PERSONAL DATA PROTECTION POLICY BDO Unibank, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Intellectual Property Center, 28 Upper Mckinley Rd. Mckinley Hill Town Center, Fort Bonifacio, Taguig City 1634, Philippines Tel

Intellectual Property Center, 28 Upper McKinley Rd. McKinley Hill Town Center, Fort Bonifacio, Taguig City 1634, Philippines Tel. No. 238-6300 Website: http://www.ipophil.gov.ph e-mail: [email protected] Publication Date: February 1, 2016 1 ALLOWED MARKS PUBLISHED FOR OPPOSITION ............................................................................................... 2 1.1 ALLOWED NATIONAL MARKS ....................................................................................................................................... 2 Intellectual Property Center, 28 Upper McKinley Rd. McKinley Hill Town Center, Fort Bonifacio, Taguig City 1634, Philippines Tel. No. 238-6300 Website: http://www.ipophil.gov.ph e-mail: [email protected] Publication Date: February 1, 2016 1 ALLOWED MARKS PUBLISHED FOR OPPOSITION 1.1 Allowed national marks Application No. Filing Date Mark Applicant Nice class(es) Number 2 March PETRON CORPORATION 1 4/2012/00002621 CARBON BUSTER 1 2012 [PH] 11 June CHOKE MAHACHAI 2 4/2012/00006912 KOKOZO 32 2012 BEVERAGE CO., LTD. [TH] 31 July VASELINE LIP CARE 3 4/2012/00009339 UNILEVER N.V. [NL] 3 2012 HEALTHY WHITE 22 WORTHINGOLD 4 4/2012/00014250 November FORTUNE CAT 31 CORPORATION [PH] 2012 12 5 4/2013/00001534 February KAMUI CHUJO CO., LTD. [JP] 28 2013 21 FAIRE TECHNOLOGIES INC. 6 4/2013/00001972 February HAWK 9 [PH] 2013 19 March EVERYONE`S UBER TECHNOLOGIES, INC. 7 4/2013/00003068 9; 38; 39 and42 2013 PRIVATE DRIVER [US] KABUSHIKI KAISHA ITALIAN 3 June TOMATO (ALSO TRADING 8 4/2013/00006367 TORIMARU 29; 30 and43 2013 AS ITALIAN TOMATO LIMITED) [JP] 6 INTERNATIONAL GAMING 9 4/2013/00010736 September FIESTA BINGO 9 and28 PROJECTS LIMITED [MT] 2013 E- 27 PHILIPPINES.COM.PH 10 4/2013/00011746 September EXPLORE. -

World Bank Document

Public Disclosure Authorized PH – RENEWABLE ENERGY DEVELOPMENT PROJECT Public Disclosure Authorized DOCUMENTATION OF THE PUBLIC CONSULTATION MEETING Public Disclosure Authorized May 16, 2013 Public Disclosure Authorized DOCUMENTATION OF THE PUBLIC CONSULTATION MEETING A. BASIC INFORMATION PROJECT NAME: Philippine Renewable Energy Development Project (PhRED) DATE and VENUE: May 16, 2013, 9:00- 12:00 am, Ascott Hotel, Makati City PARTICIPANTS (NUMBER AND AFFILIATION) 30 participants broken down as follows by groupings: (Private Commercial Bank (14), Consultants for Energy Development. Projects (2), Independent Power Providers (2), Dept of Energy (2), National Electrification Authority(3), LGUGC (3) and World Bank (4) B. OBJECTIVES OF THE CONSULTATION: To present the Environment and Social Safeguards Framework (ESSF) and seek suggestions for revisions. C. HIGHLIGHTS OF DISCUSSIONS 1. The PHRED concept and the need for it were presented to the body. The acceptability of this project was expressed by the participants specially the private bank representatives who expressed the need for it. The brown out all over Luzon the previous week helped the participants recognize the need for more stable power supply. 2. The draft ESSF was presented to the body. The participants accept the importance of safeguards operations for project sustainability. It was shared that both the national laws and the World Bank policies on safeguards must be respected. However, concerns were raised on cases of non-compliance. The private banks expressed apprehension that this will be made a condition prior to guarantee approval and/or loan release as well as a ground to withhold payment of guarantee claims. It was noted that non-compliance to safeguards may occur way after release of loans have been made and private banks will no longer have any hold on the borrower. -

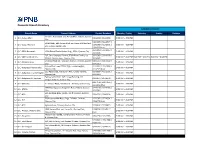

Domestic Branch Directory BANKING SCHEDULE

Domestic Branch Directory BANKING SCHEDULE Branch Name Present Address Contact Numbers Monday - Friday Saturday Sunday Holidays cor Gen. Araneta St. and Aurora Blvd., Cubao, Quezon 1 Q.C.-Cubao Main 911-2916 / 912-1938 9:00 AM – 4:00 PM City 912-3070 / 912-2577 / SRMC Bldg., 901 Aurora Blvd. cor Harvard & Stanford 2 Q.C.-Cubao-Harvard 913-1068 / 912-2571 / 9:00 AM – 4:00 PM Sts., Cubao, Quezon City 913-4503 (fax) 332-3014 / 332-3067 / 3 Q.C.-EDSA Roosevelt 1024 Global Trade Center Bldg., EDSA, Quezon City 9:00 AM – 4:00 PM 332-4446 G/F, One Cyberpod Centris, EDSA Eton Centris, cor. 332-5368 / 332-6258 / 4 Q.C.-EDSA-Eton Centris 9:00 AM – 4:00 PM 9:00 AM – 4:00 PM 9:00 AM – 4:00 PM EDSA & Quezon Ave., Quezon City 332-6665 Elliptical Road cor. Kalayaan Avenue, Diliman, Quezon 920-3353 / 924-2660 / 5 Q.C.-Elliptical Road 9:00 AM – 4:00 PM City 924-2663 Aurora Blvd., near PSBA, Brgy. Loyola Heights, 421-2331 / 421-2330 / 6 Q.C.-Katipunan-Aurora Blvd. 9:00 AM – 4:00 PM Quezon City 421-2329 (fax) 335 Agcor Bldg., Katipunan Ave., Loyola Heights, 929-8814 / 433-2021 / 7 Q.C.-Katipunan-Loyola Heights 9:00 AM – 4:00 PM Quezon City 433-2022 February 07, 2014 : G/F, Linear Building, 142 8 Q.C.-Katipunan-St. Ignatius 912-8077 / 912-8078 9:00 AM – 4:00 PM Katipunan Road, Quezon City 920-7158 / 920-7165 / 9 Q.C.-Matalino 21 Tempus Bldg., Matalino St., Diliman, Quezon City 9:00 AM – 4:00 PM 924-8919 (fax) MWSS Compound, Katipunan Road, Balara, Quezon 927-5443 / 922-3765 / 10 Q.C.-MWSS 9:00 AM – 4:00 PM City 922-3764 SRA Building, Brgy. -

ROBINSONS LAND CORPORATION 43Rd FLOOR ROBINSONS EQUITABLE TOWER ADB AVE

ROBINSONS LAND CORPORATION 43rd FLOOR ROBINSONS EQUITABLE TOWER ADB AVE. COR. POVEDA RD. ORTIGAS CENTER, PASIG CITY TEL. NO.: 633-7631, 637-1670, 240-8801 FAX NO.: 633-9387 OR 633-9207 July 10, 2012 PHILIPPINE STOCK EXCHANGE, INC. 3rd Floor, Philippine Stock Exchange Ayala Triangle, Ayala Avenue Makati City Attention: Ms. Janet A. Encarnacion Head – Disclosure Department PHILIPPINE DEALING AND EXCHANGE CORP. 37/F, Tower 1, The Enterprise Center 6766 Ayala Avenue corner Paseo de Roxas, Makati City Attention: Mr. Cesar B. Crisol President and Chief Operating Officer Re: Robinsons Land Corporation (RLC) List of Top 100 Stockholders and PCD Participants Gentlemen: In compliance with PSE Memo for Brokers No. 225-2003, please find attached the following. 1. List of Top 100 Stockholders of RLC as of June 30, 2012. 2. List of Top 100 PCD Participants of RLC as of June 30, 2012. Thank you. Very truly yours, ROSALINDA F. RIVERA Corporate Secretary /lbo BPI STOCK TRANSFER OFFICE ROBINSONS LAND CORPORATION TOP 100 STOCKHOLDERS AS OF JUNE 30, 2012 RANK STOCKHOLDER NUMBER STOCKHOLDER NAME NATIONALITY CERTIFICATE CLASS OUTSTANDING SHARES PERCENTAGE TOTAL 1 10003137 J. G. SUMMIT HOLDINGS, INC. FIL U 2,496,114,787 60.9725% 2,496,114,787 29/F GALLERIA CORPORATE CTR. EDSA COR. ORTIGAS AVE. MANDALUYONG CITY 2 16012118 PCD NOMINEE CORPORATION (NON-FILIPINO) NOF U 1,023,189,383 24.9934% 1,023,189,383 37/F THE ENTERPRISE CENTER TOWER 1, COR. PASEO DE ROXAS, AYALA AVENUE, MAKATI CITY 3 16012119 PCD NOMINEE CORPORATION (FILIPINO) FIL U 539,962,142 13.1896% 539,962,142 37/F THE ENTERPRISE CENTER TOWER 1, COR. -

Date of Correspondence

Ayala Corporation Makati Central PO Box 1444 Makati City 1254 Philippines Tel (632) 848 5643 Fax (632) 848 5768 16 January 2017 www.ayala.com.ph Philippine Stock Exchange 3/F, The Philippine Stock Exchange, Inc. Tower One and Exchange Plaza, Ayala Ave., Makati City Attention: Mr. Jose Valeriano B. Zuño III OIC-Head, Disclosure Department Philippine Dealing & Exchange Corporation 6766 Ayala Avenue corner Paseo de Roxas Makati City Attention: Ms. Vina Vanessa S. Salonga Head, Issuer Compliance and Disclosure Department Subject: Report on the Top 100 Shareholders Gentlemen: This is in connection with the Exchange’s Revised Disclosure Rules requiring Ayala Corporation to submit a report on the top 100 shareholders of the Company. In compliance therewith, we are submitting herewith the list of top 100 shareholders of the Company’s common share for the quarter-ending 31 December 2016. Thank you. Very truly yours, SOLOMON M. HERMOSURA Corporate Secretary and General Counsel BPI STOCK TRANSFER OFFICE AYALA CORPORATION TOP 100 STOCKHOLDERS AS OF DECEMBER 31, 2016 RANK STOCKHOLDER NUMBER STOCKHOLDER NAME NATIONALITY CERTIFICATE CLASS OUTSTANDING SHARES PERCENTAGE TOTAL 1 13000734 MERMAC INC FIL A 303,689,196 48.9643% 303,689,196 3RD FLOOR, MAKATI STOCK EXCHANGE BUILDING, AYALA TRIANGLE, AYALA AVENUE, MAKATI CITY 1226 2 16000305 PCD NOMINEE CORPORATION (NON-FILIPINO) NOF A 151,493,460 24.4255% 151,493,460 37F TOWER 1, THE ENTERPRISE CENTER, AYALA AVE COR PASEO DE ROXAS, 1226 MAKATI CITY 3 16000304 PCD NOMINEE CORPORATION (FILIPINO) FIL A 79,698,716 12.8499% 79,698,716 37F TOWER 1, THE ENTERPRISE CENTER, AYALA AVE COR PASEO DE ROXAS, 1226 MAKATI CITY 4 13000804 MITSUBISHI CORPORATION JAP A 63,077,540 10.1701% 63,077,540 14/F L.V. -

Intellectual Property Center, 28 Upper Mckinley Rd. Mckinley Hill Town Center, Fort Bonifacio, Taguig City 1634, Philippines Tel

Intellectual Property Center, 28 Upper McKinley Rd. McKinley Hill Town Center, Fort Bonifacio, Taguig City 1634, Philippines Tel. No. 238-6300 Website: http://www.ipophil.gov.ph e-mail: [email protected] Publication Date: 17 November 2020 1 ALLOWED MARKS PUBLISHED FOR OPPOSITION .................................................................................................... 2 1.1 ALLOWED NATIONAL MARKS ............................................................................................................................................. 2 Intellectual Property Center, 28 Upper McKinley Rd. McKinley Hill Town Center, Fort Bonifacio, Taguig City 1634, Philippines Tel. No. 238-6300 Website: http://www.ipophil.gov.ph e-mail: [email protected] Publication Date: 17 November 2020 1 ALLOWED MARKS PUBLISHED FOR OPPOSITION 1.1 Allowed national marks Application Filing No. Mark Applicant Nice class(es) Number Date 13 1 4/2018/00002788 February PRIMEA Aldex Realty Corporation [PH] 43 2018 24 April KITCHEN CITY 2 4/2018/00006872 Artemisplus Express, Inc. [PH] 43 2018 EXPRESS 26 June 3 4/2018/00010926 COCO TERO Eric Jison Ledesma [PH] 29; 30 and32 2018 8 October DELPHI Delphi Technologies IP 4 4/2018/00017889 1; 4; 7; 9 and12 2018 TECHNOLOGIES Limited [BB] 11 October Quantum Mobile Gears Corp. 5 4/2018/00018222 MOBILE MONKEY 9; 16 and35 2018 [PH] 23 January PT ANEKA KARYA KOPI 6 4/2018/00500280 JAVA JAZZ COFFEE 30 and43 2018 INDONESIA [ID] MEDTRIX HOSPITAL 8 October 7 4/2018/00504980 MANAGEMENT Duenas, John Dave [PH] 42 2018 SOFTWARE 4 January 8 4/2019/00000227 RAINBOW SANDALS Rainbow Sandals, Inc. [US] 25 2019 23 January 9 4/2019/00001242 MENQUADTT Sanofi Pasteur Inc. [US] 5 2019 COMMITTED TO 11 ASSIST Alburo Alburo and Associates 10 4/2019/00002129 February 45 ENTREPRENEURS TO Law Offices [PH] 2019 SUCCEED HUE-YOUR SOLE IDENTITY. -

(Cpd) Council for Physicians List of Accredited Providers As of September 26, 2018

CONTINUING PROFESSIONAL DEVELOPMENT (CPD) COUNCIL FOR PHYSICIANS LIST OF ACCREDITED PROVIDERS AS OF SEPTEMBER 26, 2018 ACCREDITATION E-MAIL ADDRESS TELEPHONE NO. NO. NAME OF PROVIDER ADDRESS FAX NO. DATE OF EXPIRATION Philippine Medical Association PMA Bldg., North Avenue, Quezon [email protected] / 929-6366 1 2012-001 (PMA) City www.philippinemedicalassociation.org Fax: 929-6951 13-Feb-21 College of Medicine, University of 547 Pedro Gil St., Ermita, Manila, 2 2012-002 the Philippines Philippines, 1000 [email protected] 0918-905-0862 18-Apr-20 Rm. 2007 Medical Arts Bldg., UST 749-9707 Fax No. 740- 3 2012-003 Dementia Society of the Philippines Hospital, España, Manila www.dementia.org.ph 9725 14-Feb-15 [email protected] / Unit 25 Facilities Centre, #548 [email protected]/ (632) 531-1278/ 534- 4 2012-004 Diabetes Philippines Shaw Blvd., Mandaluyong City www.diabetesphil.org 9559 12-Jul-20 Unit 205 The Garden Heights [email protected] / Condominium 268 E. Rodriguez Sr. [email protected] / 584-2700 5 2012-005 Pain Society of the Philippines, Inc. Avenue, Quezon city www.painsociety.ph Cel: 0917-6213705 13-Mar-20 Unit 4 Metro Square Townehomes, 374-1855 Pediatric Infectious Disease No. 35 Scout Tuazon cor. Scout de [email protected]/ Fax No. 412-6998 6 2012-006 Society of the Philippines (PIDSP) Guia, Quezon City www.pidsphil.org Cel: 0917-834-9837 13-Feb-21 Room 403 PPS Building, #52 Perinatal Association of the Kalayaan Avenue, Brgy. Malaya, [email protected]/ 925-3538 7 2012-007 Philippines, Inc. Quezon City www.perinatphil.org.ph Cel: 0920-945-3513 13-Feb-21 516-2900 / 405-0140 Philippine Academy of Family [email protected] / Fax: 254-5646 8 2012-008 Physicians, Inc. -

URC Top 100 Stockholders and PDTC

BPI STOCK TRANSFER OFFICE UNIVERSAL ROBINA CORPORATION TOP 100 STOCKHOLDERS AS OF JUNE 30, 2012 RANK STOCKHOLDER NUMBER STOCKHOLDER NAME NATIONALITY CERTIFICATE CLASS OUTSTANDING SHARES PERCENTAGE TOTAL 1 10002999 JG SUMMIT HOLDINGS INC. FIL U 1,320,223,061 60.5189% 1,320,223,061 43/F ROBINSONS EQUITABLE TOWER ADB AVE.,COR.POVEDA ST. ORTIGAS CENTER, PASIG CITY 2 16011312 PCD NOMINEE CORPORATION (NON-FILIPINO) NOF U 498,136,847 22.8345% 498,136,847 G/F MAKATI STOCK EXCHANGE BLDG 6767 AYALA AVE., MAKATI CITY 3 16011313 PCD NOMINEE CORPORATION (FILIPINO) FIL U 350,133,639 16.0501% 350,133,639 G/F MSE BLDG. 6767 AYALA AVE., MAKATI CITY 4 07015995 ELIZABETH Y. GOKONGWEI AND/OR JOHN GOKONGWEI JR. FIL U 2,479,400 0.1136% 2,479,400 43/F ROBINSONS EQUITABLE TOWER ADB AVE. COR POVEDA ROAD PASIG CITY 5 12009862 LITTON MILLS, INC. FIL U 2,237,434 0.1025% 2,237,434 URC CORPORATE TOWER I ROBINSON GALLERIA ORTIGAS AVENUE, PASIG METRO MANILA 6 07015993 LISA YU GOKONGWEI AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE. COR POVEDA ST. ORTIGAS CENTER, PASIG CITY 6 16029927 ROBINA GOKONGWEI PE AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE. COR POVEDA ST. ORTIGAS CENTER, PASIG CITY 6 15006669 FAITH GOKONGWEI ONG AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE. COR POVEDA ST. ORTIGAS CENTER, PASIG CITY 6 19026738 MARCIA GOKONGWEI SY AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE., COR POVEDA ST. -

Perspectives a Daiichi Properties Publication on Ideas + the Built Environment

PERSPECTIVES A DAIICHI PROPERTIES PUBLICATION ON IDEAS + THE BUILT ENVIRONMENT 1ST QUARTER 2016 The Latest Office Diet “It’s not you, it’s me.” – Your Building DAIICHIPROPERTIES.COM | perspectives \pәr-'spek-tivs\ NOUN 1. The art of drawing solid objects on a two-dimensional surface; 2. An understanding of how aspects of a subject relate to each other and to the whole; 3. A point of view. This publication has been prepared solely for information purposes. It does not intend to be a comprehensive description of the ideas contained in it. The materials on which this publication is based on have been obtained from current public information that we consider reliable, but we do not represent it as accurate or complete, and it should not be relied on as such. No part of this publication may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior consent of Daiichi Properties Inc. ©2016 Daiichi Properties Inc. All rights reserved. Penthouse, Taipan Place, F. Ortigas Jr. Rd., Ortigas Center, Pasig City, Metro Manila, Philippines. | PERSPECTIVES daiichiproperties DAIICHIPROPERTIES.COM | 3 | PERSPECTIVES Imagine the day when heading BEYOND GREEN to the office will For most of us, the home is where our minds green buildings are more attuned to health and bodies rest, heal, and rejuvenate. The issues, aiming for solutions that work for both actually make you office, on the other hand, is simply a place people and planet. At every development to work and interact with colleagues. But scale – city, neighborhood, building, floor, over the past few years, there has been a unit – poorly designed built environments feel better and tremendous movement to make the building have led to a host of medical ailments and healthier, as part of a well-balanced diet to an increased burden of chronic diseases healthier. -

Cutoffdate Stkhldrnum Natcode Totshares Stockholder Name 06/30/2014 0000201930 PH 200,647,533 DMCI HOLDINGS, INC

cutoffdate stkhldrnum natcode totshares stockholder name 06/30/2014 0000201930 PH 200,647,533 DMCI HOLDINGS, INC. 06/30/2014 0000091890 PH 50,208,756 PCD NOMINEE CORP. 06/30/2014 0000202004 PH 43,608,509 DACON CORPORATION 06/30/2014 0000202417 OA 39,605,239 PCD NOMINEE CORP. (NF) 06/30/2014 0000091855 PH 11,364,658 NATIONAL DEVELOPMENT COMPANY 06/30/2014 0000224101 PH 6,614,003 DFC HOLDINGS, INC. 06/30/2014 0000228970 PH 803,000 REGINA CAPITAL DEVELOPMENT CORP. 06/30/2014 0000224346 PH 796,334 FERNWOOD INVESTMENTS, INC. 06/30/2014 0000203000 PH 769,450 PRIVATIZATION AND MANAGEMENT OFFICE 06/30/2014 0000225571 PH 449,664 DOUBLE SPRING INVESTMENTS CORPORATION 06/30/2014 0000224608 PH 348,372 GUADALUPE HOLDINGS CORPORATION 06/30/2014 0000224318 PH 253,475 AUGUSTA HOLDINGS, INC. 06/30/2014 0000224347 PH 150,937 BERIT HOLDINGS CORPORATION 06/30/2014 0000228159 PH 115,600 MERU HOLDINGS, INC 06/30/2014 0000228933 PH 92,920 COBANKIAT, JOHNNY O. 06/30/2014 0000226041 PH 91,691 FREDA HOLDINGS, INC. 06/30/2014 0000225699 PH 80,000 VENDIVEL, OLGA P. 06/30/2014 0000151870 PH 40,030 GARCIA, JAIME B. 06/30/2014 0000226243 PH 35,077 WINDERMERE HOLDINGS INC. 06/30/2014 0000226242 PH 28,109 FERNWOOD INVESTMENTS INC. 06/30/2014 0000202400 PH 15,000 TENG, CHING BUN 06/30/2014 0000202585 PH 13,900 AMATONG, ISAGANI S. 06/30/2014 0000228860 PH 10,000 REYES, JOSEFA C. 06/30/2014 0000225899 CH 7,500 XIE BIHUI 06/30/2014 0000224409 PH 7,500 GALA, LUISMIL DE VILLA 06/30/2014 0000224639 PH 6,000 ROSARIO, VICTOR J. -

Chapter 4 Safety in the Philippines

Table of Contents Chapter 1 Philippine Regions ...................................................................................................................................... Chapter 2 Philippine Visa............................................................................................................................................. Chapter 3 Philippine Culture........................................................................................................................................ Chapter 4 Safety in the Philippines.............................................................................................................................. Chapter 5 Health & Wellness in the Philippines........................................................................................................... Chapter 6 Philippines Transportation........................................................................................................................... Chapter 7 Philippines Dating – Marriage..................................................................................................................... Chapter 8 Making a Living (Working & Investing) .................................................................................................... Chapter 9 Philippine Real Estate.................................................................................................................................. Chapter 10 Retiring in the Philippines........................................................................................................................... -

List of Ecpay Cash-In Or Loading Outlets and Branches

LIST OF ECPAY CASH-IN OR LOADING OUTLETS AND BRANCHES # Account Name Branch Name Branch Address 1 ECPAY-IBM PLAZA ECPAY- IBM PLAZA 11TH FLOOR IBM PLAZA EASTWOOD QC 2 TRAVELTIME TRAVEL & TOURS TRAVELTIME #812 EMERALD TOWER JP RIZAL COR. P.TUAZON PROJECT 4 QC 3 ABONIFACIO BUSINESS CENTER A Bonifacio Stopover LOT 1-BLK 61 A. BONIFACIO AVENUE AFP OFFICERS VILLAGE PHASE4, FORT BONIFACIO TAGUIG 4 TIWALA SA PADALA TSP_HEAD OFFICE 170 SALCEDO ST. LEGASPI VILLAGE MAKATI 5 TIWALA SA PADALA TSP_BF HOMES 43 PRESIDENTS AVE. BF HOMES, PARANAQUE CITY 6 TIWALA SA PADALA TSP_BETTER LIVING 82 BETTERLIVING SUBD.PARANAQUE CITY 7 TIWALA SA PADALA TSP_COUNTRYSIDE 19 COUNTRYSIDE AVE., STA. LUCIA PASIG CITY 8 TIWALA SA PADALA TSP_GUADALUPE NUEVO TANHOCK BUILDING COR. EDSA GUADALUPE MAKATI CITY 9 TIWALA SA PADALA TSP_HERRAN 111 P. GIL STREET, PACO MANILA 10 TIWALA SA PADALA TSP_JUNCTION STAR VALLEY PLAZA MALL JUNCTION, CAINTA RIZAL 11 TIWALA SA PADALA TSP_RETIRO 27 N.S. AMORANTO ST. RETIRO QUEZON CITY 12 TIWALA SA PADALA TSP_SUMULONG 24 SUMULONG HI-WAY, STO. NINO MARIKINA CITY 13 TIWALA SA PADALA TSP 10TH 245- B 1TH AVE. BRGY.6 ZONE 6, CALOOCAN CITY 14 TIWALA SA PADALA TSP B. BARRIO 35 MALOLOS AVE, B. BARRIO CALOOCAN CITY 15 TIWALA SA PADALA TSP BUSTILLOS TIWALA SA PADALA L2522- 28 ROAD 216, EARNSHAW BUSTILLOS MANILA 16 TIWALA SA PADALA TSP CALOOCAN 43 A. MABINI ST. CALOOCAN CITY 17 TIWALA SA PADALA TSP CONCEPCION 19 BAYAN-BAYANAN AVE. CONCEPCION, MARIKINA CITY 18 TIWALA SA PADALA TSP JP RIZAL 529 OLYMPIA ST. JP RIZAL QUEZON CITY 19 TIWALA SA PADALA TSP LALOMA 67 CALAVITE ST.