Agricultural Finance in Uganda: the Way Forward

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Report on the Implementation of the Investment Policy Review Uganda

Report on the Implementation of the Investment Policy Review Uganda United Nations Conference on Trade and Development REPORT ON THE IMPLEMENTATION OF THE INVESTMENT POLICY REVIEW UGANDA UNITED NATIONS New York and Geneva, 2007 Report on the Implementation of the Investment Policy Review Uganda Note UNCTAD serves as the focal point within the United Nations Secretariat for all matters related to foreign direct investment. This function was formerly carried out by the United Nations Centre on Transnational Corporations (1975-1992). UNCTAD's work is carried out through intergovernmental deliberations, research and analysis, technical assistance activities, seminars, workshops and conferences. The term "country" as used in this study also refers, as appropriate, to territories or areas; the designations employed and the presentation of the material do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. In addition, the designations of country groups are intended solely for statistical or analytical convenience and do not necessarily express a judgement about the stage of develop- ment reached by a particular country or area in the development process. The following symbols have been used in the tables: • Two dots (..) indicate that date are not available or not separately re- ported. Rows in tables have been omitted in those cases where no data are available for any of the elements in the row. • A dash (-) indicates that the item is equal to zero or its value is negligible. -

Agent Banking Faqs

Agent Banking Frequently Asked Questions 1. What is agent banking? An arrangement that allows a retail outlet serve as representative of the agent offering transactional services to the bank customers as defined by agency banking guidelines. 2. Where can I conduct agent banking transactions? You can perform your banking transactions at any agent in Uganda which has Agent Banking Company handshake Logo (black & green) available at the agent premises. 3. Where do I find the Standard Chartered authorised agents? The authorised Standard Chartered agents can be found at the locations below. No AGENT OUTLET NAME PHYSICAL OUTLET ADDRESS 1 Shell Namugongo Along Namugongo Road formerly Super oil Petrol Station 2 Shell Rubaga Road Along Rubaga Road 3 Shell Makerere Makerere - Bwaise Road, Opposite Eastern Gate 4 Shell Makindye Makindye- Opposite Military Barracks 5 Shell Muyenga Muyenga - Kibuli Road Towards Kabalagala 6 Shell Kansanga Kansanga - Next to Former Didi's World 7 Shell Najjanakumbi Entebbe Road - Opposite Kenjoy Supermarket 8 Shell Kampala Road Kampala Road before Commercial Plaza 9 Shell Portbell Portbell Road Adjacent to Silver Springs Hotel 10 Shell Kabowa Ndeeba, Nyanama Road 4. What should I do to become a Standard Chartered Approved Agent Visit any of the Standard Chartered branches to be provided the details of the requirements to become an Agent. 5. What types of transactions can I perform? As a Standard Charted Bank Uganda customer, you can conduct the following; a) cash deposit b) cash withdrawal 6. In which currency can I transact? You will only be allowed to perform cash withdrawal and cash deposit transactions in Uganda Shillings. -

Improving Access to Finance

46994 Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized for SmallBusiness Creating Opportunities IFC, a member of the World Bank Group, fosters sustainable economic growth in developing countries by fi nancing private sector investment, mobilizing private capital in local and international fi nancial markets, and providing advisory and risk mitigation services to businesses and governments. IFC’s vision is that poor people have the opportunity to escape poverty and improve their lives. In FY07, IFC committed $8.2 billion and mobilized an additional $3.9 billion through loan participation and structured fi nance for 299 investments in 69 developing countries. IFC also provided advisory services in 97 countries. For more information, visit www.ifc.org. Creating Opportunities for Small Business Table of Contents 2 Foreword 3 Approach 5 IFC and SMEs 7 Improving the Business Environment 11 Improving Access to Finance 15 Providing Access to Markets, Business Skills, and Information 19 Creating New Opportunities Through Innovation 21 Measuring Results 22 Frequently Asked Questions 23 Contact Details 24 Donor Partners Creating Opportunities for Small Business 1 Foreword IFC’s vision is for people in emerging markets to have opportunities IFC plays a catalytic and innovative role in developing small to escape poverty and improve their lives. This vision drives all of businesses. We can tap the policy experience of the World Bank our work to develop the private sector. These efforts range from and mobilize the resources of a wide range of partners, including investing directly in businesses, to mobilizing private fi nancing governments, other multilateral and bilateral agencies, academic from other investors, to advising companies, governments, and institutions, foundations, nongovernmental and civil society other stakeholders in private enterprises. -

Competition and Consumer Protection Scenario in Uganda

Competition and Consumer Protection Scenario in Uganda Consent Consumer Education Trust #0313 Competition and Consumer Protection Scenario in Uganda Consent CUTS Centre for Competition, Investment & Economic Regulation Consumer Education Trust Competition and Consumer Protection Scenario in Uganda Published by: CUTS Centre for Competition, Investment & Economic Regulation D-217, Bhaskar Marg, Bani Park, Jaipur 302 016, India Ph: +91.141.2207482, Fax: +91.141.2207486 Email: [email protected]/[email protected] Website: www.cuts.org Consent Consumer Education Trust Desai House, Plot 4 Parliament Avenue, GPO Box 1433, Kampala, Uganda Ph: +256.31.260431/2 Fax: +256.31.260432 Email: [email protected] Printed by: Jaipur Printers P. Ltd. Jaipur 302 001 ISBN 81-87222-85-9 © CUTS, 2003 #0313 SUGGESTED CONTRIBUTION Ush4000/INR100/US$5 Contents 1 General Background ........................................................... 5 1.1 UGANDA’S MACRO-ECONOMIC AND TRADE FRAMEWORK ................................................................... 5 1.2 STRUCTURE AND PERFORMANCE OF THE ECONOMY ............. 5 1.3 TRADE POLICY OVERVIEW ........................................................... 8 1.4 COMPETITION POLICY IN UGANDA .......................................... 10 2 Competition Policy and Law in Uganda ........................... 13 2.1 POWER SECTOR ........................................................................... 13 2.2 TELECOM ...................................................................................... 14 2.3 TRANSPORT ................................................................................. -

Daily Pricing Sheet

18th August, 2014 PAN AFRICA INDEX AND CURRENCY MOVEMENTS Country Index Name Index One Day MTD YTD 1 Year 1 Year FX Rate 1 Day MTD YTD Dollar Return % change Level % Chg % Chg % Chg High Low Current % Chg % Chg % Chg 1 Day MTD YTD Botswana BSE DCI 8,682.49 0.03 -0.07 15.61 22,116.00 7,255.90 1.00 761.87 761.87 678.51 762.10 761.27 800.03 Egypt EGX30 5,325.14 0.66 12.06 -2.51 5,969.39 4,523.32 1.00 600.98 600.98 536.39 605.63 685.49 520.40 Ghana GSE Composite 1,888.25 0.24 0.56 57.39 1,909.04 1,016.70 1.00 101.50 101.50 90.45 101.98 102.64 199.75 Ivory Coast IC COMP 208.77 0.91 -1.01 25.33 222.63 141.40 1.00 50,328.00 50,328.00 49,826.00 50,786.25 49,818.70 62,470.99 Kenya NSE 20 4,640.50 0.87 0.92 12.28 416,049.00 3,778.10 1.00 8,500.00 8,500.00 8,510.00 8,574.87 8,579.19 9,567.19 Malawi MSE AISI 6,999.98 0.06 1.24 16.37 6,999.98 5,874.77 1.00 32,600.00 32,600.00 33,369.50 32,620.57 33,004.49 38,846.96 Mauritius SEMDEX 1,869.06 -0.37 -2.38 7.91 1,956.29 1,653.98 1.00 3,000.00 3,000.00 2,955.00 2,988.48 2,926.20 3,196.64 Morocco MADEX 15,490.30 0.00 0.00 0.00 1.00 752.41 752.41 746.43 752.41 752.41 746.43 Namibia LOCAL 304.05 0.47 0.88 11.15 304.05 237.23 1.00 911.68 911.68 747.35 916.43 920.58 841.79 Nigeria NIG ALSI 37,128.40 0.31 2.67 32.23 40,012.66 20,025.93 1.00 15,950.00 15,950.00 15,515.00 15,999.55 16,377.88 20,547.60 South Africa JSE ALSI 39,638.54 -0.33 0.15 0.99 42,016.45 36,818.76 1.00 911.67 911.67 747.35 908.35 913.21 755.73 Swaziland SSX ALSI 289.42 0.00 0.00 1.31 289.42 284.32 1.00 911.67 911.67 747.35 911.67 911.67 758.47 -

Innovation Systems and Development the Journey of a Beleaguered Nile Perch Fishery in Uganda

Innovation Systems and Development The Journey of a Beleaguered Nile Perch Fishery in Uganda Maastricht Economic and social Research and training centre on Innovation and Technology © Copyright Rose Kiggundu, Maastricht 2006 ISBN-13: 978-90-5278-580-6 ISBN-10: 90 5278-580-5 Productie: Datawyse / Universitaire Pers Maastricht Innovation Systems and Development The Journey of a Beleaguered Nile Perch Fishery in Uganda PROEFSCHRIFT ter verkrijging van de graad van doctor aan de Universiteit Maastricht, op gezag van de Rector Magnificus, Prof.mr G.P.M.F. Mols, volgens het besluit van het College van Decanen in het openbaar te verdedigen op donderdag 26 oktober 2006 om 12.00 uur door Rose Kiggundu UMP UNIVERSITAIRE PERS MAASTRICHT Promotor Prof. dr. Lynn K. Mytelka Co-promotor Prof. dr. Banji Oyelaran-Oyeyinka Beoordelingscommissie Prof. dr. Robin Cowan (voorzitter) Prof. dr. ir. Wiebe Bijker Prof. Joanna Chataway, The Open University, Walton Hall, Milton Keynes, UK Acknowledgement When I started this research and learning journey six years ago, I thought I was going to write some kind of report like I always did in my past working life with banks, non- government organizations and donor agencies. A couple of years and mentoring exer- cises later, not only did I find that the world of academia had a completely different set of principles defining its values and character but also that a dissertation had its own life. My children, family and I chose to adapt our lives to the many demands of this dissertation. The path was far from easy but we were all determined to keep going and I must say we enjoyed the rollercoaster ride. -

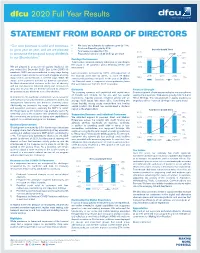

Dfcu 2020 Full Year Results

dfcu 2020 Full Year Results STATEMENT FROM BOARD OF DIRECTORS “Our core business is solid and continues • Net loans and advances to customers grew by 15%. • Customer Deposits grew by 27%. Deposits Growth Trend to grow year on year, and we are pleased • Total assets increased by 18%. 3,515 30% to announce the proposal to pay dividends • Proposed dividend of 50.33 Shillings per share. 27% 2,595 to our Shareholders.” 2,515 20% Earnings Performance 1,979 2,039 Total revenue remained relatively stable year on year despite 1,515 10% the impact of the pandemic and a declining interest rate 3% We are pleased to announce the audited results for the environment. 515 0% year ended 31st December 2020. Due to the COVID-19 0% pandemic, 2020 was unprecedented in many ways having Loan provisions increased by 107% and impairment of an adverse impact across the world and in Uganda affecting the financial asset rose by 400%, to reach 50 Billion 2018 2019 2020 many sectors and livelihoods in different ways. While the (485) -10% consequently posting a net profit for the year of 24 Billion. Deposits% Growth impact of the pandemic affected our business operations, The Financial asset is composed of non-performing loans the Bank demonstrated resilience in the face of adversity that were taken over from the 2017 transaction. and our core business remained strong and continued to grow year on year. We are therefore pleased to announce Dividends Financial Strength the proposal to pay dividends to our Shareholders. The company remained well capitalized with capital ratios Sustained growth of total assets underpins the strength and of 19.34% and 20.94% for tier one and two capital viability of our business. -

Effectiveness Review Public Disclosure Authorized Public Disclosure Authorized

Public Disclosure Authorized UGANDA Microfinance Sector Effectiveness Review Public Disclosure Authorized Public Disclosure Authorized Ruth Goodwin-Groen, CGAP consultant Till Bruett, Alternative Credit Technologies Alexia Latortue, CGAP October 2004 Public Disclosure Authorized Uganda Microfinance Effect iveness Review Page i CONTENTS Acknowledgments ………………………………………………………………….ii List of Acronyms …………………………………………………………………...iii Executive Summary…………………………………………………………...……iv I. Background ………………………………………………………………1 II. Overview of Microfinance in Uganda ……………………………………..3 III. Driver No. 1: Shared Stakeholder Vision …………………………………9 IV. Driver No. 2: Skilled Human Resources ………………………………….15 V. Driver No. 3: Intensive Stakeholder Collaboration ……………………..18 VI. The Donor Role and the Use of Subsidies …………………………….......25 Selected Bibliography ………………………………………………………………29 Annex 1: List of People Interviewed………………………………………………32 Annex 2. Ugandan MFI and Donor Survey Results……………………………...36 Uganda Microfinance Effect iveness Review Page ii ACKNOWLEDGMENTS In a short month earlier this year, we were privileged to meet a broad cross section of professionals in the microfinance sector in Uganda, as well as the sector champions from the past five years. Everyone we interviewed, individually or in a group, as well as those with whom we spoke briefly over the phone or in large meetings, was gracious and patient, and brought new insights into the development of the sector. We are truly impressed with the commitment and unity of purpose in serving low-income clients. With much gratitude, we thank each of you for your shared wisdom and trust this report will enrich your work. It was the private sector donors who had the foresight to see how much could be learned from Ugandan microfinance. It was the organizational prowess of Jackie Atenyi (GTZ), Gabriella Braun (GTZ), and Joanna Ledgerwood (SPEED) that enabled us to achieve so much in a short time. -

Cogen for Africa – Full Size Project Brief Annexes Table of Contents

COGEN FOR AFRICA – FULL SIZE PROJECT BRIEF ANNEXES TABLE OF CONTENTS ANNEX A: INCREMENTAL COST ANALYSIS .................................................................................... 3 ANNEX B: LOGICAL FRAMEWORK .................................................................................................... 7 ANNEX C: RESPONSE TO PROJECT REVIEWERS ..........................................................................15 TECHNICAL REVIEW OF COGEN FOR AFRICA PROJECT PROPOSAL ............................................................ 15 RESPONSE.............................................................................................................................................. 19 ANNEX D: THE DESIGN OF THE AFRICA COGEN CENTRE.........................................................20 ANNEX E: STAKEHOLDER GROUPS, THEIR INVOLVEMENT AND ROLE IN, AND BENEFITS FROM, THE PROJECT ........................................................................................................26 ANNEX F: MONITORING AND EVALUATION PLAN ......................................................................28 ANNEX I: WORK PLAN, SCHEDULE AND MILESTONES ..............................................................30 ANNEX J: SUMMARY OF CO-FINANCIERS.......................................................................................33 ANNEX K: PRE-FEASIBILITY ASSESSMENT OF COGENERATION IN SELECTED SUGAR FACTORIES................................................................................................................................................36 -

Dfcu Limited Was Established in 1964 As a Development Finance Institution

dfcu 2013 Annual Report i Who We Are ii Board of Directors iv Women Business Advisory Council vi Senior Management Team vii Women in Business Update viii Branch Expansion ix Harnessing Uganda’s Competitive Advantage in Agriculture x Making More Possible xii Business Highlights xiv A Rich Heritage xv Making a Difference in Our Communities xvi Financial Overview 2013 xviii Chairman’s Statement xx Sustainability Report xxiv inside Corporate Governance Statement xxvi The Year Ahead xxx Annual Report and Financial Statements 1–62 ii dfcu 2013 Annual Report Who we are dfcu Limited was established in 1964 as a Development Finance institution. Over the years dfcu has been associated with many success stories in Uganda’s economy in various sectors: agribusiness, communication, education, health, manufacturing, tourism, real estate, mining, construction, transport, trade and commerce. dfcu Limited dfcu Bank channels • Currently boasts of a network of 34 branches • Bought Uganda Leasing Company, renamed it dfcu countrywide Leasing (1999) • Is connected to Interswitch giving clients access to a • Bought Gold Trust Bank, renamed it dfcu Bank, and network of over 200 ATMs countrywide started commercial banking (2000) • Offers banking through the Internet and mobile • dfcu Limited was listed on the Uganda Securities phone channels Exchange (2004) • Merged its two businesses (Development Finance The Bank is structured into three core business units and dfcu Bank) to create a “one-stop-shop” under namely: Consumer Banking (CB), Development and dfcu Bank -

Directory of Development Organizations

EDITION 2010 VOLUME I.B / AFRICA DIRECTORY OF DEVELOPMENT ORGANIZATIONS GUIDE TO INTERNATIONAL ORGANIZATIONS, GOVERNMENTS, PRIVATE SECTOR DEVELOPMENT AGENCIES, CIVIL SOCIETY, UNIVERSITIES, GRANTMAKERS, BANKS, MICROFINANCE INSTITUTIONS AND DEVELOPMENT CONSULTING FIRMS Resource Guide to Development Organizations and the Internet Introduction Welcome to the directory of development organizations 2010, Volume I: Africa The directory of development organizations, listing 63.350 development organizations, has been prepared to facilitate international cooperation and knowledge sharing in development work, both among civil society organizations, research institutions, governments and the private sector. The directory aims to promote interaction and active partnerships among key development organisations in civil society, including NGOs, trade unions, faith-based organizations, indigenous peoples movements, foundations and research centres. In creating opportunities for dialogue with governments and private sector, civil society organizations are helping to amplify the voices of the poorest people in the decisions that affect their lives, improve development effectiveness and sustainability and hold governments and policymakers publicly accountable. In particular, the directory is intended to provide a comprehensive source of reference for development practitioners, researchers, donor employees, and policymakers who are committed to good governance, sustainable development and poverty reduction, through: the financial sector and microfinance, -

Gender Entrepreneurship Markets First

39664 Gender Entrepreneurship Markets First Quarter Edition Public Disclosure Authorized Global Newsletter: April 2007 IFC GEM welcomes you to its tenth quarterly newsletter designed to keep businesswomen in touch with key events, relevant research and, most importantly, each other! We provide brief descriptions of news, events, and online resources that will involve, inspire and inform you and others like you. Wherever possible and appropriate, we provide a link to further detail. This issue’s highlights include news of IFC and other World Bank Group activities (including the launch of women’s banking programs in Tanzania and Uganda), news Public Disclosure Authorized reports from other resources (including the Cartier Women’s Initiative Awards), upcoming events around the globe (including the Commonwealth Secretariat Women Ministers Affairs Meeting in Uganda), and links to useful resources (including the Lebanese League for Women in Business). Our regular spotlight this issue falls on Julian Omalla, the owner of Delight Ltd, a booming Ugandan business that includes juice production, a bakery, farm, and a hostel business. This newsletter shares helpful news and information with women entrepreneurs around the world. If you or your business association have an event you would like to make known, have a success story to share, or would like to tell us what you would like to read more about, please email us. This newsletter is for you and we want to keep you involved. The IFC GEM Newsletter is also available in French, Arabic, and Farsi. Public Disclosure Authorized NEWS News from IFC GEM and the World Bank Group Women’s Economic Empowerment Focus of Berlin Conference A number of European governments, the OECD, and the World Bank Group teamed up this February at a conference in Berlin to discuss ways of increasing the economic power of women.