Berlin International University of Applied Sciences

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Data Standards Manual Summary of Changes

October 2019 Visa Public gfgfghfghdfghdfghdfghfghffgfghfghdfghfg This document is a supplement of the Visa Core Rules and Visa Product and Service Rules. In the event of any conflict between any content in this document, any document referenced herein, any exhibit to this document, or any communications concerning this document, and any content in the Visa Core Rules and Visa Product and Service Rules, the Visa Core Rules and Visa Product and Service Rules shall govern and control. Merchant Data Standards Manual Summary of Changes Visa Merchant Data Standards Manual – Summary of Changes for this Edition This is a global document and should be used by members in all Visa Regions. In this edition, details have been added to the descriptions of the following MCCs in order to facilitate easier merchant designation and classification: • MCC 5541 Service Stations with or without Ancillary Services has been updated to include all engine fuel types, not just automotive • MCC 5542 Automated Fuel Dispensers has been updated to include all engine fuel types, not just automotive • MCC 5812 Eating Places, Restaurants & 5814 Fast Food Restaurants have been updated to include greater detail in order to facilitate easier segmentation • MCC 5967 Direct Marketing – Inbound Telemarketing Merchants has been updated to include adult content • MCC 6540 Non-Financial Institutions – Stored Value Card Purchase/Load has been updated to clarify that it does not apply to Staged Digital Wallet Operators (SDWO) • MCC 8398 Charitable Social Service Organizations has -

Notice of Annual General Meeting 24 July 2018 at 1.00 P.M

Notice of Annual General Meeting 24 July 2018 at 1.00 p.m. (CEST) to be held at World Trade Centre I Route de l’Aéroport 10 1216 Cointrin Geneva, Switzerland THIS NOTICE IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of the proposals referred to in this Notice or as to the action you should take, you should seek advice from a stockbroker, bank manager, solicitor, accountant or other independent professional adviser who is duly authorised under the Financial Services and Markets Act 2000 if you are in the United Kingdom, or another appropriately authorised independent adviser if you are in a territory outside the United Kingdom. If you have sold or otherwise transferred all of your ordinary shares in Wizz Air Holdings Plc please send this Notice, together with the accompanying documents, at once to the relevant purchaser or transferee, or to the stockbroker, bank or agent through whom the sale or transfer was effected for transmission to the relevant purchaser or transferee. A Form of Proxy for use at the Annual General Meeting is enclosed with this Notice. Notes on completing and returning the Form of Proxy can be found in the Form of Proxy and this Notice and should be read carefully before the Form of Proxy is completed. Wizz Air Holdings Plc Notice of Annual General Meeting EU-DOCS\21196750.7 Wizz Air Holdings Plc Company Number: 103356 44 Esplanade, St. Helier JE4 9WG Jersey, Channel Islands 24 May 2018 Dear Shareholder, ANNUAL GENERAL MEETING OF THE COMPANY – 24 JULY 2018 I am pleased to enclose the Notice convening the forthcoming annual general meeting (“AGM”) of Wizz Air Holdings Plc (the “Company”) which will be held at World Trade Centre I, Route de l’Aéroport 10, 1216 Cointrin, Geneva, Switzerland on 24 July 2018 at 1.00 p.m. -

JH Inv Funds Series I OEIC AR 05 2021.Indd

ANNUAL REPORT & ACCOUNTS For the year ended 31 May 2021 Janus Henderson Investment Funds Series I Janus Henderson Investment Funds Series I A Who are Janus Henderson Investors? Global Strength 14% 13% £309.6B 55% 45% 31% 42% Assets under Over 340 More than 2,000 25 Over 4,300 management Investment professionals employees Offi ces worldwide companies met by investment teams in 2020 North America EMEA & LatAm Asia Pacifi c Source: Janus Henderson Investors, Staff and assets under management (AUM) data as at 30 June 2021. AUM data excludes Exchange-Traded Note (ETN) assets. Who we are Janus Henderson Investors (‘Janus Henderson’) is a global asset manager off ering a full suite of actively managed investment products across asset classes. As a company, we believe the notion of ‘connecting’ is powerful – it has shaped our evolution and our world today. At Janus Henderson, we seek to benefi t clients through the connections we make. Connections enable strong relationships based on trust and insight aswell as the fl ow of ideas among our investment teams and our engagement with companies. These connections are central to our values, to what active management stands for and to the long-term outperformance we seek to deliver. Our commitment to active management off ers clients the opportunity to outperform passive strategies over the course of market cycles. Through times of both market calm and growing uncertainty, our managers apply their experience weighing risk versus reward potential – seeking to ensure clients are on the right side of change. Why Janus Henderson Investors At Janus Henderson, we believe in linking our world-class investment teams and experienced global distribution professionals with our clients around the world. -

Monthly OTP July 2019

Monthly OTP July 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This July result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG pleas [email protected] MAKE SMARTER MOVES Airline Monthly OTP – July 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size SATA International-Azores GA Garuda Indonesia 93.9% 1 13,798 52 S4 30.8% 160 833 253 Airlines S.A. XL LATAM Airlines Ecuador 92.0% 2 954 246 ZI Aigle Azur 47.8% 159 1,431 215 HD AirDo 90.2% 3 1,806 200 OA Olympic Air 50.6% 158 7,338 92 3K Jetstar Asia 90.0% 4 2,514 168 JU Air Serbia 51.6% 157 3,302 152 CM Copa Airlines 90.0% 5 10,869 66 SP SATA Air Acores 51.8% 156 1,876 196 7G Star Flyer 89.8% 6 1,987 193 A3 Aegean Airlines 52.1% 155 5,446 114 BC Skymark Airlines 88.9% 7 4,917 122 WG Sunwing Airlines Inc. -

17 1 3 Ifm Mag Rfq Submission

Confidential [email protected] 2020-01-16 15:20:10 +0000 St. Louis Lambert International Airport RFQ Submission November 1, 2019 ifm MAG 1 Cover letter ........................................................................................................................................................................ 1 2 Executive Summary and Strategic Rationale ....................................................................................................................... 2 3 Description of the IFM Investors Team ............................................................................................................................... 4 3.1 Description of Team Members .................................. ........................ ..................... .. ...................... .. ...................... .. ................ .. 4 4 Operational and Management Capability ........................................................................................................................... 5 4.1 Operational and Maintenance Expertise ............................................................................................................ ................ .. .... .. 6 4.2 Capital Improvement Experience ................... ...... .. ................ ...... .. ................ .. ... ...... .. ... ............. ...... .. ... ............. ...... .. ... ........... 15 4.3 Customer Service ......................................................................................................................................... -

Schroder UK Mid Cap Fund

Schroder UK Mid Ca p Fund plc Half Year Report and Accounts For the six months ended 31 March 2020 Key messages – Portfolio of “high conviction” stocks aiming to provide a total return in excess of the FTSE 250 (ex-Investment Companies) Index and an attractive level of yield. – Dividend has tripled since 2007 as portfolio investments have captured the cash generative nature of investee companies, in a market where income has become an increasingly important part of our investors’ anticipated returns. – Provides exposure to dynamic mid cap companies that have the potential to grow to be included in the FTSE 100 index, which are at an interesting point in their life cycle, and/or which could ultimately prove to be attractive takeover targets. – Proven research driven investment approach based on the Manager’s investment process allied with a strong selling discipline. – Managed by Andy Brough and Jean Roche with a combined 50 years’ investment experience 1, the fund has a consistent, robust and repeatable investment proces s. 1Andy Brough became Lead Manager on 1 April 2016 . Investment objective Schroder UK Mid Cap Fund plc’s (the “Company”) investment objective is to invest in mid cap equities with the aim of providing a total return in excess of the FTSE 250 (ex -Investment Companies) Index. Investment policy The strategy is to invest principally in the investment universe associated with the benchmark index, but with an element of leeway in investment remit to allow for a conviction-driven approach and an emphasis on specific companies and targeted themes. The Company may also invest in other collective investment vehicles where desirable, for example to provide exposure to specialist areas within the universe. -

Investment in Air Transport Infrastructure

Guidance for developing private participation Infrastructure Transport Air Investment in Public Disclosure Authorized Investment in Air Transport Infrastructure Guidance for developing Public Disclosure Authorized private participation Mustafa Zakir Hussain, Editor With case studies prepared by Booz Allen Hamilton Public Disclosure Authorized Public Disclosure Authorized Investment in Air Transport Infrastructure Guidance for developing private participation Investment in Air Transport Infrastructure Guidance for developing private participation Mustafa Zakir Hussain, Editor With case studies prepared by Booz Allen Hamilton © 2010 The International Bank for Reconstruction and Development / The World Bank 1818 H Street NW Washington DC 20433 Telephone: 202-473-1000 Internet: www.worldbank.org E-mail: [email protected] All rights reserved The findings, interpretations, and conclusions expressed herein are those of the author(s) and do not necessarily reflect the views of the Executive Direc- tors of the International Bank for Reconstruction and Development / The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorse- ment or acceptance of such boundaries. Rights and Permissions The material in this publication is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of appli- cable law. The International Bank for Reconstruction and Development / The World Bank encourages dissemination of its work and will normally grant permission to reproduce portions of the work promptly. -

An Intelligent Framework for Dynamic Web Services Composition in the Semantic Web

AN INTELLIGENT FRAMEWORK FOR DYNAMIC WEB SERVICES COMPOSITION IN THE SEMANTIC WEB DHAVALKUMAR THAKKER A thesis submitted in partial fulfilment of the requirements of Nottingham Trent University for the degree of Doctor of Philosophy October 2008 This work is the intellectual property of the author, and may also be owned by the research sponsor(s) and/or Nottingham Trent University. You may copy up to 5% of this work for private study, or personal, non-commercial research. Any re-use of the information contained within this document should be fully referenced, quoting the author, title, university, degree level and pagination. Queries or requests for any other use, or if a more substantial copy is required, should be directed in the first instance to the author. Acknowledgements Acknowledgements I would like to express my deep and sincere gratitude to my director of studies, Dr Taha Osman. His expertise, understanding, encouragement and personal guidance have provided an excellent basis for the present thesis. I would also like to extend thanks to my supervisors, Dr Evtim Peytchev and Professor David Al-Dabass for their guidance, advice, and input regarding this research. I am also grateful to the Maryland Information and Network Dynamics Lab Semantic Web Agents Project (MINDSWAP) members Bijan Parsia and Evren Sirin for providing open source access to the OWL reasoners Pellet and the OWL-S API. I believe that intensive courses like PhD are impossible to succeed without the patience and support of a caring family. I owe my loving thanks to my wife Neha, without her encouragement and understanding it would have been impossible for me to finish this work. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

The Week Ahead, 5Th October 2020

The Week Ahead, 5th October 2020 ANALYSTS BACKGROUND Fiona has a deep understanding of market fundamentals gained through 14 years’ experience in the financial markets. She provides up to the minute analysis and insight into the financial markets, as well as the broader economy and monetary policy in the UK, Europe, US and Asia. She is regularly quoted in the global financial press, with her name often seen on Bloomberg, Reuters, Financial Times and the Telegraph. Fiona is a familiar face after years of regular TV appearances across the globe on the likes of BBC, Sky News and Reuters. Our pick of the top macro data points and companies reporting this week. Those in bold are discussed below. ECONOMIC DATA Global Services PMI UK Services PMI Monday 5th October EZ Retail Sales US ISM Non-Mfg RBA Rate Decision UK Construction PMI Tuesday 6th October Germany Factory Orders US Trade Balance German Industrial Production Halifax House Prices Wednesday 7th October EIA Crude Inventories US FOMC Minutes Germany Trade Balance Thursday 8th October US Initial Jobless Claims China Caixin Services PMI Friday 9th October UK Trade Balance UK Monthly GDP COMPANY ANNOUNCEMENTS Monday 5th October Wizz Air Ferrexpo Restaurant Group Tuesday 6th October easyJet Air France KLM Levi Strauss (US) Wednesday 7th October Tesco Imperial Brands GVC Thursday 8th October Electrocomponents CMC Markets Delta Air (US) JD Wetherspoons (delayed) Friday 9th October Stagecoach KEY THEME Trump, Covid & Brexit Risk aversion surged at the end of last week after President Trump unexpectedly contracted Covid with just one month to go until the US Presidential elections. -

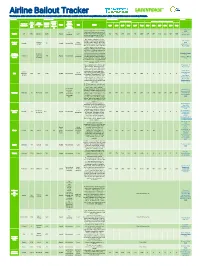

European Airline Bailout Tracker Reflects the Most up to Date Public Information Available at the Time It Was Published on June 9, 2021

Airline Bailout Tracker This European airline bailout tracker reflects the most up to date public information available at the time it was published on June 9, 2021. Financial data based on research by Profundo. Company Bailout amount Financial results Sources Amount Binding Net profits (mln €) Dividends + share buybacks (mln €) 2018 Airline/ Amount (mln €) - climate Country of Passen subsidiarie (mln €) - Under Status conditions Type Details registration gers 2019 2018 2017 2016 2015 Total 2019 2018 2017 2016 2015 Total (mln) s Agreed discussi Private on dividend ban Guardian, 6 April An initial government loan of GBP 2020 600m (ca €670m) was provided at No Reuters, 11 EasyJet UK 88.5 EasyJet 2240 Agreed Loan the start of the crisis, followed with a 393 402 246 505 742 2288 214 281 195 272 421 1383 dividends January 2021 government backed loan of GBP 1,4 bn (ca €1,570m) in January 2021. One-quarter of Norway’s rescue package for airlines (loan guarantee e24, 20 April Regional Regional Loan of NOK 6 billion ($549 million)) will 2020 Norway 121 Agreed No condition - - - - - - - - - - - - carriers carriers guarantee be divided between Widerøe, which Aeronautics, 20 offers key regional service, and other March 2020 small regional airline operators. Total pot of €455m has been made available to all airlines registered in Sweden. SAS has been loaned €137m and that has been deducted Euractiv, 13 April All airlines All airlines Loan from this amount and included in the 2020 operating in Sweden operating 318 Agreed No condition - - - - - - - - - - - - guarantee overall support provided to SAS by Finans, 17 March Sweden in Sweden Sweden and other countries, detailed 2020 the row below. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore