DAILY MARKET INSIGHTS 28-Oct-19

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GSK Q1 Report 2021

Calibrating Precision GSK Pakistan Limited FirstAnnual Quarter Report Report 20212020 CORPORATE INFORMATION As at March 31, 2021 Board of Directors Management Committee Disclosure Committee Mr. Dmytro Oliinyk Ms. Erum Shakir Rahim Ms. Erum Shakir Rahim Chairman Chief Executive Officer Chairperson Ms. Erum Shakir Rahim Mr. Abdul Samad* Mr. Abdul Samad* Chief Executive Officer Chief Financial Officer Member Mr. Abdul Samad* Mehar-e-daraksha Ameer Mr. Dmytro Oliinyk Chief Financial Officer Legal Director Member Ms. Maheen Rahman Dr. Tariq Farooq Mehar-e-daraksha Ameer Independent Director Business Unit Director BU 1 Member Mr. Muneer Kamal Syed Nasir Farid** Company Secretary Independent Director Business Unit Director BU 2 Ms. Mehar-e-daraksha Ameer Mr. Mehmood Mandviwalla Dr. Naved Masoom Ali Non-Executive Director Business Unit Director BU 3 Chief Financial Officer Mr. Mark Dawson Khurram Amjad Mr. Abdul Samad* Non-Executive Director Director Commercial Chief Internal Auditor Excellence & CTC Audit Committee Syed Ahsan Ejaz Dr. Gohar Nayab Khan Mr. Muneer Kamal Regulatory Affairs Cluster Bankers Chairman Head - Pakistan & Iran Citibank NA Mr. Dmytro Oliinyk Mr. Abdul Haseeb Pirzada Deutsche Bank A.G. Member Director Corporate Affairs and Habib Bank Limited Administration Meezan Bank Limited Mr. Mark Dawson Standard Chartered Bank (Pakistan) Ltd Member Mr. Zain Anjum Country Compliance Officer Auditors Mr. Mehmood Mandviwalla Member Dr. Yousuf Hasan Khan Yousuf Adil & Co. Chartered Director Medical Accountants Ms. Maheen Rahman Member Syed Nabigh Raza Alam Legal Advisors Tech Head Hashmi & Hashmi Human Resource Mr. Obaid Siddiqui Faisal, Mahmood Ghani and Co & Remuneration Head of Procurement Legal Consultancy Inc. Committee Mr. Farqaleet Iqbal Registered Office Mr. -

GSK Annual Report 2016

Annual Report Transcending boundaries is in our DNA. This is evident in how we continue to discover, develop and bring to market, new medicines and vaccines to address the unmet needs of healthcare providers and their patients. As a responsible healthcare company, we drive change by adopting new and innovative methodologies, aligned with our values, so that we can better serve the evolving needs of our society and enable more patients to benefit from our medicines. We firmly believe that keeping the patient at the heart of everything we do is integral to our success; inspiring us to continue on this journey and transcend boundaries. GSK Contents 002 026 062 Our Vision, Mission and Core Vaccines Key Operating and Financial Data Values 028 065 004 Primary Care Direct Cash Flow Statement Corporate Information 030 066 006 Specialty Business Unit Horizontal Analysis Financial Highlights 031 067 007 Medical Affairs Vertical Analysis DUPONT Analysis 032 070 008 Awards 2016 Statement of Compliance with the The GSK Story 034 Code of Corporate Governance 010 Global Manufacturing & Supply 072 GSK Expectations (GMS) Review Report to the Members 011 035 073 Strategic Priorities Warehousing and Auditors Report to the Members 012 Distribution (W&D) 074 Company Profile & 036 Balance Sheet Group Structure Environment Health & Safety (EHS) 075 014 Profit and Loss Account Our Behaviour 038 Quality Management System (QMS) 076 015 Cash Flow Statement Organogram 040 Corporate Social Responsibility 077 016 (CSR) Statement of Changes in Equity Geographical Presence -

OICCI CSR Report 2018-2019

COMBINING THE POWER OF SOCIAL RESPONSIBILITY Corporate Social Responsibility Report 2018-19 03 Foreword CONTENTS 05 OICCI Members’ CSR Impact 06 CSR Footprint – Members’ Participation In Focus Areas 07 CSR Footprint – Geographic Spread of CSR Activities 90 Snapshot of Participants’ CSR Activities 96 Social Sector Partners DISCLAIMER The report has been prepared by the Overseas Investors Chamber of Commerce and Industry (OICCI) based on data/information provided by participating companies. The OICCI is not liable for incorrect representation, if any, relating to a company or its activities. 02 | OICCI FOREWORD The landscape of CSR initiatives and activities is actively supported health and nutrition related initiatives We are pleased to present improving rapidly as the corporate sector in Pakistan has through donations to reputable hospitals, medical care been widely adopting the CSR and Sustainability camps and health awareness campaigns. Infrastructure OICCI members practices and making them permanent feature of the Development was also one of the growing areas of consolidated 2018-19 businesses. The social areas such as education, human interest for 65% of the members who assisted communi- capital development, healthcare, nutrition, environment ties in the vicinity of their respective major operating Corporate Social and infrastructure development are the main focus of the facilities. businesses to reach out to the underprivileged sections of Responsibility (CSR) the population. The readers will be pleased to note that 79% of our member companies also promoted the “OICCI Women” Report, highlighting the We, at OICCI, are privileged to have about 200 leading initiative towards increasing level of Women Empower- foreign investors among our membership who besides ment/Gender Equality. -

UPL Annual Report 2019

Unilever Pakistan Foods Limited Annual Report 2019 Contents Vision & Core Values 02 Company Information 03 Directors’ Profile 04 Chairman's Review 06 Directors’ Report 08 Board Meetings Attendance 14 Board Committee Meetings Held During the Year 14 Performance Indicators for 6 years 16 Statement of Financial Postion - Analysis for 6 years 19 Profit or Loss Account and other Comprehensive 21 Income - Analysis for 6 years Statement of Wealth Generated and Distributed 23 Pattern of Shareholding 24 Statement of Compliance with 26 the Code of Corporate Governance Independent Auditor's Review Report 27 Financial Statements 29 Notice of Annual General Meeting 79 Form of Proxy 85 Dividend Mandate Form 87 Vision Unilever Pakistan Foods Limited - Annual Report 2019 Our vision is to grow our business, while decoupling our environmental footprint from our growth and increasing our positive social impact. Core Values Impeccable Wowing our Integrity Consumers & We are honest, transparent Customers and ethical in our dealings We win the hearts and minds of at all times. our consumers and customers. Living an Demonstrating a Enterprise Culture Passion for Winning We believe in trust, and We deliver what we promise. outstanding teamwork. We value a creative & fun environment. Bringing out the Making a Best in All of Us Better World We are empowered leaders, who We care about and are inspired by new challenges actively contribute to and have a bias for action. the community in which we live. 02 Company Information Unilever Pakistan Foods Limited - Annual Report 2019 Board of Directors Mr. Kamran Y. Mirza Independent Director & Chairman of the Board Mr. -

Glaxosmithkline Pakistan Limited Half Yearly Report 2018 Corporate Information

GlaxoSmithKline Pakistan Limited Half Yearly Report 2018 Corporate Information Board of Directors Mr. Muhammad Imran Amin Mr. Andrew Aristidou Chairman Country Compliance Officer Mr. M. Azizul Huq Chief Executive Officer Dr. Yousuf Khan* Mr. Abdul Samad Chief Financial Officer Director Medical Mr. Husain Lawai Independent Director Mr. Mehmood Mandviwalla Non-Executive Director Mr. Sohail Matin Non-Executive Director Company Secretary Mr. Mark Dawson Non-Executive Director Syed Azeem Abbas Naqvi Audit Committee Chief Financial Officer Mr. Husain Lawai Chairman Mr. Abdul Samad Mr. Mehmood Mandviwalla Member Mr. Andrew Aristidou Member Mr. Mark Dawson Member Chief Internal Auditor Syed Ahsan Ejaz Human Resource & Remuneration Committee Mr. Mehmood Mandviwalla Chairman Bankers Mr. Husain Lawai Member Citibank NA Mr. M. Azizul Huq Member Deutsche Bank A.G. Mr. Andrew Aristidou Member Habib Bank Limited Meezan Bank Limited Standard Chartered Bank (Pakistan) Ltd Management Committee Mr. M. Azizul Huq Chief Executive Officer Auditors Deloitte Yousuf Adil & Co. Chartered Accountants Mr. Abdul Samad Chief Financial Officer Legal Advisors Syed Azeem Abbas Naqvi Cluster Legal Director - Pakistan, Iran & Bangladesh Mandviwalla & Zafar Hashmi & Hashmi Dr. Naved Masoom Ali Faisal, Mahmood Ghani and Co Business Unit Director -Primary Care Legal Consultancy Inc. Dr. Tariq Farooq Business Unit Director - Speciality Registered Office Khurram Amjad 35 - Dockyard Road, West Wharf, Director Commercial Excellence Karachi - 74000. Dr. Gohar Nayab Khan Tel: 92-21-111-475-725 Director Regulatory Affairs (111-GSK-PAK) Fax: 92-21-32314898, 32311122 Mr. Abdul Haseeb Pirzada Website: www.gsk.com.pk Head of Corporate Affairs and Administration Mr. Ahmad Ali Zia HR Cluster Head - Pakistan and Iran *Mr. -

Annual Report 2008 Find out More About GSK Online…

Do more, feel better, live longer Grow Deliver Simplify Annual Report 2008 Find out more about GSK online… www.gsk.com Website GlaxoSmithKline’s website www.gsk.com gives additional information on the Group. Information made available on the website does not constitute part of this Annual Report. Notice regarding limitations on Director liability under English Law Under the UK Companies Act 2006, a safe harbour limits the liability of Directors in respect of statements in and omissions from the Report of the Directors contained on pages 12 to 98. Under English law the Directors would be liable to the company (but not to any third party) if the Report of the Directors contains errors as a result of recklessness or knowing misstatement or dishonest concealment of a material fact, but would not otherwise be liable. Report of the Directors Pages 12 to 98 inclusive consist of a Report of the Directors that has been drawn up and presented in accordance with and in reliance upon English company law and the liabilities of the Directors in connection with that report shall be subject to the limitations and restrictions provided by such law. Cautionary statement regarding forward-looking statements The Group’s reports filed with or furnished to the US Securities and Exchange Commission (SEC), including this document and written information released, or oral statements made, to the public in the future by or on behalf of the Group, may contain forward-looking statements. Forward-looking statements give the Group’s current expectations or forecasts of future events. A shareholder can identify these statements by the fact that they do not relate strictly to historical or current facts. -

Kifayah Market Insights 28 April 2021

DAILY MARKET INSIGHTS 28-Apr-2021 Change Index points KMI 30 INDEX PERFORMANCE OVERVIEW PKR % Change Closing KMI 30 Index (437) 72,955 Contributing shares Closing Price - Rs. Oil & Gas Development Company Limited (2.42) (2.56) (135.40) 92.29 Pakistan Petroleum Limited (1.56) (1.84) (90.14) 83.19 Lucky Cement Limited (6.05) (0.70) (67.87) 854.12 KMI 30 INDEX VOLUMES Today 42 5 days average 58 59 14 days average Millions Source: https://formerdps.psx.com.pk/ & Calculations of Kifayah Investment Management Limited Top most buyer Top most seller PORTFOLIO INVESTMENT SUMMARY Other Organization Foreign Corporates Amount (Net) 566,619,364 (592,631,016) Buying / Selling sector wise composition Commercial Banks 85.94% 61.50% All other Sectors 5.20% 0.63% Technology and Communication 3.03% 8.32% Cement 0.13% 13.06% Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily FOREIGN PORTFOLIO INVESTMENT TREND Today (242) (163) 5 days average 20 14 days average Millions Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily & Calculations of Kifayah Investment Management Limited MATERIAL INFORMATION Disclosure of Interest by a Substantial Shareholder, bought 3,950 shares at the average Packages Limited price of Rs. 473.19 each on 27 April 2021. The Company is pleased to announce the facility registration of its two new facilities from U.S. Food & Drug Administration duly verified by Registrar Corp, Virginia, USA. The Searle Company Limited This registration will enable Searle Company to export its consumer products, Dietary and Nutritional Supplements to the USA Makret. -

Baby Autonomies

Autonomy Baby Country Parent Country Owned Petrobras Argentina Argentina Petrobras Brazil 67% Ypf Argentina Repsol Ypf Spain 58% British American Tobacco Bangladesh Bangladesh BAT UK 65% Lafarge Surma Cement Bangladesh Lafarge France 29% Barclays Bank of Botswana Botswana Barclays UK 68% Ambev Brazil AB-InBev Belgium 62% Aes Tiete Brazil Aes Corp USA 32% Tractebel Energia Brazil Gdf Suez France 69% Cia De Transmissao De Ene Brazil Interconexion Electrica Colombia 54% Tim Participacoes Brazil Telecom Italia Italy 77% Vivo Participacoes Brazil Telefonica Spain 35% Telecomunicacoes De Sao Brazil Telefonica Spain 37% British American Tobacco Chile Chile BAT UK 96% Embotelladoras Coca-Cola Polar Chile Coca-Cola USA 100% CCU Chile Heineken Netherlands 66% Telefonica Chile Chile Telefonica Spain 98% Aes Gener Chile Aes Corp USA 54% Empresa Nacional De Electric Chile Enel Italy 60% Exito Colombia Casino France 54% SOLIBRA Cote d'Ivoire Castel France 72% Nestlé Cote d'Ivoire Cote d'Ivoire Nestlé Switzerland 81% Unilever Cote d'Ivoire Cote d'Ivoire Unilever UK 90% Komercni Banka Czech Societe Generale France 60% Telefónica Czech Republic Czech Telefonica Spain 69% GlaxoSmithKline (Egypt) Egypt Glaxosmithkline UK 91% Guinness Ghana Ghana Diageo UK 51% Unilever Ghana Ghana Unilever UK 66% Coca-Cola Hellenic Bottling Greece Coca-Cola USA AEON Credit Service Asia Hong Kong Aeon Co Japan Magyar Telekom Telecommunica Hungary Deutsche Telekom Germany 59% Colgate Palmolive India India Colgate Palmolive USA 51% Goodyear India India Goodyear Tire & Rubber -

Value-At-Risk and Expected Stock Returns: Evidence from Pakistan

The Lahore Journal of Economics 19 : 2 (Winter 2014): pp. 71–100 Value-at-Risk and Expected Stock Returns: Evidence from Pakistan Javed Iqbal* and Sara Azher** Abstract This study investigates whether exposure to downside risk, as measured by value-at-risk (VaR), explains expected returns in an emerging market, i.e., Pakistan. We find that portfolios with a higher VaR are associated with higher average returns. In order to explore the empirical performance of VaR at the portfolio level, we use a time series approach based on 25 size and book-to-market portfolios. Based on monthly portfolio data for October 1992 to June 2008, the results show that VaR has greater explanatory power than the market, size, and book-to-market factors. Keywords: Value-at-risk, emerging market, Fama-French factors. JEL classification: C32, G32. 1. Introduction The most important implications of the capital asset pricing model (CAPM) (see Sharpe, 1964; Lintner, 1969; Black, Jensen, & Scholes, 1972) are that (i) the expected return on a risky asset is linearly and positively related to its systematic risk, and (ii) only the asset’s beta captures cross- sectional variations in expected stock returns; other variables have no explanatory power. However, the empirical evidence of the last few decades suggests that many alternative risk and nonrisk variables are able to explain average stock returns. These include size (Banz, 1981), the ratio of book equity to market equity (Fama & French, 1992, 1993, 1995, 1996; Stattman, 1980; Rosenberg, Reid, & Lanstein, 1985; Chan, Hamao, & Lakonishok, 1991), the price/earnings ratio (Basu, 1977), leverage (Bhandari, 1988), liquidity (Pastor & Stambaugh, 2003), and value-at-risk (VaR) (Bali & Cakici, 2004; Chen, Chen, & Chen, 2010). -

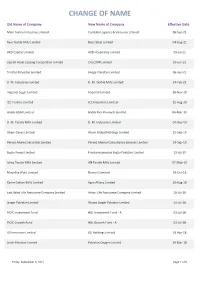

Change of Name

CHANGE OF NAME Old Name of Company New Name of Company Effective Date Mian Textile Industries Limited Cordoba Logistics & Ventures Limited 06-Sep-21 Ravi Textile Mills Limited Beco Steel Limited 04-Aug-21 AKD Capital Limited AKD Hospitality Limited 09-Jul-21 Capital Asset Leasing Corporation Limited CALCORP Limited 29-Jun-21 Tri-Star Polyester Limited Image Pakistan Limited 06-Apr-21 D. M. Industries Limited D. M. Textile Mills Limited 24-Feb-21 Imperial Sugar Limited Imperial Limited 18-Nov-20 ICC Textiles Limited ICC Industries Limited 25-Aug-20 Habib-ADM Limited Habib Rice Products Limited 06-Mar-20 D. M. Textile Mills Limited D. M. Industries Limited 04-Dec-19 Ghani Gases Limited Ghani Global Holdings Limited 25-Sep-19 Pervez Ahmed Securities Limited Pervez Ahmed Consultancy Services Limited 19-Sep-19 Engro Foods Limited Frieslandcampina Engro Pakistan Limited 11-Jul-19 Ishaq Textile Mills Limited AN Textile Mills Limited 07-May-19 Moonlite (Pak) Limited Bunny's Limited 03-Oct-18 Karim Cotton Mills Limited Agro Allianz Limited 10-Aug-18 East West Life Assurance Company Limited Askari Life Assurance Company Limited 16-Jul-18 Singer Pakistan Limited Waves Singer Pakistan Limited 11-Jul-18 PICIC Investment Fund HBL Investment Fund - A 03-Jul-18 PICIC Growth Fund HBL Growth Fund - A 03-Jul-18 IGI Insurance Limited IGI Holdings Limited 19-Apr-18 Linde Pakistan Limited Pakistan Oxygen Limited 19-Mar-18 Friday, September 3, 2021 Page 1 of 9 Old Name of Company New Name of Company Effective Date Olympia Spinning & Weaving Mills Limited Olympia Mills Limited 10-Jan-18 TPL Trakker Limited TPL Corp Limited 04-Jan-18 TPL Direct Insurance Limited TPL Insurance Limited 04-Jan-18 Taha Spinning Mills Limited Unity Foods Limited 05-Oct-17 S.G. -

Teaming up for Success

. Real business . Real people . Real experience Teaming Up for Success Reward Advisory Services AFGHANISTAN: Remuneration Benchmarking Survey 2007 February 2007 A. F. Ferguson & Co. , A member firm of Chartered Accountants 2 AFGHANISTAN Remuneration Benchmarking Survey 2007 PwC would like to invite your organization to participate in the Remuneration Benchmarking Survey 2007 which will be conducted once every year. This survey will cover all multinational organizations and local companies in AFGHANISTAN, regardless of any particular industry/ sector. This effort is being formulated so as to bring organizations at par with other players in market-resulting by bringing sanity to management and HRM practice in Afghanistan especially during reconstruction era. The survey will comprise of two parts: • Part A – remuneration to personnel in managerial and executive cadres (excluding CEOs/ Country Heads) • Part B – remuneration to CEOs/ Country Heads (international and local nationals separately) • Part C – remuneration to non-management cadre Each report is prepared separately, and participants may choose to take part in either one or all three sections of the survey. Job benchmarking and data collection from the participating organizations will be done through personal visits by our consultants. A structured questionnaire will be used to record detailed information on salaries, allowances, all cash and non-cash benefits and other compensation policies. The collected information will be treated in strict confidence and the findings of the survey will be documented in the form of a report, which will be coded. Each participating organization will be provided a code number with which they can identify their own data and the report will only be available to the participant pool. -

UPFL Annual Report 2020

Unilever Pakistan Foods Limited Annual Report 2020 Contents Vision & Core Values 02 Company Information 03 Directors’ Profile 04 Chairman's Review 06 Directors’ Report 08 Board Meetings Attendance 15 Board Committee Meetings Held During the Year 15 Performance Indicators for 6 years 17 Statement of Financial Position - Analysis for 6 years 20 Profit or Loss Account and other Comprehensive 22 Income - Analysis for 6 years Statement of Wealth Generated and Distributed 24 Pattern of Shareholding 25 Statement of Compliance with 27 the Code of Corporate Governance Independent Auditor's Review Report 28 Financial Statements 29 Notice of Annual General Meeting 80 Form of Proxy 86 Dividend Mandate Form 88 Vision Unilever Pakistan Foods Limited - Annual Report 2020 Our vision is to grow our business, while decoupling our environmental footprint from our growth and increasing our positive social impact. Core Values Impeccable Wowing our Integrity Consumers & We are honest, transparent Customers and ethical in our dealings We win the hearts and minds of at all times. our consumers and customers. Living an Demonstrating a Enterprise Culture Passion for Winning We believe in trust, and We deliver what we promise. outstanding teamwork. We value a creative & fun environment. Bringing out the Making a Best in All of Us Better World We are empowered leaders, who We care about and are inspired by new challenges actively contribute to and have a bias for action. the community in which we live. 02 Company Information Unilever Pakistan Foods Limited - Annual Report 2020 Board of Directors Mr. Kamran Y. Mirza Independent Director & Chairman of the Board Mr.