Nord Stream 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Economics of the Nord Stream Pipeline System

The Economics of the Nord Stream Pipeline System Chi Kong Chyong, Pierre Noël and David M. Reiner September 2010 CWPE 1051 & EPRG 1026 The Economics of the Nord Stream Pipeline System EPRG Working Paper 1026 Cambridge Working Paper in Economics 1051 Chi Kong Chyong, Pierre Noёl and David M. Reiner Abstract We calculate the total cost of building Nord Stream and compare its levelised unit transportation cost with the existing options to transport Russian gas to western Europe. We find that the unit cost of shipping through Nord Stream is clearly lower than using the Ukrainian route and is only slightly above shipping through the Yamal-Europe pipeline. Using a large-scale gas simulation model we find a positive economic value for Nord Stream under various scenarios of demand for Russian gas in Europe. We disaggregate the value of Nord Stream into project economics (cost advantage), strategic value (impact on Ukraine’s transit fee) and security of supply value (insurance against disruption of the Ukrainian transit corridor). The economic fundamentals account for the bulk of Nord Stream’s positive value in all our scenarios. Keywords Nord Stream, Russia, Europe, Ukraine, Natural gas, Pipeline, Gazprom JEL Classification L95, H43, C63 Contact [email protected] Publication September 2010 EPRG WORKING PAPER Financial Support ESRC TSEC 3 www.eprg.group.cam.ac.uk The Economics of the Nord Stream Pipeline System1 Chi Kong Chyong* Electricity Policy Research Group (EPRG), Judge Business School, University of Cambridge (PhD Candidate) Pierre Noёl EPRG, Judge Business School, University of Cambridge David M. Reiner EPRG, Judge Business School, University of Cambridge 1. -

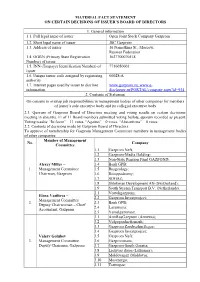

Material Fact Statement on Certain Decisions of Issuer’S Board of Directors

MATERIAL FACT STATEMENT ON CERTAIN DECISIONS OF ISSUER’S BOARD OF DIRECTORS 1. General information 1.1. Full legal name of issuer Open Joint Stock Company Gazprom 1.2. Short legal name of issuer JSC Gazprom 1.3. Address of issuer 16 Nametkina St., Moscow, Russian Federation 1.4. OGRN (Primary State Registration 1027700070518 Number) of issuer 1.5. INN (Taxpayer Identification Number) of 7736050003 issuer 1.6. Unique issuer code assigned by registering 00028-А authority 1.7. Internet pages used by issuer to disclose www.gazprom.ru; www.e- information disclosure.ru/PORTAL/company.aspx?id=934 2. Contents of Statement On consent to overlap job responsibilities in management bodies of other companies for members of issuer’s sole executive body and its collegial executive body 2.1. Quorum of Gazprom Board of Directors meeting and voting results on certain decisions: meeting in absentia, 11 of 11 Board members submitted voting ballots, quorum recorded as present. Voting results: “In favor” – 11 votes, “Against” – 0 votes, “Abstentions” – 0 votes. 2.2. Contents of decisions made by Gazprom Board of Directors: To approve of membership for Gazprom Management Committee members in management bodies of other companies: Member of Management No. Company Committee 1.1 Gazprom Neft; 1.2 Gazprom-Media Holding; 1.3 Non-State Pension Fund GAZFOND; Alexey Miller – 1.4 Bank GPB; 1. Management Committee 1.5 Rusgeology; Chairman, Gazprom 1.6 Rosippodromy; 1.7 SOGAZ; 1.8 Shtokman Development AG (Switzerland); 1.9 South Stream Transport B.V. (Netherlands). 2.1 Vostokgazprom; Elena Vasilieva – 2.2 Gazprom Investproject; Management Committee 2. -

Satellite Ice Extent, Sea Surface Temperature, and Atmospheric 2 Methane Trends in the Barents and Kara Seas

The Cryosphere Discuss., https://doi.org/10.5194/tc-2018-237 Manuscript under review for journal The Cryosphere Discussion started: 22 November 2018 c Author(s) 2018. CC BY 4.0 License. 1 Satellite ice extent, sea surface temperature, and atmospheric 2 methane trends in the Barents and Kara Seas 1 2 3 2 4 3 Ira Leifer , F. Robert Chen , Thomas McClimans , Frank Muller Karger , Leonid Yurganov 1 4 Bubbleology Research International, Inc., Solvang, CA, USA 2 5 University of Southern Florida, USA 3 6 SINTEF Ocean, Trondheim, Norway 4 7 University of Maryland, Baltimore, USA 8 Correspondence to: Ira Leifer ([email protected]) 9 10 Abstract. Over a decade (2003-2015) of satellite data of sea-ice extent, sea surface temperature (SST), and methane 11 (CH4) concentrations in lower troposphere over 10 focus areas within the Barents and Kara Seas (BKS) were 12 analyzed for anomalies and trends relative to the Barents Sea. Large positive CH4 anomalies were discovered around 13 Franz Josef Land (FJL) and offshore west Novaya Zemlya in early fall. Far smaller CH4 enhancement was found 14 around Svalbard, downstream and north of known seabed seepage. SST increased in all focus areas at rates from 15 0.0018 to 0.15 °C yr-1, CH4 growth spanned 3.06 to 3.49 ppb yr-1. 16 The strongest SST increase was observed each year in the southeast Barents Sea in June due to strengthening of 17 the warm Murman Current (MC), and in the south Kara Sea in September. The southeast Barents Sea, the south 18 Kara Sea and coastal areas around FJL exhibited the strongest CH4 growth over the observation period. -

Sanctions Against Russia: a Look Into 2020

POLICY BRIEF 27 / 2020 Sanctions Against Russia: A Look Into 2020 Ivan Timofeev, Vladimir Morozov, Yulia Timofeeva RUSSIAN INTERNATIONAL AFFAIRS COUNCIL BOARD OF TRUSTEES PRESIDIUM Sergey Lavrov – Chairman Mikhail Margelov Petr Aven of the Board of Trustees Yury Osipov Igor Ivanov – President Herman Gref Sergey Prikhodko Andrey Kortunov – Director General Aleksandr Dzasokhov Anatoly Torkunov Fyodor Lukyanov Leonid Drachevsky Andrey Fursenko Igor Morgulov Aleksandr Dynkin Aleksandr Shokhin Dmitry Peskov Mikhail Komissar Igor Yurgens Konstantin Kosachev Editors: Ivan Timofeev, Ph.D. in Political Science Vladimir Morozov Lora Chkoniya Russian International Affairs Council (RIAC) is a membership-based non-profit Russian organization. RIAC’s activities are aimed at strengthening peace, friendship and solidarity between peoples, preventing international conflicts and promoting crisis resolution. The Council was founded in accordance with Russian Presidential Order No. 59-rp ”On the Creation of the Russian International Affairs Council non- profit partnership,” dated February 2, 2010. FOUNDERS Ministry of Foreign Affairs of the Russian Federation Ministry of Education and Science of the Russian Federation Russian Academy of Sciences Russian Union of Industrialists and Entrepreneurs Interfax News Agency RIAC MISSION The mission of RIAC is to promote Russia’s prosperity by integrating it into the global world. RIAC operates as a link between the state, scholarly community, business and civil society in an effort to find solutions to foreign policy issues. The views expressed herein do not necessarily reflect those of RIAC. Russian International Affairs Council Sanctions Against Russia: A Look Into 2020 Executive Summary • The report asesses the risks of sanctions United States. The Congress, the media and against Russia over the year. -

Consolidated Financial Statements 2018

GAZPROM GERMANIA CONSOLIDATED FINANCIAL STATEMENTS 2018 www.gazprom-germania.de Consolidated Financial Statements 2018 GAZPROM Germania GmbH, Berlin Page 2 CONTENTS Contents ................................................................................................................................................. 2 Abbreviations ......................................................................................................................................... 5 Group management report ................................................................................................................... 7 Economic and regulatory conditions ................................................................................................... 7 General economic conditions .......................................................................................................... 7 Energy policy and regulatory environment ...................................................................................... 8 Business performance ......................................................................................................................... 9 Group performance ......................................................................................................................... 9 Marketing and trading business .................................................................................................... 10 Gas storage .................................................................................................................................. -

Russia to “Launder” Warpath the Inf Treaty Iranian Oil?

MONTHLY October 2018 MONTHLY AugustOctober 2018 2018 The publication prepared exclusively for PERN S.A. Date of publication in the public domain: 19th17th NovemberSeptember 2018. 2018. CONTENTS 12 19 28 PUTIN AGAIN ON THE GREAT GAME OVER RUSSIA TO “LAUNDER” WARPATH THE INF TREATY IRANIAN OIL? U.S. NATIONAL SECURITY ADVISOR PUTIN’S ANOTHER BODYGUARD JOHN BOLTON GLADDENED 3 TO BE APPOINTED GOVERNOR 18 MOSCOW’S “PARTY OF WAR” RUSSIAN ARMY TO ADD MORE GREAT GAME OVER THE INF 4 FIREPOWER IN KALININGRAD 19 TREATY PURGE IN RUSSIA’S REGIONS AS RUSSIA AND PAKISTAN TO HOLD PUTIN GETS RID OF POLITICAL JOINT MILITARY DRILLS IN THE 6 VETERANS 21 PAKISTANI MOUNTAINS SECHIN LOSES BATTLE FOR ITALY TO WITHDRAW FROM 7 RUSSIA’S STRATEGIC OIL PORT 22 ROSNEFT PROJECT SPETSNAZ, FLEET AND NUCLEAR GAS GAMES: POLISH-RUSSIANS FORCES: RUSSIA’S INTENSE 24 TENSIONS OVER A NEW LNG DEAL 9 MILITARY DRILLS RUSSIA GETS NEW ALLY AS SHOIGU GAZPROM TO RESUME IMPORTS 25 PAYS VISIT TO MONGOLIA 10 OF TURKMEN GAS MORE TENSIONS IN THE SEA 12 PUTIN AGAIN ON THE WARPATH OF AZOV: RUSSIA TO SCARE ON 27 EASTERN FLANK NOVATEK DISCOVERS NEW 13 PROFITABLE GAS DEPOSITS 28 RUSSIA TO “LAUNDER” IRANIAN OIL? NOT ONLY BALTIC LNG PLANT: MOSCOW HOPES FOR IRAQ’S CLOSE TIES BETWEEN SHELL 29 NEW GOVERNMENT 15 AND GAZPROM GAZPROM AND UKRAINE FACE PUTIN VISITS INDIA TO MARK ANOTHER LITIGATION OVER 16 PURCHASE OF RUSSIA’S MISSILES 31 GAS SUPPLIES www.warsawinstitute.org 2 SOURCE: KREMLIN.RU 8 October 2018 PUTIN’S ANOTHER BODYGUARD TO BE APPOINTED GOVERNOR According to the autumn tradition, Russia’s President Vladimir Putin dismisses some governors while appointing new ones. -

Gazprom Germania, Gm&T and Wingas with Corporate Stand at E-World 2019

— PRESS RELEASE MORE ENERGY TOGETHER: GAZPROM GERMANIA, GM&T AND WINGAS WITH CORPORATE STAND AT E-WORLD 2019 Berlin/London/Kassel/Essen, 5 February 2019: Gazprom Marketing & Trading Ltd (GM&T) and WINGAS GmbH (WINGAS) welcome customers and counterparties to their jointly hosted stand at E-world 2019. As part of continued integration, the GAZPROM Germania Group, GM&T and WINGAS are developing commercial partnership to enhance their trading and marketing capabilities across Europe. At E-world 2019 WINGAS is presenting Customer Portal 2.0 with new transaction area for the first time. In the portal WINGAS customers will have the opportunity to exercise contractual options and to buy new products directly online. Mr. Daniel Gornig, the Director of Trading for the GAZPROM Germania Group emphasizes that: “GM&T and WINGAS’ commercial and support functions work together towards the same goals and objectives. What this last year has shown is that we are stronger together. The joint stand of GAZPROM Germania, WINGAS and GM&T is another sign of further integration of the marketing and trading activities within the Group.” Mr. Matthias Peter, the Head of the Marketing for the GAZPROM Germania Group said: “The objective of closer partnership between GM&T and WINGAS is to have a global reach while keeping a focus on the development of the important European gas markets and on the needs of every individual customer. In this context we are also continuously optimising WINGAS product and service portfolio.” E-world is Europe's largest energy trade fair and takes place from 05th till 07th February, 2019 in Essen. -

On Deck Part 2

PART 2 The New Zealand Company of Master Mariners March 2015 SNIPPETS FROM THE MARITIME BIOSPHERE US NAVY’S NEW LASER WEAPON. “At less than a dollar per shot, there’s no question DOES THIS SPELL THE END OF about the value LaWS provides,” said Klunder. “With CONVENTIONAL WEAPONS? affordability a serious concern for our defense budgets, this will more effectively manage resources to ‘Shades of Buck Rogers’ ensure our Sailors and Marines are never in a fair The U.S. Navy has achieved a historic milestone with a fight.” cutting-edge new laser weapon system that can In the future, factors from the successful deployment destroy targets for less than $1 per shot. and demonstration aboard the USS Ponce will help The Navy made the announcement recently that for guide the development of weapons under ONR’s Solid- the first time ever the new laser weapon system, known as LaWS, was successfully deployed and State Laser-Technology Maturation program. According operated aboard a Navy ship in the Arabian Gulf. The to the U.S. Navy, combat-ready laser prototypes that weapon, which uses a form of concentrated directed- could be installed on vessels such as guided-missile energy to destroy a target, has been under destroyers and the Littoral Combat Ship in the early development by the Office of Naval Research for 2020s. several years. See it in action here: http://gcaptain.com/watch-u-s- navys-new-laser-weapon-action-photos- video/?utm_source=feedburner&utm_medium=feed&u tm_campaign=Feed%3A+Gcaptain+%28gCaptain.com %29 TIME-LAPSE VIDEO: ALLSEAS AUDACIA OFFSHORE PIPELAY VESSEL IN ACTION Check out this greatMIKE time SCHULER-lapse video showing exactly what Allseas’ newest pipelay vessel was built to do. -

William R. Spiegelberger the Foreign Policy Research Institute Thanks the Carnegie Corporation for Its Support of the Russia Political Economy Project

Russia Political Economy Project William R. Spiegelberger The Foreign Policy Research Institute thanks the Carnegie Corporation for its support of the Russia Political Economy Project. All rights reserved. Printed in the United States of America. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or any information storage and retrieval system, without permission in writing from the publisher. Author: William R. Spiegelberger Eurasia Program Leadership Director: Chris Miller Deputy Director: Maia Otarashvili Edited by: Thomas J. Shattuck Designed by: Natalia Kopytnik © 2019 by the Foreign Policy Research Institute April 2019 COVER: Designed by Natalia Kopytnik. Photography: Oleg Deripaska (World Economic Forum); St. Basil’s Cathedral (Adob Stock); Ruble (Adobe Stock); Vladimir Putin (kremlin.ru); Rusal logo (rusal.ru); United States Capitol (Adobe Stock; Viktor Vekselberg (Aleshru/Wikimedia Commons); Alumnium rolls (Adobe Stock); Trade War (Adobe Stock). Our Mission The Foreign Policy Research Institute is dedicated to bringing the insights of scholarship to bear on the foreign policy and national security challenges facing the United States. It seeks to educate the public, teach teachers, train students, and offer ideas to advance U.S. national interests based on a nonpartisan, geopolitical perspective that illuminates contemporary international affairs through the lens of history, geography, and culture. Offering Ideas In an increasingly polarized world, we pride ourselves on our tradition of nonpartisan scholarship. We count among our ranks over 100 affiliated scholars located throughout the nation and the world who appear regularly in national and international media, testify on Capitol Hill, and are consulted by U.S. -

Investment from Russia Stabilizes After the Global Crisis 1

Institute of World Economy and International Relations (IMEMO) of Russian Academy of Sciences Investment from Russia stabilizes after the global crisis 1 Report dated June 23, 2011 EMBARGO: The contents of this report must not be quoted or summarized in the print, broadcast or electronic media before June 23, 2011, 3:00 p.m. Moscow; 11 a.m. GMT; and 7 a.m. New York. Moscow and New York, June 23, 2011 : The Institute of World Economy and International Relations (IMEMO) of the Russian Academy of Sciences, Moscow, and the Vale Columbia Center on Sustainable International Investment (VCC), a joint undertaking of the Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their second joint survey of Russian outward investors today 2. The survey is part of a long-term study of the rapid global expansion of multinational enterprises (MNEs) from emerging markets. The present survey, conducted at the beginning of 2011, covers the period 2007-2009. Highlights Despite the global crisis of the last few years, Russia has remained one of the leading outward investors in the world. The foreign assets of Russian MNEs have grown rapidly and only China and Mexico are further ahead among emerging markets. As the results of our survey show, several non- financial 3 Russian MNEs are significant actors in the world economy. The foreign assets of the 20 leading non-financial MNEs were about USD 107 billion at the end of 2009 (table 1). Their foreign sales 4 were USD 198 billion and they had more than 200,000 employees abroad. -

Stress the Import Nce

stress the import nce 2009 Social REPoRT “ We believe that charitable programmes are even more important today than they were during the pre-crisis period. So in the future, as each year throughout the Bank’s history, we will continue to render comprehensive support and financial assistance to essential projects, reaffirming our reputation of a socially responsible company.” Rushan Khvesyuk Chairman of the Executive Board, Member of the Board of Directors Message from Alfa-Bank management As a biggest financial institution in Russia, Alfa-Bank has always attached great importance to social and charitable activities. We are pleased to present our social report telling about some of our most significant events and undertakings in 2009. Alfa-Bank has a profound respect for the cultural heritage of our great country and endeavours to contribute to preserving it. For instance, we financed restoration work on a number of unique books in the Orenburg Universal Scientific Library named after N. Krupskaya, including Decrees of Ekaterina Alexeevna and Peter II published as early as in 1743 and works of Mikhail Lomonosov. In Nizhniy Novgorod, we sponsored restoration of Nikolay Koshelev’s canvas The Burial of Christ which was the ver y fir st ar t work in the collection of the regional museum. Alfa-Bank also covered the costs of restoring two pictures of the globally recognised artist Ivan Shishkin — Evening in a Forest and Evening in a Pine Forest belonging to the Tatarstan State Museum of Fine Arts in Kazan. Having supported initiatives aimed at preserving memory of our past for many years running, we also prioritise care for the young and talented, since they are our future. -

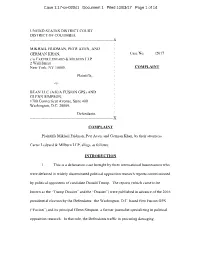

Case 1:17-Cv-02041 Document 1 Filed 10/03/17 Page 1 of 14

Case 1:17-cv-02041 Document 1 Filed 10/03/17 Page 1 of 14 UNITED STATES DISTRICT COURT DISTRICT OF COLUMBIA ----------------------------------------------------------------X : MIKHAIL FRIDMAN, PETR AVEN, AND : GERMAN KHAN, : Case No. _____/2017 c/o CARTER LEDYARD & MILBURN LLP : 2 Wall Street : New York, NY 10005, : COMPLAINT : Plaintiffs, : : -v- : : BEAN LLC (A/K/A FUSION GPS) AND : GLENN SIMPSON, : 1700 Connecticut Avenue, Suite 400 : Washington, D.C. 20009, : : Defendants. ----------------------------------------------------------------X COMPLAINT Plaintiffs Mikhail Fridman, Petr Aven, and German Khan, by their attorneys Carter Ledyard & Milburn LLP, allege as follows: INTRODUCTION 1. This is a defamation case brought by three international businessmen who were defamed in widely disseminated political opposition research reports commissioned by political opponents of candidate Donald Trump. The reports (which came to be known as the “Trump Dossier” and the “Dossier”) were published in advance of the 2016 presidential election by the Defendants: the Washington, D.C. based firm Fusion GPS (“Fusion”) and its principal Glenn Simpson, a former journalist specializing in political opposition research. In that role, the Defendants traffic in procuring damaging 8109453.2 Case 1:17-cv-02041 Document 1 Filed 10/03/17 Page 2 of 14 information about political candidates. The reports are gravely damaging in that they falsely accuse the Plaintiffs—and Alfa (“Alfa”), a consortium in which the Plaintiffs are investors—of criminal conduct and alleged cooperation with the “Kremlin” to influence the 2016 presidential election. But neither the Plaintiffs nor Alfa committed any of the acts irresponsibly attributed to them by the Defendants. To the contrary, the Plaintiffs and Alfa are collateral damage in a U.S.