History, Reorganization and Corporate Structure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CYAD JP Morgan Itinerary

Corporate Access Event January 11 - 14, 2016 Meeting Schedule, January 11th – 14th San Francisco, CA French Biotech Co. CEO, CFO VP Business Development Strategic Advisor Immuno-Oncology Company Meeting Location: Sir Francis Drake Hotel Room # 450 P owell Street San Franc isco, CA If questions should arise, please contact: Andrew McDonald Mobile: Email: [email protected] Angela Qian Mobile: Email: [email protected] -1 Corporate Access Event January 11 - 14, 2016 MEETINGS Note: (*) indicates that this meeting time is double-booked. Meeting Time Room Meeting With Note Type Monday, January 11, 2016 08:00-09:00 am Sir Francis Drake (450 1x1 Aquilo Capital Powell St), Room 530 Patrick Rivers 09:00-10:00 am Sir Francis Drake (450 1x1 Auriga Capital Powell St), Room 530 Glen Losev 10:00-11:00 am Hotel Nikko (222 Mason 1x1 Takeda St), 25th Floor, Bay Kiran Philip View Room 11:00-12:00 pm Sir Francis Drake (450 1x1 Granite Investment Partners LAST MINUTE Powell St), Room 530 Jeffrey Hoo CANCELLATION 12:00-1:00 pm Marriott Marquis (780 1x1 AbbVie Onsite Contact: Mission St), Salon 14 Niels Emmerich Tiffany Cincotta-Janzen, (847) 393-5723 01:30-02:00 pm Sir Francis Drake (450 1x1 Alpine BioVentures, GP LLC Powell St), Room 530 David Miller 03:00-03:30 pm Sir Francis Drake (450 1x1 Tara Capital Grp Powell St), Room 530 Dhesh Govender 04:00-05:00 pm Sir Francis Drake (450 1x1 EVOLUTION Life Science Partners Powell St), Room 530 Anton Gueth Tuesday, January 12, 2016 07:00-08:30 am* Breakfast Fierce Biotech Big Data Breakfast CEO will attend. -

Corporate Venturing Report 2019

Corporate Venturing 2019 Report SUMMIT@RSM All Rights Reserved. Copyright © 2019. Created by Joshua Eckblad, Academic Researcher at TiSEM in The Netherlands. 2 TABLE OF CONTENTS LEAD AUTHORS 03 Forewords Joshua G. Eckblad 06 All Investors In External Startups [email protected] 21 Corporate VC Investors https://www.corporateventuringresearch.org/ 38 Accelerator Investors CentER PhD Candidate, Department of Management 43 2018 Global Startup Fundraising Survey (Our Results) Tilburg School of Economics and Management (TiSEM) Tilburg University, The Netherlands 56 2019 Global Startup Fundraising Survey (Please Distribute) Dr. Tobias Gutmann [email protected] https://www.corporateventuringresearch.org/ LEGAL DISCLAIMER Post-Doctoral Researcher Dr. Ing. h.c. F. Porsche AG Chair of Strategic Management and Digital Entrepreneurship The information contained herein is for the prospects of specific companies. While HHL Leipzig Graduate School of Management, Germany general guidance on matters of interest, and every attempt has been made to ensure that intended for the personal use of the reader the information contained in this report has only. The analyses and conclusions are been obtained and arranged with due care, Christian Lindener based on publicly available information, Wayra is not responsible for any Pitchbook, CBInsights and information inaccuracies, errors or omissions contained [email protected] provided in the course of recent surveys in or relating to, this information. No Managing Director with a sample of startups and corporate information herein may be replicated Wayra Germany firms. without prior consent by Wayra. Wayra Germany GmbH (“Wayra”) accepts no Wayra Germany GmbH liability for any actions taken as response Kaufingerstraße 15 hereto. -

Representative Legal Matters

Representative Legal Matters Xinxing Chen Prior to joining Baker McKenzie, Xinxing handled the following matters: Private Equity Advised Warburg Pincus on: o a number of co-investment deals with its existing limited partners and/or new investors regarding various Warburg Pincus portfolios in China and other Asia Pacific areas, including with respect to Warburg Pincus' investment in the USD 8.7 billion take-private of 58.com (NYSE: WUBA), China's largest online classifieds marketplace. o its subscription for USD 230 million convertible note issued by Uxin (NASDAQ: UXIN), a Chinese used car trading platform. Advised Cartesian Capital Group on an investment by Tencent Holdings Ltd. in Cartesian's portfolio company, Tim Hortons China, a joint venture with the Canada-based restaurant chain. Advised DCP Capital, a leading Greater China-focused private equity firm co-founded by ex-KKR professionals, on its proposed USD 200 million investment in a Chinese leading non-alcoholic beverages manufacturer. Advised KKR on: o its investment in Joulon, an integrated platform based in Dubai providing asset management services to the oil and gas industry globally, and a series of add-on acquisitions made by Joulon in its expansion. o its investment in Mandala Energy, a South East Asia focused oil and gas exploration and production company based in Singapore. Advised Bain Capital on: o its acquisition of Xiamen Qinhuai Technology Company Limited (ChinData), a leading operator of hyperscale data centers in China, from Wangsu Science & Technology Co. Ltd., as well as on the combination of ChinData with Bain Capital's existing Bridge Data Centres platform. -

Inside the Ranking of Private Equity's Biggest Fundraisers Welcome to This Year's PEI 300

PEI 300 Inside the ranking of private equity's biggest fundraisers Welcome to this year's PEI 300 The PEI 300 - 2021 06:19 The changing face of the PEI 300... in 30 seconds Click the button below to see how the ranking has evolved since it was launched in 2007, when $32bn earned top spot Headquartered in North America Europe The Carlyle Group 32,500 KKR 31,000 Goldman Sachs 31,000 Blackstone 28,360 TPG 23,500 Apax Partners 18,850 Bain Capital 17,300 CVC Capital Partners 15,650 Apollo Global Mgt 13,900 2007 Warburg Pincus 13,300 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 Capital raised over preceding five years ($m) Source: Private Equity International 10 biggest risers The firms that made the biggest leap in this year's PEI 300 Headquartered in North America Europe Asia-Pacific Arcline Investment Management (Rank: 128) Up 157 places - Capital raised: $4,250m Värde Partners (135) Up 119 places - Capital raised: $3,980m Charlesbank Capital Partners (60) Up 108 places - Capital raised: $8,600m Wind Point Partners (192) Up 106 places - Capital raised: $2,579m 5Y Capital (171) Up 99 places - Capital raised: $2,872m Coatue Management (121) Up 91 places - Capital raised: $4,430m General Catalyst Partners (116) Up 86 places - Capital raised: $4,520m Vitruvian Partners (79) Up 84 places - Capital raised: $7,263m Vistria Group (112) Up 79 places - Capital raised: $4,664m Hover over the pointer to discover more about the firms making their mark on this Novacap (150) Up 78 places - Capital raised: $3,357m year's PEI 300 -

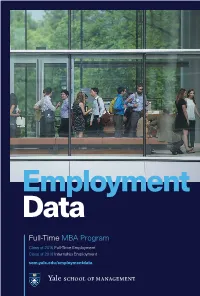

Full-Time MBA Program Class of 2015 Full-Time Employment Class of 2016 Internship Employment

Employment Data Full-Time MBA Program Class of 2015 Full-Time Employment Class of 2016 Internship Employment som.yale.edu/employmentdata Class of 2015 Full-Time Employment Status Received Job Offer Demographic Data Three Months Post Graduation (at matriculation in fall 2013) 93.4% 228 of 244 students seeking employment Mean Age 28 Gender Accepted Job Offer Three Months Post Graduation Female 39% 92.2% Male 61% 225 of 244 students seeking employment U.S. Minority 23% Class Size 278 Underrepresented Minority 10% Students Seeking Employment 244 87.8% Country of Origin Students Not Seeking Employment 31 11.2% United States 68% Starting Own Business 15 5.4% International 32% Company Sponsored 11 4.0% Average GMAT 714 Continuing Education 3 1.1% Average GPA 3.57 Postponing Search/Other 2 0.7% No Response to Survey 3 1.1% Full-Time Salary Data Overall Salary Data Base Salary1 Other Guaranteed Compensation2 25th Median 75th 25th Median 75th Percentile Percentile Percentile Percentile $105,000 $120,000 $130,000 $25,000 $34,616 $51,750 Salary by Function Base Salary1 Other Guaranteed Compensation2 Percent 25th Median 75th 25th Median 75th of Hires3 Percentile Percentile Percentile Percentile Consulting Services 37.1% $112,750 $135,000 $140,000 $25,000 $30,000 $39,000 External Consulting 28.6% $122,500 $135,000 $140,000 $25,000 $30,000 $39,250 Internal Consulting/Strategy 8.5% $85,000 $110,000 $122,500 $7,000 $27,475 $37,875 Finance/Accounting 30.4% $105,000 $122,344 $125,000 $28,000 $50,000 $60,000 Marketing/Sales 13.4% $100,000 $112,000 $117,000 -

Institutional Asset Management in Asia 2020

PRODUCT DETAILS Included with Purchase y Institutional Asset Management in Asia 2020 y Digital report in PDF format Key findings Setting the Stage for a New Era y Unlimited online firm-wide access y Analyst support y Exhibits in Excel y Interactive Report Dashboards OVERVIEW & METHODOLOGY This report takes a comprehensive examination of the Asia-Pacific region’s institutional Interactive Report landscape and outsourcing opportunities for external asset managers. It builds on our Dashboards previous research on Asian pensions, sovereign wealth funds, insurers, and other institutions, Interact and explore select and complements all our other Asian publications. The report focuses on market sizing and report data with Cerulli’s addressability, institutions’ investment behavior, strategies and allocation plans, outsourcing visualization tool. practices, manager selection, use of consultants, and other trends in Asia’s institutional asset management industry. The report explores three region-wide themes—the evolution of institutional sales, demand for alternative strategies, and de-risking and liquidity management among institutions. It y Regional Overview: Compare institutional market sizing in the also assesses the opportunities and challenges in the Australia and New Zealand institutional Asia-Pacific region, which includes investable assets by market, markets. This is followed by in-depth analysis of the institutional markets of China, Hong Kong, year, and institution type, as well as forecasted investable and Japan, Korea, Singapore, and Taiwan. addressable assets. y Institutional Type Analysis: Evaluate and compare the USE THIS REPORT TO retirement, insurance, and sovereign wealth fund markets in Asia ex-Japan, with interactive data covering investable and addressable y Analyze insourcing and fintech adoption trends among Asian institutions and how managers assets segmented by year, investment objective, and asset class. -

Proptech Global Trends 2020 Annual Barometer 2 - Proptech Global Trends 2021 Barometer the Global Proptech Industry

1 - PropTech Global Trends 2021 Barometer The Global PropTech Industry PropTech Global Trends 2020 Annual Barometer 2 - PropTech Global Trends 2021 Barometer The Global PropTech Industry Content Executive Summary 3 PropTech : Investing, Building, Managing and Living in a digital world 4 What is PropTech? 4 Why does it matter? 4 Why Now? 5 PropTech Opportunities 5 PropTech Company Categories 6 The Global PropTech Industry 9 1,724 PropTech companies unequally spread in 64 countries 10 Investment and funding structure of the PropTech Industry 11 3,118 investors worldwide mainly from the US 17 Focus on the US PropTech Industry 19 An increasing number of American PropTech companies 20 Investment: an industry dominated by a few companies 24 Funding structure of American PropTech companies 27 California: the financial heart of the American PropTech industry 28 The PropTech Industry in the Rest of World 30 PropTech companies across western countries and emerging giants 31 Investment opportunities are concentrated in a few Indian and Chinese PropTech companies 32 Funding structure of non-US PropTech companies 33 Most investors are from Europe, India and China 35 3 - PropTech Global Trends 2021 Barometer The Global PropTech Industry Executive Summary The 2020 PropTech Annual Barometer is an in-depth analysis of the international Prop- Tech sector. It analyses the evolution of PropTech over time, with graphs depicting the historical evolution of PropTech since its initial emergence. The Barometer also iden- tifies the sector’s newcomers, the quality of its emerging companies, its peak periods, and the leading companies in the Tech sector. We also visualise the PropTech sector’s geography via a world map showing the locations and amount of PropTech companies per continent and country. -

Private Equity Value Creation in Finance: Evidence from Life Insurance

University of Pennsylvania Carey Law School Penn Law: Legal Scholarship Repository Faculty Scholarship at Penn Law 2-14-2020 Private Equity Value Creation in Finance: Evidence from Life Insurance Divya Kirti International Monetary Fund Natasha Sarin University of Pennsylvania Carey Law School Follow this and additional works at: https://scholarship.law.upenn.edu/faculty_scholarship Part of the Banking and Finance Law Commons, Corporate Finance Commons, Finance Commons, Finance and Financial Management Commons, Insurance Commons, Insurance Law Commons, and the Law and Economics Commons Repository Citation Kirti, Divya and Sarin, Natasha, "Private Equity Value Creation in Finance: Evidence from Life Insurance" (2020). Faculty Scholarship at Penn Law. 2154. https://scholarship.law.upenn.edu/faculty_scholarship/2154 This Article is brought to you for free and open access by Penn Law: Legal Scholarship Repository. It has been accepted for inclusion in Faculty Scholarship at Penn Law by an authorized administrator of Penn Law: Legal Scholarship Repository. For more information, please contact [email protected]. Private Equity Value Creation in Finance: Evidence from Life Insurance Divya Kirti∗1 and Natasha Sarin2 1International Monetary Fund 2University of Pennsylvania Law School and Wharton School of Business January 13, 2020 Abstract This paper studies how private equity buyouts create value in the insurance industry, where decen- tralized regulation creates opportunities for aggressive tax and capital management. Using novel data on 57 large private equity deals in the insurance industry, we show that buyouts create value by decreasing insurers' tax liabilities; and by reaching-for-yield: PE firms tilt their subsidiaries' bond portfolios toward junk bonds while avoiding corresponding capital charges. -

Kuaishou Technology Annual Report 2020 Corporate Information

Kuaishou AR2020 Cover 04_12.36mm Eng output.pdf 1 20/4/2021 下午3:27 Kuaishou Technology (A company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability) Stock code : 1024 ANNUAL REPORT 2020 C M Y CM MY CY CMY K ANNUAL REPORT ANNUAL REPORT Head Ofce and Principal Place of Business in the PRC Address: Building 1, No. 6, Shangdi West Road, Haidian District, Beijing, the PRC Postcode:100085 Website: www.kuaishou.com Email: [email protected] 2020 WeChat Ofcial Account for Kuaishou: kuaishouApp Contents Corporate Information 2 Financial Summary and Operation Highlights 4 Chairman‘s Statement 7 Management Discussion and Analysis 11 Report of the Board of Directors 31 Corporate Governance Report 76 Independent Auditor‘s Report 92 Consolidated Income Statement 100 Consolidated Statement of Comprehensive Loss 101 Consolidated Balance Sheet 102 Consolidated Statement of Changes in Equity 104 Consolidated Statement of Cash Flows 105 Notes to the Consolidated Financial Statements 106 Definitions 193 Corporate Information BOARD OF DIRECTORS CORPORATE GOVERNANCE COMMITTEE Executive Directors Mr. WANG Huiwen (王慧文) (Chairman) Mr. SU Hua (宿華) (Chairman of the Board) Mr. HUANG Sidney Xuande (黃宣德) Mr. CHENG Yixiao (程一笑) Mr. MA Yin (馬寅) Non-executive Directors JOINT COMPANY SECRETARIES Mr. LI Zhaohui (李朝暉) Mr. JIA Hongyi (賈弘毅) Mr. ZHANG Fei (張斐) Ms. SO Ka Man (蘇嘉敏) Dr. SHEN Dou (沈抖) Mr. LIN Frank (林欣禾) (alias LIN Frank Hurst) AUTHORIZED REPRESENTATIVES Independent Non-executive Directors Mr. SU Hua (宿華) Ms. SO Ka Man (蘇嘉敏) Mr. WANG Huiwen (王慧文) 黃宣德 Mr. HUANG Sidney Xuande ( ) AUDITOR Mr. MA Yin (馬寅) PricewaterhouseCoopers AUDIT COMMITTEE Certified Public Accountants Registered Public Interest Entity Auditor Mr. -

The Money Management Gospel of Yale's Endowment Guru

The Money Management Gospel of Yale’s Endowment Guru - T... http://www.nytimes.com/2016/11/06/business/the-money-man... http://nyti.ms/2eaLzsP BUSINESS DAY The Money Management Gospel of Yale’s Endowment Guru By GERALDINE FABRIKANT NOV. 5, 2016 As he has done for decades, once a week David F. Swensen convenes his staff — including his cadre of apprentices — for a morning-long meeting among the Gothic revival flourishes and crenelations of the Yale University campus to debate investment ideas. Mr. Swensen, 62, runs the school’s $25.4 billion endowment, one of the largest in the country. Usually he is joined by his intellectual sparring partner, Dean Takahashi, his senior director. It amounts to an internship in the world of managing a university’s billions — and the young analysts have a front-row seat. “It was like watching a 70-year-old married couple go at it in full force,” recalled Andrew Golden, who was one of those Swensen acolytes in the 1980s. But forget what you think about internships and fetching doughnuts for the bosses. The meetings are supposed to be a crucible of ideas, and the analysts — some of whom stay in the positions for years — recalled bringing their own proposals in the early days, and having to defend them or face the music. “It could be jarring to have your own view shredded by them,” Mr. Golden said. As for Mr. Swensen, it’s an environment that brings together two things he loves: 1 of 9 11/30/16, 3:19 PM The Money Management Gospel of Yale’s Endowment Guru - T.. -

History and Corporate Structure

HISTORY AND CORPORATE STRUCTURE OVERVIEW The Company was incorporated in the Cayman Islands on February 11, 2014 as an exempted company with limited liability, and is the holding company of the Group with businesses conducted through its subsidiaries and Consolidated Affiliated Entities controlled by the Company by virtue of the Contractual Arrangements. The Group was founded by Mr. Su Hua and Mr. Cheng Yixiao. The development history of the Group can be traced back to 2011 when GIF Kuaishou was launched as a mobile app for users to create and share animated images known as GIFs, in essence the earliest form of short videos, according to iResearch. In 2013, we launched our short video social platform. Under the leadership of Mr. Su Hua and Mr. Cheng Yixiao, the Group launched its live streaming business as a natural extension to its platform in 2016, enabling users to be more social and engage with each other in real time on its platform, and has established live streaming, online marketing services, e-commerce, online games, online knowledge-sharing and various other monetization channels. The Group is a leading content community and social platform. Globally, we are the largest live streaming platform by gross billings from virtual gifting and average live streaming MPUs, the second largest short video platform by average DAUs, and the second largest live streaming e-commerce platform by GMV, all for the nine months ended September 30, 2020, according to iResearch. BUSINESS MILESTONES The following is a summary of our key business development milestones: Year Event 2011 GIF Kuaishou was launched for users to create and share animated images known as GIFs, in essence the earliest form of short videos.(1) 2012 We became the first mover in China’s short video industry that enabled users to create, upload and view short videos on mobile devices.(1) 2013 We launched our short video social platform. -

ANNUAL REVIEW 2018 Waking up to Impact a Recognized Leader

ANNUAL REVIEW 2018 Waking up to impact A Recognized Leader LenderLender of of the the year Year in inEurope Europe Ares Management is a global alternative asset manager built around three scaled businesses that collaborate to consistently deliver innovative, solutions-oriented results across market cycles. credit private equity real estate www.aresmgmt.com | www.arescapitalcorp.com The performance, awards/ratings noted herein may related only to selected funds/strategies and may not be representative of any client’s given experience and should not be viewed as indicative of Ares’ past performance or its funds’ future performance. REF: AM-00162 AresFullpageAds_Artwork.indd 2 2/12/19 11:50 AM Impact is everything ISSN 1474–8800 MARCH 2019 injected extra impetus into the movement, but TOBY Senior Editor, Private Equity MITCHENALL has also raised questions about definition. Who Toby Mitchenall, Tel: +44 207 566 5447 EDITOR'S [email protected] LETTER should be allowed to raise capital under the Senior Special Projects Editor “impact” label? It is currently a broad church, Graeme Kerr, Tel: +44 203 862 7491 [email protected] housing everything from philanthropically- Senior Editor, Private Equity, Americas driven capital that does not require “market” Isobel Markham, Tel: +1 646 380 6194 [email protected] returns at one end, to sleeves of existing port- Senior Reporters folios screened for their contribution to posi- Rod James, Tel: +44 207 566 5453 [email protected] tive change at the other. Carmela Mendoza, Tel: +852 2153 3148 One of our most read stories of 2018 broke the The definitional grey-ness is evident in the [email protected] news that KKR was joining the impact investing impact category of our annual awards.