Market Assessment on the Market System for Leather Products (Draft Report)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

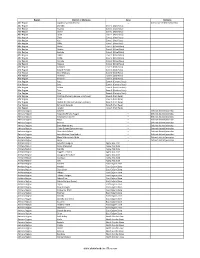

Districts of Ethiopia

Region District or Woredas Zone Remarks Afar Region Argobba Special Woreda -- Independent district/woredas Afar Region Afambo Zone 1 (Awsi Rasu) Afar Region Asayita Zone 1 (Awsi Rasu) Afar Region Chifra Zone 1 (Awsi Rasu) Afar Region Dubti Zone 1 (Awsi Rasu) Afar Region Elidar Zone 1 (Awsi Rasu) Afar Region Kori Zone 1 (Awsi Rasu) Afar Region Mille Zone 1 (Awsi Rasu) Afar Region Abala Zone 2 (Kilbet Rasu) Afar Region Afdera Zone 2 (Kilbet Rasu) Afar Region Berhale Zone 2 (Kilbet Rasu) Afar Region Dallol Zone 2 (Kilbet Rasu) Afar Region Erebti Zone 2 (Kilbet Rasu) Afar Region Koneba Zone 2 (Kilbet Rasu) Afar Region Megale Zone 2 (Kilbet Rasu) Afar Region Amibara Zone 3 (Gabi Rasu) Afar Region Awash Fentale Zone 3 (Gabi Rasu) Afar Region Bure Mudaytu Zone 3 (Gabi Rasu) Afar Region Dulecha Zone 3 (Gabi Rasu) Afar Region Gewane Zone 3 (Gabi Rasu) Afar Region Aura Zone 4 (Fantena Rasu) Afar Region Ewa Zone 4 (Fantena Rasu) Afar Region Gulina Zone 4 (Fantena Rasu) Afar Region Teru Zone 4 (Fantena Rasu) Afar Region Yalo Zone 4 (Fantena Rasu) Afar Region Dalifage (formerly known as Artuma) Zone 5 (Hari Rasu) Afar Region Dewe Zone 5 (Hari Rasu) Afar Region Hadele Ele (formerly known as Fursi) Zone 5 (Hari Rasu) Afar Region Simurobi Gele'alo Zone 5 (Hari Rasu) Afar Region Telalak Zone 5 (Hari Rasu) Amhara Region Achefer -- Defunct district/woredas Amhara Region Angolalla Terana Asagirt -- Defunct district/woredas Amhara Region Artuma Fursina Jile -- Defunct district/woredas Amhara Region Banja -- Defunct district/woredas Amhara Region Belessa -- -

Army Worm Infestation in SNNP and Oromia Regions As of 24 May

Army worm infestation in SNNP and Oromia Regions As of 24 May, some 8,368 hectares of belg cropland was reportedly destroyed by army worms in Wolayita zone of SNNPR - an area that suffered from late onset of the 2013 belg rains and subsequent heavy rains that damaged belg crops. The damage caused by the army worms will further reduce the expected harvest this season. Similar incidents were also reported from Boricha, Bona Zuria, Dara, Dale, Hawassa Zuria and Loko Abaya woredas of Sidama zone; Loma and Mareka woredas of Dawro zone (SNNPR), as well as from drought prone areas of East and West Hararge zones of Oromia Region; and quickly spreading to neighbouring areas. In Boricha woreda, for example, more than 655 hectares of belg cropland was destroyed in the course of one week, this is indicative of the speed that damage is being caused. Immediate distribution of spraying containers and chemicals to the farmers is required to prevent further loss of belg crops. For more information, contact: [email protected] Health Update The number of meningitis cases has gradually declined since the outbreak was declared in January. To date, 1,371 cases were reported from 24 woredas in five zones of SNNP and Oromia Regions. The Government, with support from health partners, is conducting a reactive vaccination in the affected areas, with 1, 678,220 people vaccinated so far. Next week, the number of people vaccinated during the Addis Ababa City Administration meningitis vaccination campaign, conducted from 20 to 26 May, will be released. Meanwhile, the number of kebeles reporting cases of Yellow Fever in South Ari, Benatsemay and Selmago woredas of South Omo zone, SNNPR, increased. -

ETHIOPIA: FOOD Emergency Appeal N° MDRET005 GLIDE N° DR-2008-000043-ETH

ETHIOPIA: FOOD Emergency appeal n° MDRET005 GLIDE n° DR-2008-000043-ETH INSECURITY 19 August 2008 This revised Appeal seeks CHF 8,157,607 (USD 7,920,006 or EUR 5,035,560) in cash, kind or services to support the Ethiopian Red Cross Society (ERCS) to assist 76,075 beneficiaries for 6 months. CHF 300,000 (USD 288,462 or EUR 187,500) was allocated from the Federation’s Disaster Relief Emergency Fund (DREF) to support this operation. Unearmarked funds to replenish DREF are encouraged. Furthermore, this emergency operation has received bilateral contributions from ECHO, through Finnish Red Cross and Austrian Red Cross (EUR 2.7 mill) and the Austrian Development Agency (EUR 200,000). Photo Above: Food distribution in process Based on the situation, this revised appeal responds to a request from ERCS to include the population of neighbouring Damot Gale who live under the same precarious situation as the population of Damot Pulasa and to provide support to 15,215 (7,200 in Damot Gale and 8,015 households in Damot Pulasa) with the total beneficiary of 76,075 (36,000 in Damot Gale and 40,075 in Damot Pulasa). This revised appeal is intended to address emergency food and relief assistance, early recovery activities as well as improving access to safe water and hygiene promotion. This operation is expected to be implemented over 6 months time The first two months’ emergency relief assistance have already been distributed in June and July 2008 in Damot Pulasa while distribution in Damot Gale is expected to start in August 2008. -

Somali Region

Food Supply Prospects FOR THE SECOND HALF OF YEAR 2013 ______________________________________________________________________________ Disaster Risk Management and Food Security Sector (DRMFSS) Ministry of Agriculture (MoA) September, 2013 Addis Ababa, Ethiopia TABLE OF CONTENTS GLOSSARY OF LOCAL NAMES .................................................................. 1 ACRONYMS ............................................................................................. 2 EXCUTIVE SUMMARY .............................................................................. 3 INTRODUCTION ....................................................................................... 7 REGIONAL SUMMARY OF FOOD SUPPLY PROSPECT ............................. 11 SOMALI .............................................................................................. 11 OROMIA ............................................................................................. 16 TIGRAY ............................................................................................... 22 AMHARA ............................................................................................ 25 AFAR .................................................................................................. 28 SNNP .................................................................................................. 32 Annex – 1: NEEDY POPULATION AND FOOD REQUIREMENT BY WOREDA (Second half of 2013) ............................................................................ 35 0 | P a g e GLOSSARY -

ETHIOPIA Food Security Outlook January to June 2010

ETHIOPIA Food Security Outlook January to June 2010 Figure 1. Current estimated food security conditions, January • An estimated 5.23 million people will require 2010 emergency food assistance up to December 2010 with the net food requirement including TSF needs being 290,271 MT estimated to cost around USD 231.3 million according to the Joint Government and Humanitarian Partners’ Humanitarian Requirement Document released on 2 February 2010 • Performance of the kiremt rains (June to September) was below normal, particularly in Gambella, the eastern half of the country and southern lowlands of SNNPR. As a result, main season meher crop harvests are poor in these areas. • Poor main season karma/karan rainfall in the pastoral region of Afar and northern zones of Somali region have led to poorer than usual pasture and water availability. Further deterioration is expected until the rains begin in March. For more information on FEWS NET’s Food Insecurity Severity Scale, • Availability of pasture and water in the southern please see: www.fews.net/FoodInsecurityScale zones of Somali region, neighboring lowlands of Source: FEWS NET and WFP Oromia and South Omo Zone of SNNP Region has marginally improved following the deyr (October‐December) rains. However, the respite will likely be short‐lived and households will continue to depend heavily on external assistance. • Several woredas in the eastern parts of Amhara, Tigray, Afar, Oromia and Somali regions are facing water shortages at the start of the dry season following the poor kiremt rains. Seasonal calendar and critical events Source: FEWS NET FEWS NET Washington FEWS NET Ethiopia FEWS NET is a USAID-funded activity. -

Periodic Monitoring Report Working 2016 Humanitarian Requirements Document – Ethiopia Group

DRMTechnical Periodic Monitoring Report Working 2016 Humanitarian Requirements Document – Ethiopia Group Covering 1 Jan to 31 Dec 2016 Prepared by Clusters and NDRMC Introduction The El Niño global climactic event significantly affected the 2015 meher/summer rains on the heels of failed belg/ spring rains in 2015, driving food insecurity, malnutrition and serious water shortages in many parts of the country. The Government and humanitarian partners issued a joint 2016 Humanitarian Requirements Document (HRD) in December 2015 requesting US$1.4 billion to assist 10.2 million people with food, health and nutrition, water, agriculture, shelter and non-food items, protection and emergency education responses. Following the delay and erratic performance of the belg/spring rains in 2016, a Prioritization Statement was issued in May 2016 with updated humanitarian requirements in nutrition (MAM), agriculture, shelter and non-food items and education.The Mid-Year Review of the HRD identified 9.7 million beneficiaries and updated the funding requirements to $1.2 billion. The 2016 HRD is 69 per cent funded, with contributions of $1.08 billion from international donors and the Government of Ethiopia (including carry-over resources from 2015). Under the leadership of the Government of Ethiopia delivery of life-saving and life- sustaining humanitarian assistance continues across the sectors. However, effective humanitarian response was challenged by shortage of resources, limited logistical capacities and associated delays, and weak real-time information management. This Periodic Monitoring Report (PMR) provides a summary of the cluster financial inputs against outputs and achievements against cluster objectives using secured funding since the launch of the 2016 HRD. -

Study on Prevalence and Identification of Ticks in Humbo District, Southern Nations, Nationalities, and People's Region (SNNPR), Ethiopia

Journal of Veterinary Medicine and Animal Health Vol. 5(3), pp. 73-80, March 2013 Available online at http://www.academicjournals.org/JVMAH DOI: 10.5897/JVMAH12.040 ©2013 Academic Journals Full Length Research Paper Study on prevalence and identification of ticks in Humbo district, Southern Nations, Nationalities, and People's Region (SNNPR), Ethiopia Pawlos Wasihun* and Derese Doda College of Veterinary Medicine, Haramaya University, Haramaya, Ethiopia, P. O. Box 138, Dire Dawa, Ethiopia. Accepted 15 February, 2013 The distribution and abundance of cattle tick species in Humbo woreda, Wolaita zone, was studied over a period of 6 months from November, 2011 to April, 2012. Adult ticks were collected from seven main body regions of 384 cattle which were under extensive management system. Out of the total of 384 cattle examined, 238 (61%) were found to be infested by one or more tick species. About 2,439 adult ticks were collected from the animal body parts and identified to genera and species level. Five tick species of three genera (Amblyomma, Boophilus and Rhipicephalus) were identified. The relative prevalence of each species was Boophilus decolaratus (30%), Rhipicephalus evertsi-evertsi (25%), Amblyomma varigatum (25%), A. cohaerence (11%), and A. lepidium (6%). The risk factors like sex and age of cattle did not show significant association with the infestation rate but there was association with both breeds and body conditions. The prevalence of tick infestation in medium body condition (78%), poor body condition (67%), and good body condition (57%) was found to be statistically significant (p < 0.05) among the three groups of body conditions. -

Archives on Veterinary Science and Technology

Archives on Veterinary Science and Technology Fassel N, Arch Pet Environ Biotechnol 2017: AVST-131. Research Article DOI:10.29011/AVST-131/100031 Prevalence of Bovine Trypanosomiasis in Wolaita Zone Kindo Di- daye District of Ethiopia Nigussu Fassel* Hawasssa University, School of Veterinary Medicine, Ethiopia *Corresponding author: Nigussu Fassel, Hawasssa university, School of veterinary medicine, Ethiopia. Tel: +251913304082; Email: [email protected] Citation: Fassel N (2017) Prevalence of Bovine Trypanosomiasis in Wolaita Zone Kindo Didaye District of Ethiopia. Arch Vet Sci Technol: AVST-131. DOI:10.29011/AVST-131/100031 Received Date: : 14 August, 2017; Accepted Date: 26 August, 2017; Published Date: 04 September, 2017 Abstract Cross sectional study was conducted in Kindo Didaye District of Wolayita administrative zone of southern region of Ethio- pia, from November 2014 to April 2015 to estimate the prevalence of bovine trypanosomiasis. In the parasitological survey, blood samples of 120 cattle were examined using a buffy coat technique and thin blood smear under Giemsa stain. The Packed Cell Volume (PCV) value of each animal was also measured using hematocrit reader. The overall prevalence of trypanosomiasis was found to be 5.9 %. The prevalence varied between different study areas; 5% in Halale, 8.3% in Shella, 5.4% in Zerada and 5.1% in Bosa-bortu areas. The most positive cases were due to Trypanosoma congolense(57.1%)followed byTrypanosoma vivax(28.6%) and mixed infection from Trypanosoma congolenseand Trypanosoma vivaxwas also recorded in (14.3%) of the tasted animals. The mean PCV value (%) of parasitaemic and aparasitaemic animals during the study period were 19.43% and 27.14% with a statistically significance (P<0.05) difference between the two groups. -

Human-Carnivore Conflict in Sodo Community Managed Conservation Forest, Wolaita Sodo Zuriya District, Southern Ethiopia

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by International Institute for Science, Technology and Education (IISTE): E-Journals Advances in Life Science and Technology www.iiste.org ISSN 2224-7181 (Paper) ISSN 2225-062X (Online) Vol.44, 2016 Conservation Challenge: Human-Carnivore Conflict in Sodo Community Managed Conservation Forest, Wolaita Sodo Zuriya District, Southern Ethiopia Yigrem Kebede 1* Wondimagegnehu Tekalign 1 Hailu Menale 2 1.Department of Biology, College of Natural and Computational Sciences, Wolaita Sodo University, P. O. Box 138, Wolaita Sodo, Ethiopia 2.Department of Natural Resource Management, College of Agriculture, Wolaita Sodo University, P. O. Box 138, Wolaita Sodo, Ethiopia Abstract Close proximity between humans and large predators results in high levels of conflict. The aim of this study was investigating the extent and factors leading to human carnivore conflict through key informant interview, focus group discussions, questionnaires and field observation in all villages around sodo community managed forest, Southern Ethiopia. Totally, 310 household samples were identified for questionnaire in eight purposefully selected villages. Livestock losses from 2005 to 2007 (n = 745) were reported to be mainly caused by spotted hyena Crocuta crocuta (174 animals), leopard (151 animals), baboon Papio anubis (79 animals), African wild dog canis aureus (42 animals) and caracal felis caracal (65 animals). These predators mainly predated sheep (34 %) and goats (20 %) and cattle (25%) and donkey (4 %). Spotted hyena being the main predators of sheep (25.69 %) and goat (14.62 %). Both anubis baboon and African wild dog were majorly depredate sheep (10.67 %). -

Addis Ababa University School of Graduate Studies Regional and Local Development Studies

ADDIS ABABA UNIVERSITY SCHOOL OF GRADUATE STUDIES REGIONAL AND LOCAL DEVELOPMENT STUDIES CHALLENGES AND COPING STRATEGIES FOR DROUGHT-INDUCED FOOD SHORTAGE : The Case of Humbo Worda, SNNPR Thesis submitted in partial fulfillment of the requirements for the Master of Art (Regional and Local Development Studies) By Elias Getahun Sankura Addis Ababa University, June 2006 ADDIS ABABA UNIVERSITY SCHOOL OF GRADUATE STUDIES REGIONAL AND LOCAL DEVELOPMENT STUDIES CHALLENGES AND COPING STRATEGIES FOR DROUGHT-INDUCED FOOD SHORTAGE The Case of Humbo Woreda of SNNPR By Elias Getahun Sankura Approved by the Examining Board Chairperson, Department Graduate Committee Advisor External Examiner Internal Examiner DECLARATION I, the undersigned, declare that this thesis is my original work and has not been presented for a degree in any other university, and all sources of material used for the thesis have been duly acknowledged. Name: Elias Gethaun Sankura Signature: Dr. Yohannes G. Michael (Advisor) Signature: Place and date of submission: Addis Ababa University, Ethiopia, June 2006 ACKNOWLEDGEMENT Above all, I would like to thank the almighty God for all the achievements which I have been able to attain in my entire life and for the successful completion of my two years postgraduate degree course in Regional and Local Development Studies. I would like to extend my deepest thanks to my beloved wife W/o Demeksi Buli for her heartfelt assistance in dealing with matters that concerned me and the DPPA for partial sponsorship. I would like to express my sincere gratitude to my advisor Yohannes G.Michael (PhD) whose invaluable guidance and encouragement steered me to translate and process vague ideas into tangible concepts. -

The Effect of Value Added Tax Administration on Revenue Performance: the Case of Gamo Gofa Zone, Southern, Ethiopia

THE EFFECT OF VALUE ADDED TAX ADMINISTRATION ON REVENUE PERFORMANCE: THE CASE OF GAMO GOFA ZONE, SOUTHERN, ETHIOPIA ARBAMINCH UNIVERSITY COLLEGE OF BUSINESS AND ECONOMICS DEPARTMENT OF ACCOUNTING AND FINANCE A THESIS SUBMITTED TO THE DEPARTMET OF ACCOUNTING AND FINANCE, SCHOOL OF POST GRADUATE STUDIES IN PARTIAL FULFILLMENT IN THE REQUIREMENTS FOR THE DEGREE OF MASTER OF SCIENCE IN ACCOUNTING AND FINANCE By AMARECH BEYENE BEZABIH ID NO RMA/003/07 PRINCIPAL ADVISOR: SHAIK ABDUL MUJEEB (PROFESSOR) CO-ADVISOR: MR NEGALIGN MAMO (MSc) JUNE, 2017 ARBAMINCH, ETHIOPIA 6 THE EFFECT OF VALUE ADDED TAX (VAT) ADMINISTRATION ON REVENUE PERFORMANCE: THE CASE OF GAMO GOFA ZONE, SOUTHERN, ETHIOIPA AMARECH BEYENE A THESIS SUBMITTED TO THE DEPARTMET OF ACCOUNTING AND FINANCE, SCHOOL OF POST GRADUATE STUDIES IN PARTIAL FULFILLMENT IN REQUIREMENTS FOR THE DEGREE OF MASTER OF SCIENCE IN ACCOUNTING AND FINANCE 7 DECLARATION I hereby declare that this MSc thesis is my original work and has not been presented for a degree in any other university, and all sources of material used for this thesis have been duly acknowledged. Amarech Beyene Signature ------------------------------------ Date--------------------------------------- 8 Examiners ‘Thesis Approval sheet School of Postgraduate Studies Arbaminch University We, the undersigned, member of the Board of Examiners of the final open defence by Amarech Beyene have read and evaluated her study entitled “The Effect of Value Added Tax (VAT) Administration on Revenue Performance: The Case of Gamo Gofa zone, Southern, Ethiopia” and examined the candidate’s oral presentation. This is, therefore, to certify that the study has been accepted in partial fulfilment of the requirements for the degree of Master of Accounting and Finance (MSc). -

After Action Review Qualitative Research on Yellow Fever Outbreak Coordination, Surveillance & Reponses in Wolaita Zone of SNNPR Region, Ethiopia

After Action Review Qualitative research on Yellow Fever outbreak Coordination, Surveillance & Reponses in Wolaita Zone of SNNPR Region, Ethiopia Yonas Assefa Tufa ( [email protected] ) Ethiopian Public Health Institute https://orcid.org/0000-0003-1650-9664 Yaregal Fufa Ethiopian Public Health Institute Diriba Gemechu Ethiopian Public Health Institute Melaku Abebe Ethiopian Public Health Institute Shambel Habebe Ethiopian Public Health Institute Niguse Yohannes Ethiopian Public Health Institute Adamu Tayachew Mekonen Ethiopian Public Health Institute Solomon Kinde Ethiopian Public Health Institute Desalegn Belay Ethiopian Public Health Institute Senait Alemayehu Ethiopian Public Health Institute Wadu Marshalo Anebo wolaita Zone health Administration Mohammed Nasir Ethiopian Public Health Institute Belete W/Mariam SNNPR Health Bureau Mesn Melese SNNPR Health Bureau Abiy Girmay World Health Organization Country Oce for Ethiopia Page 1/33 Tesfaye Tilaye World Health Organization Country Oce for Ethiopia Feyisa Regasa Ethiopian Public Health Institute Abduilhaz Assen Endris Ethiopian Public Health Institute Zewdu Assefa Ethiopian Public Health Institute Zerihun Doda Ethiopian Civil Service University Research article Keywords: After Action Review, Outbreak Response, Yellow Fever, Surveillance, Coordination Posted Date: January 30th, 2020 DOI: https://doi.org/10.21203/rs.2.22265/v1 License: This work is licensed under a Creative Commons Attribution 4.0 International License. Read Full License Page 2/33 Abstract Background: Coordinating outbreak investigations requires effective interagency communication. Important tasks include making the initial notications, establishing roles and responsibilities for each jurisdiction, providing updates on the progress of the investigations, revising priorities for the investigation, and establishing the next steps. The major goal of surveillance activities is to identify and eliminate preventable causes of morbidity and mortality.