ANNUAL REVIEW 2018 Waking up to Impact a Recognized Leader

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Orangetheory® Fitness Receives Growth Equity Investment from Roark

Contact: Amanda Bortzfield Fish Consulting 212-794-5293 [email protected] ORANGETHEORY® FITNESS RECEIVES GROWTH EQUITY INVESTMENT FROM ROARK CAPITAL GROUP - Strategic Investment to Support Leading Fitness Franchise’s Rapid Domestic and International Growth - Fort Lauderdale, Fla. – February 17, 2016 – Orangetheory® Fitness, the energizing and fast-growing fitness franchise, today announced that an affiliate of Roark Capital Group, an Atlanta-based private equity firm that focuses on investing in the franchise industry, has become a strategic investor through a growth equity investment in the company. Terms were not disclosed. “We decided to engage Roark as a strategic investor to support us as we continue to experience rapid growth in the U.S. and internationally, as well as expand our product and service quality,” said Dave Long, co-founder and chief executive officer of Orangetheory Fitness. “Our relationship with Roark will strengthen our mission to deliver proven fitness results for a healthier world.” The Orangetheory Fitness management team, including Long, will remain unchanged and continue to lead the company. Roark Capital managing directors, Erik Morris and Steve Romaniello, will join the Board of Directors and provide strategic counsel and support. Additionally, this new partnership will enable Orangetheory Fitness to improve its systems and processes, while bringing its proven workout to millions across the globe. “The founders and leadership team at Orangetheory have built a terrific brand that is generating amazing results,” said Morris. “Their culture and commitment to franchisee success aligns with Roark’s core philosophies. The corporate team, area representatives and franchisees are incredibly talented and strong, and we’re excited to help contribute to the brand’s success.” Roark Capital Group is a private equity firm that focuses on investing in franchise and multi-unit business. -

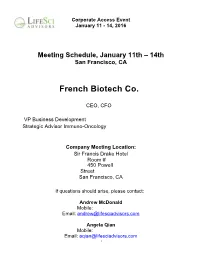

CYAD JP Morgan Itinerary

Corporate Access Event January 11 - 14, 2016 Meeting Schedule, January 11th – 14th San Francisco, CA French Biotech Co. CEO, CFO VP Business Development Strategic Advisor Immuno-Oncology Company Meeting Location: Sir Francis Drake Hotel Room # 450 P owell Street San Franc isco, CA If questions should arise, please contact: Andrew McDonald Mobile: Email: [email protected] Angela Qian Mobile: Email: [email protected] -1 Corporate Access Event January 11 - 14, 2016 MEETINGS Note: (*) indicates that this meeting time is double-booked. Meeting Time Room Meeting With Note Type Monday, January 11, 2016 08:00-09:00 am Sir Francis Drake (450 1x1 Aquilo Capital Powell St), Room 530 Patrick Rivers 09:00-10:00 am Sir Francis Drake (450 1x1 Auriga Capital Powell St), Room 530 Glen Losev 10:00-11:00 am Hotel Nikko (222 Mason 1x1 Takeda St), 25th Floor, Bay Kiran Philip View Room 11:00-12:00 pm Sir Francis Drake (450 1x1 Granite Investment Partners LAST MINUTE Powell St), Room 530 Jeffrey Hoo CANCELLATION 12:00-1:00 pm Marriott Marquis (780 1x1 AbbVie Onsite Contact: Mission St), Salon 14 Niels Emmerich Tiffany Cincotta-Janzen, (847) 393-5723 01:30-02:00 pm Sir Francis Drake (450 1x1 Alpine BioVentures, GP LLC Powell St), Room 530 David Miller 03:00-03:30 pm Sir Francis Drake (450 1x1 Tara Capital Grp Powell St), Room 530 Dhesh Govender 04:00-05:00 pm Sir Francis Drake (450 1x1 EVOLUTION Life Science Partners Powell St), Room 530 Anton Gueth Tuesday, January 12, 2016 07:00-08:30 am* Breakfast Fierce Biotech Big Data Breakfast CEO will attend. -

Press Release San Francisco, CA 94104 Tel: 415.358.3500 Fax: 415.358.3555

580 California Street Suite 2000 Press Release San Francisco, CA 94104 Tel: 415.358.3500 Fax: 415.358.3555 Roark Capital Group Acquires Corner Bakery Cafe and Il Fornaio Roark primes Corner Bakery Cafe for national expansion through franchising ATLANTA, JUNE 13, 2011 /PRNEWSWIRE/ – Roark Capital Group, an Atlanta-based private equity firm, announced today that its affiliates have acquired Il Fornaio (America) Corporation, owner of Corner Bakery Cafe and Il Fornaio Restaurants and Bakeries. Beginning in 1991 as a small bread bakery in Chicago, Corner Bakery Cafe has emerged over the last 20 years as a leader in the growing fast casual segment, serving guests made-to-order, hand-crafted favorites for breakfast, lunch and dinner, and boasting segment-leading catering services. Headquartered in Dallas, Texas and operating 119 locations nationwide, Corner Bakery Cafe launched a strategic franchise development program in 2007 to attract seasoned franchise partners with multi-unit restaurant and retail experience. Il Fornaio, averaging over $5 million in annual sales per restaurant, has been a recognized leader in the upscale Italian segment for over 20 years. Founded in Italy and based in Corte Madera, California, Il Fornaio owns and operates 22 full-service Italian restaurants in California and across the United States that serve creatively prepared, premium-quality Italian cuisine based on authentic regional Italian recipes. Il Fornaio’s wholesale bakeries produce a wide variety of hand-made breads, pastries and other artisan baked goods for sale at their own locations and to high- quality grocers and food service customers across the US. Neal Aronson, Managing Partner of Roark, said, “Mike Hislop and his outstanding teams at Corner Bakery Cafe and Il Fornaio have built two terrific brands with strong points of differentiation and excellent consumer appeal. -

Making Sense of ESG, SRI and Impact Investing INSIGHTS

Investing with Purpose: Making Sense of ESG, SRI and Impact Investing INSIGHTS Many investors want to bring their portfolios into alignment with their personal values, but don’t know where to start. This Insights outlines the three most common approaches. CARIN L. PAI, CFA® A growing awareness of environmental which companies are making the Executive Vice President, and social issues, along with the most progress in this area, investors Head of Portfolio Management availability of data on corporate can find a comfortable place on responsibility, is changing the way the spectrum between doing well individuals think about investing. financially and doing good things for Increasingly, investors are bringing their the world. portfolios into alignment with their MICHAEL FIRESTONE personal values. Three Common Approaches Managing Director, to Responsible Investing Portfolio Manager There are many different approaches to “responsible investing” and they go Responsible investing means different by different names—including ethical, things to different people, and there is sustainable and green investing. But a broad spectrum of approaches. But they all have one thing in common: the most commonly used techniques They pursue financial rewards while are ESG, SRI and Impact Investing. The approach investors take depends NATALIA LAZAR-GALOIU encouraging positive changes in Senior Investment the world. largely on their personal preferences Associate and which part of the spectrum they Doing Well Financially While find most appropriate—depending on Doing Good Socially how heavily they want to lean toward achieving financial goals versus Traditionally, investment decisions have promoting social causes. been aimed at achieving financial goals, using research on economic trends Environmental, Social, and analyzing a company’s balance Governance (ESG) sheet. -

Map of Funding Sources for EU XR Technologies

This project has received funding from the European Union’s Horizon 2020 Research and Innovation Programme under Grant Agreement N° 825545. XR4ALL (Grant Agreement 825545) “eXtended Reality for All” Coordination and Support Action D5.1: Map of funding sources for XR technologies Issued by: LucidWeb Issue date: 30/08/2019 Due date: 31/08/2019 Work Package Leader: Europe Unlimited Start date of project: 01 December 2018 Duration: 30 months Document History Version Date Changes 0.1 05/08/2019 First draft 0.2 26/08/2019 First version submitted for partners review 1.0 30/08/2019 Final version incorporating partners input Dissemination Level PU Public Restricted to other programme participants (including the EC PP Services) Restricted to a group specified by the consortium (including the EC RE Services) CO Confidential, only for members of the consortium (including the EC) This project has received funding from the European Union’s Horizon 2020 Research and Innovation Programme under Grant Agreement N° 825545. Main authors Name Organisation Leen Segers, Diana del Olmo LCWB Quality reviewers Name Organisation Youssef Sabbah, Tanja Baltus EUN Jacques Verly, Alain Gallez I3D LEGAL NOTICE The information and views set out in this report are those of the authors and do not necessarily reflect the official opinion of the European Union. Neither the European Union institutions and bodies nor any person acting on their behalf may be held responsible for the use which may be made of the information contained therein. © XR4ALL Consortium, 2019 Reproduction is authorised provided the source is acknowledged. D5.1 Map of funding sources for XR technologies - 30/08/2019 Page 1 Table of Contents INTRODUCTION ................................................................................................................ -

2014 Winners Honored at the TURNAROUND

CONGRATULATIONS: 2014 WINNER CIRCLE June 26, 2014, Chicago. Global M&A Network honored the winners from the restructuring, distressed M&A and turnaround communities in fifty awards categories, encompassing variety of restructuring styles and transaction sizes at the annual awards gala ceremony held on the evening of June 24, 2014 at the Standard Club of Chicago. The master of ceremonies, Ms. Lisa Lockwood, the reinvention expert, author and motivational speaker made the evening gala memorable and fun. “The Turnaround Atlas Awards is an opportunity to honor excellence from the restructuring communities. Winners should take pride for effecting number of successful restructurings, demonstrating their creativity, patience, hard-work and professional talents." said, Shanta Kumari, managing partner and chief executive officer of Global M&A Network. A TRADITION of EXCELLENCE: Gold standard of Performance, the annual TURNAROUND ATALS AWARDS honors excellence from the restructuring and turnaround communities, world-wide. Over the past many years, the winners are selected independently based on identifiable performance criteria such as restructuring raison - style, pre/post workout, sustainability, operational/client/HR metrics, number of creditors, timeliness, jurisdiction; leadership; resourcefulness; among other criteria unique to the award category. About: Global M&A Network is a diversified information, digital media and professionals connecting company, exclusively serving the mergers, acquisitions, alternative investing, restructuring and turnaround communities worldwide. The company produces high-caliber educational, industry Intelligence Forums and the prestigious, M&A ATLAS AWARDS ® programs including the TURNAROUND ATLAS AWARDS. Global M&A Network's digital media platform also includes the Top 100: Restructuring and Turnaround Professionals. www.globalmanetwork.com INQUIRIES, CONTACT: Raj Kashyap, T: +914.886.3085 or by E: [email protected] 7th ANNUAL WINNERS CIRCLE, 2014. -

Finding the Opportunity In

Finding the ESG disclosures: the bedrock of the opportunity sustainable finance agenda in ESG Executive summary To be successful, the development of sustainable finance in Europe needs to be grounded in access to high quality and meaningful ESG disclosures. While the quality and reliability of ESG data has improved considerably, so has the sophistication of investors and their needs for improved ESG disclosure. Investors find the most value in ESG disclosures when sustainability is embedded in the DNA of the firm as part of their competitive advantage to create long-term value. Companies that create societal value should benefit from changing policy and consumer trends, resulting in more sustainable cash flows, a lower cost of capital and higher valuations. While no standardised reporting framework can ever fully capture and reflect this. Reporting standards should, however, ensure that we move away from boilerplate disclosures and box-ticking approaches to consider the ESG risks and opportunities that are material to each company, industry and sector. While numerous standards already exist in this space, no single regulatory standard provides a comprehensive framework for companies to disclose in a way that would meet investors’ needs. Greater convergence in reporting could fill the gaps in accessing core ESG metrics that investors rely on to develop their ESG screening tools and assessment methodologies. Convergence in ESG reporting standards would also enable such data to be audited, which is becoming increasingly important to investors who base capital allocation decisions on such information. Beyond these core metrics, we need to connect ESG disclosures with real world outcomes, both adverse impacts as well as opportunities for transition. -

Future Finance & Investment Chapter

FUTURE FINANCE & INVESTMENT CHAPTER MEMBERS FUTURE FINANCE & INVESTMENT CHAPTER MEMBERS OF THE GRI GLOBAL COMMITTEE FUTURE FINANCE & INVESTMENT CHAIRPERSON VICE-CHAIR Audrey Klein Peter Plaut Head of Investor Relations (Funds) Executive Director Kennedy Wilson Wimmer Family Office Investor Relations (Funds) Investor - Family Office Kennedy Wilson is a global real estate operator. We focus Wimmer Family Office offers both bespoke investment portfolio on multifamily, office and industrial properties located in the solutions for family offices and high net worth individuals as Western U.S., U.K., Ireland and Spain. Headquartered in Beverly well as its core investment trend following strategy through the Wimmer Wealth Protection Fund. Hills, CA, and London, UK, Kennedy Wilson has 16 global offices. Audrey Klein is the Head of Fundraising for Kennedy Wilson Europe. Prior to Peter Plaut is an Executive Director at Wimmer Family Office focused on origination, this she held Head of Fundraising roles at several firms but is best known for researching and structuring private debt and equity transactions across a broad range starting the European business out of London for the Park Hill Real Estate of industries including specializing in real estate across the residential, office and hotel Group, a Division of Blackstone, which she ran for 9 yrs. Prior to joining Park and hospitality sectors. Minimum transaction size is $100mm to well over $1 billion. Hill, she ran her own business for 5 yrs marketing alternative asset funds Mr. Plaut is consistently recognized as a leader in the industry. Among his many across all asset classes including private equity, real estate and hedge funds achievements and awards, he was ranked as one of the Top 20 Rising Stars of Hedge to European investors comprised of pension funds, banks, family offices and Funds during the 2008 financial crisis –a recognition of his ability to manage through high net worth individuals. -

TRS Contracted Investment Managers

TRS INVESTMENT RELATIONSHIPS AS OF DECEMBER 2020 Global Public Equity (Global Income continued) Acadian Asset Management NXT Capital Management AQR Capital Management Oaktree Capital Management Arrowstreet Capital Pacific Investment Management Company Axiom International Investors Pemberton Capital Advisors Dimensional Fund Advisors PGIM Emerald Advisers Proterra Investment Partners Grandeur Peak Global Advisors Riverstone Credit Partners JP Morgan Asset Management Solar Capital Partners LSV Asset Management Taplin, Canida & Habacht/BMO Northern Trust Investments Taurus Funds Management RhumbLine Advisers TCW Asset Management Company Strategic Global Advisors TerraCotta T. Rowe Price Associates Varde Partners Wasatch Advisors Real Assets Transition Managers Barings Real Estate Advisers The Blackstone Group Citigroup Global Markets Brookfield Asset Management Loop Capital The Carlyle Group Macquarie Capital CB Richard Ellis Northern Trust Investments Dyal Capital Penserra Exeter Property Group Fortress Investment Group Global Income Gaw Capital Partners AllianceBernstein Heitman Real Estate Investment Management Apollo Global Management INVESCO Real Estate Beach Point Capital Management LaSalle Investment Management Blantyre Capital Ltd. Lion Industrial Trust Cerberus Capital Management Lone Star Dignari Capital Partners LPC Realty Advisors Dolan McEniry Capital Management Macquarie Group Limited DoubleLine Capital Madison International Realty Edelweiss Niam Franklin Advisers Oak Street Real Estate Capital Garcia Hamilton & Associates -

An Acuris Company Restructuring Data

Restructuring Insights - UK An Acuris Company Restructuring Data - Europe 27 May 2020 Restructuring Insights - UK Restructuring Insights - UK An Acuris Company Debtwire Europe CONTENTS AUTHORS Introduction 3 Joshua Friedman Restructuring Data Analysis 5 Global Head of Restructuring Data Creditor/Investor Analysis 19 +1 (212) 574 7867 [email protected] UK Restructurings: Marketplace & Current Issues 25 Timelines and Tables 28 Shab Mahmood Contacts 35 Restructuring Analyst Disclaimer 36 +44 203 741 1323 [email protected] Juan Mariño, CFA Restructuring Analyst +44 203 741 1364 [email protected] Donald Ndubuokwu Restructuring Analyst [email protected] 2 Restructuring Insights - UK An Acuris Company Introduction: Restructuring Data - Europe As part of the roll-out of Debtwire’s Restructuring Data - Europe, this inaugural Restructuring Insights Report serves as a preview of the power, breadth and depth of the data that will be available to subscribers. Debtwire’s global team of legal, financial, credit and data professionals has been producing analysis and data reports on a variety of restructuring topics and in jurisdictions across the globe. In a natural evolution of that data-driven direction, we have compiled and enhanced the data underlying those reports and combined it with Debtwire’s exclusive editorial coverage and financial research to create a searchable Restructuring Database, which will allow subscribers to craft bespoke data-driven answers to a wide variety of research questions and to enhance business development. With the expansion to cover Europe, the Restructuring Data platform now includes bankruptcy and restructuring situations in North America (US Chapter 11s, Chapter 7s and Chapter 15s), Asia-Pacific (NCLT processes in India) and Europe. -

Impact Investing Primer

IMPACT INVESTING PRIMER I. What is Impact Investing? II. The Veris Perspective III. Have We Reached a Tipping Point? IV. How to Approach Impact in Public Equity and Fixed Income Investments V. How to Measure Impact VI. Impact Financial Performance Across Asset Classes VII. How to Conceptualize Impact Investing in Your Portfolio VIII. Impact Investing Across All Asset Classes IX. Impact & Mission‐Related Investing Terms X. Other Impact Investing Resources XI. Additional Resources I. What is Impact Investing? Impact Investing utilizes capital markets to address global challenges. Every investment has impact, whether intended or unintended. Impact investors, however, specifically seek out investments whose environmental and social outcomes are positive and definable. As Impact Investing becomes more mainstream, there are increasingly more opportunities to invest with impact. Impact investments are already available in both public and private markets and across all asset classes—including hard assets such as real estate, timber, and agriculture. Impact investments provide capital to innovative private companies providing solutions to global sustainability issues such as climate change, accessible education, and energy and food security. They also support public and private companies with responsible and sustainable business practices. Additionally, impact investments promote community wealth building by creating jobs in low‐income communities; helping in affordable housing initiatives and neighborhood revitalization; making loans to small businesses, and raising funds for vital community services. Impact Investing, whether private or public, stocks or bonds, requires professional management of social, environmental, and financial performance. The Global Impact Investing Network (GIIN), a non‐profit organization dedicated to increasing the scale and effectiveness of Impact Investing, defines it as “investments made into companies, organizations, and funds with the intention to generate measurable social and environmental impact alongside a financial return. -

Special Report

September 2014 turnarounds & Workouts 7 Special Report European Restructuring Practices of Major U.S. Law Firms, page 1 Firm Senior Professionals Representative Clients Bingham McCutchen James Roome Elisabeth Baltay Creditors of: Arcapita Bank, Bulgaria Telecommunications/Vivacom, Crest +44.20.7661.5300 Barry G. Russell Liz Osborne Nicholson, Dannemora Minerals, DEPFA Bank, Findus Foods, Gala Coral, www.bingham.com James Terry Neil Devaney Icelandic Banks (Kaupthing, Glitnir and Landsbanki), Invitel, Klöckner Stephen Peppiatt Emma Simmonds Pentaplast, Media Works, Northland Resources, Oceanografia, OSX3 Leasing Tom Bannister B.V., Petromena, Petroplus, Preem, Punch Taverns, Royal Imtech, Selecta, Sevan Marine, Skeie Drilling, Straumur, Technicolor S.A. (Thomson S.A.), Terreal, The Quinn Group, Uralita, Wind Hellas, Xcite, and others. Cadwalader, Wickersham Gregory Petrick Louisa Watt Centerbridge Partners, Avenue Capital Group, GSO Capital Partners, & Taft Richard Nevins Paul Dunbar Oaktree Capital Management, Varde Partners, Golden Tree Asset +44 (0) 20 7170 8700 Yushan Ng Karen McMaster Management, Bluebay Asset Management, MBIA, Davidson Kempner, www.cadwalader.com Holly Neavill Alexis Kay Outrider Management, GLG Partners, Warwick Capital, Alchemy, Finnisterre Capital. Davis Polk Donald S. Bernstein Timothy Graulich Lehman Brothers International (Europe) and its U.K. Lehman affiliates, +44 20 7418 1300 Karen E. Wagner Elliot Moskowitz Sterling Equities in Madoff SIPA liquidation, Technicolor S.A., Royal www.davispolk.com Andrés V. Gil Thomas J. Reid Imtech, Carrefour, major global banks and financial institutions in Arnaud Pérès Christophe Perchet connection with several monoline insurance company restructurings, Marshall S. Huebner John Banes Goldman Sachs in connection with exposures to BP, Castle HoldCo 4, Benjamin S. Kaminetzky Reuven B.