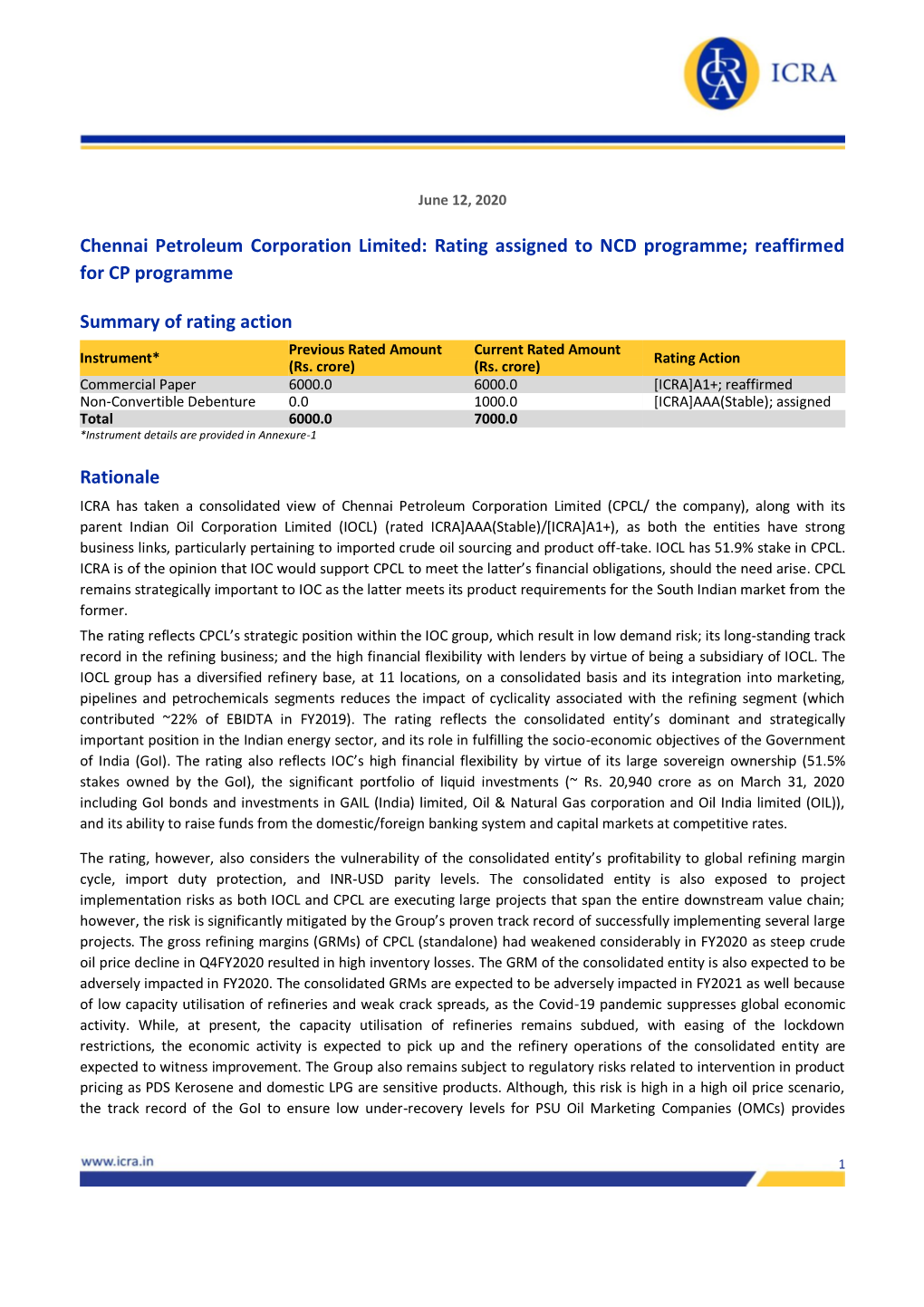

Chennai Petroleum Corporation Limited: Rating Assigned to NCD Programme; Reaffirmed for CP Programme

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Petronet LNG (PETLNG)

Petronet LNG (PETLNG) CMP: | 242 Target: | 275 (14%) Target Period: 12 months HOLD February 14, 2021 Sales volume dips; margins drive profitability... Particulars Ss Petronet LNG reported a mixed set of Q3FY21 numbers. While sales volume Particu lar Am o u n t was below estimates, blended margins were ahead of expectations. Total Market Capitaliz ation (₹ Crore) 36,315.0 volumes were flattish YoY and down 7.5% QoQ to 235 tbtu due to lower Total Debt (FY 20) (₹ Crore) 3,440.2 regas volumes. Revenues were down 17.8% YoY to | 7328.2 crore (I-direct Cash and Investments (FY 20) ( ₹ Crore) 4,432.0 estimate: | 7591 crore). EBITDA was | 1335.3 crore, up 20.6% YoY, down EV (₹ Crore) 35,323.2 2% QoQ (our estimate: | 1215.4 crore). Blended margins were at 52 week H/L 285/171 ₹ | 63.2/mmbtu on account of inventory gains and higher margin on spot Equity capital ( Crore) 1,500.0 Face value (₹) 1 0.0 volumes (our estimate: | 54.8/mmbtu). PAT increased 30.1% YoY to | 878.5 s ss crore (our estimate: | 761.7 crore). On a QoQ basis, it dipped 5.3%. Update Result Key Highlights Higher spot LNG prices lead to dip in regas volumes QoQ Results were a mixed bag as Petronet LNG’s total volumes were below our estimates on account of lower blended margins were ahead of regasification volumes from Dahej terminal. Total sales volumes came in at estimates while regas volume 235 tbtu, compared to 233 tbtu in Q3FY20 (up 0.9% YoY) and 254 tbtu in were lower than expected Q2FY21 (down 7.5% QoQ). -

Expression of Interest (Eoi) for Acquisition of Operational Solar Power Plants / Assets

GAIL (INDIA) LIMITED EXPRESSION OF INTEREST (EOI) FOR ACQUISITION OF OPERATIONAL SOLAR POWER PLANTS / ASSETS EOI DOCUMENT NO.: GAIL/ND/BD/SOLAR/EOI/2021 DATED 12.07.2021 EXPRESSION OF INTEREST (EOI) FOR ACQUISITION OF OPERATIONAL SOLAR POWER PLANTS / ASSETS EOI DOCUMENT NO. GAIL/ND/BD/SOLAR/EOI/2021 INVITATION FOR EXPRESSION OF INTEREST (EOI) FOR ACQUISITION OF OPERATIONAL SOLAR POWER PLANTS / ASSETS 1. INTRODUCTION GAIL (India) Limited (“GAIL”) is India’s leading Natural Gas Company with presence along entire natural gas value chain comprising of Exploration & Production, LNG imports, Gas Transmission & Marketing, Gas Processing, Petrochemicals, LPG transmission and City Gas Distribution. GAIL is listed on the National Stock Exchange of India, the Bombay Stock Exchange and the London Stock Exchange (in the form of GDRs) with the market capitalization of around Rs. 66,000 crores as on 30th June 2021. For additional information on GAIL, please visit http://www.gailonline.com 2. BRIEF ABOUT EOI 2.1. In line with its mission of providing clean energy & beyond and considering transformations taking place in the energy sector, GAIL is exploring opportunities in the renewable energy sector with a target of acquiring solar power plants / assets of around 1000 MW (AC) capacity. In this backdrop, GAIL invites EOI from Promoters / Independent Power Producers / Developers who are willing to offer 100% and / or 50% equity stake in their operational solar power plants / assets located in solar park(s), hereinafter referred to as ‘Interested Party(ies)’. 2.2. Basic details of this EOI are: EOI download EOI may be downloaded from any of the Websites as below: (i) www.gailonline.com (ii) GAIL’s Tender Website – www.gailtenders.in (iii) Govt. -

Government of India Ministry of Heavy Industries and Public Enterprises Department of Public Enterprises

GOVERNMENT OF INDIA MINISTRY OF HEAVY INDUSTRIES AND PUBLIC ENTERPRISES DEPARTMENT OF PUBLIC ENTERPRISES LOK SABHA UNSTARRED QUESTION NO. 1428 TO BE ANSWERED ON THE 11th FEBRUARY, 2020 ‘Job Reservation for SCs, STs and OBCs in PSUs’ 1428. SHRI A.K.P. CHINRAJ : SHRI A. GANESHAMURTHI : Will the Minister of HEAVY INDUSTRIES AND PUBLIC ENTERPRISES be pleased to state:- (a) whether the Government is planning to revamp job reservations issue for Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in State-run companies following sharp fall of employment opportunities to them consequent upon disinvestment in all the Public Sector Enterprises (PSEs); (b) if so, the details thereof; (c) whether it is true that the Department of Investment and Public Asset Management (DIPAM) is examining the issue of job reservations for SCs, STs and OBCs in State run companies following disinvestment and if so, the details thereof; (d) the total disinvestment made in various PSEs company and category-wise during the last three years along with the reasons for disinvestment; (e) the total number of SCs, STs and OBCs presently working in various PSEs company and category-wise; and (f) the total number of SCs, STs and OBCs who lost their jobs in these companies during the said period? ANSWER THE MINISTER FOR HEAVY INDUSTRIES & PUBLIC ENTERPRISES (SHRI PRAKASH JAVADEKAR) (a to d): Job reservation is available to Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in Central Public Sector Enterprises (CPSEs) as per the extant Government policy. The Government follows a policy of disinvestment in CPSEs through Strategic Disinvestment and Minority Stake sale. -

Evolution of Brazil-India Economic and Trade Relations: the Future Prospect

Brazil-India: 70 Years of Diplomatic Relations Evolution of Brazil-India Economic and Trade Relations: The Future Prospect Pranav Kumar Head - International Trade Policy Confederation of Indian Industry New Delhi India and Brazil Economy – Key Features Brazil India • The Brazilian economy is among • India is the world’s seventh-largest the ten largest in the world. economy. India is growing Economic activity is relatively faster than any other large diversified, with the GDP share of economy except for China. While services on an upward trend and focus is on reviving manufacturing, those of manufacturing and mining but services sector continues to be on a downward path. the main pillar of economy. • UNCTAD named India as the 9th • UNCTAD named Brazil the 7th largest destination for global FDI largest destination for global FDI flow in 2016. flow in 2016. • Labour intensive manufacturing • Agriculture exports continued to and services like ITES have largest dominate, increasing their share in share in India’s exports. total exports from 35.6% in 2012 to 41.5% in 2016. © Confederation of Indian Industry India-Brazil Bilateral Trade • Brazil is one of the most important trading partners of India in the entire LAC (Latin America and Caribbean) region. India-Brazil bilateral trade has increased substantially in the last two decades. However, given the economic recession in Brazil, the volume of trade continued to decrease since 2014-15. • India and Brazil have reasonably diversified trade basket. While India’s exports to Brazil includes petroleum, polyester yarn, chemical products, drugs and cotton yarn, Brazilian exports to India includes mainly crude oil, cane sugar, copper ore, soya oil • Indian exports to Brazil stood at US$2.48bn in year 2016-17 as against US$5.9bn in 2014-15. -

Dadri-Panipat Natural Gas Pipeline

Dadri-Panipat Natural Gas Pipeline Indian Oil Corporation Limited (IOCL) owns and operates 132 km long Dadri-Panipat Natural Gas Pipeline (DPPL). This pipeline is interconnected with GAIL’s Hazira-Vijaipur-Jagdishpur Pipeline (HVJPL) / Dahej-Vijaipur Pipeline (DVPL) network at Dadri. The pipeline was commissioned in 2010 as a Common Carrier pipeline for transporting natural gas from HVJPL/DVPL network to IOCL’s Panipat Refinery (PR) and Panipat Naphtha Cracker Plant (PNCP) at Panipat and other customers’ en route pipeline in Uttar Pradesh and Haryana. Presently, the authorized capacity of DPPL is 9.5 Million Standard Cubic Metres per Day (MMSCMD) including 2.375 MMSCMD as Common Carrier capacity. The pipeline has one “a homogeneous area” (AHA) of 132 km from Dadri to Panipat. Originating station is at Dadri (near GAIL’s terminal within NTPC premises) and terminal station at Panipat (within IOCL’s Northern Region Pipelines premises). The status of pipeline capacity for own use and booked for other shippers is as under: Particulars Capacity (MMSCMD) Dadri - Panipat section 9.5 IOCL’s Capacity for IOCL’s own Use 5.5 Under Contract Carrier 1.05 Common Carrier Capacity 2.375 Spare Capacity 0.575 DPPL is authorized under regulation 17(1) of the Petroleum and Natural Gas Regulatory Board (Authorizing entities to Lay, Build, Operate or Expand Natural Gas Pipelines) Regulations, 2008. (Ref: PNGRB’s authorization letter No. Infra/PL/New/17/ DPPL/ IOCL/01/11, dated 5.1.2011) The capacity of DPPL has been approved and declared by PNGRB vide order No. MI/NGPL/GGG/Capacity/IOCL dated 9.11.2012. -

Project Reliable

Good morning jury members and members of the audience. During this presentation we will present a process improvement project & share with you our learning's and experiences and how we have increased (i)Liquid Hydrocarbon Production of GAIL Gandhar, (ii) High Pressure Gas (HP) Gas quantity from ONGC Gandhar, (iii) Net Profit of GAIL Gandhar by suppling SRG to Gas Gathering Station-IV ONGC Gandhar Using Lean Gas Line of Reliance Industries Limited by using a structured DMAIC methodology. 1 We(GAIL) are in presence of these Business Vertices. 2 There are 5 subsidiary and 18 joint ventures of GAIL. 3 Process flow diagram of GAIL Gas Processing Unit Gandhar, Which is situated at Bharuch District of Gujarat. Which are associated with Oil and natural gas corporation (ONGC), Gujarat Narmada Valley Fertilizer Limited (GNFC), Gas Gathering Station No- 4 (GGS-IV M/s ONGC ), National Thermal Power Corporation Limited (NTPC), Reliance Industries Limited Dahej as upstream source and down stream consumers. 4 Steps followed in this project listed here 5 In Project background for identification, planning and prioritization of problems done in this step. 6 In This step GAIL shows our project planning and identification of opportunity area to increase our turnover. 7 These the mode of suggestions, ideas, problems identification are welcome either through online portal or offline portal are listed here. 8 Here we have shown how idea’s are generated or problem are listed through brainstorming and SAP for identification of problem. 9 In GAIL gandhar we have characterized our process area in A,B,C,D,E class for stratification of problem’s. -

CHAPTER - I Through International Competitive Biddings in a 1

CHAPTER - I through international competitive biddings in a 1. INTRODUCTION deregulated scenario. Appraisal of 35% of the total sedimentary basins is targeted together with 1.1 The Ministry of Petroleum & Natural Gas acquisition of acreages abroad and induction of (MOP&NG) is concerned with exploration & advanced technology. The results of the initiatives production of oil & natural gas (including import taken since 1999 have begun to unfold. of Liquefied Natural Gas), refining, distribution & 1.8 ONGC-Videsh Limited (OVL) a wholly owned marketing, import, export and conservation of subsidiary of ONGC is pursing to acquire petroleum products. The work allocated to the exploration acreage and oil/gas producing Ministry is given in Appendix-I. The names of the properties abroad. OVL has already acquired Public Sector Oil Undertakings and other discovered/producing properties in Vietnam (gas organisations under the ministry are listed in field-45% share), Russia (oil & gas field – 20% Appendix-II. share) and Sudan (oil field-25% share). The 1.2 Shri Ram Naik continued to hold the charge as production from Vietnam and Sudan is around Minister of Petroleum & Natural Gas during the 7.54 Million Metric Standard Cubic meters per financial year 2003-04. Smt. Sumitra Mahajan day (MMSCMD) of gas and 2,50,000 barrels of assumed the charge of Minister of State for oil per day (BOPD) respectively. The first Petroleum & Natural Gas w.e.f 24.05.2003. consignment of crude oil from Sudan project of OVL was received in May, 2003 by MRPL 1.3 Shri B.K. Chaturvedi continued to hold the charge (Mangalore Refinery Petrochemicals Limited) in as Secretary, Ministry of Petroleum & Natural Gas. -

Hindustan Petroleum Corporation Limited

HINDUSTAN PETROLEUM CORPORATION LIMITED GAS & RENEWABLES SBU- CGD Projects EXPRESSION OF INTEREST (EOI) FOR SALE OF LAND EOI Opening Date: 03rd July 2021 EOI Closing date: 02nd Aug 2021 Closing Time: 03:00 PM Hindustan Petroleum Corporation Limited (HPCL) is developing City Gas Distribution (CGD) Network in Etah, Farrukhabad and Hardoi Districts (Uttar Pradesh) and shall be engaged in supplying Piped Natural Gas (PNG) for Industrial, Commercial & Domestic House Hold & Compressed Natural Gas (CNG) for Automobiles. In order to develop the CGD network, HPCL intends to set up City Gate Station (CGS) in JARAULI KALAN, Firozabad (Tap-off at GAIL’s RT cum CGS Firozabad from Spur pipeline of DVPL, Village- JARAULI KALAN, Firozabad) for setting up of metering skid and other equipment. Expression of interest in the form of Technical & Financial offers are invited from absolute and exclusive owners or co-owners of suitable plots of land for transferring the same by way of OUTRIGHT SALE to Hindustan Petroleum Corporation Limited for setting up City Gate Station at the following locations: Location for Plot of Land: 1. Plot of land should be located within 2 Km from either side of GAIL’s RT cum CGS Firozabad from Spur pipeline of DVPL, Village- JARAULI KALAN, Firozabad. 2. Land should be on an asphalted/ concrete /paved motorable road suitable for all weather movement of Heavy Commercial Vehicles (HCV) of minimum 4m width with clear access across the entire frontage and connected to Firozabad New Bypass Road or Firozabad Bypass Road (NH-19). 3. Total distance i.e. 2 Km will be considered from the center of GAIL’s Station on either side. -

India's Energy Future in a World of Change

India’s Energy Future in a World of Change 26-28 October 2020 India Energy Forum in Review Inaugural Address Inaugural Address and Ministerial Dialogue Hon. Shri Narendra Modi, Prime Minister, India H.R.H. Prince Abdulaziz bin Salman, Minister of Energy, Kingdom of Saudi Arabia Inaugural Address and Closing Remarks Inaugural Address and Ministerial Dialogue Hon. Shri Dharmendra Pradhan, Minister of Petroleum & Natural Gas Hon. Dan Brouillette, Secretary of Energy, and Minister of Steel, Government of India United States Department of Energy 1 Indian Ministerial Dialogue Indian Ministerial Dialogue Hon. Smt. Nirmala Sitharaman, Minister of Finance and Minister of Hon. Shri Piyush Goyal, Minister of Railways and Minister of Commerce & Corporate Affairs, Government of India Industry, Government of India Ministerial Dialogue New Map of Energy for India The Hydrogen Economy and Closing Remarks Shri Tarun Kapoor, Secretary, H.E. Mohammad Sanusi Barkindo, Secretary Dr. Rajiv Kumar, Vice Chairman, NITI Aayog, Ministry of Petroleum & Natural Gas, General, OPEC Government of India Government of India 2 Leadership Dialogue Leadership Dialogue Tengku Muhammad Taufik, President & Group Chief Executive, Bernard Looney, Group Chief Executive, bp p.l.c. PETRONAS Leadership Dialogue Future of Refining & Petrochemicals in a World of Surplus Patrick Pouyanné, Chairman & Chief Executive Officer, TOTAL S.A. S.M. Vaidya, Chairman, Indian Oil Corporation Ltd. 3 Technologies to Optimize Costs, Recovery & Emissions in the Upstream Judson Jacobs, Executive Shashi Shanker, Chairman & Director, Upstream Technology, Sunil Duggal, Group Chief Managing Director, Oil and Natural Lorenzo Simonelli, Chairman & IHS Markit Executive Officer, Vedanta Gas Corporation Ltd. (ONGC) CEO, Baker Hughes Growing Share of Gas in India’s Energy Mix: What is realistic? Ernie Thrasher, Chief Executive Michael Stoppard, Chief Meg Gentle, President & Chief Manoj Jain, Chairman & Officer & Chief Marketing Officer, Strategist, Global Gas, IHS Markit Executive Officer, Tellurian Inc. -

C:\Docume~1\Mahesh~1.Bud

Expenditure Budget Vol. I, 2006-2007 39 STATEMENT 14 PLAN INVESTMENT IN PUBLIC ENTERPRISES (In crores of Rupees) Sl. Budget 2005-2006 Revised 2005-2006 Budget 2006-2007 No. Name of Ministry/Enterprise Total Budget Support Total Budget Support Total Budget Support Plan Plan Plan Outlay Equity Loans Outlay Equity Loans Outlay Equity Loans Ministry of Agriculture 58.00 ... 58.00 84.16 ... 84.16 50.00 ... 50.00 Department of Agriculture and Cooperation 58.00 ... 58.00 84.16 ... 84.16 50.00 ... 50.00 1. Land Development Banks 57.00 ... 57.00 79.16 ... 79.16 45.00 ... 45.00 2. Damodar Valley Corporation ... ... ... 5.00 ... 5.00 5.00 ... 5.00 3. National Seeds Corporation 0.30 ... 0.30 ... ... ... ... ... ... 4. State Farms Corporation of India 0.70 ... 0.70 ... ... ... ... ... ... Department of Atomic Energy 5529.70 568.10 2004.00 4205.38 300.05 1280.03 4294.34 991.19 1606.00 5. Electronics Corporation of India 34.00 9.00 ... 34.00 9.00 ... 39.34 9.34 ... 6. Indian Rare Earths Ltd. 85.10 10.00 ... 72.80 ... ... 80.79 ... ... 7. Uranium Corporation of India 280.60 119.10 ... 225.55 64.05 ... 292.36 100.00 ... 8. Nuclear Power Corporation 4700.00 ... 2004.00 3646.03 ... 1280.03 3400.00 400.00 1606.00 9. Bharatiya Nabhikiya Vidyut Nigam Ltd (BHAVINI) 430.00 430.00 ... 227.00 227.00 ... 481.85 481.85 ... Ministry of Chemicals and Fertilisers 1096.96 91.09 77.29 1109.35 41.70 80.61 1057.54 88.39 57.15 Department of Chemicals and Petrochemicals 97.70 53.60 21.00 49.33 18.21 31.12 91.46 47.53 18.15 10. -

Gail's Ucg Perspective

Indo-US Working Group on Coal –Workshop on Underground Coal Gasification GAIL’S UCG PERSPECTIVE November 13,2006 Shri Vinay Kumar General Manager (Petro Chemical Project Development) 1 MISSION & VISION Formed in 1984 as Gas Authority “TO ACCELERATE AND OPTIMIZE of India Limited THE EFFECTIVE AND ECONOMIC USE OF NATURAL GAS AND ITS FRACTIONS TO THE BENEFIT OF NATIONAL ECONOMY.” Mission Now “BE THE LEADING COMPANY IN NATURAL GAS & BEYOND, GAIL (India) Ltd WITH GLOBAL FOCUS, COMMITTED TO CUSTOMER CARE, VALUE CREATION FOR ALL STAKEHOLDERS Vision AND ENVIRONMENTAL RESPONSIBILITY” 2 GAIL - BUSINESS PORTFOLIO (ASSETS & CAPACITIES) GAS PIPELINES 5,600 KMS 123 MMSCMD 11 STATES RAJASTHAN L LP LPG PIPELINE J PATA LAKWA 1922 KMS VPL D VIJAIPUR J, 3.8 MMTPA V TRIPURA R H HA ND VAGHODIA GA GAS PROCESSING USAR VSPL 7 PLANTS KG BASIN NATURAL GAS PIPELINE 1.2 MMTPA LPG LPG PIPELINE LPG PLANT PETROCHEMICALS PETROCHEM PLANT CAUVERY 310,000 TPA BASIN POLYETHYLENE 3 GAIL - BUSINESS PORTFOLIO OFC CONNECTIVITY 13,000 KMS E&P 16 BLOCKS (3 - OVERSEAS) LNG PLL, DAHEJ RGPPL, DABHOL (10 MMTPA) GAS RETAILING IGL, MGL, BGL, TNGCL, CUGL, GGL,MNGL OFC CONNECTIVITY E&P BLOCKS MYANMAR BLOCK POWER 156 MW DAHEJ LNG TERMINAL GSEG, Hazira 4 GAIL’s INTERNATIONAL INVESTMENTS OVERSEAS PRESENCE TARGET COUNTRIES EGYPT EQUITY IN 3 GAS RETAILING COMPANIES 1) IRAN 2) TURKEY MYANMAR 3) PHILIPPINES PARTNER IN A1, A3 E&P BLOCKS 4) BANGLADESH 5) RUSSIA & CIS CHINA 6) AUSTRALIA EQUITY IN CHINA GAS FOR GAS RETAILING SINGAPORE 100% GAIL SUBSIDIARY 5 FINANCIAL PERFORMANCE TURNOVER (2005-06) RS. 14,459 CRORE NET PROFIT RS. -

IBEF Presentataion

OIL and GAS For updated information, please visit www.ibef.org November 2017 Table of Content Executive Summary……………….….…….3 Advantage India…………………..….……...4 Market Overview and Trends………..……..6 Porters Five Forces Analysis.….…..……...28 Strategies Adopted……………...……….…30 Growth Drivers……………………..............33 Opportunities…….……….......…………..…40 Success Stories………….......…..…...…....43 Useful Information……….......………….….46 EXECUTIVE SUMMARY . In FY17, India had 234.5 MMTPA of refining capacity, making it the 2nd largest refiner in Asia. By the end of Second largest refiner in 2017, the oil refining capacity of India is expected to rise and reach more than 310 million tonnes. Private Asia companies own about 38.21 per cent of total refining capacity World’s fourth-largest . India’s energy demand is expected to double to 1,516 Mtoe by 2035 from 723.9 Mtoe in 2016. Moreover, the energy consumer country’s share in global primary energy consumption is projected to increase by 2-folds by 2035 Fourth-largest consumer . In 2016-17, India consumed 193.745 MMT of petroleum products. In 2017-18, up to October, the figure stood of oil and petroleum at 115.579 MMT. products . India was 3rd largest consumer of crude oil and petroleum products in the world in 2016. LNG imports into the country accounted for about one-fourth of total gas demand, which is estimated to further increase by two times, over next five years. To meet this rising demand the country plans to increase its LNG import capacity to 50 million tonnes in the coming years. Fourth-largest LNG . India increasingly relies on imported LNG; the country is the fourth largest LNG importer and accounted for importer in 2016 5.68 per cent of global imports.