The Rise of Mid-To-High End Chinese Restaurant Chains In

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IN the MINORITY Holding on to Ethnic Identity in a Changing Beijing

IN THE MINORITY Holding on to Ethnic Identity in a Changing Beijing Follow us on WeChat Now Advertising Hotline 400 820 8428 城市漫步北京 英文版 6 月份 国内统一刊号: CN 11-5232/GO China Intercontinental Press ISSN 1672-8025 JUNE 2016 主管单位 :中华人民共和国国务院新闻办公室 Supervised by the State Council Information Office of the People's Republic of China 主办单位 :五洲传播出版社 地址 :北京市海淀区北三环中路31 号生产力大楼 B 座 602 邮编 100088 B-602 Shengchanli Building, No. 31 Beisanhuan Zhonglu, Haidian District, Beijing 100088, PRC http://www.cicc.org.cn 总编辑 Editor in Chief 慈爱民 Ci Aimin 期刊部负责人 Supervisor of Magazine Department 邓锦辉 Deng Jinhui 编辑 Editor 朱莉莉 Zhu Lili 发行 / 市场 Distribution / Marketing 黄静,李若琳 Huang Jing, Li Ruolin Editor-in-Chief Oscar Holland Food & Drink Editor Noelle Mateer Staff Reporter Dominique Wong National Arts Editor Andrew Chin Digital Content Editor Justine Lopez Designers Li Xiaoran, Iris Wang Staff Photographer Holly Li Contributors Mia Li, Zoey Zha, Virginia Werner, Jens Bakker, Emma Huang, Aelred Doyle, Dominic Ngai, Tongfei Zhang Urbanatomy Media Shanghai (Head office) 上海和舟广告有限公司 上海市蒙自路 169 号智造局 2 号楼 305-306 室 邮政编码 : 200023 Room 305-306, Building 2, No.169 Mengzi Lu, Shanghai 200023 电话 : 021-8023 2199 传真 : 021-8023 2190 (From February 13) Beijing 广告代理 : 上海和舟广告有限公司 北京市东城区东直门外大街 48 号东方银座 C 座 9G 邮政编码 : 100027 48 Dongzhimenwai Dajie Oriental Kenzo (Ginza Mall) Building C Room 9G, Dongcheng District, Beijing 100027 电话 : 010-8447 7002 传真 : 010-8447 6455 Guangzhou 上海和舟广告有限公司广州分公司 广州市越秀区麓苑路 42 号大院 2 号楼 610 房 邮政编码 : 510095 Room 610, No. 2 Building, Area 42, Lu Yuan Lu, Yuexiu District, -

Din Tai Fung As a Global Shanghai Dumpling House Made in Taiwan Haiming Liu

Flexible Authenticity Din Tai Fung as a Global Shanghai Dumpling House Made in Taiwan Haiming Liu Haiming Liu, “Flexible Authenticity: Din Tai Fung as a Global known in Taiwan, Hong Kong, or mainland China. Chinese Shanghai Dumpling House Made in Taiwan,” Chinese America: food in America reflected the racial status of Chinese Ameri- History & Perspectives —The Journal of the Chinese Histori- cans. The Chinese restaurant business, like the laundry busi- cal Society of America (San Francisco: Chinese Historical Soci- ness, was a visible menial-service occupation for Chinese ety of America with UCLA Asian American Studies Center, 2011), immigrants and their descendants. 57–65. Ethnic food also reflects immigration history. After the 1965 immigration reform, new waves of Chinese immigrants arrived. Between 1965 and 1984, an estimated 419,373 Chi- CHANGES IN THE CHINESE AMERICAN nese entered the United States.5 Post-1965 Chinese immi- REstaURANT BUSINESS grants were far more diverse in their class and cultural back- grounds than the earlier immigrants had been. Many were n December 4, 2007, the Taiwan government spon- educated professionals, engineers, technicians, or exchange sored Din Tai Fung, a steamed dumpling house in students. Their arrival fostered a new, booming Chinese res- Taipei, to hold a gastronomic demonstration in Paris taurant business in America, especially in regions such as O 1 as a diplomatic event to promote its “soft power.” Though the San Gabriel Valley in Southern California and Queens in the cooking show was held by a pro-independence regime, New York, where Chinese populations concentrated. the restaurant actually featured Shanghai cuisine rather than Accordingly, food in Chinese restaurants in Amer- native Taiwanese food. -

IT EM of M Illburn and Short Hills, 1982 Is Published Every Thursday, by the to Close Two Schools As Soon As Possible and Chen

> The Inside Story SNOW HOLIDAY—A group of township youngsters enjoy BURGLARIES CONTINUE— Break-ins again plague the sledding in T a y lo r P ark d u r township after a lull in crim e following-the holiday season. One in ing an unexpected holiday. truder surprised a woman as she was talking on her telephone. Schools were^ closed here Fo r details see V a g e 3. Monday after a northeastern torm dumped about five in LENT BEGI NS—Obser C la s s ifie d ........... 14,15 ches of snow in the township vances of Shrove Tuesday Coming events.. ..........6 beginning Sunday afternoon. and Ash Wednesday will E d ito ria l............. ..........6 Roads were cleared by Tues mark the beginning of pre- M o v ie s ................. ........7 day and classes resumed. E a ste r a ctiv itie s in township O bituaries ......... 9 Fourteen minor traffic ac Ch ristian congregations. In Religion ..........9 cidents were recorded here form ation on se rvices and S o cia l................... ..........8 Sunday night and Monday pancake suppers will be S ports................... .12,13 m orning. found on Pages 8 and 9. ITEM OF MILLBURN AND SHORT HILLS v Thursday. Xafentsryie; F o u n d e d I HUB V 0l. 94 NO. 6 • > - • ■». ; . p ef < <>p\ .Sit |>w Y e a r b> M a it to t o u r I tout ^ Member. Audit Bureno of A'.imiluli' Serving the township for 95 years Court plans April hearing on South Mountain law suit The Board of Education and opponents to tion the suit lists as piauituts Raimie. -

An Exploration of Variances in Chinese Cuisine

White 1 Abstract Food in China is often misconstrued as homogeneous, lacking in diversity. However, a closer look can expose an entire realm of unique cuisines. These foods represent the different peoples and cultures that reside in the vast expanse of land known as Greater China. This paper will look at five distinct cuisines: Shandong, Jiangsu, Szechuan, Cantonese, and Taiwanese cuisine. Through exploring the similarities and differences of cuisine in these areas, culture emerges along with a variety in food that the Western world would not expect. White 2 Introduction Food has been a driving force around the globe for longer than history has been recorded and continues to be extremely culturally relevant in the present. What food people eat, and how they go about eating it, intertwines with how people socialize, their socioeconomic class, their geographic location, and many other aspects of daily life. I argue studying cuisine is the best way to understand a culture and studying the differences in cuisine across cultures can return diverse results. When thinking of food diversity, Asia likely would not be most Westerners’ first thought since Asian food tends to get lumped together into a single category of “Chinese”. However, Asian food is highly diverse: Thai food varies greatly from Japanese food, which varies from Korean food or Indian food. Beyond all the distinct cultures “Asian cuisine” entails, Greater China itself is such an enormous region that there is an amazing amount of food diversity without the necessity of branching out to any other Asian countries. This research will focus on Shandong, Jiangsu, Szechuan, Cantonese, and Taiwanese cuisine in order to define and study how Chinese food varies due to geographical locations, social norms, and historical events. -

Steaming Is a Pure, Simple and Almost Is a Pure, Simple and Steaming Back of Cooking

STEAM CONTRIBUTORS STEAM Steaming is a pure, simple and almost spiritual way of cooking. Dating back TEXT to prehistoric times when food was Tan Su-Lyn wrote Lonely Planet’s cooked over hot springs, this culinary . World Food Guide: Malaysia and technique has since inspired chefs T Singapore, and co-authored chef, HE across the globe to harness its Jereme Leung’s cookbook, delicate heat by developing New Shanghai Cuisine. She was implements such as multi-tiered formerly the managing editor of S steamers, tagines and even recipes PIRIT Wine & Dine magazine. where food is cooked en papillote (where ingredients are sealed in PHOTOGRAPHY paper to steam in their own juices). Alexander Haselhoff spent several years in the USA working on the O To steam food is to cook ingredients Marlboro advertising campaign F LIF by enveloping them in water vapour which led to numerous awards and in a sealed vessel. This method of exhibitions. He has since contributed cooking provides even, moist heat to over 40 German cookbooks. and leaves fish, poultry and E vegetables naturally tender. Precious DESIGN nutrients are retained. Flavours Art Director Chris Wee’s Lincoln remain clean and clear. And colours Modern hardback book, created for stay true. SC Global, won an Asia Graphics Award in 2001. His work on Shopping As leading creators of top-quality magazine also won a Gold Award at appliances, Miele has naturally sought Publish Asia 2002. to produce the ultimate steamer for the contemporary kitchen. Even so, our commitment goes well beyond simply creating a highly functional machine with a sleek design. -

Evaluation of the Country Service Framework (Csf)

Restricted Distr. OCG/EVG/R.2 24 February 2005 UNITED NATIONS INDUSTRIAL DEVELOPMENT ORGANIZATION ORIGINAL: ENGLISH EVALUATION OF THE COUNTRY SERVICE FRAMEWORK (CSF) UNIDO Contribution to Environmentally Sustainable Industrial Development of China Report of the Evaluation Mission* Mr. Jaroslav NAVRATIL Evaluation Consultant, Team Leader Mr. Klaus BILLAND Deputy to the Director, Asia and the Pacific Bureau, UNIDO Mr. Yong LIU National Consultant * The designations employed and the presentation of the material in this document do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations Industrial Development Organization concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers and boundaries. Mention of company names and commercial products does not imply the endorsement of UNIDO. The views and opinions of the team do not necessarily reflect the views of UNIDO. This document has not been formally edited. ii Table of Contents Map of the People’s Republic of China 1 Abbreviations and acronyms used in the report 2 VOLUME I: PROGRAMME-WIDE EVALUATION 5 EXECUTIVE SUMMARY 5 FOLLOW-UP ON RECOMMENDATIONS 11 1. INTRODUCTION 16 2. THE CHINA COUNTRY SERVICE FRAMEWORK: AN OVERVIEW 18 2.1 Evolution of UNIDO-China cooperation 18 2.2 CSF in the context of socio-economic development in China 19 2.3 Objectives, scope and structure of the CSF 21 2.4 Funds mobilization 24 2.5 Status of implementation 25 2.6 Coordination with UNDAF and other programmes 28 2.7 CSF management 29 3. -

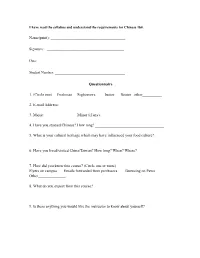

Sample Syllabus

I have read the syllabus and understand the requirements for Chinese 160. Name(print): ______________________________________ Signature: ___________________________________________ Date: _______________________________________________ Student Number: _______________________________________ Questionnaire 1. (Circle one) Freshman Sophomore Junior Senior other__________ 2. E-mail Address: 3. Major: Minor (if any): 4. Have you studied Chinese? How long? ___________________________________ 5. What is your cultural heritage which may have influenced your food culture? 6. Have you lived/visited China/Taiwan? How long? When? Where? 7. How did you know this course? (Circle one or more) Flyers on campus Emails forwarded from professors Browsing on Paws Other______________ 8. What do you expect from this course? 9. Is there anything you would like the instructor to know about yourself? Chinese 160: A Taste of China Learning Chinese Culture and Society through Cuisine I. COURSE INFORMATION Instructors: Xiaorong Wang Office: Curtin 815 E-mail: [email protected] Phone: 414-229-2492 Office Hours: TBD Meeting Time: Tuesdays and Thursdays 4:00-5:15pm Classroom: Curtin 219 Texts and Materials: CULINARIA CHINA: Country. Cuisine. Culture By Kathrin Schlotter and Elke Spielmanns-Rome Publisher: hf ULLMANN ISBN-10: 3833149957 ISBN-13: 978-3-8331-4995-5 Price :$39.99 *All articles and media from outside the textbook will be available for download or linked on the Content page of the course D2L site. Prerequisite: NONE II. COURSE DESCRIPTION This course will explore Chinese culture primarily through the study of Chinese cuisine. Food is a lens through which we can learn more about Chinese geography, philosophy, and religions because food has been historically important to Chinese life. Students will discover the uniqueness of Chinese cuisine through various class activities and assignments that focus on food practices, views about food, and the role of cuisine in daily life. -

Bachelor Thesis

CHINESE TARGET MARKET RESEARCH FOR VIRTUAL REALITY TECHNOLOGY IN EDUCATION FIELD Jiayi Li-Haapaniemi Bachelor‟s thesis Autumn 2010 International Business Oulu University of Applied Sciences ABSTRACT Oulu University of Applied Sciences Degree programme in International Business Author: Jiayi Li-Haapaniemi Title of Bachelor‟s thesis: Chinese Target Market Research for Virtual Reality Technology in Education Field Supervisor(s): Helena Ahola Term and year of completion: Autumn 2010 Number of pages: 68 + 11 ABSTRACT This thesis studies three Chinese target markets for virtual learning environment technology. The emphasis is to contribute the valuable market information to Commissioner Applebones Ltd. The research releaser problems are: 1) What is the situation of the Chinese Educational Market? a) What is the customer behaviour of the target markets? b) What are the basic policies and regulations in the relevant business field? 2) Who are the possible business contacts or what is the focus group? A qualitative method was chosen for this research and the data was gathered by desktop research and in-depth interviews. The scope of this research was defined as junior high schools and the criteria were defined by the commissioner as technological-oriented, foreign language oriented, experimental type of schools. The basic theoretical framework for this study was obtained from pertinent literature and complemented by updated information gained from online source. The findings and results of this study are of concern to the general introduction of the Chinese education market. This also includes the relevant regulation and policies, customer behaviour in terms of school principals‟ role in decision making. The lists of the schools that are fulfilling the given criteria in Shanghai and Hangzhou region and the current information communication technology (ICT) situation and development of Hong Kong Fung Kai Innovative School are presented, as well as the possibility of pilot testing for Virtual learning environment technology. -

Issn 1672-8025

Follow us on WeChat Now Advertising Hotline 400 820 8428 城市漫步北京 英文版 11 月份 国内统一刊号: CN 11-5232/GO China Intercontinental Press ISSN 1672-8025 NOVEMBER 2018 WWW.THATSMAGS.COM | NOVEMBER 2018 | 1 主管单位 : 中华人民共和国国务院新闻办公室 Supervised by the State Council Information Office of the People's Republic of China 主办单位 : 五洲传播出版社 地址 : 北京西城月坛北街 26 号恒华国际商务中心南楼 11 层文化交流中心 邮编 100045 Published by China Intercontinental Press Address: 11th Floor South Building, HengHua linternational Business Center, 26 Yuetan North Street, Xicheng District, Beijing 100045, PRC http://www.cicc.org.cn 社长 President of China Intercontinental Press 陈陆军 Chen Lujun 期刊部负责人 Supervisor of Magazine Department 付平 Fu Ping 编辑 Editor 朱莉莉 Zhu Lili 发行 Circulation 李若琳 Li Ruolin Editor-in-Chief Valerie Osipov Deputy Editor Edoardo Donati Fogliazza National Arts Editor Sarah Forman Designer Iris Wang Contributors Benjamin Lipschitz, Dominic Ngai, Flynn Murphy, Matthew Bossons, Mia Li HK FOCUS MEDIA Shanghai (Head office) 上海和舟广告有限公司 上海市蒙自路 169 号智造局 2 号楼 305-306 室 邮政编码 : 200023 Room 305-306, Building 2, No.169 Mengzi Lu, Shanghai 200023 电话 : 021-8023 2199 传真 : 021-8023 2190 (From February 13) Beijing 广告代理 : 上海和舟广告有限公司 北京市东城区东直门外大街 48 号东方银座 C 座 9G 邮政编码 : 100027 48 Dongzhimenwai Dajie Oriental Kenzo (Ginza Mall), Building C, Room 9G, Dongcheng District, Beijing 100027 电话 : 010-8447 7002 传真 : 010-8447 6455 Guangzhou 上海和舟广告有限公司广州分公司 广州市越秀区麓苑路 42 号大院 2 号楼 610 房 邮政编码 : 510095 Room 610, No. 2 Building, Area 42, Lu Yuan Lu, Yuexiu District, Guangzhou, PRC 510095 电话 : 020-8358 6125, 传真 : 020-8357 3859-800 -

MADE in NORTH KOREA a Collection of Bizarre Artifacts from the DPRK ONE for the BOOKS the Massive Library That Turned out to Be

THE FINAL COUNTDOWN MADE IN NORTH KOREA Our pick of this year’s 10 best Chinese albums A collection of bizarre artifacts from the DPRK Follow us on WeChat Now Advertising Hotline 400 820 8428 城市漫步北京 英文版 12 月份 ONE FOR THE BOOKS 国内统一刊号: CN 11-5232/GO China Intercontinental Press ISSN 1672-8025 The massive library that turned out to be fake DECEMBER 2017 WWW.THATSMAGS.COM | DECEMBER 2017 | 1 主管单位 : 中华人民共和国国务院新闻办公室 Supervised by the State Council Information Office of the People's Republic of China 主办单位 : 五洲传播出版社 地址 : 北京西城月坛北街 26 号恒华国际商务中心南楼 11 层文化交流中心 邮编 100045 Published by China Intercontinental Press Address: 11th Floor South Building, HengHua linternational Business Center, 26 Yuetan North Street, Xicheng District, Beijing 100045, PRC http://www.cicc.org.cn 社长 President of China Intercontinental Press 陈陆军 Chen Lujun 期刊部负责人 Supervisor of Magazine Department 邓锦辉 Deng Jinhui 编辑 Editor 朱莉莉 Zhu Lili 发行 Circulation 李若琳 Li Ruolin Editor-in-Chief Noelle Mateer Deputy Editor Dominique Wong National Arts Editor Erica Martin Digital Content Editor Justine Lopez Designer Iris Wang Contributors Dominic Ngai, Jocelyn Richards, Mia Li, Sky Thomas Gidge, Yuka Hayashi, Qinxin Lu, Gabriel Clermont, Tanner Brown, Nick Mateer, Oscar Holland, Betty Richardson, Zoey Zha HK FOCUS MEDIA Shanghai (Head office) 上海和舟广告有限公司 上海市蒙自路 169 号智造局 2 号楼 305-306 室 邮政编码 : 200023 Room 305-306, Building 2, No.169 Mengzi Lu, Shanghai 200023 电话 : 021-8023 2199 传真 : 021-8023 2190 (From February 13) Beijing 广告代理 : 上海和舟广告有限公司 北京市东城区东直门外大街 48 号东方银座 C 座 9G 邮政编码 : 100027 48 Dongzhimenwai Dajie Oriental Kenzo (Ginza Mall), Building C, Room 9G, Dongcheng District, Beijing 100027 电话 : 010-8447 7002 传真 : 010-8447 6455 Guangzhou 上海和舟广告有限公司广州分公司 广州市越秀区麓苑路 42 号大院 2 号楼 610 房 邮政编码 : 510095 Room 610, No. -

STRONG ACTION PLEA to G20 LEADERS IMF Says Leading Economies Have Fallen Far Behind Their 2014 Goals to Boost Growth

Friday 2 September 2016 Shanghai Call Center: Cloudy 26/35°C (86-21) 962288 • Flag day for students METRO/A4 Children fly the flag at an opening ceremony for the new semester at a primary school in Shanghai. About 2 million middle, primary and preschool students were at their desks yesterday, with more officers on duty near schools to deal with increased traffic. — Dong Jun STRONG ACTION PLEA to G20 LEADERS IMF says leading economies have fallen far behind their 2014 goals to boost growth THE International Monetary Fund is calling “a tool to improve lives.” It said they should on G20 leaders to take much stronger action adopt policies to foster innovation and new Thumbs-Up For Summit Organizers to boost demand, revive flagging trade, make industries and improve labor mobility. Senior officials in charge of prepara- long-delayed structural reforms to econo- “It is easy to blame trade for all the ills tions for the G20 summit in Hangzhou mies and share growth more broadly. afflicting a country, but curbing free trade yesterday gave a thumbs-up to China’s In a briefing note to heads of state of the would be stalling an engine that has brought organizing of the meeting under its G20 group of leading economies ahead of unprecedented welfare gains around the presidency. their summit in Hangzhou on Sunday and world over many decades,” IMF Managing A statement by the Chinese foreign Monday, the IMF said yesterday that they Director Christine Lagarde said. ministry said basic agreements had had fallen far behind in their 2014 goals “However, to make trade work for all, been reached on a G20 blueprint for to boost collective growth by 2 percentage policy-makers should help those who are innovation-driven growth, an action plan points within five years. -

Hua Ting Brasserie Chinoise

Welcome to Hua Ting Brasserie Chinoise Hua Ting’s name was inspired by the popular Hua Ting Road district in Old Shanghai - the Paris of China - famed for its row of Shanghainese restaurants. We oer the same authentic Shanghainese cuisine known for its bold lavors, complex preparation and unique cooking styles. Dining at Hua Ting oers a gastronomical journey through our exciting menu. The creatively presented dishes are classic and traditional with a modern take, making use of the freshest locally sourced ingredients that are healthy and delicious. We don’t use MSG and food is always prepared fresh. At the helm of Hua Ting is our international Shanghainese chef who hails from Shanghai, China. Expect expertly prepared delectable Shanghainese cuisine. And for those seeking variety, we have added some popular Cantonese food into the mix. For meetings and celebrations, Hua Ting has three beautiful private dining rooms, which come with a modern motorized “Lazy Susan” atop each table. Enjoy dining at Hua Ting! Cold dish appetizer 冷菜 Heirloom Shrimp 580 传承经典油爆虾 - 上海菜 Hong Kong Chicken with Shallot Oil 520 小葱香油三黄鸡 - 上海菜 Marinated Chicken in Brine “Xianji” 480 家乡咸鸡 - 上海菜 Sweet and sour Pork Ribs 480 本帮糖醋小排 - 上海菜 Classic old Shanghai smoked Fish 420 经典老上海熏鱼 - 上海菜 Cold Shrimp with Cordyceps Flower and Mushroom 380 华庭养生菜 - 上海菜 Refreshing pickled Radish 260 美味爽口腌萝卜- 上海菜 Barbeque Half / Whole 烧烤 一半 / 一只 Peking Duck AO 2,000 3,500 Variety in second way 北京烤鸭制法二 - 广东菜 Minced Duck with Lettuce 鸭松生菜包 Salt and Pepper 椒盐 Roast Duck 1,200 2,300 广东挂烧鸭 - 广东菜 Crispy Pork Belly 680 燒豬腩 - 广东菜 Honey roast Pork 520 秘制烤叉烧 - 广东菜 Chefs signature dish AO - Advance Order 厨师招牌菜 上海菜-Shanghai Cuisine 广东菜-Cantonese Cuisine 四川菜-Szechuan Cuisine 含猪肉 含乳 含坚果 无麸质 辣 All prices are in Philippine Peso.