V.R. Neelakantan Partner Projects & Project Finance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dadri-Panipat Natural Gas Pipeline

Dadri-Panipat Natural Gas Pipeline Indian Oil Corporation Limited (IOCL) owns and operates 132 km long Dadri-Panipat Natural Gas Pipeline (DPPL). This pipeline is interconnected with GAIL’s Hazira-Vijaipur-Jagdishpur Pipeline (HVJPL) / Dahej-Vijaipur Pipeline (DVPL) network at Dadri. The pipeline was commissioned in 2010 as a Common Carrier pipeline for transporting natural gas from HVJPL/DVPL network to IOCL’s Panipat Refinery (PR) and Panipat Naphtha Cracker Plant (PNCP) at Panipat and other customers’ en route pipeline in Uttar Pradesh and Haryana. Presently, the authorized capacity of DPPL is 9.5 Million Standard Cubic Metres per Day (MMSCMD) including 2.375 MMSCMD as Common Carrier capacity. The pipeline has one “a homogeneous area” (AHA) of 132 km from Dadri to Panipat. Originating station is at Dadri (near GAIL’s terminal within NTPC premises) and terminal station at Panipat (within IOCL’s Northern Region Pipelines premises). The status of pipeline capacity for own use and booked for other shippers is as under: Particulars Capacity (MMSCMD) Dadri - Panipat section 9.5 IOCL’s Capacity for IOCL’s own Use 5.5 Under Contract Carrier 1.05 Common Carrier Capacity 2.375 Spare Capacity 0.575 DPPL is authorized under regulation 17(1) of the Petroleum and Natural Gas Regulatory Board (Authorizing entities to Lay, Build, Operate or Expand Natural Gas Pipelines) Regulations, 2008. (Ref: PNGRB’s authorization letter No. Infra/PL/New/17/ DPPL/ IOCL/01/11, dated 5.1.2011) The capacity of DPPL has been approved and declared by PNGRB vide order No. MI/NGPL/GGG/Capacity/IOCL dated 9.11.2012. -

India's Energy Future in a World of Change

India’s Energy Future in a World of Change 26-28 October 2020 India Energy Forum in Review Inaugural Address Inaugural Address and Ministerial Dialogue Hon. Shri Narendra Modi, Prime Minister, India H.R.H. Prince Abdulaziz bin Salman, Minister of Energy, Kingdom of Saudi Arabia Inaugural Address and Closing Remarks Inaugural Address and Ministerial Dialogue Hon. Shri Dharmendra Pradhan, Minister of Petroleum & Natural Gas Hon. Dan Brouillette, Secretary of Energy, and Minister of Steel, Government of India United States Department of Energy 1 Indian Ministerial Dialogue Indian Ministerial Dialogue Hon. Smt. Nirmala Sitharaman, Minister of Finance and Minister of Hon. Shri Piyush Goyal, Minister of Railways and Minister of Commerce & Corporate Affairs, Government of India Industry, Government of India Ministerial Dialogue New Map of Energy for India The Hydrogen Economy and Closing Remarks Shri Tarun Kapoor, Secretary, H.E. Mohammad Sanusi Barkindo, Secretary Dr. Rajiv Kumar, Vice Chairman, NITI Aayog, Ministry of Petroleum & Natural Gas, General, OPEC Government of India Government of India 2 Leadership Dialogue Leadership Dialogue Tengku Muhammad Taufik, President & Group Chief Executive, Bernard Looney, Group Chief Executive, bp p.l.c. PETRONAS Leadership Dialogue Future of Refining & Petrochemicals in a World of Surplus Patrick Pouyanné, Chairman & Chief Executive Officer, TOTAL S.A. S.M. Vaidya, Chairman, Indian Oil Corporation Ltd. 3 Technologies to Optimize Costs, Recovery & Emissions in the Upstream Judson Jacobs, Executive Shashi Shanker, Chairman & Director, Upstream Technology, Sunil Duggal, Group Chief Managing Director, Oil and Natural Lorenzo Simonelli, Chairman & IHS Markit Executive Officer, Vedanta Gas Corporation Ltd. (ONGC) CEO, Baker Hughes Growing Share of Gas in India’s Energy Mix: What is realistic? Ernie Thrasher, Chief Executive Michael Stoppard, Chief Meg Gentle, President & Chief Manoj Jain, Chairman & Officer & Chief Marketing Officer, Strategist, Global Gas, IHS Markit Executive Officer, Tellurian Inc. -

C:\Docume~1\Mahesh~1.Bud

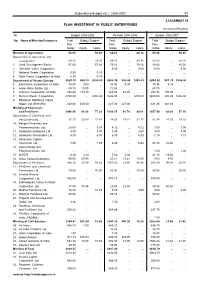

Expenditure Budget Vol. I, 2006-2007 39 STATEMENT 14 PLAN INVESTMENT IN PUBLIC ENTERPRISES (In crores of Rupees) Sl. Budget 2005-2006 Revised 2005-2006 Budget 2006-2007 No. Name of Ministry/Enterprise Total Budget Support Total Budget Support Total Budget Support Plan Plan Plan Outlay Equity Loans Outlay Equity Loans Outlay Equity Loans Ministry of Agriculture 58.00 ... 58.00 84.16 ... 84.16 50.00 ... 50.00 Department of Agriculture and Cooperation 58.00 ... 58.00 84.16 ... 84.16 50.00 ... 50.00 1. Land Development Banks 57.00 ... 57.00 79.16 ... 79.16 45.00 ... 45.00 2. Damodar Valley Corporation ... ... ... 5.00 ... 5.00 5.00 ... 5.00 3. National Seeds Corporation 0.30 ... 0.30 ... ... ... ... ... ... 4. State Farms Corporation of India 0.70 ... 0.70 ... ... ... ... ... ... Department of Atomic Energy 5529.70 568.10 2004.00 4205.38 300.05 1280.03 4294.34 991.19 1606.00 5. Electronics Corporation of India 34.00 9.00 ... 34.00 9.00 ... 39.34 9.34 ... 6. Indian Rare Earths Ltd. 85.10 10.00 ... 72.80 ... ... 80.79 ... ... 7. Uranium Corporation of India 280.60 119.10 ... 225.55 64.05 ... 292.36 100.00 ... 8. Nuclear Power Corporation 4700.00 ... 2004.00 3646.03 ... 1280.03 3400.00 400.00 1606.00 9. Bharatiya Nabhikiya Vidyut Nigam Ltd (BHAVINI) 430.00 430.00 ... 227.00 227.00 ... 481.85 481.85 ... Ministry of Chemicals and Fertilisers 1096.96 91.09 77.29 1109.35 41.70 80.61 1057.54 88.39 57.15 Department of Chemicals and Petrochemicals 97.70 53.60 21.00 49.33 18.21 31.12 91.46 47.53 18.15 10. -

IBEF Presentataion

OIL and GAS For updated information, please visit www.ibef.org November 2017 Table of Content Executive Summary……………….….…….3 Advantage India…………………..….……...4 Market Overview and Trends………..……..6 Porters Five Forces Analysis.….…..……...28 Strategies Adopted……………...……….…30 Growth Drivers……………………..............33 Opportunities…….……….......…………..…40 Success Stories………….......…..…...…....43 Useful Information……….......………….….46 EXECUTIVE SUMMARY . In FY17, India had 234.5 MMTPA of refining capacity, making it the 2nd largest refiner in Asia. By the end of Second largest refiner in 2017, the oil refining capacity of India is expected to rise and reach more than 310 million tonnes. Private Asia companies own about 38.21 per cent of total refining capacity World’s fourth-largest . India’s energy demand is expected to double to 1,516 Mtoe by 2035 from 723.9 Mtoe in 2016. Moreover, the energy consumer country’s share in global primary energy consumption is projected to increase by 2-folds by 2035 Fourth-largest consumer . In 2016-17, India consumed 193.745 MMT of petroleum products. In 2017-18, up to October, the figure stood of oil and petroleum at 115.579 MMT. products . India was 3rd largest consumer of crude oil and petroleum products in the world in 2016. LNG imports into the country accounted for about one-fourth of total gas demand, which is estimated to further increase by two times, over next five years. To meet this rising demand the country plans to increase its LNG import capacity to 50 million tonnes in the coming years. Fourth-largest LNG . India increasingly relies on imported LNG; the country is the fourth largest LNG importer and accounted for importer in 2016 5.68 per cent of global imports. -

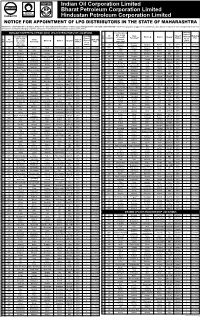

Indian Oil Corporation Limited Bharat Petroleum Corporation Limited Hindustan Petroleum Corporation Limited

Indian Oil Corporation Limited Bharat Petroleum Corporation Limited Hindustan Petroleum Corporation Limited NOTICE FOR APPOINTMENT OF LPG DISTRIBUTORS IN THE State OF MAHARASHTRA INDIAN OIL CORPORATION LTD (IOCL), BHARAT PETROLEUM CORPORATION LTD (BPCL) and HINDUSTAN PETROLEUM CORPORATION LTD (HPCL) proposes to appoint LPG distributors under various categories at locations specified below from amongst the candidates belonging to different categories mentioned therein in the State of (name of the State): DURGAM KSHETRIYA VITRAK (DKV) LPG DISTRIBUTORSHIP LOCATIONS Location (along Security with details Deposit Security Sr. Oil Gram Type of Marketing Location (along of Locality Block* @ District Category** (Amount Deposit No. Company Panchayat* Market Plan with details wherever Rs. in Sr. Oil Gram Type of (Amount Marketing of Locality Block* @ District Category** applicable) Lakhs) No. Company Panchayat* Market Rs. in Plan wherever Chinchave Chinchave Lakhs) 96 IOC Malegaon Nashik SC 2 2017-18 applicable) (Galane) (Galane) DKV 1 IOC Khirvire Khirvire Akole Ahmednagar Open DKV 4 2017-18 97 HPC Nimgaon Nimgaon Malegaon Nashik Open(W) DKV 4 2017-18 2 IOC Hatru Hatru Chikhaldara Amravati OBC DKV 3 2017-18 98 IOC Tingri Tingri Malegaon Nashik Open DKV 4 2017-18 3 IOC Ghodgaon Ghodgaon Chopda Jalgaon ST DKV 2 2017-18 99 BPC Vehelgaon Vehelgaon Nandgaon Nashik OBC DKV 3 2017-18 4 BPC Ghuikhed Ghuikhed Chandur Railway Amravati Open DKV 4 2017-18 100 IOC Thangaon Thangaon Sinnar Nashik ST(W) DKV 2 2017-18 5 IOC Jalalkheda Jalalkheda Narkhed Nagpur -

Inner 32 Arbitrage Fund Low

Tata Arbitrage Fund (An open ended scheme investing in arbitrage opportunities.) As on 30th June 2020 PORTFOLIO % to % to NAV % to % to NAV Company name Company name INVESTMENT STYLE NAV Derivative NAV Derivative The scheme invests in equity and equity related instruments that tries Hedge Positions 65.55 -65.33 Punjab National Bank 0.34 -0.34 to take advantage of the difference in prices of a security in the cash Reliance Industries Ltd. 2.34 -2.33 Sun Tv Network Ltd. 0.32 -0.32 segment and derivatives segment by turning market volatility to its ICICI Bank Ltd. 2.14 -2.13 Hindalco Industries Ltd. 0.29 -0.29 advantage. Housing Development Finance Corporation Ltd. 2.12 -2.10 ICICI Prudential Life Insurance Company Ltd. 0.24 -0.24 ITC Ltd. 1.94 -1.94 Axis Bank Ltd. 0.22 -0.22 INVESTMENT OBJECTIVE Tata Consumer Products Ltd. 1.54 -1.54 Larsen & Toubro Ltd. 0.22 -0.22 The investment objective of the Scheme is to seek to generate Sbi Life Insurance Company Ltd. 1.53 -1.53 Gmr Infrastucture Ltd. 0.20 -0.20 HCL Technologies Ltd. 1.52 -1.51 Mindtree Ltd. 0.17 -0.17 reasonable returns by investing predominantly in arbitrage Colgate-Palmolive India Ltd. 1.46 -1.46 Coal India Ltd. 0.16 -0.15 opportunities in the cash and derivatives segments of the equity Titan Company Ltd. 1.44 -1.44 Mahanagar Gas Ltd. 0.15 -0.15 markets and by investing balance in debt and money market Hindustan Unilever Ltd. 1.42 -1.42 Century Textiles & Industries Ltd. -

Omcs' Shares Are Suffering from Low Energy

OMCs’ shares are suffering from low energy OMCs’ shares fell by 3-4% on a day when the broad market slipped by 0.8% Investors don’t seem to see the value in state-owned oil marketing companies (OMCs) acquiring a sizeable stake in gas transportation company GAIL (India) Ltd. On Monday, OMC shares fell by 3-4% on a day when the broad market slipped by 0.8%. OMCs include Bharat Petroleum Corp. Ltd (BPCL), Hindustan Petroleum Corp. Ltd (HPCL) and Indian Oil Corp. Ltd (IOC). News reports indicate that BPCL and IOC may acquire the government’s equity holding in GAIL, by buying around a 26% stake each. That could see an outflow of around Rs19,500 crore for each OMC at current prices. While the move is said to be part of the government’s decision to create integrated energy companies, it’s not clear how this will do that. Both businesses are very different. OMCs run refineries and retail fuel, while GAIL transports gas through its pipelines and maintains transport infrastructure. What the move will certainly do is help the government add to its disinvestment kitty from the sale proceeds. Some worry about the lack of synergies in such a deal and the extent to which it will stretch the balance sheets of BPCL and IOC. At the end of fiscal year 2017, IOC’s and BPCL’s total consolidated borrowings stood at Rs58,800 crore and Rs31,473 crore, translating into a debt-to-equity ratio of 0.57 and 0.96, respectively. “HPCL too succumbed under the pressure, as people take a view on OMCs as a pack,” said an analyst, requesting anonymity. -

Indian Oil Corporation Limited

EOI No.: Ethanol/ Industry/ 2012-13 Page 1 Due Date & Time: 14.08.2012 of 44 at 1430 Hrs SUPPLY OF INDIGENOUS DENATURED ANHYDROUS ETHANOL EXPRESSION OF INTEREST FOR SUPPLY OF INDIGENOUS DENATURED ANHYDROUS ETHANOL EOI NO.: ETHANOL/INDUSTRY/2012 – 2013 DUE DATE:14/08/12 TIME: 1430 HRS SIGNATURE OF APPLICANT SEAL EOI No.: Ethanol/ Industry/ 2012-13 Page 2 Due Date & Time: 14.08.2012 of 44 at 1430 Hrs SUPPLY OF INDIGENOUS DENATURED ANHYDROUS ETHANOL CONTENTS SR. DESCRIPTION PAGE NO. NO. 1. Expression of Interest 3-4 2. Instructions/ Guidelines to Applicants 5-12 Annexures I. Oil Company wise/ Location wise residual Requirement for 2012-13 13-16 II. Specifications for Anhydrous Ethanol 17 III. Transportation Rate for Ethanol Supplies 18 IV. Proforma of Agreement 19-28 V. State-wise Addresses for Submission of Sealed EOI Document 29 -30 VI. Details of Relationship with Directors/ Declarations 31-34 VII. Proforma for Solvency Certificate 35 VIII. Proforma for Bank Guarantee 36-37 IX. Proforma for irrecoverable Power of Attorney 38 X. Statement of credentials 39-40 XI. Format for Ethanol Quantity Offer 41 XII. Format for Undertaking on Recovery of Dues 42-43 XIII Format of One Way Road Distance 44 Note: All pages to be signed & stamped by the applicant before submission. SIGNATURE OF APPLICANT SEAL EOI No.: Ethanol/ Industry/ 2012-13 Page 3 Due Date & Time: 14.08.2012 of 44 at 1430 Hrs SUPPLY OF INDIGENOUS DENATURED ANHYDROUS ETHANOL 1. Expression of Interest ( EOI) No. Ethanol/Industry/ 2012-13 due date 14/08/2012 for supply of Indigenous Denatured -

Indian Oil Corporation Limited: Ratings Reaffirmed Rationale

September 07, 2021 Indian Oil Corporation Limited: Ratings reaffirmed Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) Non Convertible Debentures 11,625.00 11,625.00 [ICRA]AAA (Stable) reaffirmed (NCD) Program Commercial Paper Programme 40,000.00 40,000.00 [ICRA]A1+ reaffirmed Total 51,625.00 51,625.00 *Instrument details are provided in Annexure-1 Rationale The ratings factor in IOC’s high financial flexibility arising from its large sovereign ownership (51.5% stakes owned by the GoI), significant portfolio of liquid investments including GoI bonds and investments in GAIL (India) Limited (GAIL, rated [ICRA]AAA (Stable)/[ICRA]A1+), Oil & Natural Gas corporation (ONGC, rated [ICRA]AAA(Stable)/[ICRA]A1+) and Oil India limited (OIL)), and ability to raise funds from the domestic/foreign banking system and capital markets at competitive rates. Besides, the ratings of the company continue to reflect its dominant and strategically important position in the Indian energy sector, its integrated business model and its role in fulfilling the socio-economic objectives of the GoI. The ratings take into account the diversified location base of the company’s refineries (11 refineries on a consolidated basis), translating into sizeable capacities and ~32.5% share in the domestic refining sector as on June 30, 2021. The ratings also reflect integration of IOC in marketing, pipelines, and petrochemicals segments which enables reducing the earnings volatility related to the crude oil refining segment. The ratings also factor in the vulnerability of the company’s profitability to the global refining margin cycle, import duty protection, and INR-USD parity levels. -

Year of Energy Audit Sector Name of Industry 2019-20

2019-20 Year of Energy Sector Name of Industry Audit 2019-20 Petrochemical IOCL Sangrur DO 2019-20 Petrochemical IOCL UPSO-2, Noida Office 2019-20 Petrochemical HPCL Kota LPG 2019-20 Petrochemical HPCL Hoshiarpur LPG 2019-20 Petrochemical IOCL Srinagar Depot 2019-20 Petrochemical HPCL Jammu LPG 2019-20 Petrochemical IOCL Bharatpur Terminal 2019-20 Railways NE Railway Lucknow Railway Station 2019-20 Petrochemical IOCL Utarlai Barmer AFS 2019-20 Petrochemical IOCL Aonla Depot 2019-20 Petrochemical IOCL UPSO-2, Haridwar LPG 2019-20 Petrochemical IOCL Ajmer LPG 2019-20 Petrochemical BPCL Srinagar Depot 2019-20 Petrochemical IOCL UPSO-2, Agra Terminal 2019-20 Petrochemical IOCL Amritsar DO 2019-20 Automobile AG Industries Pvt Ltd, Bawal, Sector-5 2019-20 Automobile AG Industries Pvt Ltd, Bawal, Sector-6 2019-20 Petrochemical IOCL NRO Yusuf Sarai 2019-20 Petrochemical IOCL UPSO-2, Lakhimpur Kheri LPG 2019-20 Petrochemical IOCL Jhunjhunu LPG Bottling Plant 2019-20 Petrochemical IOCL Kargil Depot 2019-20 Petrochemical IOCL Jaisalmer AFS 2019-20 Petrochemical IOCL Jaipur Terminal 2019-20 Automobile AG Industries Pvt Ltd, IMT Manesar 2019-20 Solar OIL 9 MW Solar Plant in Rajasthan 2019-20 Building OIL Office Building in Rajasthan 2019-20 Railways NCR Allahabad Jn. Railway Station 2019-20 Railways NCR Kanpur Central Railway Station 2019-20 Petrochemical IOCL Karnal AO 2019-20 Petrochemical IOCL Shimla DO 2019-20 Automobile Guru Nanak Auto Enterprises Limited, Phagwara 2019-20 Railways MCF, Raebreily Railway thru TAC Automation Pvt Ltd 2019-20 Petrochemical -

Declaration for the Loss of Subscription/ Termination Voucher

SV-TV Loss Declaration Format Ver.1 –BPC/14 DECLARATION FORMAT (To be submitted for loss of Subscription Voucher / Termination Voucher on plain paper ) DECLARATION I _______________________________son/ daughter/ wife/ widow of Shri ____________________________________________________ aged _____ years an Indian inhabitant, residing at _____________________________________ solemnly affirm and state as follows: 1. That I am / was a consumer of M/s. Indian Oil Corporation Ltd (IOCL)/ M/s.Bharat Petroleum Corpn Ltd.(BPCL) / M/s. Hindustan Corpn. Ltd.(HPCL), for LPG for domestic use at the following address _______________________________________________________________________________ since __________. My consumer number is / was _______________. I was issued with Subscription Voucher No. ____________________ by M/s. ___________________________________ towards one/two gas cylinder(s) and a regulator on loan for my use against the refundable deposit of Rs. __________. 2. That I was given the gas cylinder(s) and a regulator when I was residing in _____________________. Thereafter, I shifted to my above mentioned residence. 3. That I want to return the Subscription Voucher along with the cylinder(s) and regulator as I am shifting my residence from this town and want to terminate the agreement with the above mentioned Corporation. OR That I want to terminate the agreement with the above mentioned distributor. 4. That though I have the cylinder/s and regulator, I am not able to produce the Subscription Voucher (SV) to obtain Termination Voucher & get refund of the security deposit as the SV is misplaced / lost. OR That I am not able to produce the Termination Voucher as it misplaced / lost. 5. That I have not assigned or transferred the Subscription Voucher / Termination Voucher to any person whomsoever. -

Indian Oil Corporation Limited

Indian Oil Corporation Limited Indian Oil Corporation Ltd. (IndianOil) was formed in 1964 through the merger of Indian Oil Company Ltd. (Estd. 1959) and Indian Refineries Ltd. (Estd. 1958). It is currently India’s largest company by sales with a turnover of Rs. 1,50,677 crore (US $ 34.44 billion) and profits of Rs. 4,891 crore (US $ 1.12 billion) for fiscal 2004. IndianOil is also the highest ranked Indian company IndianOil's cross-country pipeline network has been expanded in the Fortune ‘Global 500’ listing, at 170th position. to 8,240 km in 2004-05. It is also the 18th largest petroleum company in the For the year 2004-05, IndianOil sold 50.13 million world and the # 1 petroleum trading company tonnes of petroleum products, including 1.96 million among the National Oil Companies in the Asia- tonnes through exports. Pacific region. To maintain its competitive edge and leadership status, IndianOil is investing Rs. 24,400 crore (US India’s Downstream Major $ 5.6 billion) during the X Plan period (2002-07) in The IndianOil Group of companies owns and integration and diversification projects, besides operates 10 of India’s 18 refineries with a combined refining and pipeline capacity augmentation, refining capacity of 54.20 million tonnes per annum product quality upgradation and retail expansion. (1 million barrels per day). Network Beyond Compare IndianOil and its subsidiaries account for 56% petroleum products market share among public As the flagship National Oil Company in the sector oil companies, 42% national refining capacity downstream sector, IndianOil reaches precious and 69% downstream pipeline throughput capacity.