Bay Area Toll Authority

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

To: Ashley Nguyen, Project Manager Metropolitan Transportation Commission Dear Ms

From: Terry Abrams Sent: Wednesday, June 24, 2015 5:05 PM To: MTC Info Subject: Richmond-San Rafael Bridge Access Improvement Project To: Ashley Nguyen, Project Manager Metropolitan Transportation Commission Dear Ms. Nguyen and the Metropolitan Transportation Commission, I am writing in support of adding the Richmond‐San Rafael Bridge Access Improvement Project to Plan Bay Area and to the 2015 Transportation Improvement Program. By prioritizing the re‐opening of the third lane on the Richmond‐San Rafael Bridge during peak evening commute hours, we will make a big difference in cutting traffic, reducing air pollution, and improving the quality of life in the North Bay. Thank you. Terry L. Abrams ABRAMS CONSULTING Management Consultants www.abramsconsulting.net 1 From: Jeff Alpert Sent: Wednesday, June 24, 2015 1:14 PM To: MTC Info Subject: Richmond-San Rafael Bridge Access Improvement Project To: Ashley Nguyen, Project Manager Metropolitan Transportation Commission Dear Ms. Nguyen and the Metropolitan Transportation Commission, I am writing in support of adding the Richmond-San Rafael Bridge Access Improvement Project to Plan Bay Area and to the 2015 Transportation Improvement Program. By prioritizing the re-opening of the third lane on the Richmond-San Rafael Bridge during peak evening commute hours, we will make a big difference in cutting traffic, reducing air pollution, and improving the quality of life in the North Bay. Thank you. Jeffrey D.Alpert Managing Partner Milestone Trailer Leasing LLC Ph Cell 1 From: Shannon Appelcline Sent: Monday, July 20, 2015 11:57 AM To: MTC Info Cc: Subject: Support for Richmond/San Rafael Bridge Access Improvement Project I am writing to express my strong support for a bike lane across the Richmond/San Rafael Bridge. -

2004 Transportation Programming Statute Book

Statutes Related to Programming and Funding of Transportation Projects State of California Business, Transportation, and Housing Agency Department of Transportation Division of Transportation Programming March 2004 PREFACE STATUTES BOOK This book is a collection of statutes related to programming and funding of transportation projects. It is an auxiliary tool that is meant to provide easy access to current, relevant statutes. The 2004 edition of the Statutes Book incorporates all relevant legislation passed and signed into law up to January 1, 2004. All bills, with the exception of bills that are urgency statutes, become effective January 1st of the year following the end of the session. All bills passed in the 2003 legislative session become effective January 1, 2004. Bills that are urgency statutes become effective immediately upon signing into law by the Governor. At the end of certain sections of the book, you will find a row of asterisks. These asterisks indicate there is additional legislation in this chapter, however, it was omitted as it did not pertain to programming or funding. CALIFORNIA CODES California Law consists of 29 codes which cover the State Constitution and the California Statutes. As defined, California Statutes are bills that have been chaptered by the Secretary of State after the bill has passed through the Assembly and Senate and subsequently signed by the Governor, or becomes law without the Governor’s signature. INTERNET ACCESS The Programming Statutes Book is accessible on the internet at the following address: http://www.dot.ca.gov/hq/transprog/reports.htm The Legislative Counsel of California is required by law to maintain the World Wide Web (www) site where the complete California Codes are located. -

Options for a Bay Area Transportation Network Manager

Governing Transit Seamlessly: Options for a Bay Area Transportation Network Manager A report by Seamless Bay Area April 2021 Table of Contents Executive Summary 3 Chapter 1: Introduction 9 Chapter 2: Poor Outcomes, Root Causes, and Solutions 11 Poor outcomes 11 Root causes 13 Solutions 16 Increased investment 16 Transit-supportive land uses 16 Reformed transportation institutions 16 Chapter 3: Network Manager Key Considerations & Conceptual Models 18 Functions a network manager should oversee 18 Conceptual models of network management 19 Geographical coverage considerations 20 Governing board considerations 21 Approach to geographical representation on boards 22 Relationship to existing institutions 24 Chapter 4: Network Manager Alternative Options 26 Option A: Altered MTC Network Manager 27 Option B: Regional Transit Agency Network Manager 31 Option C: Universal Transit Agency Network Manager 38 Option D: Enhanced Executive Board 43 Chapter 5: Evaluation 46 Chapter 6: Conclusions & Next Steps 49 Conclusions 49 Next Steps 51 Acknowledgments 53 Seamless Bay Area Board 53 2 Executive Summary “If you want to get people to do something, make it easy,” Nobel-prize winning behavioral economist Richard Thaler oen says. “Remove the obstacles." Seamless transit is about making transit easy so more people use it - giving people from all backgrounds true freedom of movement to live their fullest lives. It’s the reason why Principle #1 in the Seamless Transit Principles, endorsed by dozens of organizations and cities, is Run all Bay Area transit as one easy-to-use system. Easy-to-use transit isn’t a luxury that only matters to some people - transit that is easy is fundamentally also accessible, usable, and equitable. -

Solano Transportation Authority

Solano Transportation Authority Member Agencies: Benicia ♦ Dixon ♦ Fairfield ♦ Rio Vista ♦ Suisun City ♦ Vacaville ♦ Vallejo ♦ Solano County One Harbor Center, Ste. 130, Suisun City, CA 94585-2473 ♦ Phone (707) 424-6075 / Fax (707) 424-6074 Email: [email protected] ♦ Website: sta.ca.gov SOLANOEXPRESS INTERCITY TRANSIT CONSORTIUM 1:30 p.m., Tuesday, January 28, 2020 Solano Transportation Authority One Harbor Center, Suite 130 Suisun City, CA 94585 MEETING AGENDA ITEM STAFF PERSON 1. CALL TO ORDER Beth Kranda, Chair 2. APPROVAL OF AGENDA 3. OPPORTUNITY FOR PUBLIC COMMENT (1:30 –1:35 p.m.) 4. SELECTION OF CHAIR AND VICE CHAIR FOR 2020 5. REPORTS FROM MTC, STA STAFF AND OTHER AGENCIES (1:35 – 1:55 p.m. A. Update on Transportation Development Act (TDA) Reform Michael Pimentel, CTA B. Update of Corridor Strategies for SR 37, I-80 and I-680 Lloyd Nadal and Katelyn Costa 6. CONSENT CALENDAR Recommendation: Approve the following consent items in one motion. (1:55 – 2:00 p.m.) A. Minutes of the Consortium Meeting of November 19, 2019 Johanna Masiclat Recommendation: Approve the Consortium Meeting Minutes of November 19, 2019. Pg. 5 CONSORTIUM MEMBERS Claudia Williams Diane Feinstein Brandon Thomson Beth Kranda Lori DaMassa Joyce Goodwin Debbie McQuilkin VACANT (Chair) (Vice Chair) Dixon Fairfield and Rio Vista Solano County Vacaville County of Solano Mobility STA Readi-Ride Suisun Transit Delta Breeze Transit City Coach Solano (FAST) (SolTrans) Ron Grassi STA Staff The complete Consortium packet is available1 on STA’s website: www.sta.ca.gov 7. ACTION FINANCIAL A. Transit and Intercity Rail Capital Program (TIRCP) Application for Anthony Adams Solano Regional Transit Improvements Phase 2 Recommendation: Approve the following: 1. -

Alameda County

County Summaries Alameda County Overview Located at the heart of the nine-county San Francisco Bay Area, Alameda County is the second-largest county in the Bay Area, with a population of over 1.66 million. The extensive transportation network of roads, rails, buses, trails and pathways carries roughly 1.2 million commute trips daily to, from, within and through the county, supporting economic growth in the Bay Area, California and the rest of the nation. The county’s transportation system is multimodal, with non-auto trips growing more quickly than auto trips: between 2010 and 2018, for every new solo driver, four people began using transit, walking, biking, or telecommuting. Roads and Highways Alameda County roadways move people and goods within the county and beyond and support multiple transportation modes. As regional economic and population growth increase demand for goods and services, a variety of modes, including cars, transit, bikes and trucks, are competing to access the same facilities. The majority of Alameda County’s 3,978 road miles are highways, arterials and major local roads that provide access to housing, jobs, education and transit. Forty percent of daily trips in Alameda County are carried on arterials and major roads. Currently, five of the Bay Area’s top 10 most-congested freeway segments are in Alameda County, and average freeway delays are growing. The congestion in Alameda County is compounded by the large amount of vehicle, rail and Travelers have made over 14.5 million trips on the I-580 freight travel through Alameda Express Lanes since opening in February 2016. -

Cultural Resources Survey Report for the San Francisco Bay Trail at Point Molate, Contra Costa County, California

Appendix D CULTURAL RESOURCES REPORT Cultural Resources Survey Report for the San Francisco Bay Trail at Point Molate, Contra Costa County, California Prepared on Behalf of: Prepared By: East Bay Regional Park District NCE 2950 Peralta Oaks Court, P.O. Box 1760 P.O. Box 5381 Zephyr Cove, NV 89448 Oakland, CA 94605 NCE Project Number: 567.04.55 March 2018 Jeremy Hall With Contributions From: Cultural Resources Specialist Chad Moffett and Tim Smith NCE Architectural Historians Mead & Hunt ADMINISTRATIVE SUMMARY In 2009, the East Bay Regional Park District (EBRPD) entered into an agreement for the donation of an easement for the San Francisco Bay Trail (Bay Trail) along the shoreline of their southernmost property on the San Pablo Peninsula at Point Molate. In 2013-14, the EBRPD hired NCE to conduct an alignment study for a Class I bike path and as a result, recorded the trail easement. Recently, the Bay Area Toll Authority (BATA) approved the installation of a bike and pedestrian path on the Richmond-San Rafael Bridge to Marine Street, near Point Richmond, which would connect to the EBRPD’s easement at Stenmark Drive. The combined projects will connect trail users from both Richmond and Marin County to the San Pablo Peninsula. The proposed Bay Trail at Point Molate will be approximately 2.5 miles and extend north along the shoreline, through Chevron’s property, to the Point Molate Beach Park and Navel Fuel Depot property, owned and managed by the City of Richmond, giving the public access to the shoreline and the ability to connect to the Park via foot or bicycle. -

San Francisco Bay Area

Is California Dreaming? No Way! Greg Hulsizer, Cambria Solutions Norma Ortega, California Department of Transportation Denis Mulligan, Golden Gate Bridge, Highway & Transportation District Andrew Fremier, Bay Area Toll Authority, Metropolitan Transportation Commission Stephanie Wiggins, Los Angeles County Metropolitan Transportation Authority Michael Blomquist, Riverside County Transportation Commission Kia Mortazavi, Orange County Transportation Authority Michael Kraman, Transportation Corridor Agencies Gary Gallegos, San Diego Association of Governments San Francisco Bay Area • Golden Gate Bridge • I-680 Express Lanes • Antioch Bridge • Benicia-Martinez Bridge • Carquinez Bridge • Dumbarton Bridge • Richmond-San Rafael Bridge • San Francisco-Oakland Bay Bridge • San Mateo-Hayward Bridge • I-880 Express Lanes • SR 237 Express Lanes San Francisco Monterey Los Angeles County • I-10 • I-110 Metro Express Ventura Orange County San Los Angeles Bernardino • SR 73 Toll Road • SR 133 Toll Road Orange Riverside San Diego County • SR 241 Toll Road • I-15 Express Lanes • SR 261 Toll Road San Diego • SR 125 South Bay • SR 91 Express Lanes Expressway San Francisco Bay Area • Golden Gate Bridge • I-680 Express Lanes San Francisco Bay Area • Antioch Bridge • I-580 Express Lanes • Benicia-Martinez Bridge • SR 237 Extension • Carquinez Bridge • I-680 Southern Segment, Sunol • Dumbarton Bridge Northbound, Contra Costa County • Richmond-San Rafael Bridge Northern Segment • San Francisco-Oakland Bay Bridge • I-880 Express Lanes • San Mateo-Hayward Bridge -

A G E N D a BOARD of DIRECTORS MEETING San Mateo

BOARD OF DIRECTORS 2019 CAROLE GROOM, CHAIR KARYL MATSUMOTO, VICE CHAIR RON COLLINS MARINA FRASER ROSE GUILBAULT DAVE PINE JOSH POWELL PETER RATTO CHARLES STONE A G E N D A JIM HARTNETT GENERAL MANAGER/CEO BOARD OF DIRECTORS MEETING San Mateo County Transit District Administrative Building Bacciocco Auditorium – 2nd Floor 1250 San Carlos Avenue, San Carlos, CA WEDNESDAY, SEPTEMBER 4, 2019 – 2:00 pm Revised 8-30-2019 1. CALL TO ORDER/ PLEDGE OF ALLEGIANCE 2. ROLL CALL 3. CONSENT CALENDAR MOTION a. Approval of Minutes of the Board of Directors Meeting of August 7, 2019 b. Acceptance of Statement of Revenues and Expenses for July 2019 c. Acceptance of Capital Projects Quarterly Status Report 4th Quarter FY 2019 INFORMATIONAL d. Information on Statement of Revenues and Expenses for the Period Ended June 30, 2019 4. PUBLIC COMMENT FOR ITEMS NOT ON THE AGENDA Comments by each individual speaker shall be limited to two (2) minutes. Items raised that require a response will be deferred for staff reply. 5. REPORT OF THE CHAIR 6. REPORT OF THE GENERAL MANAGER/CEO 7. BOARD MEMBER REQUESTS/COMMENTS 8. RECESS TO COMMITTEE MEETINGS Note: All items appearing on the agenda are subject to action by the Board. Staff recommendations are subject to change by the Board. Page 1 of 5 SamTrans Board of Directors Meeting Agenda for September 4, 2019 A. COMMUNITY RELATIONS COMMITTEE / COMMITTEE OF THE WHOLE* (R. Guilbault, Chair; R. Collins, M. Fraser) 1. Call to Order MOTION 2. Approval of Minutes of Community Relations Committee Meeting of August 7, 2019 INFORMATIONAL 3. -

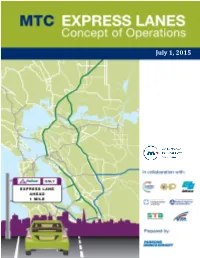

MTC Express Lanes Concept of Operations 7/1/15 I TABLE of CONTENTS

July 1, 2015 MTC Express Lanes Concept of Operations July 1, 2015 Prepared by: Parsons Brinckerhoff Revision History: Revision Date Description 0 23 May 13 Initial Release Includes the addition of the Contra Costa I-680 North (CC-680N) project, the classification of the bridge approaches as future 1 01 July 15 projects to be developed, signage and other design updates to reflect current designs, and updates to reflect current terminology and wording to be consistent with business requirements. MTC Express Lanes Concept of Operations 7/1/15 i TABLE OF CONTENTS CHAPTER 1 INTRODUCTION .............................................................................................................. 1 1.1 PURPOSE OF DOCUMENT AND INTENDED AUDIENCE .................................................................................. 1 1.2 BACKGROUND .................................................................................................................................................. 1 1.3 REGIONAL GOALS AND OBJECTIVES .............................................................................................................. 6 1.4 ORGANIZATION OF THE REPORT ................................................................................................................... 7 1.5 PLANNED FUTURE REVISIONS TO THIS DOCUMENT .................................................................................... 7 CHAPTER 2 CURRENT CHARACTERISTICS .................................................................................. 10 2.1 PROJECTS UNDER -

Frequently Asked Questions About Planned Bridge Toll Increase

Frequently Asked Questions about Planned Bridge Toll Increase Q.: What is BATA? A.: The Bay Area Toll Authority (BATA) was created by the California Legislature to administer the base toll revenues generated by the Bay Area’s seven state-owned toll bridges. In January 1998, MTC — the transportation planning, financing and coordinating agency for the nine-county region — began operations as BATA. For more information about BATA, go to <www.mtc.ca.gov/bata>. Q: Why are tolls being raised on the seven state-owned bridges? (The seven are the Antioch, Benicia-Martinez, Carquinez, Dumbarton, Richmond-San Rafael, San Mateo- Hayward and San Francisco-Oakland Bay bridges)? A: The single biggest reason is to help finance the projected $750 million cost of urgently needed seismic retrofits of the Antioch and Dumbarton bridges. Increased toll revenue also will help BATA address an estimated $35 million a year increase in its borrowing costs due to fundamental changes in the municipal bond market, and to help offset a slow but steady five-year decline in toll-paying traffic across the bridges. Q.: How is my current $4 toll spent? A.: The first dollar is used to pay for maintenance and operation of the seven state-owned bridges, and to finance the Regional Measure 1 projects approved by Bay Area voters in 1988. The third dollar is used to finance the Regional Traffic Relief Plan approved by voters in 2004 through Regional Measure 2. The second and fourth dollars were added by the state Legislature (originally in 1991 and again in 2005) to help finance the seismic retrofit of the five other state-owned toll bridges in the Bay Area. -

Statistical Summary of Bay Area Transit Operators: FY 2005-06

STATISTICAL SUMMARY OF BAY AREA TRANSIT OPERATORS OF SUMMARY BAY STATISTICAL Fiscal Years 2005-06 Through 2009-10 STATISTICAL SUMMARY OF BAY AREA TRANSIT OPERATORS June 2011 I Fiscal Years 2005-06 to 2009-10 Fiscal Years StatSumm CVR_2010.indd 1 6/8/11 2:26 PM Statistical Summary of Bay Area Transit Operators Fiscal Years 2005–06 through 2009–10 June 2011 Prepared by Metropolitan Transportation Commission Programming & Allocations Section Joseph P. Bort MetroCenter 101 Eighth Street Oakland, CA 94607 Tel 510.817.5700 TDD/TTY 510.817.5769 Fax 510.817.5848 Email [email protected] Web www.mtc.ca.gov Table of Contents 2 Introduction 4 Bay Area System — Statistical Summary Totals 6 Bay Area System — Regional Totals 8 Bay Area System — Performance by Operator Comparative Charts 11 Bay Area System — Total Transit Vehicle Fleet Operator Information 12 AC Transit (Alameda-Contra Costa Transit District) 16 ACE (Altamont Commuter Express) 20 Alameda Ferry Services 24 BART (Bay Area Rapid Transit District) 28 Benicia Breeze 32 Caltrain (Peninsula Corridor Joint Powers Board) 36 County Connection (Central Contra Costa Transit Authority) 40 Fairfield/Suisun Transit System 44 Golden Gate Transit (Golden Gate Bridge, Highway and Transportation District) 50 Healdsburg Transit 54 LAVTA (Livermore-Amador Valley Transit Authority/Wheels) 58 Muni (San Francisco Municipal Transportation Agency) 66 Petaluma Transit 70 Pleasanton Paratransit 74 Rio Vista Delta Breeze 78 SamTrans (San Mateo County Transit District) 82 Santa Rosa CityBus 86 Sonoma County Transit -

AB 455 Page 1

AB 455 Page 1 Date of Hearing: April 26, 2021 ASSEMBLY COMMITTEE ON TRANSPORTATION Laura Friedman, Chair AB 455 (Bonta) – As Amended March 25, 2021 SUBJECT: San Francisco-Oakland Bay Bridge: transit-only traffic lanes SUMMARY: Authorizes the Bay Area Toll Authority (BATA) to designate transit-only traffic lanes on the San Francisco-Oakland Bay Bridge (Bay Bridge), in consultation with the Department of Transportation (Caltrans). Specifically, this bill: 1) Defines “transit-only traffic lane” to mean any designated transit-only lane on which use is restricted to mass transit vehicles, or other designated vehicles including taxis and vanpools, during posted times. 2) Defines “other designated vehicles” to include high-occupancy vehicles (HOV) if the occupancy threshold is established in a manner that does not prevent mass transit vehicles from meeting weekday peak commute average travel times of at least 45 miles per hour (mph) in both directions along the Bay Bridge at least 90% of the weekdays of each calendar month. EXISTING LAW: 1) Establishes the Metropolitan Transportation Commission (MTC) as the transportation planning, coordinating, and financing agency for the nine-county San Francisco Bay Area. 2) Establishes MTC as the transportation planning, coordinating, and financing agency for the nine-county San Francisco Bay Area. 3) Authorizes Caltrans to construct exclusive or preferential lanes for buses only or for buses and other high-occupancy vehicles on the state highway system. 4) Designates the Bay Bridge as a state highway. 5) Authorizes BATA, a division of MTC, to designate the occupancy requirements for any bridge or segments of a highway that connects to a bridge in MTC’s jurisdiction if BATA establishes high-occupancy vehicle lane fee discounts, in consultation with Caltrans.