Institutional Asset Management in Asia 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CYAD JP Morgan Itinerary

Corporate Access Event January 11 - 14, 2016 Meeting Schedule, January 11th – 14th San Francisco, CA French Biotech Co. CEO, CFO VP Business Development Strategic Advisor Immuno-Oncology Company Meeting Location: Sir Francis Drake Hotel Room # 450 P owell Street San Franc isco, CA If questions should arise, please contact: Andrew McDonald Mobile: Email: [email protected] Angela Qian Mobile: Email: [email protected] -1 Corporate Access Event January 11 - 14, 2016 MEETINGS Note: (*) indicates that this meeting time is double-booked. Meeting Time Room Meeting With Note Type Monday, January 11, 2016 08:00-09:00 am Sir Francis Drake (450 1x1 Aquilo Capital Powell St), Room 530 Patrick Rivers 09:00-10:00 am Sir Francis Drake (450 1x1 Auriga Capital Powell St), Room 530 Glen Losev 10:00-11:00 am Hotel Nikko (222 Mason 1x1 Takeda St), 25th Floor, Bay Kiran Philip View Room 11:00-12:00 pm Sir Francis Drake (450 1x1 Granite Investment Partners LAST MINUTE Powell St), Room 530 Jeffrey Hoo CANCELLATION 12:00-1:00 pm Marriott Marquis (780 1x1 AbbVie Onsite Contact: Mission St), Salon 14 Niels Emmerich Tiffany Cincotta-Janzen, (847) 393-5723 01:30-02:00 pm Sir Francis Drake (450 1x1 Alpine BioVentures, GP LLC Powell St), Room 530 David Miller 03:00-03:30 pm Sir Francis Drake (450 1x1 Tara Capital Grp Powell St), Room 530 Dhesh Govender 04:00-05:00 pm Sir Francis Drake (450 1x1 EVOLUTION Life Science Partners Powell St), Room 530 Anton Gueth Tuesday, January 12, 2016 07:00-08:30 am* Breakfast Fierce Biotech Big Data Breakfast CEO will attend. -

Post Event Report

presents 9th Asian Investment Summit Building better portfolios 21-22 May 2014, Ritz-Carlton, Hong Kong Post Event Report 310 delegates representing 190 companies across 18 countries www.AsianInvestmentSummit.com Thank You to our sponsors & partners AIWEEK Marquee Sponsors Co-Sponsors Associate Sponsors Workshop Sponsor Supporting Organisations alternative assets. intelligent data. Tech Handset Provider Education Partner Analytics Partner ® Media Partners Offical Broadcast Partner 1 www.AsianInvestmentSummit.com Delegate Breakdown 310 delegates representing 190 companies across 18 countries Breakdown by Organisation Institutional Investors 46% Haymarket Financial Media delegate attendee data is Asset Managemer 19% independently verified by the BPA Consultant 8% Fund Distributor / Private Wealth Management 5% Media & Publishing 4% Commercial Bank 4% Index / Trading Platform Provider 3% Association 2% Other 9% Breakdown of Institutional Investors Insurance 31% Endowment / Foundation 27% Corporation 13% Pension Fund 13% Family Office 8% Breakdown by Country Sovereign Wealth Fund 6% PE Funds of Funds 1% Mulitlateral Finance Hong Kong 82% Institution 1% ASEAN 10% North Asia 5% Australia 1% Europe 1% North America 1% Breakdown by Job Function Investment 34% Finance / Treasury 20% Marketing and Investor Relations 19% Other 11% CEO / Managing Director 7% Fund Selection / Distribution 7% Strategist / Economist 2% 2 www.AsianInvestmentSummit.com Participating Companies Haymarket Financial Media delegate attendee data is independently verified by the BPA 310 institutonal investors, asset managers, corporates, bankers and advisors attended the Forum. Attending companies included: ACE Life Insurance CFA Institute Board of Governors ACMI China Automation Group Limited Ageas China BOCOM Insurance Co., Ltd. Ageas Hong Kong China Construction Bank Head Office Ageas Insurance Company (Asia) Limited China Life Insurance AIA Chinese YMCA of Hong Kong AIA Group CIC AIA International Limited CIC International (HK) AIA Pension and Trustee Co. -

Allianz Se Allianz Finance Ii B.V. Allianz

2nd Supplement pursuant to Art. 16(1) of Directive 2003/71/EC, as amended (the "Prospectus Directive") and Art. 13 (1) of the Luxembourg Act (the "Luxembourg Act") relating to prospectuses for securities (loi relative aux prospectus pour valeurs mobilières) dated 12 August 2016 (the "Supplement") to the Base Prospectus dated 2 May 2016, as supplemented by the 1st Supplement dated 24 May 2016 (the "Prospectus") with respect to ALLIANZ SE (incorporated as a European Company (Societas Europaea – SE) in Munich, Germany) ALLIANZ FINANCE II B.V. (incorporated with limited liability in Amsterdam, The Netherlands) ALLIANZ FINANCE III B.V. (incorporated with limited liability in Amsterdam, The Netherlands) € 25,000,000,000 Debt Issuance Programme guaranteed by ALLIANZ SE This Supplement has been approved by the Commission de Surveillance du Secteur Financier (the "CSSF") of the Grand Duchy of Luxembourg in its capacity as competent authority (the "Competent Authority") under the Luxembourg Act for the purposes of the Prospectus Directive. The Issuer may request the CSSF in its capacity as competent authority under the Luxemburg Act to provide competent authorities in host Member States within the European Economic Area with a certificate of approval attesting that the Supplement has been drawn up in accordance with the Luxembourg Act which implements the Prospectus Directive into Luxembourg law ("Notification"). Right to withdraw In accordance with Article 13 paragraph 2 of the Luxembourg Act, investors who have already agreed to purchase or subscribe for the securities before the Supplement is published have the right, exercisable within two working days after the publication of this Supplement, to withdraw their acceptances, provided that the new factor arose before the final closing of the offer to the public and the delivery of the securities. -

Private Equity Spotlight January 2007 / Volume 3 - Issue 1

Private Equity Spotlight January 2007 / Volume 3 - Issue 1 Welcome to the latest edition of Private Equity Spotlight, the monthly newsletter from Private Equity Intelligence, providing insights into private equity performance, investors and fundraising. Private Equity Spotlight combines information from our online products Performance Analyst, Investor Intelligence and Funds in Market. FEATURE ARTICLE page 01 INVESTOR SPOTLIGHT page 10 Overhang, what overhang? The favourable market and difficulty of getting allocations to With 2006’s $404 billion smashing all previous records for top quartile funds has led to increased LP interest in Asian private equity fund raising, some commentators are suggesting focused funds. We look at LPs investing in these funds. that there is now an ‘overhang’ of committed capital that the industry may struggle to invest. The facts suggest otherwise. • How do LPs perceive Asian focused funds? PERFORMANCE SPOTLIGHT page 05 • Who is making the most Growth in distributions to LPs and the rate of call-ups are significant investments? driving the fundraising market. Performance Spotlight looks at the trends. • Which types of investor are the most active? FUND RAISING page 06 After a record breaking year for fundraising in 2006, we • How much is being committed examine the latest news for venture and buyout funds, as well to the region? as examining the market for first-time fund vehicles. No. of Funds on INVESTOR NEWS page 12 US Europe ROW Road All the latest news on investors in private equity: Venture 202 97 83 382 • State of Wisconsin Investment Board posts high returns Buyout 100 48 36 184 boosted by its private equity portfolio Funds of Funds 65 47 12 124 • Somerset County Council Pension Fund seeks new fund of Other 129 31 42 202 funds manager • LACERA looks for new advisor Total 496 223 173 892 • Indiana PERF is set to issue real estate RFPs SUBSCRIPTIONS If you would like to receive Private Equity Spotlight each month • COPERA close to appointing new alternatives chief. -

CAFR) of the State Retirement Systems Administered by the Department of Management Services, Division of Retirement (Division)

Florida Retirement System Pension Plan And Other State Administered Systems Comprehensive Annual Financial Report Fiscal Year Ended June 30, 2020 This aerial view shows the Lower Florida Keys, near Big Pine Key, FL, known for their pristine environment and eco-friendly attractions. The Lower Keys are home to two national wildlife refuges, a portion of a national marine sanctuary and a state park, and are surrounded by a marine environment fi lled with abundant terrestial and marine life. This photograph is courtesy of Andy Newman with the Florida Keys News Bureau. Division of Retirement Toll Free: 844-377-1888 P.O. Box 9000 Local: 850-907-6500 Tallahassee, FL 32399-9000 TTY: 800-955-8771 www.frs.myfl orida.com Ron DeSantis, Governor Jonathan Satter, Secretary David DiSalvo, State Retirement Director This report has been prepared by the Department of Management Services Division of Retirement. The photographs used throughout this report highlight various islands around the State of Florida. On the cover is a photograph of Amelia Island, courtesy of Amelia Island Convention & Visitor Bureau. Intentionally Left Blank 2 TABLE OF CONTENTS INTRODUCTORY SECTION .................................................................................................................................................................... 7 Transmittal Letter .................................................................................................................................................................................. 8 Management Staff ............................................................................................................................................................................. -

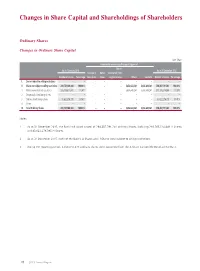

Changes in Share Capital and Shareholdings of Shareholders

Changes in Share Capital and Shareholdings of Shareholders Ordinary Shares Changes in Ordinary Share Capital Unit: Share Increase/decrease during the reporting period Shares As at 1 January 2015 As at 31 December 2015 Issuance of Bonus transferred from Number of shares Percentage new shares shares surplus reserve Others Sub-total Number of shares Percentage I. Shares subject to selling restrictions – – – – – – – – – II. Shares not subject to selling restrictions 288,731,148,000 100.00% – – – 5,656,643,241 5,656,643,241 294,387,791,241 100.00% 1. RMB-denominated ordinary shares 205,108,871,605 71.04% – – – 5,656,643,241 5,656,643,241 210,765,514,846 71.59% 2. Domestically listed foreign shares – – – – – – – – – 3. Overseas listed foreign shares 83,622,276,395 28.96% – – – – – 83,622,276,395 28.41% 4. Others – – – – – – – – – III. Total Ordinary Shares 288,731,148,000 100.00% – – – 5,656,643,241 5,656,643,241 294,387,791,241 100.00% Notes: 1 As at 31 December 2015, the Bank had issued a total of 294,387,791,241 ordinary shares, including 210,765,514,846 A Shares and 83,622,276,395 H Shares. 2 As at 31 December 2015, none of the Bank’s A Shares and H Shares were subject to selling restrictions. 3 During the reporting period, 5,656,643,241 ordinary shares were converted from the A-Share Convertible Bonds of the Bank. 79 2015 Annual Report Changes in Share Capital and Shareholdings of Shareholders Number of Ordinary Shareholders and Shareholdings Number of ordinary shareholders as at 31 December 2015: 963,786 (including 761,073 A-Share Holders and 202,713 H-Share Holders) Number of ordinary shareholders as at the end of the last month before the disclosure of this report: 992,136 (including 789,535 A-Share Holders and 202,601 H-Share Holders) Top ten ordinary shareholders as at 31 December 2015: Unit: Share Number of Changes shares held as Percentage Number of Number of during at the end of of total shares subject shares Type of the reporting the reporting ordinary to selling pledged ordinary No. -

TRS Celebrates 70 Years

Comprehensive Annual Financial Report for the Fiscal Year Ended June 30, 2009 Seasons of Change TRS Celebrates 70 Years Teachers’ Retirement System of the State of Illinois A component unit of the State of Illinois Statement of Purpose Retirement Security for Illinois Educators Mission Statement Safeguard benefit security through committed staff, engaged members, and responsible funding. Fiscal Year Highlights 2009 2008 Active contributing members 169,158 165,572 Inactive noncontributing members 101,606 98,550 Benefit recipients* 94,424 91,462 Total membership 365,188 355,584 Actuarial accrued liability (AAL) $73,027,198,000 $68,632,367,000 Less actuarial value of assets (smoothed assets in 2009 and market value assets in 2008) 38,026,044,000 38,430,723,000 Unfunded actuarial accrued liability (UAAL) $35,001,154,000 $30,201,644,000 Funded ratio (% of AAL covered by assets, based on smoothed assets in 2009 and market value assets in 2008) 52.1% 56.0% Total fund investment return (loss), net of fees (22.7%) (5.0%) Expenses Benefits paid $3,653,713,951 $3,423,981,732 Refunds paid 53,709,137 60,285,624 Administrative expenses 17, 3 8 7,93 6 16,613,364 Total expenses $3,724,811,024 $3,500,880,720 Income Member contributions $876,182,122 $865,400,168 Employer contributions 152,328,853 130,673,629 State of Illinois contributions 1,451,591,716 1,041,114,825 Total investment income (loss) (8,688,285,511) (2,014,902,366) Total income ($6,208,182,820) $22,286,256 * Benefit recipients includes retiree, disability, and survivor beneficiaries. -

Annual Investment Report Fiscal Year July 1, 2019 - June 30, 2020 State Board of Administration Table of Contents

Annual Investment Report Fiscal Year July 1, 2019 - June 30, 2020 State Board of Administration Table of Contents Executive Director’s Report and Transmittal ..................................................5 SBA Organizational Structure and Oversight ..................................................13 Advisors, Consultants and Auditors ..............................................................14 SBA Mandate Overview ................................................................................16 Asset Allocation ..............................................................................................18 Risk and the Investment Process .....................................................................19 Compliance with Investment Strategy ............................................................22 SBA’s Non-Investment Management Responsibilities ....................................23 Investment Policy Statements, Portfolio Guidelines and Trust Agreements .....................................................25 Florida Retirement System Pension Plan .........................................................26 Florida Retirement System Investment Plan .....................................................48 Florida PRIMETM .....................................................................................................53 Florida Hurricane Catastrophe Fund/State Board of Administration Finance Corporation .............................................................56 Lawton Chiles Endowment Fund ...................................................................59 -

Corporate Venturing Report 2019

Corporate Venturing 2019 Report SUMMIT@RSM All Rights Reserved. Copyright © 2019. Created by Joshua Eckblad, Academic Researcher at TiSEM in The Netherlands. 2 TABLE OF CONTENTS LEAD AUTHORS 03 Forewords Joshua G. Eckblad 06 All Investors In External Startups [email protected] 21 Corporate VC Investors https://www.corporateventuringresearch.org/ 38 Accelerator Investors CentER PhD Candidate, Department of Management 43 2018 Global Startup Fundraising Survey (Our Results) Tilburg School of Economics and Management (TiSEM) Tilburg University, The Netherlands 56 2019 Global Startup Fundraising Survey (Please Distribute) Dr. Tobias Gutmann [email protected] https://www.corporateventuringresearch.org/ LEGAL DISCLAIMER Post-Doctoral Researcher Dr. Ing. h.c. F. Porsche AG Chair of Strategic Management and Digital Entrepreneurship The information contained herein is for the prospects of specific companies. While HHL Leipzig Graduate School of Management, Germany general guidance on matters of interest, and every attempt has been made to ensure that intended for the personal use of the reader the information contained in this report has only. The analyses and conclusions are been obtained and arranged with due care, Christian Lindener based on publicly available information, Wayra is not responsible for any Pitchbook, CBInsights and information inaccuracies, errors or omissions contained [email protected] provided in the course of recent surveys in or relating to, this information. No Managing Director with a sample of startups and corporate information herein may be replicated Wayra Germany firms. without prior consent by Wayra. Wayra Germany GmbH (“Wayra”) accepts no Wayra Germany GmbH liability for any actions taken as response Kaufingerstraße 15 hereto. -

HOW to AVOID the PITFALLS in PRIVATE CREDIT Steer Clear of Mezzanine in Asia and China NPL Funds, Says Hamilton Lane

INVESTOR DIALOGUE HOW TO AVOID THE PITFALLS IN PRIVATE CREDIT Steer clear of mezzanine in Asia and China NPL funds, says Hamilton Lane. The ideal credit portfolio is a blend of special situations and direct lending By Alison Tudor-Ackroyd rivate markets promising these yield-hungry within a year, up from 37% in China. Bain Capital, KKR, investor Hamilton investors higher returns for the previous year’s survey. Hong Kong-based PAG, and P Lane sees traps lying unearthing deals outside of Private credit is one of Baring Private Equity Asia in wait for the herd of publicly traded markets. those alternative strategies. are all in the market raising institutional investors That has crushed the “It [private credit] is the funds to invest in NPLs in rushing to buy private debt premium investors usually fastest-growing area where Asia. instruments. expect as a form of hazard pay we need to answer to our However, as yet there are There is too much cash for backing riskier clients,” said Delgado- slim pickings and there is no waiting to be deployed into companies. “Now when you Moreira, outpacing buyouts guarantee that there will ever distressed debt in China allocate to credit in Asia you or growth strategies. “Around be a full-blown bad debt crisis while mezzanine in Asia is are much more focused on the four years ago we were seeing in China, where the state too risky for the slim reward absolute return than on the only about 90 funds a year, continues to dominate the the product offers, Juan spread to developed markets,” today we see over 140 funds a economy. -

Representative Legal Matters

Representative Legal Matters Xinxing Chen Prior to joining Baker McKenzie, Xinxing handled the following matters: Private Equity Advised Warburg Pincus on: o a number of co-investment deals with its existing limited partners and/or new investors regarding various Warburg Pincus portfolios in China and other Asia Pacific areas, including with respect to Warburg Pincus' investment in the USD 8.7 billion take-private of 58.com (NYSE: WUBA), China's largest online classifieds marketplace. o its subscription for USD 230 million convertible note issued by Uxin (NASDAQ: UXIN), a Chinese used car trading platform. Advised Cartesian Capital Group on an investment by Tencent Holdings Ltd. in Cartesian's portfolio company, Tim Hortons China, a joint venture with the Canada-based restaurant chain. Advised DCP Capital, a leading Greater China-focused private equity firm co-founded by ex-KKR professionals, on its proposed USD 200 million investment in a Chinese leading non-alcoholic beverages manufacturer. Advised KKR on: o its investment in Joulon, an integrated platform based in Dubai providing asset management services to the oil and gas industry globally, and a series of add-on acquisitions made by Joulon in its expansion. o its investment in Mandala Energy, a South East Asia focused oil and gas exploration and production company based in Singapore. Advised Bain Capital on: o its acquisition of Xiamen Qinhuai Technology Company Limited (ChinData), a leading operator of hyperscale data centers in China, from Wangsu Science & Technology Co. Ltd., as well as on the combination of ChinData with Bain Capital's existing Bridge Data Centres platform. -

Full-Time MBA Program Class of 2015 Full-Time Employment Class of 2016 Internship Employment

Employment Data Full-Time MBA Program Class of 2015 Full-Time Employment Class of 2016 Internship Employment som.yale.edu/employmentdata Class of 2015 Full-Time Employment Status Received Job Offer Demographic Data Three Months Post Graduation (at matriculation in fall 2013) 93.4% 228 of 244 students seeking employment Mean Age 28 Gender Accepted Job Offer Three Months Post Graduation Female 39% 92.2% Male 61% 225 of 244 students seeking employment U.S. Minority 23% Class Size 278 Underrepresented Minority 10% Students Seeking Employment 244 87.8% Country of Origin Students Not Seeking Employment 31 11.2% United States 68% Starting Own Business 15 5.4% International 32% Company Sponsored 11 4.0% Average GMAT 714 Continuing Education 3 1.1% Average GPA 3.57 Postponing Search/Other 2 0.7% No Response to Survey 3 1.1% Full-Time Salary Data Overall Salary Data Base Salary1 Other Guaranteed Compensation2 25th Median 75th 25th Median 75th Percentile Percentile Percentile Percentile $105,000 $120,000 $130,000 $25,000 $34,616 $51,750 Salary by Function Base Salary1 Other Guaranteed Compensation2 Percent 25th Median 75th 25th Median 75th of Hires3 Percentile Percentile Percentile Percentile Consulting Services 37.1% $112,750 $135,000 $140,000 $25,000 $30,000 $39,000 External Consulting 28.6% $122,500 $135,000 $140,000 $25,000 $30,000 $39,250 Internal Consulting/Strategy 8.5% $85,000 $110,000 $122,500 $7,000 $27,475 $37,875 Finance/Accounting 30.4% $105,000 $122,344 $125,000 $28,000 $50,000 $60,000 Marketing/Sales 13.4% $100,000 $112,000 $117,000