Supreme Court of Louisiana

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MONTANA BIRTH CERTIFICATE APPLICATION Cascade County Clerk & Recorder, 121 4Th St N Ste 1B1 Great Falls, MT 59401 406-454-6718 IDENTIFICATION IS REQUIRED Picture I.D

INSTRUCTIONS FOR ORDERING A BIRTH RECORD 1. Print, Fill out completely, and Sign application. (see below for who can order) 2. Provide proof of Identity (see acceptable methods below) 3. Enclose cashier’s check or money order (see Fees below) 4. Enclose a stamped self-addressed return envelope. (enclose a pre-paid envelope from express mail/UPS/FEDEX etc. for expedited service. We do not track mail once it leaves our office - keep all tracking info) 5. Mail application, I.D., payment, and return envelope to Cascade County Clerk and Recorder, 121 4th St N, Suite 1B1 Great Falls, MT 59401 WHO CAN ORDER A CERTIFIED BIRTH CERTIFICATE? Only those authorized by 50-15-121 MCA, which includes the registrant (14 years old or older) the registrant’s spouse, children, parents or guardian or an authorized representative, may obtain a certified copy of a birth record. Proof of relationship, guardianship or authorization is required. Step-relatives, in-laws, grandparents, siblings, aunts, uncles, cousins, ex-spouses, and a natural parent of an adoptive child or others are NOT eligible to receive a certified copy of a birth certificate. Non-certified informational/genealogy copies are available to anyone if record is more than 30 years old. Montana birth certificates are full size paper with a raised seal. Wallet size cards are not available. IDENTIFICATION IS REQUIRED •The person signing the request must provide an enlarged legible photocopy of both sides of their valid driver’s license or other legal picture identification with a signature, or the requestor must have the application notarized. -

State Abbreviations

State Abbreviations Postal Abbreviations for States/Territories On July 1, 1963, the Post Office Department introduced the five-digit ZIP Code. At the time, 10/1963– 1831 1874 1943 6/1963 present most addressing equipment could accommodate only 23 characters (including spaces) in the Alabama Al. Ala. Ala. ALA AL Alaska -- Alaska Alaska ALSK AK bottom line of the address. To make room for Arizona -- Ariz. Ariz. ARIZ AZ the ZIP Code, state names needed to be Arkansas Ar. T. Ark. Ark. ARK AR abbreviated. The Department provided an initial California -- Cal. Calif. CALIF CA list of abbreviations in June 1963, but many had Colorado -- Colo. Colo. COL CO three or four letters, which was still too long. In Connecticut Ct. Conn. Conn. CONN CT Delaware De. Del. Del. DEL DE October 1963, the Department settled on the District of D. C. D. C. D. C. DC DC current two-letter abbreviations. Since that time, Columbia only one change has been made: in 1969, at the Florida Fl. T. Fla. Fla. FLA FL request of the Canadian postal administration, Georgia Ga. Ga. Ga. GA GA Hawaii -- -- Hawaii HAW HI the abbreviation for Nebraska, originally NB, Idaho -- Idaho Idaho IDA ID was changed to NE, to avoid confusion with Illinois Il. Ill. Ill. ILL IL New Brunswick in Canada. Indiana Ia. Ind. Ind. IND IN Iowa -- Iowa Iowa IOWA IA Kansas -- Kans. Kans. KANS KS A list of state abbreviations since 1831 is Kentucky Ky. Ky. Ky. KY KY provided at right. A more complete list of current Louisiana La. La. -

Wills of Cascade County Great Falls, Montana Volumes One & Three

WILLS OF CASCADE COUNTY GREAT FALLS, MONTANA VOLUMES ONE & THREE No record has been found of the Volume two of the Wills of Cascade County, Montana. Retyped by Thelma L. Marshall indexed by Eddie Josey-Wilson and Evan Heisel Great Falls Genealogy Society Great Falls, Montana April 1996 ABSTRACTS OF WILLS CASCADE COUNTY, MONTANA 1884-1909 VOLUME 1 BLACK EAGLE CHAPTER DAUGHTERS OF THE AMERICAN REVOLUTION GREAT FALLS, MONTANA ABSTRACTS OF WILLS CASCADE COUNTY; MONTANA VOLUME 1 ABSTRACTS OF WILLS CASCADE COUNTY, MONTANA BLACK EAGLE CHAPTER DAUGHTERS OF THE AMERICAN REVOLUTION GREAT FALLS, MONTANA COPIED BY: Mrs. Lou Siniff Mrs. Theodore Cox Miss Ella Nelson Miss Grace Collins Grace Dutton Collins, State Chairman 1 951 - 1952 RICHARD WRIGHT of Fairfield St., Philadelphia, U.S.A. DATED: 3 Sep. 1888 WIFE: Elizabeth WRIGHT FATHER: James Wright SISTERS: Charlotte Wright, Rebecca Wright (wife of James Wright)Maria Moore (wife of J.W. MOORE). BROTHERS: William, Arthur, late brother Edmund EXECUTORS: Brother Arthur Wright, Wife Elizabeth Wright and sister Charlotte Wright. WITNESSES: S. Harlan Price and Wm.H. Walker. "Should I die in England I wish to be buried in the lot beside my father and mother, in the cemetery at Oday, Yorkshire in England. If I die away from England I wish a stone to be erected on this lot giving my birth and death dates." JAMES STONE of Great Falls, Cascade County, Montana. DATED: 27 March 1891 HEIR: In view of the fact that Thomas E. Brady has loaned me large sums of money and cared for me during this my last illness I bequeath to him all my properties, chattels and debts. -

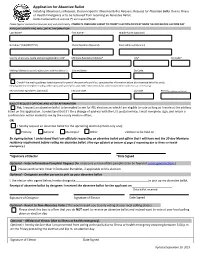

Application for Absentee Ballot

Application for Absentee Ballot Including Absentee List Request, Election Specific Absentee Ballot Request, Request for Absentee Ballot Due to Illness or Health Emergency or to be removed from receiving an Absentee Ballot. Fields marked with an asterisk (*) are required fields. Please type or use black or blue pen only and print clearly. COMPLETE FORM AND SUBMIT TO COUNTY ELECTION OFFICE BY NOON THE DAY BEFORE ELECTION DAY APPLICANT IDENTIFYING AND CONTACT INFORMATION Last Name* First Name* Middle Name (Optional) Birthdate* (MM/DD/YYYY) Phone Number (Optional) Email Address (Optional) County where you reside and are registered to vote* Montana Residence Address* City* Zip Code* Mailing Address (required if differs from residence address*) City and State Zip Code Check if the mailing address listed above is for part of the year only and if so, complete the information below (for absentee ballot list only). Clearly print the complete mailing address(es) and specify the applicable time periods for address (add more addresses as necessary). Seasonal Mailing Address (Optional) City and State Zip Code Period (mm/dd/yyyy-mm/dd/yyyy) BALLOT REQUEST OPTIONS AND VOTER AFFIRMATION Yes, I request an absentee ballot to be mailed to me for ALL elections in which I am eligible to vote as long as I reside at the address listed on this application. I understand that if I file a change of address with the U.S. postal service, I must complete, sign, and return a confirmation notice mailed to me by the county election office; OR I hereby request an absentee ballot for the upcoming election (check only one): Primary General Municipal Other election to be held on By signing below, I understand that I am officially requesting an absentee ballot and affirm that I will have met the 30-day Montana residency requirement before voting my absentee ballot. -

Partners and Mini-Grant Awardees Alaska Oklahoma Juneau Altus Pawhuska Tlingit-Haida Regional Housing Ranch Good Days, Inc

Children’s Savings Account (CSA) Partners and Mini-Grant Awardees Alaska Oklahoma Juneau Altus Pawhuska Tlingit-Haida Regional Housing Ranch Good Days, Inc. Osage Financial Resources Inc. Authority Mini-Grant Awardee CSA Partner and Mini-Grant Awardee Mini-Grant Awardee Osage Nation Financial Assistance Seldovia Anadarko Department CSA Partner Seldovia Tribal Village The Wichita and Affiliated Tribes Mini-Grant Awardee CSA Partner and Mini-Grant Awardee Pawnee BeLieving in Native Generations Pawnee Tribe Title VI Elderly CSA Partner Meals Program Maine CSA Partner Orono Anadarko Public Schools Indian Education Program Ponca City Four Directions Development CSA Partner Corporation Ponca Tribe Head Start Mini-Grant Awardee Carnegie CSA Partner Kiowa Tribe Shawnee CSA Partner and Mini-Grant Awardee Minnesota Citizen Potawatomi Community Ogema Kaw City Development Corporation CSA Partner and Mini-Grant Awardee Kaw Nation White Earth Investment Absentee Shawnee Housing Authority Initiative Mini-Grant Awardee CSA Partner and Mini-Grant Awardee Mini-Grant Awardee Miami The Modoc Tribe & the Modoc Tahlequah Montana Housing Authority of Oklahoma United Keetoowah Band of Lame Deer CSA Partner and Mini-Grant Awardee Cherokee Indians Mini-Grant Awardee The Housing Authority of the Peoria People’s Partner for Community Tribe of Indians in Oklahoma Cherokee Nation Child Support Program Development (working with the CSA Partner and Mini-Grant Awardee CSA Partner Chief Dull Knife Tribal College The American Indian Resource Center Cooperative Extension Service) Norman CSA Partner and Mini-Grant Awardee Mini-Grant Awardee The Native Alliance Against Violence Cherokee Nation Commerce Services North Carolina Mini-Grant Awardee Mini-Grant Awardee Cherokee Okmulgee Wewoka The Housing Authority of the The Sequoyah Fund, Inc. -

Lee Woodward, Long a Faculty Member (1965–1997)

In Memory of Lee A. Woodward 1931–2020 ee Woodward, long a faculty member (1965–1997) and former chairman (1970–1976) of the Department of LEarth and Planetary Sciences at the University of New Mexico (UNM), died on August 16, 2020, at the age of 89. His research contributed significantly to knowledge of New Mexico structural geology and tectonics, and the relation- ships of the structural history of an area to the occurrence of oil and gas and mineral resources. Lee spent much time studying geology in the field, and involved numerous gradu- ate students in mapping 7.5-minute quadrangles, especially in the Nacimiento Mountains region. As an educator, he trained hundreds of undergraduate students in structural and field geology, as well as teaching introductory geology courses and advanced undergraduate and graduate courses. During his time as chairman the department’s faculty expanded rapidly, attaining its highest number (14) to that point in its history, and he oversaw the strengthening of its undergraduate and graduate programs. Lee assumed leadership positions in several professional societies, and was active as an editor and contributor to New Mexico Geological Society field confer- ences and guidebooks. In addition to his work at UNM and in New Mexico, Lee also pursued research and published on aspects of the geology of his home state, Montana. These contributions are examined in more detail in the following paragraphs. Lee Woodward was born on April 22, 1931, in Omaha, Nebraska, but his family moved to Montana in 1933, settling in Great Falls in 1935 and by 1940, in Missoula. -

19-368 Ford Motor Co. V. Montana Eighth Judicial

(Slip Opinion) OCTOBER TERM, 2020 1 Syllabus NOTE: Where it is feasible, a syllabus (headnote) will be released, as is being done in connection with this case, at the time the opinion is issued. The syllabus constitutes no part of the opinion of the Court but has been prepared by the Reporter of Decisions for the convenience of the reader. See United States v. Detroit Timber & Lumber Co., 200 U. S. 321, 337. SUPREME COURT OF THE UNITED STATES Syllabus FORD MOTOR CO. v. MONTANA EIGHTH JUDICIAL DISTRICT COURT ET AL. CERTIORARI TO THE SUPREME COURT OF MONTANA No. 19–368. Argued October 7, 2020—Decided March 25, 2021* Ford Motor Company is a global auto company, incorporated in Delaware and headquartered in Michigan. Ford markets, sells, and services its products across the United States and overseas. The company also encourages a resale market for its vehicles. In each of these two cases, a state court exercised jurisdiction over Ford in a products-liability suit stemming from a car accident that injured a resident in the State. The first suit alleged that a 1996 Ford Explorer had malfunctioned, killing Markkaya Gullett near her home in Montana. In the second suit, Adam Bandemer claimed that he was injured in a collision on a Min- nesota road involving a defective 1994 Crown Victoria. Ford moved to dismiss both suits for lack of personal jurisdiction. It argued that each state court had jurisdiction only if the company’s conduct in the State had given rise to the plaintiff’s claims. And that causal link existed, according to Ford, only if the company had designed, manufactured, or sold in the State the particular vehicle involved in the accident. -

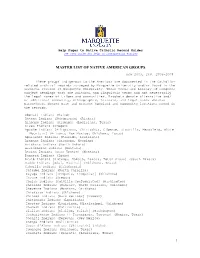

Master List of Native Groups

Help Pages to Native Catholic Record Guides See User Guide for help on interpreting entries MASTER LIST OF NATIVE AMERICAN GROUPS new 2003, rev. 2006-2008 These groups indigenous to the Americas are documented in the Catholic- related archival records surveyed by Marquette University and/or found in the archival records at Marquette University. These terms are Library of Congress subject headings that are cultural and linguistic terms and not necessarily the legal names of tribes and communities. Brackets denote alternative and/ or additional community, ethnographic, historic, and legal names whereas parentheses denote past and present homeland and community locations noted in the records. Abenaki Indians (Maine) Ahtena Indians [Athapascan] (Alaksa) Alabamu Indians [Alabama] (Louisiana, Texas) Alsea Indians (Oregon) Apache Indians [Athapascan, Chiricahua, Cibecue, Jicarilla, Mescalero, White Mountain] (Arizona, New Mexico, Oklahoma, Texas) Apalachee Indians (Florida, Louisiana) Arapaho Indians (Oklahoma, Wyoming) Arickara Indians (North Dakota) Assiniboine Indians (Montana) Atsina Indians [Gros Ventre] (Montana) Bannock Indians (Idaho) Brulé Indians [Sicangu, Dakota, Lakota, Teton Sioux] (South Dakota) Caddo Indians [Adai, Hasinai] (Oklahoma, Texas) Cahuilla Indians (California) Catawba Indians (North Carolina) Cayuga Indians [Iroquois, Iroquoian] (Oklahoma) Cayuse Indians (Oregon) Chelan Indians [Colville Confederated] (Washington) Cherokee Indians (Kansas?, North Carolina, Oklahoma) Cheyenne Indians (Montana, Oklahoma) Chickasaw Indians -

Montana Shall Issue Must Inform Officer Immediately: NO Permitless Carry State (See Must Inform Section)

Montana Shall Issue Must Inform Officer Immediately: NO Permitless Carry State (See Must Inform Section). Montana CCW Links Sheriff CCW Site CCW Application Sheriff CCW FAQs State Statutes State Admin Rules State Reciprocity Info In FAQs State Attorney General Sheriff CCW Info Site Yellowstone Co Application Packet Lewis & Clark Co. Note: Alaska, Arizona, Arkansas, Idaho, Iowa, Kansas, Kentucky, App & Instructions Maine, Montana, Mississippi, Missouri, New Hampshire, Oklahoma, South Dakota, Tennessee, Texas, Utah, Vermont, West Virginia and Secretary of State Wyoming have "Permitless Carry". Anyone who can legally possess a Age to Carry a Firearm firearm may carry in these states without a Permit/License. Check each In Other States states page for information on age and other restrictions that may apply. Last Updated: 9/1/2021 North Dakota has “Permitless Carry” for Residents only. Permits/Licenses This State Honors Listed Below Alabama Alaska Arizona Arkansas California Colorado Connecticut Florida Georgia Idaho Indiana Illinois Iowa Kansas Kentucky Louisiana Maryland Massachusetts Michigan Minnesota Mississippi Missouri Nebraska Nevada New Jersey New Mexico New York North Dakota North Carolina Ohio Oklahoma Oregon Pennsylvania South Carolina South Dakota Tennessee Texas Utah Virginia Washington West Virginia Wisconsin Wyoming Montana Honors Non-Resident Permits/Licenses From the States They Honor. Reciprocity/How This State Honors Other States Permit/Licenses 45-8-329. Concealed Weapon Permits from Other States Recognized -- Advisory Council. (1) A concealed weapon permit from another state is valid in this state if: (a) the person issued the permit has the permit in the person's immediate possession; (b) the person bearing the permit is also in possession of an official photo identification of the person, whether on the permit or on other identification; and (c) the state that issued the permit requires a criminal records background check of permit applicants prior to issuance of a permit. -

Cretaceous Eocene Correlation in New Mexico, Wyoming, Montana

BULLETIN OF THE GEOLOGICAL SOCIETY OF AMERICA V O L. 25, PP. 355-380 S E P T E M B E R 15, 1914 PROCEEDINGS OF THE PALEONTOLOGICAL SOCIETY CRETACEOUS EOCEJME CORRELATION IN NEW MEXICO, WYOMING, MONTANA, ALBERTA1 BY BARNUM BROWN (Presented before the Paleontological Society January 1, 19H ) CONTENTS Page Introduction.......................................................................................................... 355 Hell Creek formation, Montana........................................................................ 356 Red Deer River, Alberta, Canada..................................................................... 359 Edmonton formation........................................................................................... 362 Edmonton-Pierre contact................................................................................... 368 Belly River beds.................................................................................................. 369 Summary of the Red Deer River section....................................................... 371 Paskapoo formation..................................................................................... 371 Edmonton formation................................................................................... 373 Belly River beds............................................................................................376 The Ojo Alamo beds........................................................................................... 379 Conclusion............................................................................................................ -

2010 Census: Montana Profile

State Race* Breakdown 2010 Census: Montana Profile Black or African American (0.4%) American Indian and Alaska Native (6.3%) Asian (0.6%) White (89.4%) Native Hawaiian and Other Pacific Islander (0.1%) Population Density by Census Tract Some other race (0.6%) Two or more races (2.5%) *One race Hispanic or Latino (of any race) makes up 2.9% of the state population. Population by Sex and Age Total Population: 989,415 85+ Years 80 70 60 50 40 30 20 10 45,000 22,500 0 22,500 45,000 Male Female Housing Tenure Total Occupied Housing Units: 409,607 32.0% Renter 68.0% Owner Occupied Occupied Average Household Size Average Household Size of Owner-Occupied Units: of Renter-Occupied Units: 2.42 people 2.18 people People per Square Mile by Census Tract 1,000.0 to 6,589.6 200.0 to 999.9 Montana Population U.S. density is 88.4 to 199.9 88.4 1970 to 2010 20.0 to 88.3 2010 989,415 5.0 to 19.9 2000 902,195 1.0 to 4.9 1990 799,065 Less than 1.0 1980 786,690 County Boundary 0 25 50 75 100 Kilometers 1970 694,409 Montana Mean Center 0 25 50 75 100 Miles of Population U.S. Department of Commerce Economics and Statistics Administration U.S. CENSUS BUREAU Montana BASIC INFORMATION th st 2010 Census Population: 989,415 (44 ) Became a State: November 8, 1889 (41 ) th Land Area: 145,545.8 square miles (4 ) Bordering States: Idaho, North Dakota, South Dakota, Wyoming th Density: 6.8 persons per square mile (48 ) Abbreviation: MT Capital: Helena ANSI/FIPS Code: 30 HISTORY METROPOLITAN AND MICROPOLITAN STATISTICAL AREAS AND RELATED STATISTICAL AREAS The United States acquired the area of Montana from France as part of the Louisiana Purchase in 1803 and by a treaty with Great Britain in 1846. -

Take US 87 North of Great Falls to Historic Fort Benton. Drive Into Fort Benton, Once the World's Most Inland Port As Steamshi

CM RUSSELL DRIVE 248 miles [400km] | 4 hours, 30 minutes Take US 87 north of Great Falls to historic Fort Benton. Drive into Fort Benton, once the world’s most inland port as steamships carried supplies up the Missouri River. There is fine dining at the Union Grille in the Grand Union Hotel and great home cooking at the Banque Club where the former bank vault is now the cooler. Try the Wake Cup for a yummy breakfast or lunch and of course, a good cup of coffee. You’ll find history around every corner in Fort Benton so plan your drive with some spare time to enjoy what was once termed the “bloodiest block in the West.” Cross the mighty Missouri River on MT 80, drive past Geraldine and Square Butte. The little town of Square Butte is home to the eclectic Square Butte “Country Club” where you can find great food, very unique art and there is usually a local on hand to chat with. You can see the iconic butte for which the town was named and the Square Butte jail (quarried from local stone) as you drive this route. Take MT Highway 81 at the junction and drive to Lewistown, a community of about 7,000 people nestled between several island mountain ranges in the geographic center of Montana. Drive US 87 from Lewistown to Great Falls (about 100 miles). This route is designated as the CM Russell Trail. You’ll pass many scenes from Russell paintings still visible today. There’s a great side loop, about 25 miles and all paved from Hobson to Windham.