Accelerating the EV Transition – Part 1: Environmental and Economic Impacts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Automotive Sector in Tees Valley

Invest in Tees Valley A place to grow your automotive business Invest in Tees Valley Recent successes include: Tees Valley and the North East region has April 2014 everything it needs to sustain, grow and Nifco opens new £12 million manufacturing facility and Powertrain and R&D plant develop businesses in the automotive industry. You just need to look around to June 2014 see who is already here to see the success Darchem opens new £8 million thermal of this growing sector. insulation manufacturing facility With government backed funding, support agencies September 2014 such as Tees Valley Unlimited, and a wealth of ElringKlinger opens new £10 million facility engineering skills and expertise, Tees Valley is home to some of the best and most productive facilities in the UK. The area is innovative and forward thinking, June 2015 Nifco announces plans for a 3rd factory, helping it to maintain its position at the leading edge boosting staff numbers to 800 of developments in this sector. Tees Valley holds a number of competitive advantages July 2015 which have helped attract £1.3 billion of capital Cummins’ Low emission bus engine production investment since 2011. switches from China back to Darlington Why Tees Valley should be your next move Manufacturing skills base around half that of major cities and a quarter of The heritage and expertise of the manufacturing those in London and the South East. and engineering sector in Tees Valley is world renowned and continues to thrive and innovate Access to international markets Major engineering companies in Tees Valley export Skilled and affordable workforce their products around the world with our Tees Valley has a ready skilled labour force excellent infrastructure, including one of the which is one of the most affordable and value UK’s leading ports, the quickest road connections for money in the UK. -

Annual Report 2018/19 (PDF)

JAGUAR LAND ROVER AUTOMOTIVE PLC Annual Report 2018/19 STRATEGIC REPORT 1 Introduction THIS YEAR MARKED A SERIES OF HISTORIC MILESTONES FOR JAGUAR LAND ROVER: TEN YEARS OF TATA OWNERSHIP, DURING WHICH WE HAVE ACHIEVED RECORD GROWTH AND REALISED THE POTENTIAL RATAN TATA SAW IN OUR TWO ICONIC BRANDS; FIFTY YEARS OF THE EXTRAORDINARY JAGUAR XJ, BOASTING A LUXURY SALOON BLOODLINE UNLIKE ANY OTHER; AND SEVENTY YEARS SINCE THE FIRST LAND ROVER MOBILISED COMMUNITIES AROUND THE WORLD. TODAY, WE ARE TRANSFORMING FOR TOMORROW. OUR VISION IS A WORLD OF SUSTAINABLE, SMART MOBILITY: DESTINATION ZERO. WE ARE DRIVING TOWARDS A FUTURE OF ZERO EMISSIONS, ZERO ACCIDENTS AND ZERO CONGESTION – EVEN ZERO WASTE. WE SEEK CONSCIOUS REDUCTIONS, EMBRACING THE CIRCULAR ECONOMY AND GIVING BACK TO SOCIETY. TECHNOLOGIES ARE CHANGING BUT THE CORE INGREDIENTS OF JAGUAR LAND ROVER REMAIN THE SAME: RESPONSIBLE BUSINESS PRACTICES, CUTTING-EDGE INNOVATION AND OUTSTANDING PRODUCTS THAT OFFER OUR CUSTOMERS A COMPELLING COMBINATION OF THE BEST BRITISH DESIGN AND ENGINEERING INTEGRITY. CUSTOMERS ARE AT THE HEART OF EVERYTHING WE DO. WHETHER GOING ABOVE AND BEYOND WITH LAND ROVER, OR BEING FEARLESSLY CREATIVE WITH JAGUAR, WE WILL ALWAYS DELIVER EXPERIENCES THAT PEOPLE LOVE, FOR LIFE. The Red Arrows over Solihull at Land Rover’s 70th anniversary celebration 2 JAGUAR LAND ROVER AUTOMOTIVE PLC ANNUAL REPORT 2018/19 STRATEGIC REPORT 3 Introduction CONTENTS FISCAL YEAR 2018/19 AT A GLANCE STRATEGIC REPORT FINANCIAL STATEMENTS 3 Introduction 98 Independent Auditor’s report to the members -

My Jaguar Land Rover Incontrol Website Frequently Asked Questions

MY JAGUAR LAND ROVER INCONTROL WEBSITE FREQUENTLY ASKED QUESTIONS TABLE OF CONTENTS 1. OVERVIEW & SUPPORT ....................................................................................................... 1 2. REGISTER, CONNECT AND ACTIVATE ............................................................................ 2 2a. SELF SETUP OF INCONTROL SERVICES - REGISTER ................................................. 3 2b. SELF SETUP OF INCONTROL SERVICES - CONNECT .................................................. 3 2c. SELF SETUP OF INCONTROL SERVICES - ACTIVATE .................................................. 6 3. GETTING STARTED ............................................................................................................... 7 4. ACCOUNT MANAGEMENT ................................................................................................... 7 5. VEHICLE SETTINGS .............................................................................................................. 8 6. JOURNEYS ............................................................................................................................. 10 7. INCONTROL SECURE / SECURE TRACKER ................................................................. 11 1. OVERVIEW & SUPPORT The main purpose of the “My InControl” website is to enable you to set up your InControl account, manage your account and to find help and support. You can also access key functionalities found on the InControl Remote smartphone app, such as being able to view and download journeys, -

WARN Report Summary by Received Date 07/01/2019 - 06/30/2020 State Fiscal Year No

WARN Report Summary by Received Date 07/01/2019 - 06/30/2020 State Fiscal Year No. Of Notice Date Effective Date Received Date Company City County Employees Layoff/Closure 06/10/2020 06/09/2020 06/30/2020 Harbor Bay Club, Inc Alameda Alameda County 80 Layoff Temporary 03/20/2020 03/20/2020 06/30/2020 MD2 Industries, LLC Long Beach Los Angeles County 109 Closure Temporary 06/30/2020 08/21/2020 06/30/2020 NBCUniversal Media, LLC - Digital Lab Unit Universal City Los Angeles County 28 Layoff Temporary 04/22/2020 06/22/2020 06/30/2020 House of Blues Anaheim Anaheim Orange County 8 Closure Temporary 06/29/2020 08/01/2020 06/30/2020 ADESA California, LLC dba ADESA/AFC Los Mira Loma Riverside County 71 Layoff Permanent Angeles 06/17/2020 06/17/2020 06/30/2020 K&N Engineering, Inc. Riverside Riverside County 44 Layoff Permanent 06/29/2020 07/28/2020 06/30/2020 Benchmark Arrowhead, LLC dba Lake Lake Arrowhead San Bernardino County 114 Layoff Permanent Arrowhead Resort and Spa 06/18/2020 07/06/2020 06/30/2020 HOWMET Aerospace Fontana San Bernardino County 75 Layoff Temporary 06/18/2020 06/16/2020 06/30/2020 Bahia Resort Hotel San Diego San Diego County 47 Layoff Permanent 06/18/2020 06/16/2020 06/30/2020 Catamaran Resort Hotel and Spa San Diego San Diego County 46 Layoff Permanent 06/18/2020 06/16/2020 06/30/2020 The Lodge Torrey Pines La Jolla San Diego County 84 Layoff Permanent 06/18/2020 06/18/2020 06/30/2020 Bahia Resort Hotel San Diego San Diego County 33 Layoff Temporary 06/18/2020 06/18/2020 06/30/2020 Catamaran Resort Hotel and Spa San Diego San Diego County 33 Layoff Temporary 06/18/2020 06/18/2020 06/30/2020 The Lodge Torrey Pines La Jolla San Diego County 37 Layoff Temporary 06/08/2020 03/30/2020 06/30/2020 SmartCareMD Escondido San Diego County 38 Layoff Permanent 06/29/2020 08/31/2020 06/30/2020 Stryker Employment Company Menlo Park San Mateo County 33 Layoff Permanent 06/29/2020 08/29/2020 06/30/2020 Nitto, Inc. -

Corporate Presentation Who We Are Jaguar Land Rover

Jaguar Land Rover Corporate Presentation Who we are Jaguar Land Rover Jaguar Land Rover (JLR) is built around two Jaguar Land Rover was formed in 2008 when Tata iconic brands with a wonderfully rich heritage and purchased Jaguar Cars and Land Rover from Ford powerful consumer appeal and loyalty. Motor Company. JLR is a subsidiary of Tata Motors (TML). Jaguar Land Rover is headquartered in the UK and is the largest premium automotive business there. More than 25,000 of its nearly 26,000 employees globally are UK-based. Company overview Jaguar Land Rover 11 vehicle lines – with ambitious expansion New £1.1bn engine investment - plant under plans to extend product offerings construction Employs 26,000 people globally - 9,000 Jaguar F-TYPE and XF Sportbrake announced employees recruited in as the 10th & 11th vehicle lines past 2 years 3 UK vehicle assembly plants, with 2 UK Employs 7,000 engineers and designers product development facilities Global sales reach, worldwide network covering 178 countries Jaguar Land Rover Manufacturing & product development facilities Halewood Whitley Land Rover Freelander and Range Rover Evoque Global Jaguar Land Rover headquarters Utility & Premium SUV market segments Design and Engineering Centre c4,600 employees Commercial and central staff functions JD Power European Gold Plant Award (2005) Powertrain and other test facilities c4,000 employees Castle Bromwich Gaydon F-TYPE from mid-2013 Design and Engineering Centre Jaguar XF, XF Sportbrake, XJ and XK. Commercial and central staff functions Aluminium body construction facilities Extensive test track and off-road testing Medium/Large Premium & Sports market segments c6,000 employees c3,200 employees Solihull I54 South Staffordshire Range Rover, Range Rover Sport, Land Rover Dis- Jaguar Land Rover is building a state of the art covery, Land Rover Defender advanced engine facility at i54 South Staffordshire Aluminium body construction facilities Business Park. -

Trade Marks Inter Partes Decision O/589/19

O/589/19 TRADE MARKS ACT 1994 TRADE MARK APPLICATIONS 3164282/83, 3186701, 3158947/8 AND 3248751 BY JAGUAR LAND ROVER LIMITED TO REGISTER 6 THREE-DIMENSIONAL SHAPE MARKS AND OPPOSITIONS 409980-984 AND 413358 BY INEOS INDUSTRIES HOLDINGS LIMITED Background and pleadings 1. Jaguar Land Rover Limited (“JLR”) applied to register six trade marks consisting of three dimensional shapes of the Land Rover Series 1, Series 2, Defender 90 and 110 models (the latter two shapes with and without a rear mounted spare wheel). 2. The application forms show six views of each of the shapes at issue. One view of each of the shapes is shown below. 3186701 (Series 1) 3248751 (Series 2) 3164283 (DEFENDER 90) 3158947 (DEFENDER 90 SPARE WHEEL) 3164282 (DEFENDER 110) 3158948 (DEFENDER 110 SPARE WHEEL) 3. JLR seeks to register these marks in relation to a range of goods and services in classes 9, 12, 14, 28, & 37. The full list is shown at Annex A. At this stage it is Page 2 of 76 sufficient to note that it includes vehicles and parts for vehicles in class 12, toy and model vehicles in class 28, electrical goods which are, or could be, accessories for vehicles in class 9, vehicle maintenance, repair and customisation services in class 37, as well as jewellery, watches and badges in class 14. 4. Applications 3158947/8 (shapes of DEFENDER 90 and 110 with spare wheels) were filed on 11th April 2016. Applications 3164282/3 (shapes of DEFENDER 90 and 110 without spare wheels) were filed on 12th May 2016. -

2020 Annual Report Contents

2020 ANNUAL REPORT CONTENTS STRATEGIC REPORT CORPORATE GOVERNANCE Highlights 1 Board of Directors and Executive Committee 41 Our Global Footprint 2 Executive Chairman’s Introduction 45 Executive Chairman’s Statement 4 to Governance Chief Executive Officer’s Statement 6 Governance Report 46 Business Model 10 Nomination Committee Report 54 Aston Martin and the Luxury Market 12 Audit and Risk Committee Report 56 Strategy 14 Directors’ Remuneration Report 63 Key Performance Indicators 16 Directors’ Report 79 People and Stakeholder Engagement 18 Statement of Directors’ Responsibilities 85 Responsibility 24 Chief Financial Officer’s Statement 28 FINANCIAL STATEMENTS Group Financial Review 29 Independent Auditor’s Report 87 Risk and Viability Report 33 Consolidated Financial Statements 96 Notes to the Financial Statements 101 ASTON MARTIN* Company Statement of Financial Position 146 Company Statement of Changes in Equity 147 IS ONE OF THE WORLD’S Notes to the Company Financial Statements 148 MOST ICONIC LUXURY Shareholder Information 150 COMPANIES FOCUSED ON THE DESIGN, ENGINEERING AND MANUFACTURE OF HIGH LUXURY CARS * Aston Martin Lagonda Global Holdings plc. References to ”Company”, ”Group”, ”we”, ”us”, ”our”, ”Aston Martin” and other similar terms are to Aston Martin Lagonda Global Holdings plc and its direct and indirect subsidiaries. HIGHLIGHTS 1 3 4 AGGRESSIVE DE-STOCK NEW LEADERSHIP IN TRANSFORMATIVE OF DEALER INVENTORY PLACE TO DRIVE TECHNOLOGY TURNAROUND AND AGREEMENT WITH DEALER GT/SPORTS GROWTH MERCEDES-BENZ AG INVENTORY MORE THAN -

The UK Automotive Industry and the EU

The UK Automotive Industry and the EU An economic assessment of the interaction of the UK’s Automotive Industry with the European Union April 2014 kpmg.co.uk c | Section or Brochure name © 2014 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved. Introduction by Mike Hawes Europe is fundamental to the current and • Innovation in UK automotive is boosted by significant EU future success of the UK automotive industry R&D funding. In total approximately £3.5 billion has been awarded to UK businesses and universities across all sectors This report examines the evidence why, for UK automotive to encourage growth. businesses large and small, it is critical that the UK has a strong • Free movement of labour within European borders relationship with Europe. gives automotive businesses the ability to blend UK and In recent years, the UK has benefited from significant international talent at all levels of the industry. investments by many of the world’s major vehicle To supplement this report, we asked SMMT members for their manufacturers including BMW Group, Ford, Vauxhall, Jaguar views on the UK’s EU membership. Their verdict is clear. 92% Land Rover, Nissan and Toyota. This attests to the global of automotive companies said it was more beneficial to their nature and dynamism of this sector. The optimism that exists, business for the UK to stay in the EU, the majority with reform. -

Jaguar Land Rover 1 Automotive News Europe Congress, Barcelona, Spain, 5 May 2005 Sustaining Growth in the New Europe

Jaguar Land Rover 1 Automotive News Europe Congress, Barcelona, Spain, 5 May 2005 Sustaining Growth In The New Europe Slide 1. JOE GREENWELL, CEO, JAGUAR LAND ROVER I think I should start by congratulating our hosts on their sense of timing. The Automotive News Congress provides a great opportunity to discuss the trends and challenges in our industry and I’m delighted to be here ... but this year it coincides with another rather significant event in my own country - the British General Election. Slide 2. In the early hours of tomorrow morning, we will have a new government and for companies like Jaguar Land Rover, it will have a direct bearing on our ability to Sustain Growth in the New Europe. As we’re all well aware, the automotive business is facing a whole raft of challenges: * Recessionary economies * Damaging exchange rates - notably the weak dollar * Escalating commodity prices * Increasing regulation and taxation * And of course, intense competition fed, in part at least, by low cost producers. Large parts of the industry are not in the best of health right now and in the past few weeks, we’ve had very sharp reminders of that fact ... not least by events in the UK. The election was announced just as the MG Rover situation was entering its most critical phase and for all the political parties, the issues concerned became part of the campaign agenda. In the most dramatic way possible, the threats and challenges we deal with daily were revealed to the general public ... and they also showed how a new world order is shaping the industry’s future. -

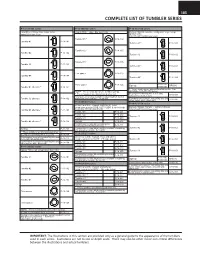

Complete List of Tumbler Series

185 COMPLETE LIST OF TUMBLER SERIES P-14-141/164 series P-14-194/196 series P-16-141/144 series Land Rover, Range Rover door locks Jaguar Tibbe – glove box locks only Datsun / Nissan, Subaru - using 6 cut keys except using X170 type keys ignition locks (X6-X7-62DT-62DU type keys) Tumbler #1 * P-14-194 Tumbler #1 P-14-141 Tumbler #1 * P-16-141 Tumbler #2 * P-14-195 Tumbler #2 P-14-142 Tumbler #2 * P-16-142 Tumbler #3 * P-14-196 Tumbler #3 P-14-143 Tumbler #3 * P-16-143 Thin spacer P-18-125 Tumbler #4 P-14-144 Tumbler #4 * P-16-144 P-16-105 Thick spacer P-18-126 Springs RP6546 Tumbler #1 alternate * P-14-161 P-00-100 * These tumblers are discontinued when out. Can NOTE: These locks do not use tumbler springs. substitute P-16-151/154 series Keying kit containing this series only * These tumblers are discontinued when out. A-16-104 Keying kit previously available containing both normal (discontinued when out) Tumbler #2 alternate * P-14-162 and glove box tumblers - A-14-108 Combination keying kit containing this and other series (disc. when out) A-16-100 P-14-201/203 series P-16-151/154 series British Cars (MG, Triumph, and others), Volvo using keys such as S71B, 62DP, 62DR, & others (code Datsun / Nissan, Subaru - using 6-cut keys Tumbler #3 alternate * P-14-163 series FS, FP, FR, and others) (X6-X7-62DT-62DU type keys) Tumbler #1 P-14-201 Tumbler #2 P-14-202 Tumbler #1 P-16-151 Tumbler #3 P-14-203 Tumbler #4 alternate * P-14-164 Springs P-14-200 Combination keying kit containing this series and P-14-211/213 series A-14-111 Tumbler #2 P-16-152 Springs P-31-100 Combination keying kit previously available containing this and other series - A-14-230 * These tumblers are discontinued when out. -

Embargoed Until 00:01 Friday 20Th September Leaders In

EMBARGOED UNTIL 00:01 FRIDAY 20TH SEPTEMBER LEADERS IN THE AUTOMOTIVE SECTOR JOIN TOGETHER TO RALLY BEHIND DISABILITY INCLUSION MOVEMENT • Three of the world’s leading automotive brands have signed up to support disability inclusion initiative The Valuable 500 • The campaign is currently striving for 500 global CEOs to commit to placing disability on their board agendas and be accountable in the fight for inclusion of all LONDON, 20th SEPTEMBER: Jaguar Land Rover, Jardine Motors, Aston Martin Lagonda today announce they are the latest global businesses to sign up to ground breaking disability inclusion campaign The Valuable 500, which is seeking 500 global businesses to address approaches to disability in business. The news comes as Jaguar Land Rover announces it will expand its work with disabled people, which currently involves the Invictus Games For wounded, injured and sick ex- services personnel, to help Future cars better meet their needs. This includes testing a prototype ‘mobility door’ that opens automatically as the driver approaches – technology that could help disabled people For whom a car is the main mode oF transport. Similarly, Jardine Motors will commit to Furthering their work to be inclusive oF all disabled people. This will include their work to help shape the wheelchair oF the Future through its partnership with corporate charity Whizz Kidz, as well as its work placement opportunities For young wheelchair users, which helps them gain important employability skills and broaden their awareness oF the types oF roles and careers available in a commercial business. Aston Martin Lagonda will build on its long history oF working with local community and charity groups to boost diversity in the work place. -

The UK Automotive Industry and the EU

The UK Automotive Industry and the EU An economic assessment of the interaction of the UK’s Automotive Industry with the European Union April 2014 kpmg.co.uk c | Section or Brochure name © 2014 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved. Introduction by Mike Hawes Europe is fundamental to the current and • Innovation in UK automotive is boosted by significant EU future success of the UK automotive industry R&D funding. In total approximately £3.5 billion has been awarded to UK businesses and universities across all sectors This report examines the evidence why, for UK automotive to encourage growth. businesses large and small, it is critical that the UK has a strong • Free movement of labour within European borders relationship with Europe. gives automotive businesses the ability to blend UK and In recent years, the UK has benefited from significant international talent at all levels of the industry. investments by many of the world’s major vehicle To supplement this report, we asked SMMT members for their manufacturers including BMW Group, Ford, Vauxhall, Jaguar views on the UK’s EU membership. Their verdict is clear. 92% Land Rover, Nissan and Toyota. This attests to the global of automotive companies said it was more beneficial to their nature and dynamism of this sector. The optimism that exists, business for the UK to stay in the EU, the majority with reform.