Albertson's, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JEWEL-OSCO (Albertsons | Chicago MSA) 12803 Harlem Avenue Palos Heights, Illinois 60463 TABLE of CONTENTS

NET LEASE INVESTMENT OFFERING JEWEL-OSCO (Albertsons | Chicago MSA) 12803 Harlem Avenue Palos Heights, Illinois 60463 TABLE OF CONTENTS TABLE OF CONTENTS I. Executive Profile II. Location Overview III. Market & Tenant Overview Executive Summary Photographs Demographic Report Investment Highlights Drones Market Overview Property Overview Aerial Tenant Overview Rent Schedule Site Plan Map NET LEASE INVESTMENT OFFERING DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. STATEMENT: It is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING EXECUTIVE SUMMARY EXECUTIVE The Boulder Group is pleased to exclusively market for sale the fee simple interest in a single tenant absolute triple net SUMMARY: leased Jewel-Osco grocery store located within the Chicago MSA in Palos Heights, Illinois. -

4700 Yelm Hwy Se | Lacey, Wa Olympia, Wa Msa

4700 YELM HWY SE | LACEY, WA OLYMPIA, WA MSA SINGLE-TENANT ABSOLUTE NET LEASE | +/- 19.6 YEARS REMAINING I RENT INCREASES THIS INVESTMENT OFFERING MEMORANDUM Seller and Thomas Company each expressly has been prepared by Thomas Company and reserve the right, at their sole discretion, to does not purport to provide a necessarily accurate reject any and all expressions of interest or summary of the Property or any of the documents offers regarding the Property and/or terminate related thereto, nor do they purport to be all discussions with any entity at any time with PLEASE CONTACT inclusive or to contained all of the information or without notice. Seller shall have no legal which prospective investors may need or desire. commitment or obligation to sell the property JEFFREY S. THOMAS All projections have been developed by Seller, to any entity reviewing the Investment Offering Thomas Company and designated sources, Memorandum or making an offer to purchase the THOMAS COMPANY and are based upon assumptions relating to the Property unless and until such offer is approved 210 Third Avenue South general economy, competition and other factors by Seller, a written agreement for the purchase of beyond the control of Seller, and therefore are the Property has been fully executed, delivered Suite 5C subject to variation. No representation is made and approved by Seller and its legal counsel and Seattle, WA 98104 by Seller or Thomas Company as to the accuracy any conditions to Seller’s obligations thereunder 800.775.3350 or completeness of the information contained have been satisfied or waived. -

Star Market Co. Division, Jewel Companies Inc. (Rhode Island Division) and United Food and Commercial Workers, AFL-CIO, Local 328 (1985)

Cornell University ILR School DigitalCommons@ILR Retail and Education Collective Bargaining Agreements - U.S. Department of Labor Collective Bargaining Agreements 6-2-1985 Star Market Co. Division, Jewel Companies Inc. (Rhode Island Division) and United Food and Commercial Workers, AFL-CIO, Local 328 (1985) Follow this and additional works at: https://digitalcommons.ilr.cornell.edu/blscontracts2 Thank you for downloading an article from DigitalCommons@ILR. Support this valuable resource today! This Article is brought to you for free and open access by the Collective Bargaining Agreements at DigitalCommons@ILR. It has been accepted for inclusion in Retail and Education Collective Bargaining Agreements - U.S. Department of Labor by an authorized administrator of DigitalCommons@ILR. For more information, please contact [email protected]. If you have a disability and are having trouble accessing information on this website or need materials in an alternate format, contact [email protected] for assistance. Star Market Co. Division, Jewel Companies Inc. (Rhode Island Division) and United Food and Commercial Workers, AFL-CIO, Local 328 (1985) Location RI; MA; CT Effective Date 6-2-1985 Expiration Date 5-31-1986 Number of Workers 1460 Employer Star Market Co. Division, Jewel Companies Inc. (Rhode Island Division) Union United Food and Commercial Workers Union Local 328 NAICS 44 Sector P Item ID 6178-008b173f019_03 Keywords collective labor agreements, collective bargaining agreements, labor contracts, labor unions, United States Department of Labor, Bureau of Labor Statistics Comments This digital collection is provided by the Martin P. Catherwood Library, ILR School, Cornell University. The information provided is for noncommercial, educational use, only. -

PGY1 Community-Based Pharmacy Residency Program Chicago, Illinois

About Albertsons Companies Application Requirements • Albertsons Companies is one of the largest food and drug • Residency program application retailers in the United States, with both a strong local • Personal statement PGY1 Community-Based presence and national scale. We operate stores across 35 • CV or resume states and the District of Columbia under 20 well-known Pharmacy Residency Program banners including Albertsons, Safeway, Vons, Jewel- • Three electronic references Chicago, Illinois Osco, Shaw’s, Haggen, Acme, Tom Thumb, Randalls, • Official transcripts United Supermarkets, Pavilions, Star Market and Carrs. • Electronic application submission via Our vision is to create patients for life as their most trusted https://portal.phorcas.org/ health and wellness provider, and our mission is to provide a personalized wellness experience with every patient interaction. National Matching Service Code • Living up to our mission and vision, we have continuously 142515 advanced pharmacist-provided patient care and expanded the scope of pharmacy practice. Albertsons Companies has received numerous industry recognitions and awards, Contact Information including the 2018 Innovator of the Year from Drug Store Chandni Clough, PharmD News, Top Large Chain Provider of Medication Therapy Management Services by OutcomesMTM for the past 3 Residency Program Director years, and the 2018 Corporate Immunization Champion [email protected] from APhA. (630) 948-6735 • Albertsons Companies is pleased to offer residency positions by Baltimore, Boise, Chicago, Denver, Houston, Philadelphia, Phoenix, Portland, and San Francisco. To build upon the Doctor of Pharmacy (PharmD) education and outcomes to develop www.albertsonscompanies.com/careers/pharmacy-residency-program.html community‐based pharmacist practitioners with diverse patient care, leadership, and education skills who are eligible to pursue advanced training opportunities including postgraduate year two (PGY2) residencies and professional certifications. -

So What Business Are You REALLY In? By: Rob Andrews Formatted: Font: 10 Pt

Formatted: Indent: Left: 0.08", Line spacing: At least 10 pt So what business are you REALLY in? By: Rob Andrews Formatted: Font: 10 pt My contention is that many boards, CEOs, and leadership teams do not fully understand the business they’re in. 74% of acquisitions fail. 23% have a neutral effect, and a miniscule 3% actually result in increased enterprise value, principally due to a lack of understanding of the acquisition. Here is an article citing one perfect example: Jim Dudlicek, Editor-in-Chief of Stagnitomedia, the leading resource periodical for specialty, gourmet, and convenience retailing said it perfectly in an article published October 159, 2013:. I can't say that it was a complete Commented [HB1]: A link ought to be added. Or some surprise to hear of Safeway's decision to pull out of the Chicago market after its 15-year attempt to make a go kind of citation. I find it here, but with Oct 9, 2013 as the of Dominick's. date (and a variety of other changes in the post): http://www.progressivegrocer.com/viewpoints-blogs/aisle- chatter/end-road-dominicks?nopaging=1 But I can say the news came with some sadness. I grew up in the Chicago suburbs, and my family became regular Dominick's shoppers after one opened close enough to home to make straying from our neighborhood Formatted: Font: Italic Jewel a convenient option. As an adult, I remained loyal to the banner, even as ownership passed from the DiMatteo family to Safeway (by way of Yucaipa), even as longtime local customers expressed their discontent with changes to the stores and lack of availability of some of their favorite brands. -

Food Distribution in the United States the Struggle Between Independents

University of Pennsylvania Law Review FOUNDED 1852 Formerly American Law Register VOL. 99 JUNE, 1951 No. 8 FOOD DISTRIBUTION IN THE UNITED STATES, THE STRUGGLE BETWEEN INDEPENDENTS AND CHAINS By CARL H. FULDA t I. INTRODUCTION * The late Huey Long, contending for the enactment of a statute levying an occupation or license tax upon chain stores doing business in Louisiana, exclaimed in a speech: "I would rather have thieves and gangsters than chain stores inLouisiana." 1 In 1935, a few years later, the director of the National Association of Retail Grocers submitted a statement to the Judiciary Committee of the House of Representatives, I Associate Professor of Law, Rutgers University School of Law. J.U.D., 1931, Univ. of Freiburg, Germany; LL. B., 1938, Yale Univ. Member of the New York Bar, 1941. This study was originally prepared under the auspices of the Association of American Law Schools as one of a series of industry studies which the Association is sponsoring through its Committee on Auxiliary Business and Social Materials for use in courses on the antitrust laws. It has been separately published and copyrighted by the Association and is printed here by permission with some slight modifications. The study was undertaken at the suggestion of Professor Ralph F. Fuchs of Indiana University School of Law, chairman of the editorial group for the industry studies, to whom the writer is deeply indebted. His advice during the preparation of the study and his many suggestions for changes in the manuscript contributed greatly to the improvement of the text. Acknowledgments are also due to other members of the committee, particularly Professors Ralph S. -

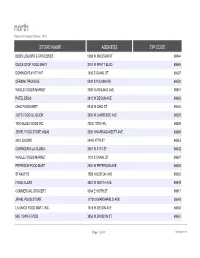

Store Name Address Zip Code

north Based on Grocery Stores - 2013 STORE NAME ADDRESS ZIP CODE BOB'S LIQUORS & GROCERIES 5069 W MADISON ST 60644 QUICK STOP FOOD MART 2751 W PRATT BLVD 60645 DOMINICK'S #147/1147 1340 S CANAL ST 60607 CERMAK PRODUCE 5220 S PULASKI RD 60632 WHOLE FOODS MARKET 3300 N ASHLAND AVE 60657 PATEL BROS 2610 W DEVON AVE 60659 OHIO FOOD MART 5345 W OHIO ST 60644 JOE'S FOOD & LIQUOR 3626 W LAWRENCE AVE 60625 TWO BLUE FOODS INC 702 E 100TH PL 60628 JEWEL FOOD STORE #3349 2520 N NARRAGANSETT AVE 60639 200 LIQUORS 204 E 47TH ST 60653 CARNICERIA LA GLORIA 2551 W 51ST ST 60632 WHOLE FOODS MARKET 1101 S CANAL ST 60607 PETERSON FOOD MART 2534 W PETERSON AVE 60659 STANLEY'S 1558 N ELSTON AVE 60622 FOOD 4 LESS 4821 W NORTH AVE 60639 COMMERCIAL GROCERY 3004 E 100TH ST 60617 JEWEL FOOD STORE 11730 S MARSHFIELD AVE 60643 LA UNICA FOOD MART, INC. 1515 W DEVON AVE 60660 MID TOWN FOODS 3855 W DIVISION ST 60651 Page 1 of 50 09/26/2021 north Based on Grocery Stores - 2013 WARD 28 50 2 23 44 50 37 39 8 36 3 14 2 50 32 37 10 34 40 27 Page 2 of 50 09/26/2021 north Based on Grocery Stores - 2013 7400 S HALSTED FOOD AND LIQUORS, INC. 7400 S HALSTED ST 60621 THREE BROTHER 900 N FRANCISCO AVE 60622 CUENCA'S BAKERY & GROCERIES 4229 W MONTROSE AVE 60641 JEWEL FOOD STORES #3262 4660 W IRVING PARK RD 60641 ROMAN BROS 1 INC 6978 N CLARK ST 60626 TAI NAM CORPORATION 4925 N BROADWAY 60640 LA JALISCIENCE 3239 W 26TH ST 60623 HOLLYWOOD TOWER MKT 5701 N SHERIDAN RD 60660 A & R FOOD MART 5952 W GRAND AVE 60639 S. -

MERGER ANTITRUST LAW Albertsons/Safeway Case Study

MERGER ANTITRUST LAW Albertsons/Safeway Case Study Fall 2020 Georgetown University Law Center Professor Dale Collins ALBERTSONS/SAFEWAY CASE STUDY Table of Contents The deal Safeway Inc. and AB Albertsons LLC, Press Release, Safeway and Albertsons Announce Definitive Merger Agreement (Mar. 6, 2014) .............. 4 The FTC settlement Fed. Trade Comm’n, FTC Requires Albertsons and Safeway to Sell 168 Stores as a Condition of Merger (Jan. 27, 2015) .................................... 11 Complaint, In re Cerberus Institutional Partners V, L.P., No. C-4504 (F.T.C. filed Jan. 27, 2015) (challenging Albertsons/Safeway) .................... 13 Agreement Containing Consent Order (Jan. 27, 2015) ................................. 24 Decision and Order (Jan. 27, 2015) (redacted public version) ...................... 32 Order To Maintain Assets (Jan. 27, 2015) (redacted public version) ............ 49 Analysis of Agreement Containing Consent Orders To Aid Public Comment (Nov. 15, 2012) ........................................................... 56 The Washington state settlement Complaint, Washington v. Cerberus Institutional Partners V, L.P., No. 2:15-cv-00147 (W.D. Wash. filed Jan. 30, 2015) ................................... 69 Agreed Motion for Endorsement of Consent Decree (Jan. 30, 2015) ........... 81 [Proposed] Consent Decree (Jan. 30, 2015) ............................................ 84 Exhibit A. FTC Order to Maintain Assets (omitted) ............................. 100 Exhibit B. FTC Order and Decision (omitted) ..................................... -

FTC V. Whole Foods Market (D.C. Cir.)

PUBLIC COPY - SEALED MATERIAL DELETED ORAL ARGUMENT NOT YET SCHEDULED No. 07-5276 IN THE UNITED STATES COURT OF APPEALS FOR THE DISTRICT OF COLUMBIA CIRCUIT FEDERAL TRADE COMMISSION, Plaintiff-Appellant, v. WHOLE FOODS MARKET, INC., and WILD OATS MARKETS, INC., Defendants-Appellees. Appeal from the United States District Court for the District of Columbia, Civ. No. 07-cv-Ol021-PLF PROOF BRIEF FOR APPELLANT FEDERAL TRADE COMMISSION JEFFREY SCHMIDT WILLIAM BLUMENTHAL Director General Counsel Bureau of Competition JOHN D. GRAUBERT KENNETH L. GLAZER Principal Deputy General Counsel Deputy Director JOHNF.DALY MICHAEL J. BLOOM Deputy General Counsel for Litigation Director of Litigation MARILYN E. KERST THOMAS J. LANG Attorney THOMAS H. BROCK Federal Trade Commission CATHARINE M. MOSCATELLI 600 Pennsylvania Ave., N.W. MICHAEL A. FRANCHAK Washington, D.C. 20580 JOAN L. HElM Ph. (202) 326-2158 Attorneys Fax (202) 326-2477 CERTIFICATE AS TO PARTIES, RULINGS, AND RELATED CASES Pursuant to Circuit Rule 28(1)(1), Appellant Federal Trade Commission certifies as follows: (A) PARTIES FEDERAL TRADE COMMISSION (Plaintiff) WHOLE FOODS MARKET, INC. (Defendant) WILD OATS MARKETS, INC. (Defendant) APOLLO MANAGEMENT HOLDING LP (Intervenor) DELHAIZE AMERICA. INC. (Interested Party) H.E. BUTT GROCERY COMPANY (Intervenor) KROGER CO. (Intervenor) PUBLIX SUPER MARKETS, INC. (Intervenor) SAFEWAY INC. (Intervenor) SUPERVALU INC (Intervenor) TRADER JOE'S COMPANY (Intervenor) TARGET CORPORATION (Movant) WAL-MART STORES, INC. (Intervenor) WINN-DIXIE STORES INC (Intervenor) WEGMANS FOOD MARKETS, INC. (Movant) AMICI CURIAE AMERICAN ANTITRUST INSTITUTE CONSUMER FEDERATION OF AMERICA ORGANIZATION FOR COMPETITIVE MARKETS (B) RULING UNDER REVIEW Federal Trade Commission v. Whole Foods Market, Inc., 502 F. -

Predictability in Merger Enforcement After California V. American Stores: Current Uncertainties and a Proposal for Change

Case Western Reserve Law Review Volume 42 Issue 2 Article 7 1992 Predictability in Merger Enforcement after California v. American Stores: Current Uncertainties and a Proposal for Change Wayne H. Elowe Follow this and additional works at: https://scholarlycommons.law.case.edu/caselrev Part of the Law Commons Recommended Citation Wayne H. Elowe, Predictability in Merger Enforcement after California v. American Stores: Current Uncertainties and a Proposal for Change, 42 Case W. Rsrv. L. Rev. 599 (1992) Available at: https://scholarlycommons.law.case.edu/caselrev/vol42/iss2/7 This Note is brought to you for free and open access by the Student Journals at Case Western Reserve University School of Law Scholarly Commons. It has been accepted for inclusion in Case Western Reserve Law Review by an authorized administrator of Case Western Reserve University School of Law Scholarly Commons. PREDICTABILITY IN MERGER ENFORCEMENT AFTER CALIFORNIA v. AMERICAN STORES: CURRENT UNCERTAINTIES AND A PROPOSAL FOR CHANGE INTRODUCTION In the 1990 decision California v. American stores, the Su- preme Court unanimously held that divestiture is a remedy avail- able to states and private plaintiffs under section 16 of the Clayton Act. In this note, the author argues that by allowing the states to seek divestiture, the American Stores decision makes it more diffi- cult for firms complying with the federal enforcement authorities to predict whether their mergers will subsequently be challenged by state authorities. To remedy this problem, the author proposes changes -

JEWEL-OSCO (Albertsons | Chicago MSA) 4650 W 103Rd Street Oak Lawn, Illinois 60453 TABLE of CONTENTS

NET LEASE INVESTMENT OFFERING JEWEL-OSCO (Albertsons | Chicago MSA) 4650 W 103rd Street Oak Lawn, Illinois 60453 TABLE OF CONTENTS TABLE OF CONTENTS I. Executive Profile II. Location Overview III. Market & Tenant Overview Executive Summary Photographs Demographic Report Investment Highlights Drone Photographs Market Overview Property Overview Aerial Tenant Overview Rent Schedule Site Plan Map NET LEASE INVESTMENT OFFERING DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. STATEMENT: It is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING EXECUTIVE SUMMARY EXECUTIVE The Boulder Group is pleased to exclusively market for sale the fee simple interest in a single tenant absolute triple net SUMMARY: leased Jewel-Osco grocery store located within the Chicago MSA in Oak Lawn, Illinois. -

How Retailers Can Keep up with Consumers

OCTOBER 2013 How retailers can keep up with consumers Ian MacKenzie, Chris Meyer, and Steve Noble The retail industry is more dynamic than ever. US retailers must evolve to succeed in the next decade. The North American retail landscape looks quite different today than it did even ten years ago. The way that consumers make purchasing decisions has dramatically altered: they stand in stores, using their smartphones to compare prices and product reviews; family and friends instantly weigh in on shopping decisions via social media; and when they’re ready to buy, an ever- growing list of online retailers deliver products directly to them, sometimes on the same day. These shifts have led a number of industry observers to forecast the end of retail as we know it. Some predict that retail will change more in the next five years than it has over the past century and that the extinction of brick-and-mortar stores isn’t far off. Our view is less dramatic, but we do believe that big changes are inevitable and that retailers must act now to win in the long term. There is historical precedent for this kind of upheaval, which recasts the industry’s winners and losers. Within the past century, local corner stores gave way to department stores and supermarkets, then to suburban shopping malls, then to discount chains and big-box retailers. Each of these shifts unfolded faster than the one that preceded it, and each elevated new companies over incumbents. Indeed, six of the ten largest US retailers in 1990 have since fallen from their positions as new winners, such as Amazon.com, Costco, and Walgreens, emerged in their place (Exhibit 1).