The Trader's Guide to Charting

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SLIM CHICKENS FALL 2021 on the COVER When Chicken Wings Are in Short Supply, FALL 2021 Boneless Alternatives Can Stand In

MENU MUST-HAVES MONEY MOVES MEETING THE MOMENT FOOD FANATICS TAKE THAT Limited Time Only 2.O EARTH MATTERS Umami is the punch menus welcome, Make bank with smarter LTO, Restaurateurs on climate change, page 12 page 51 page 65 SLIM CHICKENS SLIM FALL 2021 FALL CHICKENS WING STAND-INS STEP UP ON THE COVER When chicken wings are in short supply, FALL 2021 boneless alternatives can stand in. Add some thrill Sharing the Love of Food—Inspiring Business Success See page 30. MENU MUST-HAVES MONEY MOVES to your bar & grill. PILE IT ON THE SMARTER WAY TO LTO From sports bars to chef-driven concepts, Make bank with aggressive limited- over-the-top dishes score. time- only options. 5 51 ™ ® SIDEWINDERS Fries Junior Cut Featuring Conquest Brand Batter TAKE THAT THE POWER OF TWO Umami is the punch that diners welcome. Get an edge by pairing up with a brand. 12 54 KNEAD-TO-KNOW PIZZA FLEX YOUR MENU MUSCLE Light clear coat batter Innovation in dough and toppings rise Strategic pricing can benefit the lets the potato flavor when there’s time on your hands. bottom line. shine through 22 58 CHANGE IT UP ON THE FLY 5 ways to step up your SEO. How boneless wings can take off when 61 Unique shape for wings are grounded. Instagram-worthy 30 presentations MEETING THE PLENTY TO BEER MOMENT Complex flavors demand suds that can stand up and complement. EARTH MATTERS 40 Restaurateurs respond to the menu’s role in climate change. TREND TRACKER 65 Thicker cut and clear Homing in on what’s coming and going. -

Florida Doctor Charged in Massive $681 Million Substance Abuse

Case 9:20-mj-08265-BER Document 8 Entered on FLSD Docket 07/30/2020 Page 1 of 78 AO 91 (Rev. 11/11) Criminal Complaint UNITED STATES DISTRICT COURT for the Southern District of Florida [3 United States of America ) V. ) MICHAEL LIGOTTI ) Case No. ) 20-8265-BER ) ) ) Defendant(s) CRIMINAL COMPLAINT I, the complainant in this case, state that the following is true to the best of my knowledge and belief. On or about the date(s) of January 1, 2013 to the present in the county of Palm Beach and Broward in the Southern District of Florida , the defendant(s) violated: Code Section Offense Description 18 U.S.C. 1349 Conspiracy to commit health care fraud and wire fraud 18 U.S.C. 982(a)(7) Criminal forfeiture This criminal complaint is based on these facts: Please see the attached affidavit of Special Agent Christian Hull, Federal Bureau of Investigation ("FBI"), which is attached hereto and incorporated fu lly herein by reference. ~ Continued on the attached sheet. Complainant's signature Special Agent Christian Hull, FBI Sworn and attested to me by applicant by telephone (FaceTime) per the requirements of Fed. R. Crim. P. 4(d) and 4.1 Date: 07/29/2020 Judge 's signature City and state: West Palm Beach, Florida Hon. Bruce Reinhart, U.S. Magistrate Judge Printed name and title Case 9:20-mj-08265-BER Document 8 Entered on FLSD Docket 07/30/2020 Page 2 of 78 AFFIDAVIT I, Special Agent Christian Hull, being duly sworn, do hereby and depose and state: Affiant’s Background 1. -

Ludacris Shows His Serious Side Alyse Knorr______His Current Lifestyle

The Pendulum ARTS & ENTERTAINMENT Thursday, December 7, 2006 • Page 23 Ludacris shows his serious side Alyse Knorr_______ his current lifestyle. jail is not a place you want to be,” Bridges said. Editor Money Maker,” the most successful If “Do Your Time” is the most political single off the album, feels like the Ludacris ly intense song on the album, then “Slap” is Southern rapper Chris “Ludacris” we know and love best- playful, catchy the most emotionally intense. Bridges sets Bridges released his fifth album, “Release lyrics with an easy beat to dance to. his audience on edge with his lyrics, and Therapy,” last September, marking his third Mouths to Feed” has powerful lyrics that the slow beat and electric guitar effects number one album in a row and one of his get political, expressing the pressure that intertwined throughout the song add an Host serious accomplishments as an artist. comes with having a family to support uneasy feeling. However, “Release Therapy” has been People can relate to that,” Bridges said. “‘Slap’ was getting my views in and iiuch more than just a hit seller for this 28- A lot of people have mouths to feed and being in certain situations when you get so year-old hip-hop artist. that’s their motivation.” angry you want to slap the hell out of “It’s my classic album,” Bridges said. “It’s Tell It Like It Is” sounds like the Bridges someone,” Bridges said, hinting at his per •he most honest album, and it’s very personal.” in Step Back ’- blunt and honest about his sonal problems with Bill O’Reilly as a Bridges hop)ed to show a more serious complaints with the music industry: “See, potential inspiration. -

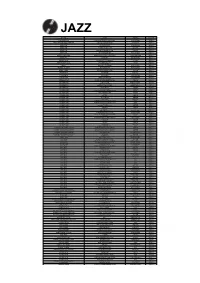

Order Form Full

JAZZ ARTIST TITLE LABEL RETAIL ADDERLEY, CANNONBALL SOMETHIN' ELSE BLUE NOTE RM112.00 ARMSTRONG, LOUIS LOUIS ARMSTRONG PLAYS W.C. HANDY PURE PLEASURE RM188.00 ARMSTRONG, LOUIS & DUKE ELLINGTON THE GREAT REUNION (180 GR) PARLOPHONE RM124.00 AYLER, ALBERT LIVE IN FRANCE JULY 25, 1970 B13 RM136.00 BAKER, CHET DAYBREAK (180 GR) STEEPLECHASE RM139.00 BAKER, CHET IT COULD HAPPEN TO YOU RIVERSIDE RM119.00 BAKER, CHET SINGS & STRINGS VINYL PASSION RM146.00 BAKER, CHET THE LYRICAL TRUMPET OF CHET JAZZ WAX RM134.00 BAKER, CHET WITH STRINGS (180 GR) MUSIC ON VINYL RM155.00 BERRY, OVERTON T.O.B.E. + LIVE AT THE DOUBLET LIGHT 1/T ATTIC RM124.00 BIG BAD VOODOO DADDY BIG BAD VOODOO DADDY (PURPLE VINYL) LONESTAR RECORDS RM115.00 BLAKEY, ART 3 BLIND MICE UNITED ARTISTS RM95.00 BROETZMANN, PETER FULL BLAST JAZZWERKSTATT RM95.00 BRUBECK, DAVE THE ESSENTIAL DAVE BRUBECK COLUMBIA RM146.00 BRUBECK, DAVE - OCTET DAVE BRUBECK OCTET FANTASY RM119.00 BRUBECK, DAVE - QUARTET BRUBECK TIME DOXY RM125.00 BRUUT! MAD PACK (180 GR WHITE) MUSIC ON VINYL RM149.00 BUCKSHOT LEFONQUE MUSIC EVOLUTION MUSIC ON VINYL RM147.00 BURRELL, KENNY MIDNIGHT BLUE (MONO) (200 GR) CLASSIC RECORDS RM147.00 BURRELL, KENNY WEAVER OF DREAMS (180 GR) WAX TIME RM138.00 BYRD, DONALD BLACK BYRD BLUE NOTE RM112.00 CHERRY, DON MU (FIRST PART) (180 GR) BYG ACTUEL RM95.00 CLAYTON, BUCK HOW HI THE FI PURE PLEASURE RM188.00 COLE, NAT KING PENTHOUSE SERENADE PURE PLEASURE RM157.00 COLEMAN, ORNETTE AT THE TOWN HALL, DECEMBER 1962 WAX LOVE RM107.00 COLTRANE, ALICE JOURNEY IN SATCHIDANANDA (180 GR) IMPULSE -

Most Requested Songs of 2020

Top 200 Most Requested Songs Based on millions of requests made through the DJ Intelligence music request system at weddings & parties in 2020 RANK ARTIST SONG 1 Whitney Houston I Wanna Dance With Somebody (Who Loves Me) 2 Mark Ronson Feat. Bruno Mars Uptown Funk 3 Cupid Cupid Shuffle 4 Journey Don't Stop Believin' 5 Neil Diamond Sweet Caroline (Good Times Never Seemed So Good) 6 Usher Feat. Ludacris & Lil' Jon Yeah 7 Walk The Moon Shut Up And Dance 8 V.I.C. Wobble 9 Earth, Wind & Fire September 10 Justin Timberlake Can't Stop The Feeling! 11 Garth Brooks Friends In Low Places 12 DJ Casper Cha Cha Slide 13 ABBA Dancing Queen 14 Bruno Mars 24k Magic 15 Outkast Hey Ya! 16 Black Eyed Peas I Gotta Feeling 17 Kenny Loggins Footloose 18 Bon Jovi Livin' On A Prayer 19 AC/DC You Shook Me All Night Long 20 Spice Girls Wannabe 21 Chris Stapleton Tennessee Whiskey 22 Backstreet Boys Everybody (Backstreet's Back) 23 Bruno Mars Marry You 24 Miley Cyrus Party In The U.S.A. 25 Van Morrison Brown Eyed Girl 26 B-52's Love Shack 27 Killers Mr. Brightside 28 Def Leppard Pour Some Sugar On Me 29 Dan + Shay Speechless 30 Flo Rida Feat. T-Pain Low 31 Sir Mix-A-Lot Baby Got Back 32 Montell Jordan This Is How We Do It 33 Isley Brothers Shout 34 Ed Sheeran Thinking Out Loud 35 Luke Combs Beautiful Crazy 36 Ed Sheeran Perfect 37 Nelly Hot In Herre 38 Marvin Gaye & Tammi Terrell Ain't No Mountain High Enough 39 Taylor Swift Shake It Off 40 'N Sync Bye Bye Bye 41 Lil Nas X Feat. -

There's No Shortcut to Longevity: a Study of the Different Levels of Hip

Running head: There’s No Shortcut to Longevity 1 This thesis has been approved by The Honors Tutorial College and the College of Business at Ohio University __________________________ Dr. Akil Houston Associate Professor, African American Studies Thesis Adviser ___________________________ Dr. Raymond Frost Director of Studies, Business Administration ___________________________ Cary Roberts Frith Interim Dean, Honors Tutorial College There’s No Shortcut to Longevity 2 THERE’S NO SHORTCUT TO LONGEVITY: A STUDY OF THE DIFFERENT LEVELS OF HIP-HOP SUCCESS AND THE MARKETING DECISIONS BEHIND THEM ____________________________________ A Thesis Presented to The Honors Tutorial College Ohio University _______________________________________ In Partial Fulfillment of the Requirements for Graduation from the Honors Tutorial College with the degree of Bachelor of Business Administration ______________________________________ by Jacob Wernick April 2019 There’s No Shortcut to Longevity 3 Table of Contents List of Tables and Figures……………………………………………………………………….4 Abstract…………………………………………………………………………………………...5 Introduction…………………………………………………………………………………..6-11 Parameters of Study……………………………………………………………..6 Limitations of Study…………………………………………………………...6-7 Preface…………………………………………………………………………7-11 Literary Review……………………………………………………………………………..12-32 Methodology………………………………………………………………………………....33-55 Jay-Z Case Study……………………………………………………………..34-41 Kendrick Lamar Case Study………………………………………………...41-44 Soulja Boy Case Study………………………………………………………..45-47 Rapsody Case Study………………………………………………………….47-48 -

Application of Whole Genome Resequencing in Mapping

www.nature.com/scientificreports There are amendments to this paper OPEN Application of Whole Genome Resequencing in Mapping of a Tomato Yellow Leaf Curl Virus Received: 8 February 2018 Accepted: 12 June 2018 Resistance Gene Published: xx xx xxxx Yinlei Wang1,2, Jing Jiang1,2, Liping Zhao1,2, Rong Zhou1,2, Wengui Yu1,2 & Tongmin Zhao1,2 Tomato yellow leaf curl virus (TYLCV) has signifcantly impacted the tomato industry around the world, and the use of insecticides and insect nets have not efectively controlled the spread of this pathogen. The tomato line AVTO1227 is highly resistant to TYLCV. In this study, F2 and BC1 populations derived from AVTO1227 and the susceptible line Money maker were used to assess the genetic mechanism underlying TYLCV resistance. We have identifed a recessive TYLCV resistance gene, hereby designated as ty-5, which is linked to SlNACI. Genomic DNA pools from resistant and susceptible groups were constructed, and their genomes were resequenced. The ty-5 gene was identifed on an interval encompassing the genomic positions 2.22 Mb to 3.19 Mb on tomato chromosome 4. Genotyping using linkage markers further mapped ty-5 within the interval between markers ty5–25 and ty5–29, where only the pelota gene is located. Consequently, pelota was considered as the candidate gene corresponding to ty-5. Two nucleotide transversions within the promoter region and one transversion in exon region of the pelota gene were detected in the parental lines. However, the relative transcript levels of pelota did not signifcantly difer among the three tomato lines, regardless of TYLCV infection. -

Make. Work Prolec Stopped ,N

, , r , '11 --~• • ' r ¸ " :' •r .... •'' •.'' .... ~~'~ LEGISLATIVE /. • ~ PARLZMENT ~UILDING~LI~IIM~Y J • ":i" " ' g' Ytc tor.t.a, B.C. , . " . VSV IZ4 1 .~ ~: - I '.. :" ; i . ~. :i:".. : • upgra' .....d]ng ......... ...... .........be'l':''ql " ...... ~,,~,:: • , , ~ .... ~ : ~: ! : :, '"~%~,;"~ *~,,'~:~;,- m,,-,~]n'U~'~u~l d bulldln;M : ~ ! ": ':" :' : ~',:::: ;'~-' ",'. :: : : :' :':: "'~ .... ~ ' ':*' :': ::~ . :: ":'" "~ ' ~:" ' ': : ' : : ~. ': : ;-:.' ":-; ".~ : ...... :;~~'" the ~rd~oMd'~ coolzulJedl. ~' : :: :: ..', " :~: ' ........ ' • Y!~ fi~ u~wan carried out my m. yth .:, ............ : ........... ........ • ,- .,,. : ,... .......... .,.: .......... : ................ ., ........ : .. m ..... ,,, ~:~ ea~rlous~nt~nr~rdt,~t ...... •.' ~*rm' l~te~ent nt the ,rmu~st Of thesehool l~0~dingac~li~fot ~ ~wo! 10 ~ In.,.;SlW.e.U.on r~t ,,w!tbl~o~le other.~,~ memebers., • ~ot:~ly.~Vo!ve~tbe'eXisUn,~ l)uildin~,, and ter~t but =i,~, ':, • :: ..~,;;;~,:: .,' .:":-:---. -. -..?. .... :: .;: ..: ':::a~ ~'dntil ~ fl~d~tec,~o'd~ l~:Ve ~ ..... :. RickShaw .th~rdinatm'.f~the~Fa/'m, said-s~l~, :'evm.vsch00i~ildaMa~]t~atvi.~i~"th~n,,m,v.?~, . ... : . ':".: Acc0rdlngtotheroport,' :~" th!ed.. ~sflcl~m~i . e~ ' .... db;. :" :...:-.imtaHe~ : .....,.. ' .. .: ..... : :.:... .... : - :....,.::-:...~:'...,~er~t...:-. ::. ~ .: ~...~ :. have~nundertakento¢orrect.tltedefldendesoutlinedin .: .:... ..... ....: . : ; : . :., - :.:::...:. TheHart Farmiis . joea:.ted. off .the.~l .•m.IY~da!)out~o... ....... ' ' ..... - : .'. @ w o~d Imming sad- propane: hen.U~ -

I Strout's Catalog

CO-OPERATIVE APTS. (Cent.) HOUSES FURNISHED (Cow.) HOUSES FURNISHED HOUSES UNFURNISHED (Coni.) BUS. OPPORTUNITIES (Cont.) BUSINESS OPPORTUNITIES BUSINESS OPPORTUNITIES BKD&M., bath. liv. rm.. porch, kitch- 2010 3rd 8T, row brie! 516 NORTH OXFORD ST.—New 8- SANDWICH SHOPPE and soda foun- YOUNG MAN. proven sales and man en. large foyer on N.E.—Lovely BEAUTY SHOP: 1st floor apt home with 6 rms. and bath, oi bedrm. Colonial: l'A baths, full tain; real opportunity; owner 111. agement background, has $10,000 ti rent, $110; heal bldg., 18th and Col. rd. and water lurn.; n.w.; 879.50. h.-w.h., completely furn. FLOYL AVAILABLE bsmt.. attic storage, automat, gas must leave town. ME. 8280. 3* purchase sound business or franchise nicely equip.; estab BUSINESS OPPORTUNITIES • llshed 15 BUSINESS OPPORTUNITIES OWNER. MI. 7528. DAVIS CO., 1629 K st. n.w.. NA heat: fenced back yard: 8 min. from Box 3I8-H. Star. • yr«.; excel. Inc.; ownei GROCERY, located near Union sta- 111: price only $2,100. Mra. Koch ATTRAC. EFFIC. APT., with E.^ 1624 Nicholson n.w.—Present occu- Pentagon. OW, and ONE-MAN foyer, 6093._—8 tion Washington Terminal. Ex- FURNITURE STORE FOR SALE, ex Others to show you. DELICATESSEN-GROG. HlGnWAV RESTAURANT. seating 21-ft. liv. room. din. alcove, pant, attached French Embassy, will Uptown n.w.; new EXCEPTONALLY nice 5 bedrooms cellent corner. Five-year lease avail- cdllent location: cash required, abou : doing over *700 wkly tS4. with separate tavern seating kit., dressing closet with vacate to suit you. 3rd house west 1434 MADISON ST. -

Sweet 16 Hot List

Sweet 16 Hot List Song Artist Happy Pharrell Best Day of My Life American Authors Run Run Run Talk Dirty to Me Jason Derulo Timber Pitbull Demons & Radioactive Imagine Dragons Dark Horse Katy Perry Find You Zedd Pumping Blood NoNoNo Animals Martin Garrix Empire State of Mind Jay Z The Monster Eminem Blurred Lines We found Love Rihanna/Calvin Love Me Again John Newman Dare You Hardwell Don't Say Goodnight Hot Chella Rae All Night Icona Pop Wild Heart The Vamps Tennis Court & Royals Lorde Songs by Coldplay Counting Stars One Republic Get Lucky Daft punk Sexy Back Justin Timberland Ain't it Fun Paramore City of Angels 30 Seconds Walking on a Dream Empire of the Sun If I loose Myself One Republic (w/Allesso mix) Every Teardrop is a Waterfall mix Coldplay & Swedish Mafia Hey Ho The Lumineers Turbulence Laidback Luke Steve Aoki Lil Jon Pursuit of Happiness Steve Aoki Heads will roll Yeah yeah yeah's A-trak remix Mercy Kanye West Crazy in love Beyonce and Jay-z Pop that Rick Ross, Lil Wayne, Drake Reason Nervo & Hook N Sling All night longer Sammy Adams Timber Ke$ha, Pitbull Alive Krewella Teach me how to dougie Cali Swag District Aye ladies Travis Porter #GETITRIGHT Miley Cyrus We can't stop Miley Cyrus Lip gloss Lil mama Turn down for what Laidback Luke Get low Lil Jon Shots LMFAO We found love Rihanna Hypnotize Biggie Smalls Scream and Shout Cupid Shuffle Wobble Hips Don’t Lie Sexy and I know it International Love Whistle Best Love Song Chris Brown Single Ladies Danza Kuduro Can’t Hold Us Kiss You One direction Don’t You worry Child Don’t -

Songs by Artist

Songs by Artist Title Title (Hed) Planet Earth 2 Live Crew Bartender We Want Some Pussy Blackout 2 Pistols Other Side She Got It +44 You Know Me When Your Heart Stops Beating 20 Fingers 10 Years Short Dick Man Beautiful 21 Demands Through The Iris Give Me A Minute Wasteland 3 Doors Down 10,000 Maniacs Away From The Sun Because The Night Be Like That Candy Everybody Wants Behind Those Eyes More Than This Better Life, The These Are The Days Citizen Soldier Trouble Me Duck & Run 100 Proof Aged In Soul Every Time You Go Somebody's Been Sleeping Here By Me 10CC Here Without You I'm Not In Love It's Not My Time Things We Do For Love, The Kryptonite 112 Landing In London Come See Me Let Me Be Myself Cupid Let Me Go Dance With Me Live For Today Hot & Wet Loser It's Over Now Road I'm On, The Na Na Na So I Need You Peaches & Cream Train Right Here For You When I'm Gone U Already Know When You're Young 12 Gauge 3 Of Hearts Dunkie Butt Arizona Rain 12 Stones Love Is Enough Far Away 30 Seconds To Mars Way I Fell, The Closer To The Edge We Are One Kill, The 1910 Fruitgum Co. Kings And Queens 1, 2, 3 Red Light This Is War Simon Says Up In The Air (Explicit) 2 Chainz Yesterday Birthday Song (Explicit) 311 I'm Different (Explicit) All Mixed Up Spend It Amber 2 Live Crew Beyond The Grey Sky Doo Wah Diddy Creatures (For A While) Me So Horny Don't Tread On Me Song List Generator® Printed 5/12/2021 Page 1 of 334 Licensed to Chris Avis Songs by Artist Title Title 311 4Him First Straw Sacred Hideaway Hey You Where There Is Faith I'll Be Here Awhile Who You Are Love Song 5 Stairsteps, The You Wouldn't Believe O-O-H Child 38 Special 50 Cent Back Where You Belong 21 Questions Caught Up In You Baby By Me Hold On Loosely Best Friend If I'd Been The One Candy Shop Rockin' Into The Night Disco Inferno Second Chance Hustler's Ambition Teacher, Teacher If I Can't Wild-Eyed Southern Boys In Da Club 3LW Just A Lil' Bit I Do (Wanna Get Close To You) Outlaw No More (Baby I'ma Do Right) Outta Control Playas Gon' Play Outta Control (Remix Version) 3OH!3 P.I.M.P. -

![3. SMACK THAT – EMINEM (Feat. Eminem) [Akon:] Shady Convict](https://docslib.b-cdn.net/cover/1496/3-smack-that-eminem-feat-eminem-akon-shady-convict-2571496.webp)

3. SMACK THAT – EMINEM (Feat. Eminem) [Akon:] Shady Convict

3. SMACK THAT – EMINEM thing on Get a little drink on (feat. Eminem) They gonna flip for this Akon shit You can bank on it! [Akon:] Pedicure, manicure kitty-cat claws Shady The way she climbs up and down them poles Convict Looking like one of them putty-cat dolls Upfront Trying to hold my woodie back through my Akon draws Slim Shady Steps upstage didn't think I saw Creeps up behind me and she's like "You're!" I see the one, because she be that lady! Hey! I'm like ya I know lets cut to the chase I feel you creeping, I can see it from my No time to waste back to my place shadow Plus from the club to the crib it's like a mile Why don't you pop in my Lamborghini away Gallardo Or more like a palace, shall I say Maybe go to my place and just kick it like Plus I got pal if your gal is game TaeBo In fact he's the one singing the song that's And possibly bend you over look back and playing watch me "Akon!" [Chorus (2X):] [Akon:] Smack that all on the floor I feel you creeping, I can see it from my Smack that give me some more shadow Smack that 'till you get sore Why don't you pop in my Lamborghini Smack that oh-oh! Gallardo Maybe go to my place and just kick it like Upfront style ready to attack now TaeBo Pull in the parking lot slow with the lac down And possibly bend you over look back and Convicts got the whole thing packed now watch me Step in the club now and wardrobe intact now! I feel it down and cracked now (ooh) [Chorus] I see it dull and backed now I'm gonna call her, than I pull the mack down Eminem is rollin', d and em rollin' bo Money