The Commercial Deals Connected with Gazprom's Nord Stream 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Economics of the Nord Stream Pipeline System

The Economics of the Nord Stream Pipeline System Chi Kong Chyong, Pierre Noël and David M. Reiner September 2010 CWPE 1051 & EPRG 1026 The Economics of the Nord Stream Pipeline System EPRG Working Paper 1026 Cambridge Working Paper in Economics 1051 Chi Kong Chyong, Pierre Noёl and David M. Reiner Abstract We calculate the total cost of building Nord Stream and compare its levelised unit transportation cost with the existing options to transport Russian gas to western Europe. We find that the unit cost of shipping through Nord Stream is clearly lower than using the Ukrainian route and is only slightly above shipping through the Yamal-Europe pipeline. Using a large-scale gas simulation model we find a positive economic value for Nord Stream under various scenarios of demand for Russian gas in Europe. We disaggregate the value of Nord Stream into project economics (cost advantage), strategic value (impact on Ukraine’s transit fee) and security of supply value (insurance against disruption of the Ukrainian transit corridor). The economic fundamentals account for the bulk of Nord Stream’s positive value in all our scenarios. Keywords Nord Stream, Russia, Europe, Ukraine, Natural gas, Pipeline, Gazprom JEL Classification L95, H43, C63 Contact [email protected] Publication September 2010 EPRG WORKING PAPER Financial Support ESRC TSEC 3 www.eprg.group.cam.ac.uk The Economics of the Nord Stream Pipeline System1 Chi Kong Chyong* Electricity Policy Research Group (EPRG), Judge Business School, University of Cambridge (PhD Candidate) Pierre Noёl EPRG, Judge Business School, University of Cambridge David M. Reiner EPRG, Judge Business School, University of Cambridge 1. -

Professional Profile Expertise Recent Experience Education

Javaid Akhtar Partner PROFESSIONAL PROFILE [email protected] Dual qualified as a Solicitor of England and Wales and Advocate in Pakistan, +92 (51) 285 5890-2 Javaid specialises in acquisitions, oil and gas and arbitration and corporate and commercial matters. Javaid is the managing partner of the Islamabad 64, Nazimuddin Road, F- 8/4, Islamabad, Pakistan office of Vellani & Vellani and was earlier a partner of Amhurst Brown, which merged with Vellani & Vellani in 2018. https://www.linkedin.com/i n/javaid-akhtar-49051313/ RECENT EXPERIENCE EDUCATION ACQUISITIONS Represented local and multinational companies in the sale and Bachelor of Law (LL. B) King’s College London - 1991 purchase of assets and shares, particularly in the upstream oil and gas sector. Acted in the purchase of Austrian owned OMV companies in Pakistan EXPERTISE (2017-8) and UK owned Premier Oil companies in Pakistan (2016), and a substantial holding in a Pakistani oil marketing company to a Dispute Resolution middle-eastern company (2018). Earlier, acted in the sale of BP’s Mergers & Acquisitions, assets in Pakistan (2011-14), purchase of Tullow Pakistan (2014) and Restructuring and aspects of the sale of Petronas Carigali Pakistan (2011). Securities Acted on the buy-side in relation to the Government of Pakistan’s sale Oil & Gas of companies and assets (i.e. privatization), including sale of state interests in petroleum concessions; in Pakistan Steel Corporation and Pakistan State Oil Ltd. Apart from the customary suite of agreements, such transactions involved extensive due diligence and, often protracted, issues to be resolved with regulatory authorities (including the Directorate General (Petroleum Concessions), the Competition Commission of Pakistan and the Securities and Exchange Commission of Pakistan). -

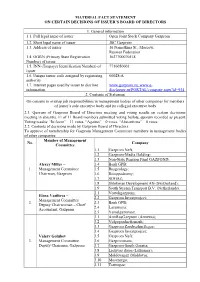

Material Fact Statement on Certain Decisions of Issuer’S Board of Directors

MATERIAL FACT STATEMENT ON CERTAIN DECISIONS OF ISSUER’S BOARD OF DIRECTORS 1. General information 1.1. Full legal name of issuer Open Joint Stock Company Gazprom 1.2. Short legal name of issuer JSC Gazprom 1.3. Address of issuer 16 Nametkina St., Moscow, Russian Federation 1.4. OGRN (Primary State Registration 1027700070518 Number) of issuer 1.5. INN (Taxpayer Identification Number) of 7736050003 issuer 1.6. Unique issuer code assigned by registering 00028-А authority 1.7. Internet pages used by issuer to disclose www.gazprom.ru; www.e- information disclosure.ru/PORTAL/company.aspx?id=934 2. Contents of Statement On consent to overlap job responsibilities in management bodies of other companies for members of issuer’s sole executive body and its collegial executive body 2.1. Quorum of Gazprom Board of Directors meeting and voting results on certain decisions: meeting in absentia, 11 of 11 Board members submitted voting ballots, quorum recorded as present. Voting results: “In favor” – 11 votes, “Against” – 0 votes, “Abstentions” – 0 votes. 2.2. Contents of decisions made by Gazprom Board of Directors: To approve of membership for Gazprom Management Committee members in management bodies of other companies: Member of Management No. Company Committee 1.1 Gazprom Neft; 1.2 Gazprom-Media Holding; 1.3 Non-State Pension Fund GAZFOND; Alexey Miller – 1.4 Bank GPB; 1. Management Committee 1.5 Rusgeology; Chairman, Gazprom 1.6 Rosippodromy; 1.7 SOGAZ; 1.8 Shtokman Development AG (Switzerland); 1.9 South Stream Transport B.V. (Netherlands). 2.1 Vostokgazprom; Elena Vasilieva – 2.2 Gazprom Investproject; Management Committee 2. -

Consolidated Financial Statements 2018

GAZPROM GERMANIA CONSOLIDATED FINANCIAL STATEMENTS 2018 www.gazprom-germania.de Consolidated Financial Statements 2018 GAZPROM Germania GmbH, Berlin Page 2 CONTENTS Contents ................................................................................................................................................. 2 Abbreviations ......................................................................................................................................... 5 Group management report ................................................................................................................... 7 Economic and regulatory conditions ................................................................................................... 7 General economic conditions .......................................................................................................... 7 Energy policy and regulatory environment ...................................................................................... 8 Business performance ......................................................................................................................... 9 Group performance ......................................................................................................................... 9 Marketing and trading business .................................................................................................... 10 Gas storage .................................................................................................................................. -

Slovenia: MOL Group' Retail Acquirement Agreement With

Slovenia: MOL Group’ retail acquirement agreement with OMV The agreed purchase price is 301 million euros (100 % share of OMV Slovenia); MOL Group reached an agreement with OMV to acquire OMV’s 92.25 % stake in OMV Slovenia, in which Croatian INA already holds a 7.75 % minority stake, from OMV Downstream GmbH as direct shareholder. The transaction includes 120 petrol stations across Slovenia. OMV Slovenia operates in the country under 3 brands: OMV (108), EuroTruck (4) and Avanti/DISKONT (8). MOL Group and INA will become the 100 % owner of the wholesale business of the acquired company, as well. With 48 MOL and 5 INA-branded service stations in Slovenia, MOL Group is currently the third largest retail market-player. However, the transaction is still subject to merger clearance. The acquisition fits into the Group’s SHAPE TOMORROW 2030+ updated long-term strategy, which places a special emphasis on the development of Consumer Services. MOL Group CEO Zsolt Hernadi said that this step is in line with group’s strategic goals to further expand retail fuel network in existing and potential new markets in central and eastern Europe. By 2025, MOL Group would like to reach 2200 petrol stations, potentially more, if more good opportunities arise. With constant development and digitization, shaping future consumer and mobility trends, MOL offers convenience as it aims to help people on the move, regardless of what powers the customer’s mode of transport. Furthermore, its integrated business model and accelerating growth enables it to provide financial resources for developing sustainable solutions and boosting circular economy in the region. -

Analiza Efikasnosti Naftnih Kompanija U Srbiji Efficency Analysis of Oil Companies in Serbia

________________________________________________________________________ 79 Analiza efikasnosti naftnih kompanija u Srbiji Efficency Analysis of Oil Companies in Serbia prof. dr. sc. Radojko Lukić Ekonomski fakultet u Beogradu [email protected] Ključne reči: ekspolatacija sirove nafte i gasa, Abstract tržišno učešće, efikasnost poslovanja, financijske Lately, significant attention has been paid to the performanse, održivo izveštavanje evolution of the performance of oil companies around Key words: exploration of crude oil and gas, market the world, by individual regions and countries. Bearing share, business efficiency, financial performance, susta- this in mind, relying on the existing theoretical and inable reporting methodological and empirical results, this paper analyzes the efficiency of operations, financial perfor- mance and sustainable reporting of oil companies in Sažetak Serbia, with special emphasis on the Petroleum Industry of Serbia (NIS). The results of the survey show signifi- U poslednje vreme značajna se pažnja poklanja cant role of mining, i.e. oil companies in creating addi- evoluaciji performansi naftnih kompanija u svetu, tional value of the entire economy of Serbia. Concer- po pojedinim regionima i zemljama. Imajući to u ning the Petroleum Industry of Serbia, it has a signi- vidu, oslanjajući se na postojeće teorijsko-metodo- ficant place in the production and trade of petroleum loške i empirijske rezultate, u ovom radu se analizi- products in Serbia. For these reasons, the efficiency of raju efikasnosti poslovanja, finansijske performanse operations, financial performance and maintenance of i održivo izveštavanje naftnih kompanija u Srbiji, s the Petroleum Industry of Serbia has been complexly posebnim osvrtom na Naftnu industriju Srbije (NIS). analyzed. In this respect, according to many indicators, Rezultati istraživanja pokazuju značajnu ulogu rudar- it is at a satisfactory level in relation to the average of the stva, odnosno naftnih kompanija u kreiranju dodatne world’s leading oil companies. -

Gazprom Germania, Gm&T and Wingas with Corporate Stand at E-World 2019

— PRESS RELEASE MORE ENERGY TOGETHER: GAZPROM GERMANIA, GM&T AND WINGAS WITH CORPORATE STAND AT E-WORLD 2019 Berlin/London/Kassel/Essen, 5 February 2019: Gazprom Marketing & Trading Ltd (GM&T) and WINGAS GmbH (WINGAS) welcome customers and counterparties to their jointly hosted stand at E-world 2019. As part of continued integration, the GAZPROM Germania Group, GM&T and WINGAS are developing commercial partnership to enhance their trading and marketing capabilities across Europe. At E-world 2019 WINGAS is presenting Customer Portal 2.0 with new transaction area for the first time. In the portal WINGAS customers will have the opportunity to exercise contractual options and to buy new products directly online. Mr. Daniel Gornig, the Director of Trading for the GAZPROM Germania Group emphasizes that: “GM&T and WINGAS’ commercial and support functions work together towards the same goals and objectives. What this last year has shown is that we are stronger together. The joint stand of GAZPROM Germania, WINGAS and GM&T is another sign of further integration of the marketing and trading activities within the Group.” Mr. Matthias Peter, the Head of the Marketing for the GAZPROM Germania Group said: “The objective of closer partnership between GM&T and WINGAS is to have a global reach while keeping a focus on the development of the important European gas markets and on the needs of every individual customer. In this context we are also continuously optimising WINGAS product and service portfolio.” E-world is Europe's largest energy trade fair and takes place from 05th till 07th February, 2019 in Essen. -

Nord Stream 2: Background, Objections, and Possible Outcomes Steven Pifer

NORD STREAM 2: BACKGROUND, OBJECTIONS, AND POSSIBLE OUTCOMES STEVEN PIFER APRIL 2021 EXECUTIVE SUMMARY Nord Stream 2 is an almost-finished natural gas pipeline from Russia to Germany. The Biden administration opposes it and has come under congressional pressure to invoke sanctions to prevent its completion, in large part because the pipeline seems a geopolitical project targeted at Ukraine. The German government, however, regards the pipeline as a “commercial project” and appears committed to its completion, perhaps in the next few months. U.S. sanctions applied on Russian entities to date have failed to stop Nord Stream 2, raising the question of whether the U.S. government would sanction German and other European companies for servicing or certifying the pipeline. Such sanctions would provoke controversy with Germany at a time when both Berlin and the Biden administration seek to rebuild good relations. The two sides have work to do if they wish to avoid Nord Stream 2 becoming a major point of U.S.-German contention. THE PIPELINE The European Union currently imports about 40% of its natural gas from Russia, or about one-third Nord Stream 2 is actually a pair of natural gas of its total gas consumption.4 Gazprom began pipelines that, if/when completed, will run some discussions with European companies on a direct 1,200 kilometers along the bottom of the Baltic Russia-Germany gas pipeline in 2001. At that time, 1 Sea from Ust-Luga, Russia to Greifswald, Germany. it shipped gas to western Europe via pipelines that The two pipelines, collectively referred to as Nord mainly transited Ukraine, and also Belarus and Stream 2, are projected to have the capacity to Poland (the Yamal system). -

LUKOIL's Market Strategy in Central and Eastern Europe 105 O Increasing the Number of Filling Stations for Petroleum Products in Russia and Other Countries

Petroleum-Gas University of Ploiesti Vol. LXII Economic Sciences 103-110 BULLETIN No. 4/2010 Series LUKOIL’s Market Strategy in Central and Eastern Europe Mihaela Oprea Ciopi Petroleum-Gas University of Ploieşti, Bd. Bucureşti 39, Ploieşti, Romania e-mail: [email protected] Abstract The economic environment has undergone significant development over the past 20 years marked, in particular, by the globalization of the economy and increased competitiveness. The large oil corporations significantly influence national economies and the global economy in general, as a result of their huge financial power and their profit-oriented corporate management, by identifying the most appropriate strategies and the most effective methods of business management . Currently, oil market in Central and Eastern Europe is controlled by three major players: the Austrian OMV, Hungarian MOL company and the Russian company LUKOIL, whose investment strategies and policies contributed to a decisive extent to the development and consolidation of oil industry in the countries in this area, thus in Romania too. In this context, the paper aims to analyze the strategy of developing and consolidating LUKOIL’s position on this market. Key words: strategic alliance, a global energy player, offensive strategy, territorial expansion JEL Classification: M10 Introduction The greatest oil corporations significantly influence national economies and the global economy in general, the effect of their huge financial power and corporate management oriented to increase profit by identifying the most appropriate strategies and the most effective methods of business management. These elements underpin the development of management as a science and was later taken over and adapted by national companies. -

5G Development in the Baltic States

NATO cyber experts have called 5G the ‘digital four frequencies but has endured criticism from nervous system of the contemporary societies.’1 Elisa Eesti, Tele2 Eesti, and Telia Eesti, the three But with the increased connectivity offered by largest operators in Estonia who claim the 5G, however, comes an exponential rise in the reduced frequency bands are too small to number of potential targets for espionage. The support a stable 5G network.4 Baltic states have begun to heed the warnings of Latvia is one of the first countries to push out a their principal ally, the United States, who is 5G network, and ranks third in Europe for 5G calling to end cooperation with the Chinese readiness.5 Its largest operator Latvijas Mobilais telecom giant Huawei. The governments of the Telefons (LMT) established the first working 5G Baltic states are discovering that road to 5G base in Riga and, alongside Tele2 Latvija, has built development is becoming increasingly complex 5G base stations that offer mobile users access to and fraught with geopolitical and national the 5G network. Bite Latvija, Latvia’s third largest security considerations. operator, is still testing. Latvia hosted their first 5G frequency auction in December of 2017, at which the 3.4-3.8GHz frequencies were auctioned off to LMT. Both Tele2 and Bite have since also acquired spectrum frequencies and in The Baltic region has been dubbed a ‘poster child’ June of 2019, agreed to merge networks in Latvia for early cases of 5G use due to the region’s and Lithuania.6 recent history of technological innovation. -

Case No COMP/M.5005 - GALP ENERGIA / EXXONMOBIL IBERIA

EN Case No COMP/M.5005 - GALP ENERGIA / EXXONMOBIL IBERIA Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(2) NON-OPPOSITION Date: 31/10/2008 In electronic form on the EUR-Lex website under document number 32008M5005 Office for Official Publications of the European Communities L-2985 Luxembourg EUROPEAN COMMISSION Competition DG Brussels, 31-10-2008 SG-Greffe D/206595 C(2008) 6641 In the published version of this decision, some information has been omitted pursuant to Article PUBLIC VERSION 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and MERGER PROCEDURE other confidential information. The omissions are shown thus […]. Where possible the information ARTICLE 6(1)(b) DECISION IN omitted has been replaced by ranges of figures or a CONJUNCTION WITH 6(2) general description. To the notifying party: Dear Sirs, Subject: Case No COMP/M.5005 – Galp Energia/ ExxonMobil Iberia Notification of 12 September 2008 pursuant to Article 4 of Council Regulation No 139/20041 1. On 12 September 2008, the Commission received a notification of a proposed concentration by which the undertaking Galp Energia, SGPS, S.A. ("Galp Energia", Portugal) belonging to the Galp Energia group ("GALP", Portugal) and controlled by ENI S.p.A. ("ENI", Italy), Amorim Energia B.V. ("Amorim", Portugal) and Caixa Geral de Depositos S.A. ("CGD" Portugal), acquires control of the whole of the undertakings Esso Portuguesa Lda. (Portugal), a wholly owned subsidiary of ExxonMobil Portugal ("ExxonMobil Portugal"), Esso Española S.L. ("ESSO Spain") and a part of ExxonMobil Petroleum & Chemical ("EMPC", Belgium), all of them wholly owned subsidiaries of ExxonMobil Corporation ("ExxonMobil", US), by way of purchase of shares. -

Migration and the New Austeriat: the Baltic Model and the Socioeconomic Costs of Neoliberal Austerity

Migration and the new austeriat: the Baltic model and the socioeconomic costs of neoliberal austerity Charles Woolfson (Linköping University, Sweden) Jeffrey Sommers (University of Wisconsin-Milwaukee) Arunas Juska (East Carolina University) W.I.R.E. Workshop on Immigration, Race, and Ethnicity Ash Center for Democratic Governance and Innovation at the Harvard Kennedy School 24 February 2015 Abstract The Great Economic Recession was experienced with particular severity in the peripheral newer European Union member states. Baltic governments in particular introduced programmes of harsh austerity known as ‘internal devaluation’. The paper argues that austerity measures have accelerated the fragmentation of the labour market into a differentially advantaged primary (largely public) sector, and an increasingly ‘informalized’ secondary (largely low-skill manufacturing and services) sector. It is suggested that the production of a segmented labour market has acted as a major stimulus towards creating, in both Latvia and Lithuania, among the highest levels of emigration in the European Union, especially during the years of the crisis from 2008 onwards. In the absence of effective state policy to address a gathering socio-demographic crisis in which this migration is a key component, so-called ‘free movement’ of labour raises troubling questions for wider societal sustainability in the European Union’s neoliberal semi- periphery in an era of protracted austerity. Keywords: Austerity, crisis, migration, Lithuania, labour market segmentation, neoliberalism, informalisation, European periphery Introduction The onset of the global economic crisis has led to a dramatic increase of emigration from a number of East European countries that have become members of the European Union (EU) (Galgóczi, Leschke, and Watt 2012).