Annual Report 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View of These Submission He Has Prayed for Allowing the Listed Application

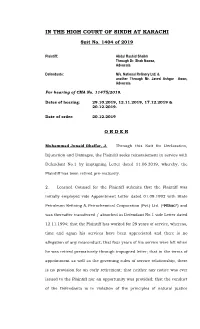

IN THE HIGH COURT OF SINDH AT KARACHI Suit No. 1404 of 2019 Plaintiff: Abdul Rashid Shaikh Through Dr. Shah Nawaz, Advocate. Defendants: M/s. National Refinery Ltd. & another Through Mr. Javed Ashgar Awan, Advocate. For hearing of CMA No. 11475/2019. Dates of hearing: 29.10.2019, 12.11.2019, 17.12.2019 & 20.12.2019. Date of order: 20.12.2019 O R D E R Muhammad Junaid Ghaffar, J. Through this Suit for Declaration, Injunction and Damages, the Plaintiff seeks reinstatement in service with Defendant No.1 by impugning Letter dated 11.06.2019, whereby, the Plaintiff has been retired pre-maturely. 2. Learned Counsel for the Plaintiff submits that the Plaintiff was initially employed vide Appointment Letter dated 01.09.1992 with State Petroleum Refining & Petrochemical Corporation (Pvt.) Ltd. (“PERAC”) and was thereafter transferred / absorbed in Defendant No.1 vide Letter dated 12.11.1994; that the Plaintiff has worked for 29 years of service, whereas, time and again his services have been appreciated and there is no allegation of any misconduct; that four years of his service were left when he was retired prematurely through impugned letter; that in the terms of appointment as well as the governing rules of service relationship, there is no provision for an early retirement; that neither any notice was ever issued to the Plaintiff nor an opportunity was provided; that the conduct of the Defendants is in violation of the principles of natural justice 2 including violation of Article 10-A of the Constitution; that the Defendants ought to have exercised discretion within certain parameters, and procedure should have been followed like issuance of a Show Cause Notice and conducting some inquiry; that it is a matter of exploitation employed by the Defendants to the very detriment of the Plaintiff and in view of these submission he has prayed for allowing the listed application. -

Annual Report 2011

SoneriBank Soneri B8nk Limited Regla11ered ortlce: Rupall House 241-242, - Upper Mall Scheme, Anand Road, Lahore - 54000, Pakistan Tel: (042) 35713101-04 Head Otnc:e: 90·8-C/11, Uberty Market, Gulberg Ill, LahcnJ • 54000, Pakistan Tal: (042) 35772362-65 Central Office: 51h FlOOr, AJ.Rahim Tower, 1.1. Chundrigar Road, Karachi ·74000, Pakistan J Tal: (021) 32439562-67 Webde: www.aonertbank.com 2417 Call C.ntre: 0800-00500 UAN: 111-80NERI Soneri Bank Limited nnnUHL REPORT 2U II An experience Beyond Banking Soneri Bank Limited R~~URl ~frO~T 2011 OUR MISSION To develop Soneri Bank into an aggressive and dynamic financial institution having the capabilities to provide personalized service to customers with cutting edge technology and a wide range of products, and during the process ensure maximum return on assets with the ultimate goal of serving the economy and the society. Soneri Bank Limited R~~URl ~frO~T 2011 Products and Services 07 Corporate Information 13 Board Committees 14 Management Committees 15 Key Performance Indicators 17 Six Years' Financial Summary 18 Six Years' Growth Summary 20 Six Years' Vertical Analysis 22 Six Years' Horizontal Analysis 24 Directors' Report to Shareholders 27 Statement of Value Addition 33 Statement of Internal Controls- by President 34 Statement of Internal Controls- by Chairman 35 Statement of Compliance with Best Practices of Code of Corporate Governance 36 Auditors' Review Report to The Members on Statement of Compliance with Best Practices of Code of Corporate Governance 38 Auditors' Report to The Members 39 Statement of Financial Position 40 Profit and Loss Account 41 Statement of Comprehensive Income 42 Cash Flow Statement 43 Statement of Changes in Equity 44 Notes to the Financial Statements 45 Shariah Advisor's Report 99 Notice of Annual General Meeting 101 Pattern of Shareholding 103 List of Branches 106 List of Foreign Correspondents 110 Soneri Bank Limited nnn ~Al ~Ero~r 2011 nnn~nl ~Ero~r 2011 As of 31 December 2011 Soneri Bank Limited was incorporated on September 28, 1991. -

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks Public Sector Banks Nationalized Banks 1. First Women Bank Limited 2. National Bank of Pakistan Specialized Banks 1. Industrial Development Bank of Pakistan (IDBP) 2. Punjab Provincial Co-operative Bank Limited (PPCB) 3. Zarai Traqiati Bank Limited 4. SME Bank Ltd. Provincial Banks 1. The Bank of Khyber 2. The Bank of Punjab Private Domestic Banks Privatized Bank 1. Allied Bank of Pakistan Limited 2. Muslim Commercial Bank Limited 3. United Bank Limited 4. Habib Bank Ltd. Private Banks 1. Askari Commercial Bank Limited 2. Bank Al-Falah Ltd. 3. Bank Al-Habib Ltd. 4. Bolan Bank Ltd. 5. Faysal Bank Ltd. 6. KASB Bank Limited 7. Meezan Bank Ltd. 8. Metropolitan Bank Ltd 9. Prime Commercial Bank Ltd. 10. PICIC Commercial Bank Ltd. 11. Saudi-Pak Commercial Bank Limited 12. Soneri Bank Ltd. 13. Union Bank Ltd. Contd. 139 12.1 Scheduled Banks Operating in Pakistan Private Banks 14. Crescent Commercial Bank Ltd. 15. Dawood bank Ltd. 16. NDLC - IFIC Bank Ltd. Foreign Banks 1. ABN AMRO Bank NV 2. Al-Baraka Islamic Bank BSC 3. American Express Bank Ltd. 4. Citi Bank NA 5. Deutsche Bank AE 6. Habib Bank AG Zurich 7. Oman International Bank SAOG 8. Rupali Bank Ltd 9. Standard Chartered Bank Ltd. 10. The Bank of Tokyo-Mitsubishi Ltd. 11. The Hong Kong & Shanghai Banking Corporation Ltd. Source: SBP Note: Banks operating as on 30th June, 2004 140 12.2 State Bank of Pakistan - Assets of the Issue Department (Million Rupees) Last Day of June Particulars 2003 2004 2005 Total Assets 522,891.0 611,903.7 705,865.7 1. -

Bank-IRC-Activity.Pdf

DOMESTIC MARKETS MONETARY MANAGEMENT DEPARTMENT STATE BANK OF PAKISTAN Quarterly Bank-wise Access to SBP IRC Facilities FY 2015-16 Q1-FY16 Q2-FY16 Q3-FY16 Q4-FY16 No. Name of Institutions Visits to SBP IRC Facilities Visits to SBP IRC Facilities Visits to SBP IRC Facilities Visits to SBP IRC Facilities 1 National Bank of Pakistan 7 6 - - 2 MCB Bank 6 3 - - 3 Bank of Punjab 7 1 - - 4 Faysal Bank 3 5 - - 5 United Bank Limited 3 4 - - 6 Askari Commercial Bank 4 2 - - 7 Pak China Investment 4 2 - - 8 Bank Al-Falah 3 2 - - 9 Summit Bank 3 2 - - 10 Pak Libya Holding Co 3 2 - - 11 Pak Brunei Investment 3 2 - - 12 Allied Bank Limited 2 3 - - 13 Bank of Khyber 3 1 - - 14 Silk Bank 3 1 - - 15 JS BANK 1 3 - - 16 Sindh Bank 3 0 - - 17 Citibank 2 1 - - 18 Soneri Bank 2 1 - - 19 Standard Chartered 1 2 - - 20 Bank Al-Habib 2 0 - - 21 Habib Metropolitan Bank 2 0 - - 22 Bank of Tokyo 1 0 - - 23 ICBC 1 0 - - 24 NIB Bank 1 0 - - 25 Pak Oman Investment Co 1 0 - - 26 Saudi Pak Investment 1 0 - - 27 First Women Bank 0 1 28 Habib Bank Limited 0 1 29 Samba Bank 0 1 Cumulative Visits to SBP IRC Facilities 72 46 - - Page 1 of 3 DOMESTIC MARKETS MONETARY MANAGEMENT DEPARTMENT STATE BANK OF PAKISTAN Bank-wise Access to Overnight Repo/Reverse Repo Facilities During Q2- FY 2015-16 Reverse Repo Facility Repo Facility Totat Number of Visits No. -

List of Acronyms

List of Acronyms A ABL Allied Bank Limited AC Air Conditioner ACP Annual Credit Plan ACAC Agriculture Credit Advisory Committee ACD Agriculture Credit Department ADs Authorized Dealers ADB Asian Development Bank ADF Asian Development Fund ADP Annual Development Plan AFS Available For Sale AIDS Acquired Immune Deficiency Syndrome APCMA All Pakistan Cement Manufacturers Association APL Attock Petroleum Limited ARPU Average Revenue per User ASEAN Association of South East Asian Nations B BAFL Bank AlFalah Limited BHU Basic Health Unit BISP Benazir Income Support Programme BMR Balancing Modernization and Replacing BOC Bank of China BOP Balance of Payment BP British Petroleum BPO Business Process Outsourcing BPRD Banking Policy Regulation Department BPS Basis Points BSC Bahbood Saving certificates, Benazir Smart Cards BSD Banking Surveillance Department BSE Bombay Stock Exchange Bt Bacillus thuringiensis C CAD Current Account Deficit CAB Current Account Balance CAGR Compound Annual Growth Rate CAR Capital Adequacy Ratio CBR Central Board of Revenue, Crude Birth Rate CBD Conventions on Biodiversity CBU Completely Built Unit CCC Climate Change Convention CDA Capital Development Authority CDR Crude Death Rate CDC Central Depository Company CDNS Central Directorate of National Saving CDs Certificate of Deposits CDS Credit Default Swap CDWA Clean drinking Water for All CDWI Clean Drinking Water Initiative CFC Common Facilities Centers CFS Continuous Funding System CFSMK-II Continuous Funding System Mark II CIA Central intelligence Agency CIB Credit -

Dispossession and Ethnic Identity in Expanding State Space of Chittagong Hill Tracts, Bangladesh

Dispossession and Ethnic Identity in Expanding State Space of Chittagong Hill Tracts, Bangladesh By Mohammad Tareq Hasan A thesis submitted to the Department of Social Anthropology, University of Bergen for the partial fulfillment of the requirements for the degree of Master of Philosophy in Anthropology of Development Spring 2014 Dispossession and Ethnic Identity in Expanding State Space of Chittagong Hill Tracts, Bangladesh ACKNOWLEDGMENTS I acknowledge the sincere contribution of my supervisor Dr. Anette Fagertun, Department of Social Anthropology, University of Bergen, Norway, for her enthusiasm on this issue and constant supports. I am also very much grateful to the Khyang people who have given their valuable opinion to prepare this thesis. I am thankful to my family and every person who consciously or unconsciously has contributed to the finalization of this project. I express sincere gratitude towards the Department of Social Anthropology, University of Bergen, Norway for this wonderful opportunity to study anthropology. It is mentionable that the project has been funded by Norwegian State Educational Loan Fund and The Meltzer Research Fund. i Dispossession and Ethnic Identity in Expanding State Space of Chittagong Hill Tracts, Bangladesh ABBREVIATIONS ADB Asian Development Bank ADAB Australian Development Assistance Bureau BDT Bangladeshi Taka BFD Bangladesh Forest Department CFUG Community Forest User Group CHC Christian Hospital Chandraghona CHT Chittagong Hill Tracts CHTDB Chittagong Hill Tracts Development Board CHTR Chittagong -

Better STRONGER Together Better STRONGER Together

ANNUAL REPORT 2016 Better STRONGER Together Better STRONGER Together TABLE of contents 02 Corporate Information 03 Vision, Mission Statement 05 Core Values 06 Management 10 Credit Rating 11 Six Years at a Glance 14 Corporate Social Responsibility (CSR) 18 President’s Message 22 Economic Review 24 Directors’ Report 45 Statement of Compliance with the Code of Corporate Governance 48 Auditors’ Review Report to the members on Code of Corporate Governance 49 Report of Shariah Board 54 Statement of Internal Controls 55 Notice of Annual General Meeting 59 Unsolidated Financial Statements of The Bank of Punjab 155 03Consolidated Financial Statements of The Bank of Punjab and its Subsidiary Punjab Modaraba Services (Pvt.) Limited 250 Pattern of Shareholding 256 Foreign Correspondents Form of Proxy ANNUAL REPORT 2016 01 CORPORATE information Board Of Directors Dr. Pervez Tahir Chairman Mr. Naeemuddin Khan President / CEO Mr. Mohammad Jehanzeb Khan Director Mr. Hamed Yaqoob Sheikh Director Dr. Umar Saif Director Syed Maratib Ali Director Dr. Muhammad Amjad Saqib Director Mr. Mohammed Afzaal Bhatti Director Khawaja Farooq Saeed Director Mr. Saeed Anwar Director Mr. Omar Saeed Director Mr. Raza Saeed Secretary to the Board Central Audit Committee (CAC) Khawaja Farooq Saeed Chairman Mr. Mohammed Afzaal Bhatti Member Mr. Saeed Anwar Member Mr. Omar Saeed Member Board Risk Management Committee (BRMC) Syed Maratib Ali Chairman Mr. Saeed Anwar Member Mr. Omar Saeed Member Human Resource & Remuneration Committee (HR&RC) Mr. Mohammad Jehanzeb Khan Chairman Syed Maratib Ali Member Mr. Mohammed Afzaal Bhatti Member Mr. Naeemuddin Khan Ex-oficio Member Auditors Deloitte Yousuf Adil Chartered Accountants Registered Ofce BOP Tower, 10-B, Block-E-II, Main Boulevard, Gulberg-III, Lahore. -

(Winner)MCB Bank Limited Best Bank of the Year 2017 – Mid Size Banks

Banking: Best Bank of the year 2017 – Large Size Banks (Winner)MCB Bank Limited Best Bank of the year 2017 – Mid Size Banks (Winner) Bank Al Habib Limited Best Bank of the year 2017 – Small Size Banks Industrial and Commercial Bank of China (Winner) Limited Best Islamic Window of the year 2017 (Winner) Habib Bank Limited Best Islamic Bank of the year 2017 (Winner) Meezan Bank Limited Corporate Finance: Transaction of the year 2017 (Winner) Habib Bank Limited for Dasu Hydropower Project Best Corporate Finance House of the year (Fixed Income) 2017 United Bank Limited (Winner) Best Corporate Finance House of the year (Fixed Income) 2017Habib Bank Limited (Runner-up) Best Corporate Finance House of the year (Equity & Advisory) - Banks Bank Alfalah Limited 2017 (Winner) Best Corporate Finance House of the year (Equity & Advisory) - Banks United Bank Limited 2017 (Runner-up) Best Corporate Finance House of the year (Equity & Advisory) – Arif Habib Limited Security Firms 2017 (Winner) Best Corporate Finance House of the year (Equity & Advisory) – AKD Securities Limited Security Firms 2017 (Runner-up) Investor Relations: Best Investor Relations – Listed Companies 2017 (Winner) Bank Alfalah Limited Best Investor Relations – Listed Companies 2017 (Runner-up) Engro Fertilizers Limited Women in Finance Initiative: Gender Diversity at Workplace Award 2017 (Winner) Unilever Pakistan Limited Recognizing Gender Diversity Award – Special Recognition: Local National Foods Limited Industry 2017 (Winner) Recognizing Gender Diversity Award – Special Recognition: -

The Role and Impact of Merger & Acquisition of Banking

Financial Markets, Institutions and Risks, Volume 3, Issue 3, 2019 ISSN (online) – 2521-1242 ISSN (print) – 2521-1250 The Role and Impact of Merger & Acquisition of Banking Sector in Pakistan Kishwar Ali School of Finance, Zhongnan University of Economics & Law, Wuhan, China Atta Ullah School of management, Huazhong University of Science and Technology, Wuhan China Abstract The paper summarizes the arguments and counterarguments in the scientific discussion on determining the effects of mergers and acquisitions for banking institutions. The purpose of this article is to conduct an empirical study to identify the nature of the impact of mergers and acquisitions on Pakistan's financial sector performance. The research in the article is carried out in the following logical sequence: a thorough literature review on the analysis of key aspects of mergers and acquisitions and their impact on the financial and economic performance of banks before and after their practical implementation; the historical basis of the experience of mergers and acquisitions caused by various economic factors, such as: GDP growth, interest rates on loans, monetary policy; financial analysis of bank profitability, solvency and liquidity indicators before and after the merger and acquisition was conducted. Five commercial banks of Pakistan that were involved in the merger and acquisition processes were selected as the subject of study. The study period is presented before and after the merger and includes two years before the acquisition report and two years after the acquisition announcement by analysis of financial ratios of liquidity, solvency and profitability. The results of empirical and theoretical research have shown that there is a positive relationship between merger and acquisition processes and liquidity ratios of banking institutions; and - the negative impact of such processes on banks' profitability and solvency in the short term. -

Consortium Contact Detail (Lahore).Xlsx

Bank Name Bank of Punjab ‐ Taqwa Islamic Banking Bank Name Meezan Bank 1st Contact person detail 1st Contact person detail Name Ghulam Mustafa Name Muhammad Ehtisham Contact number 0300‐6980309 Contact number 0304‐0920521 / 0345‐4511110 e‐mail address [email protected] e‐mail address [email protected] BOP, 7th floor, big city plaza, liberty Address roundabout opposite monal restaurant, Address 60‐Main boulevard gulberg Lahore main boulevard gulberg Lahore 2nd Contact person detail 2nd Contact person detail Name Abdul Rasheed Name Tassawar Hussain Contact number 0322‐4662808 Contact number 0304‐0920597 / 0345‐4548548 e‐mail address [email protected] e‐mail address [email protected] BOP, 7th floor, Big City Plaza, Liberty Address Roundabout Opposite Monal Restaurant, Address 60‐Main Boulevard Gulberg Lahore Main Boulevard Gulberg III Lahore Bank Name Faysal Bank limited Bank Name National Bank limited 1st Contact person detail 1st Contact person detail Name Syed Mazhar Arslan Name Mr. Farhan Ashraf Contact number 0321‐9449778 Contact number 042‐99268193 / 0321‐4998908 e‐mail address [email protected] e‐mail address [email protected] Faysal Bank, 1‐C, Sikandar Malhi Road, Address Address NBP, 69‐B, Main Boulevard, Gulberg II, Lahore. Canal Park, Gulberg II, Lahore 2nd Contact person detail 2nd Contact person detail Name Fahad Ali Name Mr. Muhammad Ashraf Contact number 0334‐4108658 Contact number 042‐99268428 / 0333‐4786078 e‐mail address [email protected] e‐mail address [email protected] Faysal Bank, 1‐C, Sikandar Malhi Road, NBP, Mezzanine Floor, Pace Tower, 27‐H, College Address Address Canal Park, Gulberg II, Lahore Road, Gulberg II, Lahore. -

GSK Q1 Report 2021

Calibrating Precision GSK Pakistan Limited FirstAnnual Quarter Report Report 20212020 CORPORATE INFORMATION As at March 31, 2021 Board of Directors Management Committee Disclosure Committee Mr. Dmytro Oliinyk Ms. Erum Shakir Rahim Ms. Erum Shakir Rahim Chairman Chief Executive Officer Chairperson Ms. Erum Shakir Rahim Mr. Abdul Samad* Mr. Abdul Samad* Chief Executive Officer Chief Financial Officer Member Mr. Abdul Samad* Mehar-e-daraksha Ameer Mr. Dmytro Oliinyk Chief Financial Officer Legal Director Member Ms. Maheen Rahman Dr. Tariq Farooq Mehar-e-daraksha Ameer Independent Director Business Unit Director BU 1 Member Mr. Muneer Kamal Syed Nasir Farid** Company Secretary Independent Director Business Unit Director BU 2 Ms. Mehar-e-daraksha Ameer Mr. Mehmood Mandviwalla Dr. Naved Masoom Ali Non-Executive Director Business Unit Director BU 3 Chief Financial Officer Mr. Mark Dawson Khurram Amjad Mr. Abdul Samad* Non-Executive Director Director Commercial Chief Internal Auditor Excellence & CTC Audit Committee Syed Ahsan Ejaz Dr. Gohar Nayab Khan Mr. Muneer Kamal Regulatory Affairs Cluster Bankers Chairman Head - Pakistan & Iran Citibank NA Mr. Dmytro Oliinyk Mr. Abdul Haseeb Pirzada Deutsche Bank A.G. Member Director Corporate Affairs and Habib Bank Limited Administration Meezan Bank Limited Mr. Mark Dawson Standard Chartered Bank (Pakistan) Ltd Member Mr. Zain Anjum Country Compliance Officer Auditors Mr. Mehmood Mandviwalla Member Dr. Yousuf Hasan Khan Yousuf Adil & Co. Chartered Director Medical Accountants Ms. Maheen Rahman Member Syed Nabigh Raza Alam Legal Advisors Tech Head Hashmi & Hashmi Human Resource Mr. Obaid Siddiqui Faisal, Mahmood Ghani and Co & Remuneration Head of Procurement Legal Consultancy Inc. Committee Mr. Farqaleet Iqbal Registered Office Mr. -

GSK Annual Report 2016

Annual Report Transcending boundaries is in our DNA. This is evident in how we continue to discover, develop and bring to market, new medicines and vaccines to address the unmet needs of healthcare providers and their patients. As a responsible healthcare company, we drive change by adopting new and innovative methodologies, aligned with our values, so that we can better serve the evolving needs of our society and enable more patients to benefit from our medicines. We firmly believe that keeping the patient at the heart of everything we do is integral to our success; inspiring us to continue on this journey and transcend boundaries. GSK Contents 002 026 062 Our Vision, Mission and Core Vaccines Key Operating and Financial Data Values 028 065 004 Primary Care Direct Cash Flow Statement Corporate Information 030 066 006 Specialty Business Unit Horizontal Analysis Financial Highlights 031 067 007 Medical Affairs Vertical Analysis DUPONT Analysis 032 070 008 Awards 2016 Statement of Compliance with the The GSK Story 034 Code of Corporate Governance 010 Global Manufacturing & Supply 072 GSK Expectations (GMS) Review Report to the Members 011 035 073 Strategic Priorities Warehousing and Auditors Report to the Members 012 Distribution (W&D) 074 Company Profile & 036 Balance Sheet Group Structure Environment Health & Safety (EHS) 075 014 Profit and Loss Account Our Behaviour 038 Quality Management System (QMS) 076 015 Cash Flow Statement Organogram 040 Corporate Social Responsibility 077 016 (CSR) Statement of Changes in Equity Geographical Presence