Hedge Papers, Trump's Wealthcare Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Look at the Legality Behind Daraprim's Price Spike Law360, New York (September 30, 2015, 12:15 PM ET)

Portfolio Media. Inc. | 860 Broadway, 6th Floor | New York, NY 10003 | www.law360.com Phone: +1 646 783 7100 | Fax: +1 646 783 7161 | [email protected] A Look At The Legality Behind Daraprim's Price Spike Law360, New York (September 30, 2015, 12:15 PM ET) -- Turing Pharmaceuticals AG and its controversial CEO Martin Shkreli recently made headlines when Turing raised the price of its antiprotozal drug Daraprim (pyrimethamine) from $13.50 to $750 per tablet.[1] The price increase received significant media attention. Here, we evaluate Turing’s Daraprim price hike from a legal perspective, including an analysis of the mechanisms used to balance innovation and drug pricing in the U.S., and their degree of application, if any, to the drug’s recent price hike. Balancing Drug Prices and Innovation The United States has traditionally incentivized drug development innovation. Charles J. Andres Patents and the U.S. Food and Drug Administration's regulatory exclusivities allow an innovator to enjoy a protected U.S. market for a finite period of time. The market protection provided by these exclusivities helps innovators to recoup their research costs and make profits which, in part, are used to fund new research. Conversely, after the expiration of patents and market exclusivities, generic drugs can enter the marketplace. Generic drugs can ultimately cost 80 percent less than the branded drug.[2] Accordingly, U.S. laws (e.g., the Hatch-Waxman Act and Biologic Price Competition and Innovation Act of 2009) attempt to strike a balance by providing market incentives to innovators to bring new medicines to market in exchange for making generic drugs available to patients at a greatly reduced cost. -

Notorious Turing CEO Martin Shkreli Arrested for Securities Fraud Like Share Tweet Share

Job Seeker: Login Sign Up Employer: Login Post Jobs HOME NEWS JOBS CAREER RESOURCES HOTBEDS CAREER FAIRS EVENTS COMPANY PROFILES INVESTORS Search Life Sciences Jobs Job Title, Keyword or Company Name City, State, or Postal Code FIND JOBS > News | News By Subject | News by Disease | News By Date | Search News Get Our FREE Industry eNewsletter email: Notorious Turing CEO Martin Shkreli Arrested for Securities Fraud Like Share Tweet Share 12/17/2015 6:20:27 AM December 17, 2015 By Alex Keown, BioSpace.com Breaking News Staff NEW YORK – Martin Shkreli, the pharmaceutical industry’s so-called “bad boy,” has been arrested on charges of securities fraud related to his tenure as chief executive officer of Retrophin Inc. (RTRX) Shkreli, who became something of an industry pariah after increasing the price of a 65-year-old drug 5,000 percent, then lamenting the fact that he didn’t raise it even higher in order to increase profit, was arrested at his home this morning, Bloomberg reported. Shkreli is being charged with a misuse of company funds when he was CEO of that company. Prosecutors allege that Shkreli took company stock and used it to pay off personal debts. Additionally, Shkreli is charged with playing shell games with his former hedge fund, MSMB Capital Management, which lost millions of investor’s dollars, Bloomberg said. In January, Shkreli came under investigation by U.S. prosecutors for possible securities violations and from the U.S. Securities and Exchange Commission for the distribution of stock without letting shareholders know. An internal probe conducted by Retrophin and filed with the Securities and Exchange Commission on Feb. -

Attorney General Herring Files Suit Against Martin

SSearch Search ... Commonwealth of Virginia Office of the Attorney General Mark Herring 202 North Ninth Street Attorney General Richmond, Virginia 23219 For media inquiries only, contact: Charlotte Gomer, Press Secretary Phone: (804)786-1022 Mobile: (804) 512-2552 Email: [email protected] ATTORNEY GENERAL HERRING FILES SUIT AGAINST MARTIN SHKRELI AND VYERA PHARMACEUTICALS ~ Lawsuit seeks repayment of illegally obtained profits, lifetime ban on Shkreli working in pharmaceutical industry ~ RICHMOND (April 14, 2020) – Attorney General Mark R. Herring today joined a multistate lawsuit filed earlier this year against Vyera Pharmaceuticals, previously Turing Pharmaceuticals, and two of its former CEOs, including Martin Shkreli, for stifling competition to protect the exorbitant, monopolistic pricing of the drug Daraprim. Daraprim (pyrimethamine) is used to treat the parasitic disease toxoplasmosis, and despite Vyera Pharmaceuticals being the only FDA-approved source of the medication, Shkreli and Vyera raised the price of the drug by more than 4,000 percent overnight to $750 per pill, after purchasing the rights to Daraprim in August 2015. “Vyera Pharmaceuticals and Martin Shkreli made unconscionable decisions to maintain their monopoly on Daraprim and make as much money as possible,” said Attorney General Herring. “Because of their greed, Americans who couldn’t afford the exorbitant price of this drug were forced to make difficult, potentially life- threatening treatment decisions. Drug companies and their executives must be held accountable when they place profits over human lives.” Attorney General Herrring is one of six attorneys general today joining the lawsuit against Vyera and Shkreli that was originally filed by New York Attorney General Letitia James and the Federal Trade Commission (FTC) in January. -

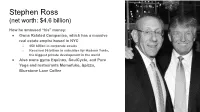

Stephen Ross (Net Worth: $4.6 Billion)

Stephen Ross (net worth: $4.6 billion) How he amassed “his” money: ● Owns Related Companies, which has a massive real estate empire based in NYC ○ $50 billion in corporate assets ○ Received $6 billion in subsidies for Hudson Yards, the biggest private development in the world ● Also owns gyms Equinox, SoulCycle, and Pure Yoga and restaurants Momofuko, &pizza, Bluestone Lane Coffee Stephen Ross (net worth: $7.6 billion) How he keeps “his” money: ● Political donations ○ Raised $12 million for Donald Trump at Hamptons fundraiser ○ Given $80,000 to Andrew Cuomo since 2005 ○ Donates to Republicans in Congress & NYS legislature ● Tax games ○ Billions in tax breaks and other subsidies for Hudson Yards project ○ Overstated value of a property donated to University of Michigan to claim large charitable deduction Stephen Ross (net worth: $7.6 billion) How he spends “his” money: ● At least six homes worth as much as $150 million ○ Hudson Yards penthouse, TriBeCa condo, West Village condo, mansions in the Hamptons and Palm Beach, and a Palm Beach condo ● Owns the Miami Dolphins NFL team ● Board seats at cultural institutions ○ Lincoln Center, Solomon R Guggenheim Foundation Stephen Ross (net worth: $114 billion) How we can tax “his” money: ● Billionaire Wealth Tax ○ Tax on wealth, including unrealized capital gains ● Ultramillionaire Income Tax ○ New 10.32% top PIT rate ● Stock Buyback Tax ○ Hits stunts like his attack on AT&T ● Carried Interest Fairness Fee ○ State tax on his under-taxed fees to investors ● 21st Century Bank Tax ○ State tax on hedge -

Outline of Selected SEC Enforcement Actions, Division of Enforcement (October 2016)

© Practising Law Institute CORPORATE LAW AND PRACTICE Course Handbook Series Number B-2303 The SEC Speaks in 2017 Co-Chairs David W. Grim Marc Wyatt To order this book, call (800) 260-4PLI or fax us at (800) 321-0093. Ask our Customer Service Department for PLI Order Number 186008, Dept. BAV5. Practising Law Institute 1177 Avenue of the Americas New York, New York 10036 © Practising Law Institute Enforcement Panel and Workshop 41 © Practising Law Institute 42 © Practising Law Institute 3 Outline of Selected SEC Enforcement Actions, Division of Enforcement (October 2016) Prepared by: Sherry A. Peyton Research Specialist Seth Groveunder Intern The SEC (SEC), as a matter of policy, disclaims responsibility for any private publication or statement by any of its employees. The views expressed herein are those of the authors and do not necessarily reflect the views of the SEC or of the authors’ colleagues upon the staff of the SEC. Parts of this outline have been used in other publications. If you find this article helpful, you can learn more about the subject by going to www.pli.edu to view the on demand program or segment for which it was written. 43 © Practising Law Institute 44 © Practising Law Institute Table of Contents ACTIONS INVOLVING BROKER-DEALERS, INVESTMENT ADVISERS AND INVESTMENT COMPANIES AND OTHER REGULATED ENTITIES ......................................................................... 9 In the Matter of Merrill Lynch, Pierce, Fenner & Smith Incorporated ........................................................................................ 11 In the Matter of Merrill Lynch, Pierce, Fenner & Smith Incorporated Professional Clearing Corp. ........................................... 13 In the Matter of William Tirrell ............................................................. 15 SEC v. Ash Narayan, et al. ................................................................. 19 In the Matter of Apex Fund Services (US), Inc. -

990-PF and Its Instructions Is at Www

l efile GRAPHIC p rint - DO NOT PROCESS As Filed Data - DLN: 93491318011814 Return of Private Foundation OMB No 1545-0052 Form 990 -PF or Section 4947 ( a)(1) Trust Treated as Private Foundation 0- Do not enter Social Security numbers on this form as it may be made public. By law, the 2013 IRS cannot redact the information on the form. Department of the Treasury 0- Information about Form 990-PF and its instructions is at www. irs.gov/form990pf . Internal Revenue Service For calendar year 2013 , or tax year beginning 01 - 01-2013 , and ending 12-31-2013 Name of foundation A Employer identification number PAULSON FAMILY FOUNDATION CO PAULSON & CO INC 26-3922995 Number and street (or P 0 box number if mail is not delivered to street address) Room/suite U ieiepnone number (see instructions) 1251 AVENUE OF THE AMERICAS 50TH FLOOR (212) 956-2221 City or town, state or province, country, and ZIP or foreign postal code C If exemption application is pending, check here F NEW YORK, NY 10020 G Check all that apply r'Initial return r'Initial return of a former public charity D 1. Foreign organizations, check here F r-Final return r'Amended return 2. Foreign organizations meeting the 85% test, r Address change r'Name change check here and attach computation E If private foundation status was terminated H Check type of organization Section 501(c)(3) exempt private foundation und er section 507 ( b )( 1 )( A ), c hec k here F_ Section 4947(a)(1) nonexempt charitable trust r'Other taxable private foundation I Fair market value of all assets at end J Accounting method F Cash F Accrual F If the foundation is in a 60-month termination of year (from Part II, col. -

Document Relates To: ALL ACTIONS ———— REPORT of PAUL GOMPERS, Ph.D

No. 20-222 In the Supreme Court of the United States GOLDMAN SACHS GROUP, INC., ET AL., PETITIONERS v. ARKANSAS TEACHER RETIREMENT SYSTEM, ET AL. ON WRIT OF CERTIORARI TO THE UNITED STATES COURT OF APPEALS FOR THE SECOND CIRCUIT JOINT APPENDIX (VOLUME 2; PAGES 401-804) KANNON K. SHANMUGAM THOMAS C. GOLDSTEIN PAUL, WEISS, RIFKIND, GOLDSTEIN & RUSSELL, P.C. WHARTON & GARRISON LLP 7475 Wisconsin Avenue 2001 K Street, N.W. Suite 850 Washington, DC 20006 Bethesda, MD 20814 (202) 223-7300 (202) 362-0636 [email protected] [email protected] Counsel of Record Counsel of Record for Petitioners for Respondents PETITION FOR A WRIT OF CERTIORARI FILED: AUGUST 21, 2020 CERTIORARI GRANTED: DECEMBER 11, 2020 TABLE OF CONTENTS Page VOLUME 1 Court of appeals docket entries (No. 18-3667) ................... 1 Court of appeals docket entries (No. 16-250) ..................... 5 District court docket entries (No. 10-3461) ........................ 8 Goldman Sachs 2007 Form 10-K: Conflicts Warning (D. Ct. Dkt. No. 78-6) .................................................... 23 Goldman Sachs 2007 Annual Report: Business Principles (D. Ct. Dkt. No. 143-16) ............................. 30 Financial Times, Markets & Investing, “Goldman’s risk control offers right example of governance,” Dec. 5, 2007 (D. Ct. Dkt. No. 193-20) .......................... 34 Dow Jones Business News, “13 Reasons Bush’s Bailout Won’t Stop Recession,” Dec. 11, 2007 (D. Ct. Dkt. No. 170-24) ................................................ 37 The Wall Street Journal, “How Goldman Won Big on Mortgage Meltdown,” Dec. 14, 2007 (front page) (D. Ct. Hearing Ex. T) ....................................... 42 The New York Times, Off the Shelf, “Economy’s Loss Was One Man’s Gain,” Dec. -

Richest Hedge Funds the World's

THE WORLD’S DR. BROWNSTEIN’S WINNING FORMULA RICHEST PAGE 40 CANYON’S SECRET EMPIRE HEDGE PAGE 56 CASHING IN ON CHAOS FUNDS PAGE 68 February 2011 BLOOMBERG MARKETS 39 100 THE WORLD’S RICHEST HEDGE FUNDS COVER STORIES FOR 20 YEARS, DON BROWNSTEIN TAUGHT philosophy at the University of Kansas. He special- ized in metaphysics, which examines the character of reality itself. ¶ In a photo from his teaching days, he looks like a young Karl Marx, with a bushy black beard and unruly hair. That photo is now a relic standing behind the curved bird’s-eye-maple desk in Brownstein’s corner office in Stamford, Connecticut. Brownstein abandoned academia in 1989 to try to make some money. ¶ The career change paid off. Brownstein is the founder of Structured Portfolio Man- agement LLC, a company managing $2 billion in five partnerships. His flagship fund, the abstrusely named Structured Servicing Holdings LP, returned 50 percent in the first 10 months of 2010, putting him at the top of BLOOMBERG MARKETS’ list of the 100 best-performing hedge CONTINUED ON PAGE 43 DR. BROWNSTEIN’S By ANTHONY EFFINGER and KATHERINE BURTON WINNING PHOTOGRAPH BY BEN BAKER/REDUX FORMULA THE STRUCTURED PORTFOLIO MANAGEMENT FOUNDER MINE S ONCE-SHUNNED MORTGAGE BONDS FOR PROFITS. HIS FLAGSHIP FUND’S 50 PERCENT GAIN PUTS HIM AT THE TOP OF OUR ROSTER OF THE BEST-PERFORMING LARGE HEDGE FUNDS. 40 BLOOMBERG MARKETS February 2011 NO. BEST-PERFORMING 1 LARGE FUNDS Don Brownstein, left, and William Mok Structured Portfolio Management FUND: Structured Servicing Holdings 50% 2010 135% 2009 TOTAL RETURN In BLOOMBERG MARKETS’ first-ever THE 100 TOP- ranking of the top 100 large PERFORMING hedge funds, bets on mortgages, gold, emerging markets and global LARGE HEDGE FUNDS economic trends stand out. -

Media Physicians Public

TOP MOST-SHARED U.S. ARTICLES ON DRUG PRICING VIA TWITTER, AUG ‘15 – AUG ‘16 MEDIA PHYSICIANS PUBLIC 1. WSJ: “Why The U.S. 1. NYT: “Valeant’s Drug Price 1. NBC News: “EpiPen Price Pays More Than Other Strategy Enriches It, But Hike Has Parents Of Kids Countries For Drugs” Infuriates Patients And With Allergies Scrambling (12/1/15) Lawmakers” (10/4/15) Ahead Of School Year” (8/17/16) 2. WSJ: “How Pfizer Set The 2. NBC News: “EpiPen Price Cost Of Its New Drug At Hike Has Parents Of Kids 2. NYT: “Drug Goes From $9,850 A Month” (12/9/15) With Allergies Scrambling $13.50 A Tablet To $750, Ahead Of School Year” Overnight” (9/20/15) 3. NYT: “Valeant’s Drug Price (8/17/16) Strategy Enriches It, But 3. AP: “Breakthrough Infuriates Patients And 3. NYT: “Martin Shkreli’s Cholesterol Drugs Fizzle Lawmakers” (10/4/15) Latest Plan To Sharply Amid Price Pushback” Raise Drug Price Prompts (4/20/16) 4. WSJ:: “For Prescription Outcry” (12/11/15) Drug Makers, Price 4. USAT: “Company Hikes Increases Drive Revenue” 4. WaPo: “This Drug Is Price 5,000% For Drug (10/5/15) Defying A Rare Form Of That Fights Complication Leukemia — And It Keeps Of AIDS, Cancer” (9/18/15) 5. NYT: “Martin Shkreli’s Getting Pricier” (3/9/16) Latest Plan To Sharply 5. CBS: “Rising Cost Of Raise Drug Price Prompts 5. WSJ: “Why The U.S. Potentially Life-Saving Outcry” (12/11/15) Pays More Than Other EpiPen Puts Pinch On Countries For Drugs” Families” (8/16/16) 6. -

The Next President Can Lower Drug Prices with the Stroke of a Pen

Why Chinese Universities Suck WINTERSPRING BOOKS ISSUE NOVEMBER/DECEMBER 2016 $5.95 U.S./$6.95 CAN PLUS: How to make conservatism great again America’s best police chief Just the Medicine How the next president can lower drug prices with the stroke of a pen. By Alicia Mundy t’s hard to watch television or read a newspaper These are not isolated incidents. List prices for drugs in these days without seeing stories about outrageous general rose 12 percent last year, on top of similar increases I prescription drug price increases. This past summer, over the previous five years. Drug prices are now on track the company Mylan was in the spotlight for hiking the to account for more than 15 percent of health care costs in price of its EpiPen, an injector containing cheap but life- America, up from less than 10 percent in 2014. That increase saving allergy medicine, from $94 for a two-pack in 2007 is helping to drive up health insurance premiums and pa- to over $600 today. Last fall, Martin Shkreli, CEO of Tur- tient deductibles. According to an August 2015 report by Kai- ing Pharmaceuticals, became the face of greed when his ser Health News, 24 percent of Americans taking prescrip- company purchased the AIDS drug Daraprim and prompt- tion drugs reported being unable to afford a prescription ly raised its price from $13.50 to $750 per pill—an increase from their doctors in 2015 over the previous year. of some 5,000 percent. Prior to that, Valeant Pharma- The only thing more depressing than these out-of-con- ceuticals drew widespread scorn for jacking up the prices trol drug prices is the seeming inability of politicians to do of two heart medications, Nitropress and Isuprel, by 212 anything about the problem. -

Imbeaumbsthesis.Pdf (2.574Mb)

Copyright is owned by the Author of the thesis. Permission is given for a copy to be downloaded by an individual for the purpose of research and private study only. The thesis may not be reproduced elsewhere without the permission of the Author. Title Page Cooperation in Competitive Miniatures Games: An examination of coopetitive behaviour A thesis presented in partial fulfilment of the requirements for the degree of Master of Business Studies in Management at Massey University Auckland, New Zealand Jean-Sebastien Imbeau 2019 1 Abstract The following study uses competitive miniatures board games as a novel research environment to examine how, when and why individuals choose between cooperative and competitive strategies to advance their interests, both within the game match itself and within the broader community of gamers, and what factors affect these decisions. Drawing on literature from the study fields of coopetition (a situation of simultaneous cooperation and competition) and decision making, the study focuses on environmental factors and systemic features of the games and game cultures, and how these impact player decisions and perspectives on the competitive/cooperative paradox. Findings supported value creation as a key motivator in player behaviour. Participants overall expressed a non zero-sum understanding of the coopetitive environment. The existence of a coopetitive tension within competitive miniatures games was acknowledged across the board, although its severity was perceived differently across participants. Participants also identified a number of key strategies and tools used to mitigate or navigate this tension. These included reciprocity, communicating intent, following the principles of clean play, and adhering to a set of unwritten rules and norms around sportsmanship and fairness. -

Complaint: Martin Shkreli, Evan Greebel, MSMB Capital

Andrew M. Calamari Sanjay Wadhwa Gerald A. Gross Paul G. Gizzi Eric M. Schmidt Attorneys for Plaintiff SECURITIES AND EXCHANGE COMMISSION New York Regional Office 200 Vesey Street, Suite 400 New York, NY 10281-1022 (212) 336-0150 (Schmidt) Email: [email protected] UNITED STATES DISTRICT COURT EASTERN DISTRICT OF NEW YORK SECURITIES AND EXCHANGE COMMISSION, Plaintiff, ECFCASE -against- COMPLAINT AND MARTIN SHKRELI, JURY DEMAND EVAN GREEBEL, MSMB CAPITAL MANAGEMENT LLC, and MSMB HEALTHCARE MANAGEMENT LLC, Defendants. Plaintiff Securities and Exchange Commission ("Commission"), for its Complaint against Defendants Martin Shkreli ("Shkreli"), Evan Greebel ("Greebel"), MSMB Capital Management LLC ("MSMB Adviser") and MSMB Healthcare Management LLC ("MSMB Healthcare Adviser"), alleges as follows: SUMMARY 1. This case involves widespread fraudulent conduct orchestrated by Shkreli from at least October 2009 through March 2014. Some of this fraudulent conduct was aided and abetted by Shkreli's lawyer, Greebel. 2. Shkreli was the founder and portfolio manager ofMSMB Capital Management LP ("MSMB") and MSMB Healthcare LP ("MSMB Healthcare"), a pair of hedge funds. He was also the managing member of defendants MSMB Adviser and MSMB Healthcare Adviser, the investment advisers to MSMB and MSMB Healthcare, respectively. Shkreli made material misrepresentations and omissions to investors and prospective investors in MSMB; lied to one of MSMB's executing brokers about MSMB's ability to settle short sales Shkreli had made in MSMB's account; and misappropriated funds from MSMB and MSMB Healthcare. Later, after Shkreli had founded and taken public a pharmaceutical company, Retrophin, Inc. ("Retrophin"), Shkreli, aided and abetted by Greebel, fraudulently induced Retrophin to fund settlements with persons who had claims against Shkreli arising out of their investments in Shkreli' s hedge funds.