Analysis of Timber Exports from the Russian Far East in 2015 WWF-Russia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Attention Wal-Mart Shoppers How Wal-Mart’S Sourcing Practices Encourage Illegal Logging and Threaten Endangered Species Contents © Eia

ATTENTION WAL-MART SHOPPERS HOW WAL-MART’S SOURCING PRACTICES ENCOURAGE ILLEGAL LOGGING AND THREATEN ENDANGERED SPECIES www.eia-global.org CONTENTS © EIA ACKNOWLEDGEMENTS 1 EXECUTIVE SUMMARY Copyright © 2007 Environmental Investigation Agency, Inc. No part of this publication may be 2 INTRODUCTION: WAL-MART IN THE WOODS reproduced in any form or by any means without permission in writing from the Environmental 4 THE IMPACTS OF ILLEGAL LOGGING Investigation Agency, Inc. Pictures on pages 8,10,11,14,15,16 were published in 6 LOW PRICES, HIGH CONTROL: WAL-MART’S BUSINESS MODEL The Russian Far East, A Reference Guide for Conservation and Development, Josh Newell, 6 REWRITING THE RULES OF THE SUPPLIER-RETAILER RELATIONSHIP 2004, published by Daniel & Daniel, Publishers, Inc. 6 SQUEEZING THE SUPPLY CHAIN McKinleyville, California, 2004. ENVIRONMENTAL INVESTIGATION AGENCY 7 BIG FOOTPRINT, BIG PLANS: WAL-MART’S ENVIRONMENTAL IMPACT 7 THE FOOTPRINT OF A GIANT PO Box 53343, Washington DC 20009, USA 7 STEPS FORWARD Tel: +1 202 483 6621 Fax: +1 202 986 8626 Email: [email protected] 8 GLOBAL REACH: WAL-MART’S SALE OF WOOD PRODUCTS Web: www.eia-global.org 8 A SNAPSHOT INTO WAL-MART’S WOOD BUYING AND RETAIL 62-63 Upper Street, London N1 ONY, UK 8 WAL-MART AND CHINESE EXPORTS 8 THE RISE OF CHINA’S WOOD PRODUCTS INDUSTRY Tel: +44(0)20 7354 7960 Fax: +44(0)20 7354 7961 10 CHINA IMPORTS RUSSIA’S GREAT EASTERN FORESTS Email: [email protected] 10 THE WILD WILD FAR EAST 11 CHINA’S GLOBAL SOURCING Web: www.eia-international.org 10 IRREGULARITIES FROM FOREST TO FRONTIER 14 ECOLOGICAL AND SOCIAL IMPACTS 15 THE FLOOD OF LOGS ACROSS THE BORDER 17 LONGJIANG SHANGLIAN: BRIEFCASES OF CASH FOR FORESTS 18 A LANDSCAPE OF WAL-MART SUPPLIERS: INVESTIGATION CASE STUDIES 18 BABY CRIBS 18 DALIAN HUAFENG FURNITURE CO. -

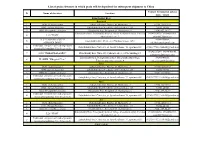

Catalogue of Exporters of Primorsky Krai № ITN/TIN Company Name Address OKVED Code Kind of Activity Country of Export 1 254308

Catalogue of exporters of Primorsky krai № ITN/TIN Company name Address OKVED Code Kind of activity Country of export 690002, Primorsky KRAI, 1 2543082433 KOR GROUP LLC CITY VLADIVOSTOK, PR-T OKVED:51.38 Wholesale of other food products Vietnam OSTRYAKOVA 5G, OF. 94 690001, PRIMORSKY KRAI, 2 2536266550 LLC "SEIKO" VLADIVOSTOK, STR. OKVED:51.7 Other ratailing China TUNGUS, 17, K.1 690003, PRIMORSKY KRAI, VLADIVOSTOK, 3 2531010610 LLC "FORTUNA" OKVED: 46.9 Wholesale trade in specialized stores China STREET UPPERPORTOVA, 38- 101 690003, Primorsky Krai, Vladivostok, Other activities auxiliary related to 4 2540172745 TEK ALVADIS LLC OKVED: 52.29 Panama Verkhneportovaya street, 38, office transportation 301 p-303 p 690088, PRIMORSKY KRAI, Wholesale trade of cars and light 5 2537074970 AVTOTRADING LLC Vladivostok, Zhigura, 46 OKVED: 45.11.1 USA motor vehicles 9KV JOINT-STOCK COMPANY 690091, Primorsky KRAI, Processing and preserving of fish and 6 2504001293 HOLDING COMPANY " Vladivostok, Pologaya Street, 53, OKVED:15.2 China seafood DALMOREPRODUKT " office 308 JOINT-STOCK COMPANY 692760, Primorsky Krai, Non-scheduled air freight 7 2502018358 OKVED:62.20.2 Moldova "AVIALIFT VLADIVOSTOK" CITYARTEM, MKR-N ORBIT, 4 transport 690039, PRIMORSKY KRAI JOINT-STOCK COMPANY 8 2543127290 VLADIVOSTOK, 16A-19 KIROV OKVED:27.42 Aluminum production Japan "ANKUVER" STR. 692760, EDGE OF PRIMORSKY Activities of catering establishments KRAI, for other types of catering JOINT-STOCK COMPANY CITYARTEM, STR. VLADIMIR 9 2502040579 "AEROMAR-ДВ" SAIBEL, 41 OKVED:56.29 China Production of bread and pastry, cakes 690014, Primorsky Krai, and pastries short-term storage JOINT-STOCK COMPANY VLADIVOSTOK, STR. PEOPLE 10 2504001550 "VLADHLEB" AVENUE 29 OKVED:10.71 China JOINT-STOCK COMPANY " MINING- METALLURGICAL 692446, PRIMORSKY KRAI COMPLEX DALNEGORSK AVENUE 50 Mining and processing of lead-zinc 11 2505008358 " DALPOLIMETALL " SUMMER OCTOBER 93 OKVED:07.29.5 ore Republic of Korea 692183, PRIMORSKY KRAI KRAI, KRASNOARMEYSKIY DISTRICT, JOINT-STOCK COMPANY " P. -

Russian Museums Visit More Than 80 Million Visitors, 1/3 of Who Are Visitors Under 18

Moscow 4 There are more than 3000 museums (and about 72 000 museum workers) in Russian Moscow region 92 Federation, not including school and company museums. Every year Russian museums visit more than 80 million visitors, 1/3 of who are visitors under 18 There are about 650 individual and institutional members in ICOM Russia. During two last St. Petersburg 117 years ICOM Russia membership was rapidly increasing more than 20% (or about 100 new members) a year Northwestern region 160 You will find the information aboutICOM Russia members in this book. All members (individual and institutional) are divided in two big groups – Museums which are institutional members of ICOM or are represented by individual members and Organizations. All the museums in this book are distributed by regional principle. Organizations are structured in profile groups Central region 192 Volga river region 224 Many thanks to all the museums who offered their help and assistance in the making of this collection South of Russia 258 Special thanks to Urals 270 Museum creation and consulting Culture heritage security in Russia with 3M(tm)Novec(tm)1230 Siberia and Far East 284 © ICOM Russia, 2012 Organizations 322 © K. Novokhatko, A. Gnedovsky, N. Kazantseva, O. Guzewska – compiling, translation, editing, 2012 [email protected] www.icom.org.ru © Leo Tolstoy museum-estate “Yasnaya Polyana”, design, 2012 Moscow MOSCOW A. N. SCRiAbiN MEMORiAl Capital of Russia. Major political, economic, cultural, scientific, religious, financial, educational, and transportation center of Russia and the continent MUSEUM Highlights: First reference to Moscow dates from 1147 when Moscow was already a pretty big town. -

List of Grain Elevators in Which Grain Will Be Deposited for Subsequent Shipment to China

List of grain elevators in which grain will be deposited for subsequent shipment to China Contact Infromation (phone № Name of elevators Location num. / email) Zabaykalsky Krai Rapeseed 1 ООО «Zabaykalagro» Zabaykalsku krai, Borzya, ul. Matrosova, 2 8-914-120-29-18 2 OOO «Zolotoy Kolosok» Zabaykalsky Krai, Nerchinsk, ul. Octyabrskaya, 128 30242-44948 3 OOO «Priargunskye prostory» Zabaykalsky Krai, Priargunsk ul. Urozhaynaya, 6 (924) 457-30-27 Zabaykalsky Krai, Priargunsky district, village Starotsuruhaytuy, Pertizan 89145160238, 89644638969, 4 LLS "PION" Shestakovich str., 3 [email protected] LLC "ZABAYKALSKYI 89144350888, 5 Zabaykalskyi krai, Chita city, Chkalova street, 149/1 AGROHOLDING" [email protected] Individual entrepreneur head of peasant 6 Zabaykalskyi krai, Chita city, st. Juravleva/home 74, apartment 88 89243877133, [email protected] farming Kalashnikov Uriy Sergeevich 89242727249, 89144700140, 7 OOO "ZABAYKALAGRO" Zabaykalsky krai, Chita city, Chkalova street, 147A, building 15 [email protected] Zabaykalsky krai, Priargunsky district, Staroturukhaitui village, 89245040356, 8 IP GKFH "Mungalov V.A." Tehnicheskaia street, house 4 [email protected] Corn 1 ООО «Zabaykalagro» Zabaykalsku krai, Borzya, ul. Matrosova, 2 8-914-120-29-18 2 OOO «Zolotoy Kolosok» Zabaykalsky Krai, Nerchinsk, ul. Octyabrskaya, 128 30242-44948 3 OOO «Priargunskye prostory» Zabaykalsky Krai, Priargunsk ul. Urozhaynaya, 6 (924) 457-30-27 Individual entrepreneur head of peasant 4 Zabaykalskyi krai, Chita city, st. Juravleva/home 74, apartment 88 89243877133, [email protected] farming Kalashnikov Uriy Sergeevich Rice 1 ООО «Zabaykalagro» Zabaykalsku krai, Borzya, ul. Matrosova, 2 8-914-120-29-18 2 OOO «Zolotoy Kolosok» Zabaykalsky Krai, Nerchinsk, ul. Octyabrskaya, 128 30242-44948 3 OOO «Priargunskye prostory» Zabaykalsky Krai, Priargunsk ul. -

Wildaid 1999

PROGRAMMATIC REPORT ON INSPECTION "TIGER" 1999 Global Survival Network (now WildAid) by Steve Galster/Karin Elliot Rick Scharlat Report compiled from report submitted by Inspection Tiger January 2000. 1 Executive Summary In 1999, anti-poaching patrols took place in 16 administrative regions of Primorsky Krai, Russia. Inspection Tiger's biodiversity conservation activities continue to focus in on: Amur tiger and leopard conservation; Wild ginseng conservation efforts; Monitoring illegal logging; Protecting hunting resources, and; Protection of marine life. Inspection Tiger has observed that the illegal trade has become more “hidden.” Moreover, information about Inspection Tiger in the mass media has drawn attention to its work, and has made the work of the rangers more dangerous and risky. More and more often Inspection Tiger is being met with more organized, more highly skilled, and frequently armed traders. To improve coordination with other agencies, GSN/WildAid and Inspection Tiger created a new Interregional-Interagency Team that is dedicated primarily to establishing formal, effective working relationships with other wildlife law-enforcement agencies, and law-enforcement agencies in general, conducting wildlife crime investigations, training other Inspection Tiger anti-poaching teams, and report writing. The Interregional-Interagency Team has proven successful in its first half-year of operations in terms of forging new ties and bolstering existing ties with other agencies. In addition to active patrolling together with members of the Police, Customs and the FSB, a concept strongly stressed and encouraged by WildAid/GSN, a great deal of time was dedicated to investigating illegal channels of wildlife trade. In 2000, Inspection Tiger and GSN (now called WildAid) plan to help Inspection Tiger become increasingly efficient in the field, and financially sustainable. -

Primorsky Krai 165,900 Sq

PRIMORSKY KHABAROVSK Trans- Siberian Railroad Russian Far East Amur River JAO Agzu Samarga Edinka POZHARSKY Svetlaya POZHARSKY Ulunga Verkhne Pereval Vostok Luchegorsk Krasny Yar Kuznetsovo Ignatevka Pozharskoe Maximovka Guberovo Glubinnoe CHINA Amgu !. Dalnerechensk Roshchino TERNEISKY Lazo Novopokrovka KRASNOARMEISKY Rakitnoe Velikaya Kema Tamga DALNERECHENSKY Malaya Kema Melnichnoe !. Lesozavodsk SKY LESOZAVOD Tury Rog Gornye Klyuchi Ternei Ariadnoe Kirovsky ¯ Novokachalinsk Lake lroad Dalny Kut KIROVSKY ORSKY KHANKA Rai Ilinka Plastun Khanka Gorny km DALNEG Cheremshany Dvoryanka berian PO ISKY Samarka Kamen-Rybolov Krasnorechensky 100 GRANICHNY Dalnegorsk !. Zharikovo Tr!.ans-SiSpassk-Dalny KY Koksharovka SPASSKY Kamenka KHOROLS AKOLEVS Khrustalny Pogranichny Khorol Y Yakovlevka EVSKY Rudny Rudnaya Pristan ! CH UGU CHERNIGOVSKY !Kavalerovo EROVSKY KY Lipovtsy ! Sibirtsevo Chuguevka KAVAL ! !. ANUCHINSKY Arsenev Yaroslavsky OKTYABRSKY Vesely Yar n MI Mikhailovka Pokrovka KHAILOVSKY Anuchino Olga a Mikhailovka Arkhipovka Nikolo-Lvovskoe !. OLGINSKY PARTI p USSURIISKY UssuriiskSHKO Terekhovka a ZANSKY TOVSKY Margaritovo NADEZHDINSKY Lazo J Sergeevka Uglovoe Artem ! !. ! Smolyaninovo ZOVSKY LA Valentin f Primorsky !. P! !. Bolshoi Kamen Partizansk o ! Russky Nakhodka Preobrazhenie ! . Popova ! a Kraskino KHASANSKY Poset Slavyanka e VLADIVOSTOK S Map 2.1 Zarubino Khasan Primorsky Krai 165,900 sq. km Newell, J. 2004. The Russian Far East: A Reference Guide for Conservation and Development. McKinleyville, CA: Daniel & Daniel. 466 pages By Newell and Zhou / Sources: Ministry of Natural Resources, 2002; ESRI, 2002. 110 Ⅲ THE RUSSIAN FAR EAST CHAPTER 2 Primorsky Krai PRIMORSKY Location Situated along the southeastern border of the rfe, Primorsky Krai, or Primorie, shares a common border with China in the west and Khabarovsk Krai in the north. To the east lies the Sea of Japan, which separates Primorsky from Japan by only 400 km. -

Illegal Logging in the Russian Far East and Siberia

International Forestry Review 5(3), 2003 303 Illegal logging in the Russian Far East and Siberia P. VANDERGERT1 and J. NEWELL2 1 Director, Forests Monitor3, 69a Lensfield Road, Cambridge, CB2 1EN, UK 2 Research Associate in the Department of Geography, University of Washington, USA Email: [email protected], [email protected] INTRODUCTION The nature of forestry operations has changed dramatically over the past decade as central control over The vast forests of the Russian Far East and Siberia forest management has diminished, and liberalisation and represent one of the last great forest wildernesses in the privatisation have become the new mantra. There is much world, containing large expanses of boreal and northern uncertainty at the local and regional level as to who has temperate forest types. These forests are of global responsibility for regulating forestry operations and laws importance as habitat for rare and endangered species, for are often unclear. the richness of biodiversity in areas such as the Sikhote- Whilst officially recorded timber production in the Alin Mountain Range and Sakhalin Island, and to help Russian Far East has declined over the past decade, this mitigate against the effects of global climate change. They masks the unregulated and unrecorded timber production are also home to tens of thousands of indigenous peoples that has characterised much of the industry during this for whom the forest is a spiritual as well as physical space period. Although some large forest concessions exist, these and which also provides traditional livelihoods for many are not the norm. Logging takes place supposedly under thousands more forest-dependent people. -

OCCASION This Publication Has Been Made Available to the Public on The

OCCASION This publication has been made available to the public on the occasion of the 50th anniversary of the United Nations Industrial Development Organisation. DISCLAIMER This document has been produced without formal United Nations editing. The designations employed and the presentation of the material in this document do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations Industrial Development Organization (UNIDO) concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries, or its economic system or degree of development. Designations such as “developed”, “industrialized” and “developing” are intended for statistical convenience and do not necessarily express a judgment about the stage reached by a particular country or area in the development process. Mention of firm names or commercial products does not constitute an endorsement by UNIDO. FAIR USE POLICY Any part of this publication may be quoted and referenced for educational and research purposes without additional permission from UNIDO. However, those who make use of quoting and referencing this publication are requested to follow the Fair Use Policy of giving due credit to UNIDO. CONTACT Please contact [email protected] for further information concerning UNIDO publications. For more information about UNIDO, please visit us at www.unido.org UNITED NATIONS INDUSTRIAL DEVELOPMENT ORGANIZATION Vienna International Centre, P.O. Box -

Illegal Logging in the Southern Part of the Russian Far East

Illegal Logging in the Southern Part of the Russian Far East Problem Analysis and Proposed Solutions WWF's mission is to stop the degradation of the planet's natural environment and to build a future in which humans live in a harmony with nature. The Fund's priority is the conservation of vitally important forest, fresh water, oceanic and coastal ecosystems. For the forest biome WWF's task is to prevent the disappearance and degradation of forests. WWF's strategic tasks in the area of forest conservation are: Creating a network of ecologically representative protected (natural) areas. Environmentally sound, socially advantageous and economically viable forest management outside the protected areas. Environmentally and socially acceptable reforestation programs. Writers: Anatoly Kotlobay Andrey Ptichnikov WWF Russia concentrates its activities on the first two tasks. Editors: Polina Gerassimova Julia Kalinicheva Irina Prokhorova Tamara Rousina Alexey Vaisman Translated by: Douglas Engelbrecht Design: Leonid Dubeykowski Photo on the cover: Vladimir Medvedev Circulation: 1,500 Published in February, 2002 by WWF, Moscow, Russia Any full or partial reproduction of this publication must include the title and give credit to the above-mentioned publisher as the copyright holder. No photographs from this publication may be reproduced without prior authorization from WWF Russia. © text 2002 WWF. All rights reserved. This work was initiated, assisted and expertized by TRAFFIC Europe-Russia. 1 CONTENT Introduction 3 Volumes and structure of timber -

Subject of the Russian Federation)

How to use the Atlas The Atlas has two map sections The Main Section shows the location of Russia’s intact forest landscapes. The Thematic Section shows their tree species composition in two different ways. The legend is placed at the beginning of each set of maps. If you are looking for an area near a town or village Go to the Index on page 153 and find the alphabetical list of settlements by English name. The Cyrillic name is also given along with the map page number and coordinates (latitude and longitude) where it can be found. Capitals of regions and districts (raiony) are listed along with many other settlements, but only in the vicinity of intact forest landscapes. The reader should not expect to see a city like Moscow listed. Villages that are insufficiently known or very small are not listed and appear on the map only as nameless dots. If you are looking for an administrative region Go to the Index on page 185 and find the list of administrative regions. The numbers refer to the map on the inside back cover. Having found the region on this map, the reader will know which index map to use to search further. If you are looking for the big picture Go to the overview map on page 35. This map shows all of Russia’s Intact Forest Landscapes, along with the borders and Roman numerals of the five index maps. If you are looking for a certain part of Russia Find the appropriate index map. These show the borders of the detailed maps for different parts of the country. -

Phoenix Final Report 2007

Phoenix Fund “Fighting for the Minds II”: strengthening tiger conservation in Primorye, Russian Far East in 2007 Final report January – December 2007 Vladivostok 2007 Phoenix Final Report _____________________________________________________________________________________________ January 01 – December 31, 2007 Contents page I. Project Overview ………………………………………………………………………....3 II. Project Implementation ………………………………………………………………….3 2.1. Education and outreach activities Eco-centre in Partizansk city and environmental education in Partizansky District………………………………………………………………………………………..3 Eco-centre in Luchegorsk city……………………………………………………………..5 Children’s art contests devoted to tigers ………………………………………………...5 Design and publication of calendars with children’s paintings of tiger ……………….6 Journalist Awards …………………………………………………………………………..6 Tiger Day Festival …………………………………………………………………………..6 2.2. Anti-poaching activities Support for Western wildlife managers’ team …………………………………………..9 III. Measurable objectives delivered ……………………………………………………...13 IV. Acknowledgement………………………………………………………………..……...14 V. Attachment…………………………………………………….…………………..……...15 2 Phoenix Final Report _____________________________________________________________________________________________ January 01 – December 31, 2007 I. Project Overview II. Project Implementation Since the year of its establishment in 1998, 2.1. Education and outreach activities the Phoenix Fund has been carrying out nature conservation projects in the south of Eco-centre in Partizansk city and the Russian -

Securing a Future for Amur Leopards and Tigers in Russia

Securing a Future for Amur Leopards and Tigers in Russia – VI 2018 Final Report Phoenix Fund 1 Securing a Future for Amur Leopards and Tigers in Russia – VI • 2018 Final Report TABLE OF CONTENTS Background ................................................................................................................................................... 2 Project Summary ........................................................................................................................................... 3 Project Activities............................................................................................................................................ 4 SMART in five protected areas .................................................................................................................. 4 Annual workshop for educators ................................................................................................................ 8 Education in Khasan, Lazo, Terney and Vladivostok ................................................................................. 9 Tiger Day in Primorye .............................................................................................................................. 11 Art Contest .............................................................................................................................................. 13 Photo credits: PRNCO “Tiger “Centre”, Far Eastern Operational Customs Office, Land of the Leopard National Park, Alexander Ratnikov, and children's paintings