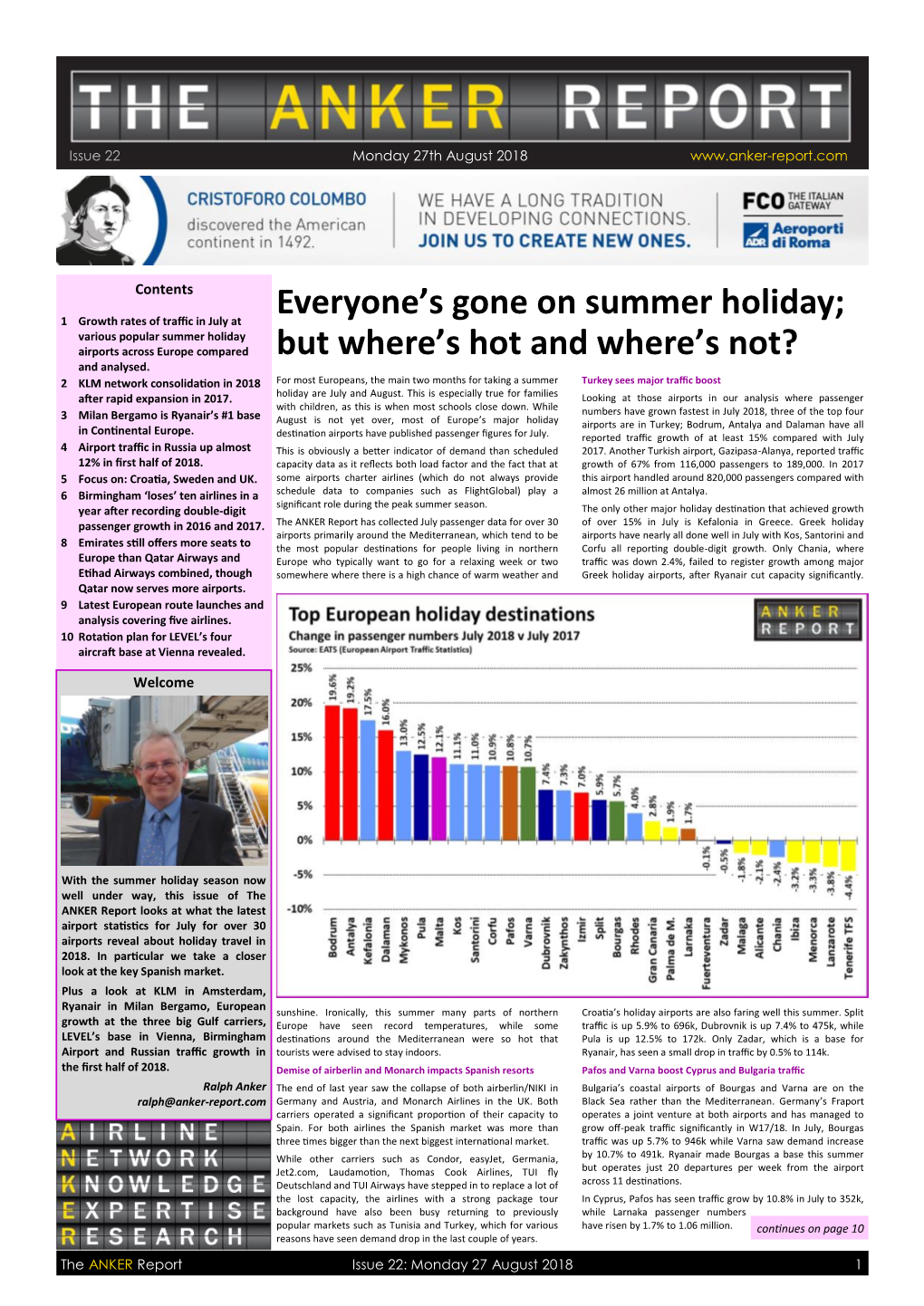

Everyone's Gone on Summer Holiday

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Aerologic, Air Berlin, Austrian Airlines, Avanti Air, Condor, Edelweiss

Christian Riedel ansgar Sinnecker arne Bierhals arne Haidle adi Fuchs Bernd Oettinger edgar Hartmans Hans Dieterich Bruno Speck Markus Kirchler David Kromka Friederike Masson Dean Masson Christoph Zogg AeroLogic Air Berlin Sun Express Lufthansa Austrian Condor AeroLogic Swiss Edelweiss Austrian Condor Germania Germania Edelweiss Hans Reichert georg Manhart Frederick Mey Karl Peter Ritter Karl Kistler nila Kiefer Jarin Beikes norbert Wittmann Florian Hofer Michael Hüsser Dieter Hensel Kevin Fuchs Judith Kümmel gerhard Knäbel Austro Control Austrian AeroLogic Condor Edelweiss TMA Germania Austrian Condor InterSky Lufthansa Swiss Austrian Condor Julian alexander Hans-georg Katharina Stephan Benjamin Jan Mühle mann aleksandar Karl-Heinz Holger Susanne Maximilian Stephan asok Sebastian Benedikt gierth Rabacher Heimann Kuzmanov Krottenmüller Deloséa Rasovic Jacobsen Schweickert Scheithauer Keydel Sukumar Oehlert Buchholz TMA Aviation Academy A. Condor Germania Air Berlin Swiss Austrian Condor Etihad Airways Austrian Germania Etihad Airways Lufthansa Air Berlin Ferdinand de Frank Lumnitzer Ja, iCH FLi ege geRn! Dr. Reinhard Heiko Schmidt Correvont Lufthansa Wenn man jüngsten Artikeln in diversen Medien Glauben schenken darf, allen Berufen scheint auch im Piloten-Alltag nicht immer nur die Sonne, Condor Lernbeiss Condor ist der Beruf des Airline-Piloten alles andere als ein Traumjob und eine dennoch vertreten die auf diesen Seiten versammelten Flugzeugführer Austrian Karriere im Cockpit alles andere als erstrebenswert. Natürlich: Wie bei einhellig -

Tui Group Interim Report 9M Fy2021 1 October 2020 – 30 June 2021

1 TUI GROUP INTERIM REPORT 9M FY2021 1 OCTOBER 2020 – 30 JUNE 2021 2 Content Interim Management Report ...................................................................................................................................................................................... 3 Q3 2021 Summary ..................................................................................................................................................................................................... 4 Report on changes in expected development .............................................................................................................................................. 8 Structure and strategy of TUI Group ................................................................................................................................................................ 8 Consolidated earnings .............................................................................................................................................................................................. 9 Segmental performance ....................................................................................................................................................................................... 10 Financial position and net assets ..................................................................................................................................................................... 14 Comments on the consolidated income statement -

Annual Report 2017 Contents & Financial Highlights

ANNUAL REPORT 2017 CONTENTS & FINANCIAL HIGHLIGHTS TUI GroupFinancial 2017 in numbers highlights Formats The Annual Report and 2017 2016 Var. % Var. % at the Magazine are also available online € 18.5 bn € 1,102.1restated m constant € million currency Turnover 18,535.0 17,153.9 + 8.1 + 11.7 Underlying EBITA1 1 1 + 11.7Hotels & %Resorts + 12.0356.5 % 303.8 + 17.3 + 19.2 Cruises 255.6 190.9 + 33.9 + 38.0 Online turnoverSource Markets underlying526.5 554.3 – 5.0 – 4.0 Northern Region 345.8 383.1 – 9.7 – 8.4 year-on-year Central Region 71.5 85.1 – 16.0 – 15.8 Western Region EBITA109.2 86.1 + 26.8 + 27.0 Other Tourism year-on-year13.4 7.9 + 69.6 + 124.6 Tourism 1,152.0 1,056.9 + 9.0 + 11.2 All other segments – 49.9 – 56.4 + 11.5 + 3.4 Mobile TUI Group 1,102.1 1,000.5 + 10.2 + 12.0 Discontinued operations – 1.2 92.9 n. a. Total 1,100.9 1,093.4 + 0.7 http://annualreport2017. tuigroup.com EBITA 2, 4 1,026.5 898.1 + 14.3 Underlying EBITDA4 1,541.7 1,379.6 + 11.7 56 %EBITDA2 4 23.61,490.9 % ROIC1,305.1 + 14.2 Net profi t for the period 910.9 464.9 + 95.9 fromEarnings hotels per share4 & € 6.751.36 % WACC0.61 + 123.0 Equity ratio (30 Sept.)3 % 24.9 22.5 + 2.4 cruisesNet capex and contentinvestments (30 Sept.) 1,071.9 634.8 + 68.9 comparedNet with cash 30 %(302 at Sept.) time 4of merger 583.0 31.8 n. -

Summer Sun Airport Growth Stalls in 2019; Croatian Airports Growing

Issue 45/46 Monday 26th August 2019 www.anker-report.com Contents 1 Summer sun airport growth stalls in Summer sun airport growth stalls in 2019; Croatian airports growing. 2 airBaltic offers almost 70 destina- tions from Riga, 24 launched in last 2019; Croatian airports’s bright spot three years; London, Moscow and Last year, in issue 22 of The ANKER Report, we looked at July back in early February has again distorted the underlying Paris are leading routes by ASKs. passenger data from 30 popular holiday destinations, mostly in demand for certain destinations, as their capacity has not been 3 Focus on: Spain and the UK. and around the Mediterranean, to see where northern completely replaced by other carriers in the German market. 4 Milan Linate set for revamped European families were choosing to spend their annual summer It has also been a difficult summer for The Thomas Cook Group holiday. As pointed out in that article, actual passenger figures with its two biggest airlines (Thomas Cook Airlines in the UK future; hourly movement limit give a much better indication of actual travel trends as these means fewer than 10m annual pax. and Condor in Germany) facing an uncertain future. As our include charter passengers. story on the UK airline shows (see page 10), after growth in the 5 Turkish Airlines and Aeroflot driving Many, but not all, charter airlines publish schedule data, so last few years, its capacity is down around 4% this summer and Europe-Indonesia capacity growth. passenger numbers are clearly a better indicator than seat it has stopped operating from four UK airports. -

03/2018 Boulevard Airport

03/18 › › › AIRPORT WARUM WIR DEN NACHTFLUG BRAUCHEN › › › FERNWEH ABTAUCHEN AUF DEN KAPVERDEN › › › AUSZEIT HANNOVERS › › › › › LECKERBISSEN EDITORIAL 3 › › › › › LIEBE LESERINNEN UND LESER, Henry Maske ist ein Gentleman. Durch und durch. Der Ausnahmesportler gibt Einblicke in sein Leben nach seiner Boxkarriere. Maske im Interview: Chef im Ring auch als Geschäftsmann. Terminalumbau und Infotainment? Am HAJ sogar open air und interaktiv! : Lesen Sie in dieser Ausgabe, wie unser XXL-Bauzaun zur Ausstellungs- DISCOVER MORE fläche wird. Tausche Winter gegen Sommer. Das geht am besten in Afrika. Wir schlagen die Kapverdischen Inseln vor. Sonnenanbeter fliegen direkt ab Hannover. Wer lieber auf dem europäischen Kontinent bleiben möchte, ANKARA fliegt bestimmt auf Ibiza. Mit Kind und Kegel ebenfalls per Direktflug. MIT DER FLUGGESELLSCHAFT, DIE SIE IN Manchmal helfen schöne Erinnerungen über die dunkle Jahreszeit hin- MEHR LÄNDER FLIEGT ALS ALLE ANDEREN weg. Lassen Sie uns an Ihren schönsten Urlaubsmomenten teilhaben. Hierzu mehr ab Seite 28. › › Sönke Jacobsen, AB HANNOVER VIA ISTANBUL UND AB DEM 24. JUNI 2019 ALS DIREKTFLUG Leiter Unternehmens- Die BOULEVARD AIRPORT geht online. Besuchen Sie unseren neuen kommunikation und Blog auf boulevard.hannover-airport.de und lesen Sie Aktuelles und Marketing. Wissenswertes. Wann immer und wo immer Sie möchten. Auf gastronomische Weise den Winterblues vertreiben. Das funktioniert im Sternerestaurant, im Flugzeug, am Flughafen oder während eines kulinarischen Stadtbummels. Wir stellen Ihnen gerne einige -

Global Aviation Monitor (GAM)

Institute of Air Transport and Airport Research Global Aviation Monitor (GAM) Analysis and Short Term Outlook of Global, European and German Air Transport June 2018 Institute of Air Transport and Global Aviation Monitor (GAM) Airport Research June 2018 Main Results of Global Air Transport Supply Analysis and Outlook Background: Covers about 3,500 airports worldwide Covers about 850 airlines worldwide Air transport supply of 2017: More than 37 M flights (non-stop) worldwide, new record value Busiest month so far in 2018: June with 3.3 M flights Air traffic increases slowly since April 2013 Forecasting methodology: Time series analysis The mean absolute forecast error over a twelve month period typically lies in a range of between 0.5 and 1.5 percentage points for a forecast horizon of 1, 2 & 3 months. Analysis: July 2017 – June 2018 Global History: About 5 % growth per year before financial crisis 2008/2009, then a rapid decline of more than 9 % between February 2008 and February 2009, followed by a rather slow recovery until 2011 (7.2 % increase between February 2009 and February 2011). Since 2011, the number of flights grows only very slowly; stagnation between September 2012 and March 2013, small growth rates since April 2013; growth rates of around 3 % since March 2015, 3.0 %- 6.3 % between December 2015 and June 2018 March 2018: 3.3 M flights supplied (+5.1 %) Airports: Heterogeneous development of no. of flights offered; strong growth e.g. at Jakarta and Frankfurt (10 % and more) Airlines: Heterogeneous development of no. of flights offered; strong growth e.g. -

Before the Department of Transportation Office of the Secretary Washington, Dc

BEFORE THE DEPARTMENT OF TRANSPORTATION OFFICE OF THE SECRETARY WASHINGTON, DC ) Application of ) ) EW DISCOVER GmbH ) ) Docket DOT-OST-2021-0081 for Blanket Statements of Authorization ) Under 14 C.F.R. Part 212 ) (Codesharing with Lufthansa, Austrian Airlines, ) Brussels Airlines, and ) Swiss International Air Lines) ) ) MOTION FOR LEAVE TO FILE AND REPLY OF EW DISCOVER GmbH Communications with respect to this document should be addressed to: Arthur J. Molins General Counsel, The Americas The Lufthansa Group 1400 RXR Plaza West Tower Uniondale, NY 11556 (516) 296-9234 (phone) [email protected] August 4, 2021 BEFORE THE DEPARTMENT OF TRANSPORTATION OFFICE OF THE SECRETARY WASHINGTON, DC ) Application of ) ) EW DISCOVER GmbH ) ) Docket DOT-OST-2021-0081 for Blanket Statements of Authorization ) Under 14 C.F.R. Part 212 ) (Codesharing with Lufthansa, Austrian Airlines, ) Brussels Airlines, and ) and Swiss International Air Lines) ) ) DATED: August 4, 2021 MOTION FOR LEAVE TO FILE AND REPLY OF EW DISCOVER GmbH EW Discover GmbH (“EW Discover”) submits this reply to “Comments” filed by Condor Flugdienst GmbH (“Condor”) regarding the above-captioned application.1 Condor is asking the Department to intervene in a competitive dispute between two German carriers involving issues that are currently under review by the German competition authority. Condor specifically demands that the Department preempt the German competition authority’s review by initiating its own investigation and taking the extraordinary and unprecedented action of requiring Lufthansa (not EW Discover, the applicant) to interline with Condor. EW Discover asks that the Department disregard Condor’s spurious intervention in this docket and promptly approve EW Discover’s 1 Comments of Condor Flugdienst GmbH, July 26, 2021 (Docket DOT-OST-2021-0081) (“Condor Comments”). -

The Impacts of Globalisation on International Air Transport Activity

Global Forum on Transport and Environment in a Globalising World 10-12 November 2008, Guadalajara, Mexico The Impacts of Globalisation on International Air Transport A ctivity Past trends and future perspectives Ken Button, School of George Mason University, USA NOTE FROM THE SECRETARIAT This paper was prepared by Prof. Ken Button of School of George Mason University, USA, as a contribution to the OECD/ITF Global Forum on Transport and Environment in a Globalising World that will be held 10-12 November 2008 in Guadalajara, Mexico. The paper discusses the impacts of increased globalisation on international air traffic activity – past trends and future perspectives. 2 TABLE OF CONTENTS NOTE FROM THE SECRETARIAT ............................................................................................................. 2 THE IMPACT OF GLOBALIZATION ON INTERNATIONAL AIR TRANSPORT ACTIVITY - PAST TRENDS AND FUTURE PERSPECTIVE .................................................................................................... 5 1. Introduction .......................................................................................................................................... 5 2. Globalization and internationalization .................................................................................................. 5 3. The Basic Features of International Air Transportation ....................................................................... 6 3.1 Historical perspective ................................................................................................................. -

Wings News 07-08 2019 02 Wings News 07-08 2019

Airbus A330-800 neo Westjet Boeing 787-9 Convair XB-58 Hustler Emirates Airbus A380 WINGS NEWS 07-08 2019 02 WINGS NEWS 07-08 2019 Photo: Tupolev 13,1 cm 1/500 7,9 cm 1/500 533324 533294 Aeroflot Tupolev TU-144S – CCCP-77109 Air China Boeing 737-800 „Beijing Expo 2019“ – B-5425 Photo: Airbus 8,4 cm 1/500 11,8 cm 1/500 533416 533287 United Airlines Boeing 737 Max 9– N76501 Airbus A330-800 neo – F-WTTO 6,0 cm 1/500 13,8 cm 1/500 533379 526777-002 Belgian Air Component Lockheed C-130H Hercules - 70th Anniversary 15 Antonov Airlines Antonov AN-124 – UR-82029 Wing / 45th Anniversary C-130 Hercules – CH-10 WINGS NEWS 07-08 2019 03 Photo: British Airways Photo: British Airways 14,1 cm 1/500 14,1 cm 1/500 533317 533393 British Airways Boeing 747-400 - 100th anniversary BOAC Heritage Design – G-BYGC British Airways Boeing 747-400 – 100th anniversary Landor Heritage Design – G-BNLY „City of Swansea“ 7,2 cm 1/500 533331 12,6 cm 1/500 Interflug echnischeT Prüfung - Flugsicherung Ilyushin IL-18 „Graue Maus“ 533300 („Grey Mouse“) – DDR-STP China Southern Airlines Boeing 787-9 Dreamliner „787th 787“ – B-1186 12,6 cm 1/500 7,5 cm 1/500 533263 533386 Etihad Airways Boeing 787-9 Dreamliner „Abu Dhabi Grand Prix“ – A6-BLV Lufthansa Airbus A320neo - new colors – D-AINO „Rastatt“ Besuchen Sie www.herpa.de für mehr Informationen zu jedem Modell. Visit www.herpa.de for more information on each item. -

Summer 2019 Scheduled Flights

PAFOS INTERNATIONAL AIRPORT - SUMMER 2019 SCHEDULED FLIGHTS (PRELIMINARY) AVERAGE INCOMING FLIGHTS PER WEEKDAY (31 Mar 2019 - 26 Oct 2019) COUNTRY 1 STOP 1 AIRLINE MONDAY TUESDAY WEDNESDAY THURSDAY FRIDAY SATURDAY SUNDAY TOTAL BELGIUM BRUSSELS BRUSSELS AIRLINES 0 0 0 0 0 1 0 1 TUI BELGIUM 0 0 0 1 0 0 1 2 BULGARIA SOFIA RYANAIR LTD 1 0 1 0 0 1 0 3 DENMARK AARHUS TIRSTRUP DANISH AIR TRANSPORT 0 0 0 0 0 1 0 1 ESTONIA TALLINN RYANAIR LTD 1 0 0 1 0 0 0 2 FINLAND HELSINKI FINNAIR OY 0 0 0 0 0 1 0 1 GERMANY BERLIN EASYJET 0 1 0 1 0 1 0 3 RYANAIR LTD 0 0 0 1 0 0 1 2 GREECE CHANIA RYANAIR LTD 1 1 0 1 0 1 0 4 MIKONOS RYANAIR LTD 0 1 0 1 0 1 0 3 THESSALONIKI RYANAIR LTD 2 1 2 2 2 1 2 12 HUNGARY BUDAPEST RYANAIR LTD 0 1 0 1 0 1 0 3 IRELAND DUBLIN RYANAIR LTD 1 0 0 0 0 1 0 2 TUI AIRWAYS 0 0 1 0 0 0 0 1 ISRAEL TEL AVIV ARKIA ISRAELI AIRLINES 1 0 0 0 1 0 0 2 ISRAIR AIRLINES 1 0 0 0 1 0 0 2 RYANAIR LTD 2 2 2 1 1 1 3 12 ITALY MILAN RYANAIR LTD 0 0 0 1 0 0 1 2 ROME RYANAIR LTD 1 0 0 0 1 0 0 2 JORDAN AMMAN RYANAIR LTD 1 1 1 0 0 1 0 4 LATVIA RIGA RYANAIR LTD 0 1 0 0 0 1 0 2 LITHUANIA KAUNAS RYANAIR LTD 0 0 0 1 0 0 0 1 NETHERLANDS AMSTERDAM TRANSAVIA 1 1 1 0 0 1 0 4 TUI FLY NEDERLANDS 0 0 0 1 0 0 0 1 POLAND KATOWICE RYANAIR SUN 0 0 0 1 0 0 0 1 TRAVEL SERVICE 0 0 0 1 0 0 0 1 KRAKOW RYANAIR LTD 0 0 1 0 0 0 1 2 POZNAN RYANAIR SUN 0 0 0 1 0 0 0 1 TRAVEL SERVICE 0 0 0 1 0 0 0 1 WARSAW RYANAIR SUN 0 0 0 1 0 0 0 1 TRAVEL SERVICE 0 0 0 1 0 0 0 1 ROMANIA BUCHAREST RYANAIR LTD 0 1 0 1 0 1 0 3 RUSSIA MOSCOW GLOBUS 1 1 1 1 1 1 1 7 ROSSIYA 1 1 1 1 1 1 1 7 URAL AIRLINES -

Airline Charges Comparison Table

1 This table was updated on May 25th 2021. It will be comprehensively checked and republished in May 2022. The charges may be checked a few days before this date. Whilst every effort has been made to ensure the information on this table is correct, we would advise confirmation with the airlines before ticket purchase. If you notice any errors, omissions or changes to the information set out below, please contact us at [email protected]. We will endeavour to make changes to the data within three working days if notified. Prices are per passenger per one way flight unless otherwise stated. Airlines in the tables are: Aer Lingus, American Airlines, British Airways, easyJet, Emirates, Jet2, KLM, Lufthansa, Norwegian, Ryanair, TUI Airways, United Airlines, Virgin Atlantic, and Wizz Air. Comparing airline fees for optional extras and other charges When buying airline tickets, to find the best value flight, there are two aspects of the choices available to consider: 1. The airfare (or ‘headline price’) and any additional taxes or surcharges; and 2. The cost of optional extras and other charges chosen to pay when booking. The table below sets out a comparison of these optional extras and other charges, so that passengers can compare like with like across the different airfares available, and take informed decisions as to which flights represent best value to them. Prices and fees shown in the tables are based on economy fare tickets unless otherwise stated. The headline price / airfare Airfares vary depending upon where and when you want to fly, when you book and with the airline that you choose to fly with. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010.