BCD 17-24 April 4, 2017 EMPLOYER STATUS DETERMINATION

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Index to Volume 77

INDEX TO VOLUME 77 Reproduction of any part of this volume for commercial pur poses is not allowed without the specific permission of the publishers. All contents © 2016 and 2017 by Kalmbach Publishing Co., Wau kesha, Wis. JANUARY 2017 THROUGH DECEMBER 2017 – 910 PAGES HOW TO USE THIS INDEX: Feature material has been indexed three or more times—once by the title under which it was published, again under the author’s last name, and finally under one or more of the subject categories or railroads. Photographs standing alone are indexed (usually by railroad), but photo graphs within a feature article are not separately indexed. Brief news items are indexed under the appropriate railroad and/or category; news stories are indexed under the appro- priate railroad and/or category and under the author’s last name. Most references to people are indexed under the company with which they are easily identified; if there is no easy identification, they may be indexed under the person’s last name (for deaths, see “Obi t uaries”). Maps, museums, radio frequencies, railroad historical societies, rosters of locomotives and equipment, product reviews, and stations are indexed under these categories. Items from countries other than the U.S. and Canada are indexed under the appropriate country. A Amtrak Capitol Limited at Point of Rocks, Md., Gallery, 10 minutes at Fassifern, In My Own Words, Jan 56-57 Mar 69 Aberdeen & Asheboro: Amtrak consists, Ask TRAINS, Nov 65 Sleepy short line to busy unit train host, Jun 24-31 (correc) Amtrak diners enter service, -

MAY 2018 Volume 32, Issue 5

MAY 2018 Volume 32, Issue 5 Daily news updates ocomotive WWW.BLE-T.ORG LE NGIN ee RS & T RAINM E N N E WS Published by the BLET, a division of the Rail Conference,• International Brotherhood of Teamsters Honoring first responders Spanning the ex-Virginian Railway bridge at Slab Fork, Norfolk Southern’s “Honoring First Responders” EMD SD60E No. 911 leads empties toward Alloy Yard from Mullens on Watco’s Kanawha River Railroad on January 24, 2017. Photo: Chase Gunnoe BLET files joint comments regarding rail industry automation he Brotherhood of Locomo- Signatories to the 26-page joint sub- its mandate from Congress, which reads to protect the jobs and incomes of their tive Engineers and Train- mission were: National President Den- in part: “[i]n carrying out its duties, the members should not be used to discount men (BLET) was one of five nis R. Pierce, Brotherhood of Locomo- Administration shall consider the as- their arguments on behalf of safety. rail Brotherhoods to file tive Engineers and Trainmen (BLET); signment and maintenance of safety as “Discounting our safety concerns joint comments on May 7 President John Previsich, SMART Trans- the highest priority, recognizing the because we fight to preserve jobs and in response to the Federal Railroad Ad- portation Division; President W. Dan clear intent, encouragement, and ded- earnings is the most extreme form of Tministration’s (FRA) March 29 Request Pickett, Brotherhood of Railroad Signal- ication of Congress to the furtherance double standard, given the profit-seek- For Information (RFI) regarding auto- men (BRS); President F. Leo McCann, of the highest degree of safety in rail- ing goal of the industry underlying its mation in the railroad industry. -

2020 West Virginia State Rail Plan

West Virginia State Rail Plan DECEMBER 2020 The West Virginia State Rail Authority appreciates the effort, energy, and engagement of our partners who helped make the 2020 West Virginia State Rail Plan possible. As committed members of the Steering Committee, the following individuals provided critical guidance, advice, information and vision throughout the plan development. Key rail champions and community members, committed to advancing rail in the state, provided enthusiasm and feedback from community and users perspectives. 2020 State Rail Plan Steering Committee Cindy Butler Executive Director, West Virginia State Rail Authority Byrd White Secretary of Transportation, West Virginia Department of Transportation Jimmy Wriston Deputy Commissioner, Division of Highways, West Virginia Department of Transportation Ira Baldwin Deputy Director, Transportation Division West Virginia Public Service Commission David Cramer Director, Commissioner’s Office of Economic Development, West Virginia Department of Transportation Jordan Damron Communications, Governor’s Office Randy Damron Information Core, West Virginia Division of Highways Jessie Fernandez-Gatti Community Planner, Federal Railroad Administration Alanna Keller Engineering Advisor, West Virginia Department of Transportation Chris Kinsey Statewide Planning Section Head, Planning Division, West Virginia Division of Highways Ryland Musick Deputy State Highway Engineer, West Virginia Division of Highways Elwood Penn Division Director, Planning Division, West Virginia Department of Highways John Perry Manager, Railroad Safety Section, West Virginia Public Service Commission Nathan Takitch Project Manager, West Virginia Department of Commerce Ann Urling Deputy Chief of Staff, Governor’s Office 2020 State Rail Plan Advisory Committee Sean D. Hill Director, West Virginia Aeronautics Commission William “Bill” Robinson Executive Director, Division of Public Transit, West Virginia Department of Transportation Robert C. -

Freight Tariff Wts 9012 Accessorial & Switching Tariff

FREIGHT TARIFF WTS 9012 ACCESSORIAL & SWITCHING TARIFF Watco Transportation Services, LLC DEMURRAGE, STORAGE, ACCESSORIAL AND SWITCHING TARIFF (Replaces and Supersedes all individual railroad tariffs falling under Watco Transportation Services and supplements/revisions thereto) CONTAINING DEMURRAGE AND STORAGE CHARGES RECIPROCAL & TERMINAL SWITCHING AND MISCELLANEOUS RAILROAD CHARGES FOR GENERAL RULES & CONDITIONS OF CARRIAGE SEE TARIFF WTS 9011-SERIES APPLICABLE ON EXPORT, IMPORT, INTERSTATE AND INTRASTATE TRAFFIC ISSUE DATE: October 2, 2018 EFFECTIVE DATE: November 1, 2018 ISSUED BY: Doug Conway - Vice President of Commercial Donovan Butler – Manager of Pricing Administration 10895 Grandview Drive, Ste 360 Overland Park, KS 66210 www.watcocompanies.com 1 | Page FREIGHT TARIFF WTS 9012 ACCESSORIAL & SWITCHING TARIFF SUBSCRIBING RAILROADS ANN ARBOR RAILROAD INC (AA) ALABAMA SOUTHERN RAILROAD LLC (ABS) ALABAMA WARRIOR RAILWAY LLC (ABWR) ARKANSAS SOUTHERN RAILROAD LLC (ARS) AUSTIN WESTERN RAILROAD LLC (AWRR) AUTAUGA NORTHERN RAILROAD LLC (AUT) BATON ROUGE SOUTHERN RAILROAD LLC (BRS) BIRMINGHAM TERMINAL RAILWAY LLC (BHRR) BLUE RIDGE SOUTHERN RAILROAD LLC (BLU) BOISE VALLEY RAILROAD LLC (BVRR) DECATUR & EASTERN ILLINOIS RAILROAD LLC (DREI) EASTERN IDAHO RAILROAD LLC (EIRR) GRAND ELK RAILROAD INC (GDLK) GREAT NORTHWEST RAILROAD LLC (GRNW) GEAUX GEAUX RAILROAD LLC (GOGR) JACKSONVILLE PORT TERMINAL RAILROAD LLC (JXPT) KANAWHA RIVER RAILROAD LLC (KNWA) KAW RIVER RAILROAD LLC (KAW) KANSAS & OKLAHOMA RAILROAD LLC (KO) LOUISIANA SOUTHERN RAILROAD -

West Virginia Rail Fast Facts for 2019 Freight Railroads …

Freight Railroads in West Virginia Rail Fast Facts For 2019 Freight railroads ….............................................................................................................................................................11 Freight railroad mileage …..........................................................................................................................................2,141 Freight rail employees …...............................................................................................................................................1,838 Average wages & benefits per employee …...................................................................................................$119,960 Railroad retirement beneficiaries …......................................................................................................................7,100 Railroad retirement benefits paid ….....................................................................................................................$188 million U.S. Economy: According to a Towson University study, in 2017, America's Class I railroads supported: Sustainability: Railroads are the most fuel efficient way to move freight over land. It would have taken approximately 9.2 million additional trucks to handle the 166.4 million tons of freight that moved by rail in West Virginia in 2019. Rail Traffic Originated in 2019 Total Tons: 62.3 million Total Carloads: 548,300 Commodity Tons (mil) Carloads Coal 55.5 474,600 Other 6.8 73,700 Source: AAR analysis -

Sand Move Starts and Finishes with Watco Short Lines by Tracie Vanbecelaere Managing Editor

The newsletter for Watco Companies - August 2017, Volume 18, Issue 8 Sand move starts and finishes with Watco short lines by Tracie VanBecelaere Managing Editor There’s a lot of sand in Louisiana, but it’s not just another day at the beach. This sand, which is actually frac sand used in drilling, moves from Wis- consin down to Louisiana by rail, originating at one Watco short line, the Wisconsin & Southern Railroad (WSOR), and ending at another, the Louisi- ana Southern Railroad (LAS). Although this particular move just began roll- ing in June of 2017, there is history behind the move that made it happen. The sand is being shipped from Badger Mining’s Fairwater mine in Utley, Wisconsin. Badger Mining merged with Atlas Resin Proppants in 2015 and that’s where the Watco connection began: Atlas had been shipping product on the LAS since 2010. Badger also has two other Watco destination termi- nals, Dore, North Dakota, and the Pecos Valley Southern Railway in Pecos, Texas. The primary difference between the shipments to Louisiana and the other locations is that this one will be consistent with an expected 2,880 railcars or 288,000 tons moving the first year. Steve Banker, Badger Mining’s logistics development manager, said, More than two million tons of sand is scheduled to ship annually from Bad- “When we need to research potential destination facilities to meet our Cus- ger Mining's Fairwater mine in Utley, Wisconsin, to Louisiana. The railcars tomer's needs, one of my first considerations is to see if there is a Watco rail- travel from Watco's Wisconsin & Southern Railroad to the CP and then the road or distribution point that services the Customer's area. -

2016 Volume 47 Number 7 July 2016

1935 - 2016 VOLUME 47 NUMBER 7 D ISTRICT 2 - CHAPTER WEBSITE : WWW .NRHS 1. ORG JULY 2016 LANCASTER DISPATCHER PAGE 2 JULY 2016 WHEN THEY WERE NEW - JULY, 1958 NEARLY NEW , TWO OF PRR’ S SIX BUDD -BUILT MP85 CARS PAUSE AT OVERBROOK DURING A PAOLI –P HILADELPHIA RUN IN JULY 1958 - AARON G. FRYER PHOTO LANCASTER DISPATCHER PAGE 3 JULY 2016 THE POWER DIRECTOR “NEWS FROM THE RAILROAD WIRES ” NTSB FINDINGS IN AMTRAK 188 CRASH DRAW “An awful explanation to the families who have lost loved ones,” lawyer WIDESPREAD CRITICISM Judy Livingston tells the AP. Another attorney, Tom Kline, says the By David Ibata, May 19, 2016 - Trains News Wire findings are “based on speculation” and inadmissible in a court of law. After focusing blame on the engineer of a Northeast Bostian and his attorney have not responded to requests for comment, the Corridor train that took a curve too fast and derailed, killing eight AP says. passengers, the National Transportation Safety Board is now under fire Following the lead of NTSB board members, others reiterate their calls for from safety experts, the locomotive engineers’ union and victims of the PTC to be installed across the nation’s rail system. accident. “While Amtrak has fully implemented PTC along the Northeast Corridor, Russ Quimby, a railroad consultant and former NTSB accident investigator, host railroads that Amtrak relies on, along with commuter rail systems criticizes the agency for putting the onus of the May 12, 2015, crash on an across the country, are still operating without this critical safety individual and not giving equal weight to the track segment in question. -

May 8, 2019 Dear Commissioners

May 8, 2019 Dear Commissioners: Enclosed please find relevant information to the Wednesday, May 15, 2019, Commission Meeting. Minutes of the Wednesday, March 20, 2019, Commission Meeting are included for your review. This meeting will be held at The Ohio Department of Public Safety, Atrium, at 1970 West Broad Street, Columbus. The Administrative Committee will meet at 10 a.m. in the Atrium. The Policy Committee will not meet. The ORDC Commission meeting will begin promptly at 11:00 a.m. If you haven’t already done so, please contact Wende Jourdan to confirm your attendance. You may reach her at 614-728-9497 (telephone) or by e-mail at [email protected]. We look forward to seeing you. Sincerely, Mark Policinski Chairman Enclosures 1 The Ohio Department of Public Safety - Atrium 1970 West Broad Street, Columbus, Ohio COMMISSION MEETING AGENDA Wednesday, May 15, 2019, 11:00 a.m. Administrative Committee will meet at 10:00 a.m. CALL TO ORDER: Mark Policinski, Chairman · Welcome · Roll Call · Approval of Minutes from March 20, 2019 Meeting EXECUTIVE DIRECTOR REPORT: Matt Dietrich FINANCE REPORT: Megan McClory ITEMS FOR APPROVAL · Resolution 19-05 Kanawha River Railroad – Hobson Yard Expansion and Rehabilitation · Resolution 19-06 Cleveland & Cuyahoga Railway – Cleveland Division Rehabilitation PROJECT BRIEFINGS · FeX Processing Expansion & Rail Spur Installation · Ashland Railway – Bridge and Culvert Repairs · Genesee & Wyoming Northeast Region – Bridge Repairs COMMITTEE REPORTS OLD BUSINESS · Resolution 19-04 Central Railroad of Indiana Mainline Rehabilitation NEW BUSINESS PUBLIC COMMENT ADJOURN 2 MINUTES FROM THE OHIO RAIL DEVELOPMENT COMMISSION REGULAR BI-MONTHLY MEETING March 20, 2019 CALL TO ORDER Due to the absence of Chairman Policinski, Vice Chair Jackson called the meeting of the Ohio Rail Development Commission to order at 11:01 am on Wednesday, March 20, 2019. -

PC*MILER Geocode Files Reference Guide | Page 1 File Usage Restrictions All Geocode Files Are Copyrighted Works of ALK Technologies, Inc

Reference Guide | Beta v10.3.0 | Revision 1 . 0 Copyrights You may print one (1) copy of this document for your personal use. Otherwise, no part of this document may be reproduced, transmitted, transcribed, stored in a retrieval system, or translated into any language, in any form or by any means electronic, mechanical, magnetic, optical, or otherwise, without prior written permission from ALK Technologies, Inc. Copyright © 1986-2017 ALK Technologies, Inc. All Rights Reserved. ALK Data © 2017 – All Rights Reserved. ALK Technologies, Inc. reserves the right to make changes or improvements to its programs and documentation materials at any time and without prior notice. PC*MILER®, CoPilot® Truck™, ALK®, RouteSync®, and TripDirect® are registered trademarks of ALK Technologies, Inc. Microsoft and Windows are registered trademarks of Microsoft Corporation in the United States and other countries. IBM is a registered trademark of International Business Machines Corporation. Xceed Toolkit and AvalonDock Libraries Copyright © 1994-2016 Xceed Software Inc., all rights reserved. The Software is protected by Canadian and United States copyright laws, international treaties and other applicable national or international laws. Satellite Imagery © DigitalGlobe, Inc. All Rights Reserved. Weather data provided by Environment Canada (EC), U.S. National Weather Service (NWS), U.S. National Oceanic and Atmospheric Administration (NOAA), and AerisWeather. © Copyright 2017. All Rights Reserved. Traffic information provided by INRIX © 2017. All rights reserved by INRIX, Inc. Standard Point Location Codes (SPLC) data used in PC*MILER products is owned, maintained and copyrighted by the National Motor Freight Traffic Association, Inc. Statistics Canada Postal Code™ Conversion File which is based on data licensed from Canada Post Corporation. -

Public Notice

PUBLIC NOTICE Federal Communications Commission News Media Information 202 / 418-0500 445 12th St., S.W. Internet: http://www.fcc.gov Washington, D.C. 20554 TTY: 1-888-835-5322 Report Number: 15795 Date of Report: 03/31/2021 Wireless Telecommunications Bureau Assignment of License Authorization Applications, Transfer of Control of Licensee Applications, De Facto Transfer Lease Applications and Spectrum Manager Lease Notifications, Designated Entity Reportable Eligibility Event Applications, and Designated Entity Annual Reports Action This Public Notice contains a listing of applications that have been acted upon by the Commission. Assignment of License Authorization Applications and Transfer of Control of Licensee Applications Purpose File Number Parties Action Date Action AA 0006906481 Assignor: Note Acquisitions 03/24/2021 Z Assignee: I.O.U. Acquisitions Full Assignment Call Sign or Lead Call Sign: WQZ691 Commencement date: 00/00/0000 Radio Service Code(s) CD Page 1 Purpose File Number Parties Action Date Action TC 0007076959 Licensee: Regional Disposal Company 03/24/2021 Z Transferor: Allied Waste Industries, Inc. Transferee: Republic Services, Inc. Transfer of Control Call Sign or Lead Call Sign: WNXU792 Commencement date: 00/00/0000 Radio Service Code(s) GB AM 0007077106 Licensee: Allied Waste North America, Inc. 03/24/2021 Z Transferor: Allied Waste Industries, Inc. Transferee: Republic Services, Inc. Transfer of Control Call Sign or Lead Call Sign: KNHT944 Commencement date: 00/00/0000 Radio Service Code(s) IG TC 0007077235 Licensee: BFI Waste Systems of North America, Inc. 03/24/2021 Z Transferor: Allied Waste Industries, Inc. Transferee: Republic Services, Inc. Transfer of Control Call Sign or Lead Call Sign: WPOA803 Commencement date: 00/00/0000 Radio Service Code(s) IG TC 0007077525 Licensee: Browning Ferris Industries of California, Inc. -

West Virginia Public Port Authority Statewide Strategic Port Master Plan

WEST VIRGINIA PUBLIC PORT AUTHORITY STATEWIDE STRATEGIC PORT MASTER PLAN PHASE I: STATEWIDE STRATEGIC PLAN FINAL REPORT April 25, 2012 PREPARED FOR: West Virginia Public Port Authority 1900 Kanawha Boulevard East Building Five, Room 122 Charleston, West Virginia 25305-0430 PREPARED BY: 100 South Charles Street Tower 1, 10th Floor Baltimore, Maryland 21201 DISCLAIMER AND LIMITATIONS This document is disseminated under the sponsorship of the West Virginia Public Port Authority. The statements, findings, conclusions, and recommendations in this report are those of the researchers and staff, and do not necessarily reflect the views of the state government agency that funded the study. Certain forward-looking statements are based upon interpretations or assessments of best available information at the time of writing. Actual events may differ from those assumed, and events are subject to change. Factors influencing the accuracy and completeness of the forward-looking statements may exist that are outside of the purview of the consulting firm. Parsons Brinckerhoff’s report is thus to be viewed as an assessment that is time-sensitive and relevant only to conditions at the time of writing. Neither the West Virginia Department of Transportation nor any agency thereof, nor any of their employees, nor any of their contractors, subcontractors or their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or any third party's use or the results of such use of any information contained in this document in whole or in part. Questions regarding this report or its contents should be directed to: Blair Garcia, Project Manager, +1 757 466 9671; Jeff Schechtman, Principal-in-Charge, +1 860 805 9595. -

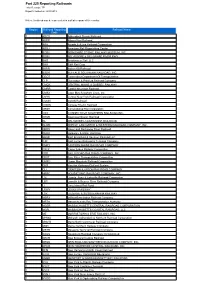

Part 225 Reporting Railroads.Pdf

Part 225 Reporting Railroads Total Records: 771 Report Created on: 4/30/2019 Notes: A railroad may be represented in multiple regions of the country. Region Railroad Reporting Railroad Name Code 1 ADCX Adirondack Scenic Railroad 1 APRR Albany Port Railroad 1 ARA Arcade & Attica Railroad Corporation 1 ARDJ American Rail Dispatching Center 1 BCRY BERKSHIRE SCENIC RAILWAY MUSEUM, INC. 1 BDRV BELVEDERE & DELAWARE RIVER RWY 1 BHR Brookhaven Rail, LLC 1 BHX B&H Rail Corp 1 BKRR Batten Kill Railroad 1 BSOR BUFFALO SOUTHERN RAILROAD, INC. 1 CDOT Connecticut Department Of Transportation 1 CLP Clarendon & Pittsford Railroad Company 1 CMQX CENTRAL MAINE & QUEBEC RAILWAY 1 CMRR Catskill Mountain Railroad 1 CMSX Cape May Seashore Lines, Inc. 1 CNYK Central New York Railroad Corporation 1 COGN COGN Railroad 1 CONW Conway Scenic Railroad 1 CRSH Consolidated Rail Corporation 1 CSO CONNECTICUT SOUTHERN RAILROAD INC. 1 DESR Downeast Scenic Railroad 1 DL DELAWARE LACKAWANNA RAILROAD 1 DLWR DEPEW, LANCASTER & WESTERN RAILROAD COMPANY, INC. 1 DRRV Dover and Rockaway River Railroad 1 DURR Delaware & Ulster Rail Ride 1 EBSR East Brookfield & Spencer Railroad LLC 1 EJR East Jersey Railroad & Terminal Company 1 EMRY EASTERN MAINE RAILROAD COMPANY 1 FGLK Finger Lakes Railway Corporation 1 FRR FALLS ROAD RAILROAD COMPANY, INC. 1 FRVT Fore River Transportation Corporation 1 GMRC Green Mountain Railroad Corporation 1 GRS Pan Am Railways/Guilford System 1 GU GRAFTON & UPTON RAILROAD COMPANY 1 HRRC HOUSATONIC RAILROAD COMPANY, INC. 1 LAL Livonia, Avon & Lakeville Railroad Corporation 1 LBR Lowville & Beaver River Railroad Company 1 LI Long Island Rail Road 1 LRWY LEHIGH RAILWAY 1 LSX LUZERNE & SUSQUEHANNA RAILWAY 1 MBRX Milford-Bennington Railroad Company 1 MBTA Massachusetts Bay Transportation Authority 1 MCER MASSACHUSETTS CENTRAL RAILROAD CORPORATION 1 MCRL MASSACHUSETTS COASTAL RAILROAD, LLC 1 ME MORRISTOWN & ERIE RAILWAY, INC.