For Official Use DAFFE/COMP/WD(2004)41

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Aerologic, Air Berlin, Austrian Airlines, Avanti Air, Condor, Edelweiss

Christian Riedel ansgar Sinnecker arne Bierhals arne Haidle adi Fuchs Bernd Oettinger edgar Hartmans Hans Dieterich Bruno Speck Markus Kirchler David Kromka Friederike Masson Dean Masson Christoph Zogg AeroLogic Air Berlin Sun Express Lufthansa Austrian Condor AeroLogic Swiss Edelweiss Austrian Condor Germania Germania Edelweiss Hans Reichert georg Manhart Frederick Mey Karl Peter Ritter Karl Kistler nila Kiefer Jarin Beikes norbert Wittmann Florian Hofer Michael Hüsser Dieter Hensel Kevin Fuchs Judith Kümmel gerhard Knäbel Austro Control Austrian AeroLogic Condor Edelweiss TMA Germania Austrian Condor InterSky Lufthansa Swiss Austrian Condor Julian alexander Hans-georg Katharina Stephan Benjamin Jan Mühle mann aleksandar Karl-Heinz Holger Susanne Maximilian Stephan asok Sebastian Benedikt gierth Rabacher Heimann Kuzmanov Krottenmüller Deloséa Rasovic Jacobsen Schweickert Scheithauer Keydel Sukumar Oehlert Buchholz TMA Aviation Academy A. Condor Germania Air Berlin Swiss Austrian Condor Etihad Airways Austrian Germania Etihad Airways Lufthansa Air Berlin Ferdinand de Frank Lumnitzer Ja, iCH FLi ege geRn! Dr. Reinhard Heiko Schmidt Correvont Lufthansa Wenn man jüngsten Artikeln in diversen Medien Glauben schenken darf, allen Berufen scheint auch im Piloten-Alltag nicht immer nur die Sonne, Condor Lernbeiss Condor ist der Beruf des Airline-Piloten alles andere als ein Traumjob und eine dennoch vertreten die auf diesen Seiten versammelten Flugzeugführer Austrian Karriere im Cockpit alles andere als erstrebenswert. Natürlich: Wie bei einhellig -

Global Aviation Monitor (GAM)

Institute of Air Transport and Airport Research Global Aviation Monitor (GAM) Analysis and Short Term Outlook of Global, European and German Air Transport June 2018 Institute of Air Transport and Global Aviation Monitor (GAM) Airport Research June 2018 Main Results of Global Air Transport Supply Analysis and Outlook Background: Covers about 3,500 airports worldwide Covers about 850 airlines worldwide Air transport supply of 2017: More than 37 M flights (non-stop) worldwide, new record value Busiest month so far in 2018: June with 3.3 M flights Air traffic increases slowly since April 2013 Forecasting methodology: Time series analysis The mean absolute forecast error over a twelve month period typically lies in a range of between 0.5 and 1.5 percentage points for a forecast horizon of 1, 2 & 3 months. Analysis: July 2017 – June 2018 Global History: About 5 % growth per year before financial crisis 2008/2009, then a rapid decline of more than 9 % between February 2008 and February 2009, followed by a rather slow recovery until 2011 (7.2 % increase between February 2009 and February 2011). Since 2011, the number of flights grows only very slowly; stagnation between September 2012 and March 2013, small growth rates since April 2013; growth rates of around 3 % since March 2015, 3.0 %- 6.3 % between December 2015 and June 2018 March 2018: 3.3 M flights supplied (+5.1 %) Airports: Heterogeneous development of no. of flights offered; strong growth e.g. at Jakarta and Frankfurt (10 % and more) Airlines: Heterogeneous development of no. of flights offered; strong growth e.g. -

The Impacts of Globalisation on International Air Transport Activity

Global Forum on Transport and Environment in a Globalising World 10-12 November 2008, Guadalajara, Mexico The Impacts of Globalisation on International Air Transport A ctivity Past trends and future perspectives Ken Button, School of George Mason University, USA NOTE FROM THE SECRETARIAT This paper was prepared by Prof. Ken Button of School of George Mason University, USA, as a contribution to the OECD/ITF Global Forum on Transport and Environment in a Globalising World that will be held 10-12 November 2008 in Guadalajara, Mexico. The paper discusses the impacts of increased globalisation on international air traffic activity – past trends and future perspectives. 2 TABLE OF CONTENTS NOTE FROM THE SECRETARIAT ............................................................................................................. 2 THE IMPACT OF GLOBALIZATION ON INTERNATIONAL AIR TRANSPORT ACTIVITY - PAST TRENDS AND FUTURE PERSPECTIVE .................................................................................................... 5 1. Introduction .......................................................................................................................................... 5 2. Globalization and internationalization .................................................................................................. 5 3. The Basic Features of International Air Transportation ....................................................................... 6 3.1 Historical perspective ................................................................................................................. -

Experts in Aviation Consultancy Our Consultancy

PROLOGIS – Experts in Aviation Consultancy Previous Projects – A Selection With offices in Germany and Abu Dhabi,PROLOGIS are one of the leading consultancy specialists within the airline industry. Here you can find brief summaries of just some of the projects that PROLOGIS has Built upon years of experience in international and interdisciplinary projects, we offer highly qualified consultancy services successfully completed. We would be happy to provide you with more information, for airline customers worldwide. or supply references if required. With the benefit of more than 15 years’ experience,PROLOGIS has in-depth expertise in a broad range of areas of the airline busi- ness. We are well aware of the dramatic changes within the aviation industry over recent years, and have been supporting airlines to On the Path to a Hybrid Business Model implement processes and systems which are capable of facing increased competition and managing new business models. Several airlines including TUIFly, Germania and Sun Express, took the decision to enhance their business models; PROLOGIS supported To date PROLOGIS has lead projects for more than 40 regional and international airlines in key business areas such as: change processes from their previous status as either a charter, network or low cost carrier, into a hybrid airline. • Revenue Management and Distribution • Reporting, MIS & Data Warehousing Hapag Lloyd Express (HLX) began life as a pure low-cost carrier. Its desire • Ground Operations and Airport Processes • Electronic Document Management & Exchange to add charter allotments to the business caused increased complexity in the areas of • Revenue Accounting • System Integration and Migration Sales and Revenue Management. -

Pressemitteilung Oliver Lackmann Neu Im BDF-Vorstand

Pressemitteilung Oliver Lackmann neu im BDF-Vorstand Berlin, am 27. November 2018 Auf der gestrigen Mitgliederversammlung des Bundesverbandes der Deutschen Fluggesellschaften e.V. (BDF) in Köln wurde Oliver Lackmann, Geschäftsführer der TUIfly GmbH, in den Vorstand des BDF gewählt. Oliver Lackmann (49) ist zum 1. März 2018 in die Geschäftsführung der TUI fly eingetreten und übernahm diesen Monat die alleinige Geschäftsführung der deutschen Ferienfluggesellschaft. Lackmann ist sowohl Mitglied im TUI Aviation Board, in dem alle Airlines der TUI Group vertreten sind, als auch im Quellmarktboard Zentral der TUI. Im Vorstand des BDF folgt er auf Roland Keppler. Oliver Lackmann: „Ich bedanke mich für das entgegengebrachte Vertrauen zur Wahl in den BDF-Vorstand und freue mich sehr auf die gemeinsame Zusammenarbeit mit den Kollegen der deutschen Airlines. Unser Ziel muss es sein, die regulatorischen und wettbewerblichen Rahmenbedingungen für die deutschen Fluggesellschaften zu verbessern und unseren Position im Luftverkehr am Standort Deutschland zu stärken.“ Der ausgebildete Flugkapitän Lackmann war bis zu seinem Eintritt in die TUIfly GmbH Geschäftsführer der österreichischen Fluggesellschaft NIKI. Davor war er bei der Air Berlin Chief Flight Operation Officer und Accountable Manager. In dieser Position hatte er u.a. die Gesamtverantwortung für den Flugbetrieb, die Crewplanung und das Operation Compliance & Safety Management. Ein Bild von Oliver Lackmann finden Sie auf http://www.bdf.aero/lackmann-vorstand Pressekontakt: Bundesverband der Deutschen Fluggesellschaften e.V., Jörg Schulze-Spohn, Friedrichstr. 79, 10117 Berlin, Fon +49 (0) 30 700 11 85 – 0, E-Mail: [email protected] Mitglieder des BDF sind die Deutsche Lufthansa, Condor, Eurowings, TUI fly, Germania, WDL Aviation sowie die Lufthansa Cargo. -

Download PDF Englisch

New Airline at Vienna Airport with a New Destination: Germania Launches Flight Service to Rostock on the Baltic Sea Effective immediately passengers have a new destination at their disposal when flying from Vienna. Starting today, Friday, May 26, 2017, the German airline Germania offers flight connecting Vienna to the Hanseatic city of Rostock. The new route will be served every Friday and Sunday deploying an Airbus A319. The new flight connection was officially opened today by Germania and Vienna Airport within the context of a photo session. “We are pleased to welcome a new airline at Vienna Airport, namely Germania. The new route to Rostock makes it even easier for passengers to reach the northern part of Germany. The Hanseatic town on the Baltic Sea is well known for numerous cruises, and Rostock is the perfect starting point. The large northern German city is also considered to be a culturally and economically important city in the southern Baltic Sea region, and offers impressive Hanseatic architecture”, says Julian Jäger, Member of the Management Board of Flughafen AG, expressing his pleasure with the new flight connection. “We offer travellers from Austria a short trip to the white Baltic Sea beaches and thus a new opportunity to take a relaxing vacation by the sea. Moreover, the trip to the cruise port of Warnemünde improved, making it easier to take discovery trips in Northern Europe,” says Claus Altenburg, Director Sales at Germania Airlines. Twice weekly to Rostock Germania serves the Vienna-Rostock route twice a week (Fridays, Sundays). The flight of the German airline will depart from Rostock at 11:50 a.m. -

Hahn Air (HR) ~ Participating Carriers (GDS FARE +50)

Hahn Air (HR) ~ Participating Carriers (GDS FARE +50) 12APR2021 Airline Code Airline Country Airline Code Airline Country 1X Branson AirExpress United States LG Luxair Luxembourg Airlines Luxemburg 2I Star Perú Peru LI Liat Antigua and Barbuda 2J Air Burkina Burkina Faso LO LOT Poland 2K AeroGal Aerolineas Galapagos Ecuador LP Lan Peru Peru 2L Helvetic Airways Switzerland LR Lacsa Costa Rica 2N Nextjet Sweden LX Swiss International Airlines Switzerland 3E Air Choice One United States LY EL AL Israel Airlines Israel 3S Air Antilles Guadeloupe M9 Motor Sich Airlines Ukraine 3M Silver Airways United States ME Middle East Airlines Lebanon 3P Tiara Air Dutch-Caribbean MF Xiamen Airlines China 3U Sichuan Airlines China MH Malaysia Airlines Malaysia 4M Lan Argentina Argentina ML Air Mediterranee France 4Q Safi Airway United Arab Emirates MN kulula South Africa 5H Five Forty Aviation Kenya MR Hunnu Air Mongolia 5N Nordavia - Regional Airlines Russia MS EgyptAir Egypt 5Z CemAir South Africa MT Thomas Cook Airlines Germany 5W speed-alliance Germany MW Mokulele Airlines United States 6H Israir Airlines Israel MY Maya Island Air Belize 7F FIRST AIR Canada NF Air Vanuatu Vanuatu 7I Insel Air NL Antilles NN VIM Airlines Russia 7R RusLine Russia NT Binter Canarias Spain 7V Federal Airlines South Africa NU Japan Transocean Air Japan 7W Windrose Aviation Ukraine NX Air Macau Macau 8I Insel Air Aruba Aruba O6 Avianca Brasil Brazil 8M Myanmar Airways Intl. Myanmar OA Olympic Air Greece 8Q Onur Air Turkey OB Boliviana de Aviación Bolivia 8U Afriqiyah Airways -

Iceland to Dallas Best S18 Example of Multiple Airlines Starting a New Route

Issue 19 Monday 25th June 2018 www.anker-report.com Contents Iceland to Dallas best S18 example of 1 Iceland to Dallas best S18 example of when multiple airlines start the same new route. multiple airlines starting a new route 2 easyJet growing capacity 14% in Launching a new route is a brave move for any airline, as it served last summer that now have at least two airlines Italy in S18; Milan MXP is second requires considerable investment and resources. Around half of competing head-to-head. An influencing factor here is that biggest base and Venice VCE all new routes launched by airlines are on routes already served some markets suddenly become desirable again, after having welcomes 13 new routes in 2018. by at least one other carrier, which has the advantage of previously been neglected. This has been seen in several tourist 3 Focus on: Austria, Bulgaria and UK. demonstrating that a significant demand exists and that the destinations in northern Africa, notably Tunisia. airline wants to grab a profitable share of that market, either by 4 Riga Airport busiest in Baltic states; As a result the new route with the most new carriers in S18 is taking passengers from other airlines, or by stimulating new between Brussels BRU and Djerba. After not being served at all 13 consecutive months of double- traffic as a result of lower fares or better service. digit growth as airBaltic leads the in S17, this summer the Tunisian destination is being connected A carrier entering an unserved market has the advantage of to the Belgian capital by no fewer than four airlines; Brussels way with new CSeries. -

Europe's Fastest-Growing Airports in 2018 in Various Categories Revealed

Issue 20 Monday 9thJuly 2018 www.anker-report.com Contents Europe’s fastest-growing airports in 1 Europe’s fastest-growing airports in 2018 in various categories revealed. 2 Blue Air consolidates in 2018 after 2018 in various categories revealed three years of rapid growth; five bases in Romania as well as two in As the European air travel market heads into its peak period of to 13 destinations including long-haul routes to Abu Dhabi, July through to September, The ANKER Report has decided to Chicago, Los Angeles, Miami, San Francisco and shorter-haul Italy, plus Larnaka and Liverpool. do some serious data-crunching to identify those European routes such as Gdansk, Krakow, Malta, Milan LIN and Turin. 3 Focus on: France and Italy. airports that have done particularly well at attracting new However, this has been more than compensated for by the 4 Genoa Airport welcomes Aegean airlines and new services to their airports during the last 12 addition of 39 new destinations including Alicante, Bari, Airlines, easyJet, Ernest Airlines and months. FlightGlobal schedules data has been used to compare Edinburgh, Genoa, Kaliningrad, London LGW, Ljubljana, SAS in 2018; capacity +23% in S18 as scheduled services being offered between May and September Montpellier, Milan MXP, Paris ORY, Singapore, Varna, Venice 2018 and the same period 12 months previously. Only services VCE and Yerevan. Alitalia and Rome lead way. that were offered a minimum of five times during that period 5 London Heathrow leads aircraft size Although just over half of these routes have been launched by (equivalent to once a month) were considered for analysis. -

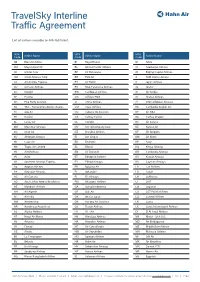

Travelsky Interline Traffic Agreement

TravelSky Interline Traffic Agreement List of airlines issuable on HR-169 ticket. IATA IATA IATA Code Airline Name Code Airline Name Code Airline Name 0B Blue Air Airline BI Royal Brunei IZ Arkia 2M Maya Island Air BL Jetstar Pacific Airlines J2 Azerbaijan Airlines 3K Jetstar Asia BP Air Botswana JD Beijing Capital Airlines 3M Silver Airways Corp BR EVA Air JJ TAM Linhas Aereas 3S Air Antilles Express BT Air Baltic JL Japan Airlines 3U Sichuan Airlines BV Blue Panorama Airlines JQ Jetstar 4O Interjet BW Caribbean Airlines JU Air Serbia 5F FlyOne CG Airlines PNG JX Starlux Airlines 5H Five Forty Aviation CI China Airlines JY Intercaribbean Airways 5U TAG - Transportes Aereos Guate... CM Copa Airlines K6 Cambodia Angkor Air 7C Jeju Air CU Cubana de Aviacion K7 Air KBZ 7R Rusline CX Cathay Pacific KA Cathay Dragon 8L Lucky Air DE Condor KC Air Astana 8M Myanmar Airways DV JSC Aircompany Scat KE Korean Air 8Q Onur Air DZ Donghai Airlines KF Air Belgium 8U Afriqiyah Airways EI Aer Lingus KM Air Malta 9K Cape Air EK Emirates KP Asky 9N Tropic Air Limited EL Ellinair KQ Kenya Airways 9U Air Moldova EN Air Dolomiti KR Cambodia Airways 9V Avior ET Ethiopian Airlines KU Kuwait Airways 9X Southern Airways Express EY Etihad Airways KX Cayman Airways A3 Aegean Airlines FB Bulgaria Air LA Lan Airlines A9 Georgian Airways FI Icelandair LG Luxair AC Air Canada FJ Fiji Airways LH Lufthansa AD Azul Linhas Aereas Brasileiras FM Shanghai Airlines LI LIAT AE Mandarin Airlines GA Garuda Indonesia LM Loganair AH Air Algerie GF Gulf Air LO LOT Polish Airlines -

Jurnalul Oficial Al Uniunii Europene C 317/1

Jurnalul Oficial C 317 al Uniunii Europene Anul 64 Ediţia în limba română Comunicări și informări 6 august 2021 Cuprins II Comunicări COMUNICĂRI PROVENIND DE LA INSTITUȚIILE, ORGANELE ȘI ORGANISMELE UNIUNII EUROPENE Comisia Europeană 2021/C 317/01 Autorizație pentru ajutoarele de stat acordate în conformitate cu dispozițiile articolelor 107 și 108 din Tratatul privind funcționarea Uniunii Europene — Cazuri în care Comisia nu ridică obiecţii (1) . 1 V Anunţuri PROCEDURI REFERITOARE LA PUNEREA ÎN APLICARE A POLITICII ÎN DOMENIUL CONCURENŢEI Comisia Europeană 2021/C 317/02 Ajutoare de stat – Portugalia – Ajutor de stat SA 60165 (2021/C) – Portugalia – Ajutor de restructurare în favoarea TAP SGPS – Invitație de a prezenta observații în temeiul articolului 108 alineatul (2) din Tratatul privind funcționarea Uniunii Europene (1) . 13 RO (1) Text cu relevanță pentru SEE. 6.8.2021 RO Jurnalul Oficial al Uniunii Europene C 317/1 II (Comunicări) COMUNICĂRI PROVENIND DE LA INSTITUȚIILE, ORGANELE ȘI ORGANISMELE UNIUNII EUROPENE COMISIA EUROPEANĂ Autorizație pentru ajutoarele de stat acordate în conformitate cu dispozițiile articolelor 107 și 108 din Tratatul privind funcționarea Uniunii Europene Cazuri în care Comisia nu ridică obiecţii (Text cu relevanță pentru SEE) (2021/C 317/01) Data adoptării deciziei 18.3.2021 Ajutorul nr. SA.48706 (2018/FC) Stat membru Germania Regiune — — Titlu (şi/sau numele beneficiarului) Mögliche Beihilfe zu Gunsten von RVV und Nordwasser GmbH Temei legal — Tipul măsurii ajutor ad hoc Nordwasser GmbH, Rostocker Versorgungs-und -

Aviation Practice

Aviation An overview of our finance and related practices Our capabilities Transportation Practice Group of the Year Law360, 2019 Hogan Lovells | 3 Overview of our aviation finance capabilities From the post-deregulation tumult of the 1980s; the rollercoaster of the high-yield market in the 1990s and early 2000s; the post-9/11 devastation; the flourishing loan and public offering Aviation industry recognition markets in the mid-2000s; and recent foreclosures, restructurings, industry consolidations and 2018, 2019 the COVID-19 economic collapse, structuring and documenting aviation finance transactions have Tier 1 or Top - Tier Firm for Transport: always been complex tasks. When the relevant assets are located across national boundaries and Aviation and Air Travel: Regulation subject to the laws of multiple jurisdictions, some of which are more creditor-friendly than others, The Legal 500 US the complexity is compounded. Timing and tax efficiency are usually critical factors in closing a transaction. 2016-2019 Band 1 for Transportation: Aviation: From New York to London to Paris to Hong Kong, our network of over 50 aviation lawyers Regulatory — Nationwide provides in-depth industry experience across practices, and particularly in aviation finance. Our Chambers USA experience spans export credit agency-supported financings, acquisition financing and disposal of individual aircraft and of portfolios and involves advising on commercial and tax-based (and, in 2019 particular, French, German and Japanese tax-based) financings, Islamic financings,