Proptech Global Trends 2020 Annual Barometer 2 - Proptech Global Trends 2021 Barometer the Global Proptech Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CYAD JP Morgan Itinerary

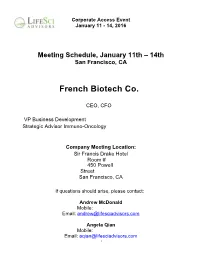

Corporate Access Event January 11 - 14, 2016 Meeting Schedule, January 11th – 14th San Francisco, CA French Biotech Co. CEO, CFO VP Business Development Strategic Advisor Immuno-Oncology Company Meeting Location: Sir Francis Drake Hotel Room # 450 P owell Street San Franc isco, CA If questions should arise, please contact: Andrew McDonald Mobile: Email: [email protected] Angela Qian Mobile: Email: [email protected] -1 Corporate Access Event January 11 - 14, 2016 MEETINGS Note: (*) indicates that this meeting time is double-booked. Meeting Time Room Meeting With Note Type Monday, January 11, 2016 08:00-09:00 am Sir Francis Drake (450 1x1 Aquilo Capital Powell St), Room 530 Patrick Rivers 09:00-10:00 am Sir Francis Drake (450 1x1 Auriga Capital Powell St), Room 530 Glen Losev 10:00-11:00 am Hotel Nikko (222 Mason 1x1 Takeda St), 25th Floor, Bay Kiran Philip View Room 11:00-12:00 pm Sir Francis Drake (450 1x1 Granite Investment Partners LAST MINUTE Powell St), Room 530 Jeffrey Hoo CANCELLATION 12:00-1:00 pm Marriott Marquis (780 1x1 AbbVie Onsite Contact: Mission St), Salon 14 Niels Emmerich Tiffany Cincotta-Janzen, (847) 393-5723 01:30-02:00 pm Sir Francis Drake (450 1x1 Alpine BioVentures, GP LLC Powell St), Room 530 David Miller 03:00-03:30 pm Sir Francis Drake (450 1x1 Tara Capital Grp Powell St), Room 530 Dhesh Govender 04:00-05:00 pm Sir Francis Drake (450 1x1 EVOLUTION Life Science Partners Powell St), Room 530 Anton Gueth Tuesday, January 12, 2016 07:00-08:30 am* Breakfast Fierce Biotech Big Data Breakfast CEO will attend. -

Corporate Venturing Report 2019

Corporate Venturing 2019 Report SUMMIT@RSM All Rights Reserved. Copyright © 2019. Created by Joshua Eckblad, Academic Researcher at TiSEM in The Netherlands. 2 TABLE OF CONTENTS LEAD AUTHORS 03 Forewords Joshua G. Eckblad 06 All Investors In External Startups [email protected] 21 Corporate VC Investors https://www.corporateventuringresearch.org/ 38 Accelerator Investors CentER PhD Candidate, Department of Management 43 2018 Global Startup Fundraising Survey (Our Results) Tilburg School of Economics and Management (TiSEM) Tilburg University, The Netherlands 56 2019 Global Startup Fundraising Survey (Please Distribute) Dr. Tobias Gutmann [email protected] https://www.corporateventuringresearch.org/ LEGAL DISCLAIMER Post-Doctoral Researcher Dr. Ing. h.c. F. Porsche AG Chair of Strategic Management and Digital Entrepreneurship The information contained herein is for the prospects of specific companies. While HHL Leipzig Graduate School of Management, Germany general guidance on matters of interest, and every attempt has been made to ensure that intended for the personal use of the reader the information contained in this report has only. The analyses and conclusions are been obtained and arranged with due care, Christian Lindener based on publicly available information, Wayra is not responsible for any Pitchbook, CBInsights and information inaccuracies, errors or omissions contained [email protected] provided in the course of recent surveys in or relating to, this information. No Managing Director with a sample of startups and corporate information herein may be replicated Wayra Germany firms. without prior consent by Wayra. Wayra Germany GmbH (“Wayra”) accepts no Wayra Germany GmbH liability for any actions taken as response Kaufingerstraße 15 hereto. -

Annual Report on the Performance of Portfolio Companies, IX November 2016

Annual report on the performance of portfolio companies, IX November 2016 Annual report on the performance of portfolio companies, IX 1 Annual report on the performance of portfolio companies, IX - November 2016 Contents The report comprises four sections: 1 2 3 4 Objectives Summary Detailed Basis of and fact base findings findings findings P3 P13 P17 P45 Annual report on the performance of portfolio companies, IX - November 2016 Foreword This is the ninth annual report The report comprises information and analysis With a large number of portfolio companies, on the performance of portfolio to assess the potential effect of Private Equity a high rate of compliance, and nine years of ownership on several measures of performance information, this report provides comprehensive companies, a group of large, of the portfolio companies. This year, the and detailed information on the effect of Private Equity (PE) - owned UK report covers 60 portfolio companies as at 31 Private Equity ownership on many measures of businesses that met defined December 2015 (2014:62), as well as a further performance of an independently determined 69 portfolio companies that have been owned group of large, UK businesses. criteria at the time of acquisition. and exited since 2005. The findings are based Its publication is one of the steps on aggregated information provided on the This report has been prepared by EY at the portfolio companies by the Private Equity firms request of the BVCA and the PERG. The BVCA adopted by the Private Equity has supported EY in its work, particularly by industry following the publication that own them — covering the entire period of Private Equity ownership. -

聯想控股股份有限公司 Legend Holdings Corporation

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. 聯想控股股份有限公司 Legend Holdings Corporation (A joint stock limited company incorporated in the People’s Republic of China with limited liability) (Stock Code: 03396) Connected Transaction Investment in a Private Equity Fund On December 24, 2019, Dongfangqihui (a subsidiary of the Company, and as one of the limited partners) and other limited partners jointly entered into the Partnership Agreement with Hony Capital Management (as the general partner and manager) to set up a fund, pursuant to which, the total amount of the final capital commitment of Dongfangqihui shall not exceed RMB800 million, and the proportion of its commitment shall not exceed 20% of the total size of the Fund. Mr. ZHAO is a connected person of the Company under Chapter 14A of the Listing Rules, and he also indirectly controls over 30% of interests in Hony Capital Management. Therefore, Hony Capital Management is deemed to be an associate of Mr. ZHAO. Under Chapter 14A of the Listing Rules, the transaction contemplated under the Partnership Agreement constitutes a connected transaction of the Company. As the applicable percentage ratio exceeds 0.1% but is less than 5%, it is subject to the reporting and announcement requirements but exempt from the independent shareholders’ approval requirements under Chapter 14A of the Listing Rules. -

Representative Legal Matters

Representative Legal Matters Xinxing Chen Prior to joining Baker McKenzie, Xinxing handled the following matters: Private Equity Advised Warburg Pincus on: o a number of co-investment deals with its existing limited partners and/or new investors regarding various Warburg Pincus portfolios in China and other Asia Pacific areas, including with respect to Warburg Pincus' investment in the USD 8.7 billion take-private of 58.com (NYSE: WUBA), China's largest online classifieds marketplace. o its subscription for USD 230 million convertible note issued by Uxin (NASDAQ: UXIN), a Chinese used car trading platform. Advised Cartesian Capital Group on an investment by Tencent Holdings Ltd. in Cartesian's portfolio company, Tim Hortons China, a joint venture with the Canada-based restaurant chain. Advised DCP Capital, a leading Greater China-focused private equity firm co-founded by ex-KKR professionals, on its proposed USD 200 million investment in a Chinese leading non-alcoholic beverages manufacturer. Advised KKR on: o its investment in Joulon, an integrated platform based in Dubai providing asset management services to the oil and gas industry globally, and a series of add-on acquisitions made by Joulon in its expansion. o its investment in Mandala Energy, a South East Asia focused oil and gas exploration and production company based in Singapore. Advised Bain Capital on: o its acquisition of Xiamen Qinhuai Technology Company Limited (ChinData), a leading operator of hyperscale data centers in China, from Wangsu Science & Technology Co. Ltd., as well as on the combination of ChinData with Bain Capital's existing Bridge Data Centres platform. -

Alternative Investments 2020: the Future of Capital for Entrepreneurs and Smes Contents Executive Summary

Alternative Investments 2020 The Future of Capital for Entrepreneurs and SMEs February 2016 World Economic Forum 2015 – All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, including photocopying and recording, or by any information storage and retrieval system. B Alternative Investments 2020: The Future of Capital for Entrepreneurs and SMEs Contents Executive summary 1 Executive summary Over the past decade, the external environment for alternative investments has seen 2 1. Introduction enormous changes. The areas affected the most are start-up capital and venture 3 1.1. Background funding for entrepreneurs, crowdfunding and marketplace lending for small businesses, 3 1.2. Scope and private debt for mid-market enterprises. 6 2. The shake-up of traditional start-up capital 6 2.1. Overview In all three cases, a set of interlocking factors is driving the emergence of new 8 2.2. What you need to know capital sources: 11 2.3. What to look out for 11 2.4. Take-away Regulation: where regulation constrains a capital flow for which there 1. is demand, a new source of capital will emerge to fulfil that demand; 12 3. The rise of crowdfunding 12 3.1. Overview 14 3.2. What you need to know Changes in demand for capital: where capital destinations develop 16 3.3. What to look out for 2. demand for new forms of funding, investors will innovate to meet it; 17 3.4. Take-away Technology: where technology enables new types of origination, 18 4. Mid-market capital 18 4.1. -

PE & QSR: Ambition on a Bun Asian Venture Capital Journal | 06

PE & QSR: Ambition on a bun Asian Venture Capital Journal | 06 November 2019 Many private equity investors think they can make a fast buck from fast dining, but rolling out a Western-style brand in Asia requires discipline on valuation and competence in execution Gondola Group was among the last remaining assets in Cinven’s fourth fund, and as one LP tells it, exit prospects were uncertain. The portfolio company’s primary business was PizzaExpress, which had 437 outlets in the UK and a further 68 internationally as of June 2014. Expansion in China by the brand’s Hong Kong-based franchise partner had been measured, with about a dozen restaurants apiece in Hong Kong and the mainland. Cinven wasn’t willing to be so patient. In May 2014, Gondola opened a directly owned outlet in Beijing – as a showcase of what the brand might achieve in China when backed by enough capital and ambition. Two months after that, PizzaExpress was sold to China’s Hony Capital for around $1.5 billion. By the start of the following year, Cinven had offloaded the remaining Gondola assets and generated a 2.4x return for its investors. The LP was “pleasantly surprised” by the outcome. Hony’s experience with the restaurant chain hasn’t be as fulfilling. Adverse commercial conditions in the UK – still home to 480 of its approximately 620 outlets – has eaten into margins and left PizzaExpress potentially unable to sustain an already highly leveraged capital structure. Hony is considering restructuring options for a GBP1.1 billion ($1.4 billion) debt pile. -

Full-Time MBA Program Class of 2015 Full-Time Employment Class of 2016 Internship Employment

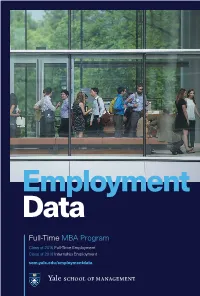

Employment Data Full-Time MBA Program Class of 2015 Full-Time Employment Class of 2016 Internship Employment som.yale.edu/employmentdata Class of 2015 Full-Time Employment Status Received Job Offer Demographic Data Three Months Post Graduation (at matriculation in fall 2013) 93.4% 228 of 244 students seeking employment Mean Age 28 Gender Accepted Job Offer Three Months Post Graduation Female 39% 92.2% Male 61% 225 of 244 students seeking employment U.S. Minority 23% Class Size 278 Underrepresented Minority 10% Students Seeking Employment 244 87.8% Country of Origin Students Not Seeking Employment 31 11.2% United States 68% Starting Own Business 15 5.4% International 32% Company Sponsored 11 4.0% Average GMAT 714 Continuing Education 3 1.1% Average GPA 3.57 Postponing Search/Other 2 0.7% No Response to Survey 3 1.1% Full-Time Salary Data Overall Salary Data Base Salary1 Other Guaranteed Compensation2 25th Median 75th 25th Median 75th Percentile Percentile Percentile Percentile $105,000 $120,000 $130,000 $25,000 $34,616 $51,750 Salary by Function Base Salary1 Other Guaranteed Compensation2 Percent 25th Median 75th 25th Median 75th of Hires3 Percentile Percentile Percentile Percentile Consulting Services 37.1% $112,750 $135,000 $140,000 $25,000 $30,000 $39,000 External Consulting 28.6% $122,500 $135,000 $140,000 $25,000 $30,000 $39,250 Internal Consulting/Strategy 8.5% $85,000 $110,000 $122,500 $7,000 $27,475 $37,875 Finance/Accounting 30.4% $105,000 $122,344 $125,000 $28,000 $50,000 $60,000 Marketing/Sales 13.4% $100,000 $112,000 $117,000 -

History, Reorganization and Corporate Structure

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. HISTORY, REORGANIZATION AND CORPORATE STRUCTURE OVERVIEW We are the largest digital medical service platform in China in terms of both the number of Internet hospitals as of December 31, 2020 and volume of digital medical consultations provided in 2019, according to Frost & Sullivan. Guided by our principle of “your health, we care” (“您的健康,我們的責任”), our vision is to establish the largest digital service platform in the world driven by technology and innovation to empower people to live healthier. Our Group was founded by Mr. Liao, the chairman of the Board, executive Director and the CEO of our Company. For the biography and industry experience of Mr. Liao, please refer to the section headed “Directors and Senior Management” in this Document. Our Group was established in 2004. In preparation for the [REDACTED], we conducted the Reorganization, details of which are set out in the sub-section headed “Reorganization” in this section. BUSINESS MILESTONES The following is a summary of our key business development milestones since our inception in 2004: Year Event 2004 Our Company was incorporated in the BVI 2006 Our Company registered by way of continuation in the Cayman Islands 2011 Our Company launched guahao.com, an online doctor appointment platform, in the PRC 2015 We upgraded our brand name from “guahao.com” to “We Doctor” We established Wuzhen Internet Hospital in Wuzhen, China, which was the first Internet hospital in the PRC 2017 We opened our first Internet hospital service center 2018 We launched our “mobile hospital” services empowered by our Internet hospital We established We Doctor Taishan Chronic Disease Internet Hospital, which was the first Internet hospital focusing on CDM in the PRC – 188 – THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. -

Hong Kong / PRC / Asia Pacific

Hong Kong / PRC / Asia Pacific Private Equity Slaughter and May is a leading international law firm with a worldwide corporate, commercial and financing practice. We provide our clients with a professional service of the highest quality, combining technical excellence with commercial awareness and a practical, constructive approach to legal issues. Slaughter and May has a long-standing presence in Asia, opening our office in Hong Kong in 1974 and our office in Beijing in 2009. The work quality is exceptional, the legal skills are outstanding and there is a consistency among their partners on how they react to different situations, which is hard to find. Chambers Asia-Pacific 2018 Overview We have extensive experience of a wide range of Our practice includes: private equity work, and our clients include leading private equity investors from Asia and around • investment work, including due diligence the world. and structuring; We regularly advise on cross-border transactions • debt financing and refinancings, including involving multiple jurisdictions and transactions in structuring and taking security; the technology and biotechnology sectors, as well as more traditional industries. • mezzanine and other hybrid or intermediate financings; • equity structuring, ratchets, management arrangements and incentives; and • exits, including trade sales, IPOs, recapitalisations and securitisation. Sophisticated Hong Kong team with growing recognition for its strength in Mainland China. Instructed by a loyal portfolio of significant clients across -

SME Financial Services in China: Institutional Framework And

SME Financial Services in China: Institutional Framework and Emerging Opportunities SMEs are the backbone of China’s economy but are under-served In China, SMEs accounted for 60% of GDP and 80% of employment but they accounted for less than 40% of total bank loans. Aside from banks, SMEs have few other sources of finance. Risk management is commercial banks’ primary concern, such that loan approval usually takes at least 1 month which certainly cannot fulfill the timely funding requirement of SMEs. Further, most types of loan products such as cashflow lending and unsecured lending are still in premature stage. SME’s difficulties are especially great during periods of liquidity tightening when bank head offices allocate lending quotas to the politically powerful state-owned enterprise sector in preference to SMEs. Rapid growth in the non-bank financing sector creates opportunities We estimated that the CAGR for new loan from non-bank channels grew at 32.8% during 2008-2012, far exceeding new RMB bank loan growth of 13.7%. This is due to the government’s promuglation of new regulations on non-bank financing institutions. As a result, the sector grew rapidly, for example, small loan companies experienced 98% and 51% growth in loan during 2011 and 2012, and finance leasing companies recorded 40% growth in receivabes during 2011. We believe that the industry is in its infancy and will grow substantially, but the industry is still quite fragmented with yet non-existence of national players. The SME financing sector has begun to receive policy support Over the past 10 years, the central government has rolled out numerous policy document encouraging SME lending and clarifying the legal status of non-bank financing institutions. -

GESCHÄFTSBERICHT 2007 ANNUAL REPORT 2007 GB P3 07.Qxp:GB P3 18.3.2008 16:15 Uhr Seite 2

GB_P3_07.qxp:GB_P3 18.3.2008 16:15 Uhr Seite 1 GESCHÄFTSBERICHT 2007 ANNUAL REPORT 2007 GB_P3_07.qxp:GB_P3 18.3.2008 16:15 Uhr Seite 2 GESCHÄFTSBERICHT 2007 ÜBERBLICK 2007 OVERVIEW 2007 ENTWICKLUNG DES BÖRSENKURSES UND DES INNEREN WERTES 01.01.2007 BIS 31.12.2007 PRICE AND NAV DEVELOPMENT 01.01.2007 UNTIL 31.12.2007 1’600 1’500 1’400 1’300 EUR in 1’200 1’100 1’000 900 12.06 01.07 02.07 03.07 04.07 05.07 06.07 07.07 08.07 09.07 10.07 11.07 12.07 Innerer Wert pro Zertifikat / Net Asset Value (NAV) per certificate Preis / Price 2 GB_P3_07.qxp:GB_P3 18.3.2008 16:15 Uhr Seite 3 ANNUAL REPORT 2007 Firmenprofil Company Profile Die Partners Group Private Equity Performance Holding Partners Group Private Equity Performance Holding Limited Limited («P3 Holding», «P3») ist eine nach dem Recht von (“P3 Holding”, “P3”) is a limited liability company, which was Guernsey gegründete Gesellschaft mit beschränkter Haftung incorporated under the laws of Guernsey and is domiciled in mit Sitz in St. Peter Port, Guernsey. Der Zweck der Gesell- St. Peter Port, Guernsey. The objective of the company is to schaft ist die Verwaltung und Betreuung eines Portfolios aus professionally manage a portfolio of investments in private Beteiligungen an Private Equity-Zielfonds, börsennotierten equity partnerships, listed private equity vehicles and direct Private Equity-Gesellschaften und Direktinvestitionen. P3 investments. P3 is supported in its activities by the Invest- wird in dieser Tätigkeit durch ihren Anlageberater Partners ment Advisor, Partners Group, which is a global alternative Group beraten.