, I remained loyal to the banner, even as ownership passed from the DiMatteo family to Safeway (by way of Yucaipa), even as longtime local customers expressed their discontent with changes to the stores and lack of availability of some of their favorite brands. -

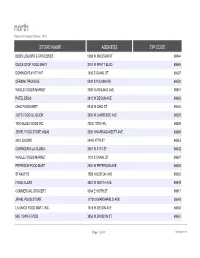

Store Name Address Zip Code

north Based on Grocery Stores - 2013 STORE NAME ADDRESS ZIP CODE BOB'S LIQUORS & GROCERIES 5069 W MADISON ST 60644 QUICK STOP FOOD MART 2751 W PRATT BLVD 60645 DOMINICK'S #147/1147 1340 S CANAL ST 60607 CERMAK PRODUCE 5220 S PULASKI RD 60632 WHOLE FOODS MARKET 3300 N ASHLAND AVE 60657 PATEL BROS 2610 W DEVON AVE 60659 OHIO FOOD MART 5345 W OHIO ST 60644 JOE'S FOOD & LIQUOR 3626 W LAWRENCE AVE 60625 TWO BLUE FOODS INC 702 E 100TH PL 60628 JEWEL FOOD STORE #3349 2520 N NARRAGANSETT AVE 60639 200 LIQUORS 204 E 47TH ST 60653 CARNICERIA LA GLORIA 2551 W 51ST ST 60632 WHOLE FOODS MARKET 1101 S CANAL ST 60607 PETERSON FOOD MART 2534 W PETERSON AVE 60659 STANLEY'S 1558 N ELSTON AVE 60622 FOOD 4 LESS 4821 W NORTH AVE 60639 COMMERCIAL GROCERY 3004 E 100TH ST 60617 JEWEL FOOD STORE 11730 S MARSHFIELD AVE 60643 LA UNICA FOOD MART, INC. 1515 W DEVON AVE 60660 MID TOWN FOODS 3855 W DIVISION ST 60651 Page 1 of 50 09/26/2021 north Based on Grocery Stores - 2013 WARD 28 50 2 23 44 50 37 39 8 36 3 14 2 50 32 37 10 34 40 27 Page 2 of 50 09/26/2021 north Based on Grocery Stores - 2013 7400 S HALSTED FOOD AND LIQUORS, INC. 7400 S HALSTED ST 60621 THREE BROTHER 900 N FRANCISCO AVE 60622 CUENCA'S BAKERY & GROCERIES 4229 W MONTROSE AVE 60641 JEWEL FOOD STORES #3262 4660 W IRVING PARK RD 60641 ROMAN BROS 1 INC 6978 N CLARK ST 60626 TAI NAM CORPORATION 4925 N BROADWAY 60640 LA JALISCIENCE 3239 W 26TH ST 60623 HOLLYWOOD TOWER MKT 5701 N SHERIDAN RD 60660 A & R FOOD MART 5952 W GRAND AVE 60639 S. -

MERGER ANTITRUST LAW Albertsons/Safeway Case Study

MERGER ANTITRUST LAW Albertsons/Safeway Case Study Fall 2020 Georgetown University Law Center Professor Dale Collins ALBERTSONS/SAFEWAY CASE STUDY Table of Contents The deal Safeway Inc. and AB Albertsons LLC, Press Release, Safeway and Albertsons Announce Definitive Merger Agreement (Mar. 6, 2014) .............. 4 The FTC settlement Fed. Trade Comm’n, FTC Requires Albertsons and Safeway to Sell 168 Stores as a Condition of Merger (Jan. 27, 2015) .................................... 11 Complaint, In re Cerberus Institutional Partners V, L.P., No. C-4504 (F.T.C. filed Jan. 27, 2015) (challenging Albertsons/Safeway) .................... 13 Agreement Containing Consent Order (Jan. 27, 2015) ................................. 24 Decision and Order (Jan. 27, 2015) (redacted public version) ...................... 32 Order To Maintain Assets (Jan. 27, 2015) (redacted public version) ............ 49 Analysis of Agreement Containing Consent Orders To Aid Public Comment (Nov. 15, 2012) ........................................................... 56 The Washington state settlement Complaint, Washington v. Cerberus Institutional Partners V, L.P., No. 2:15-cv-00147 (W.D. Wash. filed Jan. 30, 2015) ................................... 69 Agreed Motion for Endorsement of Consent Decree (Jan. 30, 2015) ........... 81 [Proposed] Consent Decree (Jan. 30, 2015) ............................................ 84 Exhibit A. FTC Order to Maintain Assets (omitted) ............................. 100 Exhibit B. FTC Order and Decision (omitted) ..................................... -

United Supermarkets

UNITED SUPERMARKETS 1201 N 23RD STREET | CANYON, TX 79015 REPRESENTATIVE PHOTO EXCLUSIVE MARKETING ADVISORS JARED AUBREY MICHAEL AUSTRY AUSTIN DIAMOND Senior Vice President First Vice President Associate +1 214 252 1031 +1 214 252 1115 +1 214 252 1119 [email protected] [email protected] [email protected] 2 OFFERING SUMMARY PRICE: $6,536,000 CAP RATE: 7.00% NET OPERATING INCOME $457,520 YEAR BUILT 2003 GROSS LEASEABLE AREA 36,258 SF LOT SIZE 4.23 ACRES LEASE TERM 20 YEARS LEASE COMMENCEMENT DECEMBER 2003 LEASE EXPIRATION DECEMBER 2023 REMAINING TERM 4 YEARS LEASE TYPE NNN ROOF & STRUCTURE TENANT RENT INCREASES NONE OPTIONS 4 X 5 OPTIONS TO PURCHASE NONE GUARANTOR CORPORATE 3 INVESTMENT HIGHLIGHTS Strong Corporate Guaranty – United Supermarkets falls under the Albertsons Companies banner, one of the largest food and drug retailers in the United States with over 2,260 retail stores in 34 states and over $60 billion LTM sales. Strong Performing Location with Very Healthy Rent-to-Sales Ratio – Lease also provides the opportunity for additional revenue through a percentage rent clause Absolute NNN Lease with Zero Landlord Responsibilities – Allows an investor the opportunity to acquire a NNN asset on a truly passive income structure Long-Term Tenant – United Supermarkets has been successfully operating at this location since 2003 Large 4.23 Acre Site with Excellent Visibility and Strong Traffic Counts - The property is located just southeast of US Highway 60 with nearly 14,000 vehicles per day Just Minutes From Palo Duro Canyon State Park - The second largest canyon in the country draws nearly 400,000 annual visitors. -

JEWEL-OSCO (Albertsons | Chicago MSA) 4650 W 103Rd Street Oak Lawn, Illinois 60453 TABLE of CONTENTS

NET LEASE INVESTMENT OFFERING JEWEL-OSCO (Albertsons | Chicago MSA) 4650 W 103rd Street Oak Lawn, Illinois 60453 TABLE OF CONTENTS TABLE OF CONTENTS I. Executive Profile II. Location Overview III. Market & Tenant Overview Executive Summary Photographs Demographic Report Investment Highlights Drone Photographs Market Overview Property Overview Aerial Tenant Overview Rent Schedule Site Plan Map NET LEASE INVESTMENT OFFERING DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. STATEMENT: It is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING EXECUTIVE SUMMARY EXECUTIVE The Boulder Group is pleased to exclusively market for sale the fee simple interest in a single tenant absolute triple net SUMMARY: leased Jewel-Osco grocery store located within the Chicago MSA in Oak Lawn, Illinois. -

Supermarkets & Grocery Stores in the US

US INDUSTRY (NAICS) REPORT 44511 Supermarkets & Grocery Stores in the US In the bag: Rising discretionary income is expected to support revenue growth Cecilia Fernandez | November 2020 IBISWorld.com +1-800-330-3772 [email protected] Supermarkets & Grocery Stores in the US 44511 November 2020 Contents About This Industry...........................................5 Competitive Landscape...................................26 Industry Definition..........................................................5 Market Share Concentration....................................... 26 Major Players................................................................. 5 Key Success Factors................................................... 26 Main Activities................................................................5 Cost Structure Benchmarks........................................27 Supply Chain...................................................................6 Basis of Competition...................................................31 Similar Industries........................................................... 6 Barriers to Entry........................................................... 32 Related International Industries....................................6 Industry Globalization..................................................33 Industry at a Glance.......................................... 7 Major Companies............................................34 Executive Summary....................................................... 9 Major Players.............................................................. -

Company Profile

COMPANY PROFILE Market Position and Strategy Overview Albertsons and Safeway completed a merger on January 30, 2015, forming a combined company that is the 2nd largest supermarket chain in the U.S. The Albertsons network now spans over 2,300 stores across 35 states and the District of Columbia under 20 well-known banners including Albertsons, Safeway, Vons, Jewel-Osco, Shaw’s, Acme, Tom Thumb, Randalls, United Supermarkets, Pavilions, Star Market, Amigos and Carrs, as well as meal kit company Plated based in New York City. Together, the retailers net upwards of $59.9 billion in sales yearly and employ 273,000 people. Albertsons is backed by private equity firm Cerberus Capital Management, and is one of the two most active acquirers in the U.S. grocery industry along with The Kroger Co. Post-merger, Albertsons and Safeway created a single, merged management team to better compete against segment leader Kroger and discount rivals such as Walmart. It’s divided into 14 retail divisions, with headquarters based in Phoenix, Boise, ID, and Pleasanton, CA. While division- level leadership is largely responsible for its own sales and profitability, the corporate team serves to deepen relationships with national vendors, set long term strategy and provide data insights to individual chains. The decentralized structure allows the company to combine the local presence of its banners (many of which have long-running operations) with its national scale in order to drive brand recognition, customer loyalty and purchasing, marketing and advertising, and distribution efficiencies. In June 2016, the joint company completed the acquisition of Bellingham, WA-based Haggen, which was facing bankruptcy at the time. -

City Retailer Or Restaurant Address

City Retailer or Restaurant Address ABILENE HEB FOOD STORE #070 ABILENE 1345 BARROW STREET, , ABILENE, TX79605 ADDISON PENNY SAVER FOOD STORE 14330 MARSH LANE, , ADDISON, TX75001 ALGOA WHITES 19838 HWY 6 EAST, , ALGOA, TX77511 ALVIN KROGER #321 3100 I35 SOUTH, , ALVIN, TX77511 ALVIN HEB FOOD STORE #288 207 W SOUTH, , ALVIN, TX77512 ANGLETON SFP LTD SPEC'S LIQUOR SPEC'S W 1201 N VELASCO SUITE B, , ANGLETON, TX77515 ARLINGTON WFM BEV CORP (WHOLEFOODS)(FTX) 801 E LAMAR, , ARLINGTON, TX76011 ARLINGTON KROGER #543 (FTX) 945 W LAMAR, , ARLINGTON, TX76012 AUSTIN PERSONALWINE.COM INC 306 E 3RD ST 'A', , AUSTIN, TX78701 AUSTIN TRAVAASA AUSTIN 13500 FM 2769, , AUSTIN, TX78726 AUSTIN TWIN LIQUORS #10 7301 RR 620N SUITE 105, , AUSTIN, TX78726 AUSTIN RANDALLS #2987 5145 FM 620 N, , AUSTIN, TX78731 AUSTIN TWIN LIQUORS 04 5505 BALCONES DRIVE, , AUSTIN, TX78731 AUSTIN SPEC'S WINES, SPIRITS & FIN#61 4970 HWY 290 WEST BLDG 6 UNIT, STORE 61, AUSTIN, TX78735 AUSTIN HEB 420 AU 22 CENTRAL MARKET 4521 WEST GATE BLVD, CENTRAL MARKET, AUSTIN, TX78745 AUSTIN SPEC'S WINE SPIRITS & FIN #64 9900 IH 35 SERVICE ROAD SOUTH, BUILDING G STORE 64, AUSTIN, TX78748 AUSTIN TWIN LIQUORS #7 1000 E 41ST STREET SUITE 810, HANCOCK CENTER, AUSTIN, TX78751 AUSTIN APPLEJACK WINES & SPIRITS #60 5775 AIRPORT BOULEVARD SUITE 1, STORE 60, AUSTIN, TX78752 AUSTIN SPEC'S WINE SPIRITS & FINER#77 10601 RR 620N SUITE 107, , AUSTIN, TX78753 AUSTIN HEB 061 AU 18 CENTRAL MKT 4001 N LAMAR, , AUSTIN, TX78756 AUSTIN ROLL ON 5350 BURNET ROAD SUITE 2, , AUSTIN, TX78756 AUSTIN SPEC'S WINES SPIRITS & FIN #62 10515 N MOPAC EXPRESSWAY, BLDG K STORE 62, AUSTIN, TX78758 AUSTIN WFM BEVERAGE CORP.